-

The Truth About Government Debt Default

The history, facts and future of the black hole called US government spending...

Freedomain Radio is 100% funded by viewers like you. Please support the show by signing up for a monthly subscription or making a one time donation at: http://www.fdrurl.com/donate

Bitcoin Address: 1Fd8RuZqJNG4v56rPD1v6rgYptwnHeJRWs

Litecoin Address: LL76SbNek3dT8bv2APZNhWgNv3nHEzAgKT

Get more from Stefan Molyneux

-

Understanding the National Debt and Budget Deficit

In which John discusses the US national debt, the federal budget deficit, plans for shrinking or eliminating the deficit, and tries to provide some context to the political rhetoric and statistics that are constantly thrown around in an election season. Along the way, I hope you'll understand why the United States' sovereign debt hasn't led us to an economic crisis, but also why budget deficits ne

-

Government Debt and You

This is an updated version of "Economic Armageddon and You." It's an easy-to-understand overview of the global economic crisis.

-

America's Debt Crisis Explained

Fact: America's national debt stands at $17 trillion. That's a tough number to grasp. Most people will never come close to making $1 million in any given yea...

-

Government Debt and Deficits Are Not the Problem - Private Debt Is

Michael Hudson: Why do they call for governments to balance the budget by pushing the economy at large deeper into debt, while trying to save the banks from ...

-

Truth About The Federal Reserve, Government, Debt, Wars, Money Exposed By Minister Louis Farrakhan

Donate to brother Umar Johnson's School. Link here

http://www.gofundme.com/nncang

Like us on facebook

https://www.facebook.com/NerdyMafia101

Twitter

https://twitter.com/Nerdymafia101

Instragram

http://instagram.com/nerdymafia101

-

What Pisses Me Off About Government Debt | The Debt Ceiling and Budget Act

MP3 Download: http://www.fdrpodcasts.com/#/3115/what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

Soundcloud: https://soundcloud.com/stefan-molyneux/fdr-3115-what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

As the Federal Government braced itself for a possible shutdown due to approaching the debt ceiling limit - John Boehner and Washington political

-

US Debt $70 Trillion Explained, Not The $16.9 Trillion The US Government Claims-

US Debt $70 Trillion Explained, Not The $16.9 Trillion The Government Claims, economy, crisis, collapse, economic, america, us, debt crisis, 2014, 2013,

-

Dead Dollar Walking: The Truth About Government Debt

Global government debt has reached over one hundred trillion dollars. But where has all of that money really gone? There will be no economic recovery. Prepar...

-

Government Debt And Deficit: Obama vs. Bush

Watch the full video here: https://www.youtube.com/watch?v=n7N-0q4WgB4&index;=12&list;=PLTpcK80irdQhWpbm37oX1p5cXTd840q4i

“Reince Preibus has some harsh words for President Barack Obama when it comes to the federal debt.

Days after the federal debt surpassed $18 trillion for the first time, the Republican National Committee chairman says no other president has failed worse than Obama, says he has

-

Government debt explained (in a few minutes)

Learn in a few minutes what the monetary creation through debt, the Fractional Reserve Banking, and the article 123 in the Lisbon treaty are... They are abso...

-

Who has the worst national debt? - Number Hub (Ep 22) - Head Squeeze

Where does your country rank in the world debt leader board? NumberHub mathematician Matt Parker figures out the figures.

National Debt Clock: http://www.nationaldebtclocks.org/debtclock/unitedstates

CIA Factbook on world debt: https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html

International Monetary Fund: http://www.imf.org/external/index.htm

G8 https://ww

-

U.S. Government Stages Fake Coup To Wipe Out National Debt

Congress says that with no way to actually pay back our debts, faking a coup to eliminate financial obligations is the best plan for the U.S. economy.

-

The National Debt and Federal Budget Deficit Deconstructed - Tony Robbins

http://www.tonyrobbins.com/ Watch Tony Robbins discuss the $15 trillion U.S. national debt -- how big is it really? And what can we do about the enormous federal budget deficit?

-

Banned US Commercial about the national debt

A new television ad about the U.S. national debt produced by Citizens Against Government Waste has been deemed "too controversial" by major networks including ABC, A&E; and The History Channel and will not be shown on those channels. The commercial is a homage to a 1986 ad that was entitled "The Deficit Trials" that was also banned by the major networks. Apparently telling the truth about the nati

-

Ron Paul: The US Government's Debt Can Never Be Repaid

http://www.RonPaul.com - 02/26/2010 Ron Paul is America's leading voice for limited constitutional government, low taxes, free markets, and a return to sound...

-

US Debt - Visualized in physical $100 bills

NEW 2013 VIDEO: http://youtu.be/jKpVlDSIz9o

http://Demonocracy.info - Economic Infographics

The faith and value of the US Dollar rests on the Government's ability to repay its debt.

"The money in the video has already been spent"

Soundtrack Composer: Lauris Reiniks (more info below)

US Debt Ceiling @ $16.4 Trillion

Article - US Debt Visualized

http://demonocracy.info/infographics/usa/us_deb

-

The Greek Debt Crisis Explained in Four Minutes

In which John explains the Greek debt crisis, which has pushed the Greek government close to defaulting on its loans, the reasons why the Euro zone and the IMF are desperately trying to bail Greece out, and what the rising cost of sovereign debt means for the massive budget deficits throughout the developed world.

Thanks to Karen Kavett at http://www.youtube.com/xperpetualmotion for the illustrat

-

The Mises View: "Government Debt Addiction" | Judge Andrew P. Napolitano

Judge Napolitano discusses one way the federal government destroys prosperity. Napolitano is Distinguished Scholar in Law and Jurisprudence at the Mises Institute. For more information, visit the Mises Institute online at mises.org.

-

US Debt Crisis - Perfectly Explained

A must watch video for all who really want to now about the reality of united states Government and the us debt crisis.

-

Chinese Professor

Donate to help end wasteful deficit spending at www.cagw.org. This new ad is part of an ongoing communications program in CAGW's decades-long fight against wasteful government spending, increased taxes, out-of-control deficit spending, and a crippling national debt that threatens the future and survival of our country.

-

China Reality Check Series :China's Local Government Debt

Please watch a very timely discussion marking the 2014 inaugural China Reality Check Series event. Identified as one of the six key priority areas of economi...

-

$17 Trillion U.S. DEBT - A Visual Perspective

What does $17 trillion dollars look like? A look into how much hard cash the US government owes and the fiscal mess the United States is in. The national debt explained.

RATE, SUBSCRIBE AND SHARE!!!

http://demonocracy.info

http://www.usdebtclock.org

The Truth About Government Debt Default

The history, facts and future of the black hole called US government spending...

Freedomain Radio is 100% funded by viewers like you. Please support the show b...

The history, facts and future of the black hole called US government spending...

Freedomain Radio is 100% funded by viewers like you. Please support the show by signing up for a monthly subscription or making a one time donation at: http://www.fdrurl.com/donate

Bitcoin Address: 1Fd8RuZqJNG4v56rPD1v6rgYptwnHeJRWs

Litecoin Address: LL76SbNek3dT8bv2APZNhWgNv3nHEzAgKT

Get more from Stefan Molyneux and Freedomain Radio including books, podcasts and other info at: http://www.freedomainradio.com

Amazon US Affiliate Link: www.fdrurl.com/AmazonUS

Amazon Canada Affiliate Link: www.fdrurl.com/AmazonCanada

Amazon UK Affiliate Link: www.fdrurl.com/AmazonUK

Freedomain Radio Facebook: http://www.fdrurl.com/fb

Freedomain Radio Twitter: https://twitter.com/freedomainradio

Freedomain Radio Google+: http://www.fdrurl.com/google

Freedomain Radio LinkedIn: http://www.fdrurl.com/LinkedIn

Sources:

http://ex-army.blogspot.ca/2013/10/default-drivel.html

http://libertarianinvestments.blogspot.ca/2013/10/the-debt-ceiling-and-default.html

http://www.examiner.com/article/the-truth-about-the-history-of-us-sovereign-default

http://beforeitsnews.com/libertarian/2013/10/the-answer-to-government-shutdown-is-less-federal-power-not-more-2529816.html

http://economix.blogs.nytimes.com/2013/10/14/for-many-hard-liners-debt-default-is-the-goal/?_r=0

http://www.forbes.com/sites/jeffreydorfman/2013/10/03/dont-believe-the-debt-ceiling-hype-the-federal-government-can-survive-without-an-increase/2/

wn.com/The Truth About Government Debt Default

The history, facts and future of the black hole called US government spending...

Freedomain Radio is 100% funded by viewers like you. Please support the show by signing up for a monthly subscription or making a one time donation at: http://www.fdrurl.com/donate

Bitcoin Address: 1Fd8RuZqJNG4v56rPD1v6rgYptwnHeJRWs

Litecoin Address: LL76SbNek3dT8bv2APZNhWgNv3nHEzAgKT

Get more from Stefan Molyneux and Freedomain Radio including books, podcasts and other info at: http://www.freedomainradio.com

Amazon US Affiliate Link: www.fdrurl.com/AmazonUS

Amazon Canada Affiliate Link: www.fdrurl.com/AmazonCanada

Amazon UK Affiliate Link: www.fdrurl.com/AmazonUK

Freedomain Radio Facebook: http://www.fdrurl.com/fb

Freedomain Radio Twitter: https://twitter.com/freedomainradio

Freedomain Radio Google+: http://www.fdrurl.com/google

Freedomain Radio LinkedIn: http://www.fdrurl.com/LinkedIn

Sources:

http://ex-army.blogspot.ca/2013/10/default-drivel.html

http://libertarianinvestments.blogspot.ca/2013/10/the-debt-ceiling-and-default.html

http://www.examiner.com/article/the-truth-about-the-history-of-us-sovereign-default

http://beforeitsnews.com/libertarian/2013/10/the-answer-to-government-shutdown-is-less-federal-power-not-more-2529816.html

http://economix.blogs.nytimes.com/2013/10/14/for-many-hard-liners-debt-default-is-the-goal/?_r=0

http://www.forbes.com/sites/jeffreydorfman/2013/10/03/dont-believe-the-debt-ceiling-hype-the-federal-government-can-survive-without-an-increase/2/

- published: 17 Oct 2013

- views: 32322

Understanding the National Debt and Budget Deficit

In which John discusses the US national debt, the federal budget deficit, plans for shrinking or eliminating the deficit, and tries to provide some context to t...

In which John discusses the US national debt, the federal budget deficit, plans for shrinking or eliminating the deficit, and tries to provide some context to the political rhetoric and statistics that are constantly thrown around in an election season. Along the way, I hope you'll understand why the United States' sovereign debt hasn't led us to an economic crisis, but also why budget deficits need to shrink in order to ensure that credit remains inexpensive and the US continues to enjoy the trust of the world economy. (Friendly reminder: Educational videos, by extensive precedent, are allowed to be longer than 4:00.)

Here's why I think the gold standard is a bad idea: 1. By restricting money supply to the supply of gold, you risk shrinking the money supply just because of a shock leading to a disruption in supply from mining. This creates a lot of volatility in the money supply for no reason. 2. The gold standard limits a government's ability to respond to changes in the market, which can (and has) led to unescapable deflationary spirals. 3. Far from inspiring investor confidence, its implementation would crush it: http://www.ocregister.com/opinion/gold-369936-standard-money.html

Posters and stuff: http://dftba.com

My tumblr: http://fishingboatproceeds.tumblr.com

My twitter: http://www.twitter.com/realjohngreen

HERE ARE A LOT OF LINKS TO NERDFIGHTASTIC THINGS:

Shirts and Stuff: http://dftba.com/artist/30/Vlogbrothers

Hank's Music: http://dftba.com/artist/15/Hank-Green

John's Books: http://amzn.to/j3LYqo

======================

Hank's Twitter: http://www.twitter.com/hankgreen

Hank's Facebook: http://www.facebook.com/hankimon

Hank's tumblr: http://edwardspoonhands.tumblr.com

John's Twitter: http://www.twitter.com/realjohngreen

John's Facebook: http://www.facebook.com/johngreenfans

John's tumblr: http://fishingboatproceeds.tumblr.com

======================

Other Channels

Crash Course: http://www.youtube.com/crashcourse

SciShow: http://www.youtube.com/scishow

Gaming: http://www.youtube.com/hankgames

VidCon: http://www.youtube.com/vidcon

Hank's Channel: http://www.youtube.com/hankschannel

Truth or Fail: http://www.youtube.com/truthorfail

======================

Nerdfighteria

http://effyeahnerdfighters.com/

http://effyeahnerdfighters.com/nftumblrs

http://reddit.com/r/nerdfighters

http://nerdfighteria.info/

A Bunny

(\(\

( - -)

((') (')

wn.com/Understanding The National Debt And Budget Deficit

In which John discusses the US national debt, the federal budget deficit, plans for shrinking or eliminating the deficit, and tries to provide some context to the political rhetoric and statistics that are constantly thrown around in an election season. Along the way, I hope you'll understand why the United States' sovereign debt hasn't led us to an economic crisis, but also why budget deficits need to shrink in order to ensure that credit remains inexpensive and the US continues to enjoy the trust of the world economy. (Friendly reminder: Educational videos, by extensive precedent, are allowed to be longer than 4:00.)

Here's why I think the gold standard is a bad idea: 1. By restricting money supply to the supply of gold, you risk shrinking the money supply just because of a shock leading to a disruption in supply from mining. This creates a lot of volatility in the money supply for no reason. 2. The gold standard limits a government's ability to respond to changes in the market, which can (and has) led to unescapable deflationary spirals. 3. Far from inspiring investor confidence, its implementation would crush it: http://www.ocregister.com/opinion/gold-369936-standard-money.html

Posters and stuff: http://dftba.com

My tumblr: http://fishingboatproceeds.tumblr.com

My twitter: http://www.twitter.com/realjohngreen

HERE ARE A LOT OF LINKS TO NERDFIGHTASTIC THINGS:

Shirts and Stuff: http://dftba.com/artist/30/Vlogbrothers

Hank's Music: http://dftba.com/artist/15/Hank-Green

John's Books: http://amzn.to/j3LYqo

======================

Hank's Twitter: http://www.twitter.com/hankgreen

Hank's Facebook: http://www.facebook.com/hankimon

Hank's tumblr: http://edwardspoonhands.tumblr.com

John's Twitter: http://www.twitter.com/realjohngreen

John's Facebook: http://www.facebook.com/johngreenfans

John's tumblr: http://fishingboatproceeds.tumblr.com

======================

Other Channels

Crash Course: http://www.youtube.com/crashcourse

SciShow: http://www.youtube.com/scishow

Gaming: http://www.youtube.com/hankgames

VidCon: http://www.youtube.com/vidcon

Hank's Channel: http://www.youtube.com/hankschannel

Truth or Fail: http://www.youtube.com/truthorfail

======================

Nerdfighteria

http://effyeahnerdfighters.com/

http://effyeahnerdfighters.com/nftumblrs

http://reddit.com/r/nerdfighters

http://nerdfighteria.info/

A Bunny

(\(\

( - -)

((') (')

- published: 23 Oct 2012

- views: 666892

Government Debt and You

This is an updated version of "Economic Armageddon and You." It's an easy-to-understand overview of the global economic crisis....

This is an updated version of "Economic Armageddon and You." It's an easy-to-understand overview of the global economic crisis.

wn.com/Government Debt And You

This is an updated version of "Economic Armageddon and You." It's an easy-to-understand overview of the global economic crisis.

America's Debt Crisis Explained

Fact: America's national debt stands at $17 trillion. That's a tough number to grasp. Most people will never come close to making $1 million in any given yea......

Fact: America's national debt stands at $17 trillion. That's a tough number to grasp. Most people will never come close to making $1 million in any given yea...

wn.com/America's Debt Crisis Explained

Fact: America's national debt stands at $17 trillion. That's a tough number to grasp. Most people will never come close to making $1 million in any given yea...

Government Debt and Deficits Are Not the Problem - Private Debt Is

Michael Hudson: Why do they call for governments to balance the budget by pushing the economy at large deeper into debt, while trying to save the banks from ......

Michael Hudson: Why do they call for governments to balance the budget by pushing the economy at large deeper into debt, while trying to save the banks from ...

wn.com/Government Debt And Deficits Are Not The Problem Private Debt Is

Michael Hudson: Why do they call for governments to balance the budget by pushing the economy at large deeper into debt, while trying to save the banks from ...

- published: 25 Mar 2013

- views: 13828

-

author: TheRealNews

Truth About The Federal Reserve, Government, Debt, Wars, Money Exposed By Minister Louis Farrakhan

Donate to brother Umar Johnson's School. Link here

http://www.gofundme.com/nncang

Like us on facebook

https://www.facebook.com/NerdyMafia101

Twitter

https://twi...

Donate to brother Umar Johnson's School. Link here

http://www.gofundme.com/nncang

Like us on facebook

https://www.facebook.com/NerdyMafia101

Twitter

https://twitter.com/Nerdymafia101

Instragram

http://instagram.com/nerdymafia101

wn.com/Truth About The Federal Reserve, Government, Debt, Wars, Money Exposed By Minister Louis Farrakhan

Donate to brother Umar Johnson's School. Link here

http://www.gofundme.com/nncang

Like us on facebook

https://www.facebook.com/NerdyMafia101

Twitter

https://twitter.com/Nerdymafia101

Instragram

http://instagram.com/nerdymafia101

- published: 07 Mar 2015

- views: 3

What Pisses Me Off About Government Debt | The Debt Ceiling and Budget Act

MP3 Download: http://www.fdrpodcasts.com/#/3115/what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

Soundcloud: https://soundcloud.com/stef...

MP3 Download: http://www.fdrpodcasts.com/#/3115/what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

Soundcloud: https://soundcloud.com/stefan-molyneux/fdr-3115-what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

As the Federal Government braced itself for a possible shutdown due to approaching the debt ceiling limit - John Boehner and Washington political class found another way to stick it to the American people.

The Bipartisan Budget Act of 2015 was passed by both the House and the Senate this week and will result in at least $85 billion in spending increases over the next three fiscal years. Most importantly it will suspend the current $18.1 trillion debt limit through March 15th, 2017.

This essentially gives President Barack Obama a blank check for future spending and removes lawmakers constitutional power to control borrowing of the federal government. Hey Founding Fathers! You wanted checks and balances - well too damn bad! We got some votes to buy!

Sources

http://www.heritage.org/research/reports/2015/10/analysis-of-the-bipartisan-budget-act-of-2015

http://www.nytimes.com/2014/08/01/opinion/laurence-kotlikoff-on-fiscal-gap-accounting.html

http://www.nationaldebtclocks.org/debtclock/unitedstates

http://www.amazon.co.uk/Time-Cross-Economics-American-Slavery/dp/0393312186

http://www.jstor.org/stable/492099?seq=2

Freedomain Radio is 100% funded by viewers like you. Please support the show by signing up for a monthly subscription or making a one time donation at: http://www.fdrurl.com/donate

Get more from Stefan Molyneux and Freedomain Radio including books, podcasts and other info at: http://www.freedomainradio.com

Amazon US Affiliate Link: http://www.fdrurl.com/AmazonUS

Amazon Canada Affiliate Link: http://www.fdrurl.com/AmazonCanada

Amazon UK Affiliate Link: http://www.fdrurl.com/AmazonUK

wn.com/What Pisses Me Off About Government Debt | The Debt Ceiling And Budget Act

MP3 Download: http://www.fdrpodcasts.com/#/3115/what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

Soundcloud: https://soundcloud.com/stefan-molyneux/fdr-3115-what-pisses-me-off-about-government-debt-the-debt-ceiling-and-budget-act

As the Federal Government braced itself for a possible shutdown due to approaching the debt ceiling limit - John Boehner and Washington political class found another way to stick it to the American people.

The Bipartisan Budget Act of 2015 was passed by both the House and the Senate this week and will result in at least $85 billion in spending increases over the next three fiscal years. Most importantly it will suspend the current $18.1 trillion debt limit through March 15th, 2017.

This essentially gives President Barack Obama a blank check for future spending and removes lawmakers constitutional power to control borrowing of the federal government. Hey Founding Fathers! You wanted checks and balances - well too damn bad! We got some votes to buy!

Sources

http://www.heritage.org/research/reports/2015/10/analysis-of-the-bipartisan-budget-act-of-2015

http://www.nytimes.com/2014/08/01/opinion/laurence-kotlikoff-on-fiscal-gap-accounting.html

http://www.nationaldebtclocks.org/debtclock/unitedstates

http://www.amazon.co.uk/Time-Cross-Economics-American-Slavery/dp/0393312186

http://www.jstor.org/stable/492099?seq=2

Freedomain Radio is 100% funded by viewers like you. Please support the show by signing up for a monthly subscription or making a one time donation at: http://www.fdrurl.com/donate

Get more from Stefan Molyneux and Freedomain Radio including books, podcasts and other info at: http://www.freedomainradio.com

Amazon US Affiliate Link: http://www.fdrurl.com/AmazonUS

Amazon Canada Affiliate Link: http://www.fdrurl.com/AmazonCanada

Amazon UK Affiliate Link: http://www.fdrurl.com/AmazonUK

- published: 30 Oct 2015

- views: 2810

US Debt $70 Trillion Explained, Not The $16.9 Trillion The US Government Claims-

US Debt $70 Trillion Explained, Not The $16.9 Trillion The Government Claims, economy, crisis, collapse, economic, america, us, debt crisis, 2014, 2013,...

US Debt $70 Trillion Explained, Not The $16.9 Trillion The Government Claims, economy, crisis, collapse, economic, america, us, debt crisis, 2014, 2013,

wn.com/US Debt 70 Trillion Explained, Not The 16.9 Trillion The US Government Claims

US Debt $70 Trillion Explained, Not The $16.9 Trillion The Government Claims, economy, crisis, collapse, economic, america, us, debt crisis, 2014, 2013,

- published: 23 Aug 2013

- views: 26250

Dead Dollar Walking: The Truth About Government Debt

Global government debt has reached over one hundred trillion dollars. But where has all of that money really gone? There will be no economic recovery. Prepar......

Global government debt has reached over one hundred trillion dollars. But where has all of that money really gone? There will be no economic recovery. Prepar...

wn.com/Dead Dollar Walking The Truth About Government Debt

Global government debt has reached over one hundred trillion dollars. But where has all of that money really gone? There will be no economic recovery. Prepar...

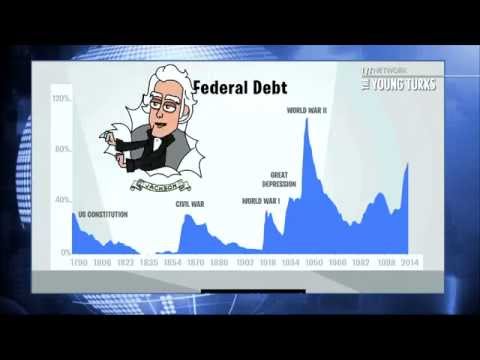

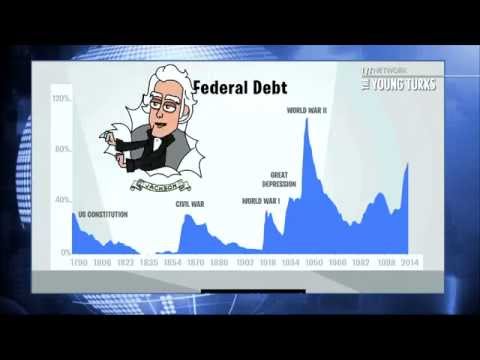

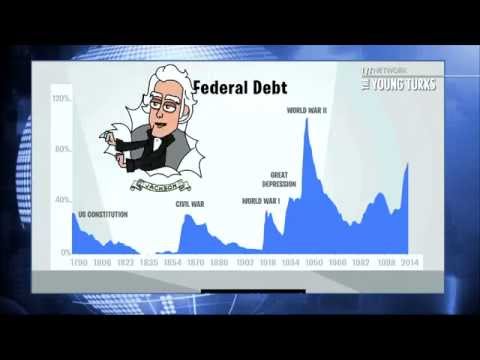

Government Debt And Deficit: Obama vs. Bush

Watch the full video here: https://www.youtube.com/watch?v=n7N-0q4WgB4&index;=12&list;=PLTpcK80irdQhWpbm37oX1p5cXTd840q4i

“Reince Preibus has some harsh words fo...

Watch the full video here: https://www.youtube.com/watch?v=n7N-0q4WgB4&index;=12&list;=PLTpcK80irdQhWpbm37oX1p5cXTd840q4i

“Reince Preibus has some harsh words for President Barack Obama when it comes to the federal debt.

Days after the federal debt surpassed $18 trillion for the first time, the Republican National Committee chairman says no other president has failed worse than Obama, says he has “the worst record of any president when it comes to putting America deeper in debt,” according to The Hill.

He also blasted the increase in debt as "immoral" and said the outcome in the midterm elections showed Americans are "tired of Democrats' free-spending ways."

While the national debt has increased by $7.3 trillion since Obama took office, Obama's supporters say much of it came in the early years of his presidency as a carryover from a recession that began under George W. Bush's watch."* The Young Turks host Cenk Uygur breaks it down.

*Read more here:

http://politics.suntimes.com/article/washington/gop-chair-blasts-obama-worst-record-federal-debt/wed-12032014-844am

Support TYT for FREE by doing your Amazon shopping through this link (bookmark it!)

http://www.amazon.com/?tag=theyoungturks-20

wn.com/Government Debt And Deficit Obama Vs. Bush

Watch the full video here: https://www.youtube.com/watch?v=n7N-0q4WgB4&index;=12&list;=PLTpcK80irdQhWpbm37oX1p5cXTd840q4i

“Reince Preibus has some harsh words for President Barack Obama when it comes to the federal debt.

Days after the federal debt surpassed $18 trillion for the first time, the Republican National Committee chairman says no other president has failed worse than Obama, says he has “the worst record of any president when it comes to putting America deeper in debt,” according to The Hill.

He also blasted the increase in debt as "immoral" and said the outcome in the midterm elections showed Americans are "tired of Democrats' free-spending ways."

While the national debt has increased by $7.3 trillion since Obama took office, Obama's supporters say much of it came in the early years of his presidency as a carryover from a recession that began under George W. Bush's watch."* The Young Turks host Cenk Uygur breaks it down.

*Read more here:

http://politics.suntimes.com/article/washington/gop-chair-blasts-obama-worst-record-federal-debt/wed-12032014-844am

Support TYT for FREE by doing your Amazon shopping through this link (bookmark it!)

http://www.amazon.com/?tag=theyoungturks-20

- published: 07 Dec 2014

- views: 16989

Government debt explained (in a few minutes)

Learn in a few minutes what the monetary creation through debt, the Fractional Reserve Banking, and the article 123 in the Lisbon treaty are... They are abso......

Learn in a few minutes what the monetary creation through debt, the Fractional Reserve Banking, and the article 123 in the Lisbon treaty are... They are abso...

wn.com/Government Debt Explained (In A Few Minutes)

Learn in a few minutes what the monetary creation through debt, the Fractional Reserve Banking, and the article 123 in the Lisbon treaty are... They are abso...

Who has the worst national debt? - Number Hub (Ep 22) - Head Squeeze

Where does your country rank in the world debt leader board? NumberHub mathematician Matt Parker figures out the figures.

National Debt Clock: http://www.natio...

Where does your country rank in the world debt leader board? NumberHub mathematician Matt Parker figures out the figures.

National Debt Clock: http://www.nationaldebtclocks.org/debtclock/unitedstates

CIA Factbook on world debt: https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html

International Monetary Fund: http://www.imf.org/external/index.htm

G8 https://www.gov.uk/government/topical-events/g8-2013

How Ponzi schemes work: http://economics.about.com/od/financialmarkets/f/ponzi_scheme.htm

http://www.youtube.com/user/HeadsqueezeTV

http://www.youtube.com/subscription_center?add_user=HeadsqueezeTV

wn.com/Who Has The Worst National Debt Number Hub (Ep 22) Head Squeeze

Where does your country rank in the world debt leader board? NumberHub mathematician Matt Parker figures out the figures.

National Debt Clock: http://www.nationaldebtclocks.org/debtclock/unitedstates

CIA Factbook on world debt: https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html

International Monetary Fund: http://www.imf.org/external/index.htm

G8 https://www.gov.uk/government/topical-events/g8-2013

How Ponzi schemes work: http://economics.about.com/od/financialmarkets/f/ponzi_scheme.htm

http://www.youtube.com/user/HeadsqueezeTV

http://www.youtube.com/subscription_center?add_user=HeadsqueezeTV

- published: 11 Jun 2013

- views: 33153

U.S. Government Stages Fake Coup To Wipe Out National Debt

Congress says that with no way to actually pay back our debts, faking a coup to eliminate financial obligations is the best plan for the U.S. economy....

Congress says that with no way to actually pay back our debts, faking a coup to eliminate financial obligations is the best plan for the U.S. economy.

wn.com/U.S. Government Stages Fake Coup To Wipe Out National Debt

Congress says that with no way to actually pay back our debts, faking a coup to eliminate financial obligations is the best plan for the U.S. economy.

- published: 04 Aug 2009

- views: 392994

-

author: The Onion

The National Debt and Federal Budget Deficit Deconstructed - Tony Robbins

http://www.tonyrobbins.com/ Watch Tony Robbins discuss the $15 trillion U.S. national debt -- how big is it really? And what can we do about the enormous federa...

http://www.tonyrobbins.com/ Watch Tony Robbins discuss the $15 trillion U.S. national debt -- how big is it really? And what can we do about the enormous federal budget deficit?

wn.com/The National Debt And Federal Budget Deficit Deconstructed Tony Robbins

http://www.tonyrobbins.com/ Watch Tony Robbins discuss the $15 trillion U.S. national debt -- how big is it really? And what can we do about the enormous federal budget deficit?

- published: 02 Apr 2012

- views: 418648

Banned US Commercial about the national debt

A new television ad about the U.S. national debt produced by Citizens Against Government Waste has been deemed "too controversial" by major networks including A...

A new television ad about the U.S. national debt produced by Citizens Against Government Waste has been deemed "too controversial" by major networks including ABC, A&E; and The History Channel and will not be shown on those channels. The commercial is a homage to a 1986 ad that was entitled "The Deficit Trials" that was also banned by the major networks. Apparently telling the truth about the national debt is a little too "hot" for the major networks to handle. But perhaps it is time to tell the American people the truth. In 1986, the U.S. national debt was around 2 trillion dollars. Today, it is rapidly approaching 14 trillion dollars. The American Dream is being ripped apart right in front of our eyes, but apparently some of the major networks don't want the American people to really understand what is going on.

The truth is that the ad does not even have anything in it that should be offensive. The commercial is set in the year 2030, and the main character is a Chinese professor that is seen lecturing his students on the fall of great empires. As images of the United States are shown on a screen behind him, the Chinese professor tells his students the following about the behavior of great empires: "They all make the same mistakes. Turning their backs on the principles that made them great. America tried to spend and tax itself out of a great recession. Enormous so-called "stimulus" spending, massive changes to health care, government takeover of private industries, and crushing debt."

Perhaps it is what the Chinese Professor says next that is alarming the big television networks: "Of course, we owned most of their debt, so now they work for us".

wn.com/Banned US Commercial About The National Debt

A new television ad about the U.S. national debt produced by Citizens Against Government Waste has been deemed "too controversial" by major networks including ABC, A&E; and The History Channel and will not be shown on those channels. The commercial is a homage to a 1986 ad that was entitled "The Deficit Trials" that was also banned by the major networks. Apparently telling the truth about the national debt is a little too "hot" for the major networks to handle. But perhaps it is time to tell the American people the truth. In 1986, the U.S. national debt was around 2 trillion dollars. Today, it is rapidly approaching 14 trillion dollars. The American Dream is being ripped apart right in front of our eyes, but apparently some of the major networks don't want the American people to really understand what is going on.

The truth is that the ad does not even have anything in it that should be offensive. The commercial is set in the year 2030, and the main character is a Chinese professor that is seen lecturing his students on the fall of great empires. As images of the United States are shown on a screen behind him, the Chinese professor tells his students the following about the behavior of great empires: "They all make the same mistakes. Turning their backs on the principles that made them great. America tried to spend and tax itself out of a great recession. Enormous so-called "stimulus" spending, massive changes to health care, government takeover of private industries, and crushing debt."

Perhaps it is what the Chinese Professor says next that is alarming the big television networks: "Of course, we owned most of their debt, so now they work for us".

- published: 02 Nov 2010

- views: 738851

Ron Paul: The US Government's Debt Can Never Be Repaid

http://www.RonPaul.com - 02/26/2010 Ron Paul is America's leading voice for limited constitutional government, low taxes, free markets, and a return to sound......

http://www.RonPaul.com - 02/26/2010 Ron Paul is America's leading voice for limited constitutional government, low taxes, free markets, and a return to sound...

wn.com/Ron Paul The US Government's Debt Can Never Be Repaid

http://www.RonPaul.com - 02/26/2010 Ron Paul is America's leading voice for limited constitutional government, low taxes, free markets, and a return to sound...

US Debt - Visualized in physical $100 bills

NEW 2013 VIDEO: http://youtu.be/jKpVlDSIz9o

http://Demonocracy.info - Economic Infographics

The faith and value of the US Dollar rests on the Government's abi...

NEW 2013 VIDEO: http://youtu.be/jKpVlDSIz9o

http://Demonocracy.info - Economic Infographics

The faith and value of the US Dollar rests on the Government's ability to repay its debt.

"The money in the video has already been spent"

Soundtrack Composer: Lauris Reiniks (more info below)

US Debt Ceiling @ $16.4 Trillion

Article - US Debt Visualized

http://demonocracy.info/infographics/usa/us_debt/us_debt.html

Article - Fiscal Cliff Visualized

http://demonocracy.info/infographics/usa/fiscal_cliff/fiscal_cliff.html

How can you help?

To help pay off the US Federal Government debt you can go to

https://www.pay.gov/ and pay/donate as much as you like.

Soundtrack Copyright:

Track: Es Skrienu

Composer: Lauris Reiniks

Arranged by: Tomas Zemler

Original Song: http://youtu.be/dG8QJAM059I

Orchestral Version: http://youtu.be/XLtcY0QO1I4

Record Label: Micrec & EMI Music Publishing Baltics

http://www.micrecmusic.lv/

Permission to use soundtrack personally authorized by Lauris Reiniks

This media is copyrighted. Do not rip and re-post elsewhere.

wn.com/US Debt Visualized In Physical 100 Bills

NEW 2013 VIDEO: http://youtu.be/jKpVlDSIz9o

http://Demonocracy.info - Economic Infographics

The faith and value of the US Dollar rests on the Government's ability to repay its debt.

"The money in the video has already been spent"

Soundtrack Composer: Lauris Reiniks (more info below)

US Debt Ceiling @ $16.4 Trillion

Article - US Debt Visualized

http://demonocracy.info/infographics/usa/us_debt/us_debt.html

Article - Fiscal Cliff Visualized

http://demonocracy.info/infographics/usa/fiscal_cliff/fiscal_cliff.html

How can you help?

To help pay off the US Federal Government debt you can go to

https://www.pay.gov/ and pay/donate as much as you like.

Soundtrack Copyright:

Track: Es Skrienu

Composer: Lauris Reiniks

Arranged by: Tomas Zemler

Original Song: http://youtu.be/dG8QJAM059I

Orchestral Version: http://youtu.be/XLtcY0QO1I4

Record Label: Micrec & EMI Music Publishing Baltics

http://www.micrecmusic.lv/

Permission to use soundtrack personally authorized by Lauris Reiniks

This media is copyrighted. Do not rip and re-post elsewhere.

- published: 05 Dec 2012

- views: 516608

The Greek Debt Crisis Explained in Four Minutes

In which John explains the Greek debt crisis, which has pushed the Greek government close to defaulting on its loans, the reasons why the Euro zone and the IMF ...

In which John explains the Greek debt crisis, which has pushed the Greek government close to defaulting on its loans, the reasons why the Euro zone and the IMF are desperately trying to bail Greece out, and what the rising cost of sovereign debt means for the massive budget deficits throughout the developed world.

Thanks to Karen Kavett at http://www.youtube.com/xperpetualmotion for the illustration.

Debt Chart: http://en.wikipedia.org/wiki/File:US_Federal_Debt_as_Percent_of_GDP_by_President.jpg

HERE ARE A LOT OF LINKS TO NERDFIGHTASTIC THINGS:

Shirts and Stuff: http://dftba.com/artist/30/Vlogbrothers

Hank's Music: http://dftba.com/artist/15/Hank-Green

John's Books: http://amzn.to/j3LYqo

======================

Hank's Twitter: http://www.twitter.com/hankgreen

Hank's Facebook: http://www.facebook.com/hankimon

Hank's tumblr: http://edwardspoonhands.tumblr.com

John's Twitter: http://www.twitter.com/realjohngreen

John's Facebook: http://www.facebook.com/johngreenfans

John's tumblr: http://fishingboatproceeds.tumblr.com

======================

Other Channels

Crash Course: http://www.youtube.com/crashcourse

SciShow: http://www.youtube.com/scishow

Gaming: http://www.youtube.com/hankgames

VidCon: http://www.youtube.com/vidcon

Hank's Channel: http://www.youtube.com/hankschannel

Truth or Fail: http://www.youtube.com/truthorfail

======================

Nerdfighteria

http://effyeahnerdfighters.com/

http://effyeahnerdfighters.com/nftumblrs

http://reddit.com/r/nerdfighters

http://nerdfighteria.info/

A Bunny

(\(\

( - -)

((') (')

wn.com/The Greek Debt Crisis Explained In Four Minutes

In which John explains the Greek debt crisis, which has pushed the Greek government close to defaulting on its loans, the reasons why the Euro zone and the IMF are desperately trying to bail Greece out, and what the rising cost of sovereign debt means for the massive budget deficits throughout the developed world.

Thanks to Karen Kavett at http://www.youtube.com/xperpetualmotion for the illustration.

Debt Chart: http://en.wikipedia.org/wiki/File:US_Federal_Debt_as_Percent_of_GDP_by_President.jpg

HERE ARE A LOT OF LINKS TO NERDFIGHTASTIC THINGS:

Shirts and Stuff: http://dftba.com/artist/30/Vlogbrothers

Hank's Music: http://dftba.com/artist/15/Hank-Green

John's Books: http://amzn.to/j3LYqo

======================

Hank's Twitter: http://www.twitter.com/hankgreen

Hank's Facebook: http://www.facebook.com/hankimon

Hank's tumblr: http://edwardspoonhands.tumblr.com

John's Twitter: http://www.twitter.com/realjohngreen

John's Facebook: http://www.facebook.com/johngreenfans

John's tumblr: http://fishingboatproceeds.tumblr.com

======================

Other Channels

Crash Course: http://www.youtube.com/crashcourse

SciShow: http://www.youtube.com/scishow

Gaming: http://www.youtube.com/hankgames

VidCon: http://www.youtube.com/vidcon

Hank's Channel: http://www.youtube.com/hankschannel

Truth or Fail: http://www.youtube.com/truthorfail

======================

Nerdfighteria

http://effyeahnerdfighters.com/

http://effyeahnerdfighters.com/nftumblrs

http://reddit.com/r/nerdfighters

http://nerdfighteria.info/

A Bunny

(\(\

( - -)

((') (')

- published: 30 Apr 2010

- views: 1023965

The Mises View: "Government Debt Addiction" | Judge Andrew P. Napolitano

Judge Napolitano discusses one way the federal government destroys prosperity. Napolitano is Distinguished Scholar in Law and Jurisprudence at the Mises Institu...

Judge Napolitano discusses one way the federal government destroys prosperity. Napolitano is Distinguished Scholar in Law and Jurisprudence at the Mises Institute. For more information, visit the Mises Institute online at mises.org.

wn.com/The Mises View Government Debt Addiction | Judge Andrew P. Napolitano

Judge Napolitano discusses one way the federal government destroys prosperity. Napolitano is Distinguished Scholar in Law and Jurisprudence at the Mises Institute. For more information, visit the Mises Institute online at mises.org.

- published: 23 Oct 2013

- views: 45250

US Debt Crisis - Perfectly Explained

A must watch video for all who really want to now about the reality of united states Government and the us debt crisis....

A must watch video for all who really want to now about the reality of united states Government and the us debt crisis.

wn.com/US Debt Crisis Perfectly Explained

A must watch video for all who really want to now about the reality of united states Government and the us debt crisis.

- published: 17 Feb 2012

- views: 184104

Chinese Professor

Donate to help end wasteful deficit spending at www.cagw.org. This new ad is part of an ongoing communications program in CAGW's decades-long fight against wast...

Donate to help end wasteful deficit spending at www.cagw.org. This new ad is part of an ongoing communications program in CAGW's decades-long fight against wasteful government spending, increased taxes, out-of-control deficit spending, and a crippling national debt that threatens the future and survival of our country.

wn.com/Chinese Professor

Donate to help end wasteful deficit spending at www.cagw.org. This new ad is part of an ongoing communications program in CAGW's decades-long fight against wasteful government spending, increased taxes, out-of-control deficit spending, and a crippling national debt that threatens the future and survival of our country.

- published: 20 Oct 2010

- views: 2700853

China Reality Check Series :China's Local Government Debt

Please watch a very timely discussion marking the 2014 inaugural China Reality Check Series event. Identified as one of the six key priority areas of economi......

Please watch a very timely discussion marking the 2014 inaugural China Reality Check Series event. Identified as one of the six key priority areas of economi...

wn.com/China Reality Check Series China's Local Government Debt

Please watch a very timely discussion marking the 2014 inaugural China Reality Check Series event. Identified as one of the six key priority areas of economi...

$17 Trillion U.S. DEBT - A Visual Perspective

What does $17 trillion dollars look like? A look into how much hard cash the US government owes and the fiscal mess the United States is in. The national debt e...

What does $17 trillion dollars look like? A look into how much hard cash the US government owes and the fiscal mess the United States is in. The national debt explained.

RATE, SUBSCRIBE AND SHARE!!!

http://demonocracy.info

http://www.usdebtclock.org

wn.com/17 Trillion U.S. Debt A Visual Perspective

What does $17 trillion dollars look like? A look into how much hard cash the US government owes and the fiscal mess the United States is in. The national debt explained.

RATE, SUBSCRIBE AND SHARE!!!

http://demonocracy.info

http://www.usdebtclock.org

- published: 22 Aug 2011

- views: 522617

-

Greece aims for debt relief deal in Feb 2016 after reforms done

Greece wants a deal on debt relief with its euro zone creditors in February to remove financial uncertainty and spur economic recovery, its finance minister said, but euro zone officials said that timetable was very ambitious and likely to slip.

Addressing a conference of investors, Finance Minister Euclid Tsakalotos said on Monday that making the ailing euro zone country's debt sustainable was t

-

US Debt Increases Half a Trillion in 3 Weeks

In a 3-week period following Congressional action to suspend the National Debt Ceiling, the United States debt increased by half a trillion dollars to $18,700,000,000,000.00. To put that increase into perspective--over a period of 22 days, our government borrowed $26 billion a day. Why does our federal government continue to borrow at such an outrageous pace? Because lawmakers can't pass a balance

-

Tenant Farmer commits Suicide at Krishna District | Debt Problems | AP Government | 10TV

Tenant Farmer Basavayya Commits Suicide at Ramannapeta in Krishna District with Heavy Debt Problems, Family Seeks Government help.

For latest news updates, Subscribe us @ http://goo.gl/MkmvFW

Visit us @ http://www.10tv.in

Like us on www.fb.com/news10tv

Follow us on https://twitter.com/thetentv

Circle us on https://plus.google.com/+10tvIntelugunews

Watch 10TV, a leading 24/7 Telugu news channel

-

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991)

A black budget is a budget that is allocated for classified and other secret operations of a nation, a corporation, a society of any form, a national department, and .

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991) A black budget is a budget that is allocated for classified and .

How Much Money Is in the Pentagon's Secret Budget? Government Debt

-

How the U.S. Government Wastes Money: Spending, Debt, Budgets, and Investment (1997)

David Maris wrote, one of the key problems with government funding of certain studies [is that] the investment is with taxpayer dollars and the benefit might be .

All our videos for just education. Subscribe our channel and facebook page to watch our new uploads Thanks. David Maris wrote, one of the key problems with .

-

President Reagan on the Stock Market Decline: Government Finance, Debt & Economy (1987)

According to a 1996 study by William A. Niskanen and Stephen Moore,[37] on 8 of the 10 key economic variables examined, the American economy performed

-

Lecture 11: Government Debt

Textbook, Chapter 14.

Public debt accumulation: 0:41

Public debt and taxation: 7:03

Ricardian equivalence theorem: 14:19

-

Thanks Government, Student Loan Repayments Just Got Way More Expensive

While George Osborne’s U-turn announcement today about scrapping controversial plans to cut family tax credits and ditching cuts to police budgets have dominated the headlines, it’s also been revealed that the UK government are shafting students and young people again.

Osborne didn’t mention it in his Spending Review speech today in the House of Commons, but the Tories have managed to sneak throu

-

Government Credit Card Debt Relief Uk | Call us now at (844) 815-3636

Do you need help on how to eliminate your credit card debts? Then do not waste another minute of your time. Call us now at (855) 535-7115.

Government Credit Card Debt Relief Uk | Call us now at (844) 815-3636

Are you having a hard time to figure out how to eliminate your debt fast and fix your credit card debts? Do not worry now. Zap Credit Card Debts are always ready to serve you. Zap Debts wi

-

Amicus Curiae - Government's tax policy roadmap & RBI's debt to equity conversion route

In this edition of Amicus Curiae, ET NOW's Ashwin Mohan speaks discusses the government's tax policy roadmap to phase out exemptions and deductions with Pranav Sayta & Uday Ved. Also catch him in a conversation with Abizer Diwanji and Nikhil Shah on the effectiveness of the RBI's debt to equity conversion route to tackle the bad loans menace.

Subscribe To ET Now For Latest Updates On Stocks, Busin

-

Government debt and fiscal policy in India II (BSE)

Subject: Business Economics

Paper: Industrial economics

Module: Government debt and fiscal policy in India II (BSE)

Content Writer:

-

Nov 3 Debt Ceiling Ticking Time Bomb for US Government #CTSECN @CrushTheStreet

Subscribe for Free to Weekly Economic Newsletter: Coming Silver Shortage: Last .

Subscribe for Free to Weekly Economic Newsletter: Coming Silver Shortage: Last . Subscribe for Free to Weekly Economic Newsletter: Coming Silver Shortage: .

Your source for unconventional news and financial trends.

-

What happens to gold silver prices government spends way out of debt May 29 2012

-

Milton Friedman - Deficits and Government Spending

Milton Friedman explains his contention that government spending is a far greater danger than government debt per se. http://www.LibertyPen.com

-

I-Search PSA Government Spending and Debt

-

U.S. Debt Default and Government Shutdown Explained

-

The Difference Between Public and Private Debt (Government Debt is a Problem)

This is a response to reading this article:

https://medium.com/@girlziplocked/why-amazon-isn-t-a-fucking-idiot-and-runs-a-deficit-f9d5734b68ec

A point I forgot to make was that while Amazon and Google may run "deficits" they are only two out of a sea of companies many who run into debt problems over time, and government being a more consequential institution shouldn't be taking similar risks.

S

-

Why the US has no real debt limit, and the true cost of government - Coming economic collapse

RULE THE WASTELAND: http://www.rulethewasteland.com

Support this channel! Buy what you need on Amazon through this link: http://amzn.to/1HqI9ce

Twitter: @MongoAggression

Instagram: eric_a_english

Funniest website of all time: http://www.englishandenglish.net

Break free from the job paradigm: http://www.secretoftheinternet.com

Buy Thermite! http://www.buythermite.com

Music by The Trouble Note

-

Government debt Top # 12 Facts

-

What Pisses Me Off About Government Debt The Debt Ceiling and Budget Act

As the Federal Government braced itself for a possible shutdown due to approaching the debt ceiling limit - John Boehner and Washington political class found another way to stick it to the American people.

The Bipartisan Budget Act of 2015 was passed by both the House and the Senate this week and will result in at least $85 billion in spending increases over the next three fiscal years. Most impo

-

RTD NEWS: $20 Trillion Man: National Debt Nearly Doubles During Obama Presidency

When Mr. Obama took over in January 2009, the total national debt stood at $10.6 trillion. That means the debt will have very nearly doubled during his eight years in office, and there is much more debt ahead with the abandonment of “sequestration” spending caps enacted in 2011.

Articles: http://www.washingtontimes.com/news/2015/nov/1/obama-presidency-to-end-with-20-trillion-national-/?page=1

ht

-

ECONOMIC PREDICTIONS: Jim Rogers US Government, Debt, Crisis, Economic Predictions

Jim Rogers US Government, Debt, Crisis, Economic Predictions PLEASE SUBSCRIBE to my channel for the latest videos FINANCIAL CRISIS / NEW WORLD .

Jim Rogers US Government, Debt, Crisis, Economic Predictions PLEASE SUBSCRIBE to my channel for the latest videos FINANCIAL CRISIS / NEW WORLD .

ECONOMIC PREDICTIONS: Jim Rogers US Government, Debt, Crisis, Economic Predictions.

debt crisis 2013, 201

-

Puerto Rican government-debt crisis Top # 7 Facts

Puerto Rican government-debt crisis Top # 7 Facts

Greece aims for debt relief deal in Feb 2016 after reforms done

Greece wants a deal on debt relief with its euro zone creditors in February to remove financial uncertainty and spur economic recovery, its finance minister sai...

Greece wants a deal on debt relief with its euro zone creditors in February to remove financial uncertainty and spur economic recovery, its finance minister said, but euro zone officials said that timetable was very ambitious and likely to slip.

Addressing a conference of investors, Finance Minister Euclid Tsakalotos said on Monday that making the ailing euro zone country's debt sustainable was the key to liberating the economy and restoring confidence among depositors and companies.

"If we don't make the critical decision in let's say February 2016, and we push the critical decision back to next summer or even 2017, then all the results will be delayed," Tsakalotos told the American-Hellenic Chamber of Commerce.

Euro zone creditors have said they are willing to consider a debt rescheduling but only once Athens successfully completes a first review of its bailout program, which requires the adoption of a further set of contentious reforms.

Weeks of delays in completing the first batch, which was less challenging politically, suggested the second set would take even longer. A February deadline for a debt deal was therefore very ambitious, euro zone officials said.

The second wave of measures which creditors want completed by mid-December include changes to the pension system to give workers incentives to work and contribute to the system longer.

They also feature overhauling the income tax systems, opening electricity markets and setting up an independent revenue office for tax revenue.

The European Commission's mission chief to Greece, Declan Costello, told the conference the EU wanted all these reforms to be wrapped up by early next year to pave the way for the start of debt relief talks. But the pace of progress depended on the Greek government and lawmakers, he said.

STABILISING GREEK GROSS FINANCING NEEDS

Tsakalotos warned against postponing debt relief, saying that failing to provide a clear pathway for Greece would also leave uncertainty hanging over the whole euro zone.

He said Athens was taking all measures required to complete a successful first review of its program in December and open negotiations on debt relief right away.

Rather than an outright write-down or "haircut" on loans by euro zone partners, which is anathema to top creditor Germany and its northern allies, the relief is to take the form of extensions of maturities, already at an average of 32.5 years, and a longer grace period before debt relief payments fall due.

"We can do a bit more with ... maturity extensions and interest deferrals, but there won’t be a nominal haircut," the head of the euro zone bailout fund Klaus Regling told the Finnish business daily Kauppalehti in an interview.

Euro zone governments, Greece's biggest creditors, agree that debt relief for Athens should be accomplished by capping its debt servicing costs at 15 percent of gross domestic product annually. Athens appears to accept that approach.

"We need to stabilize the gross financing needs, they need to be predictable and affordable," Franciscos Koutentakis, General Secretary for Fiscal Policy at the Greek Finance Ministry, told the conference.

Greece's sovereign debt is projected to reach 187.8 percent of gross domestic product in 2016 from 180.2 percent this year. But thanks to the interest deferrals, grace periods and long maturities, the burden of the debt on the economy is small.

The 2015 debt ratio may be lower, because Costello said Greek growth this year was likely to be stronger than expected when the Commission forecast a 1.4 percent contraction on Nov 5.

The International Monetary Fund has said the debt is clearly unsustainable in the medium-term and has said Greece needs debt relief beyond anything the euro zone has so far been willing to contemplate.

wn.com/Greece Aims For Debt Relief Deal In Feb 2016 After Reforms Done

Greece wants a deal on debt relief with its euro zone creditors in February to remove financial uncertainty and spur economic recovery, its finance minister said, but euro zone officials said that timetable was very ambitious and likely to slip.

Addressing a conference of investors, Finance Minister Euclid Tsakalotos said on Monday that making the ailing euro zone country's debt sustainable was the key to liberating the economy and restoring confidence among depositors and companies.

"If we don't make the critical decision in let's say February 2016, and we push the critical decision back to next summer or even 2017, then all the results will be delayed," Tsakalotos told the American-Hellenic Chamber of Commerce.

Euro zone creditors have said they are willing to consider a debt rescheduling but only once Athens successfully completes a first review of its bailout program, which requires the adoption of a further set of contentious reforms.

Weeks of delays in completing the first batch, which was less challenging politically, suggested the second set would take even longer. A February deadline for a debt deal was therefore very ambitious, euro zone officials said.

The second wave of measures which creditors want completed by mid-December include changes to the pension system to give workers incentives to work and contribute to the system longer.

They also feature overhauling the income tax systems, opening electricity markets and setting up an independent revenue office for tax revenue.

The European Commission's mission chief to Greece, Declan Costello, told the conference the EU wanted all these reforms to be wrapped up by early next year to pave the way for the start of debt relief talks. But the pace of progress depended on the Greek government and lawmakers, he said.

STABILISING GREEK GROSS FINANCING NEEDS

Tsakalotos warned against postponing debt relief, saying that failing to provide a clear pathway for Greece would also leave uncertainty hanging over the whole euro zone.

He said Athens was taking all measures required to complete a successful first review of its program in December and open negotiations on debt relief right away.

Rather than an outright write-down or "haircut" on loans by euro zone partners, which is anathema to top creditor Germany and its northern allies, the relief is to take the form of extensions of maturities, already at an average of 32.5 years, and a longer grace period before debt relief payments fall due.

"We can do a bit more with ... maturity extensions and interest deferrals, but there won’t be a nominal haircut," the head of the euro zone bailout fund Klaus Regling told the Finnish business daily Kauppalehti in an interview.

Euro zone governments, Greece's biggest creditors, agree that debt relief for Athens should be accomplished by capping its debt servicing costs at 15 percent of gross domestic product annually. Athens appears to accept that approach.

"We need to stabilize the gross financing needs, they need to be predictable and affordable," Franciscos Koutentakis, General Secretary for Fiscal Policy at the Greek Finance Ministry, told the conference.

Greece's sovereign debt is projected to reach 187.8 percent of gross domestic product in 2016 from 180.2 percent this year. But thanks to the interest deferrals, grace periods and long maturities, the burden of the debt on the economy is small.

The 2015 debt ratio may be lower, because Costello said Greek growth this year was likely to be stronger than expected when the Commission forecast a 1.4 percent contraction on Nov 5.

The International Monetary Fund has said the debt is clearly unsustainable in the medium-term and has said Greece needs debt relief beyond anything the euro zone has so far been willing to contemplate.

- published: 30 Nov 2015

- views: 2

US Debt Increases Half a Trillion in 3 Weeks

In a 3-week period following Congressional action to suspend the National Debt Ceiling, the United States debt increased by half a trillion dollars to $18,700,0...

In a 3-week period following Congressional action to suspend the National Debt Ceiling, the United States debt increased by half a trillion dollars to $18,700,000,000,000.00. To put that increase into perspective--over a period of 22 days, our government borrowed $26 billion a day. Why does our federal government continue to borrow at such an outrageous pace? Because lawmakers can't pass a balanced budget that only spends within the limits of the actual tax revenue collected, and it's always easier to borrow money than to raise taxes.

wn.com/US Debt Increases Half A Trillion In 3 Weeks

In a 3-week period following Congressional action to suspend the National Debt Ceiling, the United States debt increased by half a trillion dollars to $18,700,000,000,000.00. To put that increase into perspective--over a period of 22 days, our government borrowed $26 billion a day. Why does our federal government continue to borrow at such an outrageous pace? Because lawmakers can't pass a balanced budget that only spends within the limits of the actual tax revenue collected, and it's always easier to borrow money than to raise taxes.

- published: 30 Nov 2015

- views: 361

Tenant Farmer commits Suicide at Krishna District | Debt Problems | AP Government | 10TV

Tenant Farmer Basavayya Commits Suicide at Ramannapeta in Krishna District with Heavy Debt Problems, Family Seeks Government help.

For latest news updates, Sub...

Tenant Farmer Basavayya Commits Suicide at Ramannapeta in Krishna District with Heavy Debt Problems, Family Seeks Government help.

For latest news updates, Subscribe us @ http://goo.gl/MkmvFW

Visit us @ http://www.10tv.in

Like us on www.fb.com/news10tv

Follow us on https://twitter.com/thetentv

Circle us on https://plus.google.com/+10tvIntelugunews

Watch 10TV, a leading 24/7 Telugu news channel for all the latest news updates, breaking news, Political News, Live Reports, Weather Reports, Sports Update, Business Trends, Entertainment News And Stock Market News Along With Special Programs Like Exclusive Interviews, Cookery Shows, And Health Specials.

wn.com/Tenant Farmer Commits Suicide At Krishna District | Debt Problems | Ap Government | 10Tv

Tenant Farmer Basavayya Commits Suicide at Ramannapeta in Krishna District with Heavy Debt Problems, Family Seeks Government help.

For latest news updates, Subscribe us @ http://goo.gl/MkmvFW

Visit us @ http://www.10tv.in

Like us on www.fb.com/news10tv

Follow us on https://twitter.com/thetentv

Circle us on https://plus.google.com/+10tvIntelugunews

Watch 10TV, a leading 24/7 Telugu news channel for all the latest news updates, breaking news, Political News, Live Reports, Weather Reports, Sports Update, Business Trends, Entertainment News And Stock Market News Along With Special Programs Like Exclusive Interviews, Cookery Shows, And Health Specials.

- published: 29 Nov 2015

- views: 10

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991)

A black budget is a budget that is allocated for classified and other secret operations of a nation, a corporation, a society of any form, a national department...

A black budget is a budget that is allocated for classified and other secret operations of a nation, a corporation, a society of any form, a national department, and .

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991) A black budget is a budget that is allocated for classified and .

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991) Secret Societies of America's Elite - (PART ONE) Knights .

wn.com/How Much Money Is In The Pentagon's Secret Budget Government Debt, Programs, Wars (1991)

A black budget is a budget that is allocated for classified and other secret operations of a nation, a corporation, a society of any form, a national department, and .

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991) A black budget is a budget that is allocated for classified and .

How Much Money Is in the Pentagon's Secret Budget? Government Debt, Programs, Wars (1991) Secret Societies of America's Elite - (PART ONE) Knights .

- published: 27 Nov 2015

- views: 0

How the U.S. Government Wastes Money: Spending, Debt, Budgets, and Investment (1997)

David Maris wrote, one of the key problems with government funding of certain studies [is that] the investment is with taxpayer dollars and the benefit might be...

David Maris wrote, one of the key problems with government funding of certain studies [is that] the investment is with taxpayer dollars and the benefit might be .

All our videos for just education. Subscribe our channel and facebook page to watch our new uploads Thanks. David Maris wrote, one of the key problems with .

wn.com/How The U.S. Government Wastes Money Spending, Debt, Budgets, And Investment (1997)

David Maris wrote, one of the key problems with government funding of certain studies [is that] the investment is with taxpayer dollars and the benefit might be .

All our videos for just education. Subscribe our channel and facebook page to watch our new uploads Thanks. David Maris wrote, one of the key problems with .

- published: 27 Nov 2015

- views: 1

President Reagan on the Stock Market Decline: Government Finance, Debt & Economy (1987)

According to a 1996 study by William A. Niskanen and Stephen Moore,[37] on 8 of the 10 key economic variables examined, the American economy performed...

According to a 1996 study by William A. Niskanen and Stephen Moore,[37] on 8 of the 10 key economic variables examined, the American economy performed

wn.com/President Reagan On The Stock Market Decline Government Finance, Debt Economy (1987)

According to a 1996 study by William A. Niskanen and Stephen Moore,[37] on 8 of the 10 key economic variables examined, the American economy performed

- published: 27 Nov 2015

- views: 0

Lecture 11: Government Debt

Textbook, Chapter 14.

Public debt accumulation: 0:41

Public debt and taxation: 7:03

Ricardian equivalence theorem: 14:19...

Textbook, Chapter 14.

Public debt accumulation: 0:41

Public debt and taxation: 7:03

Ricardian equivalence theorem: 14:19

wn.com/Lecture 11 Government Debt

Textbook, Chapter 14.

Public debt accumulation: 0:41

Public debt and taxation: 7:03

Ricardian equivalence theorem: 14:19

- published: 27 Nov 2015

- views: 17

Thanks Government, Student Loan Repayments Just Got Way More Expensive

While George Osborne’s U-turn announcement today about scrapping controversial plans to cut family tax credits and ditching cuts to police budgets have dominate...

While George Osborne’s U-turn announcement today about scrapping controversial plans to cut family tax credits and ditching cuts to police budgets have dominated the headlines, it’s also been revealed that the UK government are shafting students and young people again.

Osborne didn’t mention it in his Spending Review speech today in the House of Commons, but the Tories have managed to sneak through the fact they won’t be raising the threshold for students repaying their loans in line with inflation.

Basically, that means ex-students will continue to repay 9 per cent of everything they earn above £21,000 (before tax) after they graduate, which will cost youngsters a lot more in the long run.

The freeze was made, despite massive opposition to the idea.

As reported by the Guardian, the Department for Business, Innovation and Skills (BIS) said:

To reduce government debt, the student loan repayment threshold for Plan 2 borrowers will be frozen until April 2021.

Plan 2 borrowers are those who took out loans from 2012 onwards.

The disappointing revelation comes hot on the heels of today’s news that British universities are now the most expensive in the world.

Labour MP Wes Streeting has already called the move a “betrayal”, while Martin Lewis, founder of MoneySavingExpert.com, is absolutely furious with the decision, and accused the Chancellor of cowardice for opting not to mention the freeze in his speech today.

According to Lewis, because of the rate of inflation, the freeze means 2 million graduates will end up paying £306 more each year by 2020-21 than they would have done without the change.

Speaking to the Guardian, Lewis said:

This is a disgraceful move and a breach of trust by the government that betrays a generation of students. It has chosen to freeze the repayment threshold even though 95% of the consultation responses did not support the freeze – what was the point of a consultation if when there’s huge objection it does it anyway?

It is risking fundamentally threatening any trust people have in the student finance system. It is one thing to set up a system that is unpopular but it is entirely different to make retrospective changes that mean you cannot even rely on what you were promised at the time you started to study. Even though it was warned of the huge dangers of doing this, it’s still blundering ahead, ignoring all right thinking concern.

The fact that the Chancellor didn’t even have the balls to put it in his Autumn Statement speech shows that he knew how unpopular it would be. If a commercial company made retrospective changes to their loan terms in this way they’d be slapped hard by the regulator – the Government shouldn’t be allowed to get away with it either.

Elsewhere, Osborne still said he planned to make deep cuts to public spending, slashing it by £20billion in order to get Britain out of debt by 2020.

While his plans to ditch the plans to cut £4.4bn worth of tax credits for working families proved popular, as did not going ahead with cuts to the police force in the wake of the Paris attacks, it will still be the poor who are hit hardest by today’s announcements.

£12bn worth of cuts will still be made to social security over the next five years and, although he pledged billions extra for the NHS, student doctors and nurses will still continue to suffer with an end to bursaries.

In other announcements, Osborne revealed there’d be no cuts to arts and sport, more funds for mental health and perinatal care, a rise in the basic state pension, more spending on infrastructure, a proposed fresh crackdown on tax avoidance, and billions more was promised for defence and foreign aid.

wn.com/Thanks Government, Student Loan Repayments Just Got Way More Expensive

While George Osborne’s U-turn announcement today about scrapping controversial plans to cut family tax credits and ditching cuts to police budgets have dominated the headlines, it’s also been revealed that the UK government are shafting students and young people again.

Osborne didn’t mention it in his Spending Review speech today in the House of Commons, but the Tories have managed to sneak through the fact they won’t be raising the threshold for students repaying their loans in line with inflation.

Basically, that means ex-students will continue to repay 9 per cent of everything they earn above £21,000 (before tax) after they graduate, which will cost youngsters a lot more in the long run.

The freeze was made, despite massive opposition to the idea.

As reported by the Guardian, the Department for Business, Innovation and Skills (BIS) said:

To reduce government debt, the student loan repayment threshold for Plan 2 borrowers will be frozen until April 2021.

Plan 2 borrowers are those who took out loans from 2012 onwards.

The disappointing revelation comes hot on the heels of today’s news that British universities are now the most expensive in the world.

Labour MP Wes Streeting has already called the move a “betrayal”, while Martin Lewis, founder of MoneySavingExpert.com, is absolutely furious with the decision, and accused the Chancellor of cowardice for opting not to mention the freeze in his speech today.

According to Lewis, because of the rate of inflation, the freeze means 2 million graduates will end up paying £306 more each year by 2020-21 than they would have done without the change.

Speaking to the Guardian, Lewis said:

This is a disgraceful move and a breach of trust by the government that betrays a generation of students. It has chosen to freeze the repayment threshold even though 95% of the consultation responses did not support the freeze – what was the point of a consultation if when there’s huge objection it does it anyway?

It is risking fundamentally threatening any trust people have in the student finance system. It is one thing to set up a system that is unpopular but it is entirely different to make retrospective changes that mean you cannot even rely on what you were promised at the time you started to study. Even though it was warned of the huge dangers of doing this, it’s still blundering ahead, ignoring all right thinking concern.

The fact that the Chancellor didn’t even have the balls to put it in his Autumn Statement speech shows that he knew how unpopular it would be. If a commercial company made retrospective changes to their loan terms in this way they’d be slapped hard by the regulator – the Government shouldn’t be allowed to get away with it either.

Elsewhere, Osborne still said he planned to make deep cuts to public spending, slashing it by £20billion in order to get Britain out of debt by 2020.

While his plans to ditch the plans to cut £4.4bn worth of tax credits for working families proved popular, as did not going ahead with cuts to the police force in the wake of the Paris attacks, it will still be the poor who are hit hardest by today’s announcements.

£12bn worth of cuts will still be made to social security over the next five years and, although he pledged billions extra for the NHS, student doctors and nurses will still continue to suffer with an end to bursaries.

In other announcements, Osborne revealed there’d be no cuts to arts and sport, more funds for mental health and perinatal care, a rise in the basic state pension, more spending on infrastructure, a proposed fresh crackdown on tax avoidance, and billions more was promised for defence and foreign aid.

- published: 25 Nov 2015

- views: 0

Government Credit Card Debt Relief Uk | Call us now at (844) 815-3636

Do you need help on how to eliminate your credit card debts? Then do not waste another minute of your time. Call us now at (855) 535-7115.

Government Credit C...

Do you need help on how to eliminate your credit card debts? Then do not waste another minute of your time. Call us now at (855) 535-7115.

Government Credit Card Debt Relief Uk | Call us now at (844) 815-3636

Are you having a hard time to figure out how to eliminate your debt fast and fix your credit card debts? Do not worry now. Zap Credit Card Debts are always ready to serve you. Zap Debts will sit down with you and take a deep look at your credit card debt situation, then they will give you the best course of action to eliminate debt or your credit card debts. It has an effective debt elimination program that will surely beat the collectors game and help you get out of debt and get your life back into normal. Once your okay with the program and ready to eliminate debt our Zap Debt's and team will work quickly to REDUCE DEBT to ZERO without long term negatives destroying your credit, all with NO MONTHLY CREDIT CARD PAYMENTS. See, it is exciting right? So hurry! Start free debt living today and calling us at your phone number (855) 535-7115.

Visit also our website by clicking this link http://www.zapcreditcarddebt.net/

wn.com/Government Credit Card Debt Relief UK | Call US Now At (844) 815 3636

Do you need help on how to eliminate your credit card debts? Then do not waste another minute of your time. Call us now at (855) 535-7115.

Government Credit Card Debt Relief Uk | Call us now at (844) 815-3636