-

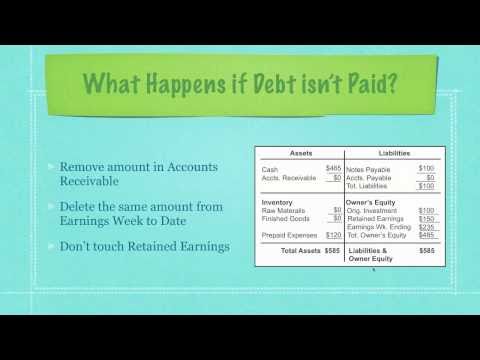

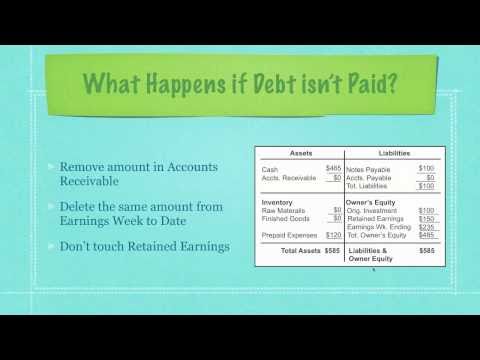

Financial Statements Explained

Support me on Patreon : https://www.patreon.com/derekbanas

I explain the basics on balance sheets and income statements using an example business. I also explain all of the following: Assets, Equity, Liabilities, Accounts Receivable, Notes Payable, Accounts Payable, Prepaid Expenses and more.

-

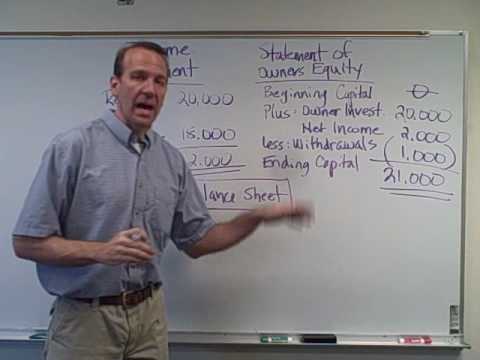

James Webb: How to Read a Financial Statement

Crowell School of Business Professor, James Webb, teaches on the importance of knowing how to read a financial statement.

Download the Excel file at: http://crowell.biola.edu/blog/2012/nov/12/business-fundamentals-how-read-financial-statement/

September 12, 2012

-

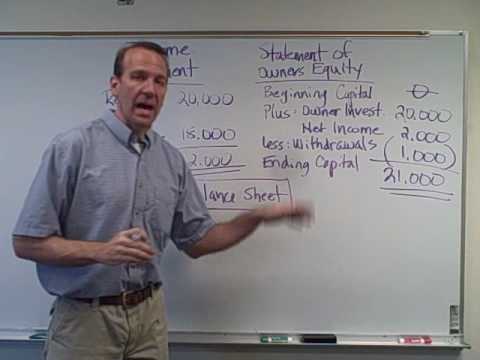

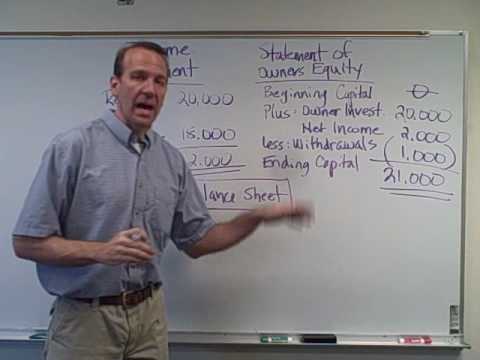

Financial Statements - Ch. 1 Video 3

Basic Financial Statements

-

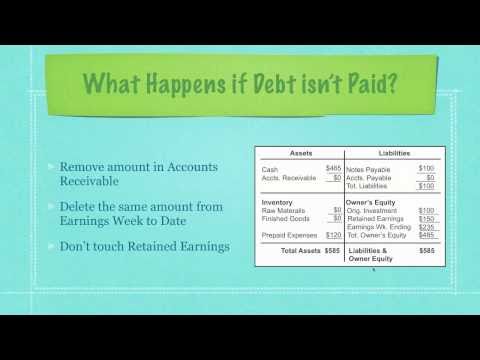

5 Minute Finance Lesson: Financial Statement Basics

This video is a brief tutorial on the basics of the 3 main financial statements: the balance sheet, statement of cash flows, and income statement. It provides a bare bones description of each of the 3 statements for those without a business or accounting background

Please note that the 3 financial statements used in the video should be considered separate examples and do not match up to one anoth

-

Episode 89: Introduction to Financial Statements, Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb

To view additional video lectures as well as other materials access the following links:

YouTube Channel: http://bit.ly/1kkvZoO

Website: http://bit.ly/1ccT2QA

Facebook: http://on.fb.me/1cpuBhW

Twitter: http://bit.ly/1bY2WFA

Google+: http://b

-

1 - The Four Core Financial Statements

An overview of the four core financial statements, to accompany http://www.principlesofaccounting.com Chapter 1, Welcome to the World of Accounting

*Check out the Classroom page to find out how to take this course for credit: http://www.principlesofaccounting.com/classroom.html

-

How the Three Financial Statements Fit Together

Brought to you by StratPad: Simple Business Plan App.

Try it free at http://www.stratpad.com

This video completes our course on financial statements by showing you how the income statement, balance sheet and statement of cash flows are connected. We'll take you through two months in the life of a company as it's recorded in the financial statements. If you've watched all the videos in the series,

-

Financial Statements - Lecture 7 - The Statement of Financial Position - IFRS

MUSIC

'Rumble' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0

-

Analysis of Financial Statements

-

Learn Accounting in 1 HOUR Final Lesson: Preparing Financial Statements

In our last lesson, we will learn how to prepare and present the income statement, the statement of changes in equity, and the balance sheet.

-

What are Financial Statements and the Types of Financial Statements (FA Tutorial #5)

This tutorial should provide you with an elementary understanding of the Income Statement, Retained Earnings Statement, Balance Sheet and Cash Flow Statement.

Examples are included like always and if you have any questions feel free to post below in the comment section :)

** NotePirate is privately owned and exclusive to NotePirate.com**

Website: http://www.notepirate.com

Follow us on Facebook

-

Projecting the 3 Financial Statements: The Balance Sheet

In this tutorial, you will learn how to decide which Income Statement line items Balance Sheet accounts such as Accounts Receivable, Prepaid Expenses, and Deferred Revenue should be linked to.

You’ll also see an example of how to check your work, how to tell when you’ve linked something incorrectly, and what to do with more “random” line items.

Table of Contents:

2:23: The Rough Answer to Proje

-

Accounting 1: Program #4 - "Intro to Financial Statements"

Accounting 1

Program #4

Chapter 1

"Intro to Financial Statements"

dkrug@jccc.edu

-

The ABCs of Stock Valuation (2/3) - Reading Financial Statements

Download TradeHero App: http://tradehero.mobi/download

Curriculum contributed by: http://synapsetrading.com/

Introducing the TradeHero Academy with over 45 videos to learn stock trading from. The TradeHero Academy will contain 3 main series divided into 5 categories:

1. Basics of Trading & Investing: http://youtu.be/ehyM9gWy6V0

1.1 Market Basics: http://youtu.be/aZbHR2_K55g

1.2 Stock Market Basi

-

Introduction to Financial Statements

MUSIC

'Jazzy Frenchy' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0

-

FINANCIAL STATEMENTS (PART 1) PROFIT & LOSS ACCOUNT AND BALANCE SHEET)

THIS VIDEO EXPLAINS CLOSING ENTRIES FROM TRIAL BALANCE. ALSO EXPLAINED IS THE PREPARATION OF TRADING & PROFIT AND LOSS A/C AND BALANCE SHEET (WITHOUT ADJUSTMENTS). IN LAST OPENING ENTRIES HAVE ALSO BEEN EXPLAINED.

-

Consolidation of Financial Statements Part 1

-

Accounting Equation and Basic FInancial Statements Lecture

The Accounting Equation and Basic Financial Statements Lecture

-

FINANCIAL STATEMENTS (WITH ADJUSTMENTS) PROFIT & LOSS ACCOUNT AND BALANCE SHEET

THIS VIDEO EXPLAINS PREPARATION OF PROFIT & LOSS A/C AND BALANCE SHEET WHEN ADJUSTMENTS OUTSIDE THE TRIAL BALANCE ARE GIVEN.

-

How to Read Financial Statements - Painless, Light, Quick and Simple

NO NUMBERS!

Adult learner-friendly, surprisingly clear. It's the basics for people who need the real basics.

This quick simple bit is part of a simplified series of introductory finance tutorials:

How to Read Financial Statements (11 min)

Financial Forecasting (11 min)

Cash Flow Forecasting (12 min)

Bookkeeping (10 min)

Financial Analysis (11 min)

... for you, for your family, for your business,

-

Preparing the Financial Statements (Financial Accounting Tutorial #25)

This financial accounting tutorial explores how the adjusted trial balance is used to complete the 3 main financial statements: the Income Statement, the Balance Sheet, and the Retained Earnings Statement. We examine how to construct these basic finance tools, explain why you construct each statement in a specific order, and examine effects on accounts like equity.

Feel free to skip over parts. I

-

Financial Statements - An Introduction

Basic overview of the four financial statements required by GAAP.

-

How to Prepare Financial Statements

How to Prepare Financial Statements for Your Business or Corporation- A Practical Guide. For a transcript of this video, and to download the slides and spreadsheet, see http://madanca.com/blog/how-to-prepare-financial-statements/#more-2068

Follow us on Twitter - https://twitter.com/Madan_CA

Like us on Facebook - https://www.facebook.com/MadanCharteredAccountant

Add us on Google Plus- https://plus

Financial Statements Explained

Support me on Patreon : https://www.patreon.com/derekbanas

I explain the basics on balance sheets and income statements using an example business. I also expla...

Support me on Patreon : https://www.patreon.com/derekbanas

I explain the basics on balance sheets and income statements using an example business. I also explain all of the following: Assets, Equity, Liabilities, Accounts Receivable, Notes Payable, Accounts Payable, Prepaid Expenses and more.

wn.com/Financial Statements Explained

Support me on Patreon : https://www.patreon.com/derekbanas

I explain the basics on balance sheets and income statements using an example business. I also explain all of the following: Assets, Equity, Liabilities, Accounts Receivable, Notes Payable, Accounts Payable, Prepaid Expenses and more.

- published: 22 Oct 2010

- views: 87310

James Webb: How to Read a Financial Statement

Crowell School of Business Professor, James Webb, teaches on the importance of knowing how to read a financial statement.

Download the Excel file at: http://cr...

Crowell School of Business Professor, James Webb, teaches on the importance of knowing how to read a financial statement.

Download the Excel file at: http://crowell.biola.edu/blog/2012/nov/12/business-fundamentals-how-read-financial-statement/

September 12, 2012

wn.com/James Webb How To Read A Financial Statement

Crowell School of Business Professor, James Webb, teaches on the importance of knowing how to read a financial statement.

Download the Excel file at: http://crowell.biola.edu/blog/2012/nov/12/business-fundamentals-how-read-financial-statement/

September 12, 2012

- published: 08 Dec 2012

- views: 115600

5 Minute Finance Lesson: Financial Statement Basics

This video is a brief tutorial on the basics of the 3 main financial statements: the balance sheet, statement of cash flows, and income statement. It provides a...

This video is a brief tutorial on the basics of the 3 main financial statements: the balance sheet, statement of cash flows, and income statement. It provides a bare bones description of each of the 3 statements for those without a business or accounting background

Please note that the 3 financial statements used in the video should be considered separate examples and do not match up to one another.

wn.com/5 Minute Finance Lesson Financial Statement Basics

This video is a brief tutorial on the basics of the 3 main financial statements: the balance sheet, statement of cash flows, and income statement. It provides a bare bones description of each of the 3 statements for those without a business or accounting background

Please note that the 3 financial statements used in the video should be considered separate examples and do not match up to one another.

- published: 03 Apr 2012

- views: 46281

Episode 89: Introduction to Financial Statements, Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb

To...

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb

To view additional video lectures as well as other materials access the following links:

YouTube Channel: http://bit.ly/1kkvZoO

Website: http://bit.ly/1ccT2QA

Facebook: http://on.fb.me/1cpuBhW

Twitter: http://bit.ly/1bY2WFA

Google+: http://bit.ly/1kX7s6P

The purpose of financial accounting is to provide information to external stakeholders. This information is largely meant to aid in determining the overall health of a company. A primary component of financial accounting is the production of what we refer to as financial statements. These include: the balance sheet, income statement, and the statement of cash flows.

This video is a is the first of a two-part series on financial statements. In addition to discussing the purpose of financial statements, I also provide an overview of the balance sheet.

wn.com/Episode 89 Introduction To Financial Statements, Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb

To view additional video lectures as well as other materials access the following links:

YouTube Channel: http://bit.ly/1kkvZoO

Website: http://bit.ly/1ccT2QA

Facebook: http://on.fb.me/1cpuBhW

Twitter: http://bit.ly/1bY2WFA

Google+: http://bit.ly/1kX7s6P

The purpose of financial accounting is to provide information to external stakeholders. This information is largely meant to aid in determining the overall health of a company. A primary component of financial accounting is the production of what we refer to as financial statements. These include: the balance sheet, income statement, and the statement of cash flows.

This video is a is the first of a two-part series on financial statements. In addition to discussing the purpose of financial statements, I also provide an overview of the balance sheet.

- published: 21 Feb 2013

- views: 16006

1 - The Four Core Financial Statements

An overview of the four core financial statements, to accompany http://www.principlesofaccounting.com Chapter 1, Welcome to the World of Accounting

*Check out ...

An overview of the four core financial statements, to accompany http://www.principlesofaccounting.com Chapter 1, Welcome to the World of Accounting

*Check out the Classroom page to find out how to take this course for credit: http://www.principlesofaccounting.com/classroom.html

wn.com/1 The Four Core Financial Statements

An overview of the four core financial statements, to accompany http://www.principlesofaccounting.com Chapter 1, Welcome to the World of Accounting

*Check out the Classroom page to find out how to take this course for credit: http://www.principlesofaccounting.com/classroom.html

- published: 06 Mar 2010

- views: 68209

How the Three Financial Statements Fit Together

Brought to you by StratPad: Simple Business Plan App.

Try it free at http://www.stratpad.com

This video completes our course on financial statements by showing...

Brought to you by StratPad: Simple Business Plan App.

Try it free at http://www.stratpad.com

This video completes our course on financial statements by showing you how the income statement, balance sheet and statement of cash flows are connected. We'll take you through two months in the life of a company as it's recorded in the financial statements. If you've watched all the videos in the series, you'll recognize all the terms and realize how far you've come in your understanding of financial statements.

http://www.stratpad.com/financial-statements-made-easy-video-course/how-the-three-financial-statements-fit-together/

Video Transcript

Nicely done! You've made it to the last video. And, by the way, don't be put off by the busy-ness of this screen. You know all this stuff here: income statement, statement of cash flows, the balance sheet. What I'm going to do now is a very fast rattle through of all three of these, just to cover off all the work that you already know.

Alright are you ready? Let's get going. Oh one thing -- by the way -- you'll see negative numbers don't have a dash in front of them; they're represented with brackets around them. Ok, ready go.

This is for January for Acme Web Design. The income statement starts off with sales of $5,000 and a corresponding costs of goods sold of $1,000. We know to subtract the $1,000 from the $5,000 to get to $4,000. Then we have a bunch of expenses: general and and administrative $6,000 -- that's your rent, telecommunications costs, administrative costs, that type of thing; no research and development costs; we have sales and marketing -- there was salary in there and a small campaign. Add all those up to get to $9,000.

Then subtract $9,000 from $4,000 to get to ($5,000). That's our fancily named subtotal: earnings before interest, taxes, depreciation and amortization or called EBITDA. We didn't have no interest -- we didn't pay anything to the bank — and therefore our net income is a ($5,000) loss. That means we didn't make any money here.

That ($5,000) goes over to the top of the statement of cash flows. The $5,000 worth of sales wasn't paid to us. Half of it instead went to accounts receivable ($2,500). When that happens it decreases the amount of cash available, therefore a negative number. But you can also see that it increases the accounts receivable showing on the balance sheet $2,500. But then, we didn't pay some of the costs this month. That increased our accounts payable $1,000 and also increased the amount of cash that we have on hand. There's our accounts payable down here $1,000.

So total cash from operations is ($6,500). We didn't buy any equipment, we didn't take out a loan, but the founder did put in $25,000 against common stock. Therefore, the total cash proceeds coming into the company this month is $18,500. That's the total of this ($6,500) and this zero and this $25,000. Cash at the start of the period was zero. Therefore, cash at the end of the period was $18,500 and this starts off our balance sheet right here.

We know what the accounts receivable is $2,500, therefore total current assets is $21,000. No equipment. There's the accounts payable $1,000. Total current liabilities of $1,000. No long-term liabilities. Total overall liabilities of $1,000.

There's the common stock $25,000 sliding in here. Retained earnings is, as you know, the total of all the profits and losses since the company began. If you look down, you see a total of liabilities and equity of $21,000 which balances with the total assets of $21,000. Our balance sheet balances -- whew.

We're almost there. I just want to show you one more thing.

Ok, so what I've done here is added in another month. We're going to go through the month of February and we're going to do it very quickly.

Alright, sales of $7,000 is up from the previous month. Corresponding 20 per cent of cost of goods sold $1,400 leaves a total gross profit of $5,600. Expenses hasn't changed, still $9,000 worth of expenses. $5,600 of gross profit minus the $9,000 of expenses equals the EBITDA of ($3,400). So we're still losing money but not as badly, which is exactly what you want to see in a new company.

We did pay the bank $100 worth of interest and I'll show you why in just a minute. ($3,400) minus $100 is equal to ($3,500) the loss for the month. And that starts off our statement of cash flows at the top ($3,500).

Ok, here's a little trickiness. The $2,500 in accounts receivable last month got paid to us this month but we also then took half. This sales then went back into accounts receivable. The difference between the $2,500 from last month and the $3,500 from this month is $1,000. So accounts receivable went up by $1,000 as you can see here, which just reduces our cash.

The rest of the video transcript can be found here:

http://www.stratpad.com/financial-statements-made-easy-video-course/how-the-three-financial-statements-fit-together/

wn.com/How The Three Financial Statements Fit Together

Brought to you by StratPad: Simple Business Plan App.

Try it free at http://www.stratpad.com

This video completes our course on financial statements by showing you how the income statement, balance sheet and statement of cash flows are connected. We'll take you through two months in the life of a company as it's recorded in the financial statements. If you've watched all the videos in the series, you'll recognize all the terms and realize how far you've come in your understanding of financial statements.

http://www.stratpad.com/financial-statements-made-easy-video-course/how-the-three-financial-statements-fit-together/

Video Transcript

Nicely done! You've made it to the last video. And, by the way, don't be put off by the busy-ness of this screen. You know all this stuff here: income statement, statement of cash flows, the balance sheet. What I'm going to do now is a very fast rattle through of all three of these, just to cover off all the work that you already know.

Alright are you ready? Let's get going. Oh one thing -- by the way -- you'll see negative numbers don't have a dash in front of them; they're represented with brackets around them. Ok, ready go.

This is for January for Acme Web Design. The income statement starts off with sales of $5,000 and a corresponding costs of goods sold of $1,000. We know to subtract the $1,000 from the $5,000 to get to $4,000. Then we have a bunch of expenses: general and and administrative $6,000 -- that's your rent, telecommunications costs, administrative costs, that type of thing; no research and development costs; we have sales and marketing -- there was salary in there and a small campaign. Add all those up to get to $9,000.

Then subtract $9,000 from $4,000 to get to ($5,000). That's our fancily named subtotal: earnings before interest, taxes, depreciation and amortization or called EBITDA. We didn't have no interest -- we didn't pay anything to the bank — and therefore our net income is a ($5,000) loss. That means we didn't make any money here.

That ($5,000) goes over to the top of the statement of cash flows. The $5,000 worth of sales wasn't paid to us. Half of it instead went to accounts receivable ($2,500). When that happens it decreases the amount of cash available, therefore a negative number. But you can also see that it increases the accounts receivable showing on the balance sheet $2,500. But then, we didn't pay some of the costs this month. That increased our accounts payable $1,000 and also increased the amount of cash that we have on hand. There's our accounts payable down here $1,000.

So total cash from operations is ($6,500). We didn't buy any equipment, we didn't take out a loan, but the founder did put in $25,000 against common stock. Therefore, the total cash proceeds coming into the company this month is $18,500. That's the total of this ($6,500) and this zero and this $25,000. Cash at the start of the period was zero. Therefore, cash at the end of the period was $18,500 and this starts off our balance sheet right here.

We know what the accounts receivable is $2,500, therefore total current assets is $21,000. No equipment. There's the accounts payable $1,000. Total current liabilities of $1,000. No long-term liabilities. Total overall liabilities of $1,000.

There's the common stock $25,000 sliding in here. Retained earnings is, as you know, the total of all the profits and losses since the company began. If you look down, you see a total of liabilities and equity of $21,000 which balances with the total assets of $21,000. Our balance sheet balances -- whew.

We're almost there. I just want to show you one more thing.

Ok, so what I've done here is added in another month. We're going to go through the month of February and we're going to do it very quickly.

Alright, sales of $7,000 is up from the previous month. Corresponding 20 per cent of cost of goods sold $1,400 leaves a total gross profit of $5,600. Expenses hasn't changed, still $9,000 worth of expenses. $5,600 of gross profit minus the $9,000 of expenses equals the EBITDA of ($3,400). So we're still losing money but not as badly, which is exactly what you want to see in a new company.

We did pay the bank $100 worth of interest and I'll show you why in just a minute. ($3,400) minus $100 is equal to ($3,500) the loss for the month. And that starts off our statement of cash flows at the top ($3,500).

Ok, here's a little trickiness. The $2,500 in accounts receivable last month got paid to us this month but we also then took half. This sales then went back into accounts receivable. The difference between the $2,500 from last month and the $3,500 from this month is $1,000. So accounts receivable went up by $1,000 as you can see here, which just reduces our cash.

The rest of the video transcript can be found here:

http://www.stratpad.com/financial-statements-made-easy-video-course/how-the-three-financial-statements-fit-together/

- published: 09 Jun 2013

- views: 44749

Financial Statements - Lecture 7 - The Statement of Financial Position - IFRS

MUSIC

'Rumble' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0...

MUSIC

'Rumble' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0

wn.com/Financial Statements Lecture 7 The Statement Of Financial Position Ifrs

MUSIC

'Rumble' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0

- published: 05 Sep 2014

- views: 11945

Learn Accounting in 1 HOUR Final Lesson: Preparing Financial Statements

In our last lesson, we will learn how to prepare and present the income statement, the statement of changes in equity, and the balance sheet....

In our last lesson, we will learn how to prepare and present the income statement, the statement of changes in equity, and the balance sheet.

wn.com/Learn Accounting In 1 Hour Final Lesson Preparing Financial Statements

In our last lesson, we will learn how to prepare and present the income statement, the statement of changes in equity, and the balance sheet.

- published: 28 Jun 2014

- views: 17351

What are Financial Statements and the Types of Financial Statements (FA Tutorial #5)

This tutorial should provide you with an elementary understanding of the Income Statement, Retained Earnings Statement, Balance Sheet and Cash Flow Statement.

...

This tutorial should provide you with an elementary understanding of the Income Statement, Retained Earnings Statement, Balance Sheet and Cash Flow Statement.

Examples are included like always and if you have any questions feel free to post below in the comment section :)

** NotePirate is privately owned and exclusive to NotePirate.com**

Website: http://www.notepirate.com

Follow us on Facebook: https://www.facebook.com/pages/Note-Pirate/514933148520001?ref=hl

Follow us on Twitter: http://twitter.com/notepirate

wn.com/What Are Financial Statements And The Types Of Financial Statements (Fa Tutorial 5)

This tutorial should provide you with an elementary understanding of the Income Statement, Retained Earnings Statement, Balance Sheet and Cash Flow Statement.

Examples are included like always and if you have any questions feel free to post below in the comment section :)

** NotePirate is privately owned and exclusive to NotePirate.com**

Website: http://www.notepirate.com

Follow us on Facebook: https://www.facebook.com/pages/Note-Pirate/514933148520001?ref=hl

Follow us on Twitter: http://twitter.com/notepirate

- published: 10 Dec 2013

- views: 8355

Projecting the 3 Financial Statements: The Balance Sheet

In this tutorial, you will learn how to decide which Income Statement line items Balance Sheet accounts such as Accounts Receivable, Prepaid Expenses, and Defer...

In this tutorial, you will learn how to decide which Income Statement line items Balance Sheet accounts such as Accounts Receivable, Prepaid Expenses, and Deferred Revenue should be linked to.

You’ll also see an example of how to check your work, how to tell when you’ve linked something incorrectly, and what to do with more “random” line items.

Table of Contents:

2:23: The Rough Answer to Projecting Balance Sheet Line Items

5:43: Rules of Thumb for Specific Line Items

9:36: Example for Atlassian – Checking Your Work

14:38: How to Handle “Random” Line Items

16:30: Recap and Summary

The Rough Answer to Projecting Balance Sheet Line Items

The rough answer is: “Stop worrying about what each individual item should be linked to, and instead worry about the OVERALL change in working capital as a % of the change in revenue.”

This question represents a case of overlooking the forest for the trees – yes, how you link individual items can make a difference, but it does NOT make a bigger difference than the overall change in working capital.

Remember that all that Balance Sheet items such as Accounts Receivable, Prepaid Expenses, Inventory, and Deferred Revenue really impact is the company’s cash flow – does it spend cash as it grows, or does it earn more cash as a result of growth?

If you understand that bigger picture item, you’ll be well on your way to “getting” this concept.

Rules of Thumb for Specific Line Items

Accounts Receivable: Link it to revenue.

Deferred Revenue: Link it to revenue.

Inventory: Link it to COGS.

Accounts Payable, Accrued Expenses, and Prepaid Expenses: Link these to COGS, or OpEx, or both, depending on the company.

“Other” Assets or Liabilities: Hold these constant or link them to revenue.

“Random” Items: Find a matching Income Statement item and link them there, or make them a percentage of revenue.

Example for Atlassian – Checking Your Work

For Atlassian, we check all the numbers by calculating the historical Change in Working Capital and then comparing the Change in WC as a % of the Change in Revenue to the future numbers there.

Historically, the average Change in WC as a % of the Change in Revenue was around 23%, and going forward it is set to approximately 10-20%, so we feel it is a reasonable estimate.

If we had linked to an incorrect line item instead, such as linking

Trade Payables to Revenue rather than OpEx, it would be fairly noticeable since the Change in WC would not follow a clean trend.

How to Handle “Random” Line Items

For “random items,” such as Maintenance Provisions on a company’s Balance Sheet, you can always try to match them with the relevant Income Statement line items. That works in this example for EasyJet.

If that doesn’t work, you could just set these items to a % of revenue instead and simplify the whole process.

You can check your work with the same method: calculate the

Change in WC as a % of the Change in Revenue and verify that it follows a relatively clean trend line over time.

Recap and Summary

Whenever you build 3-statement projections, always start with the

END GOAL – measuring the cash flow impact – in mind.

Accounts Receivable and Deferred Revenue: Link it to revenue.

Inventory: Link it to COGS.

Accounts Payable, Accrued Expenses, and Prepaid Expenses: Link these to COGS, or OpEx, or both, depending on the company.

“Other” Assets or Liabilities: Hold these constant or link them to revenue.

“Random” Items: Find a matching Income Statement item and link them there, or make them a percentage of revenue.

To check your work, determine if the company spends in advance of its growth (the Change in WC as a % of the Change in Revenue will be negative), or whether it gets extra money as a result of its growth (the Change in WC as a % of the Change in Revenue will be positive).

wn.com/Projecting The 3 Financial Statements The Balance Sheet

In this tutorial, you will learn how to decide which Income Statement line items Balance Sheet accounts such as Accounts Receivable, Prepaid Expenses, and Deferred Revenue should be linked to.

You’ll also see an example of how to check your work, how to tell when you’ve linked something incorrectly, and what to do with more “random” line items.

Table of Contents:

2:23: The Rough Answer to Projecting Balance Sheet Line Items

5:43: Rules of Thumb for Specific Line Items

9:36: Example for Atlassian – Checking Your Work

14:38: How to Handle “Random” Line Items

16:30: Recap and Summary

The Rough Answer to Projecting Balance Sheet Line Items

The rough answer is: “Stop worrying about what each individual item should be linked to, and instead worry about the OVERALL change in working capital as a % of the change in revenue.”

This question represents a case of overlooking the forest for the trees – yes, how you link individual items can make a difference, but it does NOT make a bigger difference than the overall change in working capital.

Remember that all that Balance Sheet items such as Accounts Receivable, Prepaid Expenses, Inventory, and Deferred Revenue really impact is the company’s cash flow – does it spend cash as it grows, or does it earn more cash as a result of growth?

If you understand that bigger picture item, you’ll be well on your way to “getting” this concept.

Rules of Thumb for Specific Line Items

Accounts Receivable: Link it to revenue.

Deferred Revenue: Link it to revenue.

Inventory: Link it to COGS.

Accounts Payable, Accrued Expenses, and Prepaid Expenses: Link these to COGS, or OpEx, or both, depending on the company.

“Other” Assets or Liabilities: Hold these constant or link them to revenue.

“Random” Items: Find a matching Income Statement item and link them there, or make them a percentage of revenue.

Example for Atlassian – Checking Your Work

For Atlassian, we check all the numbers by calculating the historical Change in Working Capital and then comparing the Change in WC as a % of the Change in Revenue to the future numbers there.

Historically, the average Change in WC as a % of the Change in Revenue was around 23%, and going forward it is set to approximately 10-20%, so we feel it is a reasonable estimate.

If we had linked to an incorrect line item instead, such as linking

Trade Payables to Revenue rather than OpEx, it would be fairly noticeable since the Change in WC would not follow a clean trend.

How to Handle “Random” Line Items

For “random items,” such as Maintenance Provisions on a company’s Balance Sheet, you can always try to match them with the relevant Income Statement line items. That works in this example for EasyJet.

If that doesn’t work, you could just set these items to a % of revenue instead and simplify the whole process.

You can check your work with the same method: calculate the

Change in WC as a % of the Change in Revenue and verify that it follows a relatively clean trend line over time.

Recap and Summary

Whenever you build 3-statement projections, always start with the

END GOAL – measuring the cash flow impact – in mind.

Accounts Receivable and Deferred Revenue: Link it to revenue.

Inventory: Link it to COGS.

Accounts Payable, Accrued Expenses, and Prepaid Expenses: Link these to COGS, or OpEx, or both, depending on the company.

“Other” Assets or Liabilities: Hold these constant or link them to revenue.

“Random” Items: Find a matching Income Statement item and link them there, or make them a percentage of revenue.

To check your work, determine if the company spends in advance of its growth (the Change in WC as a % of the Change in Revenue will be negative), or whether it gets extra money as a result of its growth (the Change in WC as a % of the Change in Revenue will be positive).

- published: 26 May 2015

- views: 6124

Accounting 1: Program #4 - "Intro to Financial Statements"

Accounting 1

Program #4

Chapter 1

"Intro to Financial Statements"

dkrug@jccc.edu...

Accounting 1

Program #4

Chapter 1

"Intro to Financial Statements"

dkrug@jccc.edu

wn.com/Accounting 1 Program 4 Intro To Financial Statements

Accounting 1

Program #4

Chapter 1

"Intro to Financial Statements"

dkrug@jccc.edu

- published: 31 Aug 2011

- views: 135114

The ABCs of Stock Valuation (2/3) - Reading Financial Statements

Download TradeHero App: http://tradehero.mobi/download

Curriculum contributed by: http://synapsetrading.com/

Introducing the TradeHero Academy with over 45 vid...

Download TradeHero App: http://tradehero.mobi/download

Curriculum contributed by: http://synapsetrading.com/

Introducing the TradeHero Academy with over 45 videos to learn stock trading from. The TradeHero Academy will contain 3 main series divided into 5 categories:

1. Basics of Trading & Investing: http://youtu.be/ehyM9gWy6V0

1.1 Market Basics: http://youtu.be/aZbHR2_K55g

1.2 Stock Market Basics: http://youtu.be/CN1dh6w54B8

1.3 Other Financial Products - Coming Soon!

ONLY AVAILABLE IN THE TRADEHERO APP!

2. Riding the Big Market Cycles

2.1 Business & Market cycles: :http://youtu.be/jKy5CioBFFM

2.2 What moves the markets?:http://youtu.be/4EqEdMvYaCc

2.3 Economic Indicators-Coming Soon!

3. The ABCs of Stock Valuation

3.1 Finding Value in Stocks: http://youtu.be/4v5_NsX8QvY

3.2 Reading Financial Statements: http://youtu.be/v8D-_BI77UI

3.3 Financial Ratio Shortcuts-Coming Soon!

4. Behavioural Analysis & Market Timing

4.1 Basics of market timing-Coming Soon!

4.2 Trend & Moving averages-Coming Soon!

4.3 Price & volume-Coming Soon!

5. Making Your First Trade

5.1 Capital allocation-Coming Soon!

5.2 Position-sizing strategies-Coming Soon!

5.3 Placing a trade-Coming Soon!

DOWNLOAD THE TRADEHERO APP TO BE ABLE TO VIEW ALL THE VIDEOS! http://tradehero.mobi/download

wn.com/The Abcs Of Stock Valuation (2 3) Reading Financial Statements

Download TradeHero App: http://tradehero.mobi/download

Curriculum contributed by: http://synapsetrading.com/

Introducing the TradeHero Academy with over 45 videos to learn stock trading from. The TradeHero Academy will contain 3 main series divided into 5 categories:

1. Basics of Trading & Investing: http://youtu.be/ehyM9gWy6V0

1.1 Market Basics: http://youtu.be/aZbHR2_K55g

1.2 Stock Market Basics: http://youtu.be/CN1dh6w54B8

1.3 Other Financial Products - Coming Soon!

ONLY AVAILABLE IN THE TRADEHERO APP!

2. Riding the Big Market Cycles

2.1 Business & Market cycles: :http://youtu.be/jKy5CioBFFM

2.2 What moves the markets?:http://youtu.be/4EqEdMvYaCc

2.3 Economic Indicators-Coming Soon!

3. The ABCs of Stock Valuation

3.1 Finding Value in Stocks: http://youtu.be/4v5_NsX8QvY

3.2 Reading Financial Statements: http://youtu.be/v8D-_BI77UI

3.3 Financial Ratio Shortcuts-Coming Soon!

4. Behavioural Analysis & Market Timing

4.1 Basics of market timing-Coming Soon!

4.2 Trend & Moving averages-Coming Soon!

4.3 Price & volume-Coming Soon!

5. Making Your First Trade

5.1 Capital allocation-Coming Soon!

5.2 Position-sizing strategies-Coming Soon!

5.3 Placing a trade-Coming Soon!

DOWNLOAD THE TRADEHERO APP TO BE ABLE TO VIEW ALL THE VIDEOS! http://tradehero.mobi/download

- published: 25 Nov 2014

- views: 7346

Introduction to Financial Statements

MUSIC

'Jazzy Frenchy' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0...

MUSIC

'Jazzy Frenchy' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0

wn.com/Introduction To Financial Statements

MUSIC

'Jazzy Frenchy' - Bensound

www.bensound.com

License: CC Attribution 3.0

'Pop Dance' - Bensound

www.bensound.com

License: CC Attribution 3.0

- published: 15 Aug 2014

- views: 5812

FINANCIAL STATEMENTS (PART 1) PROFIT & LOSS ACCOUNT AND BALANCE SHEET)

THIS VIDEO EXPLAINS CLOSING ENTRIES FROM TRIAL BALANCE. ALSO EXPLAINED IS THE PREPARATION OF TRADING & PROFIT AND LOSS A/C AND BALANCE SHEET (WITHOUT ADJUSTME...

THIS VIDEO EXPLAINS CLOSING ENTRIES FROM TRIAL BALANCE. ALSO EXPLAINED IS THE PREPARATION OF TRADING & PROFIT AND LOSS A/C AND BALANCE SHEET (WITHOUT ADJUSTMENTS). IN LAST OPENING ENTRIES HAVE ALSO BEEN EXPLAINED.

wn.com/Financial Statements (Part 1) Profit Loss Account And Balance Sheet)

THIS VIDEO EXPLAINS CLOSING ENTRIES FROM TRIAL BALANCE. ALSO EXPLAINED IS THE PREPARATION OF TRADING & PROFIT AND LOSS A/C AND BALANCE SHEET (WITHOUT ADJUSTMENTS). IN LAST OPENING ENTRIES HAVE ALSO BEEN EXPLAINED.

- published: 03 Mar 2013

- views: 89498

Accounting Equation and Basic FInancial Statements Lecture

The Accounting Equation and Basic Financial Statements Lecture...

The Accounting Equation and Basic Financial Statements Lecture

wn.com/Accounting Equation And Basic Financial Statements Lecture

The Accounting Equation and Basic Financial Statements Lecture

- published: 08 Jul 2012

- views: 10455

FINANCIAL STATEMENTS (WITH ADJUSTMENTS) PROFIT & LOSS ACCOUNT AND BALANCE SHEET

THIS VIDEO EXPLAINS PREPARATION OF PROFIT & LOSS A/C AND BALANCE SHEET WHEN ADJUSTMENTS OUTSIDE THE TRIAL BALANCE ARE GIVEN....

THIS VIDEO EXPLAINS PREPARATION OF PROFIT & LOSS A/C AND BALANCE SHEET WHEN ADJUSTMENTS OUTSIDE THE TRIAL BALANCE ARE GIVEN.

wn.com/Financial Statements (With Adjustments) Profit Loss Account And Balance Sheet

THIS VIDEO EXPLAINS PREPARATION OF PROFIT & LOSS A/C AND BALANCE SHEET WHEN ADJUSTMENTS OUTSIDE THE TRIAL BALANCE ARE GIVEN.

- published: 21 Apr 2013

- views: 28071

How to Read Financial Statements - Painless, Light, Quick and Simple

NO NUMBERS!

Adult learner-friendly, surprisingly clear. It's the basics for people who need the real basics.

This quick simple bit is part of a simplified seri...

NO NUMBERS!

Adult learner-friendly, surprisingly clear. It's the basics for people who need the real basics.

This quick simple bit is part of a simplified series of introductory finance tutorials:

How to Read Financial Statements (11 min)

Financial Forecasting (11 min)

Cash Flow Forecasting (12 min)

Bookkeeping (10 min)

Financial Analysis (11 min)

... for you, for your family, for your business, at www.businessbuffet.com.

(How else are we supposed to understand this stuff?)

Among other things, building a successful business is about managing money. Financial statements provide information not always visible on the surface. To learn more, easily and simply, get the complete program ($99). You can order here; http://www.businessbuffet.com/order.html .

This program demonstrates the relationship between balance sheet and income statement in a unique way that promotes USING them as well as READING them. (balance sheet, income statement.) http://www.businessbuffet.com/order.html

wn.com/How To Read Financial Statements Painless, Light, Quick And Simple

NO NUMBERS!

Adult learner-friendly, surprisingly clear. It's the basics for people who need the real basics.

This quick simple bit is part of a simplified series of introductory finance tutorials:

How to Read Financial Statements (11 min)

Financial Forecasting (11 min)

Cash Flow Forecasting (12 min)

Bookkeeping (10 min)

Financial Analysis (11 min)

... for you, for your family, for your business, at www.businessbuffet.com.

(How else are we supposed to understand this stuff?)

Among other things, building a successful business is about managing money. Financial statements provide information not always visible on the surface. To learn more, easily and simply, get the complete program ($99). You can order here; http://www.businessbuffet.com/order.html .

This program demonstrates the relationship between balance sheet and income statement in a unique way that promotes USING them as well as READING them. (balance sheet, income statement.) http://www.businessbuffet.com/order.html

- published: 20 Apr 2013

- views: 14430

Preparing the Financial Statements (Financial Accounting Tutorial #25)

This financial accounting tutorial explores how the adjusted trial balance is used to complete the 3 main financial statements: the Income Statement, the Balanc...

This financial accounting tutorial explores how the adjusted trial balance is used to complete the 3 main financial statements: the Income Statement, the Balance Sheet, and the Retained Earnings Statement. We examine how to construct these basic finance tools, explain why you construct each statement in a specific order, and examine effects on accounts like equity.

Feel free to skip over parts. It's a pretty simple tutorial where I mainly transfer account balances.

We appreciate all of the support you've given us. Be a part of the mission to help us reach more students by subscribing, thumbs upping and adding the videos to your favorites!

** Notepirate is privately owned and exclusive to Notepirate.com. **

Website: http://www.notepirate.com

Follow us on Facebook: https://www.facebook.com/pages/Note-Pirate/514933148520001?ref=hl

Follow us on Twitter: http://twitter.com/notepirate

wn.com/Preparing The Financial Statements (Financial Accounting Tutorial 25)

This financial accounting tutorial explores how the adjusted trial balance is used to complete the 3 main financial statements: the Income Statement, the Balance Sheet, and the Retained Earnings Statement. We examine how to construct these basic finance tools, explain why you construct each statement in a specific order, and examine effects on accounts like equity.

Feel free to skip over parts. It's a pretty simple tutorial where I mainly transfer account balances.

We appreciate all of the support you've given us. Be a part of the mission to help us reach more students by subscribing, thumbs upping and adding the videos to your favorites!

** Notepirate is privately owned and exclusive to Notepirate.com. **

Website: http://www.notepirate.com

Follow us on Facebook: https://www.facebook.com/pages/Note-Pirate/514933148520001?ref=hl

Follow us on Twitter: http://twitter.com/notepirate

- published: 19 Dec 2013

- views: 11226

Financial Statements - An Introduction

Basic overview of the four financial statements required by GAAP....

Basic overview of the four financial statements required by GAAP.

wn.com/Financial Statements An Introduction

Basic overview of the four financial statements required by GAAP.

- published: 01 Oct 2011

- views: 21076

How to Prepare Financial Statements

How to Prepare Financial Statements for Your Business or Corporation- A Practical Guide. For a transcript of this video, and to download the slides and spreadsh...

How to Prepare Financial Statements for Your Business or Corporation- A Practical Guide. For a transcript of this video, and to download the slides and spreadsheet, see http://madanca.com/blog/how-to-prepare-financial-statements/#more-2068

Follow us on Twitter - https://twitter.com/Madan_CA

Like us on Facebook - https://www.facebook.com/MadanCharteredAccountant

Add us on Google Plus- https://plus.google.com/u/1/108551869453511666601/posts

Please download our free eBook “20 Free Tax Secrets for Canadians” http://www.smashwords.com/books/view/490114

You can also download it from Amazon for just 99 cents. All profits from your purchase will go to charity! http://www.amazon.com/dp/B00P8D24S0

Table Of Contents

00:39 -- Getting Organized

01:20 -- Prepare Expenses Spreadsheet

03:24 -- Special Accounts

05:30 -- Calculate Tax Depreciation

06:41 -- Income statement

07:44 -- Balance Sheet

Disclaimer:

The information provided in this video is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided in this video.

wn.com/How To Prepare Financial Statements

How to Prepare Financial Statements for Your Business or Corporation- A Practical Guide. For a transcript of this video, and to download the slides and spreadsheet, see http://madanca.com/blog/how-to-prepare-financial-statements/#more-2068

Follow us on Twitter - https://twitter.com/Madan_CA

Like us on Facebook - https://www.facebook.com/MadanCharteredAccountant

Add us on Google Plus- https://plus.google.com/u/1/108551869453511666601/posts

Please download our free eBook “20 Free Tax Secrets for Canadians” http://www.smashwords.com/books/view/490114

You can also download it from Amazon for just 99 cents. All profits from your purchase will go to charity! http://www.amazon.com/dp/B00P8D24S0

Table Of Contents

00:39 -- Getting Organized

01:20 -- Prepare Expenses Spreadsheet

03:24 -- Special Accounts

05:30 -- Calculate Tax Depreciation

06:41 -- Income statement

07:44 -- Balance Sheet

Disclaimer:

The information provided in this video is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Allan Madan and Madan Chartered Accountant will not be held liable for any problems that arise from the usage of the information provided in this video.

- published: 12 Sep 2013

- views: 11300

-

Business Analysis Valuation Using Financial Statements No Cases

-

Business Analysis and Valuation Using Financial Statements Text and Cases with Thomson Analytics Pri

-

Accelerate Accounting Group - About Us

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are a pro-active and innovative accounting and business advisory firm based in Balcatta in Perth that specialises in helping business owners succeed.

To find more information or contact us visit us at

http://www.accelerateaccountinggroup.com.a

-

8. CFA Level 1 Financial Reporting and Analysis Reading 24 LO4

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial Reporting Standards

Learning Object

-

6. CFA Level 1 Financial Reporting and Analysis Reading 24 LO1 and LO2 Part 1

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial Reporting Standards

Learning Object

-

Connecting the three financial statements

Watch the next finance lesson: https://bluebookacademy.com/courses

-

Notes menu options in the financial statements

The notes menu is located above the first note in the Jazzit financial statements. A number of note related options are available there. This includes:

Period end date wording options

Various note and policy heading options

Note dividers

Note reference formatting options

Browse display options

Links to statements in other CaseWare files (external entities – for example consolidations)

-

10 1 Consolidated financial statements introduction

-

Accelerate Accounting Group

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are a pro-active and innovative accounting and business advisory firm based in Balcatta in Perth that specialises in helping business owners succeed.

-

FINC 5713 Lecture 3 Part 2

Proforma Financial Statements

-

5. CFA Level 1 Financial Reporting and Analysis Reading 23 LO4 to LO8

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial reporting Mechanics

Learning Objec

-

Financial Reporting

In this overview of the Financial Reporting coursework, Dean Raedy explains why financial reporting, and the preparation of financial statements, sits at the core of the accounting process.

-

Mike Weddington Financial Statements

Financial statements are a summary of what you do all month long.

For More Information visit us: www.mikeweddingtoncg.com

-

Union Function for Efficient Financial Statement Analysis

Shows how to use a user defined function to make putting together financial statements much easier.

-

CAS2-01 OB 05-06 Financial Statements and GAAP

This video screencast was created with Doceri on an iPad. Doceri is free in the iTunes app store. Learn more at http://www.doceri.com

-

Accounts of Company - Part 7 a | Section 136

Corporate and Allied Laws- CA:

Accounts of company | Section 136

Section 136

Circulation of financial statements and other documents to members and others

- Documents to be circulated

- Persons entitled to receive

- Time limit

- Circulation in case of a listed company. Deemed to be compiled if:

Documents available at registered office

Statement with salient features is circ

-

Interrelationships of Financial Statements

-

Venditto's long awaited SRB explainantion

If all we've been hearing from Supervisor Venditto for the last 6 months is, " The SRB loan guarantee's are null and void", to the tune of a one million dollar outside counsel fee, at tax payer expense, why is he so afraid to terminate the contracts with SRB and move on?

Why is he reaching with this "assignment" deal?

Why would he give the new and so far unknown group of investors an exclusive ve

-

Accounts of Company (part 8) | Section 137

Corporate and Allied Laws- CA:

Accounts of Company (part 8) | Section 137

Section 137

- Filling Financial Statements and other documents with ROC

- Documents to be filled within 30 days of AGM

Rule 12

Companies (Accounts) Rule 2014

Video by Edupedia World (www.edupediaworld.com), Free Online Education;

Click here https://www.youtube.com/playlist?list=PLJumA3phskPH5YoBcfqxge34jimmM72XO for more v

-

FAC4861/3: Presentation of Financial Statements Tutorial

Presented by Fungai Makoni CA (SA)

-

Learn to read financial statements free online course - corporate finance institute

In this 2-part course, we use Microsoft's 2010 financial statements and annual report to understand the financial strength of a company and help us to make informed decisions.

Module 1

In this first module, we use the balance sheet and the related notes to Microsoft's 2010 financial statements to understand the financial strength of a company and help us make informed decisions. By the end of th

-

Learn Accounting Fundamentals - Free Online Course - Corporate Finance Institute

This 2-part series will guide you through the accounting process. We explore the layout of the balance sheet, income statement, and cash flow statement; and demonstrate how to prepare financial statements from scratch.

Part 1

In this first module, we explore the layout of the balance sheet and income statement, explore how transactions are recorded, and prepare a simple balance sheet and income

-

Market Watchers Have Come to Rely on the Opinions of Brokerage Firm Analysts (2001)

Writing reports or notes expressing opinions is always a part of "sell-side" (brokerage) analyst job and is often not required for "buy-side" (investment firms) analysts. Traditionally, analysts use fundamental analysis principles but technical chart analysis and tactical evaluation of the market environment are also routine. Often at the end of the assessment of analyzed securities, an analyst wo

Accelerate Accounting Group - About Us

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are ...

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are a pro-active and innovative accounting and business advisory firm based in Balcatta in Perth that specialises in helping business owners succeed.

To find more information or contact us visit us at

http://www.accelerateaccountinggroup.com.au/

wn.com/Accelerate Accounting Group About US

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are a pro-active and innovative accounting and business advisory firm based in Balcatta in Perth that specialises in helping business owners succeed.

To find more information or contact us visit us at

http://www.accelerateaccountinggroup.com.au/

- published: 05 Feb 2016

- views: 1

8. CFA Level 1 Financial Reporting and Analysis Reading 24 LO4

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM...

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial Reporting Standards

Learning Objectives:

4. Describe the International Accounting Standards Board's conceptual framework, including the objective and qualitative characteristics of financial statements, required reporting elements, and constraints and assumptions in preparing financial statements

wn.com/8. Cfa Level 1 Financial Reporting And Analysis Reading 24 Lo4

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial Reporting Standards

Learning Objectives:

4. Describe the International Accounting Standards Board's conceptual framework, including the objective and qualitative characteristics of financial statements, required reporting elements, and constraints and assumptions in preparing financial statements

- published: 04 Feb 2016

- views: 20

6. CFA Level 1 Financial Reporting and Analysis Reading 24 LO1 and LO2 Part 1

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM...

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial Reporting Standards

Learning Objectives:

1. Describe the objective of financial statements and the importance of financial reporting standards in security analysis and valuation

2. Describe roles and desirable attributes of financial reporting standard-setting bodies and regulatory authorities in establishing and enforcing reporting standards, and describe the role of the International Organization of Securities Commissions

wn.com/6. Cfa Level 1 Financial Reporting And Analysis Reading 24 Lo1 And Lo2 Part 1

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial Reporting Standards

Learning Objectives:

1. Describe the objective of financial statements and the importance of financial reporting standards in security analysis and valuation

2. Describe roles and desirable attributes of financial reporting standard-setting bodies and regulatory authorities in establishing and enforcing reporting standards, and describe the role of the International Organization of Securities Commissions

- published: 04 Feb 2016

- views: 16

Connecting the three financial statements

Watch the next finance lesson: https://bluebookacademy.com/courses...

Watch the next finance lesson: https://bluebookacademy.com/courses

wn.com/Connecting The Three Financial Statements

Watch the next finance lesson: https://bluebookacademy.com/courses

- published: 04 Feb 2016

- views: 0

Notes menu options in the financial statements

The notes menu is located above the first note in the Jazzit financial statements. A number of note related options are available there. This includes:

Period ...

The notes menu is located above the first note in the Jazzit financial statements. A number of note related options are available there. This includes:

Period end date wording options

Various note and policy heading options

Note dividers

Note reference formatting options

Browse display options

Links to statements in other CaseWare files (external entities – for example consolidations)

wn.com/Notes Menu Options In The Financial Statements

The notes menu is located above the first note in the Jazzit financial statements. A number of note related options are available there. This includes:

Period end date wording options

Various note and policy heading options

Note dividers

Note reference formatting options

Browse display options

Links to statements in other CaseWare files (external entities – for example consolidations)

- published: 04 Feb 2016

- views: 22

Accelerate Accounting Group

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are ...

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are a pro-active and innovative accounting and business advisory firm based in Balcatta in Perth that specialises in helping business owners succeed.

wn.com/Accelerate Accounting Group

If you're a business owner looking for more than just financial statements and tax returns from your accountant, welcome to Accelerate Accounting Group. We are a pro-active and innovative accounting and business advisory firm based in Balcatta in Perth that specialises in helping business owners succeed.

- published: 04 Feb 2016

- views: 6

FINC 5713 Lecture 3 Part 2

Proforma Financial Statements...

Proforma Financial Statements

wn.com/Finc 5713 Lecture 3 Part 2

Proforma Financial Statements

- published: 03 Feb 2016

- views: 1

5. CFA Level 1 Financial Reporting and Analysis Reading 23 LO4 to LO8

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM...

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial reporting Mechanics

Learning Objectives:

4. Describe the process of recording business transactions using an accounting system based on the accounting equation

5. Describe the need for accruals and valuation adjustments in preparing financial statements

6. Describe the relationship among the income statement, balance sheet, statement of cash flows, and statement of owner’s equity

7. Describe the flow of information in an accounting system

8. Describe the use of the results of the accounting process in security analysis

wn.com/5. Cfa Level 1 Financial Reporting And Analysis Reading 23 Lo4 To Lo8

Microeconomics

https://www.youtube.com/watch?v=wD_fVYjF-8E&list;=PLM9WI-4yn8BIkIVB9yfFcTVKT3uO_d3hZ

Fixed Income:

https://www.youtube.com/watch?v=nLWtT1XlHSM&list;=PLM9WI-4yn8BI0Jy0CH0SQw9ZMiYTWBz0c

Quantitative Methods:

https://www.youtube.com/watch?v=BUzBMtfxfqI&list;=PLM9WI-4yn8BIYIUfgssEaLXUpUiOtZSD_

CFA Level 1

Financial Reporting and Analysis

Financial reporting Mechanics

Learning Objectives:

4. Describe the process of recording business transactions using an accounting system based on the accounting equation

5. Describe the need for accruals and valuation adjustments in preparing financial statements

6. Describe the relationship among the income statement, balance sheet, statement of cash flows, and statement of owner’s equity

7. Describe the flow of information in an accounting system

8. Describe the use of the results of the accounting process in security analysis

- published: 03 Feb 2016

- views: 21

Financial Reporting

In this overview of the Financial Reporting coursework, Dean Raedy explains why financial reporting, and the preparation of financial statements, sits at the co...

In this overview of the Financial Reporting coursework, Dean Raedy explains why financial reporting, and the preparation of financial statements, sits at the core of the accounting process.

wn.com/Financial Reporting

In this overview of the Financial Reporting coursework, Dean Raedy explains why financial reporting, and the preparation of financial statements, sits at the core of the accounting process.

- published: 03 Feb 2016

- views: 17

Mike Weddington Financial Statements

Financial statements are a summary of what you do all month long.

For More Information visit us: www.mikeweddingtoncg.com...

Financial statements are a summary of what you do all month long.

For More Information visit us: www.mikeweddingtoncg.com

wn.com/Mike Weddington Financial Statements

Financial statements are a summary of what you do all month long.

For More Information visit us: www.mikeweddingtoncg.com

- published: 03 Feb 2016

- views: 7

Union Function for Efficient Financial Statement Analysis

Shows how to use a user defined function to make putting together financial statements much easier....

Shows how to use a user defined function to make putting together financial statements much easier.

wn.com/Union Function For Efficient Financial Statement Analysis

Shows how to use a user defined function to make putting together financial statements much easier.

- published: 03 Feb 2016

- views: 3

CAS2-01 OB 05-06 Financial Statements and GAAP

This video screencast was created with Doceri on an iPad. Doceri is free in the iTunes app store. Learn more at http://www.doceri.com...

This video screencast was created with Doceri on an iPad. Doceri is free in the iTunes app store. Learn more at http://www.doceri.com

wn.com/Cas2 01 Ob 05 06 Financial Statements And Gaap

This video screencast was created with Doceri on an iPad. Doceri is free in the iTunes app store. Learn more at http://www.doceri.com

- published: 03 Feb 2016

- views: 30

Accounts of Company - Part 7 a | Section 136

Corporate and Allied Laws- CA:

Accounts of company | Section 136

Section 136

Circulation of financial statements and other documents to members and others

- D...

Corporate and Allied Laws- CA:

Accounts of company | Section 136

Section 136

Circulation of financial statements and other documents to members and others

- Documents to be circulated

- Persons entitled to receive

- Time limit

- Circulation in case of a listed company. Deemed to be compiled if:

Documents available at registered office

Statement with salient features is circulated

- Circulation in case of a prescribed company

- Display on the website

- Circulation of separate audited accounts at the subsidiaries

- Inspection

Video by Edupedia World (www.edupediaworld.com), Free Online Education;

Click here https://www.youtube.com/playlist?list=PLJumA3phskPH5YoBcfqxge34jimmM72XO for more videos on Corporate and Allied Laws- CA;

All Rights Reserved.

wn.com/Accounts Of Company Part 7 A | Section 136

Corporate and Allied Laws- CA:

Accounts of company | Section 136

Section 136

Circulation of financial statements and other documents to members and others

- Documents to be circulated

- Persons entitled to receive

- Time limit

- Circulation in case of a listed company. Deemed to be compiled if:

Documents available at registered office

Statement with salient features is circulated

- Circulation in case of a prescribed company

- Display on the website

- Circulation of separate audited accounts at the subsidiaries

- Inspection

Video by Edupedia World (www.edupediaworld.com), Free Online Education;

Click here https://www.youtube.com/playlist?list=PLJumA3phskPH5YoBcfqxge34jimmM72XO for more videos on Corporate and Allied Laws- CA;

All Rights Reserved.

- published: 03 Feb 2016

- views: 3

Venditto's long awaited SRB explainantion

If all we've been hearing from Supervisor Venditto for the last 6 months is, " The SRB loan guarantee's are null and void", to the tune of a one million dollar ...

If all we've been hearing from Supervisor Venditto for the last 6 months is, " The SRB loan guarantee's are null and void", to the tune of a one million dollar outside counsel fee, at tax payer expense, why is he so afraid to terminate the contracts with SRB and move on?

Why is he reaching with this "assignment" deal?

Why would he give the new and so far unknown group of investors an exclusive vetting without competition?

I think Venditto's hoping to get it all straightened out and remove the loan guarantee portions of the contract prior to finally submitting the towns "late" financial audit.

"Town officials have blamed the late 2014 audited financial statements on problems that arose when it switched to a new software system more than two years ago. The town disclosed this week that it expects to finish the audited financial statements by March 31."

So they had a two year old system but never had a "glitch" till now?

IMO Venditto's is risking the towns credit rating to remove the illegal loan guarantee's prior to submitting the "fixed" 2014 Financial Budget.

wn.com/Venditto's Long Awaited Srb Explainantion

If all we've been hearing from Supervisor Venditto for the last 6 months is, " The SRB loan guarantee's are null and void", to the tune of a one million dollar outside counsel fee, at tax payer expense, why is he so afraid to terminate the contracts with SRB and move on?

Why is he reaching with this "assignment" deal?

Why would he give the new and so far unknown group of investors an exclusive vetting without competition?

I think Venditto's hoping to get it all straightened out and remove the loan guarantee portions of the contract prior to finally submitting the towns "late" financial audit.

"Town officials have blamed the late 2014 audited financial statements on problems that arose when it switched to a new software system more than two years ago. The town disclosed this week that it expects to finish the audited financial statements by March 31."

So they had a two year old system but never had a "glitch" till now?

IMO Venditto's is risking the towns credit rating to remove the illegal loan guarantee's prior to submitting the "fixed" 2014 Financial Budget.

- published: 03 Feb 2016

- views: 48

Accounts of Company (part 8) | Section 137

Corporate and Allied Laws- CA:

Accounts of Company (part 8) | Section 137

Section 137

- Filling Financial Statements and other documents with ROC

- Documents t...

Corporate and Allied Laws- CA:

Accounts of Company (part 8) | Section 137

Section 137

- Filling Financial Statements and other documents with ROC

- Documents to be filled within 30 days of AGM

Rule 12

Companies (Accounts) Rule 2014

Video by Edupedia World (www.edupediaworld.com), Free Online Education;

Click here https://www.youtube.com/playlist?list=PLJumA3phskPH5YoBcfqxge34jimmM72XO for more videos on Corporate and Allied Laws- CA;

All Rights Reserved.

wn.com/Accounts Of Company (Part 8) | Section 137

Corporate and Allied Laws- CA:

Accounts of Company (part 8) | Section 137

Section 137

- Filling Financial Statements and other documents with ROC

- Documents to be filled within 30 days of AGM

Rule 12

Companies (Accounts) Rule 2014

Video by Edupedia World (www.edupediaworld.com), Free Online Education;

Click here https://www.youtube.com/playlist?list=PLJumA3phskPH5YoBcfqxge34jimmM72XO for more videos on Corporate and Allied Laws- CA;

All Rights Reserved.

- published: 03 Feb 2016

- views: 4

Learn to read financial statements free online course - corporate finance institute

In this 2-part course, we use Microsoft's 2010 financial statements and annual report to understand the financial strength of a company and help us to make info...

In this 2-part course, we use Microsoft's 2010 financial statements and annual report to understand the financial strength of a company and help us to make informed decisions.

Module 1

In this first module, we use the balance sheet and the related notes to Microsoft's 2010 financial statements to understand the financial strength of a company and help us make informed decisions. By the end of this module, you will have a solid understanding of the specific accounts of a typical balance sheet and related notes to the financial statements.

Navigate successfully through the notes to the financial statements.

Read and interpret the various items in a published balance sheet.

Understand complex balance sheet concepts (e.g. deferred taxes, goodwill, investments, etc.)

Module 2

In this second module, we continue exploring Microsoft’s 2010 financial statements through to the income statement and statement of cash flows, and conclude by covering the key contents of an annual report. By the end of this module, you will have a solid understanding of a typical income statement, statement of cash flows and annual report in its entirety.

Understand the different ways to present an income statements and cash flow statement.

Read and interpret the various items in a published income statement.

Identify the operating, financing, and investing activities of a company.

Determine what's contained in an annual report and where to find it.

This course is highly interactive with a wide range of applied exercises and case studies. Sophisticated search and navigation tools allow you to go at your own pace while pop quizzes test what you’ve just learnt. The course also includes two PDF reference guides – an accounting factsheet and a financial statements glossary - that can be used while taking the course and downloaded to your computer for future reference.

wn.com/Learn To Read Financial Statements Free Online Course Corporate Finance Institute

In this 2-part course, we use Microsoft's 2010 financial statements and annual report to understand the financial strength of a company and help us to make informed decisions.

Module 1

In this first module, we use the balance sheet and the related notes to Microsoft's 2010 financial statements to understand the financial strength of a company and help us make informed decisions. By the end of this module, you will have a solid understanding of the specific accounts of a typical balance sheet and related notes to the financial statements.

Navigate successfully through the notes to the financial statements.

Read and interpret the various items in a published balance sheet.

Understand complex balance sheet concepts (e.g. deferred taxes, goodwill, investments, etc.)

Module 2

In this second module, we continue exploring Microsoft’s 2010 financial statements through to the income statement and statement of cash flows, and conclude by covering the key contents of an annual report. By the end of this module, you will have a solid understanding of a typical income statement, statement of cash flows and annual report in its entirety.

Understand the different ways to present an income statements and cash flow statement.

Read and interpret the various items in a published income statement.

Identify the operating, financing, and investing activities of a company.

Determine what's contained in an annual report and where to find it.