- published: 12 Mar 2014

- views: 338

- author: KillikFinanceVideos

-

remove the playlistFixed Income

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistFixed Income

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 15 Sep 2011

- views: 30504

- author: Krassimir Petrov

- published: 04 Nov 2013

- views: 12826

- author: Elanguidesvideos

- published: 24 Jun 2011

- views: 57248

- author: Ben Burden

- published: 20 Aug 2014

- views: 0

- published: 20 Sep 2010

- views: 34152

- author: BNPParibasCIBStudent

- published: 10 May 2013

- views: 16216

- author: MIT OpenCourseWare

- published: 10 May 2013

- views: 12644

- author: MIT OpenCourseWare

- published: 10 May 2013

- views: 10167

- author: MIT OpenCourseWare

- published: 04 Mar 2014

- views: 1469

- author: Passed Tense

- published: 05 Sep 2014

- views: 5

- published: 04 Feb 2015

- views: 21

Fixed income refers to any type of investment that is not equity, which obligates the borrower/issuer to make payments on a fixed schedule, even if the number of the payments may be variable.

For example, if you lend money to a borrower and the borrower has to pay interest once a month, you have been issued a fixed-income security. Governments issue government bonds in their own currency and sovereign bonds in foreign currencies. Local governments issue municipal bonds to finance themselves. Debt issued by government-backed agencies is called an agency bond. Companies can issue a corporate bond or get money from a bank through a corporate loan ("preferred stock" can be "fixed income" in some contexts). Securitized bank lending (e.g. credit card debt, car loans or mortgages) can be structured into other types of fixed income products such as ABS – asset-backed securities which can be traded on exchanges just like corporate and government bonds.

The term fixed income is also applied to a person's income that does not vary with each period. This can include income derived from fixed-income investments such as bonds and preferred stocks or pensions that guarantee a fixed income. When pensioners or retirees are dependent on their pension as their dominant source of income, the term "fixed income" can also carry the implication that they have relatively limited discretionary income or have little financial freedom to make large expenditures.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Joshua Paul "Josh" Davis (born June 29, 1972) better known as DJ Shadow is an American music producer, DJ and songwriter. He is considered a prominent figure in the development of instrumental hip hop and first gained notice with the release of his highly acclaimed debut album Endtroducing....., which was the first album to be recorded using only sampled sounds. He has an exceptionally large personal record collection, with over 60,000 records. He is the cousin of singer and guitarist Richie Kotzen.

DJ Shadow was experimenting with a four-track recorder while in high school in Davis, California, and began his music career as a disc jockey for the University of California, Davis campus radio station KDVS. During this period he was significant in developing the experimental hip hop style associated with the London-based Mo' Wax record label. His early singles, including "In/Flux" and "Lost and Found (S.F.L.)", were genre-bending works of art merging elements of funk, rock, hip hop, ambient, jazz, soul, and used-bin found records. Andy Pemberton, a music journalist writing for Mixmag, coined the term "trip hop" in June 1994 to describe Shadow's "In/Flux" single and similar tracks being spun in London clubs at the time. Though his music is hard to categorize, his early contributions were certainly important for alternative hip hop. He cited groups such as Kurtis Mantronik, Steinski, and Prince Paul as influences on his sample-based sound, further claiming that "lyrics (...) were confining, too specific". His music rarely features more than short clips of voices or vocal work.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

9:58

9:58Tim Bennett Explains: What are fixed income securities (bonds) - part 1

Tim Bennett Explains: What are fixed income securities (bonds) - part 1Tim Bennett Explains: What are fixed income securities (bonds) - part 1

What are fixed income securities (bonds)? Here Tim Bennett introduces how they work and breaks down the key jargon for novice investors. Subscribe here http:... -

36:54

36:54Fixed-Income Securities - Lecture 01

Fixed-Income Securities - Lecture 01Fixed-Income Securities - Lecture 01

bond, fixed-income, security, stock, real assets, financial assets, financial instruments, investor, lender, borrower, interest, principal, face value, matur... -

328:39

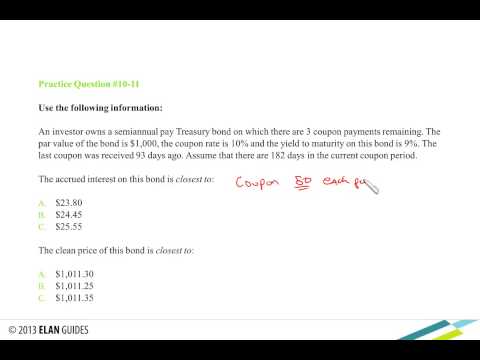

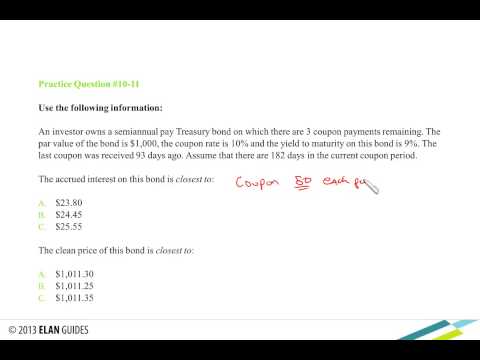

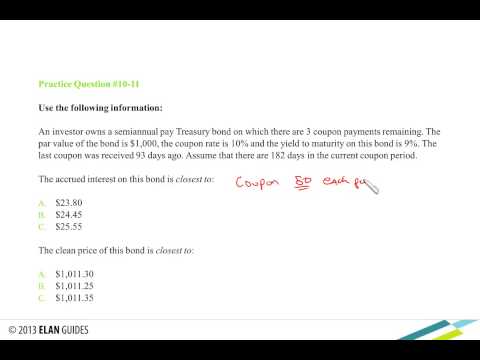

328:39CFA Level I 2013 - Intensive Review Seminar - Fixed Income

CFA Level I 2013 - Intensive Review Seminar - Fixed IncomeCFA Level I 2013 - Intensive Review Seminar - Fixed Income

We believe that we offer the most comprehensive, thorough and easy-to-understand study materials for the CFA exams. That is why we are offering you some of o... -

5:05

5:05Dj Shadow - Fixed Income

Dj Shadow - Fixed IncomeDj Shadow - Fixed Income

A music video I put together with all sorts of footage I found. -

4:50

4:50DJ Shadow - Fixed Income

DJ Shadow - Fixed IncomeDJ Shadow - Fixed Income

Album: The Private Press Label: Island Records, Mo Wax Released: 04 Jun 2002 http://www.discogs.com/DJ-Shadow-The-Private-Press/release/2217251 Please view the videos with a resolution higher than 240p. -

3:07

3:07Ira, Fixed Income Capital Markets, BNP Paribas CIB, New York

Ira, Fixed Income Capital Markets, BNP Paribas CIB, New YorkIra, Fixed Income Capital Markets, BNP Paribas CIB, New York

I am a foreign exchange spot trader. We take speculative positions on the movements of various currencies. -

71:57

71:57Ses 4: Present Value Relations III & Fixed-Income Securities I

Ses 4: Present Value Relations III & Fixed-Income Securities ISes 4: Present Value Relations III & Fixed-Income Securities I

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

79:19

79:19Ses 5: Fixed-Income Securities II

Ses 5: Fixed-Income Securities IISes 5: Fixed-Income Securities II

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

79:54

79:54Ses 6: Fixed-Income Securities III

Ses 6: Fixed-Income Securities IIISes 6: Fixed-Income Securities III

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

5:14

5:14CFA Level I 2014 - Reading 53, Part 1: Introduction to Fixed-Income Markets

CFA Level I 2014 - Reading 53, Part 1: Introduction to Fixed-Income MarketsCFA Level I 2014 - Reading 53, Part 1: Introduction to Fixed-Income Markets

Like this video? Gain access to more videos and other CFA exam study tools here: https://www.passedtense.com/Enroll/3 Passed Tense provides customizable CFA ... -

7:23

7:23CFA Level 1 Fixed Income Trading

CFA Level 1 Fixed Income TradingCFA Level 1 Fixed Income Trading

We are developing video content for the CFA Level 1 and are currently in BETA. For more videos like this, visit learnsignal.com and sign up. -

9:27

9:27Fixed Income Essentials

Fixed Income EssentialsFixed Income Essentials

A great introduction to fixed income securities. To learn more visit http://quickstep.ie/modules/detail/fixed-income-securities -

99:19

99:19CFA L1 Fixed Income on Valuation

CFA L1 Fixed Income on ValuationCFA L1 Fixed Income on Valuation

-

79:48

79:48Fundamentals of Fixed Income Webinar 2013

Fundamentals of Fixed Income Webinar 2013Fundamentals of Fixed Income Webinar 2013

Hosted by Elizabeth Moran, Director of Education and Fixed Income Research at FIIG Securities, join us for the Fundamentals of Fixed Income webinar to unders...

- Agency bond

- Agency debt

- Bad debt

- Bank

- Bank of England

- Bankruptcy

- Base rate

- Bond (finance)

- Bond convexity

- Bond duration

- Bond future

- Bond market

- Bond option

- Bond valuation

- Callable bond

- Central bank

- Charge-off

- Clean price

- Climate risk

- Collection agency

- Commercial paper

- Commodity market

- Common stock

- Consumer debt

- Consumer lending

- Consumer Price Index

- Convertible bond

- Convexity risk

- Corporate bond

- Corporate debt

- Corporate finance

- Corporate loan

- Coupon (bond)

- Credit default swap

- Credit derivative

- Credit spread (bond)

- Currency

- Current yield

- Debenture

- Debt

- Debt bondage

- Debt buyer

- Debt collection

- Debt compliance

- Debt consolidation

- Debt evasion

- Debt management plan

- Debt relief

- Debt restructuring

- Debt-snowball method

- Debtors' prison

- Default (finance)

- Default risk

- Deposit account

- Derivatives market

- DIP financing

- Dirty price

- Discretionary income

- Distressed debt

- Duration risk

- ECB

- Embedded option

- Emerging market debt

- Equity (finance)

- Exchange rate

- Exchangeable bond

- Extendible bond

- External debt

- Federal Reserve

- Finance

- Financial market

- Financial regulation

- Fixed income

- Fixed rate bond

- Floating rate note

- Forward contract

- Futures contract

- Futures exchange

- Garnishment

- Government bond

- Government debt

- High-yield debt

- Hybrid security

- I-spread

- ICMA

- Indenture

- Inflation derivative

- Inflation swap

- Insolvency

- Interest

- Interest rate

- Interest rate future

- Interest rate swap

- Internal debt

- Investment

- Issuer

- Liquidity risk

- Loan

- Loan shark

- Market

- Maturity (finance)

- Money market

- Mortgage yield

- Municipal bond

- Municipal debt

- Nominal yield

- Option (finance)

- Ownership equity

- Payday loan

- Pensions

- Perpetual bond

- Personal finance

- Phantom debt

- Predatory lending

- Preferred stock

- Public finance

- Puttable bond

- Real estate market

- Registered share

- Reinsurance market

- Reverse convertible

- Securities

- Securitization

- Security (finance)

- Senior debt

- SIFMA

- Sovereign bond

- Spot market

- Stock

- Stock certificate

- Stock exchange

- Stock market

- Strategic default

- Subordinated debt

- Swap (finance)

- Tax adjustment risk

- Template Bond market

- Template Debt

- Template talk Debt

- Trader (finance)

- Usury

- Venture debt

- Voting share

- Yield to maturity

- Z-spread

- Zero-coupon bond

-

Tim Bennett Explains: What are fixed income securities (bonds) - part 1

What are fixed income securities (bonds)? Here Tim Bennett introduces how they work and breaks down the key jargon for novice investors. Subscribe here http:... -

Fixed-Income Securities - Lecture 01

bond, fixed-income, security, stock, real assets, financial assets, financial instruments, investor, lender, borrower, interest, principal, face value, matur... -

CFA Level I 2013 - Intensive Review Seminar - Fixed Income

We believe that we offer the most comprehensive, thorough and easy-to-understand study materials for the CFA exams. That is why we are offering you some of o... -

Dj Shadow - Fixed Income

A music video I put together with all sorts of footage I found. -

DJ Shadow - Fixed Income

Album: The Private Press Label: Island Records, Mo Wax Released: 04 Jun 2002 http://www.discogs.com/DJ-Shadow-The-Private-Press/release/2217251 Please view the videos with a resolution higher than 240p. -

Ira, Fixed Income Capital Markets, BNP Paribas CIB, New York

I am a foreign exchange spot trader. We take speculative positions on the movements of various currencies. -

Ses 4: Present Value Relations III & Fixed-Income Securities I

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

Ses 5: Fixed-Income Securities II

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

Ses 6: Fixed-Income Securities III

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

CFA Level I 2014 - Reading 53, Part 1: Introduction to Fixed-Income Markets

Like this video? Gain access to more videos and other CFA exam study tools here: https://www.passedtense.com/Enroll/3 Passed Tense provides customizable CFA ... -

CFA Level 1 Fixed Income Trading

We are developing video content for the CFA Level 1 and are currently in BETA. For more videos like this, visit learnsignal.com and sign up. -

Fixed Income Essentials

A great introduction to fixed income securities. To learn more visit http://quickstep.ie/modules/detail/fixed-income-securities -

CFA L1 Fixed Income on Valuation

-

Fundamentals of Fixed Income Webinar 2013

Hosted by Elizabeth Moran, Director of Education and Fixed Income Research at FIIG Securities, join us for the Fundamentals of Fixed Income webinar to unders... -

Fixed income – 2015 Outlook

Phil Apel, Head of Fixed Income at Henderson, shares his views on the outlook for fixed income markets in 2015, and the lessons learnt from ‘a really interesting year for bond investors’. In the video he discusses: central bank policy divergence, fixed income liquidity and volatility in 2014, where he sees risks and opportunities in 2015, how a lower oil price could spur growth and his current in -

Guide to Understanding Fixed Income Securities - Debashis Basu

http://www.moneylife.in/ http://foundation.moneylife.in/ http://foundation.moneylife.in/?th_galleries=debt-investment-made-easy-moneylife-foundation-fixed-in... -

Level I CFA Fixed Income Reading Summary: Introduction to Fixed Income Valuation

CFA Video Lectures by Irfanullah Financial Training http://www.irfanullah.co -

What are fixed income investments?

FIIG's Director of Private Client Services Paul Gray explains the different types of investments in the fixed income asset class. -

Katie, Fixed Income Debt Capital Markets, BNP Paribas CIB, London

Within Dept Capital Markets there are two areas and you either cover corporates or financials. I personally cover financials, which means banks or insurance ... -

What is "fixed income investing"?

What is "fixed income investing"? Hi I'm David Luhman and welcome to "Bond and Fixed Income Investing for Everyone". In this tape I'll introduce you to some of the important points of investing in bonds and other types of fixed income instruments. First, if you're like me, you may be wondering where the phrase "fixed income" came from. Why not call this tape "Bond Investing for Everyone"? Well, -

CFA Level I- 2015 -Fixed Income : Risk and Return Part I(of 4)

FinTree website link: http://www.fintreeindia.com This series of videos discusses the following key points: The sources of return from investing in a fixed-rate bond Macaulay, Modified, and Effective Durations. Why Effective duration is the most appropriate measure of interest rate risk for bonds with embedded options Key rate duration and describe the key use of key rate durations in measuri -

Dj Shadow - Fixed Income [Live]

Dj Shadow's Fixed Income off the Live! Album. -

Fixed Income Portfolio Management Part I

Tim Bennett Explains: What are fixed income securities (bonds) - part 1

- Order: Reorder

- Duration: 9:58

- Updated: 02 Aug 2014

- views: 338

- author: KillikFinanceVideos

- published: 12 Mar 2014

- views: 338

- author: KillikFinanceVideos

Fixed-Income Securities - Lecture 01

- Order: Reorder

- Duration: 36:54

- Updated: 04 Sep 2014

- views: 30504

- author: Krassimir Petrov

- published: 15 Sep 2011

- views: 30504

- author: Krassimir Petrov

CFA Level I 2013 - Intensive Review Seminar - Fixed Income

- Order: Reorder

- Duration: 328:39

- Updated: 30 Aug 2014

- views: 12826

- author: Elanguidesvideos

- published: 04 Nov 2013

- views: 12826

- author: Elanguidesvideos

Dj Shadow - Fixed Income

- Order: Reorder

- Duration: 5:05

- Updated: 14 Aug 2013

- views: 57248

- author: Ben Burden

- published: 24 Jun 2011

- views: 57248

- author: Ben Burden

DJ Shadow - Fixed Income

- Order: Reorder

- Duration: 4:50

- Updated: 20 Aug 2014

- views: 0

- published: 20 Aug 2014

- views: 0

Ira, Fixed Income Capital Markets, BNP Paribas CIB, New York

- Order: Reorder

- Duration: 3:07

- Updated: 30 Jul 2014

- views: 34152

- author: BNPParibasCIBStudent

- published: 20 Sep 2010

- views: 34152

- author: BNPParibasCIBStudent

Ses 4: Present Value Relations III & Fixed-Income Securities I

- Order: Reorder

- Duration: 71:57

- Updated: 06 Sep 2014

- views: 16216

- author: MIT OpenCourseWare

- published: 10 May 2013

- views: 16216

- author: MIT OpenCourseWare

Ses 5: Fixed-Income Securities II

- Order: Reorder

- Duration: 79:19

- Updated: 06 Sep 2014

- views: 12644

- author: MIT OpenCourseWare

- published: 10 May 2013

- views: 12644

- author: MIT OpenCourseWare

Ses 6: Fixed-Income Securities III

- Order: Reorder

- Duration: 79:54

- Updated: 04 Aug 2014

- views: 10167

- author: MIT OpenCourseWare

- published: 10 May 2013

- views: 10167

- author: MIT OpenCourseWare

CFA Level I 2014 - Reading 53, Part 1: Introduction to Fixed-Income Markets

- Order: Reorder

- Duration: 5:14

- Updated: 14 Aug 2014

- views: 1469

- author: Passed Tense

- published: 04 Mar 2014

- views: 1469

- author: Passed Tense

CFA Level 1 Fixed Income Trading

- Order: Reorder

- Duration: 7:23

- Updated: 05 Sep 2014

- views: 5

- published: 05 Sep 2014

- views: 5

Fixed Income Essentials

- Order: Reorder

- Duration: 9:27

- Updated: 04 Feb 2015

- views: 21

- published: 04 Feb 2015

- views: 21

CFA L1 Fixed Income on Valuation

- Order: Reorder

- Duration: 99:19

- Updated: 17 Nov 2015

- views: 174

- published: 17 Nov 2015

- views: 174

Fundamentals of Fixed Income Webinar 2013

- Order: Reorder

- Duration: 79:48

- Updated: 05 Apr 2014

- views: 1053

- author: FIIG Securities

- published: 25 Nov 2013

- views: 1053

- author: FIIG Securities

Fixed income – 2015 Outlook

- Order: Reorder

- Duration: 7:05

- Updated: 16 Dec 2014

- views: 3

- published: 16 Dec 2014

- views: 3

Guide to Understanding Fixed Income Securities - Debashis Basu

- Order: Reorder

- Duration: 52:43

- Updated: 05 Jun 2014

- views: 519

- author: Debashis Basu

- published: 20 Jan 2014

- views: 519

- author: Debashis Basu

Level I CFA Fixed Income Reading Summary: Introduction to Fixed Income Valuation

- Order: Reorder

- Duration: 40:05

- Updated: 21 Oct 2014

- views: 1

- published: 21 Oct 2014

- views: 1

What are fixed income investments?

- Order: Reorder

- Duration: 2:43

- Updated: 20 Aug 2013

- views: 481

- author: FIIG Securities

- published: 09 Jul 2013

- views: 481

- author: FIIG Securities

Katie, Fixed Income Debt Capital Markets, BNP Paribas CIB, London

- Order: Reorder

- Duration: 3:08

- Updated: 12 Aug 2014

- views: 21539

- author: BNPParibasCIBStudent

- published: 20 Sep 2010

- views: 21539

- author: BNPParibasCIBStudent

What is "fixed income investing"?

- Order: Reorder

- Duration: 2:54

- Updated: 19 Sep 2014

- views: 0

- published: 19 Sep 2014

- views: 0

CFA Level I- 2015 -Fixed Income : Risk and Return Part I(of 4)

- Order: Reorder

- Duration: 27:48

- Updated: 31 Oct 2015

- views: 32

- published: 31 Oct 2015

- views: 32

Dj Shadow - Fixed Income [Live]

- Order: Reorder

- Duration: 6:01

- Updated: 04 Jul 2013

- views: 56121

- author: Schectersch1

- published: 01 Jun 2009

- views: 56121

- author: Schectersch1

Fixed Income Portfolio Management Part I

- Order: Reorder

- Duration: 92:02

- Updated: 25 Jun 2014

- views: 19

- author: Bình Lương

- published: 22 Jun 2014

- views: 19

- author: Bình Lương

-

CFA Level III-Fixed Income Portfolio management - Summary Video(sample)

FinTree website link: http://www.fintreeindia.com FB Page link :http://www.facebook.com/Fin... We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with! This Video lecture was recorded by our popular trainer for CFA, Mr. Utkarsh Jain, during one of his live CFA Level III Classes -

Morgan Stanley CEO: Fundamentals Don't Support Violent Market Correction

Jan. 21 -- James Gorman, chairman and chief executive officer at Morgan Stanley, discusses the scope of the global market selloff, fixed-income job cuts at the firm, his intention to remain with the bank for another five years, and whether or not he sees a rate cut coming from the Federal Reserve. He speaks from the World Economic Forum in Davos, Switzerland on "Bloomberg ?GO?." -

The Year Ahead 19 Jan 16 - CBA fixed income outlook for 2016

CBA Head of Fixed Income Strategy, Adam Donaldson speaks with CommSec’s Tom Piotrowski about his outlook for US and Australian interest rates. -

49. CFA Level 1 Quantitative Methods Common Probability Distributions LO17 and LO18

Other Playlists for CFA Level 1 Macroeconomics: https://www.youtube.com/watch?v=08ezkRxsX9I&list;=PLM9WI-4yn8BKpJUc_u0uHokYV-RPIqTTW Microeconomics https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ Fixed Income: https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c Quantitative Methods CFA Level 1 Common Probability Distribution -

Find a Safe Haven From Stormy Stocks in These Bond ETFs

Battered stock market investors seeking a safe haven in bonds should consider moving assets into the iShares Core US Aggregate Bond ETF (AGG), said Matt Tucker, head of fixed income strategy at iShares. 'This is the kind of market where you are seeing a lot of red, where equities are dropping and you want to have that core fixed income position,' said Tucker. 'The AGG is the largest fixed income E -

48. CFA Level 1 Quantitative Methods Common Probability Distributions LO16 Part 2

Other Playlists for CFA Level 1 Macroeconomics: https://www.youtube.com/watch?v=08ezkRxsX9I&list;=PLM9WI-4yn8BKpJUc_u0uHokYV-RPIqTTW Microeconomics https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ Fixed Income: https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c Quantitative Methods CFA Level 1 Common Probability Distribution -

44. CFA Level 1 Quantitative Methods Common Probability Distributions LO12

Other Playlists for CFA Level 1 Macroeconomics: https://www.youtube.com/watch?v=08ezkRxsX9I&list;=PLM9WI-4yn8BKpJUc_u0uHokYV-RPIqTTW Microeconomics https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ Fixed Income: https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c Quantitative Methods CFA Level 1 Common Probability Distribution -

Secured Fixed Income Fund Presentation hosted by Cherif Medawar for Accredited Investors (011516)

Welcome to SFI Fund - Secured Fixed Income Fund, LLC Cherif Medawar and his select group of Co-Sponsors established Secured Fixed Income Fund (SFIFund), a real estate hedge fund. The fund was officially filed with the Securities and Exchange Commissions (SEC) in October of 2015 and has been operating successfully ever since. To find out more visit: www.sfifund.com -

Lipper 2015 Q4 U.S. Fixed Income Mutual Fund Performance Review WebEx Replay

In this quarter’s review Jeff Tjornehoj reflects on recent Fed-inspired volatility as well as the impact low energy prices are having on various bond sectors these days. The fall of loan funds and junk bond funds this quarter is covered, as well as surging muni bond funds.

CFA Level III-Fixed Income Portfolio management - Summary Video(sample)

- Order: Reorder

- Duration: 10:39

- Updated: 22 Jan 2016

- views: 129

- published: 22 Jan 2016

- views: 129

Morgan Stanley CEO: Fundamentals Don't Support Violent Market Correction

- Order: Reorder

- Duration: 10:56

- Updated: 22 Jan 2016

- views: 645

- published: 22 Jan 2016

- views: 645

The Year Ahead 19 Jan 16 - CBA fixed income outlook for 2016

- Order: Reorder

- Duration: 7:19

- Updated: 20 Jan 2016

- views: 165

- published: 20 Jan 2016

- views: 165

49. CFA Level 1 Quantitative Methods Common Probability Distributions LO17 and LO18

- Order: Reorder

- Duration: 10:38

- Updated: 20 Jan 2016

- views: 18

- published: 20 Jan 2016

- views: 18

Find a Safe Haven From Stormy Stocks in These Bond ETFs

- Order: Reorder

- Duration: 3:03

- Updated: 20 Jan 2016

- views: 29

- published: 20 Jan 2016

- views: 29

48. CFA Level 1 Quantitative Methods Common Probability Distributions LO16 Part 2

- Order: Reorder

- Duration: 16:55

- Updated: 20 Jan 2016

- views: 9

- published: 20 Jan 2016

- views: 9

44. CFA Level 1 Quantitative Methods Common Probability Distributions LO12

- Order: Reorder

- Duration: 9:07

- Updated: 20 Jan 2016

- views: 5

- published: 20 Jan 2016

- views: 5

Secured Fixed Income Fund Presentation hosted by Cherif Medawar for Accredited Investors (011516)

- Order: Reorder

- Duration: 21:07

- Updated: 18 Jan 2016

- views: 12

- published: 18 Jan 2016

- views: 12

Lipper 2015 Q4 U.S. Fixed Income Mutual Fund Performance Review WebEx Replay

- Order: Reorder

- Duration: 20:48

- Updated: 14 Jan 2016

- views: 0

- published: 14 Jan 2016

- views: 0

-

Fixed-Income Securities - Lecture 02

bond indenture, maturity, term-to-maturity, short-term, long-term, intermediate term, volatility, principal value, face value, nominal value, par value, coup... -

Fixed-Income Securities - Lecture 05

Time Value of Money, TVM, present value, future value, fundamental value, intrinsic value, discounted value, discounting, compounding, discount rate, discoun... -

Ses 7: Fixed-Income Securities IV

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More i... -

CFA level 2 FIXED INCOME by Sanjay Saraf Sir

-

Level I CFA Fixed Income Reading Summary: Defining Elements

CFA Video Lectures by Irfanullah Financial Training http://www.irfanullah.co -

Sanjay Saraf on CFA Fixed Income Level 3

Sanjay Saraf providing lecture on CFA Fixed Income Level 3 for CFA Professionals at SSEI classes. SSEI (Sanjay Saraf Educational Institute), the leading provider of CA, CS, CFA, SFM, CWA & other national & international financial coaching & training classes. Visit www.ssei.co.in to know more. -

Level I CFA Fixed Income Reading Summary: Understanding Fixed-Income Risk and Return

CFA Video Lectures by Irfanullah Financial Training http://www.irfanullah.co -

CFA Level 3 - Fixed Income - Portfolio Management - Part 1 (of 3)

FinTree website link: http://www.fintreeindia.com FB Page link :http://www.facebook.com/Fin... We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with! This Video lecture was recorded by our popular trainer for CFA, Mr. Utkarsh Jain, during one of his live CFA Level III Classes -

2015- CFA Level 2 - Fixed Income - Term Structure and Interest Rate Dynamics- Part 1 (of 5)

FinTree website link: http://www.fintreeindia.com FB Page link :http://www.facebook.com/Fin... We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with! This Video lecture was recorded by our popular trainer for CFA, Mr. Utkarsh Jain, during one of his live CFA Level II Classes -

Fixed Income Annuity Review - What are fixed income annuities?

What is fixed income annuity – Are fixed income annuities really any good? 1-800-566-1002 http://www.RetireSharp.com . Learn the steps on how to use a fixed income annuity specifically for retirement planning. Avoid the mistakes that individuals make when trying to set up their proper deferred fixed income annuity plan costing those thousands of dollars in retirement. Tax-Deferred Growth in a F -

Level I CFA® Webinar: Fixed Income Securities - Analysis and Valuation

http://www.edupristine.com - KickStart your CFA® prep with EduPristine. Get free consultation from our experts, drop a mail at: query@edupristine.com CFA® is... -

Trick of the Trade: Pouring Liquidity Back Into Fixed Income

The alarm has sounded in the fixed-income markets, with the Bank for International Settlements being the latest major authority to warn about the lack of liquidity. Historically low interest rates, surging bond issuance and shrinking dealer balance sheets all raise the risk that a minor dislocation will cause a panic as sellers overwhelm a thinly traded marketplace. Is this the new normal in fixed

Fixed-Income Securities - Lecture 02

- Order: Reorder

- Duration: 46:34

- Updated: 13 Aug 2014

- views: 12194

- author: Krassimir Petrov

- published: 15 Sep 2011

- views: 12194

- author: Krassimir Petrov

Fixed-Income Securities - Lecture 05

- Order: Reorder

- Duration: 42:15

- Updated: 01 Aug 2014

- views: 6233

- author: Krassimir Petrov

- published: 23 Sep 2011

- views: 6233

- author: Krassimir Petrov

Ses 7: Fixed-Income Securities IV

- Order: Reorder

- Duration: 75:57

- Updated: 09 Jul 2014

- views: 6028

- author: MIT OpenCourseWare

- published: 10 May 2013

- views: 6028

- author: MIT OpenCourseWare

CFA level 2 FIXED INCOME by Sanjay Saraf Sir

- Order: Reorder

- Duration: 104:41

- Updated: 03 Sep 2015

- views: 2

- published: 03 Sep 2015

- views: 2

Level I CFA Fixed Income Reading Summary: Defining Elements

- Order: Reorder

- Duration: 21:00

- Updated: 21 Oct 2014

- views: 4

- published: 21 Oct 2014

- views: 4

Sanjay Saraf on CFA Fixed Income Level 3

- Order: Reorder

- Duration: 123:55

- Updated: 24 Sep 2014

- views: 2

- published: 24 Sep 2014

- views: 2

Level I CFA Fixed Income Reading Summary: Understanding Fixed-Income Risk and Return

- Order: Reorder

- Duration: 31:01

- Updated: 21 Oct 2014

- views: 4

- published: 21 Oct 2014

- views: 4

CFA Level 3 - Fixed Income - Portfolio Management - Part 1 (of 3)

- Order: Reorder

- Duration: 53:54

- Updated: 04 Nov 2014

- views: 3

- published: 04 Nov 2014

- views: 3

2015- CFA Level 2 - Fixed Income - Term Structure and Interest Rate Dynamics- Part 1 (of 5)

- Order: Reorder

- Duration: 38:47

- Updated: 06 Jan 2015

- views: 71

- published: 06 Jan 2015

- views: 71

Fixed Income Annuity Review - What are fixed income annuities?

- Order: Reorder

- Duration: 20:08

- Updated: 04 Feb 2015

- views: 2

- published: 04 Feb 2015

- views: 2

Level I CFA® Webinar: Fixed Income Securities - Analysis and Valuation

- Order: Reorder

- Duration: 78:00

- Updated: 23 May 2014

- views: 1219

- author: EduPristine

- published: 24 Apr 2013

- views: 1219

- author: EduPristine

Trick of the Trade: Pouring Liquidity Back Into Fixed Income

- Order: Reorder

- Duration: 62:34

- Updated: 28 Apr 2015

- views: 5

- published: 28 Apr 2015

- views: 5

- Playlist

- Chat

- Playlist

- Chat

Tim Bennett Explains: What are fixed income securities (bonds) - part 1

- published: 12 Mar 2014

- views: 338

-

author:

KillikFinanceVideos

Add Playlist for this Author

Fixed-Income Securities - Lecture 01

- published: 15 Sep 2011

- views: 30504

-

author:

Krassimir Petrov

Add Playlist for this Author

CFA Level I 2013 - Intensive Review Seminar - Fixed Income

- published: 04 Nov 2013

- views: 12826

-

author:

Elanguidesvideos

Add Playlist for this Author

Dj Shadow - Fixed Income

- published: 24 Jun 2011

- views: 57248

-

author:

Ben Burden

Add Playlist for this Author

DJ Shadow - Fixed Income

- published: 20 Aug 2014

- views: 0

Ira, Fixed Income Capital Markets, BNP Paribas CIB, New York

- published: 20 Sep 2010

- views: 34152

-

author:

BNPParibasCIBStudent

Add Playlist for this Author

Ses 4: Present Value Relations III & Fixed-Income Securities I

- published: 10 May 2013

- views: 16216

-

author:

MIT OpenCourseWare

Add Playlist for this Author

Ses 5: Fixed-Income Securities II

- published: 10 May 2013

- views: 12644

-

author:

MIT OpenCourseWare

Add Playlist for this Author

Ses 6: Fixed-Income Securities III

- published: 10 May 2013

- views: 10167

-

author:

MIT OpenCourseWare

Add Playlist for this Author

CFA Level I 2014 - Reading 53, Part 1: Introduction to Fixed-Income Markets

- published: 04 Mar 2014

- views: 1469

-

author:

Passed Tense

Add Playlist for this Author

CFA Level 1 Fixed Income Trading

- published: 05 Sep 2014

- views: 5

Fixed Income Essentials

- published: 04 Feb 2015

- views: 21

CFA L1 Fixed Income on Valuation

- published: 17 Nov 2015

- views: 174

Fundamentals of Fixed Income Webinar 2013

- published: 25 Nov 2013

- views: 1053

-

author:

FIIG Securities

Add Playlist for this Author

- Playlist

- Chat

CFA Level III-Fixed Income Portfolio management - Summary Video(sample)

- published: 22 Jan 2016

- views: 129

Morgan Stanley CEO: Fundamentals Don't Support Violent Market Correction

- published: 22 Jan 2016

- views: 645

The Year Ahead 19 Jan 16 - CBA fixed income outlook for 2016

- published: 20 Jan 2016

- views: 165

49. CFA Level 1 Quantitative Methods Common Probability Distributions LO17 and LO18

- published: 20 Jan 2016

- views: 18

Find a Safe Haven From Stormy Stocks in These Bond ETFs

- published: 20 Jan 2016

- views: 29

48. CFA Level 1 Quantitative Methods Common Probability Distributions LO16 Part 2

- published: 20 Jan 2016

- views: 9

44. CFA Level 1 Quantitative Methods Common Probability Distributions LO12

- published: 20 Jan 2016

- views: 5

Secured Fixed Income Fund Presentation hosted by Cherif Medawar for Accredited Investors (011516)

- published: 18 Jan 2016

- views: 12

Lipper 2015 Q4 U.S. Fixed Income Mutual Fund Performance Review WebEx Replay

- published: 14 Jan 2016

- views: 0

- Playlist

- Chat

Fixed-Income Securities - Lecture 02

- published: 15 Sep 2011

- views: 12194

-

author:

Krassimir Petrov

Add Playlist for this Author

Fixed-Income Securities - Lecture 05

- published: 23 Sep 2011

- views: 6233

-

author:

Krassimir Petrov

Add Playlist for this Author

Ses 7: Fixed-Income Securities IV

- published: 10 May 2013

- views: 6028

-

author:

MIT OpenCourseWare

Add Playlist for this Author

CFA level 2 FIXED INCOME by Sanjay Saraf Sir

- published: 03 Sep 2015

- views: 2

Level I CFA Fixed Income Reading Summary: Defining Elements

- published: 21 Oct 2014

- views: 4

Sanjay Saraf on CFA Fixed Income Level 3

- published: 24 Sep 2014

- views: 2

Level I CFA Fixed Income Reading Summary: Understanding Fixed-Income Risk and Return

- published: 21 Oct 2014

- views: 4

CFA Level 3 - Fixed Income - Portfolio Management - Part 1 (of 3)

- published: 04 Nov 2014

- views: 3

2015- CFA Level 2 - Fixed Income - Term Structure and Interest Rate Dynamics- Part 1 (of 5)

- published: 06 Jan 2015

- views: 71

Fixed Income Annuity Review - What are fixed income annuities?

- published: 04 Feb 2015

- views: 2

Level I CFA® Webinar: Fixed Income Securities - Analysis and Valuation

- published: 24 Apr 2013

- views: 1219

-

author:

EduPristine

Add Playlist for this Author

Trick of the Trade: Pouring Liquidity Back Into Fixed Income

- published: 28 Apr 2015

- views: 5

-

Lyrics list:text lyricsplay full screenplay karaoke

Whale Deaths On North Sea Beaches Baffle Scientists

Edit WorldNews.com 25 Jan 2016Atlanta Black Woman Tells Husband: Vote For Trump Or We're Getting Divorced

Edit WorldNews.com 25 Jan 2016Analysis: Will the West intervene in Libya?

Edit Al Jazeera 26 Jan 2016NASA’s Opportunity rover was supposed to last 90 days on Mars. Today is its 12th anniversary

Edit LA Daily News 25 Jan 2016Massive funnel-web's spider venom to be milked in Australia

Edit BBC News 25 Jan 2016Morgan Stanley Names Kevin Dunleavy to Run Fixed-Income Sales

Edit Bloomberg 26 Jan 2016Janus Capital Group Inc. Announces Fourth Quarter and Full-Year 2015 Results

Edit Stockhouse 26 Jan 2016German Note Yields Drop to Records as Oil Slump Fuels Haven Bid

Edit Bloomberg 26 Jan 2016ZSE Drafts Debt Market Conventions

Edit All Africa 26 Jan 2016Janus Fourth-Quarter Profit Little Changed as Assets, Fees Climb

Edit Bloomberg 26 Jan 2016TLN: Interest payment of LHV Group (NASDAQ OMX Baltic - Nasdaq OMX Tallinn AS)

Edit Public Technologies 26 Jan 2016Dollar's Gain Is Companies' Pain as Currency Woes Extend to 2016

Edit Bloomberg 26 Jan 2016Russell's Duval Sees `Super Challenging' Markets Amid Volatility

Edit Bloomberg 26 Jan 2016UBS selects Markit for index administration (Markit Group Limited)

Edit Public Technologies 26 Jan 2016Junk Bonds in Europe Find Greater Losses From Brazil Than China

Edit Bloomberg 26 Jan 2016Euroclear Reports Robust 2015 Operating Results 26.01.2016 (Euroclear SA)

Edit Public Technologies 26 Jan 2016Daily iNAV and Portfolio Disclosure (ISE - The Irish Stock Exchange plc)

Edit Public Technologies 26 Jan 2016Institutional investors warn of increasing correlations, finds Natixis survey (Natixis SA)

Edit Public Technologies 26 Jan 2016- 1

- 2

- 3

- 4

- 5

- Next page »