- published: 08 Oct 2015

- views: 117077

-

remove the playlistFed Policy

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistFed Policy

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 15 Mar 2012

- views: 63355

- published: 25 Jan 2016

- views: 22

- published: 22 Jul 2015

- views: 4318

- published: 19 Jan 2012

- views: 56935

- author: Jason Welker

- published: 19 Oct 2015

- views: 313

- published: 19 Aug 2015

- views: 1368

- published: 17 Aug 2015

- views: 2375

- published: 23 Nov 2008

- views: 7504

- author: RussiaToday

- published: 25 Jun 2015

- views: 170

- published: 18 Sep 2015

- views: 72

The Federal Reserve System (also known as the Federal Reserve, and informally as the Fed) is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907. Over time, the roles and responsibilities of the Federal Reserve System have expanded and its structure has evolved. Events such as the Great Depression were major factors leading to changes in the system.

The Congress established three key objectives for monetary policy—maximum employment, stable prices, and moderate long-term interest rates—in the Federal Reserve Act. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and today, according to official Federal Reserve documentation, include conducting the nation's monetary policy, supervising and regulating banking institutions, maintaining the stability of the financial system and providing financial services to depository institutions, the U.S. government, and foreign official institutions. The Fed also conducts research into the economy and releases numerous publications, such as the Beige Book.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

A policy is typically described as a principle or rule to guide decisions and achieve rational outcomes. The term is not normally used to denote what is actually done, this is normally referred to as either procedure or protocol. Policies are generally adopted by the Board of or senior governance body within an organization whereas procedures or protocols would be developed and adopted by senior executive officers. Policies can assist in both subjective and objective decision making. Policies to assist in subjective decision making would usually assist senior management with decisions that must consider the relative merits of a number of factors before making decisions and as a result are often hard to objectively test e.g. work-life balance policy. In contrast policies to assist in objective decision making are usually operational in nature and can be objectively tested e.g. password policy.[citation needed]

A Policy can be considered as a "Statement of Intent" or a "Commitment". For that reason at least, the decision-makers can be held accountable for their "Policy".[citation needed]

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

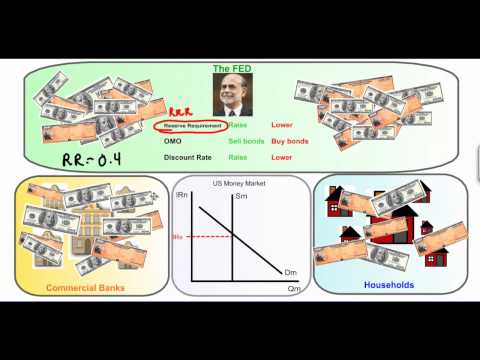

Ben Shalom Bernanke (English pronunciation: /bərˈnæŋki/ bər-NANG-kee; born December 13, 1953) is an American economist and currently chairman of the Federal Reserve, the central bank of the United States. During his tenure as chairman, Bernanke has overseen the Federal Reserve's response to the late-2000s financial crisis.

Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the department of economics there from 1996 to September 2002, when he went on public service leave. From 2002 until 2005, he was a member of the Board of Governors of the Federal Reserve System, proposed the Bernanke Doctrine, and first discussed "the Great Moderation"--the theory that traditional business cycles have declined in volatility in recent decades through structural changes that have occurred in the international economy, particularly increases in the economic stability of developing nations, diminishing the influence of macroeconomic (monetary and fiscal) policy. Bernanke then served as chairman of President George W. Bush's Council of Economic Advisers before President Bush appointed him on February 1, 2006, to be chairman of the United States Federal Reserve. Bernanke was confirmed for a second term as chairman on January 28, 2010, after being re-nominated by President Barack Obama.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

9:25

9:25What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

This week on Crash Course Economics, we're talking about monetary policy. The reality of the world is that the United States (and most of the world's economies) are, to varying degrees, Keynesian. When things go wrong, economically, the central bank of the country intervenes to try aand get things back on track. In the United States, the Federal Reserve is the organization that steps in to use monetary policy to steer the economy. When the Fed, as it's called, does step in, there are a few different tacks it can take. The Fed can change interest rates, or it can change the money supply. This is pretty interesting stuff, and it's what we're ge -

5:21

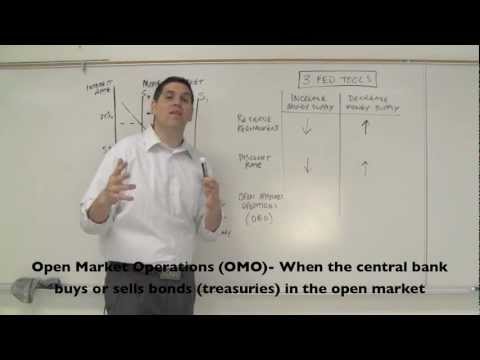

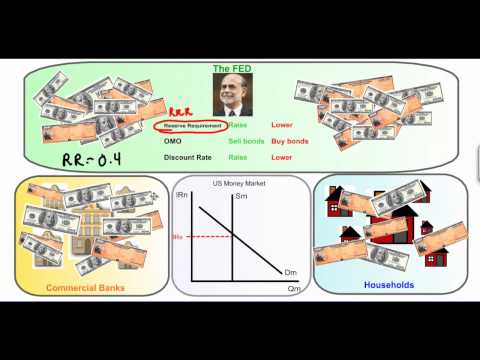

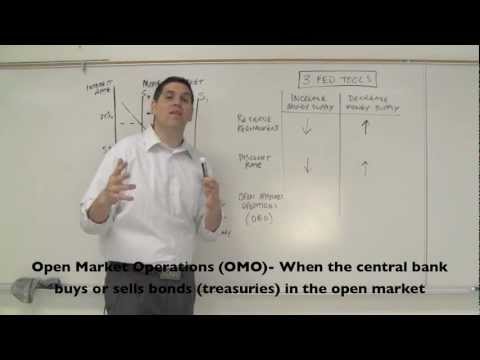

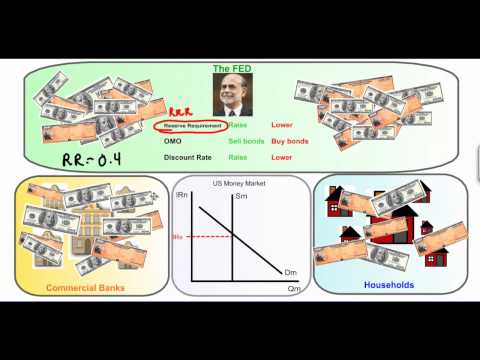

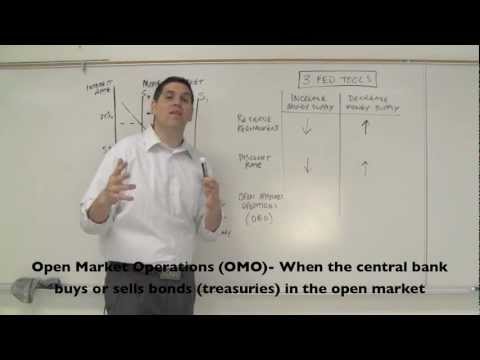

5:21Macro 4.1- Money Market and FED Tools (Monetary Policy)

Macro 4.1- Money Market and FED Tools (Monetary Policy)Macro 4.1- Money Market and FED Tools (Monetary Policy)

Mr. Clifford explains the supply and demand for money and the three tools that the FED uses to adjust the money supply -

0:43

0:43Bill Gross - 2016 US FED Policy, Stock Market And Investment Adice

Bill Gross - 2016 US FED Policy, Stock Market And Investment AdiceBill Gross - 2016 US FED Policy, Stock Market And Investment Adice

Bond King, Mr. Gross shares his views on the US economy, stock market and federal reserve 2016 policy predictions -

43:21

43:21Nomi Prins-Fed Trapped in Money Printing Policy

Nomi Prins-Fed Trapped in Money Printing PolicyNomi Prins-Fed Trapped in Money Printing Policy

What about all the talk of the Fed raising interest rates this fall? Former top Wall Street banker Nomi Prins explains, “They have backed themselves into a corner. If you raise interest rates 50 basis points, the market will drop 500 points that day. That’s what you are dealing with. That’s just the reality of the situation that has been created. I think if the Fed does raise rates to save face, it will be by a very small amount. The markets will tank . . . and completely stop raising rates going forward, or they don’t do it at all, which is kind of what’s been happening. . . . If they do raise rates, they create a very big knock on eff -

16:30

16:30The Tools of Monetary Policy

The Tools of Monetary PolicyThe Tools of Monetary Policy

This video lesson graphically presents the three tools Central Banks have at their disposal for managing the level of aggregate demand in the economy. Throug... -

5:46

5:46Fed's Williams: Policy to Be Accommodative for Few Years

Fed's Williams: Policy to Be Accommodative for Few YearsFed's Williams: Policy to Be Accommodative for Few Years

Oct. 19 -- San Francisco Fed President John C. Williams comments on the state of the U.S. economy and Fed policy during an interview with Bloomberg's Mike McKee on "Bloomberg Markets." -

6:37

6:37BOMBSHELL! Federal Reserve Admits It's Monetary Policy Has Failed. By Gregory Mannarino

BOMBSHELL! Federal Reserve Admits It's Monetary Policy Has Failed. By Gregory MannarinoBOMBSHELL! Federal Reserve Admits It's Monetary Policy Has Failed. By Gregory Mannarino

**St. Louis Fed official: No evidence QE boosted economy: Click here: http://www.cnbc.com/2015/08/18/st-louis-fed-official-no-evidence-qe-boosted-economy.html *GET YOUR FREE COPY of my 197 page eBook "Ultimate Guide To Money And The Markets." Visit my website TradersChoice. Click here: https://traderschoice.net/ *Check out TradeGame, my newest project. Click here: https://www.youtube.com/channel/UCh-7La1nAYq5n_kv1N_PnPg *Follow my Seeking Alpha Instablog. Click here: http://seekingalpha.com/user/29482055/instablog **Trading involves risk and you could lose your entire investment. You and you alone are responsible for your own investment decis -

9:33

9:33Failed Monetary Policy, US Economic Death Spiral, No Sept. Fed. Rate Hike. By Gregory Mannarino

Failed Monetary Policy, US Economic Death Spiral, No Sept. Fed. Rate Hike. By Gregory MannarinoFailed Monetary Policy, US Economic Death Spiral, No Sept. Fed. Rate Hike. By Gregory Mannarino

NEW INTERVIEW with USAWatchdog Greg Hunter, "Extreme Debt Will Cause a Global Meltdown and China’s Currency Devaluation." Click here: https://www.youtube.com/watch?v=M-eC7kFUrPc *GET YOUR FREE COPY of my 197 page eBook "Ultimate Guide To Money And The Markets." Visit my website TradersChoice. Click here: https://traderschoice.net/ *Check out TradeGame, my newest project. Click here: https://www.youtube.com/channel/UCh-7La1nAYq5n_kv1N_PnPg *Follow my Seeking Alpha Instablog. Click here: http://seekingalpha.com/user/29482055/instablog **Trading involves risk and you could lose your entire investment. You and you alone are responsible for your o -

1:46

1:46Americans protest against U.S. Fed policy

Americans protest against U.S. Fed policyAmericans protest against U.S. Fed policy

While leaders in Peru grapple with the financial fallout, Americans angry at the multi-billion dollar bailout plans are protesting in Washington. They say th... -

![[382] How Fed policy contributed to the housing boom and bust; updated 25 Jun 2015; published 25 Jun 2015](http://web.archive.org./web/20160128024037im_/http://i.ytimg.com/vi/L3ETAyTMVWI/0.jpg) 27:52

27:52[382] How Fed policy contributed to the housing boom and bust

[382] How Fed policy contributed to the housing boom and bust[382] How Fed policy contributed to the housing boom and bust

Millions of Americans who were at risk of losing their healthcare coverage will stay insured. On Thursday, in a 6 to 3 ruling, the Supreme Court said that nationwide subsidies called for in the Affordable Care Act were legal, giving the healthcare legislation a new lifeline. It was all hung up on one very small phrase in the legislation that says subsidies can only apply to participants enrolled through “an exchange established by the State.” Boom Bust’s Ameera David weighs in. Then, Edward Harrison sits down with David Beckworth – associate professor of economics at Western Kentucky University and adjunct scholar at The Cato Institute. Dav -

7:22

7:22Peter Schiff On The U.S. economy, Stocks, Fed Policy

Peter Schiff On The U.S. economy, Stocks, Fed PolicyPeter Schiff On The U.S. economy, Stocks, Fed Policy

Peter Schiff On The U.S. economy, Stocks, Fed Policy -

3:55

3:55Mark Weisbrot Discusses Fed Policy & Interest Rates - Al Jazeera English

Mark Weisbrot Discusses Fed Policy & Interest Rates - Al Jazeera EnglishMark Weisbrot Discusses Fed Policy & Interest Rates - Al Jazeera English

Mark Weisbrot Discusses Fed Policy & Interest Rates Al Jazeera English, September 17, 2015 -

![[306] Beckworth on Jobs, the Taylor Rule and Fed Policy; updated 06 Mar 2015; published 06 Mar 2015](http://web.archive.org./web/20160128024037im_/http://i.ytimg.com/vi/QzVdmJdQa8U/0.jpg) 27:55

27:55[306] Beckworth on Jobs, the Taylor Rule and Fed Policy

[306] Beckworth on Jobs, the Taylor Rule and Fed Policy[306] Beckworth on Jobs, the Taylor Rule and Fed Policy

US job numbers came out on Friday and showed employers added 295,000 jobs in February while the unemployment rate dropped to 5.5%. The declining unemployment rate – from 5.7% in January to 5.5% in February – took unemployment to its lowest level since May 2008. This significantly beat Wall Street’s expectations; economists were anticipating the payrolls to rise by only 240,000 jobs. Erin weighs in. Then, Erin is joined by David Beckworth – assistant professor of economics at Western Kentucky University and adjunct scholar at the Cato Institute. David tells us why a one-size-fits-all interest rate policy works in the US but not Europe and g -

1:57

1:57Ben Bernanke on Fed Policy, U.S. Housing Bubble

Ben Bernanke on Fed Policy, U.S. Housing BubbleBen Bernanke on Fed Policy, U.S. Housing Bubble

Oct. 8 (Bloomberg) -- Former Federal Reserve Chair Ben Bernanke reflects on the factors that lead to the housing bubble and 2008 financial crisis and the role played by monetary policy. He speaks on "Bloomberg ‹GO›" -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong,

- Agency debt

- Agricultural policy

- Alan Greenspan

- Aldrich-Vreeland Act

- Aldrich–Vreeland Act

- Alexander Hamilton

- American Civil War

- American cuisine

- American Dream

- American English

- American Gold Eagle

- American imperialism

- American Indian Wars

- American literature

- American philosophy

- American Revolution

- Americans

- Andrew Jackson

- Anti-Americanism

- Asset

- ATM card

- Austrian School

- Bailouts

- Balance of trade

- Balance sheet

- Balanced budget

- Bangladesh Bank

- Bank

- Bank Al-Maghrib

- Bank holding company

- Bank Indonesia

- Bank Negara Malaysia

- Bank of Albania

- Bank of Algeria

- Bank of Botswana

- Bank of Canada

- Bank of Cape Verde

- Bank of England

- Bank of Eritrea

- Bank of Estonia

- Bank of Ghana

- Bank of Israel

- Bank of Jamaica

- Bank of Japan

- Bank of Korea

- Bank of Lithuania

- Bank of Mauritius

- Bank of Mexico

- Bank of Mongolia

- Bank of Namibia

- Bank of Somaliland

- Bank of South Sudan

- Bank of Sudan

- Bank of Tanzania

- Bank of Thailand

- Bank of Uganda

- Bank of Zambia

- Bank regulation

- Bank reserves

- Bank run

- Bank Secrecy Act

- Bankers Trust

- Banque du Liban

- Barack Obama

- Basis point

- Beige Book

- Ben Bernanke

- Bloomberg L.P.

- Board of Governors

- Bretton Woods system

- Budgetary policy

- Call report

- CAMEL rating system

- CAMELS ratings

- Capital control

- Capital requirement

- Category Government

- Central bank

- Central Bank of Cuba

- Central Bank of Iraq

- Central Bank of Oman

- Check 21 Act

- Cheque

- Christmas

- CNNMoney

- Coin

- Coins

- Cold War

- Collateral (finance)

- Colorado River

- Columbia River

- Commerce minister

- Commercial paper

- Commercial policy

- Congressman

- Consumer protection

- Core inflation

- Credit card

- Currency

- Currency board

- Currency union

- Czech National Bank

- Da Afghanistan Bank

- Daniel Tarullo

- David Vitter

- Debit card

- Deficit spending

- Deflation

- Demand account

- Developed market

- Dillon Read

- Discount rate

- Discount window

- Dividend

- Donald L. Kohn

- Dot-com bubble

- E pluribus unum

- Eccles Building

- Economic growth

- Economic policy

- Edge Act

- Elizabeth A. Duke

- Energy policy

- Enron

- Eurodollars

- Eurosystem

- Excess reserves

- External debt

- Fair debt collection

- FED (disambiguation)

- Fed model

- Federal funds

- Federal funds rate

- Federal preemption

- Federal Reporter

- Federal Reserve Act

- Federal Reserve Bank

- Federal reserve note

- Federal Reserve Note

- Federal savings bank

- Federalist Era

- Fedspeak

- Fedwire

- Finance minister

- Financial market

- Financial panics

- Fiscal adjustment

- Fiscal policy

- Fiscal union

- Fiscal Year

- FRB (disambiguation)

- Free banking

- Free Banking Era

- Free trade

- G. Edward Griffin

- Gains from trade

- George H.W. Bush

- George W. Bush

- George Washington

- Gilded Age

- Glass–Steagall Act

- Gold

- Gold reserve

- Gold Reserve Act

- Gold standard

- Government budget

- Government debt

- Government revenue

- Government spending

- Great Depression

- Great Plains

- Greenspan put

- Harvard University

- In God We Trust

- Independent Treasury

- Industrial policy

- Inflation

- Inflation targeting

- Interest rate

- Internal debt

- Investment policy

- Iraq War

- ISO 4217

- J. P. Morgan

- James Madison

- Janet Yellen

- Jekyll Island

- Jeremy C. Stein

- Jerome H. Powell

- Kevin Warsh

- Korean War

- Lawrence H. White

- Legal liability

- Legal Tender Cases

- Liquidity trap

- Lobbying

- Louisiana

- Mandatory spending

- MarketWatch

- Mexican–American War

- Mid-Atlantic states

- Mill (currency)

- Milton Friedman

- Mississippi River

- Missouri River

- Monetary authority

- Monetary base

- Monetary inflation

- Monetary policy

- Monetary reform

- Money creation

- Money market

- Money market account

- Money supply

- Murray N. Rothbard

- Mutilated currency

- National bank

- National Banking Act

- Nelson Aldrich

- Nepal Rastra Bank

- New England

- Non-tariff barrier

- Non-tax revenue

- Norges Bank

- Ohio River

- Pacific States

- Panic of 1873

- Panic of 1893

- Panic of 1907

- Paper currency

- Paul Volcker

- Paul Warburg

- Peter Diamond

- Policy mix

- Portal United States

- Pre-Columbian era

- Primary dealer

- Primary dealers

- Prime rate

- Protectionism

- Public finance

- Public policy

- Qatar Central Bank

- Recessions

- Regulation D (FRB)

- Regulation Q

- Repurchase agreement

- Reserve Bank of Fiji

- Reserve requirement

- Reserve requirements

- Richard Clarida

- Rio Grande

- Roaring Twenties

- Robert L. Owen

- Rocky Mountains

- Ron Paul

- Sarah Bloom Raskin

- Savings account

- Second-wave feminism

- Seigniorage

- Social policy

- Sovereignty

- Space Race

- Spanish–American War

- Star note

- State bank

- Substitute check

- Sveriges Riksbank

- Swiss National Bank

- Systemic risk

- Tariff

- Tax policy

- Tax revenue

- Template Cleanup doc

- The Carlyle Group

- The Great Depression

- Thirteen Colonies

- Thomas Jefferson

- Trade bloc

- Trade creation

- Trade diversion

- Trade policy

- Treasury security

- Truth in Lending Act

- Truth in Savings Act

- U.S. Congress

- U.S. dollar

- U.S. state

- U.S. Supreme Court

- U.S. Treasury

- Uncle Sam

- Unemployment rate

- United States

- United States Army

- United States Code

- United States dollar

- United States Mint

- United States Navy

- United States Note

- United States Senate

- Vietnam War

- Wall Street

- War of 1812

- War on Terror

- Washington, D.C.

- Wikipedia Cleanup

- Wikipedia Link rot

- Wildcat banking

- William Greider

- Wire transfer

- Woodrow Wilson

- World Bank Group

- Alan Greenspan

- Alexander Hamilton

- Americans

- Andrew Jackson

- Barack Obama

- Ben Bernanke

- Daniel Tarullo

- David Vitter

- George Washington

- James Madison

- Janet Yellen

- Kevin Warsh

- Korean War

- Milton Friedman

- Paul Volcker

- Paul Warburg

- Peter Diamond

- Ron Paul

- Sarah Bloom Raskin

- Thomas Jefferson

- William Greider

- Woodrow Wilson

-

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

This week on Crash Course Economics, we're talking about monetary policy. The reality of the world is that the United States (and most of the world's economies) are, to varying degrees, Keynesian. When things go wrong, economically, the central bank of the country intervenes to try aand get things back on track. In the United States, the Federal Reserve is the organization that steps in to use mon -

Macro 4.1- Money Market and FED Tools (Monetary Policy)

Mr. Clifford explains the supply and demand for money and the three tools that the FED uses to adjust the money supply -

Bill Gross - 2016 US FED Policy, Stock Market And Investment Adice

Bond King, Mr. Gross shares his views on the US economy, stock market and federal reserve 2016 policy predictions -

Nomi Prins-Fed Trapped in Money Printing Policy

What about all the talk of the Fed raising interest rates this fall? Former top Wall Street banker Nomi Prins explains, “They have backed themselves into a corner. If you raise interest rates 50 basis points, the market will drop 500 points that day. That’s what you are dealing with. That’s just the reality of the situation that has been created. I think if the Fed does raise rates to save fa -

The Tools of Monetary Policy

This video lesson graphically presents the three tools Central Banks have at their disposal for managing the level of aggregate demand in the economy. Throug... -

Fed's Williams: Policy to Be Accommodative for Few Years

Oct. 19 -- San Francisco Fed President John C. Williams comments on the state of the U.S. economy and Fed policy during an interview with Bloomberg's Mike McKee on "Bloomberg Markets." -

BOMBSHELL! Federal Reserve Admits It's Monetary Policy Has Failed. By Gregory Mannarino

**St. Louis Fed official: No evidence QE boosted economy: Click here: http://www.cnbc.com/2015/08/18/st-louis-fed-official-no-evidence-qe-boosted-economy.html *GET YOUR FREE COPY of my 197 page eBook "Ultimate Guide To Money And The Markets." Visit my website TradersChoice. Click here: https://traderschoice.net/ *Check out TradeGame, my newest project. Click here: https://www.youtube.com/channel/U -

Failed Monetary Policy, US Economic Death Spiral, No Sept. Fed. Rate Hike. By Gregory Mannarino

NEW INTERVIEW with USAWatchdog Greg Hunter, "Extreme Debt Will Cause a Global Meltdown and China’s Currency Devaluation." Click here: https://www.youtube.com/watch?v=M-eC7kFUrPc *GET YOUR FREE COPY of my 197 page eBook "Ultimate Guide To Money And The Markets." Visit my website TradersChoice. Click here: https://traderschoice.net/ *Check out TradeGame, my newest project. Click here: https://www.yo -

Americans protest against U.S. Fed policy

While leaders in Peru grapple with the financial fallout, Americans angry at the multi-billion dollar bailout plans are protesting in Washington. They say th... -

[382] How Fed policy contributed to the housing boom and bust

Millions of Americans who were at risk of losing their healthcare coverage will stay insured. On Thursday, in a 6 to 3 ruling, the Supreme Court said that nationwide subsidies called for in the Affordable Care Act were legal, giving the healthcare legislation a new lifeline. It was all hung up on one very small phrase in the legislation that says subsidies can only apply to participants enrolled t -

Peter Schiff On The U.S. economy, Stocks, Fed Policy

Peter Schiff On The U.S. economy, Stocks, Fed Policy -

Mark Weisbrot Discusses Fed Policy & Interest Rates - Al Jazeera English

Mark Weisbrot Discusses Fed Policy & Interest Rates Al Jazeera English, September 17, 2015 -

[306] Beckworth on Jobs, the Taylor Rule and Fed Policy

US job numbers came out on Friday and showed employers added 295,000 jobs in February while the unemployment rate dropped to 5.5%. The declining unemployment rate – from 5.7% in January to 5.5% in February – took unemployment to its lowest level since May 2008. This significantly beat Wall Street’s expectations; economists were anticipating the payrolls to rise by only 240,000 jobs. Erin weighs i -

Ben Bernanke on Fed Policy, U.S. Housing Bubble

Oct. 8 (Bloomberg) -- Former Federal Reserve Chair Ben Bernanke reflects on the factors that lead to the housing bubble and 2008 financial crisis and the role played by monetary policy. He speaks on "Bloomberg ‹GO›" -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of globa -

Fed's Policy of Creating More Bubbles Can't Last

Peter Schiff on Fox Business (7/8/2014) Listen to The Peter Schiff Show Live Weekdays 10am to noon ET on http://www.SchiffRadio.com Buy my newest book at htt... -

Fed Chair Signals Possible Policy Shift On Unemployment

PERI Co-Director Gerald Epstein discusses how Fed Chair Janet Yellen's recent comments on bringing unemployment down could be positive but Fed policy still r... -

CNBC Interview: Stan Druckenmiller on Fed Policy - Nov 2015

Great interview with legendary fund manager on reckless Fed Policy and where it is all headed... however what's inevitable is not always imminent. -

Systemic COLLAPSE as Fed Policy Causes Extreme Stock Market Moves!

Look Inside My Book!: http://book.themoneygps.com ******************************************************************** My Free eBooks: FLUORIDE: http://fluoride.themoneygps.com GMO: http://gmo.themoneygps.com VACCINES: http://vaccines.themoneygps.com Join The Money GPS Insiders: http://themoneygps.com PREPARE for the COLLAPSE: http://amazon.themoneygps.com ************************************* -

How Investors Are Reacting to the Fed's Policy Statement

Jan. 28 -- The Federal Reserve maintained its pledge to be “patient” on raising interest rates and boosted its assessment of the economy and labor market, even as it expects inflation to decline further. Bloomberg's Scarlet Fu examines how investors are reacting on "Bottom Line." -

James Grant: Two Alternative Outcomes From Fed Policy – Much Higher Inflation or More Money Printing

In a special reprise edition of FS Insider, Jim is pleased to welcome James Grant, Founder and Editor of Grant's Interest Rate Observer. James and Jim cover ... -

How Will U.S. Jobs Report Impact Fed Policy?

July 2 -- Princeton Professor of Economics Alan Krueger discusses the U.S. labor market. He speaks on “Market Makers.” -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most -

Benn Steil on Fed Policy

Did U.S. Federal Reserve Chair Ben Bernanke cause the Ukraine crisis? "You can certainly say that Bernanke was at least the butterfly wings that precipitated... -

How is the market turmoil impacting Fed policy?

The Wall Street Journal Chief Economics Correspondent Jon Hilsenrath on the market turmoil and the future of Federal Reserve.

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

- Order: Reorder

- Duration: 9:25

- Updated: 08 Oct 2015

- views: 117077

- published: 08 Oct 2015

- views: 117077

Macro 4.1- Money Market and FED Tools (Monetary Policy)

- Order: Reorder

- Duration: 5:21

- Updated: 15 Mar 2012

- views: 63355

- published: 15 Mar 2012

- views: 63355

Bill Gross - 2016 US FED Policy, Stock Market And Investment Adice

- Order: Reorder

- Duration: 0:43

- Updated: 25 Jan 2016

- views: 22

- published: 25 Jan 2016

- views: 22

Nomi Prins-Fed Trapped in Money Printing Policy

- Order: Reorder

- Duration: 43:21

- Updated: 22 Jul 2015

- views: 4318

- published: 22 Jul 2015

- views: 4318

The Tools of Monetary Policy

- Order: Reorder

- Duration: 16:30

- Updated: 29 Aug 2014

- views: 56935

- author: Jason Welker

- published: 19 Jan 2012

- views: 56935

- author: Jason Welker

Fed's Williams: Policy to Be Accommodative for Few Years

- Order: Reorder

- Duration: 5:46

- Updated: 19 Oct 2015

- views: 313

- published: 19 Oct 2015

- views: 313

BOMBSHELL! Federal Reserve Admits It's Monetary Policy Has Failed. By Gregory Mannarino

- Order: Reorder

- Duration: 6:37

- Updated: 19 Aug 2015

- views: 1368

- published: 19 Aug 2015

- views: 1368

Failed Monetary Policy, US Economic Death Spiral, No Sept. Fed. Rate Hike. By Gregory Mannarino

- Order: Reorder

- Duration: 9:33

- Updated: 17 Aug 2015

- views: 2375

- published: 17 Aug 2015

- views: 2375

Americans protest against U.S. Fed policy

- Order: Reorder

- Duration: 1:46

- Updated: 24 Oct 2012

- views: 7504

- author: RussiaToday

- published: 23 Nov 2008

- views: 7504

- author: RussiaToday

[382] How Fed policy contributed to the housing boom and bust

- Order: Reorder

- Duration: 27:52

- Updated: 25 Jun 2015

- views: 170

- published: 25 Jun 2015

- views: 170

Peter Schiff On The U.S. economy, Stocks, Fed Policy

- Order: Reorder

- Duration: 7:22

- Updated: 27 Nov 2015

- views: 250

- published: 27 Nov 2015

- views: 250

Mark Weisbrot Discusses Fed Policy & Interest Rates - Al Jazeera English

- Order: Reorder

- Duration: 3:55

- Updated: 18 Sep 2015

- views: 72

- published: 18 Sep 2015

- views: 72

[306] Beckworth on Jobs, the Taylor Rule and Fed Policy

- Order: Reorder

- Duration: 27:55

- Updated: 06 Mar 2015

- views: 112

- published: 06 Mar 2015

- views: 112

Ben Bernanke on Fed Policy, U.S. Housing Bubble

- Order: Reorder

- Duration: 1:57

- Updated: 08 Oct 2015

- views: 167

- published: 08 Oct 2015

- views: 167

Fed's Policy of Creating More Bubbles Can't Last

- Order: Reorder

- Duration: 13:11

- Updated: 30 Aug 2014

- views: 12141

- author: Peter Schiff

- published: 09 Jul 2014

- views: 12141

- author: Peter Schiff

Fed Chair Signals Possible Policy Shift On Unemployment

- Order: Reorder

- Duration: 6:30

- Updated: 05 Sep 2014

- views: 3080

- author: TheRealNews

- published: 26 Aug 2014

- views: 3080

- author: TheRealNews

CNBC Interview: Stan Druckenmiller on Fed Policy - Nov 2015

- Order: Reorder

- Duration: 24:56

- Updated: 06 Nov 2015

- views: 71

- published: 06 Nov 2015

- views: 71

Systemic COLLAPSE as Fed Policy Causes Extreme Stock Market Moves!

- Order: Reorder

- Duration: 4:31

- Updated: 12 Oct 2014

- views: 301

- published: 12 Oct 2014

- views: 301

How Investors Are Reacting to the Fed's Policy Statement

- Order: Reorder

- Duration: 0:51

- Updated: 28 Jan 2015

- views: 64

- published: 28 Jan 2015

- views: 64

James Grant: Two Alternative Outcomes From Fed Policy – Much Higher Inflation or More Money Printing

- Order: Reorder

- Duration: 25:45

- Updated: 05 Sep 2014

- views: 3587

- author: Financial Sense

- published: 28 Aug 2014

- views: 3587

- author: Financial Sense

How Will U.S. Jobs Report Impact Fed Policy?

- Order: Reorder

- Duration: 3:20

- Updated: 02 Jul 2015

- views: 94

- published: 02 Jul 2015

- views: 94

Benn Steil on Fed Policy

- Order: Reorder

- Duration: 7:13

- Updated: 20 Aug 2014

- views: 1120

- author: Foreign Affairs

- published: 06 Aug 2014

- views: 1120

- author: Foreign Affairs

How is the market turmoil impacting Fed policy?

- Order: Reorder

- Duration: 6:05

- Updated: 07 Jan 2016

- views: 159

- published: 07 Jan 2016

- views: 159

-

Investors Sell as FED's Policy Failure Becomes Apparent

http://circlesquaredalts.com AIR DATE: January 25, 2016 Courtesy: FOX Business Founder and Chief Investment Officer of Circle Squared, Jeff Sica, joins Countdown to the Closing Bell at the end of the trading session. Jeff comments on Apple Inc's upcoming earnings report, as well as recent recession-like earnings. -

Jim Bruce Federal Reserve Rate Increase

Money for Nothing: Inside the Federal Reserve” filmmaker Jim Bruce Comments on His Upcoming Visit to the New York Investing meetup: It’s a great pleasure for me to be giving my talk, “What to Expect When the Fed’s Expecting (To Raise Rates)” at your group on July 21st. When I decided to embark on a speaking tour that I hope will take place throughout the United States, the New York Investing meetu -

Weekend Review 1.24.16: VIX, TLT, USO, FXI, BABA, IBB, SPY, IWM, QQQ, AAPL, FB, AMZN, NFLX, GOOGL

Be sure to "Like" my video & Follow me on Twitter: @JustinPulitzer Follow my *NEW* Instagram account. I'll post 15 second videos about what key Factor(s) are moving the Market that day: https://www.instagram.com/justinpulitzertrades/ Periscope 1.20.15 LIVE Q&A; Session: https://youtu.be/juOospi9AP4 In this video I discuss trade set-ups in: VIX, UUP, TLT, HYG, USO, XOM, CVX, FXI, BABA, IBB, GILD, -

Weekend Review Supplimental 1.24.16: Banks (BAC, JPM, DB)

Be sure to "Like" my video & Follow me on Twitter: @JustinPulitzer Follow my *NEW* Instagram account. I'll post 15 second videos about what key Factor(s) are moving the Market that day: https://www.instagram.com/justinpulitzertrades/ Weekend Review Video 1.24.16: https://youtu.be/kRSHpVvgwGw Periscope 1.20.16 LIVE Q&A; Session: https://youtu.be/juOospi9AP4 In this video I discuss trade set-ups -

Here Is What to Expect From the Federal Reserve’s January Policy Meeting

Don’t expect the Federal Reserve to dwell on the current spat of stock market volatility in its January statement, released next week. ‘We’re likely to see the Fed say that their medium-term outlook is relatively unchanged and recent events [in the markets] have been temporary and driven by mostly foreign factors,’ said Stewart Warther, a U.S. equity and derivative strategist at BNP Paribas. Plung -

Citigroup's Prepared for Market Volatility, CEO Says

Jan. 21 -- Citigroup CEO Michael Corbat discusses market volatility, emerging markets and Fed policy at the World Economic Forum in Davos. He speaks on "Bloomberg GO." -

We will cause an Economic Collapse if you audit the FED - Bernanke

Said Bernanke to The Congress: "We will cause an Economic Collapse if you audit the FED" -

Periscope 1.8.15 LIVE Q&A; Session

If you missed my segment on Benzinga lasw week, here it is. Skip to 59:43 for my part to start. https://soundcloud.com/bztv/premarket-prep-for-december-31-wrapping-up-2015#t=59:43 Follow my *NEW* Instagram account. I'll post 15 second videos about what key Factor(s) are moving the Market that day: https://www.instagram.com/justinpulitzertrades/ Weekend Review 1/3/15 VIDEO: https://youtu.be/m9832 -

Periscope 1.13.15 LIVE Q&A; Session

If you missed my segment on Benzinga lasw week, here it is. Skip to 59:43 for my part to start. https://soundcloud.com/bztv/premarket-prep-for-december-31-wrapping-up-2015#t=59:43 Follow my *NEW* Instagram account. I'll post 15 second videos about what key Factor(s) are moving the Market that day: https://www.instagram.com/justinpulitzertrades/ Weekend Review 1/10/15 VIDEO: https://youtu.be/KiIA -

Periscope 1.20.15 LIVE Q&A; Session

Follow my *NEW* Instagram account. I'll post 15 second videos about what key Factor(s) are moving the Market that day: https://www.instagram.com/justinpulitzertrades/ Weekend Review 1/17/15 VIDEO: https://youtu.be/W9TMe-6X1Wo Fed Article 1 - Welcome to Fed's #Lower4Longer Lifestyle: http://realmoney.thestreet.com/articles/08/03/2015/welcome-feds-lower4longer-lifestyle?cm_ven_int=homepage-latest- -

James Turk - The Fed will become technically insolvent with a rate hike

In this episode Paul Buitink and Tuur Demeester talk with gold veteran James Turk about the prospects of the Fed raising interest rates and the way in this will . Aug. 24 -- Mohamed El-Erian, former CEO of Pimco and a Bloomberg View columnist, comments on the selloff in stocks. He speaks during an interview with . Sept. 11 -- Mohamed El-Erian, Pimco's former chief executive officer and a Bloombe -

Joseph Trevisani: Fed Monetary Policy--Quantitative Easing

Date of issue: 13 November 2013. Speaker: Joseph Trevisani. “If something cannot go on forever, it will stop.” “Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth.” Those two famous quotes, the first from American economist and writer Herbert Stein , and the second from Sir Arthur Conan Doyle, the creator of Sherlock Holmes, neatly frame the economic a -

Weekend Review 1.10.16: VIX, TLT, USO, FXI, IBB, GILD, SPY, IWM, QQQ, AAPL, FB, AMZN, NFLX, GOOGL

Be sure to "Like" my video & Follow me on Twitter: @JustinPulitzer Follow my *NEW* Instagram account. I'll post 15 second videos about what key Factor(s) are moving the Market that day: https://www.instagram.com/justinpulitzertrades/ Periscope 1.8.15 LIVE Q&A; Session: https://youtu.be/mgjQE24JKkI In this video I discuss trade set-ups in: VIX, UUP, TLT, FXI, USO, IBB, GILD, SPY NKE, DIS, XOM, CV -

Fed planning to move very slowly on interest rates?

Monster Worldwide Senior V.P. Joanie Courtney, The Wall Street Journal Chief Economics Correspondent Jon Hilsenrath and Stifel Chief Economist Lindsey Piegza on the potential impact of the December jobs report on Federal Reserve policy. -

McCullough: San Francisco Fed Head Is Full of Baloney

On CNBC yesterday, San Francisco Fed President John Williams actually said, “The dollar is not a target of FOMC policy.” In this brief, hard-hitting excerpt of The Macro Show, Hedgeye CEO Keith McCullough explains why that is just flat-out “ridiculous.” Subscribe to The Macro Show today for access to this and all other episodes: https://accounts.hedgeye.com/products/macro-show/128 Subscribe to H -

Policy Watch – Episode 198 | US Fed interest rate hike & latest Macroeconomic data

Policy Watch analyses the major economic developments that have taken place in the country with subject experts. In this week's episode we discuss the US Federal Reserves’ decision to hike the interest rate, the latest Macroeconomic data and what do these indicators tell about what lies ahead in 2016. Guests: Andrew Holland, CEO, Ambit Investment Advisors ; Vineet Bhatnagar, Managing Director, Ph -

ECB and the Fed's crucial December decisions - Business Line

This year December is very important for the world's two most powerful central banks as during this month they decide on their monetary policy. The US Federal Reserve meets in a few days, while the ECB has already made up its mind, though its decision was unexpected and, for some, even disappointing. In this edition of Business Line we take a closer look at the central banks' main concern: infl -

Warren Buffett on Fed policy and economy

Wednesday, 16 Oct 2013 | 7:28 AM ET Warren Buffett, Berkshire Hathaway chairman & CEO, says he has no idea when the Fed will begin to taper, and even if Congress comes to a resolution today, people's opinion of Congress still will have diminished. -

Eran Peleg on Fed Policy in 2016

Eran Peleg, Chief Investment Officer at Clarity Capital, explains what to expect from the US interest rate in 2016. Learn more, www.claritycap.com -

4.8 The Fed and Monetary Policy AP Macro

Intro to The Fed and Monetary Policy -

How Does the Economy Recover from Recession, Hyperinflation? Monetary Policy (2002)

Several members of the congress have criticized the Fed. On July 25, 1921, Senator Owen stated on the editorial page of The New York Times, The Federal Reserve Board is the most gigantic financial power in all the world. Instead of using this great power as the Federal Reserve Act intended that it should, the board....delegated this power to the banks, threw the weight of its influence toward the

Investors Sell as FED's Policy Failure Becomes Apparent

- Order: Reorder

- Duration: 2:58

- Updated: 25 Jan 2016

- views: 7

- published: 25 Jan 2016

- views: 7

Jim Bruce Federal Reserve Rate Increase

- Order: Reorder

- Duration: 55:05

- Updated: 25 Jan 2016

- views: 56

- published: 25 Jan 2016

- views: 56

Weekend Review 1.24.16: VIX, TLT, USO, FXI, BABA, IBB, SPY, IWM, QQQ, AAPL, FB, AMZN, NFLX, GOOGL

- Order: Reorder

- Duration: 51:49

- Updated: 25 Jan 2016

- views: 474

- published: 25 Jan 2016

- views: 474

Weekend Review Supplimental 1.24.16: Banks (BAC, JPM, DB)

- Order: Reorder

- Duration: 2:48

- Updated: 24 Jan 2016

- views: 140

- published: 24 Jan 2016

- views: 140

Here Is What to Expect From the Federal Reserve’s January Policy Meeting

- Order: Reorder

- Duration: 4:46

- Updated: 22 Jan 2016

- views: 73

- published: 22 Jan 2016

- views: 73

Citigroup's Prepared for Market Volatility, CEO Says

- Order: Reorder

- Duration: 8:28

- Updated: 22 Jan 2016

- views: 996

- published: 22 Jan 2016

- views: 996

We will cause an Economic Collapse if you audit the FED - Bernanke

- Order: Reorder

- Duration: 2:13

- Updated: 21 Jan 2016

- views: 3275

- published: 21 Jan 2016

- views: 3275

Periscope 1.8.15 LIVE Q&A; Session

- Order: Reorder

- Duration: 45:39

- Updated: 09 Jan 2016

- views: 149

- published: 09 Jan 2016

- views: 149

Periscope 1.13.15 LIVE Q&A; Session

- Order: Reorder

- Duration: 44:53

- Updated: 13 Jan 2016

- views: 318

- published: 13 Jan 2016

- views: 318

Periscope 1.20.15 LIVE Q&A; Session

- Order: Reorder

- Duration: 37:59

- Updated: 21 Jan 2016

- views: 203

- published: 21 Jan 2016

- views: 203

James Turk - The Fed will become technically insolvent with a rate hike

- Order: Reorder

- Duration: 4:08

- Updated: 18 Jan 2016

- views: 6

- published: 18 Jan 2016

- views: 6

Joseph Trevisani: Fed Monetary Policy--Quantitative Easing

- Order: Reorder

- Duration: 61:54

- Updated: 12 Jan 2016

- views: 6

- published: 12 Jan 2016

- views: 6

Weekend Review 1.10.16: VIX, TLT, USO, FXI, IBB, GILD, SPY, IWM, QQQ, AAPL, FB, AMZN, NFLX, GOOGL

- Order: Reorder

- Duration: 46:05

- Updated: 11 Jan 2016

- views: 217

- published: 11 Jan 2016

- views: 217

Fed planning to move very slowly on interest rates?

- Order: Reorder

- Duration: 5:01

- Updated: 08 Jan 2016

- views: 92

- published: 08 Jan 2016

- views: 92

McCullough: San Francisco Fed Head Is Full of Baloney

- Order: Reorder

- Duration: 1:33

- Updated: 05 Jan 2016

- views: 953

- published: 05 Jan 2016

- views: 953

Policy Watch – Episode 198 | US Fed interest rate hike & latest Macroeconomic data

- Order: Reorder

- Duration: 26:19

- Updated: 04 Jan 2016

- views: 277

- published: 04 Jan 2016

- views: 277

ECB and the Fed's crucial December decisions - Business Line

- Order: Reorder

- Duration: 8:39

- Updated: 04 Jan 2016

- views: 9

- published: 04 Jan 2016

- views: 9

Warren Buffett on Fed policy and economy

- Order: Reorder

- Duration: 1:16

- Updated: 03 Jan 2016

- views: 8

- published: 03 Jan 2016

- views: 8

Eran Peleg on Fed Policy in 2016

- Order: Reorder

- Duration: 3:58

- Updated: 29 Dec 2015

- views: 53

- published: 29 Dec 2015

- views: 53

4.8 The Fed and Monetary Policy AP Macro

- Order: Reorder

- Duration: 7:29

- Updated: 27 Dec 2015

- views: 9

- published: 27 Dec 2015

- views: 9

How Does the Economy Recover from Recession, Hyperinflation? Monetary Policy (2002)

- Order: Reorder

- Duration: 92:21

- Updated: 19 Dec 2015

- views: 1

- published: 19 Dec 2015

- views: 1

-

Ron Paul Hearing on the Fed's Inflationary Monetary Policy -- 3/17/11

This hearing, entitled "The Relationship of Monetary Policy and Rising Prices," examined the Federal Reserve's easy money policies and their impact on inflat... -

FED Chair Janet Yellen Press Conference On Monetary Policy And The Economy

September 17, 2015 C-SPAN http://MOXNews.com http://mikehawk2016.com/ https://www.facebook.com/mikehawk2016 https://twitter.com/askmikehawk -

Fed's Policies Attack Capitalism & Liberty - GOLD is the Solution | Jim Willie (Part 1)

IN PART 1: - The U.S. Dollar is a joke ►0:58 - Capital is under attack by the Fed's policies ►15:46 - Can gold solve America's financial problems? ►20:55 - SUBSCRIBE (it's FREE!) to be notified when part 2 is released! ►http://bit.ly/Subscription-Link - OR watch the rest of the interview now ► https://youtu.be/wugNMo5lWEw?t=30m56s SUBSCRIBE (it's FREE!) to our 2nd sponsor: Reluctant Preppers, "H -

Macro Principles Money Multiplier and Fed Policy

This video is designed to help introductory macro students understand how central banks affect the money supply, specifically through using open market opera... -

"The Fed, Free Enterprise and Foreign Policy," Ron Paul. Introduction by Walter Block.

Walter Block Introduces Ron Paul for his Loyola University appearance; "The Fed, Free Enterprise and Foreign Policy" at Loyola University New Orleans. Sept. ... -

What Is the Proper Role for Monetary Policy in Addressing Inequality?

St. Louis Fed president James Bullard joins Matthew Winkler of Bloomberg News to discuss monetary policy and its effects on economic inequality. Bullard describes the life-cycle model of the... -

Policy Watch - Episode 184 | Impact of US Fed’s decision & Gold Bond/Monetisation Scheme

Policy Watch analyses the major economic developments that have taken place in the country with subject experts. In this week's episode we discuss the impact of US Fed’s moves and how successful would be the gold bond scheme and the gold monetisation scheme. Guests: Saugata Bhattacharya, Chief Economist, Axis Bank ; Ajay Bagga, Executive Chairman, OPC Asset Solutions Pvt. Ltd. ; Chandan Taparia, -

Fed Policy and Economy Joe Guinan and Andy Busch

Joe Guinan and Andy Busch discuss the economy and fed policy. Advantage Futures -

The Federal Reserve Bank Conspiracy Explained - Century of Enslavement // Top Documentary Films

The Federal Reserve Bank Conspiracy Explained - Century of Enslavement // Top Documentary Films. The Federal Reserve System (also known as the Federal Reserve, and informally as the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe pa -

Does the Fed Run America? Alan Greenspan: Federal Reserve Monetary Policy Report (1998)

The Federal Reserve System — also known as the Federal Reserve or simply as the Fed — is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907. Over time, the roles and responsibilities of the Federal Reserve System have expanded, a -

The Federal Reserve System, Economy & Monetary Policy: Fed Chair (2013)

Bernanke has given several lectures at the London School of Economics on monetary theory and policy and has written three textbooks on macroeconomics, and one on microeconomics. He was the Director of the Monetary Economics Program of the National Bureau of Economic Research and the editor of the American Economic Review. He is among the 50 most published economists in the world according to IDEAS -

Greek Bond Sale w Yanis Varoufakis & Fed Policy w Tim Duy

-

Globalization of Financial Markets: China, The Fed, and Future Policy Options

A panel discussion on the world financial markets with James Healy, Capra Ibex Advisors; Sadeq Sayeed, Metage Capital Limited; and Leah Zell, Lizard Investors LLC. Moderated by Jan Svejnar, Columbia SIPA. Event Date: September 21, 2015 -

Money, Banking and the Federal Reserve

Thomas Jefferson and Andrew Jackson understood "The Monster". But to most Americans today, "Federal Reserve" is just a name on the dollar bill. They have no ... -

Panel: Impact of Fed Policy on Millenials

YAF Panel. Moderator: Jiesi Zhao Panelists: Jared Meyer, Johanness Schmidt, Julie Borowski -

Cleveland Fed Policy Summit 2012 - Sandra Pianalto Keynote Address

The Federal Reserve Bank of Cleveland's 10th annual Policy Summit, held June 28 and 29, 2012, focused on effective strategies to strengthen and rebuild commu... -

Ron Pauls True Foreign Policy, Economic Plan, Ending the Fed & The Defense of our Liberties

A Interview with Doug Wead, Sr. Advisor for Dr. Ron Paul. Mr. Wead discusses Ron Pauls True Foreign Policy, Economic Plan & The Defense of our Liberties. Thi...

Ron Paul Hearing on the Fed's Inflationary Monetary Policy -- 3/17/11

- Order: Reorder

- Duration: 85:26

- Updated: 07 Nov 2013

- views: 3460

- author: CongressmanRonPaul

- published: 14 Nov 2012

- views: 3460

- author: CongressmanRonPaul

FED Chair Janet Yellen Press Conference On Monetary Policy And The Economy

- Order: Reorder

- Duration: 58:10

- Updated: 18 Sep 2015

- views: 49

- published: 18 Sep 2015

- views: 49

Fed's Policies Attack Capitalism & Liberty - GOLD is the Solution | Jim Willie (Part 1)

- Order: Reorder

- Duration: 31:35

- Updated: 16 Nov 2015

- views: 819

- published: 16 Nov 2015

- views: 819

Macro Principles Money Multiplier and Fed Policy

- Order: Reorder

- Duration: 31:51

- Updated: 30 Nov 2013

- views: 60

- author: Chris Martin

- published: 19 Nov 2013

- views: 60

- author: Chris Martin

"The Fed, Free Enterprise and Foreign Policy," Ron Paul. Introduction by Walter Block.

- Order: Reorder

- Duration: 67:22

- Updated: 03 Jan 2014

- views: 4275

- author: Walter Block

- published: 29 Nov 2011

- views: 4275

- author: Walter Block

What Is the Proper Role for Monetary Policy in Addressing Inequality?

- Order: Reorder

- Duration: 59:16

- Updated: 01 Sep 2014

- views: 1160

- author: Council on Foreign Relations

- published: 26 Jun 2014

- views: 1160

- author: Council on Foreign Relations

Policy Watch - Episode 184 | Impact of US Fed’s decision & Gold Bond/Monetisation Scheme

- Order: Reorder

- Duration: 28:06

- Updated: 18 Sep 2015

- views: 178

- published: 18 Sep 2015

- views: 178

Fed Policy and Economy Joe Guinan and Andy Busch

- Order: Reorder

- Duration: 24:19

- Updated: 06 Apr 2015

- views: 8

- published: 06 Apr 2015

- views: 8

The Federal Reserve Bank Conspiracy Explained - Century of Enslavement // Top Documentary Films

- Order: Reorder

- Duration: 90:12

- Updated: 02 Dec 2014

- views: 5

- published: 02 Dec 2014

- views: 5

Does the Fed Run America? Alan Greenspan: Federal Reserve Monetary Policy Report (1998)

- Order: Reorder

- Duration: 99:09

- Updated: 01 Dec 2015

- views: 13

- published: 01 Dec 2015

- views: 13

The Federal Reserve System, Economy & Monetary Policy: Fed Chair (2013)

- Order: Reorder

- Duration: 58:15

- Updated: 26 Jun 2015

- views: 14

- published: 26 Jun 2015

- views: 14

Greek Bond Sale w Yanis Varoufakis & Fed Policy w Tim Duy

- Order: Reorder

- Duration: 27:59

- Updated: 11 Dec 2015

- views: 97

- published: 11 Dec 2015

- views: 97

Globalization of Financial Markets: China, The Fed, and Future Policy Options

- Order: Reorder

- Duration: 85:09

- Updated: 23 Sep 2015

- views: 19

- published: 23 Sep 2015

- views: 19

Money, Banking and the Federal Reserve

- Order: Reorder

- Duration: 42:09

- Updated: 05 Sep 2014

- views: 975747

- author: misesmedia

- published: 22 Feb 2006

- views: 975747

- author: misesmedia

Panel: Impact of Fed Policy on Millenials

- Order: Reorder

- Duration: 23:55

- Updated: 15 Sep 2015

- views: 5

- published: 15 Sep 2015

- views: 5

Cleveland Fed Policy Summit 2012 - Sandra Pianalto Keynote Address

- Order: Reorder

- Duration: 24:43

- Updated: 18 Apr 2013

- views: 83

- author: ClevelandFed

- published: 01 Aug 2012

- views: 83

- author: ClevelandFed

Ron Pauls True Foreign Policy, Economic Plan, Ending the Fed & The Defense of our Liberties

- Order: Reorder

- Duration: 37:34

- Updated: 26 Aug 2014

- views: 1581

- author: The Story of Liberty

- published: 26 Jan 2012

- views: 1581

- author: The Story of Liberty

- Playlist

- Chat

- Playlist

- Chat

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

- published: 08 Oct 2015

- views: 117077

Macro 4.1- Money Market and FED Tools (Monetary Policy)

- published: 15 Mar 2012

- views: 63355

Bill Gross - 2016 US FED Policy, Stock Market And Investment Adice

- published: 25 Jan 2016

- views: 22

Nomi Prins-Fed Trapped in Money Printing Policy

- published: 22 Jul 2015

- views: 4318

The Tools of Monetary Policy

- published: 19 Jan 2012

- views: 56935

-

author:

Jason Welker

Add Playlist for this Author

Fed's Williams: Policy to Be Accommodative for Few Years

- published: 19 Oct 2015

- views: 313

BOMBSHELL! Federal Reserve Admits It's Monetary Policy Has Failed. By Gregory Mannarino

- published: 19 Aug 2015

- views: 1368

Failed Monetary Policy, US Economic Death Spiral, No Sept. Fed. Rate Hike. By Gregory Mannarino

- published: 17 Aug 2015

- views: 2375

Americans protest against U.S. Fed policy

- published: 23 Nov 2008

- views: 7504

-

author:

RussiaToday

Add Playlist for this Author

[382] How Fed policy contributed to the housing boom and bust

- published: 25 Jun 2015

- views: 170

Peter Schiff On The U.S. economy, Stocks, Fed Policy

- published: 27 Nov 2015

- views: 250

Mark Weisbrot Discusses Fed Policy & Interest Rates - Al Jazeera English

- published: 18 Sep 2015

- views: 72

[306] Beckworth on Jobs, the Taylor Rule and Fed Policy

- published: 06 Mar 2015

- views: 112

Ben Bernanke on Fed Policy, U.S. Housing Bubble

- published: 08 Oct 2015

- views: 167

- Playlist

- Chat

Investors Sell as FED's Policy Failure Becomes Apparent

- published: 25 Jan 2016

- views: 7

Jim Bruce Federal Reserve Rate Increase

- published: 25 Jan 2016

- views: 56

Weekend Review 1.24.16: VIX, TLT, USO, FXI, BABA, IBB, SPY, IWM, QQQ, AAPL, FB, AMZN, NFLX, GOOGL

- published: 25 Jan 2016

- views: 474

Weekend Review Supplimental 1.24.16: Banks (BAC, JPM, DB)

- published: 24 Jan 2016

- views: 140

Here Is What to Expect From the Federal Reserve’s January Policy Meeting

- published: 22 Jan 2016

- views: 73

Citigroup's Prepared for Market Volatility, CEO Says

- published: 22 Jan 2016

- views: 996

We will cause an Economic Collapse if you audit the FED - Bernanke

- published: 21 Jan 2016

- views: 3275

Periscope 1.8.15 LIVE Q&A; Session

- published: 09 Jan 2016

- views: 149

Periscope 1.13.15 LIVE Q&A; Session

- published: 13 Jan 2016

- views: 318

Periscope 1.20.15 LIVE Q&A; Session

- published: 21 Jan 2016

- views: 203

James Turk - The Fed will become technically insolvent with a rate hike

- published: 18 Jan 2016

- views: 6

Joseph Trevisani: Fed Monetary Policy--Quantitative Easing

- published: 12 Jan 2016

- views: 6

Weekend Review 1.10.16: VIX, TLT, USO, FXI, IBB, GILD, SPY, IWM, QQQ, AAPL, FB, AMZN, NFLX, GOOGL

- published: 11 Jan 2016

- views: 217

Fed planning to move very slowly on interest rates?

- published: 08 Jan 2016

- views: 92

- Playlist

- Chat

Ron Paul Hearing on the Fed's Inflationary Monetary Policy -- 3/17/11

- published: 14 Nov 2012

- views: 3460

-

author:

CongressmanRonPaul

Add Playlist for this Author

FED Chair Janet Yellen Press Conference On Monetary Policy And The Economy

- published: 18 Sep 2015

- views: 49

Fed's Policies Attack Capitalism & Liberty - GOLD is the Solution | Jim Willie (Part 1)

- published: 16 Nov 2015

- views: 819

Macro Principles Money Multiplier and Fed Policy

- published: 19 Nov 2013

- views: 60

-

author:

Chris Martin

Add Playlist for this Author

"The Fed, Free Enterprise and Foreign Policy," Ron Paul. Introduction by Walter Block.

- published: 29 Nov 2011

- views: 4275

-

author:

Walter Block

Add Playlist for this Author

What Is the Proper Role for Monetary Policy in Addressing Inequality?

- published: 26 Jun 2014

- views: 1160

-

author:

Council on Foreign Relations

Add Playlist for this Author

Policy Watch - Episode 184 | Impact of US Fed’s decision & Gold Bond/Monetisation Scheme

- published: 18 Sep 2015

- views: 178

Fed Policy and Economy Joe Guinan and Andy Busch

- published: 06 Apr 2015

- views: 8

The Federal Reserve Bank Conspiracy Explained - Century of Enslavement // Top Documentary Films

- published: 02 Dec 2014

- views: 5

Does the Fed Run America? Alan Greenspan: Federal Reserve Monetary Policy Report (1998)

- published: 01 Dec 2015

- views: 13

The Federal Reserve System, Economy & Monetary Policy: Fed Chair (2013)

- published: 26 Jun 2015

- views: 14

Greek Bond Sale w Yanis Varoufakis & Fed Policy w Tim Duy

- published: 11 Dec 2015

- views: 97

Globalization of Financial Markets: China, The Fed, and Future Policy Options

- published: 23 Sep 2015

- views: 19

Money, Banking and the Federal Reserve

- published: 22 Feb 2006

- views: 975747

-

author:

misesmedia

Add Playlist for this Author

Former Pentagon Chief Robert Gates Trashes GOP Candidate Slate On National Security Issues

Edit WorldNews.com 27 Jan 2016Wal-Mart Closings To Create 'Food Deserts' In 3 States

Edit WorldNews.com 27 Jan 2016

Galloway wins permission to sue Google

Edit BBC News 27 Jan 2016Syrian Opposition Group Demands Additional Conditions Prior To Peace Talks

Edit WorldNews.com 27 Jan 2016Trump refuses to debate; calls Fox's Megyn Kelly 'a lightweight'

Edit Chicago Sun-Times 27 Jan 2016Sexwork 2016 Policy Agenda For Legislators Policy Agenda provides a roadmap for legislators looking to understand the legislative consequences of decriminalizing sex work

Edit PR Newswire 28 Jan 2016New Campus Policy Updates Announced (Boise State University)

Edit Public Technologies 28 Jan 2016Council event policy blamed for wedding industry downturn

Edit Australian Broadcasting Corporation 28 Jan 2016Proposed new policy: If parents don’t show, kids can’t play.

Edit Atlanta Journal 28 Jan 2016Railways to introduce new hawker policy

Edit The Hindu 28 Jan 2016Obama, Sanders talk foreign policy, economy — and politics

Edit Rocky Mount Telegram 28 Jan 2016Youth summit gets under way

Edit The Hindu 28 Jan 2016Cantwell: ‘We Need to Update and Modernize Our Energy Policies’ (US Senate Committee on Energy ...

Edit Public Technologies 28 Jan 2016Centre doing a rethink on multi-brand retail FDI

Edit Yahoo Daily News 28 Jan 2016Cattle Industry Kicks off Annual Meeting and NCBA Trade Show in San Diego (National Cattlemen's ...

Edit Public Technologies 28 Jan 2016Making ‘Make in India’ meaningful

Edit Yahoo Daily News 28 Jan 2016Release of Canada's Energy Future 2016: Energy Supply and Demand Projections to 2040 (Embassy of ...

Edit Public Technologies 28 Jan 2016Presentation - Release of Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 ...

Edit Public Technologies 28 Jan 2016- 1

- 2

- 3

- 4

- 5

- Next page »