These debt-related shocks will occur regularly for many more years, and each shock will advance or retard the rebalancing process so that it affects the way future shocks occur. There are only a few broad paths along which the Chinese economy can rebalance, and if we can get some sense of the China’s institutional constraints and balance sheet structures, we can figure what these paths are and how likely we are to slip from one to another. In order to get Chinas right I would argue that above all we must understand the dynamics of debt, and of balance sheet structures more generally.

Read more ›All Content

Do markets determine the value of the RMB?

By Michael Pettis Last Tuesday the PBoC surprised the markets with a partial deregulation of the currency regime, prompting a great deal of discussion and debate about the value of the RMB. Part of the discussion was informed by a consensus developing in one part of the market that the RMB is no longer undervalued but is in fact overvalued. […]

Read more ›China’s stock markets and revisiting 2011 predictions

By Michael Pettis originally written on 31 Jul 2015 I plan to post a new entry very soon but before doing so I wanted to say a few things about the stock markets, which continue to be insane (but not unexpectedly so) and then repost a blog entry that is nearly five years old. By the time I published my […]

Read more ›The Greece debt bailout negotiations are really about France, not Greece

This post was originally written for Credit Writedowns Pro on 12 Jun before Greece defaulted on loans to the IMF. The situation in Greece is not about Greece at all. It is about enforcing an economic framework onto all Eurozone countries. And because the policy goal is primarily about enforcing this economic framework everywhere in the eurozone, there is less policy space available […]

Read more ›Did lending by foreign banks really cause the Greek debt crisis?

There are a lot of competing narratives going around as to why Greece is in such trouble relative to the rest of the eurozone. A lot of this centers on whether Greek fiscal profligacy or poor credit controls by foreign banks was the main cause of the Greek debt crisis. Let me throw my hat into this ring with a few comments. What I say below will generally shade toward the problem being one of fiscal profligacy worsened by an ECB monetary policy that was inappropriate for the eurozone periphery as a whole and Greece in particular.

Read more ›The coming Greek bank nationalization, bail-in and privatization

The existence of capital controls eliminates contagion and makes it possible to bail-in deposits that would normally be considered to have systemic consequences. The more I look at it, the less benign this bailout deal appears. Indeed it looks to me as if it was set up to do considerable damage to the Greek economy. Once this becomes apparent, Greeks are surely likely to change their minds about staying in the Euro.

Read more ›Variable geometry bites back: Schäuble’s motives

Success of the German-inspired solution for the latest Greek crisis is far from assured. If it fails, the Eurozone may be changed forever. This column argues that the failure would lead to an outcome that has been favoured for decades by Germany’s Finance Minister, Wolfgang Schäuble. Perhaps the package the Eurozone agreed is just a backdoor way of getting to the ‘variable geometry’ and monetary unification for the core that the Maastricht criteria had failed to achieve.

Read more ›The new European Union

The new bailout deal for Greece was not easy. This column argues that it was also a failure. It will not be enough to recapitalise banks, it asks for structural reform that exceeds Greek capacities, and it raises the Greek debt-to-GDP ratio to unsustainable levels. In a few months or quarters, the programme will fail and the Grexit question will flare up again.

Read more ›More on Greek Tax Anticipation Note IOUs

The rumour making the rounds today is that these two paragraphs in a recent Ambrose Evans-Pritchard piece in the Telegraph are what were the final straw for Syriza that cost Yanis Varoufakis his job. I don’t know whether there is any basis to these rumours. However, I do know that Syriza want Greece to remain in the eurozone and that recent decisions by the ECB make it difficult for Greece. So the questions of government IOUs have to asked.

Read more ›A Return to Fundamentals?

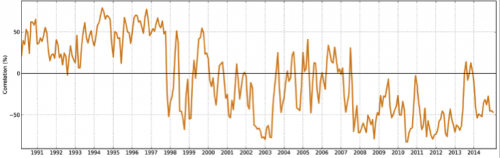

Overall, I don’t see any clear signs that the risk on, risk off mentality, which has ruled since 2008, is finally coming to an end. Yes, correlations have begun to recede a little bit here and there; however, if it is indeed a sign of bigger things to come, it is still very early days.

Read more ›Greek default

Now that Greece has defaulted on its payments to the IMF, I am going to take this article from behind the paywall. The views in it regarding the impact of default and Grexit are still very much operative four months later. I believe that, short of Grexit, Greece’s impact on the rest of Europe and European asset markets is now limited and that contagion risk is really redenomination risk and only materializes in great measure if Greece leaves the eurozone. The original post from 10 Mar 2015 is below.

Read more ›The Euro is a failure

When I was discussing the Greek economic crisis last night with my colleague Ameera David, she asked me who I blame for the mess we are in. I told her I blame the euro because the euro is a monetary union created for political reasons without political union. It is a failure and the Greek crisis shows us one reason why. But I have a catalogue of other reasons. So I have decided to write them down and explain my thinking to you in greater detail.

Read more ›