-

remove the playlistInvestor

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistInvestor

- remove the playlistLatest Videos

- remove the playlistLongest Videos

Investor AB is a Swedish investment company, founded in 1916 and still controlled by the Wallenberg family through their foundation asset management company FAM. The company owns a controlling stake in several large Swedish companies with smaller positions in a number of other firms. In 2006 it had a market value of 119 billion kronor (€13 billion, $16 billion). Currently Investor has a strong financial position and is almost debt free.

December 31, 2004

October 15, 2006

In 1916, new legislation made it more difficult for banks to own stocks in industrial companies on a long-term basis. Investor was formed as an investment part of Stockholms Enskilda Bank, at the time the largest instrument of power in the Wallenberg family.

Investor held shares in the following companies as of 31 December 2010:

Investor's other investments include:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

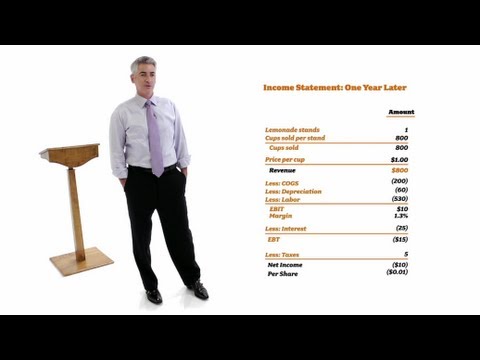

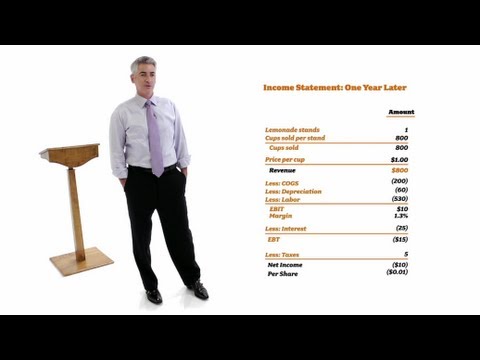

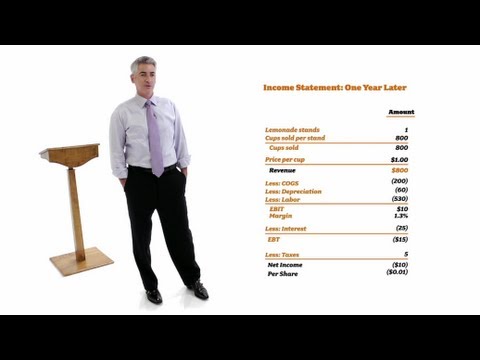

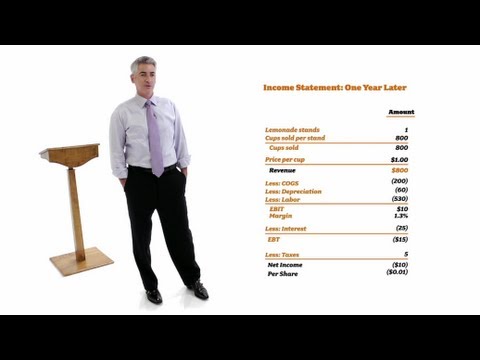

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour -

Warren Buffett on The Intelligent Investor - Ben Graham

Warren Buffett on The Intelligent Investor - Ben GrahamWarren Buffett on The Intelligent Investor - Ben Graham

The Intelligent Investor: http://amzn.to/132mEbD Security Analysis: http://amzn.to/S3qdNs Warren Buffett's official recommendation for the "Best book on inve... -

Tom Gayner | The Evolution of a Value Investor

Tom Gayner | The Evolution of a Value InvestorTom Gayner | The Evolution of a Value Investor

About the Talk Tom Gayner is the CIO of Markel Corp, where he manages the company's investment portfolio. He talks about his journey as an individual and value investor. A recent Wall Street Journal feature on Mr Gayner's investing style mentions: "He has an outstanding investing record. He works only for Markel and doesn’t take outside clients, but every investor can learn from him.You never would know any of this [extraordinary success] from listening to Mr. Gayner. After a good year, most portfolio managers beat their chests even harder than they beat the market; Mr. Gayner’s 2014 report merely said, “our overall equity portfolio earned 18 -

Kannada Award winning Short Film Ambani the investor

Kannada Award winning Short Film Ambani the investorKannada Award winning Short Film Ambani the investor

-

14 year old investor on his way to become a millionare!!!

14 year old investor on his way to become a millionare!!!14 year old investor on his way to become a millionare!!!

www.Driven-Magazine.com "The Source for GenY Entrepreneurs" By age 14, Damon Williams has built a portfolio worth $50000, knows blue chips like most kids kn... -

The broke investor. Kansiime Anne. African Comedy.

The broke investor. Kansiime Anne. African Comedy.The broke investor. Kansiime Anne. African Comedy.

What!!? U have not Subscribed yet??? Eh nga you are a RISK -TAKER!! NOW NEW CLIPS EVERY Friday !!! pls also like me on facebook https://www.facebook.com/pages/Kansiime-Anne-Entertainer/263758240421584?ref=ts&fref;=ts -

India's top value investor S Naren shares his investing mantra

India's top value investor S Naren shares his investing mantraIndia's top value investor S Naren shares his investing mantra

Most veterans in the market point to S Naren as one of the best value investors in India. With an investment career spanning over 25 years, Mr Naren has seen enough market manias and panics to be able to tell what is a good time to act and when to wait on the sidelines. Now, on Value Investing Decoded, S Naren, CIO of ICICI Prudential AMC, shares his investing method with us. Watch full show: http://profit.ndtv.com/videos/value-investing-decoded/video-indias-top-value-investor-s-naren-shares-his-investing-mantra-361801?yt -

Benjamin Graham - The Intelligent Investor

Benjamin Graham - The Intelligent InvestorBenjamin Graham - The Intelligent Investor

The Intelligent Investor By Benjamin Graham This classic text is annotated to update Graham's timeless wisdom for today's market conditions... The greatest investment advisor of the twentieth century, Benjamin Graham, taught and inspired people worldwide. Graham's philosophy of "value investing" -- which shields investors from substantial error and teaches them to develop long-term strategies -- has made The Intelligent Investor the stock market bible ever since its original publication in 1949. Over the years, market developments have proven the wisdom of Graham's strategies. While preserving the integrity of Graham's original text, this r -

This is TFM: The Investor

This is TFM: The InvestorThis is TFM: The Investor

A perverted TFM investor storms into the office and demands the writers start posting weird hazing, and "nips and tips." Written by Jordan Gershowitz Directed by Dylan VanDam Starring Dillon Cheverere W.R. Bolen Rob Fox William K. Gilliam, Jr. -

Whiz Kid Investor (MoneyTrack Episode 312)

Whiz Kid Investor (MoneyTrack Episode 312)Whiz Kid Investor (MoneyTrack Episode 312)

Meet John-Paul Pigeón, a successful investor, author and motivational speaker in Dallas who is on a mission to change his generations money-management skills... -

Watch an Investor Pitch in Action

Watch an Investor Pitch in ActionWatch an Investor Pitch in Action

A CreativeLive student applies what he learned in the class and gives an investor pitch. http://cr8.lv/ssfybgyt Adam Luther of Helping Hand tutoring tries hi... -

Paradox Of The Skilled Investor (Intelligent Investing With Steve Forbes)

Paradox Of The Skilled Investor (Intelligent Investing With Steve Forbes)Paradox Of The Skilled Investor (Intelligent Investing With Steve Forbes)

Legg Mason's Michael Mauboussin on how luck can trump skill when investing in the stock market. Mauboussin, who is author of the book "THINK TWICE: Harnessin... -

Investor's Guide: Birla Sun Life Frontline Equity Fund

Investor's Guide: Birla Sun Life Frontline Equity FundInvestor's Guide: Birla Sun Life Frontline Equity Fund

In this week's edition of Investor's Guide, we tell you how to go about your first investment plan. In our product review, we talk about the Birla Sun Life Frontline Equity Fund. And we tell young investors how to start saving to build a home. Subscribe Now To Our Network Channels :- ET Now : http://goo.gl/5XreUq Times Now : http://goo.gl/U9ibPb The NewsHour Debate : http://goo.gl/LfNgFF To Stay Updated Download the Times Now App :- Android Google Play : https://goo.gl/zJhWjC Apple App Store : https://goo.gl/d7QBQZ Social Media Links :- Twitter - http://goo.gl/hA0vDt Facebook - http://goo.gl/5Lr4mC G+ - http://goo.gl/hYxrmj -

CH1: The Intelligent Investor

CH1: The Intelligent InvestorCH1: The Intelligent Investor

Access free tools and calculators at: http://www.BuffettsBooks.com Preston Pysh is the #1 selling Amazon author of two books on Warren Buffett. The books can be found at the following location: http://www.amazon.com/gp/product/0982967624/ref=as_li_tl?ie=UTF8&camp;=1789&creative;=9325&creativeASIN;=0982967624&linkCode;=as2&tag;=pypull-20&linkId;=EOHYVY7DPUCW3WD4 http://www.amazon.com/gp/product/1939370159/ref=as_li_tl?ie=UTF8&camp;=1789&creative;=9325&creativeASIN;=1939370159&linkCode;=as2&tag;=pypull-20&linkId;=XRE5CA2QJ3I2OWSW

- ABB Group

- Aktiebolag

- Aleris

- Alfa Laval

- Assa Abloy

- Asset

- AstraZeneca

- Atlas Copco

- Boliden AB

- Bredbandsbolaget

- Capgemini

- Chairman

- Cision

- Corporation

- Dollar

- Electrolux

- EQT Partners

- Equity (finance)

- Ericsson

- Euro

- Gambro

- Getinge Group

- H&M;

- Handelsbanken

- Holding company

- Hong Kong

- Husqvarna AB

- Hutchison 3G

- IBX Group AB

- Investment AB Latour

- Investment company

- Investor AB

- Jacob Wallenberg

- Lundin Petroleum

- Modern Times Group

- Nasdaq

- NASDAQ OMX Group

- Net income

- Nokia

- Nordea

- OMX

- OMX Stockholm 30

- Portal Companies

- Private equity

- Public company

- Ratos

- Saab

- Saab Automobile

- Sandvik

- Scania AB

- Securitas AB

- Skanska

- SKF

- SSAB

- Stock

- Stockholm

- Swedbank

- Sweden

- Swedish krona

- Swedish Match

- Tele2

- Telenor

- TeliaSonera

- Ticker symbol

- Venture capital

- Volkswagen AG

- Volvo

- Wallenberg family

- WM-data

'Investor' is featured as a movie character in the following productions:

Anything's Possible (2013)

Actors: Robert J. Walsh (composer), George Miklos (actor), Kelli Kirkland (actress), Craig Chapman (producer), Daron Niemerow (editor), Corby Sullivan (actor), Adam Dunnells (actor), Mike McKee (actor), Kevin Teh (actor), Richie Lillard (actor), Douglas Rouillard (actor), Scott Wissner (actor), Stephanie Oderwald (producer), Douglas A. Rouillard (producer), Douglas A. Rouillard (director),

Plot: Inspired by actual events, Anything's Possible shadows the journey of a young boys dream to become an actor in the seemingly impossible industry to break into, Hollywood. Doug, played by: (Douglas Rouillard) will take his parents advice and push it to limits very few have achieved and against the odds to prove anything is possible if you try hard enough. From childhood through adulthood, he learns the hard way, but one thing is constant, never give up. His dreams of film making and finding the love of his life will keep you holding on tight. If you want something bad enough, stop at nothing to get it, just don't get mixed up with the wrong crowd along the way. This story delivers hope, passion and a will worth fighting for that is relatable to all. Life is a marathon of events; join him on the run of his life.

Genres: Comedy,The Projectionist (2012)

Actors: Alexanderson Bolaño De La Lanza (writer), Alexanderson Bolaño De La Lanza (writer), Alexanderson Bolaño De La Lanza (producer), Alexanderson Bolaño De La Lanza (director), Alexanderson Bolaño De La Lanza (editor), Alexander Bolaño (producer), Isela Acosta Ramos (actor), Brandon Paddock (producer), Gibran Ruiz (composer), Zuleika de la Lanza (producer), Erick Cortgar (actor), Montse Flores (actor), Enrique Gomez Peña (actor), Sandra Varela (actress),

Genres: Drama, Fantasy, Romance, Short,Elite Productions (2008)

Actors: Andrea Ulrich (miscellaneous crew), Bob Socci (actor), James Malki (producer), David Karges (actor), Dan Cantagallo (editor), Robert Arensen (actor), John Henry Soto (actor), Anton Nadler (producer), Anton Nadler (director), Anton Nadler (writer), Kirsten La Greca (costume designer), Leslie Korein (actress), Pamela Ehn (actress), Himad Beg (actor), Fabrice Mougas (actor),

Plot: VP of Production Lin Cho-Fung arrives late to the investor meeting to find chaos. Somehow, the eclectic ethnicity's of the investors have clashed, and all around cultural faux pas has been committed. Just when Lin settles restores order, Executive Producer Andy Reeves enters the room less than sober, and more than enthusiastic. A few embarrassing moments later, the boardroom is crashed by a six foot Malaysian prostitute demanding swift remittance for her services. We discover that her customer was none other than Andy (who is sporting a black eye under his dark sunglasses). After the Executive Producer's dirty laundry is publicly aired, security finally enters to remove the enraged prostitute. A vicious fight ensues in the boardroom between the unpaid street walker and security force which unfortunately results in electrocution, unconsciousness, and awkward silence. Just a typical day at Elite productions.

Keywords: low-comedy, office-comedyGenres: Comedy, Short,

Taglines: The documentary team invades the offices of Elite Productions during a big investor meeting which results in prostitution, electrocution, unconsciousness, and awkward silence.

Quotes:

Andy Reeves: I did not take a shit on her chest!Chances Are (2006)

Actors: Jaime Aymerich (actor), Keiko Agena (actress), Andrew Kaiser (composer), Narbeh Nazarian (actor), Bailey Kobe (miscellaneous crew), Mark Arbitrario (editor), Mark Arbitrario (actor), Josh Kameyer (director), Josh Kameyer (writer), Dean Lemont (actor), Johnny Ray (actor), Micaela Brown (miscellaneous crew), Dean Lemont (actor), Peggy Wang (costume designer), Emily Moore (miscellaneous crew),

Genres: Comedy, Short,Offset (2006)

Actors: Katharina Thalbach (actress), Alexandra Maria Lara (actress), Razvan Vasilescu (actor), Andi Vasluianu (actor), Manfred Zapatka (actor), Valentin Popescu (actor), Doru Ana (actor), Doru Ana (actor), Ada Solomon (producer), Alfred Hürmer (producer), Bruno Cathomas (actor), Pepe Danquart (actor), Valentin Platareanu (actor), Cristian Mungiu (producer), Philippe Avril (producer),

Genres: Drama,Return of the Jackalope (2006)

Actors: Dave R. Watkins (actor), Dave R. Watkins (actor), Mark Oliver (actor), Steve Warren (actor), Ron McLellen (actor), Martin L. Kelley (actor), Robert Hatch (actor), Matt Cornwell (actor), Chris Burns (actor), Chris Burns (actor), Chris Burns (actor), Ernie Hudson (actor), Michael D. Friedman (actor), Chris Burns (producer), Debi Derryberry (actress),

Plot: In 1995, brothers Jimmy Ray Johnson and Bobby Ray Johnson collaborated to produce the horror movie "Curse of the Jackalope." The film was purchased at the Lula (GA) International Film Festival and Barbeque Cook-Off by producer Richard McCovey and released into theaters by his company, McCovey Pictures. Amid bad reviews and a disastrous distribution, the film grossed a total of $17 at the box office. Over time, the film has gained a hint of notoriety as the "lowest grossing film of all time." Richard McCovey Jr has taken over his father's company, with grand plans of re-releasing the film. But first, he has to reunite the cast & crew for the ten-year Anniversary screening, an event he's dubbed "Jackalope X."

Keywords: b-movie, fake-documentary, film-industry, film-within-a-film, georgia-usa, improvisation, jackalope, mockumentary, reunionGenres: Comedy, Horror,

Taglines: A movie about people who shouldn't make movies.

Back at the Ranch (2004)

Actors: Tom Young (actor), Richard Jackson (actor), Holland Roden (actress), Cara Gayle Grippin (actress), Carlee Avers (actress), Keni LaTronico (actress), Shannon Oliver (actress), Don Kruizinga (actor), Leslie Roberson (director), Leslie Roberson (writer), Leslie Roberson (producer), Rob Hood (actor), Doug Luke (actor), Tim Randolph (actor), Mark Roberson (composer),

Plot: J.T. Leatherwood, the typical rugged cowboy, has fallen on hard times and must decide what is right for his family. Despite the protests of his wife and three daughters, JT decides to sell the cattle ranch he has worked his entire life to Pixie Entertainment for a sum that will make all his problems go away. However, when he finds out what Pixie has in store for his beloved land and cattle, J.T. wants no part of it. As it seems that all hope is lost, Jean, J.T.'s wife, discovers the answer has been right in their hands the whole time.

Genres: Drama, Short,Traders (2001)

Actors: Eric Rochant (director), Roberta Angelica (actress), Livingstone Beaumont (actor), Imad Lahoud (actor), Michel Antonas (actor),

Genres: Documentary, Short,Working Tra$h (1990)

Actors: Kristi Frankenheimer (miscellaneous crew), George Carlin (actor), Mindy Sterling (actress), Dan Castellaneta (actor), George Wallace (actor), Brian McMillan (miscellaneous crew), Leslie Hope (actress), Newell Alexander (actor), Michael J. Pollard (actor), Buddy Ebsen (actor), Michael Gregory (actor), Ben Stiller (actor), Andrew Sugerman (producer), Stephen Polk (actor), Jack Blessing (actor),

Genres: Comedy,The Bad Sister (1931)

Actors: Sammy Blum (actor), Sammy Blum (actor), Humphrey Bogart (actor), David Durand (actor), Charles Giblyn (actor), Charles Giblyn (actor), Payne B. Johnson (actor), Cornelius Keefe (actor), Conrad Nagel (actor), Cyril Ring (actor), Bert Roach (actor), Slim Summerville (actor), Will Walling (actor), Will Walling (actor), King Baggot (actor),

Plot: Marianne falls in love with con man Valentine who uses their relation to get her father's endorsement on a money-raising scheme. He runs off with the money and Marianne, later dumping her. Her sister Laura loves Dr. Lindley although she knows he loves Marianne. Marianne returns and marries a wealthy young man, and Lindley turns his love toward Laura.

Keywords: based-on-novel, con-man, remakeGenres: Drama,

-

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour. WILLIAM ACKMAN, Activist Investor and Hedge-Fund Manager We all want to be financially stable and enjoy a well-funded retirement, and we don't want to throw out our hard earned money on poor investments. But most of us don't know the first thing about finance and investing. Acclaimed value investor William -

Warren Buffett on The Intelligent Investor - Ben Graham

The Intelligent Investor: http://amzn.to/132mEbD Security Analysis: http://amzn.to/S3qdNs Warren Buffett's official recommendation for the "Best book on inve... -

Tom Gayner | The Evolution of a Value Investor

About the Talk Tom Gayner is the CIO of Markel Corp, where he manages the company's investment portfolio. He talks about his journey as an individual and value investor. A recent Wall Street Journal feature on Mr Gayner's investing style mentions: "He has an outstanding investing record. He works only for Markel and doesn’t take outside clients, but every investor can learn from him.You never woul -

Kannada Award winning Short Film Ambani the investor

-

14 year old investor on his way to become a millionare!!!

www.Driven-Magazine.com "The Source for GenY Entrepreneurs" By age 14, Damon Williams has built a portfolio worth $50000, knows blue chips like most kids kn... -

The broke investor. Kansiime Anne. African Comedy.

What!!? U have not Subscribed yet??? Eh nga you are a RISK -TAKER!! NOW NEW CLIPS EVERY Friday !!! pls also like me on facebook https://www.facebook.com/pages/Kansiime-Anne-Entertainer/263758240421584?ref=ts&fref;=ts -

India's top value investor S Naren shares his investing mantra

Most veterans in the market point to S Naren as one of the best value investors in India. With an investment career spanning over 25 years, Mr Naren has seen enough market manias and panics to be able to tell what is a good time to act and when to wait on the sidelines. Now, on Value Investing Decoded, S Naren, CIO of ICICI Prudential AMC, shares his investing method with us. Watch full show: htt -

Benjamin Graham - The Intelligent Investor

The Intelligent Investor By Benjamin Graham This classic text is annotated to update Graham's timeless wisdom for today's market conditions... The greatest investment advisor of the twentieth century, Benjamin Graham, taught and inspired people worldwide. Graham's philosophy of "value investing" -- which shields investors from substantial error and teaches them to develop long-term strategies -- -

This is TFM: The Investor

A perverted TFM investor storms into the office and demands the writers start posting weird hazing, and "nips and tips." Written by Jordan Gershowitz Directed by Dylan VanDam Starring Dillon Cheverere W.R. Bolen Rob Fox William K. Gilliam, Jr. -

Whiz Kid Investor (MoneyTrack Episode 312)

Meet John-Paul Pigeón, a successful investor, author and motivational speaker in Dallas who is on a mission to change his generations money-management skills... -

Watch an Investor Pitch in Action

A CreativeLive student applies what he learned in the class and gives an investor pitch. http://cr8.lv/ssfybgyt Adam Luther of Helping Hand tutoring tries hi... -

Paradox Of The Skilled Investor (Intelligent Investing With Steve Forbes)

Legg Mason's Michael Mauboussin on how luck can trump skill when investing in the stock market. Mauboussin, who is author of the book "THINK TWICE: Harnessin... -

Investor's Guide: Birla Sun Life Frontline Equity Fund

In this week's edition of Investor's Guide, we tell you how to go about your first investment plan. In our product review, we talk about the Birla Sun Life Frontline Equity Fund. And we tell young investors how to start saving to build a home. Subscribe Now To Our Network Channels :- ET Now : http://goo.gl/5XreUq Times Now : http://goo.gl/U9ibPb The NewsHour Debate : http://goo.gl/LfNgFF To Sta -

CH1: The Intelligent Investor

Access free tools and calculators at: http://www.BuffettsBooks.com Preston Pysh is the #1 selling Amazon author of two books on Warren Buffett. The books can be found at the following location: http://www.amazon.com/gp/product/0982967624/ref=as_li_tl?ie=UTF8&camp;=1789&creative;=9325&creativeASIN;=0982967624&linkCode;=as2&tag;=pypull-20&linkId;=EOHYVY7DPUCW3WD4 http://www.amazon.com/gp/product/19393 -

Investor’s Guide - Franklin India Prima Plus

In this week's episode of Investor’s Guide, we tell you all about PNB's Metlife Mera Term Plan. In our product review, we look at the Franklin India Prima Plus fund, and tell you whether you should book your profits in mutual funds. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► http://goo.gl/5XreUq Subscribe Now To Our Network Channels :- Times Now : http://goo.gl/U9ibP -

Barbara Corcoran's Angel Investor Checklist

In this 'Trep Talk Extra, the Shark Tank star and angel investor shares the hard-hitting questions she asks entrepreneurs before investing in their business.... -

The Worlds Greatest Investor - Warren Buffet Documentary

The Worlds Greatest Investor - Warren Buffet Documentary is a american documentary about Warren Buffets life and journey to becoming the Oracle of Omaha and the Second Richest Man in the world ( as of writing this ) For More Investing/Entrepreneur/Economics Videos Check Out The Channel What is Investors Archive ? = Its a Youtube Channel dedicated to having all the best Interviews/ Biography -

Six numbers every investor should know - MoneyWeek Investment Tutorials

Like this MoneyWeek Video? Want to find out more about investment banks? Go to http://www.moneyweekvideos.com/six-numbers-every-investor-should-know/ now and... -

Becoming a Millionaire Real Estate Investor Using The One Thing with Jay Papasan | BP Podcast 113

http://biggerpockets.com/show113 Today on the BiggerPockets Podcast we’re excited to bring you another fantastic interview by one of the most successful real estate authors in America. Jay Papasan is best known to this audience as the co-author of “the Millionaire Real Estate Investor” (co-written with Gary Keller) which has been our top-recommended real estate book here from BiggerPockets Podca -

Investor's Guide: EPFO Invests In Equity

In this week's episode, we tell you all about EPFO investing in equity and what impact it will have on your investments. In our product review, we talk about the Reliance Tax Saver. We also help NRIs understand tax implications of investing in MFs. Tune in. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► http://goo.gl/5XreUq Subscribe Now To Our Network Channels :- Times N -

Real Estate Investing 101 What Every Investor Must Know

Previously private and hidden, the demand has finally required VIP Financial Education to share this fabulous class with the public. Watch nationally renowned real estate experts Matthew Pillmore and Charles Roberts break down how investors of all experience levels can grow wealth by investing while beating the banks at their own game. -

Eveillard: Legendary Value Investor

An exclusive interview with legendary value investor Jean-Marie Eveillard, who was named Morningstar’s International Manager of the Year in 2001 and received its first Fund Manager Lifetime Achievement Award in 2003. A self-described value investor for 50 years, he is known for his meticulous stock research, cautious, contrarian views and emphasis on avoiding lasting losses for his shareholders. H -

Die Goldenen Zitronen - Der Investor (Official Video)

Aus dem Album "Who's Bad" erhältlich als CD, DoLP, Digital (Buback/Indigo/Finetunes) buback.de/shop/ Digital: itunes.apple.com/de/album/whos-bad/id705110355 ...

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- Order: Reorder

- Duration: 43:57

- Updated: 27 Nov 2012

- views: 715546

- published: 27 Nov 2012

- views: 715546

Warren Buffett on The Intelligent Investor - Ben Graham

- published: 10 Dec 2012

- views: 15830

- author: afalde

Tom Gayner | The Evolution of a Value Investor

- Order: Reorder

- Duration: 58:39

- Updated: 30 Jun 2015

- views: 67

- published: 30 Jun 2015

- views: 67

Kannada Award winning Short Film Ambani the investor

- Order: Reorder

- Duration: 18:15

- Updated: 23 Oct 2014

- views: 96

- published: 23 Oct 2014

- views: 96

14 year old investor on his way to become a millionare!!!

- Order: Reorder

- Duration: 4:15

- Updated: 28 Aug 2014

- views: 15069

- author: TheDrivenMagazine

- published: 28 Dec 2009

- views: 15069

- author: TheDrivenMagazine

The broke investor. Kansiime Anne. African Comedy.

- Order: Reorder

- Duration: 3:24

- Updated: 30 Sep 2015

- views: 12510

- published: 30 Sep 2015

- views: 12510

India's top value investor S Naren shares his investing mantra

- Order: Reorder

- Duration: 12:43

- Updated: 31 Mar 2015

- views: 212

- published: 31 Mar 2015

- views: 212

Benjamin Graham - The Intelligent Investor

- Order: Reorder

- Duration: 179:43

- Updated: 16 Aug 2015

- views: 0

- published: 16 Aug 2015

- views: 0

This is TFM: The Investor

- Order: Reorder

- Duration: 3:17

- Updated: 02 Sep 2015

- views: 7536

- published: 02 Sep 2015

- views: 7536

Whiz Kid Investor (MoneyTrack Episode 312)

- Order: Reorder

- Duration: 6:36

- Updated: 31 Aug 2014

- views: 55742

- author: moneytracktv

- published: 28 Oct 2009

- views: 55742

- author: moneytracktv

Watch an Investor Pitch in Action

- Order: Reorder

- Duration: 9:06

- Updated: 05 Aug 2014

- views: 1747

- author: CreativeLive

- published: 16 Apr 2014

- views: 1747

- author: CreativeLive

Paradox Of The Skilled Investor (Intelligent Investing With Steve Forbes)

- published: 10 Nov 2011

- views: 11392

- author: Forbes

Investor's Guide: Birla Sun Life Frontline Equity Fund

- Order: Reorder

- Duration: 24:13

- Updated: 20 Jul 2015

- views: 103

- published: 20 Jul 2015

- views: 103

CH1: The Intelligent Investor

- Order: Reorder

- Duration: 8:49

- Updated: 09 Nov 2014

- views: 625

- published: 09 Nov 2014

- views: 625

Investor’s Guide - Franklin India Prima Plus

- Order: Reorder

- Duration: 24:56

- Updated: 14 Aug 2015

- views: 149

- published: 14 Aug 2015

- views: 149

Barbara Corcoran's Angel Investor Checklist

- Order: Reorder

- Duration: 2:37

- Updated: 28 Aug 2014

- views: 3703

- author: Entrepreneur

- published: 09 Jan 2014

- views: 3703

- author: Entrepreneur

The Worlds Greatest Investor - Warren Buffet Documentary

- Order: Reorder

- Duration: 48:00

- Updated: 13 Dec 2014

- views: 11

- published: 13 Dec 2014

- views: 11

Six numbers every investor should know - MoneyWeek Investment Tutorials

- Order: Reorder

- Duration: 12:26

- Updated: 04 Sep 2014

- views: 106680

- author: MoneyWeekVideos

- published: 05 Aug 2011

- views: 106680

- author: MoneyWeekVideos

Becoming a Millionaire Real Estate Investor Using The One Thing with Jay Papasan | BP Podcast 113

- Order: Reorder

- Duration: 58:16

- Updated: 12 Mar 2015

- views: 180

- published: 12 Mar 2015

- views: 180

Investor's Guide: EPFO Invests In Equity

- Order: Reorder

- Duration: 22:52

- Updated: 02 Sep 2015

- views: 16

- published: 02 Sep 2015

- views: 16

Real Estate Investing 101 What Every Investor Must Know

- Order: Reorder

- Duration: 77:42

- Updated: 10 Mar 2015

- views: 2497

- published: 10 Mar 2015

- views: 2497

Eveillard: Legendary Value Investor

- Order: Reorder

- Duration: 27:27

- Updated: 07 Feb 2015

- views: 1309

- published: 07 Feb 2015

- views: 1309

Die Goldenen Zitronen - Der Investor (Official Video)

- Order: Reorder

- Duration: 4:08

- Updated: 04 Sep 2014

- views: 42417

- author: Buback Tonträger

- published: 17 Oct 2013

- views: 42417

- author: Buback Tonträger

-

Booking Live's Web Summit 2015 Investor Pitch

Booking Live CEO Vinnie Morgan gives a quick overview of the online booking software business Booking Live. Booking Live are heading to Web Summit 2015, visit them on stand B182 on November 4th 2015. Follow the company @BookingLive -

Real State Investor And High Yeild Income

-

Small Business and investor Financing

YouTube: Business & Real Estate Investor Financing Solutions - created at http://animoto.com -

Investor Special! Home in Goose Creek

For more details: http://view.paradym.com/3698011 58 Guerry Circle Goose Creek, SC 29445 $180,000, 4 bed, 3.0 bath, 2,774 SF, MLS# 15025309 Investor special! Rental income history for house and apartment is $2300/mo. Home features 4 very large bedrooms, 2 full baths, living room, formal dining room, laundry room, and eat-in kitchen. Also included is a furnished one bedroom apartment with -

Market Volatility & Investor Behavior: How should investors deal with spikes in market volatility?

Peter Greenberger, Director of Mutual Fund Research, discusses market volatility and weathering rising interest rates. Learn more here: http://raymondjames.com/pointofview/kalturaplaylist.aspx?a=2516&l;=market_volatility_and_investor_behavior -

Market Volatility & Investor Behavior: How does volatility affect investor behavior?

Peter Greenberger, Director of Mutual Fund Research, discusses market volatility and weathering rising interest rates. Learn more here: http://raymondjames.com/pointofview/kalturaplaylist.aspx?a=2516&l;=market_volatility_and_investor_behavior -

Market Volatility & Investor Behavior: How should investors position their portfolios?

Peter Greenberger, Director of Mutual Fund Research, discusses market volatility and weathering rising interest rates. Learn more here: http://raymondjames.com/pointofview/kalturaplaylist.aspx?a=2516&l;=market_volatility_and_investor_behavior -

Robert Vazquez real estate investor cross-country motorcycle trip

via YouTube Capture -

Building Wealth Investing in Real Estate Webinar with Glenn Estrabillo - October 14th 2015

th Investing in Real Estate Webinar by Glenn Estrabillo September 24th 2015 For more information visit: www.1plus12.com/webinars To see Glenn live at his next workshop, rsvp @: www.1plus12.com/pre-qualified-investor-partner-real-estate-investment-training-workshop -

Awaaz Investor Club - Anu Jain & Rahul Arora

Awaaz Investor Club is a platform on India's #1 business channel CNBC-AWAAZ to help you learn investing basics. Join now, just SMS ‘AIC’ SPACE ‘your name’ to 51818 and upload video questions to @CNBC_Awaaz on Twitter using #AwaazInvestorClub. -

BE Modern Man Ben Carter Shares Investing Wisdom

Ben Carter offers pointers on getting started in your journey to becoming a competent and capable investor. -

Investor and Share update from London South East's Week Ahead 19th October 2015

Investor and Share update for the week commencing the 19th October 2015. See what is happening in the UK Equity market with a round-up of Trading Announcements, Drilling Reports, and more. Find out more at lse.co.uk. -

Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk by Gary Ebook PDF

Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk by Gary Ebook PDF Click http://bit.ly/1PwB25z Author: Gary Antonacci Publish: 2014-10-31 The strategy that consistently gets high returns with low risk--because it knows when to adapt After examining more than two hundred years of data across dozens of markets and asset classes, the conclusion is clear: Momentum con -

The White Coat Investor A Doctors Guide To Personal Finance And Investing

-

Indinvest Partners - Investor Day

Plus d'information sur : http://www.idinvest.com/ -

Investor Signposts 16 Oct 15: Tame week ahead on the domestic economic calendar

CommSec Chief Economist Craig James takes a look at the economic data due out in the week ahead, including the RBA Board Minutes and the Japan, Europe & US ‘Flash’ PMI readings. Visit CommSec http://www.commsec.com.au Follow Us On Twitter http://www.twitter.com/commsec Subscribe to CommSecTV http://youtube.com/subscrip... Discuss the market in CommSec Community. Log into your CommSec account, -

Real Estate Investing

#praise #msdallasknows #favor #LOA #universe #heartsdesire #balancedlife #family #rewards #health #wealth #life #longevity #standing #Stretch #blessed #mysoulrejoice #gifts #love Ladies FREE EVENT I am hosting an all male panel! Make sure you come out and network, learn and leave empowered! Free knowledge don't miss it #lifechanging #realestate #housejerk #msdallasknows Www.housejerk.org/msdallask -

CarboNation Investor Pitch: Conrad Spirit of Innovation Challenge

Presenting Team CarboNation's Investor Pitch for the 2015-2016 Conrad Spirit of Innovation Challenge. -

Mealworm Investor Pitch

This is Team Mealworm's Investor Pitch for the 2015-2016 Conrad Spirit of Innovation Challenge. -

North Lakes - For The Investor!! No Sinking Funds, No ...

1/5 Wallis Circuit, North Lakes Elle Evans This near new property offers an open plan living design downstairs and all of its oversized bedrooms are located upstairs - the master is fitted with an A/C unit. This property is also fully fitted with security screens and gas cooking in the Kitchen. Combine the lack of overheads & the low maintenance aspects of this property with the huge rental r -

What Every Real Estate Investor Needs to Know About Cash Flow...And 36 Other Key FInancial Ebook PDF

What Every Real Estate Investor Needs to Know About Cash Flow...And 36 Other Key FInancial Ebook PDF Click http://bitly.com/1MsQ1sa Author: Frank Gallinelli Publish: 2003-12-21 Real estate financial calculations made easy Every real estate investor needs to know how to calculate cash flow, long-term gain, net operating income, and a few other basic financial formulas. What Every Real Estate Invest -

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Coun EBOOK

http://book99download.com/readbook.php?asin=0060555661.html The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Coun EBOOK -

TOP Immobilie: voll vermietet für den klugen Investor, beste Lage in Kirchhellen

Booking Live's Web Summit 2015 Investor Pitch

- Order: Reorder

- Duration: 1:03

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

Real State Investor And High Yeild Income

- Order: Reorder

- Duration: 0:36

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

Small Business and investor Financing

- Order: Reorder

- Duration: 1:25

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

Investor Special! Home in Goose Creek

- Order: Reorder

- Duration: 0:57

- Updated: 16 Oct 2015

- views: 1

- published: 16 Oct 2015

- views: 1

Market Volatility & Investor Behavior: How should investors deal with spikes in market volatility?

- Order: Reorder

- Duration: 3:39

- Updated: 16 Oct 2015

- views: 5

- published: 16 Oct 2015

- views: 5

Market Volatility & Investor Behavior: How does volatility affect investor behavior?

- Order: Reorder

- Duration: 2:13

- Updated: 16 Oct 2015

- views: 1

- published: 16 Oct 2015

- views: 1

Market Volatility & Investor Behavior: How should investors position their portfolios?

- Order: Reorder

- Duration: 2:06

- Updated: 16 Oct 2015

- views: 1

- published: 16 Oct 2015

- views: 1

Robert Vazquez real estate investor cross-country motorcycle trip

- Order: Reorder

- Duration: 2:27

- Updated: 16 Oct 2015

- views: 1

- published: 16 Oct 2015

- views: 1

Building Wealth Investing in Real Estate Webinar with Glenn Estrabillo - October 14th 2015

- Order: Reorder

- Duration: 41:41

- Updated: 16 Oct 2015

- views: 7

- published: 16 Oct 2015

- views: 7

Awaaz Investor Club - Anu Jain & Rahul Arora

- Order: Reorder

- Duration: 20:47

- Updated: 16 Oct 2015

- views: 398

- published: 16 Oct 2015

- views: 398

BE Modern Man Ben Carter Shares Investing Wisdom

- Order: Reorder

- Duration: 1:10

- Updated: 16 Oct 2015

- views: 52

- published: 16 Oct 2015

- views: 52

Investor and Share update from London South East's Week Ahead 19th October 2015

- Order: Reorder

- Duration: 1:32

- Updated: 16 Oct 2015

- views: 222

- published: 16 Oct 2015

- views: 222

Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk by Gary Ebook PDF

- Order: Reorder

- Duration: 0:21

- Updated: 16 Oct 2015

- views: 3

- published: 16 Oct 2015

- views: 3

The White Coat Investor A Doctors Guide To Personal Finance And Investing

- Order: Reorder

- Duration: 0:21

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

Indinvest Partners - Investor Day

- Order: Reorder

- Duration: 5:47

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

Investor Signposts 16 Oct 15: Tame week ahead on the domestic economic calendar

- Order: Reorder

- Duration: 2:09

- Updated: 16 Oct 2015

- views: 59

- published: 16 Oct 2015

- views: 59

Real Estate Investing

- Order: Reorder

- Duration: 0:36

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

CarboNation Investor Pitch: Conrad Spirit of Innovation Challenge

- Order: Reorder

- Duration: 1:31

- Updated: 16 Oct 2015

- views: 12

- published: 16 Oct 2015

- views: 12

Mealworm Investor Pitch

- Order: Reorder

- Duration: 1:35

- Updated: 16 Oct 2015

- views: 9

- published: 16 Oct 2015

- views: 9

North Lakes - For The Investor!! No Sinking Funds, No ...

- Order: Reorder

- Duration: 0:48

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

What Every Real Estate Investor Needs to Know About Cash Flow...And 36 Other Key FInancial Ebook PDF

- Order: Reorder

- Duration: 0:21

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Coun EBOOK

- Order: Reorder

- Duration: 1:30

- Updated: 16 Oct 2015

- views: 0

- published: 16 Oct 2015

- views: 0

TOP Immobilie: voll vermietet für den klugen Investor, beste Lage in Kirchhellen

- Order: Reorder

- Duration: 1:37

- Updated: 15 Oct 2015

- views: 0

- published: 15 Oct 2015

- views: 0

-

Investor’s Guide - IDFC Premier Equity

In this edition of Investor's Guide, we tell you whether you should be investing in ULIPs. In our product review, we talk about the IDFC Premier Equity Fund, and we tell first-time investors how to get started from scratch. Tune in. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► http://goo.gl/5XreUq Subscribe Now To Our Network Channels :- Times Now : http://goo.gl/U9ib -

Guy Spier: The Education of a Value Investor - Authors@Google

The Education of a Value Investor: My Transformative Quest for Wealth, Wisdom, and Enlightenment About the Book: What happens when a young Wall Street investment banker spends a small fortune to have lunch with Warren Buffett? He becomes a real value investor. In this fascinating inside story, Guy Spier details his career from Harvard MBA to hedge fund manager. But the path was not so straightfo -

VICTIM INVESTOR GUYANA (Official)

The Devastating Experiences of a Brazilian Investor in Guyana - Shocking Documentary -

Basant Maheshwari - The Thoughtful Investor - Book Reading Event by IAIP, Kolkata

Book Reading Event Organized by India CFA Society (IAIP) The Thoughtful Investor - A Journey to Financial Freedom Through Stock Market Investing by Basant Maheshwari -

How To Pitch To Investors With 13 Slides In Under 10 Minutes

Updated June 16, 2014: For a copy of the 13 slides used in this video, download them here: http://www.democoach.com/s/13slides.pdf This video shares a proven... -

Trading Strategies for the Online Investor

A presentation by our chief technical analyst, Mr. Juanis Barredo, during the PSE's Capital Market Investment Conference. May 16, 2014 at Marriott Hotel, Ceb... -

Best Real Estate Investor Robert Kiyosaki Rich Dad Poor Dad Author Investment Strategies

Best Real Estate Investor Robert Kiyosaki Rich Dad Poor Dad Author Investment Strategies, -

Jim Mellon speaking on the Mainstage at Master Investor 2015

Seeing through the mists to the Fast Forward Future Jim's book 'Fast Forward' is available on Amazon or via www.fastforwardbook.com You can book tickets to next year's show via- https://www.eventbrite.co.uk/e/master-investor-2016-tickets-16691554890 -

6 Steps to Becoming a Real Estate Investor On The Road with Robert Kiyosaki and Dolf De Roos

Robert Kiyosaki, author of Rich Dad Poor Dad - the international runaway bestseller that has held a top spot on the New York Times bestsellers list for over six years - is an investor, entrepreneur and educator whose perspectives on money and investing fly in the face of conventional wisdom. He has, virtually single-handedly, challenged and changed the way tens of millions, around the world, think -

John Heins & Whitney Tilson: "The Art of Value Investing"

“John Heins and Whitney Tilson, co-founders of the Value Investor Insight newsletter, have done a thorough job of explaining how to look for stocks that are trading at significant discounts to what they are worth — the concept known as the value style of investing.…the authors present a clear framework for ferreting out undervalued companies.” —The New York Times About the book: In The Art of Val -

BiggerPockets Podcast 93: Real Estate Investor Marketing

Check out the show notes at http://www.biggerpockets.com/renewsblog/2014/10/23/smart-marketing-erik-stark/ Many people take their time in building their real estate investing… but not today’s guest, who has used his incredible marketing skills to do more than 400 deals in the past five years! Erik Stark got his start after he had been flipping cars out of high school and wanted to move on to big -

Angel Investors

Part of 2010 Conference on Entrepreneurship What role do angel investors play in financing start-ups? What other value can angels contribute beyond capital? ... -

Investor’s Guide - Why You Shouldn't Invest in Gold

Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► http://goo.gl/5XreUq Subscribe Now To Our Network Channels :- Times Now : http://goo.gl/U9ibPb The NewsHour Debate : http://goo.gl/LfNgFF To Stay Updated Download the Times Now App :- Android Google Play : https://goo.gl/zJhWjC Apple App Store : https://goo.gl/d7QBQZ Social Media Links :- Twitter - http://goo.gl/hA0vDt F

Investor’s Guide - IDFC Premier Equity

- Order: Reorder

- Duration: 23:25

- Updated: 28 Sep 2015

- views: 48

- published: 28 Sep 2015

- views: 48

Guy Spier: The Education of a Value Investor - Authors@Google

- Order: Reorder

- Duration: 65:08

- Updated: 22 Sep 2014

- views: 175

- published: 22 Sep 2014

- views: 175

VICTIM INVESTOR GUYANA (Official)

- Order: Reorder

- Duration: 40:41

- Updated: 18 Feb 2014

- views: 361424

- published: 18 Feb 2014

- views: 361424

Basant Maheshwari - The Thoughtful Investor - Book Reading Event by IAIP, Kolkata

- Order: Reorder

- Duration: 102:00

- Updated: 12 May 2014

- views: 10043

- published: 12 May 2014

- views: 10043

How To Pitch To Investors With 13 Slides In Under 10 Minutes

- Order: Reorder

- Duration: 27:38

- Updated: 06 Sep 2014

- views: 59723

- author: Nathan Gold

- published: 24 Sep 2011

- views: 59723

- author: Nathan Gold

Trading Strategies for the Online Investor

- Order: Reorder

- Duration: 72:50

- Updated: 02 Sep 2014

- views: 4561

- author: COL Financial Group, Inc.

- published: 23 May 2014

- views: 4561

- author: COL Financial Group, Inc.

Best Real Estate Investor Robert Kiyosaki Rich Dad Poor Dad Author Investment Strategies

- Order: Reorder

- Duration: 30:29

- Updated: 02 Sep 2014

- views: 8668

- author: William Driscoll

- published: 01 Aug 2013

- views: 8668

- author: William Driscoll

Jim Mellon speaking on the Mainstage at Master Investor 2015

- Order: Reorder

- Duration: 59:17

- Updated: 06 May 2015

- views: 320

- published: 06 May 2015

- views: 320

6 Steps to Becoming a Real Estate Investor On The Road with Robert Kiyosaki and Dolf De Roos

- Order: Reorder

- Duration: 64:02

- Updated: 03 Jul 2015

- views: 0

- published: 03 Jul 2015

- views: 0

John Heins & Whitney Tilson: "The Art of Value Investing"

- Order: Reorder

- Duration: 79:04

- Updated: 11 Dec 2014

- views: 10111

- published: 11 Dec 2014

- views: 10111

BiggerPockets Podcast 93: Real Estate Investor Marketing

- Order: Reorder

- Duration: 67:41

- Updated: 06 Nov 2014

- views: 61

- published: 06 Nov 2014

- views: 61

Angel Investors

- Order: Reorder

- Duration: 80:33

- Updated: 04 Sep 2014

- views: 26382

- author: Stanford Graduate School of Business

- published: 23 Mar 2010

- views: 26382

- author: Stanford Graduate School of Business

Investor’s Guide - Why You Shouldn't Invest in Gold

- Order: Reorder

- Duration: 23:05

- Updated: 28 Jul 2015

- views: 17

- published: 28 Jul 2015

- views: 17

- Playlist

- Chat

- Playlist

- Chat

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour

- published: 27 Nov 2012

- views: 715546

Warren Buffett on The Intelligent Investor - Ben Graham

- published: 10 Dec 2012

- views: 15830

-

author:

afalde

Add Playlist for this Author

Tom Gayner | The Evolution of a Value Investor

- published: 30 Jun 2015

- views: 67

Kannada Award winning Short Film Ambani the investor

- published: 23 Oct 2014

- views: 96

14 year old investor on his way to become a millionare!!!

- published: 28 Dec 2009

- views: 15069

-

author:

TheDrivenMagazine

Add Playlist for this Author

The broke investor. Kansiime Anne. African Comedy.

- published: 30 Sep 2015

- views: 12510

India's top value investor S Naren shares his investing mantra

- published: 31 Mar 2015

- views: 212

Benjamin Graham - The Intelligent Investor

- published: 16 Aug 2015

- views: 0

This is TFM: The Investor

- published: 02 Sep 2015

- views: 7536

Whiz Kid Investor (MoneyTrack Episode 312)

- published: 28 Oct 2009

- views: 55742

-

author:

moneytracktv

Add Playlist for this Author

Watch an Investor Pitch in Action

- published: 16 Apr 2014

- views: 1747

-

author:

CreativeLive

Add Playlist for this Author

Paradox Of The Skilled Investor (Intelligent Investing With Steve Forbes)

- published: 10 Nov 2011

- views: 11392

-

author:

Forbes

Add Playlist for this Author

Investor's Guide: Birla Sun Life Frontline Equity Fund

- published: 20 Jul 2015

- views: 103

CH1: The Intelligent Investor

- published: 09 Nov 2014

- views: 625

- Playlist

- Chat

Booking Live's Web Summit 2015 Investor Pitch

- published: 16 Oct 2015

- views: 0

Real State Investor And High Yeild Income

- published: 16 Oct 2015

- views: 0

Small Business and investor Financing

- published: 16 Oct 2015

- views: 0

Investor Special! Home in Goose Creek

- published: 16 Oct 2015

- views: 1

Market Volatility & Investor Behavior: How should investors deal with spikes in market volatility?

- published: 16 Oct 2015

- views: 5

Market Volatility & Investor Behavior: How does volatility affect investor behavior?

- published: 16 Oct 2015

- views: 1

Market Volatility & Investor Behavior: How should investors position their portfolios?

- published: 16 Oct 2015

- views: 1

Robert Vazquez real estate investor cross-country motorcycle trip

- published: 16 Oct 2015

- views: 1

Building Wealth Investing in Real Estate Webinar with Glenn Estrabillo - October 14th 2015

- published: 16 Oct 2015

- views: 7

Awaaz Investor Club - Anu Jain & Rahul Arora

- published: 16 Oct 2015

- views: 398

BE Modern Man Ben Carter Shares Investing Wisdom

- published: 16 Oct 2015

- views: 52

Investor and Share update from London South East's Week Ahead 19th October 2015

- published: 16 Oct 2015

- views: 222

Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk by Gary Ebook PDF

- published: 16 Oct 2015

- views: 3

The White Coat Investor A Doctors Guide To Personal Finance And Investing

- published: 16 Oct 2015

- views: 0

- Playlist

- Chat

Investor’s Guide - IDFC Premier Equity

- published: 28 Sep 2015

- views: 48

Guy Spier: The Education of a Value Investor - Authors@Google

- published: 22 Sep 2014

- views: 175

VICTIM INVESTOR GUYANA (Official)

- published: 18 Feb 2014

- views: 361424

Basant Maheshwari - The Thoughtful Investor - Book Reading Event by IAIP, Kolkata

- published: 12 May 2014

- views: 10043

How To Pitch To Investors With 13 Slides In Under 10 Minutes

- published: 24 Sep 2011

- views: 59723

-

author:

Nathan Gold

Add Playlist for this Author

Trading Strategies for the Online Investor

- published: 23 May 2014

- views: 4561

-

author:

COL Financial Group, Inc.

Add Playlist for this Author

Best Real Estate Investor Robert Kiyosaki Rich Dad Poor Dad Author Investment Strategies

- published: 01 Aug 2013

- views: 8668

-

author:

William Driscoll

Add Playlist for this Author

Jim Mellon speaking on the Mainstage at Master Investor 2015

- published: 06 May 2015

- views: 320

6 Steps to Becoming a Real Estate Investor On The Road with Robert Kiyosaki and Dolf De Roos

- published: 03 Jul 2015

- views: 0

John Heins & Whitney Tilson: "The Art of Value Investing"

- published: 11 Dec 2014

- views: 10111

BiggerPockets Podcast 93: Real Estate Investor Marketing

- published: 06 Nov 2014

- views: 61

Angel Investors

- published: 23 Mar 2010

- views: 26382

-

author:

Stanford Graduate School of Business

Add Playlist for this Author

Investor’s Guide - Why You Shouldn't Invest in Gold

- published: 28 Jul 2015

- views: 17

Russian plane crash: Aircraft broke up in the air, says official

Edit The Irish Times 01 Nov 2015In Drone-Assassination Matrix Altitude Determines Attitude

Edit WorldNews.com 01 Nov 2015Will Syria Be Obama's Vietnam?

Edit The Daily Beast 01 Nov 2015How scorpions became an unlikely ally in the fight against cancer

Edit The Guardian 01 Nov 2015Islamic State seizes central Syrian town near key highway

Edit The Himalayan 01 Nov 2015Air pollution and a sour equities market

Edit South China Morning Post 02 Nov 2015Investors should avoid MFs’ close-ended fixed tenure plans

Edit The Times of India 02 Nov 2015Post-plenum trading may see stocks rising

Edit China Daily 02 Nov 2015Government looking to ease FDI rules: Jaitley

Edit The Times of India 02 Nov 2015Uncertainties Are Holding the Market Hostage

Edit Real Clear Politics 02 Nov 2015Greece Sets Terms for Aiding $15.9 Billion Bank Recapitalization

Edit Bloomberg 02 Nov 2015Greek banks must raise €14.4bn for ECB stress tests

Edit The Irish Times 02 Nov 2015PAX Global Named "Best Overall for Corporate Governance - Hong Kong" (PAX Global Technology Ltd) ...

Edit Public Technologies 02 Nov 2015S&P; ratings of countries vary from AAA to D

Edit The Times of India 02 Nov 2015Record Pakistan Reserves Conceal Risks of Needing More IMF Aid

Edit Bloomberg 02 Nov 2015Charlie Munger Isn't Done Bashing Valeant

Edit Bloomberg 02 Nov 2015Why are influential investors suddenly bullish on India’s aviation sector?

Edit The Times of India 02 Nov 2015- 1

- 2

- 3

- 4

- 5

- Next page »