- published: 04 Aug 2015

- views: 429

-

remove the playlistNational Banking Act

-

remove the playlistLongest Videos

- remove the playlistNational Banking Act

- remove the playlistLongest Videos

- published: 16 Apr 2008

- views: 178

- published: 09 May 2013

- views: 1264993

- published: 12 Mar 2016

- views: 158

- published: 26 Nov 2015

- views: 289

- published: 08 Apr 2014

- views: 507

- published: 19 May 2014

- views: 852

- published: 13 Apr 2016

- views: 461

- published: 08 Oct 2013

- views: 159

Barney Frank

Barnett "Barney" Frank (born March 31, 1940) is an American politician who served as a member of the U.S. House of Representatives from Massachusetts from 1981 to 2013. A member of the Democratic Party, he served as chairman of the House Financial Services Committee (2007–2011) and was a leading co-sponsor of the 2010 Dodd–Frank Act, a sweeping reform of the U.S. financial industry. Frank, a resident of Newton, Massachusetts, is considered the most prominent gay politician in the United States.

Born and raised in Bayonne, New Jersey, Frank graduated from Harvard College and Harvard Law School. He worked as a political aide before winning election to the Massachusetts House of Representatives in 1972. He was elected to the U.S. House of Representatives in 1980 with 52 percent of the vote. He was re-elected every term thereafter by wide margins. In 1987, he publicly came out as gay, after coming out to family, friends and close associates a few years prior, becoming the first member of Congress to do so voluntarily. From 2003 until his retirement, Frank was the leading Democrat on the House Financial Services Committee, and he served as committee chairman when his party held a House majority from 2007 to 2011. In July 2012, he married his long-time partner, James Ready, becoming the first member of Congress to marry someone of the same sex while in office. Frank did not seek re-election in 2012, and retired from Congress at the end of his term in January 2013. Frank had expressed interest in serving temporarily in the United States Senate after John Kerry had been confirmed as Secretary of State but was ultimately passed over for Mo Cowan. A biography of Frank was published in 2015.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

62:01

62:01The Glass-Steagall Banking Act and Its Effects on Markets: U.S. Finance

The Glass-Steagall Banking Act and Its Effects on Markets: U.S. FinanceThe Glass-Steagall Banking Act and Its Effects on Markets: U.S. Finance

Because the Federal Reserve’s interpretations of Glass–Steagall Sections 20 and 32 had weakened those restrictions, commentators did not find much significance in the repeal of those sections. Instead, the five year anniversary of their repeal was marked by numerous sources explaining that the GLBA had not significantly changed the market structure of the banking and securities industries. More significant changes had occurred during the 1990s when commercial banking firms had gained a significant role in securities markets through “Section 20 affiliates.” After the financial crisis of 2007–08, however, many commentators argued that the repeal of Sections 20 and 32 had played an important role in leading to the crisis. The main article on this subject, Glass–Steagall: Aftermath of repeal, has sections on: Commentator response to Section 20 and 32 repeal Financial industry developments after repeal of Sections 20 and 32 Glass–Steagall “repeal” and the financial crisis It also mentions that in the 1960s the Office of the Comptroller of the Currency made the Glass Steagall Act allow national banks to engage in a variety amount of securities actitivites. In the essay by Neely, from the federal reserve history website, she also mentions the important information presented above but expanded with it more. For example, she expands on what banks can underwrite which includes commercial paper, mortgage-backed securities, equity and corporate debt as long as these contribute to a small percentage of their affiliate’s revenue. She also adds that the Office of the Comptroller of the Currency allows banks to engage in mutual fund related activities including discount brokerage services. https://en.wikipedia.org/wiki/Glass%E2%80%93Steagall_Legislation -

3:32

3:32The Balancing Act Show 810 - First National Bank of Omaha

The Balancing Act Show 810 - First National Bank of OmahaThe Balancing Act Show 810 - First National Bank of Omaha

In this segment, online banking tips to help women save more towards financial security. -

15:05

15:05Age of Jackson: Crash Course US History #14

Age of Jackson: Crash Course US History #14Age of Jackson: Crash Course US History #14

In which John Green teaches you about the presidency of Andrew Jackson So how did a president with astoundingly bad fiscal policies end up on the $20 bill? That's a question we can't answer, but we can tell you how Jackson got to be president, and how he changed the country when he got the job. Jackson's election was more democratic than any previous presidential election. More people were able to vote, and they picked a doozie. Jackson was a well-known war hero, and he was elected over his longtime political enemy, John Quincy Adams. Once Jackson was in office, he did more to expand executive power than any of the previous occupants of the White House. He used armed troops to collect taxes, refused to enforce legislation and supreme court legislation, and hired and fired his staff based on support in elections. He was also the first president to regularly wield the presidential veto as a political tool. Was he a good president? Watch this video and draw your own conclusions. Support CrashCourse on Patreon: https://www.patreon.com/crashcourse -

2:46

2:46A Tale of Two Bankers - PBNBA.com

A Tale of Two Bankers - PBNBA.comA Tale of Two Bankers - PBNBA.com

Visit http://www.PBNBA.com It was the best of times; it was the worst of times in America. There is a Public Banker, a member of the bank corporations and there is the Private Banker, a member of the Common Law and Federal law, a National Banking Association. Both Bankers are under the Federal Reserve Banking Act and the U.C.C. universal code of law. Both bankers can process and issue promissory notes. The public banker processes promissory notes to presumed borrows to create money by forcing your signatures on the promissory note without you having the time to read what you sign and without full knowledge that the promissory note is then money and that you just gave the bank the first loan. The bank turns around and loans you their credit and gives your loan back to you as a loan of both principal and interest that you have to pay back. You are borrowing money into existence as per the Public Incorporated Banks own publications, rules, and regulations. The Private Banker of the unincorporated Private Bankers National Banking Association, PBNBA, under Federal, U.C.C., and Common Law also processes promissory notes for its Private Banker members to write, make, and issue these preprocessed promissory notes for a small fee as full payment and full settlement of the alleged and presumed debt or loan to the bank corporations. The PBNBA promissory notes are money also, but given to and accepted by the Public Banker with full disclosure by you as a lifetime member of the Private Bankers National Banking Association, PBNBA, to pay off your presumed debt with full settlement under Common, Federal and U.C.C. Law without waiting years and maybe losing your property to the public incorporated banks. So as you can see, you, as a lifetime member of the Private Bankers National Banking Association, PBNBA, can pay off your debts with promissory notes that are processed by the Private Bankers National Banking Association, PBNBA, for mere pennies on the dollar or normally less than 1% of your alleged bank loan at http://www.PBNBA.com today. Let's beat the banks at their own game. -

2:25

2:25PBNBA Private Bankers National Banking Association

PBNBA Private Bankers National Banking AssociationPBNBA Private Bankers National Banking Association

BECOME A PRIVATE BANKER http://www.PBNBA.COM lets you do just that! Private Bankers National Banking Association. The Federal Reserve Bank District of Columbia Note Dollars are not meant for you, the public, to spend as money. 12 U.S.C. § 411- ISSUANCE TO RESERVE BANKS; NATURE OF OBLIGATION; REDEMPTION states: Federal Reserve notes, to be issued at the discretion of the Board of Governors of the Federal Reserve System for the purpose of making advances to Federal Reserve banks through the Federal Reserve agents as hereinafter set forth and for no other purpose, are authorized. The said notes shall be obligations of the United States and shall be receivable by all national and member banks and Federal reserve banks and for all taxes, customs, and other public dues. They shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, District of Columbia, or at any Federal Reserve bank. Private Bankers National Banking Association, PBNBA, is a new legal and lawful unincorporated bank and was established 6 October, 2012, as a Private National Banking Association under COMMON LAW and Federal Law for Lifetime members of ordinary people like you to become a Private Banker to write, by signing your signature on, and to issue pre-processed promissory notes for a small fee for processing as per Congressional Positive Statutes At Large Law, Title 62 - Banks and Banking; the Attorney written United States Code of Banking Law at Title 12 U.S.C. seventh; and Title 18 U.S.C. §8 so the average man or woman can pay off debts without using Federal Reserve Note Debt Dollars from a private fictitious government corporation company located in Washing DC for the District of Columbia fraudulently passing themselves off to the American and World people as the U.S. GOVERNMENT, that is actually foreign to the united States of America, the original several Confederate Republic Colonial states of America. The U.S. GOVERNMENT company has a British Crown Dunn & Bradstreet Business Company Number that counterfeits money as per 12 U.S.C. § 411, the Federal Reserve Act, U.C.C. Law, and the Confederation of Individual State Nations Organic Republic Constitution For the united States of America, Ratified in 1787. When you become a Private Banker and Lifetime Member of the Private Bankers National Banking Association, PBNBA, you will receive the educational E-booklet; a Registered, Certified Membership Certificate; ten (10) value shares of the Constitutional Common Law Private Bankers National Banking Association, PBNBA, Private Company COMMON Stock for FREE; PLUS a $500.00 discount on every Promissory Note you write that has been processed for a processing fee by our Associate Financial Security Documents Processing Company. Join today and beat the UNITED STATES CORPORATION COMPANY Federal Reserve Banks at their own game! -

0:49

0:49History banking act of 1935

History banking act of 1935History banking act of 1935

-

66:03

66:03Building on 150 Years: The Future of National Banking with Christopher Dodd and Barney Frank

Building on 150 Years: The Future of National Banking with Christopher Dodd and Barney FrankBuilding on 150 Years: The Future of National Banking with Christopher Dodd and Barney Frank

Building on 150 Years: The Future of National Banking Sponsored by The Office of the Comptroller of the Currency and Boston University Center for Finance, Law & Policy. Discussion with Christopher Dodd, former U.S. Senator and Chairman of the Senate Committee on Banking, Housing and Urban Affairs and Barney Frank, former U.S. Congressman and Chairman of the House Financial Services Committee. Moderated by Amy Friend, Senior Deputy Comptroller and Chief Counsel, Office of the Comptroller of the Currency. March 31, 2014. -

40:35

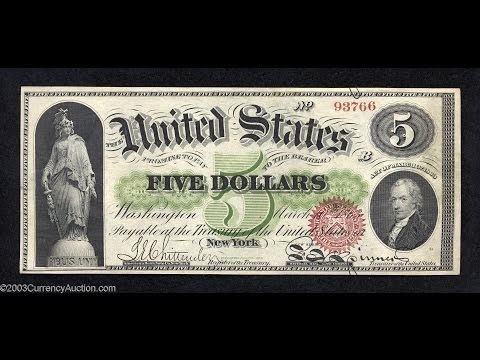

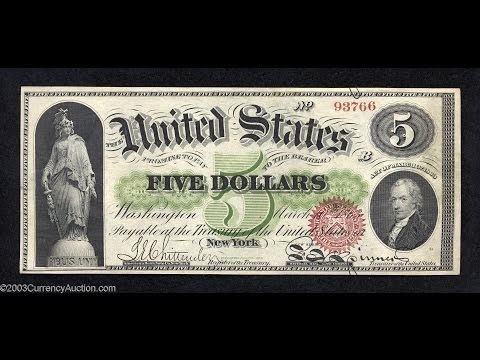

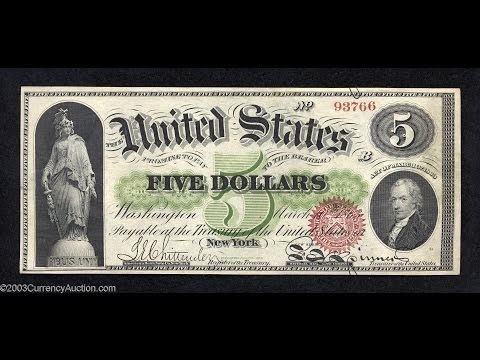

40:35The Civil War Legal Tender Acts (1862-1865): A Revolution In U.S. Monetary Policy

The Civil War Legal Tender Acts (1862-1865): A Revolution In U.S. Monetary PolicyThe Civil War Legal Tender Acts (1862-1865): A Revolution In U.S. Monetary Policy

This video highlights the Legal Tender Bill passed by the federal government on February 25, 1862. It explores the revolutionary nature of the bill including constitutional, inflationary and moral aspects. http://historicalspotlight.com Historical Topics Covered: Union finances during the winter of 1862 Introduction of the Legal Tender Bill Congressional debate Constitutional defense Constitutional problems Depreciation Inflation Moral problems Why the bill passed Effects on the wartime economy The reason for the bill Was the bill necessary National Banking Acts -

1:06

1:06Mps Debate Bill Seeking To Amend The Banking Act

Mps Debate Bill Seeking To Amend The Banking ActMps Debate Bill Seeking To Amend The Banking Act

Mps Debate Bill Seeking To Amend The Banking Act. Citizen TV is Kenya's leading television station commanding an audience reach of over 60% and in its over 12 years of existence as a pioneer brand for the Royal Media Services (RMS), it has set footprints across the country leaving no region uncovered. This is your ideal channel for the latest and breaking news, top stories, politics, business, sports, lifestyle and entertainment from Kenya and around the world. Follow us: http://citizentv.co.ke https://twitter.com/citizentvkenya https://www.facebook.com/Citizentvkenya https://plus.google.com/+CitizenTVKenya https://instagram.com/citizentvkenya -

6:08

6:08Reinstate Glass Steagall Now? The banking Act and bailouts

Reinstate Glass Steagall Now? The banking Act and bailoutsReinstate Glass Steagall Now? The banking Act and bailouts

The Banking Act, No relation to Steven Seagall The Glass--Steagall Act refers to the well-known provisions of the United States banking act of 1933 -- -- this act limited commercial banks from my having brokerage operations and limited certain affiliations between brokerage and securities firms with commercial banks. The act was named for its sponsors Sen. Carl glass and Rep. Henry Steagall From the 1930s to the 1960s many of these provisions were evolving ignored or enforced by the 1960s there was several new interpretations about the way that the act work and in 1999 there was a P from the repeal of the act which allowed for the first time in many years mergers of banks and brokerage firms such as Solomon Smith Barney and Citibank and others. Many blame the repeal of this act for the financial meltdown in reality the meltdown would've been a natural part of business had the banking and brokerage firm spends simply allowed to thrive or fail based on the merits of their business model and real capitalism. Unfortunately the government was lobbied into saving banks from foolish decisions by making massive bailouts much of which went to bonuses for Wall Street executives who made aggressive bets. The best way to avoid more financial crisis in the future is to allow banks to thrive and fail in their own that was government involvement such as huge bailouts taken from taxpayers. Please also follow me on Facebook at http://www.facebook.com/brucefentonpage

-

The Glass-Steagall Banking Act and Its Effects on Markets: U.S. Finance

Because the Federal Reserve’s interpretations of Glass–Steagall Sections 20 and 32 had weakened those restrictions, commentators did not find much significance in the repeal of those sections. Instead, the five year anniversary of their repeal was marked by numerous sources explaining that the GLBA had not significantly changed the market structure of the banking and securities industries. More significant changes had occurred during the 1990s when commercial banking firms had gained a significant role in securities markets through “Section 20 affiliates.” After the financial crisis of 2007–08, however, many commentators argued that the repeal of Sections 20 and 32 had played an important role in leading to the crisis. The main article on this subject, Glass–Steagall: Aftermath of repeal,... -

The Balancing Act Show 810 - First National Bank of Omaha

In this segment, online banking tips to help women save more towards financial security. -

Age of Jackson: Crash Course US History #14

In which John Green teaches you about the presidency of Andrew Jackson So how did a president with astoundingly bad fiscal policies end up on the $20 bill? That's a question we can't answer, but we can tell you how Jackson got to be president, and how he changed the country when he got the job. Jackson's election was more democratic than any previous presidential election. More people were able to vote, and they picked a doozie. Jackson was a well-known war hero, and he was elected over his longtime political enemy, John Quincy Adams. Once Jackson was in office, he did more to expand executive power than any of the previous occupants of the White House. He used armed troops to collect taxes, refused to enforce legislation and supreme court legislation, and hired and fired his staff based o... -

A Tale of Two Bankers - PBNBA.com

Visit http://www.PBNBA.com It was the best of times; it was the worst of times in America. There is a Public Banker, a member of the bank corporations and there is the Private Banker, a member of the Common Law and Federal law, a National Banking Association. Both Bankers are under the Federal Reserve Banking Act and the U.C.C. universal code of law. Both bankers can process and issue promissory notes. The public banker processes promissory notes to presumed borrows to create money by forcing your signatures on the promissory note without you having the time to read what you sign and without full knowledge that the promissory note is then money and that you just gave the bank the first loan. The bank turns around and loans you their credit and gives your loan back to you as a loan of bo... -

PBNBA Private Bankers National Banking Association

BECOME A PRIVATE BANKER http://www.PBNBA.COM lets you do just that! Private Bankers National Banking Association. The Federal Reserve Bank District of Columbia Note Dollars are not meant for you, the public, to spend as money. 12 U.S.C. § 411- ISSUANCE TO RESERVE BANKS; NATURE OF OBLIGATION; REDEMPTION states: Federal Reserve notes, to be issued at the discretion of the Board of Governors of the Federal Reserve System for the purpose of making advances to Federal Reserve banks through the Federal Reserve agents as hereinafter set forth and for no other purpose, are authorized. The said notes shall be obligations of the United States and shall be receivable by all national and member banks and Federal reserve banks and for all taxes, customs, and other public dues. They shall be redeemed in... -

History banking act of 1935

-

Building on 150 Years: The Future of National Banking with Christopher Dodd and Barney Frank

Building on 150 Years: The Future of National Banking Sponsored by The Office of the Comptroller of the Currency and Boston University Center for Finance, Law & Policy. Discussion with Christopher Dodd, former U.S. Senator and Chairman of the Senate Committee on Banking, Housing and Urban Affairs and Barney Frank, former U.S. Congressman and Chairman of the House Financial Services Committee. Moderated by Amy Friend, Senior Deputy Comptroller and Chief Counsel, Office of the Comptroller of the Currency. March 31, 2014. -

The Civil War Legal Tender Acts (1862-1865): A Revolution In U.S. Monetary Policy

This video highlights the Legal Tender Bill passed by the federal government on February 25, 1862. It explores the revolutionary nature of the bill including constitutional, inflationary and moral aspects. http://historicalspotlight.com Historical Topics Covered: Union finances during the winter of 1862 Introduction of the Legal Tender Bill Congressional debate Constitutional defense Constitutional problems Depreciation Inflation Moral problems Why the bill passed Effects on the wartime economy The reason for the bill Was the bill necessary National Banking Acts -

Mps Debate Bill Seeking To Amend The Banking Act

Mps Debate Bill Seeking To Amend The Banking Act. Citizen TV is Kenya's leading television station commanding an audience reach of over 60% and in its over 12 years of existence as a pioneer brand for the Royal Media Services (RMS), it has set footprints across the country leaving no region uncovered. This is your ideal channel for the latest and breaking news, top stories, politics, business, sports, lifestyle and entertainment from Kenya and around the world. Follow us: http://citizentv.co.ke https://twitter.com/citizentvkenya https://www.facebook.com/Citizentvkenya https://plus.google.com/+CitizenTVKenya https://instagram.com/citizentvkenya -

Reinstate Glass Steagall Now? The banking Act and bailouts

The Banking Act, No relation to Steven Seagall The Glass--Steagall Act refers to the well-known provisions of the United States banking act of 1933 -- -- this act limited commercial banks from my having brokerage operations and limited certain affiliations between brokerage and securities firms with commercial banks. The act was named for its sponsors Sen. Carl glass and Rep. Henry Steagall From the 1930s to the 1960s many of these provisions were evolving ignored or enforced by the 1960s there was several new interpretations about the way that the act work and in 1999 there was a P from the repeal of the act which allowed for the first time in many years mergers of banks and brokerage firms such as Solomon Smith Barney and Citibank and others. Many blame the repeal of this act for the...

The Glass-Steagall Banking Act and Its Effects on Markets: U.S. Finance

- Order: Reorder

- Duration: 62:01

- Updated: 04 Aug 2015

- views: 429

- published: 04 Aug 2015

- views: 429

The Balancing Act Show 810 - First National Bank of Omaha

- Order: Reorder

- Duration: 3:32

- Updated: 16 Apr 2008

- views: 178

- published: 16 Apr 2008

- views: 178

Age of Jackson: Crash Course US History #14

- Order: Reorder

- Duration: 15:05

- Updated: 09 May 2013

- views: 1264993

- published: 09 May 2013

- views: 1264993

A Tale of Two Bankers - PBNBA.com

- Order: Reorder

- Duration: 2:46

- Updated: 12 Mar 2016

- views: 158

- published: 12 Mar 2016

- views: 158

PBNBA Private Bankers National Banking Association

- Order: Reorder

- Duration: 2:25

- Updated: 26 Nov 2015

- views: 289

- published: 26 Nov 2015

- views: 289

History banking act of 1935

- Order: Reorder

- Duration: 0:49

- Updated: 26 Nov 2013

- views: 65

- published: 26 Nov 2013

- views: 65

Building on 150 Years: The Future of National Banking with Christopher Dodd and Barney Frank

- Order: Reorder

- Duration: 66:03

- Updated: 08 Apr 2014

- views: 507

- published: 08 Apr 2014

- views: 507

The Civil War Legal Tender Acts (1862-1865): A Revolution In U.S. Monetary Policy

- Order: Reorder

- Duration: 40:35

- Updated: 19 May 2014

- views: 852

- published: 19 May 2014

- views: 852

Mps Debate Bill Seeking To Amend The Banking Act

- Order: Reorder

- Duration: 1:06

- Updated: 13 Apr 2016

- views: 461

- published: 13 Apr 2016

- views: 461

Reinstate Glass Steagall Now? The banking Act and bailouts

- Order: Reorder

- Duration: 6:08

- Updated: 08 Oct 2013

- views: 159

- published: 08 Oct 2013

- views: 159

-

Century of Enslavement: The History of The Federal Reserve

TRANSCRIPT AND RESOURCES: http://www.corbettreport.com/federalreserve What is the Federal Reserve system? How did it come into existence? Is it part of the federal government? How does it create money? Why is the public kept in the dark about these important matters? In this feature-length documentary film, The Corbett Report explores these important question and pulls back the curtain on America's central bank. -

How Banks Work - History of Banks Documentary - Documentary Films

How Banks Work - History of Banks Documentary The history and purpose of the Federal Reserve Bank is not what is commonly believed to be the truth. Its function in the financial affairs of the United States carries a definite dark side to it - one that would shock the average US citizen. Here are some details about this 5-part article series exposing the real truth behind this very powerful agency and why the nation listens when it speaks. This first article lays the foundation of the history of the Federal Reserve by pointing out why there ever was an attempt to grab the controls of the reigns of agencies that produce the money in the US. Going back to England, it was shown that central banks have known for centuries that controlling the making and lending of currency to a nation ultima... -

American Finance: Banking, Financial Markets, Money and Stocks (2014)

Legislation passed by the federal government during the 1980s, such as the Depository Institutions Deregulation and Monetary Control Act of 1980 and the Garn–St. Germain Depository Institutions Act of 1982, reduced the distinctions between banks and other financial institutions in the United States. This legislation is frequently referred to as "deregulation," and it is often blamed for the failure of over 500 savings and loan associations between 1980 and 1988, and the subsequent failure of the Federal Savings and Loan Insurance Corporation (FSLIC) whose obligations were assumed by the FDIC in 1989. However, some critics of this viewpoint, particularly libertarians, have pointed-out that the federal government's attempts at deregulation granted easy credit to federally insured financial i... -

Corporation Nation (The U.S. is a CORPORATION not a Country)

ALL RIGHTS RESERVED UNITED STATES Inc. "Congress copyrights Constitution for the thirteen united States of America and renames it the CONSTITUTION OF THE UNITED STATES OF AMERICA. New corporate government for the District of Columbia, commands all it's vessels to swear oath to new copyrighted version." -District of Columbia Organic Act of 1871: Forty-First Congress of the United States, Session III, Chapter 61 and 62, sec. 34 enacted February 21, 1871 UNITED STATES CODE, Title 28, 3002(15)(A) -- Re-iterates "The United States government is a foreign corporation with respect to a State" (NY re: Merriam 36 N.E. 505 1441 S. 0.1973, 14 L. Ed. 287). Volume 20: Corpus Juris Sec. 1785 The United States of America is a corporation endowed with the capacity to sue and be sued, to convey and receive... -

"Let me open your eyes . . " ►William Cooper ►12.10.1993

The Truth About the Federal Reserve Bank http://educate-yourself.org/cn/fedreservebankexplained19dec05.shtml Dear American: Pursuant to your request, I will attempt to clear up questions you have about the Federal Reserve Bank (FED). I spent much time researching the FED and these are the shocking and revealing conclusions. THE FEDERAL RESERVE BANK IS A PRIVATE COMPANY. Article 1, Section 8 of the Constitution states that Congress shall have the power to coin (create) money and regulate the value thereof. Today however, the FED, which is a privately owned company, controls and profits by printing money through the Treasury, and regulating its value. The FED began with approximately 300 people or banks that became owners (stockholders purchasing stock at $100 per share - the stock is no... -

Alan Greenspan on the Bank Industry, Restructuring Federal Reserve Loans (1991)

Banking in the United States is regulated by both the federal and state governments. The five largest banks in the United States at December 31, 2011 were JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs.[1] In December 2011, the five largest banks' assets were equal to 56 percent of the U.S. economy, compared with 43 percent five years earlier. The U.S. finance industry comprised only 10% of total non-farm business profits in 1947, but it grew to 50% by 2010. Over the same period, finance industry income as a proportion of GDP rose from 2.5% to 7.5%, and the finance industry's proportion of all corporate income rose from 10% to 20%. The mean earnings per employee hour in finance relative to all other sectors has closely mirrored the share of total U.S. income ea... -

Building on 150 Years: The Future of National Banking - The Future of Banking

Building on 150 Years: The Future of National Banking The Future of Banking Sponsored by The Office of the Comptroller of the Currency and Boston University Center for Finance, Law & Policy. Discussion with Camden Fine, President of the Independent Community Bankers of America, Sharon Bowles, Chair of the Economic and Monetary Affairs Committee of the European Parliament and Karen Shaw Petrou, Managing Partner, Federal Financial Analytics, Inc. Moderated by Andrew Calamare, Executive Vice President, The Co-operative Central Bank. March 31, 2014

Century of Enslavement: The History of The Federal Reserve

- Order: Reorder

- Duration: 90:12

- Updated: 06 Jul 2014

- views: 771014

- published: 06 Jul 2014

- views: 771014

How Banks Work - History of Banks Documentary - Documentary Films

- Order: Reorder

- Duration: 44:53

- Updated: 09 Dec 2015

- views: 32405

- published: 09 Dec 2015

- views: 32405

American Finance: Banking, Financial Markets, Money and Stocks (2014)

- Order: Reorder

- Duration: 27:31

- Updated: 26 Feb 2015

- views: 421

- published: 26 Feb 2015

- views: 421

Corporation Nation (The U.S. is a CORPORATION not a Country)

- Order: Reorder

- Duration: 193:57

- Updated: 01 Feb 2014

- views: 39249

- published: 01 Feb 2014

- views: 39249

"Let me open your eyes . . " ►William Cooper ►12.10.1993

- Order: Reorder

- Duration: 106:43

- Updated: 22 Aug 2015

- views: 14881

- published: 22 Aug 2015

- views: 14881

Alan Greenspan on the Bank Industry, Restructuring Federal Reserve Loans (1991)

- Order: Reorder

- Duration: 169:23

- Updated: 27 Sep 2015

- views: 215

- published: 27 Sep 2015

- views: 215

Building on 150 Years: The Future of National Banking - The Future of Banking

- Order: Reorder

- Duration: 68:12

- Updated: 16 Apr 2014

- views: 463

- published: 16 Apr 2014

- views: 463

- Playlist

- Chat

- Playlist

- Chat

The Glass-Steagall Banking Act and Its Effects on Markets: U.S. Finance

- Report rights infringement

- published: 04 Aug 2015

- views: 429

The Balancing Act Show 810 - First National Bank of Omaha

- Report rights infringement

- published: 16 Apr 2008

- views: 178

Age of Jackson: Crash Course US History #14

- Report rights infringement

- published: 09 May 2013

- views: 1264993

A Tale of Two Bankers - PBNBA.com

- Report rights infringement

- published: 12 Mar 2016

- views: 158

PBNBA Private Bankers National Banking Association

- Report rights infringement

- published: 26 Nov 2015

- views: 289

History banking act of 1935

- Report rights infringement

- published: 26 Nov 2013

- views: 65

Building on 150 Years: The Future of National Banking with Christopher Dodd and Barney Frank

- Report rights infringement

- published: 08 Apr 2014

- views: 507

The Civil War Legal Tender Acts (1862-1865): A Revolution In U.S. Monetary Policy

- Report rights infringement

- published: 19 May 2014

- views: 852

Mps Debate Bill Seeking To Amend The Banking Act

- Report rights infringement

- published: 13 Apr 2016

- views: 461

Reinstate Glass Steagall Now? The banking Act and bailouts

- Report rights infringement

- published: 08 Oct 2013

- views: 159

- Playlist

- Chat

Century of Enslavement: The History of The Federal Reserve

- Report rights infringement

- published: 06 Jul 2014

- views: 771014

How Banks Work - History of Banks Documentary - Documentary Films

- Report rights infringement

- published: 09 Dec 2015

- views: 32405

American Finance: Banking, Financial Markets, Money and Stocks (2014)

- Report rights infringement

- published: 26 Feb 2015

- views: 421

Corporation Nation (The U.S. is a CORPORATION not a Country)

- Report rights infringement

- published: 01 Feb 2014

- views: 39249

"Let me open your eyes . . " ►William Cooper ►12.10.1993

- Report rights infringement

- published: 22 Aug 2015

- views: 14881

Alan Greenspan on the Bank Industry, Restructuring Federal Reserve Loans (1991)

- Report rights infringement

- published: 27 Sep 2015

- views: 215

Building on 150 Years: The Future of National Banking - The Future of Banking

- Report rights infringement

- published: 16 Apr 2014

- views: 463

No US role in failed Turkish military coup: Kerry

Edit Deccan Herald 17 Jul 2016French PM says clear that Nice truck driver was radicalised quickly

Edit The Himalayan 17 Jul 2016Honor Killing: Pakistani Social Media Star Strangled to Death by brother

Edit Voa News 16 Jul 2016Why Mike Pence won't be Donald Trump's attack dog

Edit Business Insider 17 Jul 2016UK offered Brexit free trade deal with Australia

Edit BBC News 17 Jul 2016Around dozen bills listed for taking up in parliament's monsoon session

Edit The Times of India 17 Jul 2016China targets capacity cuts in sectors such as steel, coal

Edit Arabnews 17 Jul 2016Congress failed to 'market' UPA's feats, says senior leader Mallikarjun Kharge

Edit The Times of India 17 Jul 2016Cooperative bank chairman held after his car mows down woman

Edit The Times of India 17 Jul 2016Naik fans raise pro-Pak slogans in Patna, booked for sedition

Edit The Times of India 17 Jul 2016Listed firms raise Rs 8,000 crore via ebook

Edit Deccan Chronicle 17 Jul 2016Companies raise over Rs 8,000 crore via bond issues on e-book platforms

Edit The Times of India 17 Jul 2016Hyderabad: RBI Governor Raghuram Rajan to address seminar on rural development tomorrow

Edit Indian Express 17 Jul 2016Cos raise over Rs 8,000 cr via bond issues on e-book platforms

Edit The Times of India 17 Jul 2016Investors lift Otago property

Edit Otago Daily Times 17 Jul 2016Saudi's largest lender National Commercial Bank says profit rises on higher lending

Edit The National 17 Jul 2016- 1

- 2

- 3

- 4

- 5

- Next page »