-

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour.

WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager

We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William

-

Campaign Finance Reform Corrupts

What corrupts politics more: Millionaires and billionaires? Or the rules that intend to limit the influence of wealthy donors? George Will, author and Pulitzer Prize-winning columnist for the Washington Post, explains who designed campaign finance reform and why Congress's solution to the problem may actually be the bigger problem.

You can support PragerU by clicking https://www.classy.org/checko

-

THE BILLIONAIRE LIFE OF Warren Buffett - Finance Money Biography (Full BBC documentary)

Click here: --------------------.

Warren Buffett Biography - Documentary.

the billionaire life of warren buffett (full documentary). thanks for watching history life discovery science learning education national earth planet channe.

The man who donated $37 Billion dollars to Charity! Warren Edward Buffett (/ˈbʌfɨt/; born August 30, 1930) is an American business magnate, investor, and phi.

-

1. Why Finance?

Financial Theory (ECON 251)

This lecture gives a brief history of the young field of financial theory, which began in business schools quite separate from economics, and of my growing interest in the field and in Wall Street. A cornerstone of standard financial theory is the efficient markets hypothesis, but that has been discredited by the financial crisis of 2007-09. This lecture describes the

-

The Alchemy of Finance by George Soros Full Audiobook

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordina...

-

1. Introduction, Financial Terms and Concepts

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

View the complete course: http://ocw.mit.edu/18-S096F13

Instructor: Peter Kempthorne, Choongbum Lee, Vasily Strela, Jake Xia

In the first lecture of this course, the instructors introduce key terms and concepts related to financial products, markets, and quantitative analysis.

License: Creative Commons BY-NC-SA

More inform

-

Qui finance Daesh ?

-

The Stock Market Explained Simply: Finance and Investing Basics - Animated Film (1957)

The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. The NYSE is open for trading Monday through Friday from 9:30 am -- 4:00 pm ET, with the exception of holidays declared by the Exchange in advance.

The NYSE trades in a continuous auction format, where traders can execut

-

Money and Finance: Crash Course Economics #11

So, we've been putting off a kind of basic question here. What is money? What is currency? How are the two different. Well, not to give away too much, but money has a few basic functions. It acts as a store of value, a medium of exchange, and as a unit of account. Money isn't just bills and coins. It can be anything that meets these three criteria. In US prisons, apparently, pouches of Mackerel ar

-

Careers in Finance

A mini documentary for young people and school children investigating career opportunities in finance and the varied routes into the industry. Get the scoop ...

-

Cash investigation - La finance folle: l'attaque des robots traders

Saison 1 Episode 3 (partie 1) : la finance folle, l'attaque des robots traders

Le monde de la finance est dominé par des machines hors de contrôle, qui pilotent des algorithmes élaborés par des mathématiciens dans le but de faire le plus de profit possible en l'espace de quelques secondes. Mais il arrive parfois que les logiciels s'emballent et provoquent ce que les experts appellent un «flash cr

-

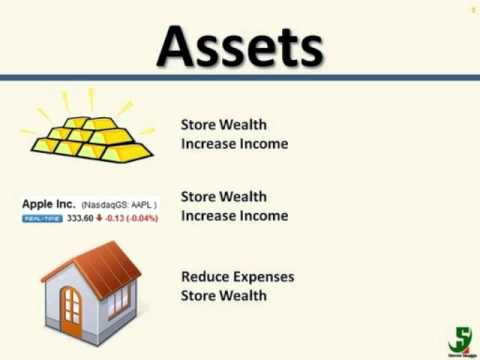

Basic Ideas of Finance

Chapter 2 Basic Ideas of Finance.

-

Math 176. Math of Finance. Lecture 01.

UCI Math 176: Math of Finance (Fall 2014)

Lec 01. Math of Finance

View the complete course: http://ocw.uci.edu/courses/math_176_math_of_finance.html

Instructor: Donald Saari, Ph.D.

License: Creative Commons CC-BY-SA

Terms of Use: http://ocw.uci.edu/info

More courses at http://ocw.uci.edu

Description: UCI Math 176 covers the following topics: reviewing of tools from probability, statistics, and e

-

Financial Management - Lecture 01

finance, financial management, Brigham, CFO, financial decision, corporate finance, business finance, financial economics, financial markets, financial institutions, financial institutions, financial instruments, securities, financial assets, financial system, money markets, capital markets, money-market instruments, capital-market instruments, banking, investments, portfolio management, portfolio

-

The Future of Banking And Finance Careers

http://bit.ly/obTzlr Simon Dixon presents on the future of banking and finance careers in the entrepreneurial unemployment economy ahead. Simon shares the di...

-

The Data Science Revolution (Jeremy Howard) - Exponential Finance 2014

Data Science (Big Data, Data Analysis, Machine Learning) is said to represent a larger potential disruption than the industrial revolution. This session will...

-

10 Ways to Finance and Start a Business

Click here http://www.briantracy.com/wealthreport to receive my FREE REPORT: The Way to Wealth! One of the key questions that first-time business owners ask ...

-

Behavioral Finance and Investment Strategy

Greg LaBlanc, Lecturer, Economic Analysis and Policy Group, Haas School of Business The emerging field of Behavioral Finance has developed a wide range of in...

-

60 minutes pour comprendre:Quelle place pour la finance participative au Maroc ?

60 minutes pour comprendre:Quelle place pour la finance participative au Maroc ?

-

Ses 1: Introduction and Course Overview

MIT 15.401 Finance Theory I, Fall 2008

View the complete course: http://ocw.mit.edu/15-401F08

Instructor: Andrew Lo

License: Creative Commons BY-NC-SA

More information at http://ocw.mit.edu/terms

More courses at http://ocw.mit.edu

-

Personal Finance Wisdom You'll Hear No Where Else

http://www.freedommentor.com/personal-finance-wisdom/ - The most valuable personal finance wisdom that you probably will hear no where else.

-

How I moved from finance to engineering in a year

In 2015, I became my company’s first internal transfer from a non-technical team into software engineering.

This montage tells the story of being a self-taught programmer, big scary changing careers and (somewhat comically) answers the question of how I went from financial analyst to software engineer in a year.

Read more on my blog: http://www.gettingbit.com

-

11. Behavioral Finance and the Role of Psychology

Financial Markets (2011) (ECON 252) Deviating from an absolute belief in the principle of rationality, Professor Shiller elaborates on human failings and foi...

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour.

WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager

We all want...

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour.

WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager

We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement.

The Floating University

Originally released September 2011.

Additional Lectures:

Michio Kaku: The Universe in a Nutshell

http://www.youtube.com/watch?v=0NbBjNiw4tk

Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the Problem?)

http://www.youtube.com/watch?v=2vr44C_G0-o

Steven Pinker: Linguistics as a Window to Understanding the Brain http://www.youtube.com/watch?v=Q-B_ONJIEcE

Leon Botstein: Art Now (Aesthetics Across Music, Painting, Architecture, Movies, and More.)

http://www.youtube.com/watch?v=j6F-sHhmfrY

Tamar Gendler: An Introduction to the Philosophy of Politics and Economics

http://www.youtube.com/watch?v=mm8asJxdcds

Nicholas Christakis: The Sociological Science Behind Social Networks and Social Influence

http://www.youtube.com/watch?v=wadBvDPeE4E

Paul Bloom: The Psychology of Everything: What Compassion, Racism, and Sex tell us about Human Nature

http://www.youtube.com/watch?v=328wX2x_s5g

Saul Levmore: Monopolies as an Introduction to Economics

http://www.youtube.com/watch?v=FK2qHyF-8u8

Lawrence Summers: Decoding the DNA of Education in Search of Actual Knowledge

http://www.youtube.com/watch?v=C6SY6N1iMcU

Douglas Melton: Is Biomedical Research Really Close to Curing Anything?

http://www.youtube.com/watch?v=Y95hT-koAC8

wn.com/William Ackman Everything You Need To Know About Finance And Investing In Under An Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour.

WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager

We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William Ackman teaches you what it takes to finance and grow a successful business and how to make sound investments that will grant you to a cash-comfy retirement.

The Floating University

Originally released September 2011.

Additional Lectures:

Michio Kaku: The Universe in a Nutshell

http://www.youtube.com/watch?v=0NbBjNiw4tk

Joel Cohen: An Introduction to Demography (Malthus Miffed: Are People the Problem?)

http://www.youtube.com/watch?v=2vr44C_G0-o

Steven Pinker: Linguistics as a Window to Understanding the Brain http://www.youtube.com/watch?v=Q-B_ONJIEcE

Leon Botstein: Art Now (Aesthetics Across Music, Painting, Architecture, Movies, and More.)

http://www.youtube.com/watch?v=j6F-sHhmfrY

Tamar Gendler: An Introduction to the Philosophy of Politics and Economics

http://www.youtube.com/watch?v=mm8asJxdcds

Nicholas Christakis: The Sociological Science Behind Social Networks and Social Influence

http://www.youtube.com/watch?v=wadBvDPeE4E

Paul Bloom: The Psychology of Everything: What Compassion, Racism, and Sex tell us about Human Nature

http://www.youtube.com/watch?v=328wX2x_s5g

Saul Levmore: Monopolies as an Introduction to Economics

http://www.youtube.com/watch?v=FK2qHyF-8u8

Lawrence Summers: Decoding the DNA of Education in Search of Actual Knowledge

http://www.youtube.com/watch?v=C6SY6N1iMcU

Douglas Melton: Is Biomedical Research Really Close to Curing Anything?

http://www.youtube.com/watch?v=Y95hT-koAC8

- published: 27 Nov 2012

- views: 715546

Campaign Finance Reform Corrupts

What corrupts politics more: Millionaires and billionaires? Or the rules that intend to limit the influence of wealthy donors? George Will, author and Pulitzer ...

What corrupts politics more: Millionaires and billionaires? Or the rules that intend to limit the influence of wealthy donors? George Will, author and Pulitzer Prize-winning columnist for the Washington Post, explains who designed campaign finance reform and why Congress's solution to the problem may actually be the bigger problem.

You can support PragerU by clicking https://www.classy.org/checkout/donation?eid=60079 Free videos are great, but to continue producing high-quality content, contributions--even small ones--are greater.

Do you shop on Amazon? Now you can feel even better about it! Click http://smile.amazon.com/ch/27-1763901 and a percentage of every Amazon purchase will be donated to PragerU. Same great products. Same low price. Charity made simple.

Visit us directly!

http://www.prageru.com

LIKE us!

https://www.facebook.com/prageru

Follow us!

Twitter: https://twitter.com/prageru

Instagram: https://instagram.com/prageru/

If you are an educator and are interested in using material like this in your classroom, click https://www.prageru.com/educator-program.php

wn.com/Campaign Finance Reform Corrupts

What corrupts politics more: Millionaires and billionaires? Or the rules that intend to limit the influence of wealthy donors? George Will, author and Pulitzer Prize-winning columnist for the Washington Post, explains who designed campaign finance reform and why Congress's solution to the problem may actually be the bigger problem.

You can support PragerU by clicking https://www.classy.org/checkout/donation?eid=60079 Free videos are great, but to continue producing high-quality content, contributions--even small ones--are greater.

Do you shop on Amazon? Now you can feel even better about it! Click http://smile.amazon.com/ch/27-1763901 and a percentage of every Amazon purchase will be donated to PragerU. Same great products. Same low price. Charity made simple.

Visit us directly!

http://www.prageru.com

LIKE us!

https://www.facebook.com/prageru

Follow us!

Twitter: https://twitter.com/prageru

Instagram: https://instagram.com/prageru/

If you are an educator and are interested in using material like this in your classroom, click https://www.prageru.com/educator-program.php

- published: 16 Nov 2015

- views: 45815

THE BILLIONAIRE LIFE OF Warren Buffett - Finance Money Biography (Full BBC documentary)

Click here: --------------------.

Warren Buffett Biography - Documentary.

the billionaire life of warren buffett (full documentary). thanks for watching h...

Click here: --------------------.

Warren Buffett Biography - Documentary.

the billionaire life of warren buffett (full documentary). thanks for watching history life discovery science learning education national earth planet channe.

The man who donated $37 Billion dollars to Charity! Warren Edward Buffett (/ˈbʌfɨt/; born August 30, 1930) is an American business magnate, investor, and phi.

Warren Buffett Documentary - The Oracle of Omaha Learn the secrets to success of Warren Buffett the world's #1 Investor. .

wn.com/The Billionaire Life Of Warren Buffett Finance Money Biography (Full BBC Documentary)

Click here: --------------------.

Warren Buffett Biography - Documentary.

the billionaire life of warren buffett (full documentary). thanks for watching history life discovery science learning education national earth planet channe.

The man who donated $37 Billion dollars to Charity! Warren Edward Buffett (/ˈbʌfɨt/; born August 30, 1930) is an American business magnate, investor, and phi.

Warren Buffett Documentary - The Oracle of Omaha Learn the secrets to success of Warren Buffett the world's #1 Investor. .

- published: 30 Dec 2014

- views: 0

1. Why Finance?

Financial Theory (ECON 251)

This lecture gives a brief history of the young field of financial theory, which began in business schools quite separate from econ...

Financial Theory (ECON 251)

This lecture gives a brief history of the young field of financial theory, which began in business schools quite separate from economics, and of my growing interest in the field and in Wall Street. A cornerstone of standard financial theory is the efficient markets hypothesis, but that has been discredited by the financial crisis of 2007-09. This lecture describes the kinds of questions standard financial theory nevertheless answers well. It also introduces the leverage cycle as a critique of standard financial theory and as an explanation of the crisis. The lecture ends with a class experiment illustrating a situation in which the efficient markets hypothesis works surprisingly well.

00:00 - Chapter 1. Course Introduction

10:16 - Chapter 2. Collateral in the Standard Theory

17:54 - Chapter 3. Leverage in Housing Prices

33:47 - Chapter 4. Examples of Finance

46:13 - Chapter 5. Why Study Finance?

50:13 - Chapter 6. Logistics

58:22 - Chapter 7. A Experiment of the Financial Market

Complete course materials are available at the Yale Online website: online.yale.edu

This course was recorded in Fall 2009.

wn.com/1. Why Finance

Financial Theory (ECON 251)

This lecture gives a brief history of the young field of financial theory, which began in business schools quite separate from economics, and of my growing interest in the field and in Wall Street. A cornerstone of standard financial theory is the efficient markets hypothesis, but that has been discredited by the financial crisis of 2007-09. This lecture describes the kinds of questions standard financial theory nevertheless answers well. It also introduces the leverage cycle as a critique of standard financial theory and as an explanation of the crisis. The lecture ends with a class experiment illustrating a situation in which the efficient markets hypothesis works surprisingly well.

00:00 - Chapter 1. Course Introduction

10:16 - Chapter 2. Collateral in the Standard Theory

17:54 - Chapter 3. Leverage in Housing Prices

33:47 - Chapter 4. Examples of Finance

46:13 - Chapter 5. Why Study Finance?

50:13 - Chapter 6. Logistics

58:22 - Chapter 7. A Experiment of the Financial Market

Complete course materials are available at the Yale Online website: online.yale.edu

This course was recorded in Fall 2009.

- published: 01 Apr 2011

- views: 291421

The Alchemy of Finance by George Soros Full Audiobook

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordina......

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordina...

wn.com/The Alchemy Of Finance By George Soros Full Audiobook

New chapter by Soros on the secrets to his success along with a new Preface and Introduction. New Foreword by renowned economist Paul Volcker "An extraordina...

- published: 19 Apr 2014

- views: 444

-

author: Sid t-nash

1. Introduction, Financial Terms and Concepts

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

View the complete course: http://ocw.mit.edu/18-S096F13

Instructor: Peter Kempthorne, ...

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

View the complete course: http://ocw.mit.edu/18-S096F13

Instructor: Peter Kempthorne, Choongbum Lee, Vasily Strela, Jake Xia

In the first lecture of this course, the instructors introduce key terms and concepts related to financial products, markets, and quantitative analysis.

License: Creative Commons BY-NC-SA

More information at http://ocw.mit.edu/terms

More courses at http://ocw.mit.edu

wn.com/1. Introduction, Financial Terms And Concepts

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

View the complete course: http://ocw.mit.edu/18-S096F13

Instructor: Peter Kempthorne, Choongbum Lee, Vasily Strela, Jake Xia

In the first lecture of this course, the instructors introduce key terms and concepts related to financial products, markets, and quantitative analysis.

License: Creative Commons BY-NC-SA

More information at http://ocw.mit.edu/terms

More courses at http://ocw.mit.edu

- published: 06 Jan 2015

- views: 166

The Stock Market Explained Simply: Finance and Investing Basics - Animated Film (1957)

The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered ...

The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. The NYSE is open for trading Monday through Friday from 9:30 am -- 4:00 pm ET, with the exception of holidays declared by the Exchange in advance.

The NYSE trades in a continuous auction format, where traders can execute stock transactions on behalf of investors. They will gather around the appropriate post where a specialist broker, who is employed by an NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open outcry auction market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10% of the time) facilitate the trades by committing their own capital and as a matter of course disseminate information to the crowd that helps to bring buyers and sellers together. The auction process moved toward automation in 1995 through the use of wireless hand held computers (HHC). The system enabled traders to receive and execute orders electronically via wireless transmission. On September 25, 1995, NYSE member Michael Einersen, who designed and developed this system, executed 1000 shares of IBM through this HHC ending a 203 year process of paper transactions and ushering in an era of automated trading.

As of January 24, 2007, all NYSE stocks can be traded via its electronic hybrid market (except for a small group of very high-priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market. In the first three months of 2007, in excess of 82% of all order volume was delivered to the floor electronically.[23] NYSE works with US regulators like the SEC and CFTC to coordinate risk management measures in the electronic trading environment through the implementation of mechanisms like circuit breakers and liquidity replenishment points.[24]

Until 2005, the right to directly trade shares on the exchange was conferred upon owners of the 1366 "seats". The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the number of seats was set at 1,366. These seats were a sought-after commodity as they conferred the ability to directly trade stock on the NYSE, and seat holders were commonly referred to as members of the NYSE. The Barnes family is the only known lineage to have five generations of NYSE members: Winthrop H. Barnes (admitted 1894), Richard W.P. Barnes (admitted 1926), Richard S. Barnes (admitted 1951), Robert H. Barnes (admitted 1972), Derek J. Barnes (admitted 2003). Seat prices varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive inflation-adjusted seat was sold in 1929 for $625,000, which, today, would be over six million dollars. In recent times, seats have sold for as high as $4 million in the late 1990s and as low as $1 million in 2001. In 2005, seat prices shot up to $3.25 million as the exchange entered into an agreement to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 in cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange. Licences for floor trading are available for $40,000 and a licence for bond trading is available for as little as $1,000 as of 2010.[25] Neither are resell-able, but may be transferable in during the change of ownership of a cooperation holding a trading licence.

On February 15, 2011 NYSE and Deutsche Börse announced their merger to form a new company, as yet unnamed, wherein Deutsche Börse shareholders will have 60% ownership of the new entity, and NYSE Euronext shareholders will have 40%.

On February 1, 2012, the European Commission blocked the merger of NYSE with Deutsche Börse, after commissioner Joaquin Almunia stated that the merger "would have led to a near-monopoly in European financial derivatives worldwide".[38] Instead, Deutsche Börse and NYSE will have to sell either their Eurex derivatives or LIFFE shares in order to not create a monopoly. On February 2, 2012, NYSE Euronext and Deutsche Börse agreed to scrap the merger.[39]

In April 2011, IntercontinentalExchange (ICE), an American futures exchange, and NASDAQ OMX Group had together made an unsolicited proposal to buy NYSE Euronext for approximately US$11 billion, a deal in which NASDAQ would have taken control of the stock exchanges.[40] NYSE Euronext rejected this offer two times, but it was finally terminated after the United States Department of Justice indicated their intention to block the deal due to antitrust concerns.

http://en.wikipedia.org/wiki/New_York_Stock_Exchange

wn.com/The Stock Market Explained Simply Finance And Investing Basics Animated Film (1957)

The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. The NYSE is open for trading Monday through Friday from 9:30 am -- 4:00 pm ET, with the exception of holidays declared by the Exchange in advance.

The NYSE trades in a continuous auction format, where traders can execute stock transactions on behalf of investors. They will gather around the appropriate post where a specialist broker, who is employed by an NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open outcry auction market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10% of the time) facilitate the trades by committing their own capital and as a matter of course disseminate information to the crowd that helps to bring buyers and sellers together. The auction process moved toward automation in 1995 through the use of wireless hand held computers (HHC). The system enabled traders to receive and execute orders electronically via wireless transmission. On September 25, 1995, NYSE member Michael Einersen, who designed and developed this system, executed 1000 shares of IBM through this HHC ending a 203 year process of paper transactions and ushering in an era of automated trading.

As of January 24, 2007, all NYSE stocks can be traded via its electronic hybrid market (except for a small group of very high-priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market. In the first three months of 2007, in excess of 82% of all order volume was delivered to the floor electronically.[23] NYSE works with US regulators like the SEC and CFTC to coordinate risk management measures in the electronic trading environment through the implementation of mechanisms like circuit breakers and liquidity replenishment points.[24]

Until 2005, the right to directly trade shares on the exchange was conferred upon owners of the 1366 "seats". The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the number of seats was set at 1,366. These seats were a sought-after commodity as they conferred the ability to directly trade stock on the NYSE, and seat holders were commonly referred to as members of the NYSE. The Barnes family is the only known lineage to have five generations of NYSE members: Winthrop H. Barnes (admitted 1894), Richard W.P. Barnes (admitted 1926), Richard S. Barnes (admitted 1951), Robert H. Barnes (admitted 1972), Derek J. Barnes (admitted 2003). Seat prices varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive inflation-adjusted seat was sold in 1929 for $625,000, which, today, would be over six million dollars. In recent times, seats have sold for as high as $4 million in the late 1990s and as low as $1 million in 2001. In 2005, seat prices shot up to $3.25 million as the exchange entered into an agreement to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 in cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange. Licences for floor trading are available for $40,000 and a licence for bond trading is available for as little as $1,000 as of 2010.[25] Neither are resell-able, but may be transferable in during the change of ownership of a cooperation holding a trading licence.

On February 15, 2011 NYSE and Deutsche Börse announced their merger to form a new company, as yet unnamed, wherein Deutsche Börse shareholders will have 60% ownership of the new entity, and NYSE Euronext shareholders will have 40%.

On February 1, 2012, the European Commission blocked the merger of NYSE with Deutsche Börse, after commissioner Joaquin Almunia stated that the merger "would have led to a near-monopoly in European financial derivatives worldwide".[38] Instead, Deutsche Börse and NYSE will have to sell either their Eurex derivatives or LIFFE shares in order to not create a monopoly. On February 2, 2012, NYSE Euronext and Deutsche Börse agreed to scrap the merger.[39]

In April 2011, IntercontinentalExchange (ICE), an American futures exchange, and NASDAQ OMX Group had together made an unsolicited proposal to buy NYSE Euronext for approximately US$11 billion, a deal in which NASDAQ would have taken control of the stock exchanges.[40] NYSE Euronext rejected this offer two times, but it was finally terminated after the United States Department of Justice indicated their intention to block the deal due to antitrust concerns.

http://en.wikipedia.org/wiki/New_York_Stock_Exchange

- published: 16 Apr 2014

- views: 89593

Money and Finance: Crash Course Economics #11

So, we've been putting off a kind of basic question here. What is money? What is currency? How are the two different. Well, not to give away too much, but money...

So, we've been putting off a kind of basic question here. What is money? What is currency? How are the two different. Well, not to give away too much, but money has a few basic functions. It acts as a store of value, a medium of exchange, and as a unit of account. Money isn't just bills and coins. It can be anything that meets these three criteria. In US prisons, apparently, pouches of Mackerel are currency. Yes, mackerel the fish. Paper and coins work as money because they're backed by the government, which is an advantage over mackerel. So, once you've got money, you need finance. We'll talk about borrowing, lending, interest, and stocks and bonds. Also, this episode features a giant zucchini, which Adriene grew in her garden. So that's cool.

Special thanks to Dave Hunt for permission to use his PiPhone video. this guy really did make an artisanal smartphone! https://www.youtube.com/watch?v=8eaiNsFhtI8

Crash Course is on Patreon! You can support us directly by signing up at http://www.patreon.com/crashcourse

Thanks to the following Patrons for their generous monthly contributions that help keep Crash Course free for everyone forever:

Fatima Iqbal, Penelope Flagg, Eugenia Karlson, Alex S, Jirat, Tim Curwick, Christy Huddleston, Eric Kitchen, Moritz Schmidt, Today I Found Out, Avi Yashchin, Chris Peters, Eric Knight, Jacob Ash, Simun Niclasen, Jan Schmid, Elliot Beter, Sandra Aft, SR Foxley, Ian Dundore, Daniel Baulig, Jason A Saslow, Robert Kunz, Jessica Wode, Steve Marshall, Anna-Ester Volozh, Christian, Caleb Weeks, Jeffrey Thompson, James Craver, and Markus Persson

--

Want to find Crash Course elsewhere on the internet?

Facebook - http://www.facebook.com/YouTubeCrashCourse

Twitter - http://www.twitter.com/TheCrashCourse

Tumblr - http://thecrashcourse.tumblr.com

Support Crash Course on Patreon: http://patreon.com/crashcourse

CC Kids: http://www.youtube.com/crashcoursekids

wn.com/Money And Finance Crash Course Economics 11

So, we've been putting off a kind of basic question here. What is money? What is currency? How are the two different. Well, not to give away too much, but money has a few basic functions. It acts as a store of value, a medium of exchange, and as a unit of account. Money isn't just bills and coins. It can be anything that meets these three criteria. In US prisons, apparently, pouches of Mackerel are currency. Yes, mackerel the fish. Paper and coins work as money because they're backed by the government, which is an advantage over mackerel. So, once you've got money, you need finance. We'll talk about borrowing, lending, interest, and stocks and bonds. Also, this episode features a giant zucchini, which Adriene grew in her garden. So that's cool.

Special thanks to Dave Hunt for permission to use his PiPhone video. this guy really did make an artisanal smartphone! https://www.youtube.com/watch?v=8eaiNsFhtI8

Crash Course is on Patreon! You can support us directly by signing up at http://www.patreon.com/crashcourse

Thanks to the following Patrons for their generous monthly contributions that help keep Crash Course free for everyone forever:

Fatima Iqbal, Penelope Flagg, Eugenia Karlson, Alex S, Jirat, Tim Curwick, Christy Huddleston, Eric Kitchen, Moritz Schmidt, Today I Found Out, Avi Yashchin, Chris Peters, Eric Knight, Jacob Ash, Simun Niclasen, Jan Schmid, Elliot Beter, Sandra Aft, SR Foxley, Ian Dundore, Daniel Baulig, Jason A Saslow, Robert Kunz, Jessica Wode, Steve Marshall, Anna-Ester Volozh, Christian, Caleb Weeks, Jeffrey Thompson, James Craver, and Markus Persson

--

Want to find Crash Course elsewhere on the internet?

Facebook - http://www.facebook.com/YouTubeCrashCourse

Twitter - http://www.twitter.com/TheCrashCourse

Tumblr - http://thecrashcourse.tumblr.com

Support Crash Course on Patreon: http://patreon.com/crashcourse

CC Kids: http://www.youtube.com/crashcoursekids

- published: 14 Oct 2015

- views: 14705

Careers in Finance

A mini documentary for young people and school children investigating career opportunities in finance and the varied routes into the industry. Get the scoop ......

A mini documentary for young people and school children investigating career opportunities in finance and the varied routes into the industry. Get the scoop ...

wn.com/Careers In Finance

A mini documentary for young people and school children investigating career opportunities in finance and the varied routes into the industry. Get the scoop ...

Cash investigation - La finance folle: l'attaque des robots traders

Saison 1 Episode 3 (partie 1) : la finance folle, l'attaque des robots traders

Le monde de la finance est dominé par des machines hors de contrôle, qui piloten...

Saison 1 Episode 3 (partie 1) : la finance folle, l'attaque des robots traders

Le monde de la finance est dominé par des machines hors de contrôle, qui pilotent des algorithmes élaborés par des mathématiciens dans le but de faire le plus de profit possible en l'espace de quelques secondes. Mais il arrive parfois que les logiciels s'emballent et provoquent ce que les experts appellent un «flash crack» : un effondrement de la bourse en quelques instants. «Cash Investigation» a enquêté dans le milieu des «speed traders» et a découvert leurs méthodes souvent choquantes. Les journalistes dénoncent un monde de la finance qui, quatre ans après la première crise de 2008, semble ne pas avoir tiré les enseignements.

Elise Lucet

France 2

#cashinvestigation

Toutes l'actualité de Cash Investigation

http://www.francetvinfo.fr/replay-magazine/france-2/cash-investigation/

https://www.facebook.com/cashinvestigationfrance2

Twitter: @cashinvestigati

wn.com/Cash Investigation La Finance Folle L'Attaque Des Robots Traders

Saison 1 Episode 3 (partie 1) : la finance folle, l'attaque des robots traders

Le monde de la finance est dominé par des machines hors de contrôle, qui pilotent des algorithmes élaborés par des mathématiciens dans le but de faire le plus de profit possible en l'espace de quelques secondes. Mais il arrive parfois que les logiciels s'emballent et provoquent ce que les experts appellent un «flash crack» : un effondrement de la bourse en quelques instants. «Cash Investigation» a enquêté dans le milieu des «speed traders» et a découvert leurs méthodes souvent choquantes. Les journalistes dénoncent un monde de la finance qui, quatre ans après la première crise de 2008, semble ne pas avoir tiré les enseignements.

Elise Lucet

France 2

#cashinvestigation

Toutes l'actualité de Cash Investigation

http://www.francetvinfo.fr/replay-magazine/france-2/cash-investigation/

https://www.facebook.com/cashinvestigationfrance2

Twitter: @cashinvestigati

- published: 21 Jul 2015

- views: 193

Basic Ideas of Finance

Chapter 2 Basic Ideas of Finance....

Chapter 2 Basic Ideas of Finance.

wn.com/Basic Ideas Of Finance

Chapter 2 Basic Ideas of Finance.

- published: 07 Jan 2011

- views: 7989

-

author: FIN205

Math 176. Math of Finance. Lecture 01.

UCI Math 176: Math of Finance (Fall 2014)

Lec 01. Math of Finance

View the complete course: http://ocw.uci.edu/courses/math_176_math_of_finance.html

Instructor:...

UCI Math 176: Math of Finance (Fall 2014)

Lec 01. Math of Finance

View the complete course: http://ocw.uci.edu/courses/math_176_math_of_finance.html

Instructor: Donald Saari, Ph.D.

License: Creative Commons CC-BY-SA

Terms of Use: http://ocw.uci.edu/info

More courses at http://ocw.uci.edu

Description: UCI Math 176 covers the following topics: reviewing of tools from probability, statistics, and elementary differential and partial differential equations, concepts such as hedging, arbitrage, Puts, Calls, the design of portfolios, the derivation and solution of the Blac-Scholes, and other equations.

Recorded on January 7, 2014

Required attribution: Saari, Donald. Math 176 (UCI OpenCourseWare: University of California, Irvine), http://ocw.uci.edu/courses/math_176_math_of_finance.html. [Access date]. License: Creative Commons Attribution-ShareAlike 4.0 United States License. (http://creativecommons.org/licenses/by-sa/4.0/).

wn.com/Math 176. Math Of Finance. Lecture 01.

UCI Math 176: Math of Finance (Fall 2014)

Lec 01. Math of Finance

View the complete course: http://ocw.uci.edu/courses/math_176_math_of_finance.html

Instructor: Donald Saari, Ph.D.

License: Creative Commons CC-BY-SA

Terms of Use: http://ocw.uci.edu/info

More courses at http://ocw.uci.edu

Description: UCI Math 176 covers the following topics: reviewing of tools from probability, statistics, and elementary differential and partial differential equations, concepts such as hedging, arbitrage, Puts, Calls, the design of portfolios, the derivation and solution of the Blac-Scholes, and other equations.

Recorded on January 7, 2014

Required attribution: Saari, Donald. Math 176 (UCI OpenCourseWare: University of California, Irvine), http://ocw.uci.edu/courses/math_176_math_of_finance.html. [Access date]. License: Creative Commons Attribution-ShareAlike 4.0 United States License. (http://creativecommons.org/licenses/by-sa/4.0/).

- published: 31 Jan 2014

- views: 15258

Financial Management - Lecture 01

finance, financial management, Brigham, CFO, financial decision, corporate finance, business finance, financial economics, financial markets, financial institut...

finance, financial management, Brigham, CFO, financial decision, corporate finance, business finance, financial economics, financial markets, financial institutions, financial institutions, financial instruments, securities, financial assets, financial system, money markets, capital markets, money-market instruments, capital-market instruments, banking, investments, portfolio management, portfolio theory, security analysis, behavioral finance, personal finance, public finance, proprietorship, partnership, corporation, retained earnings, dividends, profit maximization, wealth, shareholder wealth, market price, share price, value, fundamental value, intrinsic value, true value, discounted value, fundamental value, risk, true risk, perceived risk,

wn.com/Financial Management Lecture 01

finance, financial management, Brigham, CFO, financial decision, corporate finance, business finance, financial economics, financial markets, financial institutions, financial institutions, financial instruments, securities, financial assets, financial system, money markets, capital markets, money-market instruments, capital-market instruments, banking, investments, portfolio management, portfolio theory, security analysis, behavioral finance, personal finance, public finance, proprietorship, partnership, corporation, retained earnings, dividends, profit maximization, wealth, shareholder wealth, market price, share price, value, fundamental value, intrinsic value, true value, discounted value, fundamental value, risk, true risk, perceived risk,

- published: 26 Oct 2011

- views: 261426

The Future of Banking And Finance Careers

http://bit.ly/obTzlr Simon Dixon presents on the future of banking and finance careers in the entrepreneurial unemployment economy ahead. Simon shares the di......

http://bit.ly/obTzlr Simon Dixon presents on the future of banking and finance careers in the entrepreneurial unemployment economy ahead. Simon shares the di...

wn.com/The Future Of Banking And Finance Careers

http://bit.ly/obTzlr Simon Dixon presents on the future of banking and finance careers in the entrepreneurial unemployment economy ahead. Simon shares the di...

The Data Science Revolution (Jeremy Howard) - Exponential Finance 2014

Data Science (Big Data, Data Analysis, Machine Learning) is said to represent a larger potential disruption than the industrial revolution. This session will......

Data Science (Big Data, Data Analysis, Machine Learning) is said to represent a larger potential disruption than the industrial revolution. This session will...

wn.com/The Data Science Revolution (Jeremy Howard) Exponential Finance 2014

Data Science (Big Data, Data Analysis, Machine Learning) is said to represent a larger potential disruption than the industrial revolution. This session will...

10 Ways to Finance and Start a Business

Click here http://www.briantracy.com/wealthreport to receive my FREE REPORT: The Way to Wealth! One of the key questions that first-time business owners ask ......

Click here http://www.briantracy.com/wealthreport to receive my FREE REPORT: The Way to Wealth! One of the key questions that first-time business owners ask ...

wn.com/10 Ways To Finance And Start A Business

Click here http://www.briantracy.com/wealthreport to receive my FREE REPORT: The Way to Wealth! One of the key questions that first-time business owners ask ...

- published: 12 Apr 2012

- views: 138840

-

author: Brian Tracy

Behavioral Finance and Investment Strategy

Greg LaBlanc, Lecturer, Economic Analysis and Policy Group, Haas School of Business The emerging field of Behavioral Finance has developed a wide range of in......

Greg LaBlanc, Lecturer, Economic Analysis and Policy Group, Haas School of Business The emerging field of Behavioral Finance has developed a wide range of in...

wn.com/Behavioral Finance And Investment Strategy

Greg LaBlanc, Lecturer, Economic Analysis and Policy Group, Haas School of Business The emerging field of Behavioral Finance has developed a wide range of in...

60 minutes pour comprendre:Quelle place pour la finance participative au Maroc ?

60 minutes pour comprendre:Quelle place pour la finance participative au Maroc ?...

60 minutes pour comprendre:Quelle place pour la finance participative au Maroc ?

wn.com/60 Minutes Pour Comprendre Quelle Place Pour La Finance Participative Au Maroc

60 minutes pour comprendre:Quelle place pour la finance participative au Maroc ?

- published: 28 Oct 2015

- views: 2646

Ses 1: Introduction and Course Overview

MIT 15.401 Finance Theory I, Fall 2008

View the complete course: http://ocw.mit.edu/15-401F08

Instructor: Andrew Lo

License: Creative Commons BY-NC-SA

More inf...

MIT 15.401 Finance Theory I, Fall 2008

View the complete course: http://ocw.mit.edu/15-401F08

Instructor: Andrew Lo

License: Creative Commons BY-NC-SA

More information at http://ocw.mit.edu/terms

More courses at http://ocw.mit.edu

wn.com/Ses 1 Introduction And Course Overview

MIT 15.401 Finance Theory I, Fall 2008

View the complete course: http://ocw.mit.edu/15-401F08

Instructor: Andrew Lo

License: Creative Commons BY-NC-SA

More information at http://ocw.mit.edu/terms

More courses at http://ocw.mit.edu

- published: 10 May 2013

- views: 90188

Personal Finance Wisdom You'll Hear No Where Else

http://www.freedommentor.com/personal-finance-wisdom/ - The most valuable personal finance wisdom that you probably will hear no where else....

http://www.freedommentor.com/personal-finance-wisdom/ - The most valuable personal finance wisdom that you probably will hear no where else.

wn.com/Personal Finance Wisdom You'll Hear No Where Else

http://www.freedommentor.com/personal-finance-wisdom/ - The most valuable personal finance wisdom that you probably will hear no where else.

How I moved from finance to engineering in a year

In 2015, I became my company’s first internal transfer from a non-technical team into software engineering.

This montage tells the story of being a self-taught...

In 2015, I became my company’s first internal transfer from a non-technical team into software engineering.

This montage tells the story of being a self-taught programmer, big scary changing careers and (somewhat comically) answers the question of how I went from financial analyst to software engineer in a year.

Read more on my blog: http://www.gettingbit.com

wn.com/How I Moved From Finance To Engineering In A Year

In 2015, I became my company’s first internal transfer from a non-technical team into software engineering.

This montage tells the story of being a self-taught programmer, big scary changing careers and (somewhat comically) answers the question of how I went from financial analyst to software engineer in a year.

Read more on my blog: http://www.gettingbit.com

- published: 16 Jul 2015

- views: 14

11. Behavioral Finance and the Role of Psychology

Financial Markets (2011) (ECON 252) Deviating from an absolute belief in the principle of rationality, Professor Shiller elaborates on human failings and foi......

Financial Markets (2011) (ECON 252) Deviating from an absolute belief in the principle of rationality, Professor Shiller elaborates on human failings and foi...

wn.com/11. Behavioral Finance And The Role Of Psychology

Financial Markets (2011) (ECON 252) Deviating from an absolute belief in the principle of rationality, Professor Shiller elaborates on human failings and foi...

- published: 05 Apr 2012

- views: 42784

-

author: YaleCourses

-

Accounts Receivable Factoring With Recourse Versus Without Recourse On Sale

Accounting for the sales of receivables (accounts receivable) compaing a sale with recourse versus a sale without recourse, factoring of accounts receivable,...

-

James Emmett, Global Head of Trade and Receivables Finance, HSBC

James Emmett, Global Head of Trade and Receivables Finance, HSBC

-

Funding Invoice Learning Centre - Receivables Finance

Welcome to the Funding Invoice Learning Centre where you'll find a wealth of information on financing your business!

This video explains what "Receivables Finance" is and how you might use it.

http://fundinginvoice.com/

-

How Receivables Financing Works For Manufacturing & Fabrication Companies

What Is Factoring Receivables For Manufacturing & Fabrication? http://www.universalfunding.com/factoring-receivables factoring invoices, factoring receivable...

-

Stuart Tait, global head, trade and receivables finance, HSBC - View from Sibos 2014

Jane Cooper, The Banker's technology and transaction banking editor speaks with Stuart Tait, global head, trade and receivables finance, HSBC, during the Sibos 2014 conference held in Boston.

-

Account Receivables Financing For A Printing or Publishing Company

Printer Account Receivables Financing http://www.universalfunding.com/account-receivables-financing InWest Printing, Inc. opened their doors for business in ...

-

Accounts Receivable Factoring - What is It?

What is accounts receivable factoring? For information, visit http://www.comcapfactoring.com/products/accounts-receivable-factoring/

This video explains how accounts receivable financing works and how it can be used to improve your cash flow. The video also provides a sample transaction.

-

Receivables Finance - the life blood of trade

Receivables Finance - the life blood of trade.

-

Guide to Invoice Factoring (a.k.a. Receivables Financing)

Business finance expert DB Squared provides a great overview of the Invoice Factoring (a.k.a. Receivables Financing) process. In this guide to invoice factoring, you will find out how the invoice factoring process works and how it benefits businesses.

Businesses usually factor invoices to help maintain more consistent cash flow, but that is just the beginning. Factoring invoices with a non-reco

-

Financial Accounting: Receivables

Introduction to Financial Accounting Receivables (Chapter 8) March 25th, 2013 by Professor Victoria Chiu The Professor starts this lecture off with a review ...

-

Bank Financing vs. Receivables Factoring

http://www.driveyoursuccess.com Costs of financing receivables with a bank versus receivables factoring. The video breaks down how to compare costs and how t...

-

Receivables Financing Programs for Staffing Companies

Receivables Financing Programs for Staffing Companies If you are a staffing company, you know that making payroll is one of the more significant challenges f...

-

Will receivable finance play a greater role in the future? | World Finance Videos

World Finance speaks to Simon Featherstone, CEO of Bibby Financial Services Global, to discuss the future of the receivable finance and invoice finance industry.

Payday lending has come under serious criticism as of late, not least for their dealings with small companies, and regulators have recently tried to stamp out unethical and uncompetitive performance. World Finance speaks to Simon Feather

-

Why attend TFR's receivables Finance masterclass?

Geoffrey Wynne leads our receivables finance masterclass 27 March. Just £445+VAT

Email events@ark-group.com or phone 44(0)207 324 2365 to book your place or for more information.

-

Why Accounts Receivables Financing can be Better than a Bank Loan

Why Accounts Receivables Financing can be Better than a Bank Loan

Many often feel as though non-traditional commercial financing options are only for those companies that have been turned down for a traditional bank loan. Yet, for many other companies, going the non-traditional route through a product such as accounts receivable financing may be the better financing method even if the option for a

-

Comparing Factoring Receivables and Purchase Order Financing

Factoring Receivables and Purchase Order Financing are great alternatives to bank loans. Purchase Order financing is a short term financing option used to co...

-

Manage Account receivables,Finance Manager

-

Client Testimonial for Export Receivables Financing Program

http://www.drakefinance.com/application/ http://www.drakefinance.com info@drakefinance.com Footage of the 2012 Conference for South Florida Exporters brought...

-

USA Factoring Accounts Receivable Finance

http://www.usafactoring.com What is accounts receivable factoring? Factoring accounts receivable is a tool that speeds up cash flow from accounts receivables...

-

Bank Subordination Agreements with Receivables Financing

How to get the working capital you need through bank subordination and solutions for low bank lines of credit through invoice factoring, purchase order finan...

-

oracle fusion financial accounts receivables and account payables

Oracle Fusion Account Receivables and Payable Cloud Services.

Learn about the latest features and benefits of Oracle Fusion Financials.

-

Experience Transformation with SAP Fiori UX – Process Receivables

The new SAP Fiori user experience in SAP Simple Finance makes financial management processes, including receivables management, more efficient. This video demonstrates how a cash collections specialist benefits from SAP Fiori UX vs. SAP GUI.

-

Oracle Financial Functional Accounts Receivables AR Class 5

Accounts Receivable Factoring With Recourse Versus Without Recourse On Sale

Accounting for the sales of receivables (accounts receivable) compaing a sale with recourse versus a sale without recourse, factoring of accounts receivable,......

Accounting for the sales of receivables (accounts receivable) compaing a sale with recourse versus a sale without recourse, factoring of accounts receivable,...

wn.com/Accounts Receivable Factoring With Recourse Versus Without Recourse On Sale

Accounting for the sales of receivables (accounts receivable) compaing a sale with recourse versus a sale without recourse, factoring of accounts receivable,...

James Emmett, Global Head of Trade and Receivables Finance, HSBC

James Emmett, Global Head of Trade and Receivables Finance, HSBC...

James Emmett, Global Head of Trade and Receivables Finance, HSBC

wn.com/James Emmett, Global Head Of Trade And Receivables Finance, Hsbc

James Emmett, Global Head of Trade and Receivables Finance, HSBC

- published: 10 Jun 2014

- views: 5

Funding Invoice Learning Centre - Receivables Finance

Welcome to the Funding Invoice Learning Centre where you'll find a wealth of information on financing your business!

This video explains what "Receivables Fina...

Welcome to the Funding Invoice Learning Centre where you'll find a wealth of information on financing your business!

This video explains what "Receivables Finance" is and how you might use it.

http://fundinginvoice.com/

wn.com/Funding Invoice Learning Centre Receivables Finance

Welcome to the Funding Invoice Learning Centre where you'll find a wealth of information on financing your business!

This video explains what "Receivables Finance" is and how you might use it.

http://fundinginvoice.com/

- published: 08 Jul 2015

- views: 10

How Receivables Financing Works For Manufacturing & Fabrication Companies

What Is Factoring Receivables For Manufacturing & Fabrication? http://www.universalfunding.com/factoring-receivables factoring invoices, factoring receivable......

What Is Factoring Receivables For Manufacturing & Fabrication? http://www.universalfunding.com/factoring-receivables factoring invoices, factoring receivable...

wn.com/How Receivables Financing Works For Manufacturing Fabrication Companies

What Is Factoring Receivables For Manufacturing & Fabrication? http://www.universalfunding.com/factoring-receivables factoring invoices, factoring receivable...

Stuart Tait, global head, trade and receivables finance, HSBC - View from Sibos 2014

Jane Cooper, The Banker's technology and transaction banking editor speaks with Stuart Tait, global head, trade and receivables finance, HSBC, during the Sibos ...

Jane Cooper, The Banker's technology and transaction banking editor speaks with Stuart Tait, global head, trade and receivables finance, HSBC, during the Sibos 2014 conference held in Boston.

wn.com/Stuart Tait, Global Head, Trade And Receivables Finance, Hsbc View From Sibos 2014

Jane Cooper, The Banker's technology and transaction banking editor speaks with Stuart Tait, global head, trade and receivables finance, HSBC, during the Sibos 2014 conference held in Boston.

- published: 01 Oct 2014

- views: 1

Account Receivables Financing For A Printing or Publishing Company

Printer Account Receivables Financing http://www.universalfunding.com/account-receivables-financing InWest Printing, Inc. opened their doors for business in ......

Printer Account Receivables Financing http://www.universalfunding.com/account-receivables-financing InWest Printing, Inc. opened their doors for business in ...

wn.com/Account Receivables Financing For A Printing Or Publishing Company

Printer Account Receivables Financing http://www.universalfunding.com/account-receivables-financing InWest Printing, Inc. opened their doors for business in ...

Accounts Receivable Factoring - What is It?

What is accounts receivable factoring? For information, visit http://www.comcapfactoring.com/products/accounts-receivable-factoring/

This video explains how ac...

What is accounts receivable factoring? For information, visit http://www.comcapfactoring.com/products/accounts-receivable-factoring/

This video explains how accounts receivable financing works and how it can be used to improve your cash flow. The video also provides a sample transaction.

wn.com/Accounts Receivable Factoring What Is It

What is accounts receivable factoring? For information, visit http://www.comcapfactoring.com/products/accounts-receivable-factoring/

This video explains how accounts receivable financing works and how it can be used to improve your cash flow. The video also provides a sample transaction.

- published: 27 Nov 2013

- views: 1110

Guide to Invoice Factoring (a.k.a. Receivables Financing)

Business finance expert DB Squared provides a great overview of the Invoice Factoring (a.k.a. Receivables Financing) process. In this guide to invoice factorin...

Business finance expert DB Squared provides a great overview of the Invoice Factoring (a.k.a. Receivables Financing) process. In this guide to invoice factoring, you will find out how the invoice factoring process works and how it benefits businesses.

Businesses usually factor invoices to help maintain more consistent cash flow, but that is just the beginning. Factoring invoices with a non-recourse factoring company also helps to limit risk from bad debt.

The working capital made available by factoring invoices can be used to save money by negotiating more favorable terms with vendors or buying in bulk for volume discounts. In addition, since companies that factor invoices no longer have to wait for customers to pay, they can even choose to extend more favorable payment terms to their own customers, thereby creating a competitive advantage.

DB Squared also provides a helpful checklist of some of the hidden costs that can be found in some invoice factoring agreements. Businesses that are comparing factoring contracts should look for hidden costs such as long term contract commitments, penalties for contract termination, auto-renewal windows that make it almost impossible to leave, administrative fees, expiring or introductory rates and fees and much more.

For a free quote or to get more information about receivables financing, you can visit www.dbsquaredinc.com or contact them directly at 866.855.3640.

wn.com/Guide To Invoice Factoring (A.K.A. Receivables Financing)

Business finance expert DB Squared provides a great overview of the Invoice Factoring (a.k.a. Receivables Financing) process. In this guide to invoice factoring, you will find out how the invoice factoring process works and how it benefits businesses.

Businesses usually factor invoices to help maintain more consistent cash flow, but that is just the beginning. Factoring invoices with a non-recourse factoring company also helps to limit risk from bad debt.

The working capital made available by factoring invoices can be used to save money by negotiating more favorable terms with vendors or buying in bulk for volume discounts. In addition, since companies that factor invoices no longer have to wait for customers to pay, they can even choose to extend more favorable payment terms to their own customers, thereby creating a competitive advantage.

DB Squared also provides a helpful checklist of some of the hidden costs that can be found in some invoice factoring agreements. Businesses that are comparing factoring contracts should look for hidden costs such as long term contract commitments, penalties for contract termination, auto-renewal windows that make it almost impossible to leave, administrative fees, expiring or introductory rates and fees and much more.

For a free quote or to get more information about receivables financing, you can visit www.dbsquaredinc.com or contact them directly at 866.855.3640.

- published: 15 Jul 2014

- views: 64

Financial Accounting: Receivables

Introduction to Financial Accounting Receivables (Chapter 8) March 25th, 2013 by Professor Victoria Chiu The Professor starts this lecture off with a review ......

Introduction to Financial Accounting Receivables (Chapter 8) March 25th, 2013 by Professor Victoria Chiu The Professor starts this lecture off with a review ...

wn.com/Financial Accounting Receivables

Introduction to Financial Accounting Receivables (Chapter 8) March 25th, 2013 by Professor Victoria Chiu The Professor starts this lecture off with a review ...

- published: 30 May 2013

- views: 4968

-

author: rutgersweb

Bank Financing vs. Receivables Factoring

http://www.driveyoursuccess.com Costs of financing receivables with a bank versus receivables factoring. The video breaks down how to compare costs and how t......

http://www.driveyoursuccess.com Costs of financing receivables with a bank versus receivables factoring. The video breaks down how to compare costs and how t...

wn.com/Bank Financing Vs. Receivables Factoring

http://www.driveyoursuccess.com Costs of financing receivables with a bank versus receivables factoring. The video breaks down how to compare costs and how t...

Receivables Financing Programs for Staffing Companies

Receivables Financing Programs for Staffing Companies If you are a staffing company, you know that making payroll is one of the more significant challenges f......

Receivables Financing Programs for Staffing Companies If you are a staffing company, you know that making payroll is one of the more significant challenges f...

wn.com/Receivables Financing Programs For Staffing Companies

Receivables Financing Programs for Staffing Companies If you are a staffing company, you know that making payroll is one of the more significant challenges f...

Will receivable finance play a greater role in the future? | World Finance Videos

World Finance speaks to Simon Featherstone, CEO of Bibby Financial Services Global, to discuss the future of the receivable finance and invoice finance industry...

World Finance speaks to Simon Featherstone, CEO of Bibby Financial Services Global, to discuss the future of the receivable finance and invoice finance industry.

Payday lending has come under serious criticism as of late, not least for their dealings with small companies, and regulators have recently tried to stamp out unethical and uncompetitive performance. World Finance speaks to Simon Featherstone, CEO of Bibby Financial Services Global, to discuss the future of the receivables finance and invoice finance industry.

For a full transcript visit: http://www.worldfinance.com/videos/will-receivable-finance-play-a-greater-role-in-the-future-video

For more World Finance interviews go to http://www.worldfinance.com/videos/

wn.com/Will Receivable Finance Play A Greater Role In The Future | World Finance Videos

World Finance speaks to Simon Featherstone, CEO of Bibby Financial Services Global, to discuss the future of the receivable finance and invoice finance industry.

Payday lending has come under serious criticism as of late, not least for their dealings with small companies, and regulators have recently tried to stamp out unethical and uncompetitive performance. World Finance speaks to Simon Featherstone, CEO of Bibby Financial Services Global, to discuss the future of the receivables finance and invoice finance industry.

For a full transcript visit: http://www.worldfinance.com/videos/will-receivable-finance-play-a-greater-role-in-the-future-video

For more World Finance interviews go to http://www.worldfinance.com/videos/

- published: 08 Jan 2015

- views: 27

Why attend TFR's receivables Finance masterclass?

Geoffrey Wynne leads our receivables finance masterclass 27 March. Just £445+VAT

Email events@ark-group.com or phone 44(0)207 324 2365 to book your place or for...

Geoffrey Wynne leads our receivables finance masterclass 27 March. Just £445+VAT

Email events@ark-group.com or phone 44(0)207 324 2365 to book your place or for more information.

wn.com/Why Attend Tfr's Receivables Finance Masterclass

Geoffrey Wynne leads our receivables finance masterclass 27 March. Just £445+VAT

Email events@ark-group.com or phone 44(0)207 324 2365 to book your place or for more information.

- published: 19 Mar 2014

- views: 14

Why Accounts Receivables Financing can be Better than a Bank Loan

Why Accounts Receivables Financing can be Better than a Bank Loan

Many often feel as though non-traditional commercial financing options are only for those comp...

Why Accounts Receivables Financing can be Better than a Bank Loan

Many often feel as though non-traditional commercial financing options are only for those companies that have been turned down for a traditional bank loan. Yet, for many other companies, going the non-traditional route through a product such as accounts receivable financing may be the better financing method even if the option for a bank loan is still on the table.

A closer look at the unique advantages that receivables financing has to offer reveals many aspects that could potentially make such an option more attractive than conventional financing means. These benefits include:

• Fast turnaround times: A traditional loan can take up to 30 days for a lender to process; as credit profiles are checked, collateral is arranged, and payment schedules are set up. When you choose to finance your receivables, you can often have your approval processed in as little as 72 hours.

• Collateral: With a bank loan you’re required to put up a tangible business asset as collateral, in the case of financing your receivables, your invoices themselves are collateral.

• Client relationships: Financing receivables allows you to continue to build solid relationships with your clients by offering them credit terms while benefiting from the monetary value of those invoices in the short-term.

• Financial flexibility: Obtaining your financing through non-traditional means, allows you to get the working capital you need, without impacting your credit profile and/or tying up other valuable business assets. Should you need access to those tools in the future, they’re still available to be called upon.

While unconventional, financing your company’s growth through accounts receivables financing offers you a number of distinct advantages. If you’re interested in financing your company’s receivables, just give us a call at 1.800.405.6035 today or visit universalfunding.com.

http://www.universalfunding.com/factoring

http://www.universalfunding.com/invoice-factoring

http://www.universalfunding.com/factoring-companies

http://www.universalfunding.com/factoring-company

http://www.universalfunding.com/invoice-factoring-companies

factoring, invoice factoring, factoring companies, factoring company, invoice factoring companies,

wn.com/Why Accounts Receivables Financing Can Be Better Than A Bank Loan

Why Accounts Receivables Financing can be Better than a Bank Loan

Many often feel as though non-traditional commercial financing options are only for those companies that have been turned down for a traditional bank loan. Yet, for many other companies, going the non-traditional route through a product such as accounts receivable financing may be the better financing method even if the option for a bank loan is still on the table.

A closer look at the unique advantages that receivables financing has to offer reveals many aspects that could potentially make such an option more attractive than conventional financing means. These benefits include:

• Fast turnaround times: A traditional loan can take up to 30 days for a lender to process; as credit profiles are checked, collateral is arranged, and payment schedules are set up. When you choose to finance your receivables, you can often have your approval processed in as little as 72 hours.

• Collateral: With a bank loan you’re required to put up a tangible business asset as collateral, in the case of financing your receivables, your invoices themselves are collateral.

• Client relationships: Financing receivables allows you to continue to build solid relationships with your clients by offering them credit terms while benefiting from the monetary value of those invoices in the short-term.

• Financial flexibility: Obtaining your financing through non-traditional means, allows you to get the working capital you need, without impacting your credit profile and/or tying up other valuable business assets. Should you need access to those tools in the future, they’re still available to be called upon.

While unconventional, financing your company’s growth through accounts receivables financing offers you a number of distinct advantages. If you’re interested in financing your company’s receivables, just give us a call at 1.800.405.6035 today or visit universalfunding.com.

http://www.universalfunding.com/factoring

http://www.universalfunding.com/invoice-factoring

http://www.universalfunding.com/factoring-companies

http://www.universalfunding.com/factoring-company

http://www.universalfunding.com/invoice-factoring-companies

factoring, invoice factoring, factoring companies, factoring company, invoice factoring companies,

- published: 14 May 2015

- views: 0

Comparing Factoring Receivables and Purchase Order Financing

Factoring Receivables and Purchase Order Financing are great alternatives to bank loans. Purchase Order financing is a short term financing option used to co......

Factoring Receivables and Purchase Order Financing are great alternatives to bank loans. Purchase Order financing is a short term financing option used to co...

wn.com/Comparing Factoring Receivables And Purchase Order Financing

Factoring Receivables and Purchase Order Financing are great alternatives to bank loans. Purchase Order financing is a short term financing option used to co...

Client Testimonial for Export Receivables Financing Program

http://www.drakefinance.com/application/ http://www.drakefinance.com info@drakefinance.com Footage of the 2012 Conference for South Florida Exporters brought......

http://www.drakefinance.com/application/ http://www.drakefinance.com info@drakefinance.com Footage of the 2012 Conference for South Florida Exporters brought...

wn.com/Client Testimonial For Export Receivables Financing Program

http://www.drakefinance.com/application/ http://www.drakefinance.com info@drakefinance.com Footage of the 2012 Conference for South Florida Exporters brought...

USA Factoring Accounts Receivable Finance

http://www.usafactoring.com What is accounts receivable factoring? Factoring accounts receivable is a tool that speeds up cash flow from accounts receivables......

http://www.usafactoring.com What is accounts receivable factoring? Factoring accounts receivable is a tool that speeds up cash flow from accounts receivables...

wn.com/USA Factoring Accounts Receivable Finance

http://www.usafactoring.com What is accounts receivable factoring? Factoring accounts receivable is a tool that speeds up cash flow from accounts receivables...

Bank Subordination Agreements with Receivables Financing

How to get the working capital you need through bank subordination and solutions for low bank lines of credit through invoice factoring, purchase order finan......

How to get the working capital you need through bank subordination and solutions for low bank lines of credit through invoice factoring, purchase order finan...

wn.com/Bank Subordination Agreements With Receivables Financing

How to get the working capital you need through bank subordination and solutions for low bank lines of credit through invoice factoring, purchase order finan...

oracle fusion financial accounts receivables and account payables

Oracle Fusion Account Receivables and Payable Cloud Services.

Learn about the latest features and benefits of Oracle Fusion Financials....

Oracle Fusion Account Receivables and Payable Cloud Services.

Learn about the latest features and benefits of Oracle Fusion Financials.

wn.com/Oracle Fusion Financial Accounts Receivables And Account Payables

Oracle Fusion Account Receivables and Payable Cloud Services.

Learn about the latest features and benefits of Oracle Fusion Financials.

- published: 25 May 2015

- views: 10

Experience Transformation with SAP Fiori UX – Process Receivables

The new SAP Fiori user experience in SAP Simple Finance makes financial management processes, including receivables management, more efficient. This video demon...

The new SAP Fiori user experience in SAP Simple Finance makes financial management processes, including receivables management, more efficient. This video demonstrates how a cash collections specialist benefits from SAP Fiori UX vs. SAP GUI.

wn.com/Experience Transformation With Sap Fiori Ux – Process Receivables

The new SAP Fiori user experience in SAP Simple Finance makes financial management processes, including receivables management, more efficient. This video demonstrates how a cash collections specialist benefits from SAP Fiori UX vs. SAP GUI.

- published: 15 May 2015

- views: 853

-

Muthoot Finance Overdraft Scheme

The Muthoot Group brings you Muthoot Finance Overdraft Scheme. Now, you can get urgent funds for your business, anytime, through this additional bank limit, that can be secured against gold.

Some of the benefits of Overdraft Scheme are:

1) Instant Loan

2) Interest payable only on the amount you use

3) No change in interest rate for 1 year

4) No EMI, only monthly interest

5) Unlimited transaction

-

Finances at Uni| Overdrafts, Student Finance & Making Money

The stereotype is that we're broke ass students, but we don't have to be! I talk managing overdrafts and debt, your student finance loan and making money through surveys, apps and part-time jobs!

SURVEY WEBSITES

YouGov| http://bit.ly/1VW3RKo

GlobalTestMarket| globaltestmarket.com

Valued Opinions| valuedopinions.co.uk

MONEY SAVING APPS & WEBSITES

RewardBox| http://rbx.us/rGbzLA

Topcashback|

-

Inspired Cashflow - Why Invoice Finance and not a Bank Overdraft?

Unlike a business overdraft where you have to negotiate if you need extra money Invoice Finance automatically increases with your sales turnover, making it a...

-

Banks and Overdraft Fees Law: Personal Finance (2009)

Consumers who use checking accounts are exposed to unnecessary financial risk and high fees, according to a new report from Pew. In the United States some ...

In the United States some consumer reporting agencies such as ChexSystems, Early Warning Services, and TeleCheck track how people manage their ...

Consumers who use checking accounts are exposed to unnecessary financial risk and high fee

-

Banks and Overdraft Fees Law: Personal Finance (2009)

In the United States some consumer reporting agencies such as ChexSystems, Early Warning Services, and TeleCheck track how people manage their checking accou...

-

Overdrafts and Finance Tips | Studentpad

New student-related videos uploaded every Wednesday! Remember to check out the Studentpad website for helpful links and student and housing guides: http://www.studentpad.co.uk

And don't forget to stop by the Studentpad blog!

MORE LINKS:

Blog: http://blog.pad-group.com/Studentpadhome

Facebook: https://www.facebook.com/Studentpad

Twitter: https://twitter.com/studentpad

Google+: https://plus.googl

-

DEBTOR FINANCE VS. BANK OVERDRAFTS -- WHY RISK YOUR HOUSE?

Significant changes to the ATO's Director Penalty Notices regime mean a broader definition of 'Director' and less options for penalty avoidance. CashFlow Adv...

-