- published: 28 Oct 2011

- views: 100195

- author: Abu Musa

-

remove the playlistMonetary

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistMonetary

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 08 Oct 2015

- views: 115479

- published: 22 Aug 2013

- views: 2676

- author: The Atlantic

- published: 13 Jul 2015

- views: 77750

- published: 05 Apr 2012

- views: 34312

- published: 07 Mar 2012

- views: 139927

- author: Khan Academy

- published: 03 Sep 2011

- views: 53764

- author: APM Marketplace

- published: 06 May 2014

- views: 4210

- author: ACDCLeadership

- published: 10 Mar 2012

- views: 25036

- author: mouaan saeed

- published: 21 Jul 2013

- views: 40597

- author: Gold Silver Profits

- published: 19 Jan 2012

- views: 56935

- author: Jason Welker

- published: 28 Feb 2013

- views: 11506

- author: SubscriptionFreeTV

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy. It is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in hopes of avoiding the resulting distortions and deterioration of asset values.

Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

51:09

51:09International Monetary System - New Economic Slavery

International Monetary System - New Economic SlaveryInternational Monetary System - New Economic Slavery

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called mod... -

9:25

9:25What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

This week on Crash Course Economics, we're talking about monetary policy. The reality of the world is that the United States (and most of the world's economies) are, to varying degrees, Keynesian. When things go wrong, economically, the central bank of the country intervenes to try aand get things back on track. In the United States, the Federal Reserve is the organization that steps in to use monetary policy to steer the economy. When the Fed, as it's called, does step in, there are a few different tacks it can take. The Fed can change interest rates, or it can change the money supply. This is pretty interesting stuff, and it's what we're ge -

2:50

2:50Monetary Policy: A Quick and Dirty Explainer

Monetary Policy: A Quick and Dirty ExplainerMonetary Policy: A Quick and Dirty Explainer

What's the difference between fiscal policy and monetary policy? Of the hundreds of questions submitted by readers to our Economics in Plain English video se... -

3:33

3:33What Is The International Monetary Fund (IMF)?

What Is The International Monetary Fund (IMF)?What Is The International Monetary Fund (IMF)?

Will The European Union Fall Apart? BIT.LY LINK Subscribe! http://bitly.com/1iLOHml In June, Greece missed a deadline to pay back emergency loans from the International Monetary Fund. So, what is the IMF and what does it do? Learn More: Why the IMF was created and how it works https://www.imf.org/external/about.htm "The IMF, also known as the Fund, was conceived at a UN conference in Bretton Woods, New Hampshire, United States, in July 1944." IMF Members' Quotas and Voting Power, and IMF Board of Governors https://www.imf.org/external/np/sec/memdir/members.aspx "The Board of Governors, the highest decision-making body o -

71:32

71:3218. Monetary Policy

18. Monetary Policy18. Monetary Policy

Financial Markets (2011) (ECON 252) To begin the lecture, Professor Shiller explores the origins of central banking, from the goldsmith bankers in the United Kingdom to the founding of the Bank of England in 1694, which was a private institution that created stability in the U.K. financial system by requiring other banks to have deposits in it. Turning his attention to the U.S., Professor Shiller outlines the evolution of its banking system from the Suffolk System, via the National Banking era, to the founding of the Federal Reserve System in 1913. After presenting approaches to central banking in the European Union and in Japan, he emphasiz -

8:54

8:54Monetary and Fiscal Policy

Monetary and Fiscal PolicyMonetary and Fiscal Policy

Basic mechanics of monetary and fiscal policy More free lessons at: http://www.khanacademy.org/video?v=ntxMOKXHlfo. -

5:49

5:49Fiscal and Monetary Policy

Fiscal and Monetary PolicyFiscal and Monetary Policy

Often conflated, often confused, fiscal and monetary policies take very different approaches to influence the economy. And use two very different departments... -

3:59

3:59Fiscal & Monetary Policy Review- AP Macro

Fiscal & Monetary Policy Review- AP MacroFiscal & Monetary Policy Review- AP Macro

Mr. Clifford explains fiscal and monetary policy and how the economy adjust in the long run. -

115:11

115:11Sheikh Imran Hosein Islam & the International Monetary System

Sheikh Imran Hosein Islam & the International Monetary SystemSheikh Imran Hosein Islam & the International Monetary System

-

9:02

9:02Micro-documentary: How Our Monetary System Works And Fails

Micro-documentary: How Our Monetary System Works And FailsMicro-documentary: How Our Monetary System Works And Fails

Receive 3 exclusive reports for free at http://welcome.globalgold.ch Monetary history teaches us that governments always abuse their money-printing powers. D... -

16:30

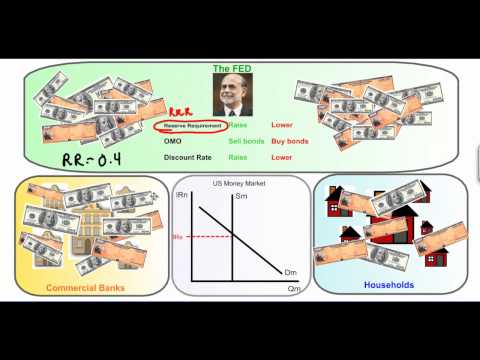

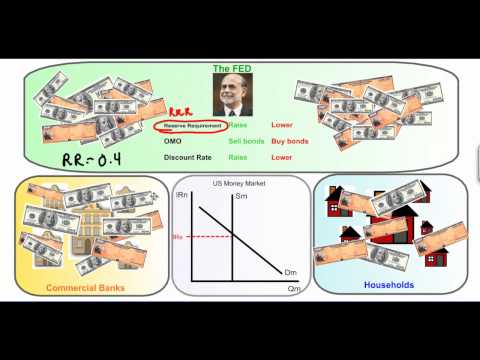

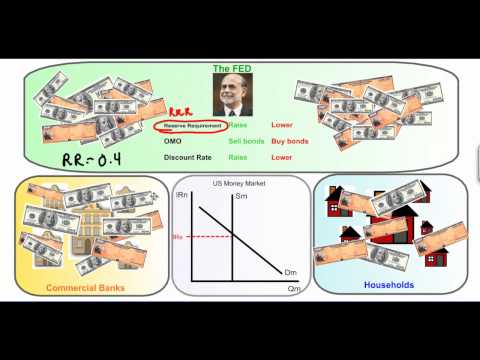

16:30The Tools of Monetary Policy

The Tools of Monetary PolicyThe Tools of Monetary Policy

This video lesson graphically presents the three tools Central Banks have at their disposal for managing the level of aggregate demand in the economy. Throug... -

79:29

79:29The Money Fix - A Monetary Reform Documentary

The Money Fix - A Monetary Reform DocumentaryThe Money Fix - A Monetary Reform Documentary

THE MONEY FIX is a feature-length documentary exploring our society's relationship with the almighty dollar. Money is at the intersection of nearly every asp... -

5:35

5:35Monetary Policy- EconMovies #9: Despicable Me

Monetary Policy- EconMovies #9: Despicable MeMonetary Policy- EconMovies #9: Despicable Me

EconMovies explain economic concepts through movies. In this episode, I use Despicable Me to explain monetary policy, interest rates, and the role of banks in the economy. Good luck studying economics. Oh, and don't mess with Janet Yellen. -

18:30

18:30Economics: Monetary Policies 1.1

Economics: Monetary Policies 1.1Economics: Monetary Policies 1.1

Ayussh deals with introduction to monetary policy. Please provide your honest feedback in the comments below. Also lets us know if you want Roman Saini to make economics video or should Ayussh continue. Download the PDFs of the video at http://instamojo.com/unacademy Visit us at http://upsc.unacademy.in and http://facebook.com/romansaini.official Video by Unacademy for IAS Preparation. How to prepare for IAS exam, Best IAS Coaching, IAS Civil Services Syllabus, Study Material for IAS Exam, IAS Civil Services Exam, UPSC Preparation, Tips for IAS, Material for IAS Preparation, UPSC Exam Material, IAS How to prepare, Other good resources: Mru

- Agricultural policy

- Alan Greenspan

- Argentina

- Australia

- Balance of payments

- Balance of trade

- Balanced budget

- Bank of England

- Bank of Japan

- Bank reserves

- Bank vault

- Barry Eichengreen

- Base money

- Ben Bernanke

- Benjamin M. Friedman

- Bond (finance)

- Brazil

- Bretton Woods system

- Budgetary policy

- Bulgaria

- Business cycles

- Canada

- Capital control

- Capital flow

- Category Government

- Central bank

- Chile

- China

- Colombia

- Commerce minister

- Commercial policy

- Consumer

- Consumer Price Index

- Corporation

- Cost push inflation

- Credit (finance)

- Credit Channel

- Credit quality

- Cultural policy

- Currency

- Currency board

- Currency union

- Czech Republic

- Defence policy

- Deficit spending

- Deflation

- Deposits

- Derivative (finance)

- Discount rate

- Discount window

- Dollarization

- Domestic policy

- Drug policy

- Drug policy reform

- Economic growth

- Economic policy

- Economy

- Economy of Estonia

- Education policy

- Energy policy

- Environmental policy

- Equities

- Estonia

- Exchange rate

- Exchange rate regime

- External debt

- Federal funds rate

- Federal Reserve

- Fiat money

- Finance minister

- Financial crisis

- Financial Times

- Fiscal adjustment

- Fiscal policy

- Fiscal union

- Fixed exchange rate

- Food policy

- Foreign policy

- Fractional reserve

- Free trade

- Friedrich von Hayek

- Futures contract

- Gains from trade

- Gold reserve

- Gold standard

- Government borrowing

- Government budget

- Government debt

- Government revenue

- Government spending

- Great Depression

- Greenspan put

- Health policy

- Hong Kong

- Housing policy

- Hungary

- Hyperinflation

- Iceland

- Immigration policy

- Incomes policy

- India

- Industrial policy

- Inflation

- Inflation targeting

- Interbank rate

- Interest

- Interest rate

- Interest rates

- Internal debt

- Investment policy

- Jiaozi (currency)

- John B. Taylor

- Kenneth Rogoff

- Keynesian economics

- Knowledge policy

- Language policy

- Ludwig von Mises

- Macroeconomic model

- Mandatory spending

- Marginal benefit

- Marginal cost

- Marginal revolution

- Milton Friedman

- Monetarism

- Monetarist

- Monetary authority

- Monetary base

- Monetary economics

- Monetary policy

- Monetary reform

- Money supply

- Multiplier effect

- New Zealand

- Nigeria

- Nixon shock

- Non-tariff barrier

- Non-tax revenue

- Norway

- Option (finance)

- Output gap

- Paper money

- Paul Volcker

- Philippines

- Poland

- Policy analysis

- Policy credibility

- Policy mix

- Policy studies

- Promissory notes

- Protectionism

- Public finance

- Public policy

- Quantitative easing

- Recession

- Regulation

- Renminbi

- Reserve requirement

- Science policy

- Seigniorage

- Social policy

- South Africa

- Space policy

- Speculation

- Stanford University

- Supply of money

- Swap (finance)

- Sweden

- Tariff

- Tax

- Tax policy

- Tax revenue

- Taylor rule

- Technology policy

- Time inconsistency

- Trade bloc

- Trade creation

- Trade diversion

- Trade policy

- Trading band

- Turkey

- Unemployment

- United Kingdom

- Vaccination policy

- World War II

- Yuan Dynasty

-

International Monetary System - New Economic Slavery

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called mod... -

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

This week on Crash Course Economics, we're talking about monetary policy. The reality of the world is that the United States (and most of the world's economies) are, to varying degrees, Keynesian. When things go wrong, economically, the central bank of the country intervenes to try aand get things back on track. In the United States, the Federal Reserve is the organization that steps in to use mon -

Monetary Policy: A Quick and Dirty Explainer

What's the difference between fiscal policy and monetary policy? Of the hundreds of questions submitted by readers to our Economics in Plain English video se... -

What Is The International Monetary Fund (IMF)?

Will The European Union Fall Apart? BIT.LY LINK Subscribe! http://bitly.com/1iLOHml In June, Greece missed a deadline to pay back emergency loans from the International Monetary Fund. So, what is the IMF and what does it do? Learn More: Why the IMF was created and how it works https://www.imf.org/external/about.htm "The IMF, also known as the Fund, was conceived at a UN conference -

18. Monetary Policy

Financial Markets (2011) (ECON 252) To begin the lecture, Professor Shiller explores the origins of central banking, from the goldsmith bankers in the United Kingdom to the founding of the Bank of England in 1694, which was a private institution that created stability in the U.K. financial system by requiring other banks to have deposits in it. Turning his attention to the U.S., Professor Shiller -

Monetary and Fiscal Policy

Basic mechanics of monetary and fiscal policy More free lessons at: http://www.khanacademy.org/video?v=ntxMOKXHlfo. -

Fiscal and Monetary Policy

Often conflated, often confused, fiscal and monetary policies take very different approaches to influence the economy. And use two very different departments... -

Fiscal & Monetary Policy Review- AP Macro

Mr. Clifford explains fiscal and monetary policy and how the economy adjust in the long run. -

Sheikh Imran Hosein Islam & the International Monetary System

-

Micro-documentary: How Our Monetary System Works And Fails

Receive 3 exclusive reports for free at http://welcome.globalgold.ch Monetary history teaches us that governments always abuse their money-printing powers. D... -

The Tools of Monetary Policy

This video lesson graphically presents the three tools Central Banks have at their disposal for managing the level of aggregate demand in the economy. Throug... -

The Money Fix - A Monetary Reform Documentary

THE MONEY FIX is a feature-length documentary exploring our society's relationship with the almighty dollar. Money is at the intersection of nearly every asp... -

Monetary Policy- EconMovies #9: Despicable Me

EconMovies explain economic concepts through movies. In this episode, I use Despicable Me to explain monetary policy, interest rates, and the role of banks in the economy. Good luck studying economics. Oh, and don't mess with Janet Yellen. -

Economics: Monetary Policies 1.1

Ayussh deals with introduction to monetary policy. Please provide your honest feedback in the comments below. Also lets us know if you want Roman Saini to make economics video or should Ayussh continue. Download the PDFs of the video at http://instamojo.com/unacademy Visit us at http://upsc.unacademy.in and http://facebook.com/romansaini.official Video by Unacademy for IAS Preparation. How to p -

Macro 4.3- Graphing Monetary Policy Practice (AP Macroeconomics)

Mr. Clifford explains how the Fed uses monetary policy to adjust interests rates and shift aggregate demand. -

L1/P2: Banking-Monetary Policy Introduction, CRR, SLR, OMO

1. Evolution from Barter system to Money system 2. What are Financial Intermediaries? 3. What is Monetary Policy? 4. Dear vs Cheap Money policy during Inflation vs Deflation 5. What are the tools of Monetary Policy? 6. Time and Demand liabilities of a Bank 7. NDTL, CRR, SLR- purpose, features 8. OMO:Open Market Operation -

(Macro) Episode 32: Monetary Policy

This video gives a brief overview of the Fed's three monetary policy tools: Open Market Operations, the Required Reserve Ratio, and the Discount Rate. "(Macr... -

Macro 4.1- Money Market and FED Tools (Monetary Policy)

Mr. Clifford explains the supply and demand for money and the three tools that the FED uses to adjust the money supply -

Monetary and Fiscal Policy of India

This Lecture talks about Monetary and Fiscal Policy of India -

The Monetary Model of Exchange Rates

A short video on the Monetary Model of Exchange Rates under both fixed and floating exchange rates. -

Macro 4.2- Monetary Policy and Aggregate Demand

Mr. Clifford explains how to connect the supply and demand for money to aggregate demand and supply. -

AS 21) Monetary Policy (Interest Rates, Money Supply and Exchange Rate)

Monetary Policy (Interest Rates, Money Supply and Exchange Rate) - An understanding of how monetary policy works with reference to central bank inflation tar... -

Sheikh Imran Hosein - 20130223 The International Monetary System & Future of money

British and American policy makers began to plan the post war international monetary system in the early 1940s. The objective was to create an order that com...

International Monetary System - New Economic Slavery

- published: 28 Oct 2011

- views: 100195

- author: Abu Musa

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

- Order: Reorder

- Duration: 9:25

- Updated: 08 Oct 2015

- views: 115479

- published: 08 Oct 2015

- views: 115479

Monetary Policy: A Quick and Dirty Explainer

- Order: Reorder

- Duration: 2:50

- Updated: 13 Aug 2014

- views: 2676

- author: The Atlantic

- published: 22 Aug 2013

- views: 2676

- author: The Atlantic

What Is The International Monetary Fund (IMF)?

- Order: Reorder

- Duration: 3:33

- Updated: 13 Jul 2015

- views: 77750

- published: 13 Jul 2015

- views: 77750

18. Monetary Policy

- Order: Reorder

- Duration: 71:32

- Updated: 05 Apr 2012

- views: 34312

- published: 05 Apr 2012

- views: 34312

Monetary and Fiscal Policy

- Order: Reorder

- Duration: 8:54

- Updated: 06 Sep 2014

- views: 139927

- author: Khan Academy

- published: 07 Mar 2012

- views: 139927

- author: Khan Academy

Fiscal and Monetary Policy

- Order: Reorder

- Duration: 5:49

- Updated: 04 Sep 2014

- views: 53764

- author: APM Marketplace

- published: 03 Sep 2011

- views: 53764

- author: APM Marketplace

Fiscal & Monetary Policy Review- AP Macro

- Order: Reorder

- Duration: 3:59

- Updated: 31 Aug 2014

- views: 4210

- author: ACDCLeadership

- published: 06 May 2014

- views: 4210

- author: ACDCLeadership

Sheikh Imran Hosein Islam & the International Monetary System

- Order: Reorder

- Duration: 115:11

- Updated: 05 Sep 2014

- views: 25036

- author: mouaan saeed

- published: 10 Mar 2012

- views: 25036

- author: mouaan saeed

Micro-documentary: How Our Monetary System Works And Fails

- Order: Reorder

- Duration: 9:02

- Updated: 29 Aug 2014

- views: 40597

- author: Gold Silver Profits

- published: 21 Jul 2013

- views: 40597

- author: Gold Silver Profits

The Tools of Monetary Policy

- Order: Reorder

- Duration: 16:30

- Updated: 29 Aug 2014

- views: 56935

- author: Jason Welker

- published: 19 Jan 2012

- views: 56935

- author: Jason Welker

The Money Fix - A Monetary Reform Documentary

- Order: Reorder

- Duration: 79:29

- Updated: 29 Aug 2014

- views: 11506

- author: SubscriptionFreeTV

- published: 28 Feb 2013

- views: 11506

- author: SubscriptionFreeTV

Monetary Policy- EconMovies #9: Despicable Me

- Order: Reorder

- Duration: 5:35

- Updated: 02 Nov 2015

- views: 2250

- published: 02 Nov 2015

- views: 2250

Economics: Monetary Policies 1.1

- Order: Reorder

- Duration: 18:30

- Updated: 04 Sep 2015

- views: 2549

- published: 04 Sep 2015

- views: 2549

Macro 4.3- Graphing Monetary Policy Practice (AP Macroeconomics)

- Order: Reorder

- Duration: 2:45

- Updated: 31 Aug 2014

- views: 32963

- author: ACDCLeadership

- published: 15 Mar 2012

- views: 32963

- author: ACDCLeadership

L1/P2: Banking-Monetary Policy Introduction, CRR, SLR, OMO

- Order: Reorder

- Duration: 51:52

- Updated: 18 Jan 2015

- views: 7

- published: 18 Jan 2015

- views: 7

(Macro) Episode 32: Monetary Policy

- published: 12 Nov 2009

- views: 120533

- author: mjmfoodie

Macro 4.1- Money Market and FED Tools (Monetary Policy)

- Order: Reorder

- Duration: 5:21

- Updated: 15 Mar 2012

- views: 63355

- published: 15 Mar 2012

- views: 63355

Monetary and Fiscal Policy of India

- Order: Reorder

- Duration: 55:49

- Updated: 30 Oct 2014

- views: 55

- published: 30 Oct 2014

- views: 55

The Monetary Model of Exchange Rates

- Order: Reorder

- Duration: 7:51

- Updated: 18 Mar 2015

- views: 1

- published: 18 Mar 2015

- views: 1

Macro 4.2- Monetary Policy and Aggregate Demand

- Order: Reorder

- Duration: 3:21

- Updated: 04 Sep 2014

- views: 39786

- author: ACDCLeadership

- published: 15 Mar 2012

- views: 39786

- author: ACDCLeadership

AS 21) Monetary Policy (Interest Rates, Money Supply and Exchange Rate)

- Order: Reorder

- Duration: 9:35

- Updated: 19 Aug 2014

- views: 4094

- author: EconplusDal

- published: 17 Apr 2014

- views: 4094

- author: EconplusDal

Sheikh Imran Hosein - 20130223 The International Monetary System & Future of money

- published: 23 Feb 2013

- views: 31597

- author: icemaker

-

Dr Sant's speech on the "Joint debate - Economic and Monetary Union".

-

International monetary fund

Brief explanation of the IMF for final project. -

Charles Grant responds to a question to Max on monetary union

Charles Grant is Director at Centre for European Reform -

CBDT increases monetary limit for court appeal by I-T to 10 lakhs

Central Board of Direct Taxes (CBDT) has issued a fresh directive asking the Income Tax Department to go into appeal at ITAT only when the "tax effect" in question is Rs 10 lakh (from earlier Rs 4 lakh) and Rs 20 lakh (from earlier Rs 10 lakh) if the appeal is to be filed in a High Court. Connect with Puthiya Thalaimurai TV Online: SUBSCRIBE to get the latest updates : http://bit.ly/1O4soYP Vi -

The Death of Money - China and the International Monetary Fund Ready to Move Away from the Dollar

The Death of Money - China and the International Monetary Fund Ready to Move Away from the Dollar The Coming Collapse of the International Monetary System James Rickards -

monetary chanter sentire sidewalk

One world. All languages are beautiful..Combination of languages is the greatest joy of our lives. World music stage. -

Elizabeth Kucinich speaks on monetary Reform at the AMI Conference in Chicago.

Elizabeth Kucinich, a major factor in creating and promoting Dennis Kucinich's NEED Act (National Emergency Employment Defense Act) discusses monetary reform at the 8th annual American Monetary Institute Money Reform Conference at University Center in Chicago. Elizabeth has focused on monetary Reform starting from age 18! See http://www.monetary.org for details on the 12th Annual Monetary Reform C -

[442] Gerald Posner on the Vatican Bank, Scott Sumner on Monetary Policy

The Federal Trade Commission is reportedly investigating whether Google has been using its Android mobile operating system to curb competition. And this . The Federal Trade Commission is reportedly investigating whether Google has been using its Android mobile operating system to curb competition. And this . ORIGINAL AIR DATE: WEDNESDAY, APRIL 1 Erin sits down with Gerald Posner – author of “God -

International Monetary System New Economic Slavery

A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called modern day . A brief about paper money, 1. How paper money is created 2. policy of using it, 3. debt, 4. inflation 5. Interest International Monetary system is called modern day . A brief about paper money, 1. How paper money is created 2. -

Terrorism lies masking major monetary developments: gold, silver, the yuan and the ruble

Today on The Janssen Report: While we are bombarded (literally and figuratively) with terrorism lies, major events are going on in the monetary system. Watch the video to find out more… Sources: - http://sputniknews.com/politics/20151205/1031294555/gold-ruble-yuan-global-dedolarization.html#ixzz3ta9Jy7PT - http://money.cnn.com/2015/12/02/news/economy/janet-yellen-fed-december/ - http://investmen -

Policy Watch – Episode 196 | New GDP data & Monetary Policy review

Policy Watch analyses the major economic developments that have taken place in the country with subject experts. In this week's episode we discuss the new macro-economic indices; RBI’s Monetary Policy review and what all needs to be done to keep the momentum up. Guests: Dr. Shubhada Rao, Chief Economist, Yes Bank ; Suchita Singla, Associate Director, Credit & Market Research, India Ratings & Rese -

RBI Independence: Monetary Policy Committee

Issues relating to RBI and Monetary Policy is regularly asked in the UPSC examinations. This year this takes on a special relevance for aspirants due to the controversy that has erupted over the Monetary Policy Committee and the supposed assault on the Independence of the Central Bank. It is quite likely that questions requiring analysis of the MPC structure and the concept of Central bank Indepen -

Alan Greenspan: The Federal Reserve, Economics, Finance & Monetary Policy (1990)

On October 7, 2008, the Federal Reserve further expanded the collateral it will loan against to include commercial paper using the new Commercial Paper Funding Facility (CPFF). The action made the Fed a crucial source of credit for non-financial businesses in addition to commercial banks and investment firms. Fed officials said they'll buy as much of the debt as necessary to get the market functio -

Home Minister Centre To Give Monetary Help To Rain Hit Tn

- -

The Big Picture – GDP numbers & Monetary Policy

Guests: S P Sharma, Chief of Economist, PHD Chamber of Commerce & Industry ; Renu Kohli, Former Staff Member, RBI & International Monetary Fund (IMF) ; Priya Ranjan Dash, Senior Journalist ; Ajay Dua, Former Secretary, Ministry of Commerce & Industry Anchor: Frank Pereira Air date: Dec 1, 2015 -

Experts view on RBI monetary policy review

The Reserve Bank of India kept its key lending rate unchanged on Tuesday, leaving the door open for more easing in the future. Watch more videos: http://www.ndtv.com/video?yt Download the NDTV news app: https://play.google.com/store/apps/details?id=com.july.ndtv&referrer;=utm_source%3Dyoutubecards%26utm_medium%3Dcpc%26utm_campaign%3Dyoutube

Dr Sant's speech on the "Joint debate - Economic and Monetary Union".

- Order: Reorder

- Duration: 1:50

- Updated: 15 Dec 2015

- views: 8

- published: 15 Dec 2015

- views: 8

International monetary fund

- Order: Reorder

- Duration: 3:59

- Updated: 14 Dec 2015

- views: 16

- published: 14 Dec 2015

- views: 16

Charles Grant responds to a question to Max on monetary union

- Order: Reorder

- Duration: 4:19

- Updated: 14 Dec 2015

- views: 0

- published: 14 Dec 2015

- views: 0

CBDT increases monetary limit for court appeal by I-T to 10 lakhs

- Order: Reorder

- Duration: 1:00

- Updated: 14 Dec 2015

- views: 83

- published: 14 Dec 2015

- views: 83

The Death of Money - China and the International Monetary Fund Ready to Move Away from the Dollar

- Order: Reorder

- Duration: 2:02

- Updated: 14 Dec 2015

- views: 3

- published: 14 Dec 2015

- views: 3

monetary chanter sentire sidewalk

- Order: Reorder

- Duration: 4:10

- Updated: 14 Dec 2015

- views: 0

- published: 14 Dec 2015

- views: 0

Elizabeth Kucinich speaks on monetary Reform at the AMI Conference in Chicago.

- Order: Reorder

- Duration: 45:16

- Updated: 13 Dec 2015

- views: 9

- published: 13 Dec 2015

- views: 9

[442] Gerald Posner on the Vatican Bank, Scott Sumner on Monetary Policy

- Order: Reorder

- Duration: 37:39

- Updated: 11 Dec 2015

- views: 1

- published: 11 Dec 2015

- views: 1

International Monetary System New Economic Slavery

- Order: Reorder

- Duration: 206:30

- Updated: 09 Dec 2015

- views: 1

- published: 09 Dec 2015

- views: 1

Terrorism lies masking major monetary developments: gold, silver, the yuan and the ruble

- Order: Reorder

- Duration: 12:16

- Updated: 07 Dec 2015

- views: 226

- published: 07 Dec 2015

- views: 226

Policy Watch – Episode 196 | New GDP data & Monetary Policy review

- Order: Reorder

- Duration: 27:39

- Updated: 07 Dec 2015

- views: 914

- published: 07 Dec 2015

- views: 914

RBI Independence: Monetary Policy Committee

- Order: Reorder

- Duration: 53:05

- Updated: 07 Dec 2015

- views: 965

- published: 07 Dec 2015

- views: 965

Alan Greenspan: The Federal Reserve, Economics, Finance & Monetary Policy (1990)

- Order: Reorder

- Duration: 126:20

- Updated: 05 Dec 2015

- views: 0

- published: 05 Dec 2015

- views: 0

Home Minister Centre To Give Monetary Help To Rain Hit Tn

- Order: Reorder

- Duration: 1:55

- Updated: 02 Dec 2015

- views: 11

- published: 02 Dec 2015

- views: 11

The Big Picture – GDP numbers & Monetary Policy

- Order: Reorder

- Duration: 27:01

- Updated: 02 Dec 2015

- views: 238

- published: 02 Dec 2015

- views: 238

Experts view on RBI monetary policy review

- Order: Reorder

- Duration: 25:23

- Updated: 01 Dec 2015

- views: 18

- published: 01 Dec 2015

- views: 18

-

Monetary Warfare & The Tianjin China Event -- Bill Holter

What may go down as the biggest geopolitical false flag event since 9/11, the Tianjin, China explosions will remain a critical topic of conversation for some time because the Chinese government still cannot determine what caused the blast the melted more than 8,000 cars, multiple buildings and the deaths of more than 110 people, with 90 still missing and presumed dead. Bill Holter asks the questi -

Fourth Bi-Monthly Monetary Policy Press Conference 2015-2016, September 29, 2015

Governor, Reserve Bank of India’s Press Conference -

A new era for monetary policy - Adair Turner

http://www.positivemoney.org/ A high-level workshop "A new era for monetary policy" with Lord Turner, a Senior Fellow at the Institute of New Economic Thinking took place on October 7th 2014 in London to explore new thinking on debt, economic instability, and monetary policy. This small, high-level workshop has brought together economic thinkers from civil society, trade unions, business, and pol -

Bill Mitchell: Demystifying Modern Monetary Theory

In a challenge to conventional views on modern monetary and fiscal policy, Professor Bill Mitchell of Newcastle University in Australia has emerged as one of the foremost exponents of Modern Monetary Theory (MMT), a heterodox challenge to the prevailing paradigms which dominate how mainstream economics is taught and economic policy implemented. In his works, and the interview below, Mitchell pres -

Monetary Restoration - Bill Schnoebelen

This is an important teaching which goes into depth about the un-Biblical practices which have brought the US to the brink of financial ruin and what we - as believers - can do to provide Biblical solutions. If you are worried about the current monetary crisis, you need to see this! If you appreciate the content of this video, please consider sending a donation to Bill Schnoebelen's ministry, wi -

The Money Masters - #1 Best Monetary (Money) HIstory Available - Full Length

This is by far one of, if not the, best movie on the history of the monetary system! The content is amazing while the aesthetics & cinematography are not exa... -

Peter Schiff at Jackson Hole Summit: The Monetary Roach Motel

Peter Schiff's speech at The Jackson Hole Summit 8/28/15 "Monetary Roach Motel: There Is No Exit from the Fed’s Stimulus" Learn more about the Summit: http://jacksonholesummit.org Sign up for my free newsletter: http://www.europac.net/subscribe_free_reports Peter Schiff Gold News: http://www.SchiffGold.com/news Buy my newest book at http://www.tinyurl.com/RealCrash Friend me on http://www.Facebo -

CFA 2013 Level1 Videos19 Monetary and Fiscal Policy

-

F. A. Hayek on Monetary Policy, the Gold Standard, Deficits, Inflation, and John Maynard Keynes

Nobel laureate F. A. Hayek was one of the world’s leading free-market economists and social philosophers. In this video from 1984, Hayek is interviewed at the University of Freiburg in Germany by James U. Blanchard III, chairman of the National Committee for Monetary Reform and a member of the Cato Institute’s Board of Directors. A transcript of this interview can be found here: http://bit.ly/1 -

Why Monetary Reform Must Become Your Number One Issue

Joe Bongiovanni discusses our monetary system and why fixing it is the single most important issue facing people and the planet. Joe explains how money is cr... -

Warren Mosler: What Modern Monetary Theory Tells Us About Economic Policy

Welcome to our new video series called "New Economic Thinking." The series will feature dozens of conversations with leading economists on the most important... -

Economics 470 - Monetary Theory and Policy - Fall 2009 - Tuesday 9/29/2009 - Lecture 1

Economics 470 - Monetary Theory and Policy - Fall 2009 - Tuesday 9/29/2009 - Lecture 1. -

The Death of Money: The Coming Collapse of the International Monetary System (Audio 1 of 4)

Written by James Rickards. "The next financial collapse will resemble nothing in history. . . . Deciding upon the best course to follow will require comprehending a minefield of risks, while poised at a crossroads, pondering the death of the dollar." The international monetary system has collapsed three times in the past hundred years, in 1914, 1939, and 1971. Each collapse was followed by a per -

Jesus Chatline - No Monetary Compensation (October 8, 2012)

NEVAR 4GET JCL YOU'LL BE DA BEST FOREVER doing it 〉FOR FREE since before it was cool -

Davos 2014 - The Future of Monetary Policy

Central banks around the world took extraordinary measures to reboot the global economy. What are efficient and responsible options for ending monetary stimulus? Dimensions to be addressed: - Communicating with the market - Moderating employment implications - Mitigating global ramifications · Thomas J. Jordan, Chairman of the Governing Board, Swiss National Bank, Switzerland · Haruhiko Kuroda -

Economics 1 - Lecture 20: Fiscal and Monetary Policy Combine

Introduction to Economics.

Monetary Warfare & The Tianjin China Event -- Bill Holter

- Order: Reorder

- Duration: 28:48

- Updated: 17 Aug 2015

- views: 1365

- published: 17 Aug 2015

- views: 1365

Fourth Bi-Monthly Monetary Policy Press Conference 2015-2016, September 29, 2015

- Order: Reorder

- Duration: 0:00

- Updated: 24 Sep 2015

- views: 1

- published: 24 Sep 2015

- views: 1

A new era for monetary policy - Adair Turner

- Order: Reorder

- Duration: 56:32

- Updated: 17 Feb 2015

- views: 125

- published: 17 Feb 2015

- views: 125

Bill Mitchell: Demystifying Modern Monetary Theory

- Order: Reorder

- Duration: 22:43

- Updated: 28 Dec 2014

- views: 152

- published: 28 Dec 2014

- views: 152

Monetary Restoration - Bill Schnoebelen

- Order: Reorder

- Duration: 92:50

- Updated: 10 Nov 2014

- views: 35

- published: 10 Nov 2014

- views: 35

The Money Masters - #1 Best Monetary (Money) HIstory Available - Full Length

- Order: Reorder

- Duration: 209:20

- Updated: 29 Jan 2014

- views: 298

- author: eBuy Bitcoin

- published: 11 Nov 2013

- views: 298

- author: eBuy Bitcoin

Peter Schiff at Jackson Hole Summit: The Monetary Roach Motel

- Order: Reorder

- Duration: 23:30

- Updated: 24 Sep 2015

- views: 2772

- published: 24 Sep 2015

- views: 2772

CFA 2013 Level1 Videos19 Monetary and Fiscal Policy

- Order: Reorder

- Duration: 57:20

- Updated: 22 Mar 2014

- views: 1774

- published: 22 Mar 2014

- views: 1774

F. A. Hayek on Monetary Policy, the Gold Standard, Deficits, Inflation, and John Maynard Keynes

- Order: Reorder

- Duration: 26:28

- Updated: 29 Apr 2015

- views: 715

- published: 29 Apr 2015

- views: 715

Why Monetary Reform Must Become Your Number One Issue

- published: 29 Sep 2013

- views: 4120

- author: argusfest

Warren Mosler: What Modern Monetary Theory Tells Us About Economic Policy

- Order: Reorder

- Duration: 26:05

- Updated: 05 Sep 2014

- views: 10534

- author: INETeconomics

- published: 23 Jul 2013

- views: 10534

- author: INETeconomics

Economics 470 - Monetary Theory and Policy - Fall 2009 - Tuesday 9/29/2009 - Lecture 1

- Order: Reorder

- Duration: 77:16

- Updated: 20 Jul 2014

- views: 15786

- author: Mark Thoma

- published: 29 Sep 2009

- views: 15786

- author: Mark Thoma

The Death of Money: The Coming Collapse of the International Monetary System (Audio 1 of 4)

- Order: Reorder

- Duration: 219:34

- Updated: 04 Feb 2015

- views: 0

- published: 04 Feb 2015

- views: 0

Jesus Chatline - No Monetary Compensation (October 8, 2012)

- Order: Reorder

- Duration: 87:32

- Updated: 10 Jan 2015

- views: 542

- published: 10 Jan 2015

- views: 542

Davos 2014 - The Future of Monetary Policy

- Order: Reorder

- Duration: 63:50

- Updated: 01 Feb 2014

- views: 7326

- published: 01 Feb 2014

- views: 7326

Economics 1 - Lecture 20: Fiscal and Monetary Policy Combine

- Order: Reorder

- Duration: 46:17

- Updated: 04 Sep 2014

- views: 23770

- author: UCBerkeley

- published: 09 Nov 2011

- views: 23770

- author: UCBerkeley

- Playlist

- Chat

- Playlist

- Chat

International Monetary System - New Economic Slavery

- published: 28 Oct 2011

- views: 100195

-

author:

Abu Musa

Add Playlist for this Author

What's all the Yellen About? Monetary Policy and the Federal Reserve: Crash Course Economics #10

- published: 08 Oct 2015

- views: 115479

Monetary Policy: A Quick and Dirty Explainer

- published: 22 Aug 2013

- views: 2676

-

author:

The Atlantic

Add Playlist for this Author

What Is The International Monetary Fund (IMF)?

- published: 13 Jul 2015

- views: 77750

18. Monetary Policy

- published: 05 Apr 2012

- views: 34312

Monetary and Fiscal Policy

- published: 07 Mar 2012

- views: 139927

-

author:

Khan Academy

Add Playlist for this Author

Fiscal and Monetary Policy

- published: 03 Sep 2011

- views: 53764

-

author:

APM Marketplace

Add Playlist for this Author

Fiscal & Monetary Policy Review- AP Macro

- published: 06 May 2014

- views: 4210

-

author:

ACDCLeadership

Add Playlist for this Author

Sheikh Imran Hosein Islam & the International Monetary System

- published: 10 Mar 2012

- views: 25036

-

author:

mouaan saeed

Add Playlist for this Author

Micro-documentary: How Our Monetary System Works And Fails

- published: 21 Jul 2013

- views: 40597

-

author:

Gold Silver Profits

Add Playlist for this Author

The Tools of Monetary Policy

- published: 19 Jan 2012

- views: 56935

-

author:

Jason Welker

Add Playlist for this Author

The Money Fix - A Monetary Reform Documentary

- published: 28 Feb 2013

- views: 11506

-

author:

SubscriptionFreeTV

Add Playlist for this Author

Monetary Policy- EconMovies #9: Despicable Me

- published: 02 Nov 2015

- views: 2250

Economics: Monetary Policies 1.1

- published: 04 Sep 2015

- views: 2549

- Playlist

- Chat

Dr Sant's speech on the "Joint debate - Economic and Monetary Union".

- published: 15 Dec 2015

- views: 8

International monetary fund

- published: 14 Dec 2015

- views: 16

Charles Grant responds to a question to Max on monetary union

- published: 14 Dec 2015

- views: 0

CBDT increases monetary limit for court appeal by I-T to 10 lakhs

- published: 14 Dec 2015

- views: 83

The Death of Money - China and the International Monetary Fund Ready to Move Away from the Dollar

- published: 14 Dec 2015

- views: 3

monetary chanter sentire sidewalk

- published: 14 Dec 2015

- views: 0

Elizabeth Kucinich speaks on monetary Reform at the AMI Conference in Chicago.

- published: 13 Dec 2015

- views: 9

[442] Gerald Posner on the Vatican Bank, Scott Sumner on Monetary Policy

- published: 11 Dec 2015

- views: 1

International Monetary System New Economic Slavery

- published: 09 Dec 2015

- views: 1

Terrorism lies masking major monetary developments: gold, silver, the yuan and the ruble

- published: 07 Dec 2015

- views: 226

Policy Watch – Episode 196 | New GDP data & Monetary Policy review

- published: 07 Dec 2015

- views: 914

RBI Independence: Monetary Policy Committee

- published: 07 Dec 2015

- views: 965

Alan Greenspan: The Federal Reserve, Economics, Finance & Monetary Policy (1990)

- published: 05 Dec 2015

- views: 0

Home Minister Centre To Give Monetary Help To Rain Hit Tn

- published: 02 Dec 2015

- views: 11

- Playlist

- Chat

Monetary Warfare & The Tianjin China Event -- Bill Holter

- published: 17 Aug 2015

- views: 1365

Fourth Bi-Monthly Monetary Policy Press Conference 2015-2016, September 29, 2015

- published: 24 Sep 2015

- views: 1

A new era for monetary policy - Adair Turner

- published: 17 Feb 2015

- views: 125

Bill Mitchell: Demystifying Modern Monetary Theory

- published: 28 Dec 2014

- views: 152

Monetary Restoration - Bill Schnoebelen

- published: 10 Nov 2014

- views: 35

The Money Masters - #1 Best Monetary (Money) HIstory Available - Full Length

- published: 11 Nov 2013

- views: 298

-

author:

eBuy Bitcoin

Add Playlist for this Author

Peter Schiff at Jackson Hole Summit: The Monetary Roach Motel

- published: 24 Sep 2015

- views: 2772

CFA 2013 Level1 Videos19 Monetary and Fiscal Policy

- published: 22 Mar 2014

- views: 1774

F. A. Hayek on Monetary Policy, the Gold Standard, Deficits, Inflation, and John Maynard Keynes

- published: 29 Apr 2015

- views: 715

Why Monetary Reform Must Become Your Number One Issue

- published: 29 Sep 2013

- views: 4120

-

author:

argusfest

Add Playlist for this Author

Warren Mosler: What Modern Monetary Theory Tells Us About Economic Policy

- published: 23 Jul 2013

- views: 10534

-

author:

INETeconomics

Add Playlist for this Author

Economics 470 - Monetary Theory and Policy - Fall 2009 - Tuesday 9/29/2009 - Lecture 1

- published: 29 Sep 2009

- views: 15786

-

author:

Mark Thoma

Add Playlist for this Author

The Death of Money: The Coming Collapse of the International Monetary System (Audio 1 of 4)

- published: 04 Feb 2015

- views: 0

Jesus Chatline - No Monetary Compensation (October 8, 2012)

- published: 10 Jan 2015

- views: 542

-

Lyrics list:text lyricsplay full screenplay karaoke

Feds Charge Martin Shkreli With Running Pharmaceutical Companies Like Ponzi Scheme

Edit WorldNews.com 17 Dec 2015Giant Salamander Believed To Be 200 Years Old Found In Chinese Cave

Edit WorldNews.com 16 Dec 2015Leishmaniasis: What is the 'flesh-eating' disease that's spreading across Syria?

Edit The Independent 17 Dec 2015Alleged Gun Buyer In San Bernardino Rampage To Be Charged Today, Officials Say

Edit WorldNews.com 17 Dec 2015Apple Names Jeff Williams – "The Guy That Makes Apple Run" Company's New COO

Edit WorldNews.com 17 Dec 2015Effects of starting to end cheap money to be seen

Edit China Daily 18 Dec 2015report

Edit Topix 18 Dec 2015Fed’s liftoff ends uncertainty

Edit The Hindu 18 Dec 2015IMF Predicts Economic Growth in 2016

Edit Topix 18 Dec 2015Bank of Mexico raises interest rates

Edit Topix 18 Dec 2015After Fed Rate Hike, Mortgage Rates Move Slightly Higher

Edit The Oklahoman 18 Dec 2015Japan Stocks Fall First Time in Three Days Before BOJ

Edit Bloomberg 18 Dec 2015Irulas released from bondage

Edit The Hindu 18 Dec 2015Hoover Reading List 2015: An Overview of Books By Our Fellows (Hoover Institution)

Edit Public Technologies 18 Dec 2015Remarks by President Donald Tusk following the first session of the European Council meeting (Council ...

Edit Public Technologies 18 Dec 2015Fed rate rise sparks caution in China as Hong Kong braces for cash outflow

Edit South China Morning Post 18 Dec 2015Perspectives on 2015 (Hoover Institution)

Edit Public Technologies 18 Dec 2015OPEC Members In Jeopardy, How Long Can They Hold Out?

Edit Oil Price 18 Dec 2015- 1

- 2

- 3

- 4

- 5

- Next page »