So Long, From Sabernomics

Well folks, I’m afraid it’s come to an end. What started as an experiment nearly seven years ago became more than I anticipated. For the past seven years I’ve had a place to explore my whimsical ideas on baseball in public, and I’ve enjoyed having the outlet.

The New Year offers a good time for change. My work responsibilities are expanding, and I’d like to drink my morning coffee without my hands on the keyboard. I still have Twitter to pass on links and opinions, and that’s all I want to do for a while. My research continues, but I won’t be blogging about it. I might write an occasional article in other places, but it’s time to move on from the blogosphere. The website will remain for the time being.

I’d like to thank everyone out there for reading my work. I wish you the best.

J.C.

Happy Christmas

Christmas Is A Time That Can’t Be Stolen, The Charlotte News, Christmas 1974.

by TOM BRADBURY (1943 — 2010)

It is a first requirement of good literature that it be true, and honest. Not in the sense that it contains only a factual recounting of actual events, but that it portray honestly the thing at its core — be that emotions, or events, people, or principles. Even fables, for example, can be entirely fanciful and concocted, and yet convey a truth.

That’s why I think Dr. Seuss’ How The Grinch Stole Christmas qualifies as good and honest literature, because it tells a truth about Christmas. Namely, it tells the truth that Christmas can’t be stolen, even by a Grinch of vast power and vile cunning.

For most of us, that amounts to poetic truth. It doesn’t reassure us about burglars who might clean out the stocking on Christmas Eve, but warns us about a commoner danger that we might make the Grinch’s mistake of thinking Christmas is in the trappings. It’s the same thing we here from pulpits and tell to children. The importance is not in the message, which is old, but in the particular telling, which is new and effective.

Or so I thought until I read the story of American POWs who played the people of who-ville to the North Vietnamese “Grinch”. There was an attempt to steal their “Christmas”, even though it consisted only of carols written on toilet paper, and presents made of camp scraps. But that theft, like the Grinch’s, failed, because Christmas is not really a thing of packages and presents, but of spirit. Dr. Suess’ fable, as good fables sometimes do, turned out to possess a measure of literal truth.

The story of POWs who found strength from the Grinch fable does more than confirm the central truth of the tale. It suggests another dimension. The real point is not the observance of Christmas, but the original gift the observance celebrates. It is a gift of hope, a hope that gives men strength to endure, and even celebrate.

But that’s merely an intellectual explanation of a very physical and emotional reality. As such it’s inadequate, but about as close as those of use who haven’t had to live on hope alone can get to the matter. I might as well try to describe what it feels like to freeze, or starve or die.

A better look at it, however, can be had through the words of a man who did learn to endure on hope and faith alone. Listen to what German pastor and theologian Dietrich Bonhoeffer wrote from a Nazi prison to his parents at Christmas, 1943. At that time, some 16 months before his execution for complicity in anti-Hitler plots, he had been in a Berlin Prison for some eight months:

“… I long to be released and to see you all again. But for years you have given us such perfectly lovely Christmases that our grateful recollection of them is strong enough to put a darker one into the background.

“It is not till such times as these that we realize what it means to possess the past and a spiritual inheritance independent of changes of time and circumstance. The consciousness of being borne up by a spiritual tradition that goes back for centuries gives one a feeling of confidence and security in the face of all passing strains and stresses.

“I believe that anyone who is a aware of such reserves of strength need not be ashamed of more tender feelings evoked by the memory of a rich and noble past, for in my opinion they belong to the better and nobler part of mankind. They will not overwhelm those who held fast to values that no one can take from them.”

Bonhoeffer, above all, was a proudly self-disciplined German. That’s why he worried in a way most of us probably wouldn’t, about wallowing in sentimental memories. But what I find important is that even this sternly disciplined man found strength and sustenance from Christmas. He found it in the whole of Christmas, which includes the gift of the first Christmas and the centuries of faith and tradition that grew from it.

What Bonhoeffer grasps is not just Christmas as one day of joy, but the faith that grows from the day and its gift and makes possible a lifetime of hope. That’s what the Grinch, or the Nazis, or anyone else, can’t steal.

Dr. Suess, in his inimitable and fanciful way, told a true story. Not just about the un-stealable-ness of Christmas, but about the warmth of it — the hands held, the carols sung, the thanks given, the beast carved at the family table; the family and societal tradition that intertwines with faith to give men sustenance and hope even in the darkest circumstances.

What’s Wrong with Replacement-Level Valuing of Players

In my previous post on 15 tenets of sabermetrics, my response to one tenet received the bulk of the comments. I showed that the talent of the league is distributed normally, and the assumption that there is an abundance of similarly-skilled players on the margin of the majors—the underlying assumption of replacement—is wrong. Replacement-level metrics themselves do just fine at measuring player skill relative to one another, it’s the implication of that these metrics tell us something about the objective value of players that bothers me.

I’ve written quite a bit about my dislike of replacement level over the years. You can see posts that I have written on the subject here, here, and here. But, I thought I’d briefly summarize my reasons for rejecting replacement-level theory in a single post.

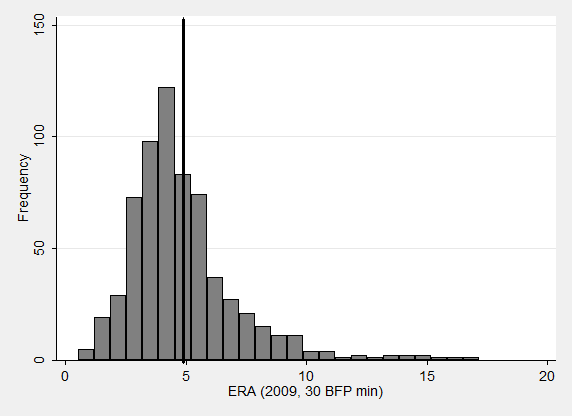

— If there was an abundance of talent at the bottom of the league, then the frequency of poor play on the inferior side of the talent distribution should be evident. But as the distributions below indicate, the distribution of talent is bell-shaped.

(UPDATE: Some people don’t like the 100 PA/BFP cutoff, so I’ve replaced the histograms with 30 PA/BFP cutoffs. As I’ve said, it doesn’t make much difference. These distributions have the basic bell-shape, but are negatively skewed, not positively skewed as would be expected if there was an abundance of near-equal talent around replacement level.)

There is no grouping of poor talent on the edge of the league, which means that when seeking replacement who are not in the league, teams must select from a scarce talent pool where some players are better than others. This means there will be price differences between players, with teams willing to pay more for better players and less for worse players according to their marginal revenue products. Now, this doesn’t mean that inferior players don’t serve as competition for superior players, by offering their inferior services for a lower price, but they are not simply worth the league minimum.

— Even if there was an abundance of talent in this range, it is not freely available. Talent outside of 25-men major-league rosters is not a collection of free agents. Each team has a farm system with five or six minor-league clubs, full of players whose playing rights are owned by other clubs. That means that the next-best few thousand non-major-leaguers are off limits for clubs to choose from freely.

So, let’s say a bench player goes down and the team needs a replacement to serve in his place, the team has a few options. It can bring up the most-talented player in its minor-league system that can play the vacated position. This player will be paid a pro-rated share the league minimum while he is in the league. The value of having that player on the roster will be equivalent to his marginal revenue product, which is almost certainly worth more than the league minimum. But just playing the player isn’t free, because there is an opportunity cost to playing him. If it starts his major-league service-time clock prematurely, the team will lose future value from the player. If another team was also seeking a similar player—and given the scarcity of talent, there almost always is—the team forgoes the value it could get from selling his surplus vale (MRP – wage) to another team. And if you want to acquire a player from another minor-league roster, you have to pay the team for the opportunity cost of a player.

— The next step is to put a dollar-value on players based on their contribution beyond replacement level. (I should also add that the linear dollar-per-win estimates often used are biased by estimating a non-linear function with a linear estimator and neglecting to include a y-intercept in the estimate.) If we assume that replacement-level players are worth only league minimum, then players who play worse than replacement level are costing their teams money, because supposedly there is a superior player available for the league minimum. Sounds good in theory, but in practice, about 1/3 of the league—eight players per team—are identified as below replacement-level by the popular sabermetric website Fangraphs.

And this isn’t just some random error involved here: 16% of players cost their teams $1 million or more in 2009. This assumes quite a bit of ignorance on the part of general managers, which is doubly problematic because when free-agent salaries are used to measure the value of players, there is an implicit assumption made that GMs are making rational decisions. Paying $4 million per team for below-replacement players (16% * 25-man roster = 4 players; 4 players * $1 million = $4 million) that should be available for under $1 million is irrational.

Of course, we could respond by saying that replacement-level is being set too low. But, why bother saving a metric that has too many other problems.

— Replacement-level terminology is unnecessarily complicated. If the sabermetric community wants to continue spreading influence beyond its small sphere of influence it can express all its important concepts in terms familiar to all baseball fans. When I played little league, we talked about on-base percentage and slugging percentage. It’s easy to explain DIPS through discussing strikeouts, walks, and homers (“see, the pitcher does these things all on his own, without fielding help”). But replacement level, why not just bring up quantum physics? This is baseball, it’s supposed to be fun. Replacement-level language is complicated and it adds no useful additional information to concepts that can be expressed more simply, especially in reference to league average. Replacement-level terminology should be rejected for parsimony alone. As I previously stated,

I read a lot of dumb things by established baseball writers who deserve to be called out. But when you start inundating people who have lived and breathed baseball for much of there lives—no less than active sabermetricians—with new acronyms that are not in their lexicon, don’t be surprised when they are confused. And getting snooty about it doesn’t help. Baseball already has a language, and there is nothing too complex in sabermetics that cannot be explained through terms and statistics understood by little-leaguers.

Freakonomics Q&A

My answers to questions asked by Freakonomics readers about baseball economics is now posted. You can read my answers here. Thanks to Stephen Dubner for the opportunity.

Agreeing and Disagreeing with Bill James

I have long admired Bill James and I enjoy reading his work. I remember when Doug Drinen let me borrow his collection of Abstracts, and the jealousy I felt about growing up without ever knowing of James’s work. In my mind, Bill James thinks like an economist, and I didn’t realize my way of thinking naturally was commonplace in economics until I got to college. Had I found Bill James as a teenager, my life probably would have been a little bit different.

I happened across a post by King Kaufman the other day, which led me to A Bill James Primer, extracted from James’s 1988 Abstract. But, as I read the primer, I was surprised to see how often I disagree with many of the tenets. Though I’ve been writing about these issues for years, I just hadn’t noticed. So, I thought I’d wander through the primer in a blog post. I’ll point out where I agree, disagree, and have qualified agreement and why.

1. Minor league batting statistics will predict major league batting performance with essentially the same reliability as previous major league statistics.

I think that minor-league statistics can predict performance; though, I wouldn’t go so far as to say that they predict with the same reliability as major-league statistics. In Chapter 8 of Hot Stove Economics, I examine how minor-league baseball statistics can be used to predict major-league performance. I find that certain minor-league statistics at the High-A level and above are correlated with major-league performance. However, performances at Low-A and below do not have much ability to predict major-league performance. As a general rule, the closer you get to the big leagues, the more reliable predictor minor-league statistics become. The problem is that because the quality of minor-league players is so widely dispersed, good minor-league performances can be aided by taking advantage of qualities of the competition that won’t survive in the majors. However, it’s rare for someone who performs poorly in the minors and to excel in the majors.

2. Talent in baseball is not normally distributed. It is a pyramid. For every player who is 10 percent above the average player, there are probably twenty players who are 10 pecent below average.

I disagree. Below are two graphs that showing the distribution of hitters and pitchers in baseball, with a minimum of 100 plate appearances or batters faced in 2009. The solid line is league average and the dashed lines bound the standard deviation.

For this reason, I don’t believe replacement players are cheap and abundant, and it’s one of the reasons I dislike replacement-level metrics.

3. What a player hits in one ballpark may be radically different from what he would hit in another.

I agree that ballpark effects are real. You can’t judge players without adjusting for park effects. This seems obvious now, but I don’t believe it always was. I think that James was one of the first people to study and measure park effects.

4. Ballplayers, as a group, reach their peak value much earlier and decline much more rapidly than people believe.

Depends on which “people” you are. I think James’s claim that player peak at age 27 is wrong. I believe the methodology of his initial study of the issue is flawed. My own estimates indicate that players peak around 29. Though I disagree with his initial findings, the chapter on aging in his 1982 Abstract was groundbreaking in how he thought about aging functions.

5. Players taken in the June draft coming out of college (or with at least two years of college) perform dramatically better than players drafted out of high school.

It depends on what you mean by dramatic, and how this ought to inform draft strategy. Jim Callis of Baseball America conducted an analysis of how well high school and college players succeeded in the majors. College players did a little bit better—I wouldn’t call the difference “dramatic”—but that’s not surprising and I don’t think the identified difference should affect teams’ drafting strategy.

College prospects are a survivors of a previous high school draft pool. After three or four years of observation, we have a better idea of whom the good players are. It should be no more surprising that college players succeed at a slightly higher rate than high school players than that minor-league players three years from high school are more successful than recently-drafted players. We have better information about them, and time has culled out some non-prospects. But, if a team tried to improve its return to the draft by drafting more college players, it’s not necessarily going to benefit from the previously measured higher success rate of college players. The college draft pool is more certain: not only do we know the good players, we know the bad ones too. Part of the reason the returns to drafting college players are better is that teams stop drafting college players once the good ones are gone.

Let’s say you had to buy a car today. You have time to test-drive three, and you like one and hate the other two. But by the time you go to buy the good car you test-drove it’s gone. Should you buy one of the cars you know you don’t like or go for one you have a chance of liking from a pool of cars you didn’t test drive that were on your list of prospective cars from Consumer Reports? The latter group of cars has more risk, but at least has an upside that the former group doesn’t have.

So, agree with James here on the fact, but I don’t think the higher success rate of college draftees means that teams can improve their drafts by focusing on more college players. However, I’m not sure if James believes anything more than the fact.

6. The chance of getting a good player with a high draft pick is substantial enough that it is clearly a disastrous strategy to give up a first round draft choice to sign a mediocre free agent.

I’d probably agree with this, but I think the fact that the pick will likely yield a player who can be paid far less than he’s worth is more important than the likelihood that the drafted player is good. On talent alone, I expect a mediocre free agent has an expected talent value of close to that of a high draft pick.

7. A power pitcher has a dramatically higher expectation for future wins than does a finesse picther of the same age and ability.

I don’t know.

8. Single season won-lost records have almost no value as an indicator of a pitcher’s contribution to a team.

9. The largest variable determining how many runs a team will score is how many times they get their leadoff man on base.

Getting the first man on in the inning is important, but I’m not sure that it’s the largest variable. I’ll concede that I don’t know.

10. A great deal of what is perceived as being pitching is in fact defense.

I find baseball is 13% defense, and so does James. Agreement.

11. True shortage of talent almost never occurs at the left end of the defensive spectrum.

Possibly, but the problem is that for most of the game, players have to play both sides of the ball. And because fielding is such a relatively small part of baseball, purely defensive guys don’t have a lot of value. There is a shortage of guys who are decent hitters and play defense well, especially at defensive positions.

12. Rightward shifts along the defensive spectrum almost never work.

Agree.

13. Our idea of what makes a team good on artificial turf is not supported by any research.

I have no clue, so he’s probably right.

14. When a team improves sharply one season they will almost always decline in the next.

Agree, that’s simple mean reversion.

15. The platoon differential is real and virtually universal.

Agree.

Even as I find differences here, my affection and respect for James as a thinker has never diminished. I agree with Tyler Cowen that James is one of the greatest living social scientists. What I like about James is the way he approaches problems and finds answers. I may not agree with the exact method used or the answer—although; in most cases I do—but I like the frame of mind with which James tackles curiosities. The sabermetric approach that James espouses is right. That his findings sometimes don’t fit with mine, doesn’t bother me.

Valuing Cliff Lee, the Mystery Team Hoax, and the Prediction Market

Well, Cliff Lee finally signed, and it wasn’t with the favorite Texas Rangers or New York Yankees. Lee agreed to a five-year, $120 million deal to return to the Philadelphia Phillies—a “mystery team” that wasn’t ever considered to be in the mix until yesterday.

While many people scoffed at the idea of a mystery team being anything more than a ploy to get the Rangers or Yankees to raise their offers, I don’t think such shenanigans are all that credible, given the intelligence of the parties involved. Even if Lee had ended up in New York, I’d remain confident that another team had an offer on the table. The reason is that general managers of MLB teams aren’t dopes. If you’re Brian Cashman and Lee’s agent brings you an offer from a team that he refuses to identify, how credible do you think that offer is? When you go shopping for a car, and the dealer says he’s got five other customers hot to pay full price, do you believe him? Because for the fake mystery team bargaining to work, you’d have to believe that Brian Cashman is a complete idiot. I’m not saying it’s never happened, but such threats just aren’t credible to me, and I doubt that Cashman or any other GM would up an offer when they don’t have hard information about an alternative.

It’s also interesting to see how the prediction market viewed the pursuit of Lee. Intrade sold shares on contracts for Lee ending up with the Yankees, Rangers, Nationals, Mets, and others. The graphs below show the prices at which these shares were selling over time (note: the date the graphs identify as “Dec 10” is actually December 1). It seems that traders believed Lee was going to the Yankees, but became skeptical over the weekend. But, the traders seemed to think that this meant he was more likely to go to the Rangers than and other team. The “Other” contract didn’t rise until today.

And finally, what do I think Lee is worth? I estimate that over the next five years that Lee is worth about $110 million ($22 million per year) to an average team. Because the Phillies are a winning club, he’s worth a little more than that to the team. I wrote a bit about this in October; in fact, I based my estimates on the assumption that he’d get a five-year deal. The contract also includes a $27.5 million vesting option for a sixth year, so if he continues to pitch well he could end up getting as much or more than was rumored to be on the table from the Rangers and Yankees. He also gets a partial no-trade clause, which likely cost him some salary.

Valuing Carl Crawford and SoSH Chat

The Boston Red Sox and Carl Crawford have agreed to a seven-year, $142 million contract. I have Crawford valued at $135 million over that timespan.

Looks like I picked a good day to do a live chat at Sons of Sam Horn (today at noon). If you have any questions, be sure to stop by

Defending My Defense of the Jayson Werth Deal

Justin Bopp takes issue with my defense of the Jayson Werth contract, Rob Neyer went so far as to call it a fisking: however, I think fisking requires snark, I thought it was a polite response. I respond briefly below.

1. Aging – Bradbury contends that aging is “rather flat,” for which his estimate takes account, but doesn’t mention that Werth is a post-peak player getting paid like a player that projects to peak over the next several years.

My aging corrections are based an aging study that I did a while ago. I conducted this study because I found several flaws in current approaches to aging. If I was going to do age projections, I was going to have to do my own. The study is based on historical data and uses statistical techniques designed to handle some tough problems.

My estimate of future performance is not based on Werth being at his peak; if it was, he’d be worth more. Werth is a good player, and even as he declines, he will continue being a good player. This is consistent with findings in the academic literature on aging and athletic performance that humans tend to decline between 0.75 to 1 percent per year after reaching peak performance.

Revenue Projection – He projects MLB revenue growth will remain at 9% through the the life of the contract, in what I presume is to suggest that Werth’s percentage of the Nationals’ total expenditures will go down accordingly.

Werth’s percentage of expenditures to the Nationals will go down, but that isn’t what motivates my argument. In the future, wins will be worth more nominal dollars, therefore his value and expected salary will increase. Teams don’t just spend a set budget like fantasy players, they invest when returns are positive (with caveats). As I said in the post, this is based on historical revenue growth. If we assume revenue growth will be less, he will be worth less. If you want to assume it will be less, go right ahead. I’m basing my assumption on a historical trend.

. Adam Dunn – Probably the best argument in the article, JC takes issue with the idea that the Nats could get the same production for less cost. The idea is that Dunn’s “defense” makes him more valuable to an AL club, but he makes no mention of why paying another player 70 MILLION additional dollars (over an additional 3 years) is a way to leverage that AL/NL value disparity.

I don’t really understand this point. I argued that the salary that Dunn got for the time they would have him will be more than he would be worth to the Nationals over that time period. I estimate that Werth is getting close to his worth, and Dunn would have to be paid more than his worth.

Albatross Contracts vs. Risk of Loss – This last argument has me somewhat stumped, honestly, but the gist of it is that albatross contracts can be mitigated by cutting losses, dealing away good players, and recouping some amount of the contract.

I was arguing that the risk of an albatross contact is somewhat counterbalanced by the contract turning out well and Werth being even more valuable (for example, if the Nationals become a perennial winning team). There are also ways teams can insure against losses by diversifying risky contracts across several players or through direct insurance. And just because a player doesn’t live up to its expected worth doesn’t mean that the loss is equivalent to the entire value of the contract.

Finally, Bopp finishes with the following.

The problem is that the Nationals, for whatever reason, overpaid the current market value.

I see no evidence to support this assertion. Is it because some GMs a said it seems high? Of course, every GM who doesn’t sign a player is going to think the signing GM overpaid, that’s why the player ends up with the team that values him most. It’s what creates winner’s curse in auctions. I’ll call the reverse effect loser’s lurgy (for Harry Potter fans). If I’m a GM who loses out, you better believe I trash the high-dollar signings of other players. While the Nats may have had the high bid, I have no doubt that there were competitive bids on the table, and the Nats didn’t just blindly throw this number out there.

I’ve been reporting my numbers for many players that are signing this offseason. In my book, I compare my estimates to actual salaries paid and find a decent fit. And while I try to maintain skeptical of my own estimates, I think it is interesting to see my numbers fit with a contract like this one.

One final criticism was leveled in the comments by Sky (a frequent critic of mine), but the questions he raise about my model that are mostly addressed in my book. I estimated many alternate models with different estimation strategies to account for potential omitted variables, interactions, outliers, etc. (In particular, I think throwing out the Yankees—a high revenue team and a big player in the free-agent market—would do far more damage than including the team.) Appendix B looks at some alternate estimates, including some that are nested within individual markets. In these models where I control for unique market characteristics, the best estimate continues to be non-linear. When you use models that try and get at team-specific effects, winning and team effects become difficult to disentangle. That is why I use the common-pool estimation procedure.

I don’t care what players make. I’m trying to develop a model to understand why players make what they make. These are my results, and I have toyed with many different models trying to understand what is going on. And I am not claiming that my estimates are objectively correct. In fact, I go so far as to refer to them as “crude,” a term I borrowed from Gerald Scully who developed the first estimates of player worth in the 1970s.

Valuing Carlos Pena

The Chicago Cubs have signed free agent first baseman Carlos Pena to a one-year $10, million deal. Interestingly enough, that is exactly what I projected his value to be for 2011. Though the dollar estimate is right on, I think this is a curious move by the Cubs, unless they have other moves in the works. The Cubs have a big payroll and are not a very good team. We’ll just have to wait and see how the offseason plays out.

Defending the Jayson Werth Deal

Yesterday, I learned that there are two crazy people in the world, Washington Nationals GM Mike Rizzo and me. Rizzo signed Jayson Werth to a seven-year, $126 million contract, and I stated that Werth was projected to be worth $127 million in terms of revenue generation over this time period. I understand why this contract is universally hated. This is a huge contract, a long contract that takes Werth into his late-30s, and while most fans understand that Werth is good he’s not considered a superstar.

Werth has risen from an injury-plagued and disappointing career to the top of the game, without being flashy. He’s played on a good team where he’s been overshadowed by Roy Halladay, Ryan Howard, Chase Utley, and the list could go on. In 2010, I estimate that he was the sixth-best player in the National League—just behind Adrian Gonzalez, who is apparently discussing a longer and more valuable contract extension with the Boston Red Sox. Werth is an excellent and valuable player.

How will Werth age? A lot of people feel that players age drastically, and that at 38 Werth will have aged out of the league. That is possible, but my research indicates that aging is rather flat. Good players tend to stay good, bad players tend to stay bad. When players get to their late-30s, it’s difficult to study aging, but I use my aging function to diminish his performance according to the past history of major-league players, so this value roughly accounts for that.

I also assume that league revenue will grow at nine percent per year. That may seem like an aggressive assumption—and revenue cannot continue to grow at that rate forever, or MLB will take over the US economy—but it is consistent with historical revenue growth. If you’d like to scale the growth rate back, I won’t argue with you. But, I can see where the Nationals might get their revenue projection.

And what about the argument that the Nats would have been better of by signing Adam Dunn? The Chicago White Sox signed away Dunn with a four-year, $56 million deal. I estimate that as a designated hitter, Dunn is worth $54 million. But, if he has to play the NL, where his defensive liabilities can’t be hidden on the bench, he’s worth only $49 million. The Nationals might have liked to have kept Dunn, but an AL team was going to value him more. Furthermore, Werth is a better player than Dunn: in 2010, I estimate that Werth’s play was worth about $5 million more than Dunn’s.

And what about the future? A few years down the road the Nationals may not just be a losing team, but a loser with an albatross contract. I think the Nationals signed this contract looking forward, rather than trying to make a splash now. The Nats may have needed some good press in DC, but Werth isn’t quite the household name to make that splash. The Nats have a core of good young players, such Ryan Zimmerman, Stephen Strasburg, and Bryce Harper. In a few years, when the team wants to add another piece to push them into the playoffs (and with players will be worth more) Werth could be worth more than his contract. Now, if the plan doesn’t work out, the Nats may end up having to cut their losses and deal away some of their good players. When that time comes, they can minimize some of their losses by selling away overpaid players for less—the loss isn’t the full salary of the contract. Yes, a loss is a loss, but risking a loss to make money is something that businesses must do every day.

I’m not sure I would have recommended this deal to Rizzo if asked, but I can understand why this deal was made. It’s aggressive, but reasonable.