- published: 12 May 2011

- views: 64260

- author: Khan Academy

-

remove the playlistLeveraged Buyout

- remove the playlistLeveraged Buyout

- published: 26 Mar 2015

- views: 0

- published: 17 Jun 2014

- views: 1610

- author: Mergers & Inquisitions / Breaking Into Wall Street

- published: 03 Jun 2014

- views: 19973

- author: Bloomberg News

- published: 17 Nov 2014

- views: 5

- published: 18 Mar 2013

- views: 21269

- author: Wall Street Prep

- published: 16 Sep 2013

- views: 772

- author: Forex Trading

- published: 26 Nov 2013

- views: 2394

- author: Mergers & Inquisitions / Breaking Into Wall Street

- published: 06 May 2011

- views: 634

- author: MrLBOgordonBizar

- published: 29 Oct 2011

- views: 15243

- author: Paul Pignataro

- published: 20 Oct 2012

- views: 823

- author: Christopher Hunt

- published: 21 Feb 2013

- views: 16497

- author: Mergers & Inquisitions / Breaking Into Wall Street

A leveraged buyout (or LBO, or highly leveraged transaction (HLT), or "bootstrap" transaction) occurs when an investor, typically a financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage (borrowing). The assets of the acquired company are used as collateral for the borrowed capital, sometimes with assets of the acquiring company. Typically, leveraged buyout uses a combination of various debt instruments from bank and debt capital markets. The bonds or other paper issued for leveraged buyouts are commonly considered not to be investment grade because of the significant risks involved. If the company subsequently defaults on its debts, the LBO transaction will frequently be challenged by creditors or a bankruptcy trustee under a theory of fraudulent transfer.

Companies of all sizes and industries have been the target of leveraged buyout transactions, although because of the importance of debt and the ability of the acquired firm to make regular loan payments after the completion of a leveraged buyout, some features of potential target firms make for more attractive leverage buyout candidates, including:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Timothy Maxwell "Max" Keiser (born January 23, 1960) is an American broadcaster and film-maker. He hosts Keiser Report, a financial program broadcast on RT (formerly Russia Today). Keiser also anchors On the Edge, a program of news and analysis hosted by Iran's Press TV. He hosted the New Year's Eve special, The Keiser's Business Guide to 2010 for BBC Radio 5 Live. Keiser presented a season of The Oracle with Max Keiser on BBC World News. Previously he produced and appeared regularly in the TV series People & Power on the Al-Jazeera English network. He also presents a weekly show about finance and markets on London's Resonance FM, as well as writing for The Huffington Post.

In addition to his broadcasting work Keiser is known for his invention of "Virtual Specialist Technology", a software system used by the Hollywood Stock Exchange.

Keiser has been involved with markets and finance for 25 years. He started his career as a stock broker on Wall Street after graduating from New York University.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

5:36

5:36Basic Leveraged Buyout (LBO)

Basic Leveraged Buyout (LBO)Basic Leveraged Buyout (LBO)

The mechanics of a simple leveraged buy-out More free lessons at: http://www.khanacademy.org/video?v=LVMLs2z1JYg. -

6:01

6:01Leveraged Buyouts Explained (Part 1)

Leveraged Buyouts Explained (Part 1)Leveraged Buyouts Explained (Part 1)

Watch the first in our series on explaining why investors and companies buy businesses using leveraged buyouts. See more videos at https://bluebook.io. -

13:25

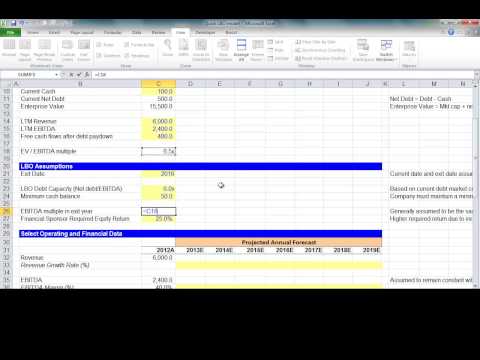

13:25Simple LBO Model - Case Study and Tutorial

Simple LBO Model - Case Study and TutorialSimple LBO Model - Case Study and Tutorial

http://breakingintowallstreet.com/biws/ http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-04-Simple-LBO-Model.pdf http://youtube-breakingintowal... -

25:10

25:10Henry Kravis: How the Corporate Titan Rocked Wall Street

Henry Kravis: How the Corporate Titan Rocked Wall StreetHenry Kravis: How the Corporate Titan Rocked Wall Street

Nov. 12 (Bloomberg) -- His name is synonymous with 'Corporate Titan.' As co-founder of KKR, Henry Kravis re-wrote the rules of leveraged buyouts; he and his ... -

75:53

75:53Leveraged Buyout Case on Heinz

Leveraged Buyout Case on HeinzLeveraged Buyout Case on Heinz

Based on the Wiley Finance Leveraged Buyout book by Paul Pignataro, Mr. Pignataro will step through core Leveraged Buyout (LBO) fundamentals and an LBO analysis to better understand Part I of the book. The book, found below, is recommended to fully understand the material discussed. http://www.amazon.com/Leveraged-Buyouts-Website-Practical-Investment/dp/1118674545/ref=sr_1_1?ie=UTF8&qid;=1391540998&sr;=8-1&keywords;=leveraged+buyouts -

8:56

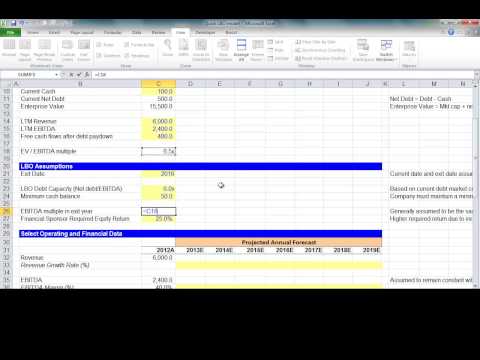

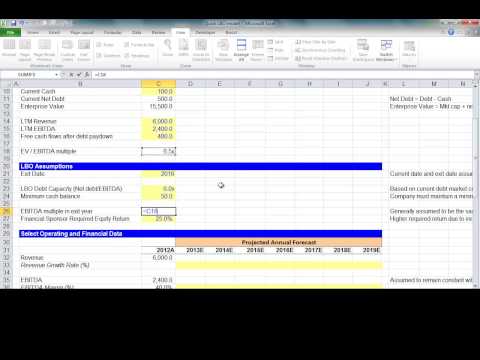

8:56Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

Note: To download the Excel template that goes with this video, go to http://www.wallstreetprep.com/blog/financial-modeling-quick-lesson-simple-lbo-model/ In... -

1:18

1:18Leveraged Buyouts

Leveraged BuyoutsLeveraged Buyouts

LBOs are often presented as predatory by the media. Find out why. ++++++++++++++++++++++++++++++++++++++++++++++++ Stock Rights Issue - http://www.youtube.... -

13:17

13:17LBO Model Concept: Leveraged Buyout and Buying a House

LBO Model Concept: Leveraged Buyout and Buying a HouseLBO Model Concept: Leveraged Buyout and Buying a House

http://breakingintowallstreet.com/biws/ http://youtube-breakingintowallstreet-com.s3.amazonaws.com/LBO-Explanation.xlsx In this lesson, you'll learn the conc... -

5:08

5:08Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

http://gordonbizar.com http://gettingrichyourway.com Leveraged Buyout (LBO) has been taught at Bizar Financing for over 30 years. Mr.LBO, Gordon Bizar, expla... -

37:40

37:40Leveraged Buyout Analysis

Leveraged Buyout AnalysisLeveraged Buyout Analysis

Paul Pignataro of the New York School of Finance (formerly AnEx Training) walks through a simple leveraged buyout analysis. If you are interested in free tra... -

1:04

1:04Leveraged Buyout Explained

Leveraged Buyout ExplainedLeveraged Buyout Explained

An Easy Overview Of "Leveraged Buyout" -

23:12

23:12LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

http://www.mergersandinquisitions.com/leveraged-buyout-lbo-model-overview-capital-structure/ (Click to access the full case study and FREE downloadable templ... -

9:59

9:59RIGGED: Wall Street's Leveraged Buyout of America - AMTV Classic Countdown Day 7

RIGGED: Wall Street's Leveraged Buyout of America - AMTV Classic Countdown Day 7RIGGED: Wall Street's Leveraged Buyout of America - AMTV Classic Countdown Day 7

In today's classic video, Christopher Greene of AMTV explains how Wall Street rigged the financial markets. http://www.amtvmedia.com/re-direct-rigged-wall-st... -

8:44

8:44LBO leveraged buyouts explained by Max Keiser

LBO leveraged buyouts explained by Max KeiserLBO leveraged buyouts explained by Max Keiser

Max Keiser talks to Stacy Herbert about leveraged buyout recorded on November 7th 2009.

- Accounts receivable

- Alliance Boots

- Angel investor

- Arbitrage

- Asher Edelman

- Asset stripping

- Associate company

- Bank

- Bankruptcy

- Bankruptcy Code

- Bear Stearns

- Berkshire Hathaway

- Bond (finance)

- Book building

- Bookrunner

- Bootstrap funding

- Business plan

- Business valuation

- Buy side

- Buy–sell agreement

- Capital call

- Capital structure

- Carl Icahn

- Carried interest

- Chapter 11

- Citigroup

- Commercial bank

- Control premium

- Controlling interest

- Convertible bond

- Corporate finance

- Corporate raid

- Cost of capital

- Cov-lite

- Debt

- Debt restructuring

- Demerger

- Dex Media

- Discounted cash flow

- Divestment

- Divisional buyout

- Drag-along right

- EBITDA

- Economic Value Added

- Economist

- Enterprise value

- Entrepreneurship

- Envy ratio

- Equity carve-out

- Equity co-investment

- Exchangeable bond

- Fairness opinion

- Family office

- Federal Reserve

- Financial distress

- Financial endowment

- Financial modeling

- Financial sponsor

- Firesale

- Follow-on offering

- Free cash flow

- Fund of funds

- George R. Roberts

- Germany

- Gerry Schwartz

- Golden parachute

- Goldman Sachs

- Greenshoe

- Growth capital

- Harold Clark Simmons

- Henry Kravis

- High-yield bonds

- High-yield debt

- Hostile takeover

- Insolvency

- Insurance company

- Inventory

- Investment bank

- Investment banking

- Investment grade

- Investment U

- IPO

- James B. Stewart

- Jerome Kohlberg, Jr.

- Journal of Finance

- Kirk Kerkorian

- Labor Day

- Leverage (finance)

- Leveraged buyout

- Limited partnership

- Malcolm McLean

- Management buyout

- Management fee

- Market value added

- Merchant bank

- Merrill Lynch

- Metro-Goldwyn-Mayer

- Mezzanine capital

- Michael Milken

- Minority interest

- Morgan Stanley

- Nelson Peltz

- Net present value

- New York Times

- Nicholas F. Brady

- Nolo contendere

- Nonrecourse debt

- Off balance sheet

- Onex Corporation

- Orkin

- Ownership equity

- Pari passu

- Pension fund

- PIK loan

- Pitch book

- Pledge fund

- Poison pill

- Post-money valuation

- Pre-emption right

- Pre-money valuation

- Preferred stock

- Private equity

- Private equity firm

- Private equity fund

- Private foundation

- Private placement

- Privatization

- Project finance

- Proxy fight

- Publicly traded

- Revco

- Reverse greenshoe

- Reverse takeover

- Revolving credit

- Rights issue

- RJR Nabisco

- Robert Bass

- Robert Campeau

- Salomon Brothers

- Sarbanes–Oxley Act

- Second lien loan

- Secured debt

- Secured loan

- Seed money

- Sell side

- Senior debt

- Shareholder loan

- Shearson Lehman

- Sir James Goldsmith

- Spin out

- Sponsor (commercial)

- Squeeze out

- Startup company

- Stock

- Stock manipulation

- Stock valuation

- Subordinated debt

- SunGard

- Syndicated loan

- T. Boone Pickens

- Tag-along right

- Takeover

- Tax shield

- Tender offer

- The Hudsucker Proxy

- TIME (magazine)

- Toys "R" Us

- Trans World Airlines

- Triarc

- TXU

- UBS AG

- Undercapitalization

- Underwriter

- Valuation (finance)

- Venture capital

- Venture debt

- Venture round

- Victor Posner

- Warrant (finance)

- Warren Buffett

- Window dress

-

Basic Leveraged Buyout (LBO)

The mechanics of a simple leveraged buy-out More free lessons at: http://www.khanacademy.org/video?v=LVMLs2z1JYg. -

Leveraged Buyouts Explained (Part 1)

Watch the first in our series on explaining why investors and companies buy businesses using leveraged buyouts. See more videos at https://bluebook.io. -

Simple LBO Model - Case Study and Tutorial

http://breakingintowallstreet.com/biws/ http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-04-Simple-LBO-Model.pdf http://youtube-breakingintowal... -

Henry Kravis: How the Corporate Titan Rocked Wall Street

Nov. 12 (Bloomberg) -- His name is synonymous with 'Corporate Titan.' As co-founder of KKR, Henry Kravis re-wrote the rules of leveraged buyouts; he and his ... -

Leveraged Buyout Case on Heinz

Based on the Wiley Finance Leveraged Buyout book by Paul Pignataro, Mr. Pignataro will step through core Leveraged Buyout (LBO) fundamentals and an LBO analysis to better understand Part I of the book. The book, found below, is recommended to fully understand the material discussed. http://www.amazon.com/Leveraged-Buyouts-Website-Practical-Investment/dp/1118674545/ref=sr_1_1?ie=UTF8&qid;=13915409 -

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

Note: To download the Excel template that goes with this video, go to http://www.wallstreetprep.com/blog/financial-modeling-quick-lesson-simple-lbo-model/ In... -

Leveraged Buyouts

LBOs are often presented as predatory by the media. Find out why. ++++++++++++++++++++++++++++++++++++++++++++++++ Stock Rights Issue - http://www.youtube.... -

LBO Model Concept: Leveraged Buyout and Buying a House

http://breakingintowallstreet.com/biws/ http://youtube-breakingintowallstreet-com.s3.amazonaws.com/LBO-Explanation.xlsx In this lesson, you'll learn the conc... -

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

http://gordonbizar.com http://gettingrichyourway.com Leveraged Buyout (LBO) has been taught at Bizar Financing for over 30 years. Mr.LBO, Gordon Bizar, expla... -

Leveraged Buyout Analysis

Paul Pignataro of the New York School of Finance (formerly AnEx Training) walks through a simple leveraged buyout analysis. If you are interested in free tra... -

Leveraged Buyout Explained

An Easy Overview Of "Leveraged Buyout" -

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

http://www.mergersandinquisitions.com/leveraged-buyout-lbo-model-overview-capital-structure/ (Click to access the full case study and FREE downloadable templ... -

RIGGED: Wall Street's Leveraged Buyout of America - AMTV Classic Countdown Day 7

In today's classic video, Christopher Greene of AMTV explains how Wall Street rigged the financial markets. http://www.amtvmedia.com/re-direct-rigged-wall-st... -

LBO leveraged buyouts explained by Max Keiser

Max Keiser talks to Stacy Herbert about leveraged buyout recorded on November 7th 2009. -

What is a Leverage Buyout (LBO)?

Welcome to the Investors Trading Academy talking glossary of financial terms and events. Our word of the day is “Leverage Buyout” The use of a target company's asset value to finance most or all of the debt incurred in acquiring the company. This strategy enables a takeover using little capital; however, it can result in considerably more risk to owners and creditors. See also hostile leveraged b -

WST: 15.1 LBO Modeling - Leveraged Buyout Overview

Wall St. Training Self-Study Instructor, Hamilton Lin, CFA describes the basic financial theory of leveraged buyouts and the rationale behind LBOs. For more ... -

Quick Leveraged Buyout Analysis

In class today we discussed the mechanics of a leveraged buyout analysis. We also covered assumptions, drivers, and a two-variable data table. Learn more at the New York School of Finance. -

Leveraged buyout

A leveraged buyout (LBO) is when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts o... -

Minute Investing-- Leveraged Buyout

fundingwarehouse.com -

Minute Real Estate -- Leveraged Buyout

Learn real estate, one minute at a time. Difficult concepts simplified. fundingwarehouse.com -

LBO Candidates - Criteria and How to Pick Them

In this lesson, LBO Candidates - Criteria and How to Pick Them, you’ll learn what make an “ideal” leveraged buyout candidate, and how you can do a quick 1-2-minute financial screen of a company to see how suitable it would be for a leveraged buyout. http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" Table of Contents: 1:36 Crit -

LBO Model Tutorial - Revenue and Expense Scenarios - DELL Case Study (Part 2)

http://www.mergersandinquisitions.com/leveraged-buyout-lbo-model-revenue-expense-scenarios/ (Click to access the full case study and FREE downloadable templa... -

LBO - Returns Attribution Analysis

http://breakingintowallstreet.com/biws/ http://youtube-breakingintowallstreet-com.s3.amazonaws.com/109-06-LBO-Returns-Attribution-Analysis.xlsx In this tutorial, you’ll learn about what drives the IRR or money-on-money multiple in a leveraged buyout, and you’ll see how EBITDA growth, multiple expansion, and debt pay-down and cash generation all play a role – and what drivers make a deal look fav

Basic Leveraged Buyout (LBO)

- Order: Reorder

- Duration: 5:36

- Updated: 31 Aug 2014

- views: 64260

- author: Khan Academy

- published: 12 May 2011

- views: 64260

- author: Khan Academy

Leveraged Buyouts Explained (Part 1)

- Order: Reorder

- Duration: 6:01

- Updated: 26 Mar 2015

- views: 0

- published: 26 Mar 2015

- views: 0

Simple LBO Model - Case Study and Tutorial

- Order: Reorder

- Duration: 13:25

- Updated: 03 Sep 2014

- views: 1610

- author: Mergers & Inquisitions / Breaking Into Wall Street

- published: 17 Jun 2014

- views: 1610

- author: Mergers & Inquisitions / Breaking Into Wall Street

Henry Kravis: How the Corporate Titan Rocked Wall Street

- Order: Reorder

- Duration: 25:10

- Updated: 04 Sep 2014

- views: 19973

- author: Bloomberg News

- published: 03 Jun 2014

- views: 19973

- author: Bloomberg News

Leveraged Buyout Case on Heinz

- Order: Reorder

- Duration: 75:53

- Updated: 17 Nov 2014

- views: 5

- published: 17 Nov 2014

- views: 5

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

- Order: Reorder

- Duration: 8:56

- Updated: 20 Aug 2014

- views: 21269

- author: Wall Street Prep

- published: 18 Mar 2013

- views: 21269

- author: Wall Street Prep

Leveraged Buyouts

- Order: Reorder

- Duration: 1:18

- Updated: 04 Jul 2014

- views: 772

- author: Forex Trading

- published: 16 Sep 2013

- views: 772

- author: Forex Trading

LBO Model Concept: Leveraged Buyout and Buying a House

- Order: Reorder

- Duration: 13:17

- Updated: 01 Sep 2014

- views: 2394

- author: Mergers & Inquisitions / Breaking Into Wall Street

- published: 26 Nov 2013

- views: 2394

- author: Mergers & Inquisitions / Breaking Into Wall Street

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

- Order: Reorder

- Duration: 5:08

- Updated: 12 Jun 2013

- views: 634

- author: MrLBOgordonBizar

- published: 06 May 2011

- views: 634

- author: MrLBOgordonBizar

Leveraged Buyout Analysis

- Order: Reorder

- Duration: 37:40

- Updated: 18 Jul 2014

- views: 15243

- author: Paul Pignataro

- published: 29 Oct 2011

- views: 15243

- author: Paul Pignataro

Leveraged Buyout Explained

- Order: Reorder

- Duration: 1:04

- Updated: 12 Jul 2013

- views: 823

- author: Christopher Hunt

- published: 20 Oct 2012

- views: 823

- author: Christopher Hunt

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

- Order: Reorder

- Duration: 23:12

- Updated: 26 Aug 2014

- views: 16497

- author: Mergers & Inquisitions / Breaking Into Wall Street

- published: 21 Feb 2013

- views: 16497

- author: Mergers & Inquisitions / Breaking Into Wall Street

RIGGED: Wall Street's Leveraged Buyout of America - AMTV Classic Countdown Day 7

- published: 26 Dec 2013

- views: 9596

- author: AMTV

LBO leveraged buyouts explained by Max Keiser

- Order: Reorder

- Duration: 8:44

- Updated: 20 Jul 2013

- views: 12821

- author: marcchabotyt

- published: 08 Nov 2009

- views: 12821

- author: marcchabotyt

What is a Leverage Buyout (LBO)?

- Order: Reorder

- Duration: 1:55

- Updated: 02 Sep 2015

- views: 8

- published: 02 Sep 2015

- views: 8

WST: 15.1 LBO Modeling - Leveraged Buyout Overview

- published: 08 Jul 2008

- views: 23480

- author: wstss

Quick Leveraged Buyout Analysis

- Order: Reorder

- Duration: 37:21

- Updated: 29 Jul 2015

- views: 1

- published: 29 Jul 2015

- views: 1

Leveraged buyout

- Order: Reorder

- Duration: 24:43

- Updated: 26 Aug 2014

- views: 2

- author: Audiopedia

- published: 26 Aug 2014

- views: 2

- author: Audiopedia

Minute Investing-- Leveraged Buyout

- Order: Reorder

- Duration: 1:13

- Updated: 27 Jul 2015

- views: 17

- published: 27 Jul 2015

- views: 17

Minute Real Estate -- Leveraged Buyout

- Order: Reorder

- Duration: 1:11

- Updated: 17 Jul 2015

- views: 70

- published: 17 Jul 2015

- views: 70

LBO Candidates - Criteria and How to Pick Them

- Order: Reorder

- Duration: 16:41

- Updated: 13 Oct 2015

- views: 154

- published: 13 Oct 2015

- views: 154

LBO Model Tutorial - Revenue and Expense Scenarios - DELL Case Study (Part 2)

- Order: Reorder

- Duration: 36:24

- Updated: 28 Jul 2014

- views: 4629

- author: Mergers & Inquisitions / Breaking Into Wall Street

- published: 10 Apr 2013

- views: 4629

- author: Mergers & Inquisitions / Breaking Into Wall Street

LBO - Returns Attribution Analysis

- Order: Reorder

- Duration: 18:43

- Updated: 02 Dec 2014

- views: 29

- published: 02 Dec 2014

- views: 29

- Playlist

- Chat

- Playlist

- Chat

Basic Leveraged Buyout (LBO)

- published: 12 May 2011

- views: 64260

-

author:

Khan Academy

Add Playlist for this Author

Leveraged Buyouts Explained (Part 1)

- published: 26 Mar 2015

- views: 0

Simple LBO Model - Case Study and Tutorial

- published: 17 Jun 2014

- views: 1610

-

author:

Mergers & Inquisitions / Breaking Into Wall Street

Add Playlist for this Author

Henry Kravis: How the Corporate Titan Rocked Wall Street

- published: 03 Jun 2014

- views: 19973

-

author:

Bloomberg News

Add Playlist for this Author

Leveraged Buyout Case on Heinz

- published: 17 Nov 2014

- views: 5

Financial Modeling Quick Lesson: Simple LBO Model (1 of 3)

- published: 18 Mar 2013

- views: 21269

-

author:

Wall Street Prep

Add Playlist for this Author

Leveraged Buyouts

- published: 16 Sep 2013

- views: 772

-

author:

Forex Trading

Add Playlist for this Author

LBO Model Concept: Leveraged Buyout and Buying a House

- published: 26 Nov 2013

- views: 2394

-

author:

Mergers & Inquisitions / Breaking Into Wall Street

Add Playlist for this Author

Entrepreneur, Gordon Bizar, explains to entrepreneurs leveraged buyout (LBO).

- published: 06 May 2011

- views: 634

-

author:

MrLBOgordonBizar

Add Playlist for this Author

Leveraged Buyout Analysis

- published: 29 Oct 2011

- views: 15243

-

author:

Paul Pignataro

Add Playlist for this Author

Leveraged Buyout Explained

- published: 20 Oct 2012

- views: 823

-

author:

Christopher Hunt

Add Playlist for this Author

LBO Model Tutorial - Full DELL Case Study with Templates (Part 1)

- published: 21 Feb 2013

- views: 16497

-

author:

Mergers & Inquisitions / Breaking Into Wall Street

Add Playlist for this Author

RIGGED: Wall Street's Leveraged Buyout of America - AMTV Classic Countdown Day 7

- published: 26 Dec 2013

- views: 9596

-

author:

AMTV

Add Playlist for this Author

LBO leveraged buyouts explained by Max Keiser

- published: 08 Nov 2009

- views: 12821

-

author:

marcchabotyt

Add Playlist for this Author

Attackers in California shooting had thousands of bullets

Edit The Associated Press 03 Dec 2015San Bernardino Mass Shooters Syed Farook, Tashfeen Malik Part Of A Sleeper Cell Network?

Edit Inquisitr 03 Dec 2015Here's why the US is reluctant to bomb ISIS oil fields

Edit Business Insider 03 Dec 2015ISIS video claims beheading of Russian spy, threatens Russian people

Edit CNN 02 Dec 2015'Allah is punishing' Turkey's rulers: Putin

Edit Yahoo Daily News 04 Dec 2015Golub Capital sees opportunity in choppy markets

Edit Reuters 03 Dec 2015Energy Future Nears Bankruptcy Exit After Judge Approves Split

Edit Rigzone 03 Dec 2015Energy Future Wins Approval of Settlement Behind Debt Plan

Edit Bloomberg 03 Dec 2015Former Orange boss Sanjiv Ahuja teams up with TPG, frontrunner to buy Reliance Communications’ towers

Edit The Times of India 03 Dec 2015Apollo Said to Opt Out of Verso Debt Talks as Creditors Organize

Edit Bloomberg 02 Dec 2015Private Equity Sees Strong Investment in Q3 of 2015 (Private Equity Growth Capital Council)

Edit Public Technologies 25 Nov 2015CalPERS fee disclosure raises question of whether private equity returns are worth it

Edit The Los Angeles Times 25 Nov 2015Exclusive - Three Goldman bankers leave for Uber as tech world raids Wall Street talent

Edit Yahoo Daily News 25 Nov 2015Three Goldman bankers leave for Uber as tech world raids Wall Street talent

Edit Deccan Chronicle 25 Nov 2015CalPERS paid $3.4 billion in private equity bonuses since 1990

Edit The Los Angeles Times 24 Nov 2015Weil Elects 8 New Partners and 12 New Counsel (Weil, Gotshal & Manges LLP)

Edit Public Technologies 24 Nov 2015Business news in brief

Edit Philadelphia Daily News 24 Nov 2015Warburg Pincus Raises $12 Billion in Six Months for 12th Fund

Edit Bloomberg 23 Nov 2015- 1

- 2

- 3

- 4

- 5

- Next page »