- published: 23 Jan 2011

- views: 1037160

-

remove the playlistCredit (finance)

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistCredit (finance)

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 22 Sep 2014

- views: 15

- published: 15 May 2012

- views: 636

- author: fordcreditdigital

- published: 25 Jan 2013

- views: 1553

- author: Missouri State University

- published: 24 May 2010

- views: 25671

- author: MintSoftware

- published: 25 Apr 2011

- views: 14613

- author: Krassimir Petrov

- published: 29 Oct 2011

- views: 16149

- author: 2minutefinance

- published: 02 Jul 2013

- views: 1284

- author: Miguel Silva

- published: 29 Jun 2012

- views: 586

- author: CarCreditTampaFla

- published: 14 Nov 2014

- views: 2

- published: 29 Jun 2012

- views: 424

- author: CarCreditTampaFla

- published: 26 Sep 2011

- views: 3084

- author: TeacherPhilEnglish

Credit is the trust which allows one party to provide resources to another party where that second party does not reimburse the first party immediately (thereby generating a debt), but instead arranges either to repay or return those resources (or other materials of equal value) at a later date. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower.

Credit does not necessarily require money. The credit concept can be applied in barter economies as well, based on the direct exchange of goods and services (Ingham 2004 p. 12-19). However, in modern societies credit is usually denominated by a unit of account. Unlike money, credit itself cannot act as a unit of account.

Movements of financial capital are normally dependent on either credit or equity transfers. Credit is in turn dependent on the reputation or creditworthiness of the entity which takes responsibility for the funds. Credit is also traded in financial markets. The purest form is the credit default swap market, which is essentially a traded market in credit insurance. A credit default swap represents the price at which two parties exchange this risk – the protection "seller" takes the risk of default of the credit in return for a payment, commonly denoted in basis points (one basis point is 1/100 of a percent) of the notional amount to be referenced, while the protection "buyer" pays this premium and in the case of default of the underlying (a loan, bond or other receivable), delivers this receivable to the protection seller and receives from the seller the par amount (that is, is made whole).

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Credit may refer to:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

The Crisis of Credit Visualized - HD

The Crisis of Credit Visualized - HDThe Crisis of Credit Visualized - HD

The Short and Simple Story of the Credit Crisis -- The Full Version By Jonathan Jarvis. Crisisofcredit.com The goal of giving form to a complex situation like the credit crisis is to quickly supply the essence of the situation to those unfamiliar and uninitiated. This is the original, full version. -

Trade Finance in the Spotlight – Letters of Credit

Trade Finance in the Spotlight – Letters of CreditTrade Finance in the Spotlight – Letters of Credit

Welcome to the fifth video in ANZ's Trade Finance Education Series - "Trade Finance in the Spotlight". In this series of videos we will be discussing a range of Trade Finance products and concepts. We will discuss the pros and cons of trade products, how they work and when they should be used. In this episode we will introduce Letters of Credit and review the main parties involved in a Letter of Credit transaction. Stay tuned for upcoming videos featuring more information on Trade Finance products and concepts. Also take a look at the Trade Finance Podcast Series for information on Incoterms 2010. DISCLAIMER: The information on the -

Ford Credit Finance Tools

Ford Credit Finance ToolsFord Credit Finance Tools

Thank you for your interest in Ford Credit. With our suite of online finance tools, you'll be sure to get the information you need. You can estimate a paymen... -

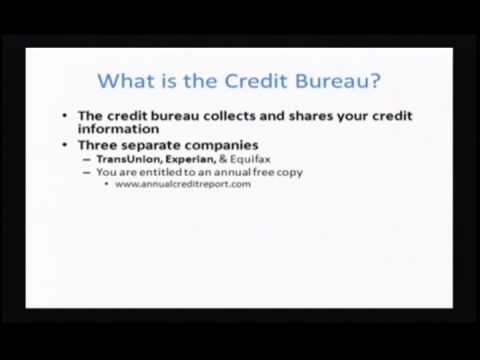

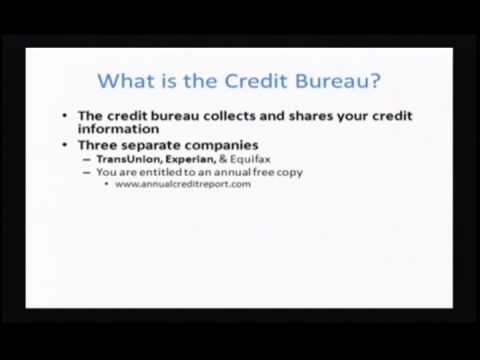

Personal Finance: Class 3 - Credit

Personal Finance: Class 3 - CreditPersonal Finance: Class 3 - Credit

A study of personal finance topics from the consumer and societal perspectives. Topics include the preparation and interpretation of personal financial state... -

Quest for Credit - Complete Version from Mint.com

Quest for Credit - Complete Version from Mint.comQuest for Credit - Complete Version from Mint.com

http://www.mint.com | The importance of good credit in our society is unquestionable — as is the destructive power of its ugly cousin, bad credit. Yet, milli... -

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Structured Finance, Lecture 2 - Credit Derivatives - Part 1Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Introduction to Credit derivatives and Credit Default Swaps. Dr. Krassimir Petrov, AUBG Professor: Krassimir Petrov, Ph. D. -

Banks vs. Credit Unions: What's the Difference? - 2 Minute Finance

Banks vs. Credit Unions: What's the Difference? - 2 Minute FinanceBanks vs. Credit Unions: What's the Difference? - 2 Minute Finance

Thinking about moving your money out of a big bank and into a local credit union? Get the low down on their differences in this two minute video. For more in... -

InCreditable Advisors - Business Credit Finance Suite Walkthrough

InCreditable Advisors - Business Credit Finance Suite WalkthroughInCreditable Advisors - Business Credit Finance Suite Walkthrough

A great sneak peek of how the Indiana Business Credit Finance Suite works. For more information please give us a call at 317.837.4969 or 855.445.9636 or visi... -

Car Credit Finance Video

Car Credit Finance VideoCar Credit Finance Video

At Car Credit, not all cars are the same. Every one of our cars are hand picked by automotive professionals and checked and serviced 4 times before they are ... -

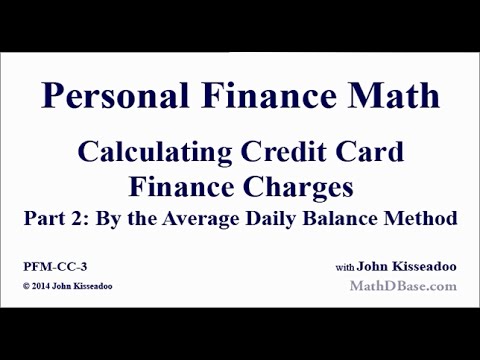

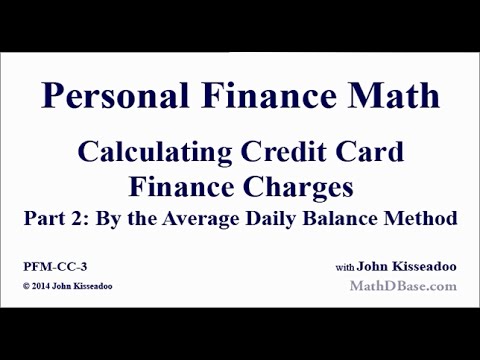

Personal Finance Math 3 Calculating Credit Card Finance Charges Part 2

Personal Finance Math 3 Calculating Credit Card Finance Charges Part 2Personal Finance Math 3 Calculating Credit Card Finance Charges Part 2

Personal Finance Math 3: Calculating Credit Card Finance Charges, Part 2: By the average daily balance method How to reconcile results found on your credit card statements. In this anicast we calculate credit card finance charges and new balances using the average daily balance method. -

Car Credit Finance Video en Espanol

Car Credit Finance Video en EspanolCar Credit Finance Video en Espanol

En Car Credit, sin dudarlo, todavia "Es tan sencillo" En Car Credit, no todos los carros son iguales. Nosotros escojemos nuestros carros. Ademas utilizamos u... -

Business and Finance Lesson 5: Credit Sales, Credit Policies (Learn English)

Business and Finance Lesson 5: Credit Sales, Credit Policies (Learn English)Business and Finance Lesson 5: Credit Sales, Credit Policies (Learn English)

We discuss issues such as credit sales vs cash sales, lending money to customers, credit terms such as 2/10 net30, What are good credit terms?, What are bad ... -

Are Credit Cards Good or Bad for the Economy? Debt, Finance, Market (2001)

Are Credit Cards Good or Bad for the Economy? Debt, Finance, Market (2001)Are Credit Cards Good or Bad for the Economy? Debt, Finance, Market (2001)

Credit card debt has increased steadily. Since the late 1990s, lawmakers, consumer advocacy groups, college officials and other higher education affiliates have become increasingly concerned about the rising use of credit cards among college students. The major credit card companies have been accused of targeting a younger audience, especially college students, many of whom are already in debt with college tuition fees and college loans and who typically are less experienced at managing their own finances. Credit card debt may also negatively affect their grades as they are likely to work more both part and full-time positions. Another contr -

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

Auto Loans Bad Credit Car Loans BlueSky Auto FinanceAuto Loans Bad Credit Car Loans BlueSky Auto Finance

Auto finance for bad credit car loans. Get pre-approved car financing for up to $30000 dollars in minutes - even if you have bad credit.

- Accounting scandals

- Arthur O' Sullivan

- Audit

- Bad debt

- Bank

- Bank credit

- Bankruptcy

- Bond (finance)

- Bond market

- Borrower

- Call option

- Capital budgeting

- Cash

- Central bank

- Charge-off

- Collection agency

- Commerce

- Commodity market

- Consumer credit

- Consumer debt

- Consumer lending

- Corporate bond

- Corporate debt

- Corporate finance

- Credit (finance)

- Credit bureau

- Credit card

- Credit default swap

- Credit history

- Credit manager

- Credit rating agency

- Credit risk

- Credit score

- Creditor

- Creditworthiness

- Debenture

- Debt

- Debt bondage

- Debt buyer

- Debt collection

- Debt compliance

- Debt consolidation

- Debt evasion

- Debt management plan

- Debt relief

- Debt restructuring

- Debt-snowball method

- Debtor

- Debtors' prison

- Default (finance)

- Deficit spending

- Deposit account

- Derivative (finance)

- Derivatives market

- DIP financing

- Economic history

- Employment contract

- Exotic option

- External debt

- Finance

- Financial capital

- Financial instrument

- Financial literacy

- Financial market

- Financial planner

- Financial regulation

- Financial statement

- Fixed income

- Futures contract

- Garnishment

- Goods and services

- Government bond

- Government budget

- Government debt

- Government spending

- Insolvency

- Installment credit

- Interest

- Interest rate

- Internal debt

- International

- Investment credit

- Investor

- ISO 31000

- Lender

- Leveraged buyout

- Line of credit

- Lists of banks

- Loan

- Loan shark

- Money

- Money market

- Money supply

- Mortgage loan

- Municipal bond

- Municipal debt

- Non-tax revenue

- Option (finance)

- Payday loan

- Percent

- Personal finance

- Phantom debt

- Predatory lending

- Private equity

- Public credit

- Public finance

- Put option

- Real estate

- Recession

- Reimburse

- Resources

- Retail

- Retirement

- Revolving credit

- Risk

- Risk-return spectrum

- Securitization

- Security (finance)

- Settlement (finance)

- Social Credit

- Speculation

- Spot market

- Stock

- Stock market

- Stock market bubble

- Stock market crash

- Strategic default

- Structured finance

- Sub prime lending

- Tax

- Template Debt

- Template talk Debt

- Time deposit

- Trade

- Trade credit

- Transfer payment

- Unit of account

- Usury

- Venture capital

- Venture debt

- Warrant of payment

- Wikiquote Credit

-

The Crisis of Credit Visualized - HD

The Short and Simple Story of the Credit Crisis -- The Full Version By Jonathan Jarvis. Crisisofcredit.com The goal of giving form to a complex situation like the credit crisis is to quickly supply the essence of the situation to those unfamiliar and uninitiated. This is the original, full version. -

Trade Finance in the Spotlight – Letters of Credit

Welcome to the fifth video in ANZ's Trade Finance Education Series - "Trade Finance in the Spotlight". In this series of videos we will be discussing a range of Trade Finance products and concepts. We will discuss the pros and cons of trade products, how they work and when they should be used. In this episode we will introduce Letters of Credit and review the main parties involved in a Letter -

Ford Credit Finance Tools

Thank you for your interest in Ford Credit. With our suite of online finance tools, you'll be sure to get the information you need. You can estimate a paymen... -

Personal Finance: Class 3 - Credit

A study of personal finance topics from the consumer and societal perspectives. Topics include the preparation and interpretation of personal financial state... -

Quest for Credit - Complete Version from Mint.com

http://www.mint.com | The importance of good credit in our society is unquestionable — as is the destructive power of its ugly cousin, bad credit. Yet, milli... -

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

Introduction to Credit derivatives and Credit Default Swaps. Dr. Krassimir Petrov, AUBG Professor: Krassimir Petrov, Ph. D. -

Banks vs. Credit Unions: What's the Difference? - 2 Minute Finance

Thinking about moving your money out of a big bank and into a local credit union? Get the low down on their differences in this two minute video. For more in... -

InCreditable Advisors - Business Credit Finance Suite Walkthrough

A great sneak peek of how the Indiana Business Credit Finance Suite works. For more information please give us a call at 317.837.4969 or 855.445.9636 or visi... -

Car Credit Finance Video

At Car Credit, not all cars are the same. Every one of our cars are hand picked by automotive professionals and checked and serviced 4 times before they are ... -

Personal Finance Math 3 Calculating Credit Card Finance Charges Part 2

Personal Finance Math 3: Calculating Credit Card Finance Charges, Part 2: By the average daily balance method How to reconcile results found on your credit card statements. In this anicast we calculate credit card finance charges and new balances using the average daily balance method. -

Car Credit Finance Video en Espanol

En Car Credit, sin dudarlo, todavia "Es tan sencillo" En Car Credit, no todos los carros son iguales. Nosotros escojemos nuestros carros. Ademas utilizamos u... -

Business and Finance Lesson 5: Credit Sales, Credit Policies (Learn English)

We discuss issues such as credit sales vs cash sales, lending money to customers, credit terms such as 2/10 net30, What are good credit terms?, What are bad ... -

Are Credit Cards Good or Bad for the Economy? Debt, Finance, Market (2001)

Credit card debt has increased steadily. Since the late 1990s, lawmakers, consumer advocacy groups, college officials and other higher education affiliates have become increasingly concerned about the rising use of credit cards among college students. The major credit card companies have been accused of targeting a younger audience, especially college students, many of whom are already in debt wit -

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

Auto finance for bad credit car loans. Get pre-approved car financing for up to $30000 dollars in minutes - even if you have bad credit. -

Trade Credit Insurance | My Invoice Finance

Trade Credit Insurance | My Invoice Finance Trade Credit Insurance http://myinvoicefinance.co.uk/trade-credit-insurance/ My Invoice Finance provides a comprehensive line of trade credit insurance to protect companies against potential non-payment by their customers, with cover provided in approximately 200 countries. HOW DOES IT WORK? My Invoice Finance insurance partners pays you an indemnity t -

DO NOT USE CREDIT ACCEPTANCE CORP To FINANCE YOUR CAR LOAN

If you are a consumer in United States, do not use credit acceptance corp to finance your car loan. Credit Acceptance Corp is a car financing company whose headquarters are located in Southfield Michigan. -

Exporting with Confidence: Trade Finance and Letters of Credit - Lloyds TSB

Documentary letters of credit are internationally recognised instruments that help ensure the creditworthiness and payment of the overseas parties you're tra... -

Structured Finance, Lecture 1 - The Alphabet Soup of the Credit Crisis

Introduces the alphabet soup (CDO, CMO, ABS, CLO, MBS, CDS, CBO, CPDO, LBO, MBO, CP, ABCP, etc.) of structured finance and other instruments that contributed... -

Good Car Dealers for Bad Credit Auto Finance. Buying a Car with Bad Credit

If you're buying a car with bad credit, make sure you go to a good car car dealership for bad credit auto finance. Good car dealers for people with bad credi... -

How to Get a Home Loan. Australian Credit and Finance

http://home.creditandfinance.com.au/borrowing-power Want to talk 1300 737 455 We can help with home loan finance, mortgage, first home loans, investment loans, property finance, new mortgages, refinancing. Get Approved Quickly. Get an INSTANT QUOTE - Talk to your Australian Credit and Finance broker today about how they can help you take control of your finances. -

Credit Default Swaps explained clearly in five minutes

BBC Newsnight feature by Alex Ritson on Credit Default Swaps - until recently a little-known financial product that Lehmans Brothers, AIG and the Icelandic b... -

Rules of Debit and Credit

In this video, you will learn in depth about accounting of business transactions and learn about how they affect different accounts, and how to apply the rul... -

Commercial Credit and Finance PLC

The Crisis of Credit Visualized - HD

- Order: Reorder

- Duration: 11:11

- Updated: 23 Jan 2011

- views: 1037160

- published: 23 Jan 2011

- views: 1037160

Trade Finance in the Spotlight – Letters of Credit

- Order: Reorder

- Duration: 7:14

- Updated: 22 Sep 2014

- views: 15

- published: 22 Sep 2014

- views: 15

Ford Credit Finance Tools

- Order: Reorder

- Duration: 1:21

- Updated: 27 Jul 2014

- views: 636

- author: fordcreditdigital

- published: 15 May 2012

- views: 636

- author: fordcreditdigital

Personal Finance: Class 3 - Credit

- Order: Reorder

- Duration: 26:10

- Updated: 29 Apr 2014

- views: 1553

- author: Missouri State University

- published: 25 Jan 2013

- views: 1553

- author: Missouri State University

Quest for Credit - Complete Version from Mint.com

- Order: Reorder

- Duration: 7:53

- Updated: 15 Aug 2013

- views: 25671

- author: MintSoftware

- published: 24 May 2010

- views: 25671

- author: MintSoftware

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

- Order: Reorder

- Duration: 71:12

- Updated: 06 Jul 2014

- views: 14613

- author: Krassimir Petrov

- published: 25 Apr 2011

- views: 14613

- author: Krassimir Petrov

Banks vs. Credit Unions: What's the Difference? - 2 Minute Finance

- Order: Reorder

- Duration: 2:15

- Updated: 01 Sep 2014

- views: 16149

- author: 2minutefinance

- published: 29 Oct 2011

- views: 16149

- author: 2minutefinance

InCreditable Advisors - Business Credit Finance Suite Walkthrough

- Order: Reorder

- Duration: 19:25

- Updated: 23 Feb 2014

- views: 1284

- author: Miguel Silva

- published: 02 Jul 2013

- views: 1284

- author: Miguel Silva

Car Credit Finance Video

- Order: Reorder

- Duration: 1:46

- Updated: 21 Mar 2013

- views: 586

- author: CarCreditTampaFla

- published: 29 Jun 2012

- views: 586

- author: CarCreditTampaFla

Personal Finance Math 3 Calculating Credit Card Finance Charges Part 2

- Order: Reorder

- Duration: 5:30

- Updated: 14 Nov 2014

- views: 2

- published: 14 Nov 2014

- views: 2

Car Credit Finance Video en Espanol

- Order: Reorder

- Duration: 1:52

- Updated: 29 Jun 2012

- views: 424

- author: CarCreditTampaFla

- published: 29 Jun 2012

- views: 424

- author: CarCreditTampaFla

Business and Finance Lesson 5: Credit Sales, Credit Policies (Learn English)

- Order: Reorder

- Duration: 10:15

- Updated: 21 Jul 2014

- views: 3084

- author: TeacherPhilEnglish

- published: 26 Sep 2011

- views: 3084

- author: TeacherPhilEnglish

Are Credit Cards Good or Bad for the Economy? Debt, Finance, Market (2001)

- Order: Reorder

- Duration: 73:35

- Updated: 18 May 2015

- views: 2

- published: 18 May 2015

- views: 2

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

- Order: Reorder

- Duration: 2:29

- Updated: 01 Sep 2014

- views: 29018

- author: BlueSky Auto Finance

- published: 24 Oct 2013

- views: 29018

- author: BlueSky Auto Finance

Trade Credit Insurance | My Invoice Finance

- Order: Reorder

- Duration: 1:05

- Updated: 23 May 2015

- views: 4

- published: 23 May 2015

- views: 4

DO NOT USE CREDIT ACCEPTANCE CORP To FINANCE YOUR CAR LOAN

- Order: Reorder

- Duration: 10:52

- Updated: 21 Dec 2013

- views: 9

- published: 21 Dec 2013

- views: 9

Exporting with Confidence: Trade Finance and Letters of Credit - Lloyds TSB

- Order: Reorder

- Duration: 5:37

- Updated: 19 Jun 2014

- views: 3239

- author: UK Trade & Investment (UKTI)

- published: 26 Apr 2012

- views: 3239

- author: UK Trade & Investment (UKTI)

Structured Finance, Lecture 1 - The Alphabet Soup of the Credit Crisis

- Order: Reorder

- Duration: 62:18

- Updated: 05 Jun 2014

- views: 12612

- author: Krassimir Petrov

- published: 25 Apr 2011

- views: 12612

- author: Krassimir Petrov

Good Car Dealers for Bad Credit Auto Finance. Buying a Car with Bad Credit

- Order: Reorder

- Duration: 4:19

- Updated: 15 Mar 2014

- views: 4705

- author: autocreditexpress

- published: 09 Nov 2010

- views: 4705

- author: autocreditexpress

How to Get a Home Loan. Australian Credit and Finance

- Order: Reorder

- Duration: 1:21

- Updated: 04 Feb 2014

- views: 105

- published: 04 Feb 2014

- views: 105

Credit Default Swaps explained clearly in five minutes

- Order: Reorder

- Duration: 5:08

- Updated: 03 Sep 2014

- views: 170153

- author: thebigscreen

- published: 17 Oct 2008

- views: 170153

- author: thebigscreen

Rules of Debit and Credit

- Order: Reorder

- Duration: 13:57

- Updated: 04 Sep 2014

- views: 62931

- author: financetrain

- published: 13 Feb 2013

- views: 62931

- author: financetrain

Commercial Credit and Finance PLC

- Order: Reorder

- Duration: 6:40

- Updated: 01 Nov 2013

- views: 6

- published: 01 Nov 2013

- views: 6

-

Personal Finance Tips How to Get a Personal Loan With Bad Credit

-

Personal Finance Tips How to Get a Personal Loan With Bad Credit

-

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

-

Credit One - Looking for Marine Finance for your next boat?

Looking for Marine Finance for your next boat? Find out why over 100,000 Australian's choose Credit One for their Finance needs. Offering fully protected Marine Finance, Caravan Finance, Car Finance, Bike Finance, Property Finance and Business Finance solutions for both individuals and businesses throughout Australia. -

How to Finance a Business : How to Get a Business Loan With Bad Credit

Get a business loan when you have bad credit by disputing credit reports. Find out how to get around credit problems when financing a business in this free . At Ventury Capital We Understand Entreprenuers Because We Were Founded By Entrepreneurs. -Kevin Harrington Ventury Capital helps business owners . How to start a Small Business with no Money and Bad Credit? How can I start a business with -

Business Credit & Finance Suite

-

Business Credit & Finance Commercial

-

Bad Credit Car Finance The Car Loan Warehouse

Cám ơn các bạn đã xem video! Nhớ bấm ĐĂNG KÝ cho kênh nhé ^^ Chúc các bạn xem video vui vẻ! FO3 mang lại nhiều cảm súc cho game thủ :v -

Bad Credit Car Finance Loans Louth, Grimsby, Cleethorpes, Immingham

Cám ơn các bạn đã xem video! Nhớ bấm ĐĂNG KÝ cho kênh nhé ^^ Chúc các bạn xem video vui vẻ! FO3 mang lại nhiều cảm súc cho game thủ :v

Personal Finance Tips How to Get a Personal Loan With Bad Credit

- Order: Reorder

- Duration: 0:58

- Updated: 22 Oct 2015

- views: 0

- published: 22 Oct 2015

- views: 0

Personal Finance Tips How to Get a Personal Loan With Bad Credit

- Order: Reorder

- Duration: 1:17

- Updated: 22 Oct 2015

- views: 0

- published: 22 Oct 2015

- views: 0

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

- Order: Reorder

- Duration: 1:25

- Updated: 22 Oct 2015

- views: 0

- published: 22 Oct 2015

- views: 0

Credit One - Looking for Marine Finance for your next boat?

- Order: Reorder

- Duration: 1:00

- Updated: 22 Oct 2015

- views: 7

- published: 22 Oct 2015

- views: 7

How to Finance a Business : How to Get a Business Loan With Bad Credit

- Order: Reorder

- Duration: 3:26

- Updated: 22 Oct 2015

- views: 0

- published: 22 Oct 2015

- views: 0

Business Credit & Finance Suite

- Order: Reorder

- Duration: 1:49

- Updated: 21 Oct 2015

- views: 1

- published: 21 Oct 2015

- views: 1

Business Credit & Finance Commercial

- Order: Reorder

- Duration: 2:19

- Updated: 21 Oct 2015

- views: 0

- published: 21 Oct 2015

- views: 0

Bad Credit Car Finance The Car Loan Warehouse

- Order: Reorder

- Duration: 2:40

- Updated: 18 Oct 2015

- views: 17

- published: 18 Oct 2015

- views: 17

Bad Credit Car Finance Loans Louth, Grimsby, Cleethorpes, Immingham

- Order: Reorder

- Duration: 3:09

- Updated: 18 Oct 2015

- views: 45

- published: 18 Oct 2015

- views: 45

-

Structured Finance, Lecture 3 - Credit Derivatives, Part 2

Provides a survey of all major credit derivative instruments - credit default swaps, credit default options, indemnity agreements, total return swaps, credit... -

PRE SHIPMENT FINANCE AND POST SHIPMENT CREDIT

-

Structured Finance, Lecture 4 - Credit Default Swaps

Provides an in-depth overview at an introductory level of Credit Default Swaps, contract specifications, financial and economic interpretations, and practica... -

Personal Finance Basics: How to Raise Your Credit Score

Galia Gichon offers actionable tips on how you can quickly raise your credit score. http://cr8.lv/ggpfafyt In this clip from Personal Finance for Artists & Freelancers, Galia talks about reviewing your credit report, finding and dealing with errors, and raising your credit score. Get a complete guide to improving your financial health: http://cr8.lv/ggpfafyt CreativeLive unleashes your creativ -

Do Debt Settlement Companies Really Work? Credit Card Debt Relief, Finance (2010)

Debt settlement, also known as debt arbitration, debt negotiation or credit settlement, is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full. In the U.K. you can appoint an Arbiter or legal entity to negotiate with the creditors. Creditors often accept reduced balances in a final payment and this is called full and f -

Sources of Finance

This animation teaches the learner various sources of finance namely, retained earnings, trade credit, factoring, lease finance, public deposits and commerci... -

The Bank of America - Merrill Lynch Merger: Finance, Stocks, Credit, Wealth Management (2009)

Merrill Lynch Wealth Management is the wealth management division of Bank of America. The firm is headquartered in New York City, and occupies the entire 34 stories of the Four World Financial Center building in Manhattan. Merrill Lynch employs over 15,000 financial advisors and manages $2.2 trillion in client assets.[4] The firm has its origins in Merrill Lynch & Co., Inc. which, prior to 2009, w -

[Finance] Conférence "Une histoire moderne du risque de crédit"

Vendredi 5 décembre 2014 à l'ESILV, Ecole Supérieure d'Ingénieurs Léonard de Vinci (Paris-La Défense). Plus d'infos sur l'ESILV : http://www.esilv.fr Diplômé de l’Ecole Polytechnique et titulaire d’un doctorat de physique théorique, Vivien BRUNEL a fait l’essentiel de sa carrière au sein d’institutions financières prestigieuses. Il a ainsi successivement occupé des postes à la Direction de la Rech -

Global Financial Meltdown - One Of The Best Financial Crisis Documentary Films

Meltdown is a four-part investigation into a world of greed and recklessness that brought down the financial world. The show begins with the 2008 crash that pushed 30 million people into unemployment, brought countries to the edge of insolvency and turned the clock back to 1929. But how did it all go so wrong? Lack of government regulation; easy lending in the US housing market meant anyone could -

WSC Corporate Credit & Financing Crash Course

-

Crash Gordon ( The Financial Crisis)

Andrew Rawnsley presents the inside political story of the credit crunch, charting the roller coaster journey of Gordon Brown's fortunes from the moment the ... -

Interviews with Seller Finance Experts #6 - Getting Business Credit - Robert Ritchie

Get your free Dodd-Frank Disclosure at www.Dodd-FrankNotes.com. 619-786-5550 This is our conversation with Robert Ritchie, a true specialist in establishing business credit for real estate investors and other types of entrepreneurs. -

How Do New Credit Card Rules Affect Consumers? Personal Finance Advice - Debt (2010)

The Credit Card Accountability Responsibility and Disclosure Act of 2009 or Credit CARD Act of 2009 is a federal statute passed by the United States Congress... -

Investment Banking and Structured Finance - 02/16 - Pricing of credit derivatives (Part 1)

Investment Banking and Structured Finance 02 - Pricing of credit derivatives (Part 1) Prof. Andrea Fabbri The course focuses on the business of structured fi... -

Investment Banking and Structured Finance - 03/16 - Pricing of credit derivatives (Part 2)

Investment Banking and Structured Finance 03 - Pricing of credit derivatives (Part 2) Prof. Andrea Fabbri The course focuses on the business of structured fi... -

L8/P6: Climate Finance mechanisms: National & International level,carbon credit,PAT

Language: Hindi, Topics Covered: 1. international climate finance: Kyoto- Clean Development mechanism (CDM) and carbon trading, survey points 2. Global environment facility at Washington vs. Green climate fund at Songdo, South Korea- what’s the difference? 3. budget – taxation provisions for combating climate change 4. case for increasing coal cess further 5. national action plan on climate change -

Pre shipment Finance and Post shipment Credit NEW

-

Troubled Asset Relief Program Oversight: Credit, Loans, Finance - Elizabeth Warren Testimony (2010)

The banks agreeing to receive preferred stock investments from the Treasury include Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank o... -

Credit Markets: What's Next?

Institute Chairman Mike Milken moderates our annual look at the issues shaping the global credit markets. How are corporate bond markets responding to new capital-requirement rules for banks and dealers? What's the outlook for rates over the next year, and how are fixed income investors preparing? What are the opportunities in structured finance - including residential MBS, ABS (such as auto and a

Structured Finance, Lecture 3 - Credit Derivatives, Part 2

- Order: Reorder

- Duration: 71:11

- Updated: 15 Aug 2014

- views: 8189

- author: Krassimir Petrov

- published: 25 Apr 2011

- views: 8189

- author: Krassimir Petrov

PRE SHIPMENT FINANCE AND POST SHIPMENT CREDIT

- published: 23 Nov 2013

- views: 234

- author: iimtnew

Structured Finance, Lecture 4 - Credit Default Swaps

- Order: Reorder

- Duration: 68:49

- Updated: 11 Mar 2014

- views: 5267

- author: Krassimir Petrov

- published: 25 Apr 2011

- views: 5267

- author: Krassimir Petrov

Personal Finance Basics: How to Raise Your Credit Score

- Order: Reorder

- Duration: 24:35

- Updated: 23 Mar 2015

- views: 32

- published: 23 Mar 2015

- views: 32

Do Debt Settlement Companies Really Work? Credit Card Debt Relief, Finance (2010)

- Order: Reorder

- Duration: 38:56

- Updated: 20 Oct 2014

- views: 50

- published: 20 Oct 2014

- views: 50

Sources of Finance

- published: 31 Jul 2012

- views: 5521

- author: Iken Edu

The Bank of America - Merrill Lynch Merger: Finance, Stocks, Credit, Wealth Management (2009)

- Order: Reorder

- Duration: 203:53

- Updated: 02 Sep 2015

- views: 1

- published: 02 Sep 2015

- views: 1

[Finance] Conférence "Une histoire moderne du risque de crédit"

- Order: Reorder

- Duration: 113:52

- Updated: 09 Mar 2015

- views: 10

- published: 09 Mar 2015

- views: 10

Global Financial Meltdown - One Of The Best Financial Crisis Documentary Films

- Order: Reorder

- Duration: 169:16

- Updated: 24 Nov 2013

- views: 282901

- published: 24 Nov 2013

- views: 282901

WSC Corporate Credit & Financing Crash Course

- Order: Reorder

- Duration: 31:00

- Updated: 31 Jul 2014

- views: 2202

- author: WholeSaleShelfCorporations

- published: 12 Mar 2014

- views: 2202

- author: WholeSaleShelfCorporations

Crash Gordon ( The Financial Crisis)

- published: 15 Sep 2012

- views: 25311

- author: BLIAR209

Interviews with Seller Finance Experts #6 - Getting Business Credit - Robert Ritchie

- Order: Reorder

- Duration: 45:17

- Updated: 12 Dec 2014

- views: 5

- published: 12 Dec 2014

- views: 5

How Do New Credit Card Rules Affect Consumers? Personal Finance Advice - Debt (2010)

- Order: Reorder

- Duration: 42:25

- Updated: 21 Jun 2014

- views: 391

- author: The Film Archives

- published: 14 Jun 2014

- views: 391

- author: The Film Archives

Investment Banking and Structured Finance - 02/16 - Pricing of credit derivatives (Part 1)

- Order: Reorder

- Duration: 62:36

- Updated: 27 May 2014

- views: 8635

- author: UniBocconi

- published: 28 May 2009

- views: 8635

- author: UniBocconi

Investment Banking and Structured Finance - 03/16 - Pricing of credit derivatives (Part 2)

- Order: Reorder

- Duration: 75:17

- Updated: 21 Jan 2014

- views: 3664

- author: UniBocconi

- published: 28 May 2009

- views: 3664

- author: UniBocconi

L8/P6: Climate Finance mechanisms: National & International level,carbon credit,PAT

- Order: Reorder

- Duration: 37:04

- Updated: 20 Jun 2015

- views: 5

- published: 20 Jun 2015

- views: 5

Pre shipment Finance and Post shipment Credit NEW

- Order: Reorder

- Duration: 24:44

- Updated: 21 May 2014

- views: 12

- author: video iimts

- published: 15 May 2014

- views: 12

- author: video iimts

Troubled Asset Relief Program Oversight: Credit, Loans, Finance - Elizabeth Warren Testimony (2010)

- Order: Reorder

- Duration: 110:41

- Updated: 06 Dec 2013

- views: 186

- author: The Film Archives

- published: 10 Oct 2013

- views: 186

- author: The Film Archives

Credit Markets: What's Next?

- Order: Reorder

- Duration: 61:08

- Updated: 29 Apr 2015

- views: 35

- published: 29 Apr 2015

- views: 35

- Playlist

- Chat

- Playlist

- Chat

The Crisis of Credit Visualized - HD

- published: 23 Jan 2011

- views: 1037160

Trade Finance in the Spotlight – Letters of Credit

- published: 22 Sep 2014

- views: 15

Ford Credit Finance Tools

- published: 15 May 2012

- views: 636

-

author:

fordcreditdigital

Add Playlist for this Author

Personal Finance: Class 3 - Credit

- published: 25 Jan 2013

- views: 1553

-

author:

Missouri State University

Add Playlist for this Author

Quest for Credit - Complete Version from Mint.com

- published: 24 May 2010

- views: 25671

-

author:

MintSoftware

Add Playlist for this Author

Structured Finance, Lecture 2 - Credit Derivatives - Part 1

- published: 25 Apr 2011

- views: 14613

-

author:

Krassimir Petrov

Add Playlist for this Author

Banks vs. Credit Unions: What's the Difference? - 2 Minute Finance

- published: 29 Oct 2011

- views: 16149

-

author:

2minutefinance

Add Playlist for this Author

InCreditable Advisors - Business Credit Finance Suite Walkthrough

- published: 02 Jul 2013

- views: 1284

-

author:

Miguel Silva

Add Playlist for this Author

Car Credit Finance Video

- published: 29 Jun 2012

- views: 586

-

author:

CarCreditTampaFla

Add Playlist for this Author

Personal Finance Math 3 Calculating Credit Card Finance Charges Part 2

- published: 14 Nov 2014

- views: 2

Car Credit Finance Video en Espanol

- published: 29 Jun 2012

- views: 424

-

author:

CarCreditTampaFla

Add Playlist for this Author

Business and Finance Lesson 5: Credit Sales, Credit Policies (Learn English)

- published: 26 Sep 2011

- views: 3084

-

author:

TeacherPhilEnglish

Add Playlist for this Author

Are Credit Cards Good or Bad for the Economy? Debt, Finance, Market (2001)

- published: 18 May 2015

- views: 2

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

- published: 24 Oct 2013

- views: 29018

-

author:

BlueSky Auto Finance

Add Playlist for this Author

- Playlist

- Chat

Personal Finance Tips How to Get a Personal Loan With Bad Credit

- published: 22 Oct 2015

- views: 0

Personal Finance Tips How to Get a Personal Loan With Bad Credit

- published: 22 Oct 2015

- views: 0

Auto Loans Bad Credit Car Loans BlueSky Auto Finance

- published: 22 Oct 2015

- views: 0

Credit One - Looking for Marine Finance for your next boat?

- published: 22 Oct 2015

- views: 7

How to Finance a Business : How to Get a Business Loan With Bad Credit

- published: 22 Oct 2015

- views: 0

Business Credit & Finance Suite

- published: 21 Oct 2015

- views: 1

Business Credit & Finance Commercial

- published: 21 Oct 2015

- views: 0

Bad Credit Car Finance The Car Loan Warehouse

- published: 18 Oct 2015

- views: 17

Bad Credit Car Finance Loans Louth, Grimsby, Cleethorpes, Immingham

- published: 18 Oct 2015

- views: 45

- Playlist

- Chat

Structured Finance, Lecture 3 - Credit Derivatives, Part 2

- published: 25 Apr 2011

- views: 8189

-

author:

Krassimir Petrov

Add Playlist for this Author

PRE SHIPMENT FINANCE AND POST SHIPMENT CREDIT

- published: 23 Nov 2013

- views: 234

-

author:

iimtnew

Add Playlist for this Author

Structured Finance, Lecture 4 - Credit Default Swaps

- published: 25 Apr 2011

- views: 5267

-

author:

Krassimir Petrov

Add Playlist for this Author

Personal Finance Basics: How to Raise Your Credit Score

- published: 23 Mar 2015

- views: 32

Do Debt Settlement Companies Really Work? Credit Card Debt Relief, Finance (2010)

- published: 20 Oct 2014

- views: 50

Sources of Finance

- published: 31 Jul 2012

- views: 5521

-

author:

Iken Edu

Add Playlist for this Author

The Bank of America - Merrill Lynch Merger: Finance, Stocks, Credit, Wealth Management (2009)

- published: 02 Sep 2015

- views: 1

[Finance] Conférence "Une histoire moderne du risque de crédit"

- published: 09 Mar 2015

- views: 10

Global Financial Meltdown - One Of The Best Financial Crisis Documentary Films

- published: 24 Nov 2013

- views: 282901

WSC Corporate Credit & Financing Crash Course

- published: 12 Mar 2014

- views: 2202

-

author:

WholeSaleShelfCorporations

Add Playlist for this Author

Crash Gordon ( The Financial Crisis)

- published: 15 Sep 2012

- views: 25311

-

author:

BLIAR209

Add Playlist for this Author

Interviews with Seller Finance Experts #6 - Getting Business Credit - Robert Ritchie

- published: 12 Dec 2014

- views: 5

How Do New Credit Card Rules Affect Consumers? Personal Finance Advice - Debt (2010)

- published: 14 Jun 2014

- views: 391

-

author:

The Film Archives

Add Playlist for this Author

Investment Banking and Structured Finance - 02/16 - Pricing of credit derivatives (Part 1)

- published: 28 May 2009

- views: 8635

-

author:

UniBocconi

Add Playlist for this Author

Miley Cyrus Gets Very Nude for 'V' Magazine

Edit Billboard 11 Nov 2015Kremlin-controlled TV airs 'secret' plans for nuclear weapon

Edit Dayton Daily News 12 Nov 2015Billionaire buys world's most expensive diamond for his 7-year-old

Edit CNN 12 Nov 2015South Carolina Boy, 13, Kills Would-Be Robber With His Mother’s Handgun

Edit Inquisitr 12 Nov 2015Credit China Announces Third Quarter 2015 Results Internet Finance Revenue Surged 1.6 Times to RMB144 ...

Edit Public Technologies 12 Nov 2015Credit China Proposes Placing to Raise HK$605 Million to Strengthen Capital Base and Consolidate Internet ...

Edit Public Technologies 12 Nov 2015LOLC Group Credit Rating upgraded to [SL]A with Stable Outlook by ICRA Lanka (Lanka ORIX ...

Edit Public Technologies 12 Nov 20155 Rewards Credit Cards With No Annual Fee

Edit Palm Beach Post 12 Nov 2015Credit Karma Launches Direct Dispute Feature to Help the One in Four Americans with a ...

Edit Public Technologies 12 Nov 2015Second-charge mortgage repossessions down almost 50% in Q3 2015 (FLA - Finance & Leasing Association) ...

Edit Public Technologies 12 Nov 2015Car financing revving up car sales in Pakistan

Edit Dawn 12 Nov 2015JFM SB No.78: R&I; Assigns AA+ (R&I; - Rating and Investment Information Inc)

Edit Public Technologies 12 Nov 2015Activists to protest Japanese financing of coal projects (Friends of the Earth USA)

Edit Public Technologies 12 Nov 2015FSB publishes reports on transforming shadow banking into resilient market-based finance (FSB - Financial Stability ...

Edit Public Technologies 12 Nov 2015Fitch Rates AmeriCredit Automobile Receivables Trust 2015-4 (Fitch Inc)

Edit Public Technologies 12 Nov 2015Retail finance round-up - 12 November 2015 (Eversheds LLP)

Edit Public Technologies 12 Nov 2015Beijing boosts its spending to give Chinese economy a lift as credit dries up

Edit South China Morning Post 12 Nov 2015- 1

- 2

- 3

- 4

- 5

- Next page »