In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the Consumer Price Index) over time.

Inflation's effects on an economy are various and can be simultaneously positive and negative. Negative effects of inflation include a decrease in the real value of money and other monetary items over time, uncertainty over future inflation which may discourage investment and savings, and if inflation is rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future. Positive effects include ensuring central banks can adjust nominal interest rates (intended to mitigate recessions), and encouraging investment in non-monetary capital projects.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Milton Friedman (July 31, 1912 – November 16, 2006) was an American economist, statistician, and author who taught at the University of Chicago for more than three decades. He was a recipient of the Nobel Memorial Prize in Economic Sciences, and is known for his research on consumption analysis, monetary history and theory, and the complexity of stabilization policy. As a leader of the Chicago school of economics, he influenced the research agenda of the economics profession. A survey of economists ranked Friedman as the second most popular economist of the twentieth century behind John Maynard Keynes, and The Economist described him as "the most influential economist of the second half of the 20th century…possibly of all of it."

Friedman's challenges to what he later called "naive Keynesian" (as opposed to New Keynesian) theory began with his 1950s reinterpretation of the consumption function, and he became the main advocate opposing activist Keynesian government policies. In the late 1960s he described his own approach (along with all of mainstream economics) as using "Keynesian language and apparatus" yet rejecting its "initial" conclusions. During the 1960s he promoted an alternative macroeconomic policy known as "monetarism". He theorized there existed a "natural" rate of unemployment, and argued that governments could increase employment above this rate (e.g., by increasing aggregate demand) only at the risk of causing inflation to accelerate. He argued that the Phillips curve was not stable and predicted what would come to be known as stagflation. Friedman argued that, given the existence of the Federal Reserve, a constant small expansion of the money supply was the only wise policy.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Leonard Susskind (born 1940) is the Felix Bloch Professor of Theoretical Physics at Stanford University. His research interests include string theory, quantum field theory, quantum statistical mechanics and quantum cosmology. He is a member of the National Academy of Sciences, and the American Academy of Arts and Sciences, an associate member of the faculty of Canada's Perimeter Institute for Theoretical Physics, and a distinguished professor of the Korea Institute for Advanced Study.

Susskind is widely regarded as one of the fathers of string theory, having, with Yoichiro Nambu and Holger Bech Nielsen, independently introduced the idea that particles could in fact be states of excitation of a relativistic string. He was the first to introduce the idea of the string theory landscape in 2003.

In 1997, Susskind was awarded the J.J. Sakurai Prize for his "pioneering contributions to hadronic string models, lattice gauge theories, quantum chromodynamics, and dynamical symmetry breaking." Susskind's hallmark, according to colleagues, has been the application of "brilliant imagination and originality to the theoretical study of the nature of the elementary particles and forces that make up the physical world."

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

What is Inflation?

What is Inflation? -

What is Inflation

What is InflationWhat is Inflation

The basics of what price inflation is and how the CPI-U is calculated More free lessons at: http://www.khanacademy.org/video?v=yahEP620480. -

What is Inflation?

What is Inflation?What is Inflation?

Short animation explaining what is Inflation, what is the CPI, how it is calculated and how Inflation should be measured more accurately in Lebanon. This pro... -

Inflation einfach erklärt (by explainity®)

Inflation einfach erklärt (by explainity®)Inflation einfach erklärt (by explainity®)

Der Begriff der Inflation geistert seit geraumer Zeit durch die Medien. Doch was hat es mit der Inflation genau auf sich und wie entsteht sie? explainity ver... -

Inflation and Bubbles and Tulips: Crash Course Economics #7

Inflation and Bubbles and Tulips: Crash Course Economics #7Inflation and Bubbles and Tulips: Crash Course Economics #7

In which Adriene and Jacob teach you about how and why prices rise. Sometimes prices rise as a result of inflation, which is a pretty normal thing for economies to do. We'll talk about how across the board prices rise over time, and how economists track inflation. Bubbles are a pretty normal thing for humans to do. One item, like tulips or beanie babies or houses or tech startups experience a rapid rise in prices. This is often accompanied by speculation, a bunch of outrageous profits, and then a nasty crash when the bubble bursts. People get excited about rising prices, and next thing you know, people are trading their life savings for a tul -

Milton Friedman - Understanding Inflation

Milton Friedman - Understanding InflationMilton Friedman - Understanding Inflation

Professor Friedman explains the origins of money and how inflation both comes about and is cured. http://www.LibertyPen.com. -

Econ Vids for Kids: What is Inflation?

Econ Vids for Kids: What is Inflation?Econ Vids for Kids: What is Inflation?

What is inflation? In this video, we examine how the expansion of a money supply can occur and the effects of inflation on an economy. http://inkwellscholars.org -

Inflation

InflationInflation

Most economists agree that inflation of about 2% or 3% annually is a natural function of a growing economy. But people are worried government stimulus measur... -

What Causes Inflation?

What Causes Inflation?What Causes Inflation?

Why Are White Farmers Losing Their Land In Zimbabwe? - http://testu.be/1e07uOA Subscribe! http://bitly.com/1iLOHml In Zimbabwe, inflation was so bad that the government offered $175 quadrillion Zimbabwe dollars for $5 U.S. dollars. So, what is inflation? Learn More: Zimbabwe offers new exchange rate: $1 for 35,000,000,000,000,000 old dollars http://www.theguardian.com/world/2015/jun/12/zimbabwe-offers-new-exchange-rate-1-for-35000000000000000-old-dollars “Zimbabweans will start exchanging “quadrillions” of local dollars for a few US dollars next week as President Robert Mugabe’s government discards its virtually worthless natio -

Michael Snyder- Deflation then Inflation Through the Roof

Michael Snyder- Deflation then Inflation Through the RoofMichael Snyder- Deflation then Inflation Through the Roof

What do you look out for as a warning sign of the next calamity? Michael Snyder of TheEconomicCollapseblog.com says, “When there is a financial crisis, all of a sudden, banks don’t want to lend. They don’t want to lend to each other, and they don’t want to lend to anyone else. Credit freezes up, and our financial system is based on debt and the flow of money from the banks lending it to the rest of us. I believe we will have a brief period of deflation before the response by the Federal Reserve and the federal government, where we are going to then have tremendous inflation through the roof.” How can this be fixed? It can’t be fixed w -

Der Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HD

Der Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HDDer Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HD

Für mehr neue Dokumentationen in HD bitte abonnieren! Danke! -

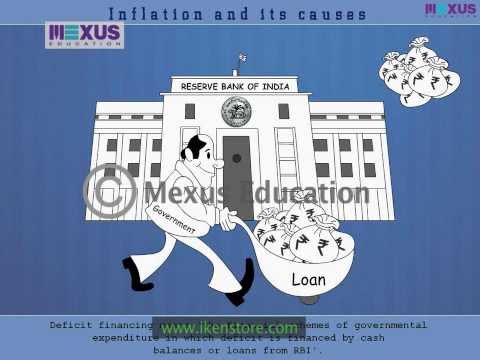

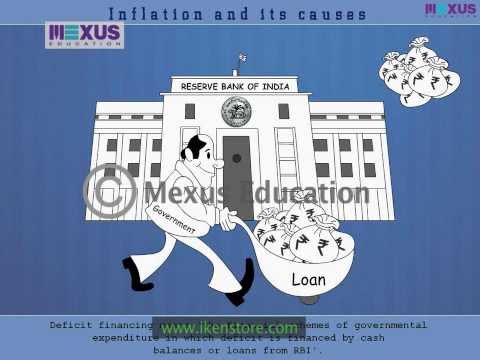

Inflation and its Causes

Inflation and its CausesInflation and its Causes

In this module, the learner will be introduced to two major causes of inflation i.e. increase in demand and decrease in supply and factors that create these ... -

Aspects of Eternal Inflation, Lecture 1 of 4 | Leonard Susskind

Aspects of Eternal Inflation, Lecture 1 of 4 | Leonard SusskindAspects of Eternal Inflation, Lecture 1 of 4 | Leonard Susskind

Leonard Susskind Stanford University July 18, 2011 First of four lectures by Leonard Susskind discussing Aspects of Eternal Inflation at the Prospects in Theoretical Physics 2011 summer workshop. Video can also be found here: http://video.ias.edu -

inflation part 1

inflation part 1inflation part 1

Ias online coaching classes, online coaching classes, Civils online coaching classes, Civil services online coaching classes, Ias coaching classes online, Coaching classes for civil services on Indian History and Indian Economy can be found here http://youtu.be/1vEYtP591Ag

- Aggregate demand

- Alan S. Blinder

- American Civil War

- Arthur O'Sullivan

- Austrian School

- Balance of trade

- Baltimore

- Bank of England

- Banknote

- Bargaining power

- Barter

- Behavioral economics

- Ben Bernanke

- Black Death

- Bretton Woods System

- Bretton Woods system

- Built-in inflation

- Bullion coin

- Business cycles

- Business economics

- Category Economics

- Central bank

- Commodity

- Commodity money

- Consumer price index

- Consumer Price Index

- Core inflation

- Cost of living

- Cost-push inflation

- Creative destruction

- Cultural economics

- Currency board

- David Hume

- David Ricardo

- Deflation

- Demand

- Demand-pull theory

- Depreciation

- Devaluation

- Discount rate

- Disinflation

- Dollars & Sense

- Earl J. Hamilton

- Ecological economics

- Econometrics

- Economic bubble

- Economic geography

- Economic growth

- Economic history

- Economic methodology

- Economic system

- Economics

- Economy

- Economy of Africa

- Economy of Asia

- Economy of Europe

- Economy of Oceania

- Education economics

- Endogenous money

- Equation of exchange

- Exchange rate

- Federal funds rate

- Federal Reserve

- Fiat currency

- Financial asset

- Financial economics

- Fiscal policy

- Fixed exchange rate

- Frederic Mishkin

- Game theory

- GDP deflator

- Gold standard

- Good (economics)

- Habsburg Spain

- Hangover inflation

- Health economics

- Henry Hazlitt

- Heterodox economics

- Hoarding

- Hosni Mubarak

- Hyperinflation

- Incomes policies

- Inflation

- Inflation hedge

- Inflation rate

- Interest rate

- John B. Taylor

- JSTOR

- Kenneth W. Harl

- Keynesian

- Keynesian economics

- Labour (economics)

- Labour economics

- Law and economics

- Leonardo Auernheimer

- Liquidity trap

- List of economists

- Long term

- Macroeconomics

- Managerial economics

- Margaret Thatcher

- Marxian economics

- Means of exchange

- Median

- Menu costs

- Michael C. Burda

- Microeconomics

- Milton Friedman

- Mises Institute

- Monetarism

- Monetary authority

- Monetary economics

- Monetary inflation

- Monetary policy

- Money supply

- Mundell–Tobin effect

- N. Gregory Mankiw

- NAIRU

- NASA

- National accounting

- Netherlands

- New World

- Olivier Blanchard

- Outline of economics

- Paper money

- Personnel economics

- Philips curve

- Phillips curve

- Physical capital

- Post-Keynesian

- Potential output

- Price controls

- Price index

- Price level

- Price revolution

- Price signal

- Price wage spiral

- Producer price index

- Producer Price Index

- Productivity

- Public economics

- Purchasing power

- Ratio

- Real bills doctrine

- Recession

- Recessions

- Reflation

- Regional science

- Relative price

- Reserve requirements

- Reuters-CRB Index

- Richard Nixon

- Robert Barro

- Robert J. Gordon

- Robert P. Murphy

- Robert Zoellick

- Rural economics

- Scarcity

- Seasonally adjusted

- Seigniorage

- Shoe leather cost

- Silver certificate

- Social security

- Speculative attack

- Stagflation

- Statistical noise

- Steady state economy

- Stock

- Supply and demand

- Talk Inflation

- Taylor rule

- The Accord

- The Independent

- Trade-off

- Triangle model

- Tunisian revolution

- Unemployment

- Unit price

- Urban economics

- Value (economics)

- Velocity of money

- Volatility (finance)

- Wassenaar Agreement

- Welfare

- Welfare economics

- Wikipedia Link rot

- William Baumol

- World Bank

-

What is Inflation?

What is Inflation?What is Inflation?

Economists constantly refer to inflation and tend to suggest it is a Very Bad Thing. But why exactly, where does it come from and what could one do to tame it? Please help us to make films by subscribing here: http://tinyurl.com/o28mut7 Brought to you by http://www.theschooloflife.com Produced in collaboration with Vale Productions http://www.valeproductions.co.uk -

What is Inflation

What is InflationWhat is Inflation

The basics of what price inflation is and how the CPI-U is calculated More free lessons at: http://www.khanacademy.org/video?v=yahEP620480. -

What is Inflation?

What is Inflation?What is Inflation?

Short animation explaining what is Inflation, what is the CPI, how it is calculated and how Inflation should be measured more accurately in Lebanon. This pro... -

Inflation einfach erklärt (by explainity®)

Inflation einfach erklärt (by explainity®)Inflation einfach erklärt (by explainity®)

Der Begriff der Inflation geistert seit geraumer Zeit durch die Medien. Doch was hat es mit der Inflation genau auf sich und wie entsteht sie? explainity ver... -

Inflation and Bubbles and Tulips: Crash Course Economics #7

Inflation and Bubbles and Tulips: Crash Course Economics #7Inflation and Bubbles and Tulips: Crash Course Economics #7

In which Adriene and Jacob teach you about how and why prices rise. Sometimes prices rise as a result of inflation, which is a pretty normal thing for economies to do. We'll talk about how across the board prices rise over time, and how economists track inflation. Bubbles are a pretty normal thing for humans to do. One item, like tulips or beanie babies or houses or tech startups experience a rapid rise in prices. This is often accompanied by speculation, a bunch of outrageous profits, and then a nasty crash when the bubble bursts. People get excited about rising prices, and next thing you know, people are trading their life savings for a tul -

Milton Friedman - Understanding Inflation

Milton Friedman - Understanding InflationMilton Friedman - Understanding Inflation

Professor Friedman explains the origins of money and how inflation both comes about and is cured. http://www.LibertyPen.com. -

Econ Vids for Kids: What is Inflation?

Econ Vids for Kids: What is Inflation?Econ Vids for Kids: What is Inflation?

What is inflation? In this video, we examine how the expansion of a money supply can occur and the effects of inflation on an economy. http://inkwellscholars.org -

Inflation

InflationInflation

Most economists agree that inflation of about 2% or 3% annually is a natural function of a growing economy. But people are worried government stimulus measur... -

What Causes Inflation?

What Causes Inflation?What Causes Inflation?

Why Are White Farmers Losing Their Land In Zimbabwe? - http://testu.be/1e07uOA Subscribe! http://bitly.com/1iLOHml In Zimbabwe, inflation was so bad that the government offered $175 quadrillion Zimbabwe dollars for $5 U.S. dollars. So, what is inflation? Learn More: Zimbabwe offers new exchange rate: $1 for 35,000,000,000,000,000 old dollars http://www.theguardian.com/world/2015/jun/12/zimbabwe-offers-new-exchange-rate-1-for-35000000000000000-old-dollars “Zimbabweans will start exchanging “quadrillions” of local dollars for a few US dollars next week as President Robert Mugabe’s government discards its virtually worthless natio -

Michael Snyder- Deflation then Inflation Through the Roof

Michael Snyder- Deflation then Inflation Through the RoofMichael Snyder- Deflation then Inflation Through the Roof

What do you look out for as a warning sign of the next calamity? Michael Snyder of TheEconomicCollapseblog.com says, “When there is a financial crisis, all of a sudden, banks don’t want to lend. They don’t want to lend to each other, and they don’t want to lend to anyone else. Credit freezes up, and our financial system is based on debt and the flow of money from the banks lending it to the rest of us. I believe we will have a brief period of deflation before the response by the Federal Reserve and the federal government, where we are going to then have tremendous inflation through the roof.” How can this be fixed? It can’t be fixed w -

Der Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HD

Der Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HDDer Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HD

Für mehr neue Dokumentationen in HD bitte abonnieren! Danke! -

Inflation and its Causes

Inflation and its CausesInflation and its Causes

In this module, the learner will be introduced to two major causes of inflation i.e. increase in demand and decrease in supply and factors that create these ... -

Aspects of Eternal Inflation, Lecture 1 of 4 | Leonard Susskind

Aspects of Eternal Inflation, Lecture 1 of 4 | Leonard SusskindAspects of Eternal Inflation, Lecture 1 of 4 | Leonard Susskind

Leonard Susskind Stanford University July 18, 2011 First of four lectures by Leonard Susskind discussing Aspects of Eternal Inflation at the Prospects in Theoretical Physics 2011 summer workshop. Video can also be found here: http://video.ias.edu -

inflation part 1

inflation part 1inflation part 1

Ias online coaching classes, online coaching classes, Civils online coaching classes, Civil services online coaching classes, Ias coaching classes online, Coaching classes for civil services on Indian History and Indian Economy can be found here http://youtu.be/1vEYtP591Ag -

World Events Mean Deflation First, Then Inflation

World Events Mean Deflation First, Then InflationWorld Events Mean Deflation First, Then Inflation

More: http://www.hiddensecretsofmoney.com "The reason I think that deflation has to happen first is because looking throughout all of history, I can't find a... -

Explaining Inflation | by Wall Street Survivor

Explaining Inflation | by Wall Street SurvivorExplaining Inflation | by Wall Street Survivor

What is Inflation? Inflation is the overall rise in prices of goods and services in the economy. Inflation is THE reason you need to be investing; inflation ... -

Crash Course: Chapter 10 - Inflation by Chris Martenson

Crash Course: Chapter 10 - Inflation by Chris MartensonCrash Course: Chapter 10 - Inflation by Chris Martenson

Chapter 10 (Inflation): Dr. Martenson establishes inflation as a monetary phenomenon, defined as the decrease of the value of money, caused by too much money... -

EconMovies 6: Back to the Future (Nominal vs. Real, Unemployment, Inflation)

EconMovies 6: Back to the Future (Nominal vs. Real, Unemployment, Inflation)EconMovies 6: Back to the Future (Nominal vs. Real, Unemployment, Inflation)

EconMovies explain economic concepts through movies. In this episode, I use the Back to the Future Trilogy to introduce the concepts of GDP growth, Nominal G... -

16. Qu'est-ce que l'inflation ?

16. Qu'est-ce que l'inflation ?16. Qu'est-ce que l'inflation ?

Qu'est-ce que l'inflation ? Dans cette vidéo, nous analysons les causes et les conséquences de l'inflation, en lien avec la création monétaire. -

BambiBlaze Body Inflation: Dr. Blimp 7

BambiBlaze Body Inflation: Dr. Blimp 7BambiBlaze Body Inflation: Dr. Blimp 7

Of all the BB videos in my archive, this one is my personal favorite. It has everything I want to see in a BB video, its only one part, so it doesn't drag for a minute, and panties. -

Inflation Commercials

Inflation CommercialsInflation Commercials

A couple of good old commercials I used to love when I was younger. The first one was really, really, REALLY HARD to find, but making deep searching I found it for you guys. It is a commercial for "Peñafiel Agua Mineral" (Mexico) The second one is from "Rexona Teens" Thank you all for your support and please subscribe MORE VIDEOS COMING!! -

Princess Maydine's Blueberry inflation (Extended Version)

Princess Maydine's Blueberry inflation (Extended Version)Princess Maydine's Blueberry inflation (Extended Version)

I kept my promise, all you fans. It maybe different but it worth it, so i hope you still love it, but please respect my youngest cousin, she's the one that voiced Princess Maydine and I voiced the random bird. I hope putting the oompa loompa song on intro is good enough for you. I also added some new sounds and the juicing room scene too. -

Gravitational Wave Discovery! Evidence of Cosmic Inflation

Gravitational Wave Discovery! Evidence of Cosmic InflationGravitational Wave Discovery! Evidence of Cosmic Inflation

Baby photos of our universe show huge early growth spurt! Check out Audible: http://bit.ly/AudibleVe Regression to the Mean: http://bit.ly/1lgZQAQ Some clari...

- Order: Reorder

- Duration: 8:01

- Updated: 03 Aug 2015

- published: 03 Aug 2015

- views: 11417

- Order: Reorder

- Duration: 3:30

- Updated: 31 Aug 2014

- author: Khan Academy

- published: 21 Jul 2011

- views: 68493

- author: Khan Academy

- Order: Reorder

- Duration: 3:45

- Updated: 31 Jul 2014

- author: TheLEAproject

- published: 13 Jun 2012

- views: 26937

- author: TheLEAproject

- Order: Reorder

- Duration: 4:24

- Updated: 06 Sep 2014

- author: explainity einfach erklärt

- published: 27 Jan 2012

- views: 168466

- author: explainity einfach erklärt

- Order: Reorder

- Duration: 10:25

- Updated: 13 Sep 2015

- published: 13 Sep 2015

- views: 6459

- Order: Reorder

- Duration: 13:42

- Updated: 03 Sep 2014

- author: LibertyPen

- published: 24 Mar 2014

- views: 17912

- author: LibertyPen

- Order: Reorder

- Duration: 7:41

- Updated: 09 Jun 2014

- published: 09 Jun 2014

- views: 41

- Order: Reorder

- Duration: 8:12

- Updated: 04 Sep 2014

- author: APM Marketplace

- published: 03 Sep 2009

- views: 110784

- author: APM Marketplace

- Order: Reorder

- Duration: 3:32

- Updated: 07 Jul 2015

- published: 07 Jul 2015

- views: 7507

- Order: Reorder

- Duration: 25:37

- Updated: 22 Oct 2014

- published: 22 Oct 2014

- views: 2625

- Order: Reorder

- Duration: 43:31

- Updated: 11 Mar 2015

- published: 11 Mar 2015

- views: 39

- published: 06 Dec 2012

- views: 17839

- author: Iken Edu

- Order: Reorder

- Duration: 87:19

- Updated: 24 Nov 2014

- published: 24 Nov 2014

- views: 5

- Order: Reorder

- Duration: 24:43

- Updated: 21 Aug 2013

- published: 21 Aug 2013

- views: 16

- Order: Reorder

- Duration: 9:40

- Updated: 03 Sep 2014

- author: Mike Maloney

- published: 05 Aug 2014

- views: 40815

- author: Mike Maloney

- Order: Reorder

- Duration: 1:27

- Updated: 31 Aug 2014

- author: Wall Street Survivor

- published: 18 Jan 2012

- views: 19515

- author: Wall Street Survivor

- Order: Reorder

- Duration: 11:49

- Updated: 25 Aug 2014

- author: ChrisMartensondotcom

- published: 27 Feb 2009

- views: 203839

- author: ChrisMartensondotcom

- Order: Reorder

- Duration: 6:30

- Updated: 02 Sep 2014

- author: ACDCLeadership

- published: 13 Feb 2014

- views: 5262

- author: ACDCLeadership

- Order: Reorder

- Duration: 5:35

- Updated: 28 Aug 2014

- author: Nicolas Olivier

- published: 21 Jan 2014

- views: 1813

- author: Nicolas Olivier

- Order: Reorder

- Duration: 9:47

- Updated: 04 May 2015

- published: 04 May 2015

- views: 3253

- Order: Reorder

- Duration: 1:07

- Updated: 07 Apr 2015

- published: 07 Apr 2015

- views: 21

- Order: Reorder

- Duration: 4:56

- Updated: 13 Aug 2015

- published: 13 Aug 2015

- views: 566

- Order: Reorder

- Duration: 10:42

- Updated: 06 Sep 2014

- author: Veritasium

- published: 25 Mar 2014

- views: 462455

- author: Veritasium

What is Inflation?

- published: 03 Aug 2015

- views: 11417

What is Inflation

- published: 21 Jul 2011

- views: 68493

- author: Khan Academy

What is Inflation?

- published: 13 Jun 2012

- views: 26937

- author: TheLEAproject

Inflation einfach erklärt (by explainity®)

- published: 27 Jan 2012

- views: 168466

- author: explainity einfach erklärt

Inflation and Bubbles and Tulips: Crash Course Economics #7

- published: 13 Sep 2015

- views: 6459

Milton Friedman - Understanding Inflation

- published: 24 Mar 2014

- views: 17912

- author: LibertyPen

Econ Vids for Kids: What is Inflation?

- published: 09 Jun 2014

- views: 41

Inflation

- published: 03 Sep 2009

- views: 110784

- author: APM Marketplace

What Causes Inflation?

- published: 07 Jul 2015

- views: 7507

Michael Snyder- Deflation then Inflation Through the Roof

- published: 22 Oct 2014

- views: 2625

Der Euro fällt immer mehr - Deutschlands Inflation 2016 - Dokumentation 2015 Neu in HD

- published: 11 Mar 2015

- views: 39

Inflation and its Causes

- published: 06 Dec 2012

- views: 17839

- author: Iken Edu

Aspects of Eternal Inflation, Lecture 1 of 4 | Leonard Susskind

- published: 24 Nov 2014

- views: 5

inflation part 1

- published: 21 Aug 2013

- views: 16

- 1

- 2

- 3

- 4

- 5

- Next page »

- Lyrics: play full screen play karaoke

- Inflation - Whitest Boy Alive

Painless

So easy

You come fast

And leave me

Half a life

For one kiss

Inflation

And now this

The player game

Innocently

Was always there

But used to be

Only one way

To feel love

But now it is