- Loading...

-

Basic Income Tax Course - Part 1

Basic Income Tax Course - Part 1 -

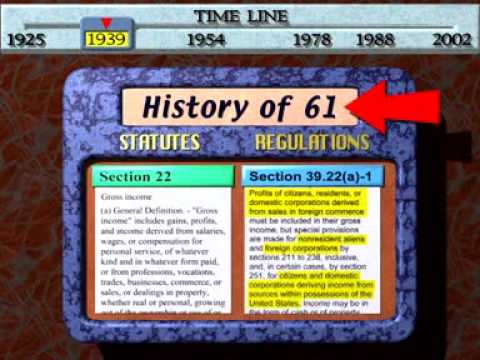

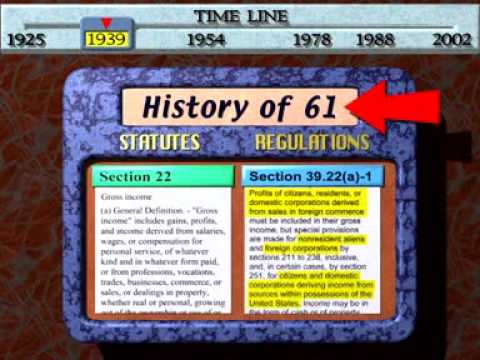

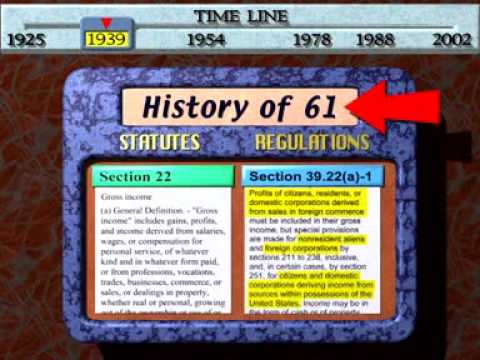

Theft By Deception - Deciphering The Federal Income Tax

Theft By Deception - Deciphering The Federal Income TaxTheft By Deception - Deciphering The Federal Income Tax

The misrepresentation and misapplication of the United States federal income tax constitutes the largest acquisition of wealth by way of deception in history... -

How Did We Start Paying Income Tax?

How Did We Start Paying Income Tax?How Did We Start Paying Income Tax?

The US tax system is notoriously complex, but where did it come from? How did it end up this way, and what sort of alternatives have people proposed? Join Ben Bowlin to learn more about the bizarre evolution of taxes. Whether the topic is popcorn or particle physics, you can count on the HowStuffWorks team to explore - and explain - the everyday science in the world around us on BrainStuff. Download the New TestTube iOS app! http://testu.be/1ndmmMq Watch More BrainStuff on TestTube http://testtube.com/brainstuff Subscribe Now! http://www.youtube.com/subscription_center?add_user=brainstuffshow Watch More http://www.youtube.com/BrainStuffS -

IPCC - Income Tax - Salary - Lecture 1

IPCC - Income Tax - Salary - Lecture 1IPCC - Income Tax - Salary - Lecture 1

Full 1st Lecture of Salary. -

Federal Income Tax - Why you should not pay

Federal Income Tax - Why you should not payFederal Income Tax - Why you should not pay

This clip comes from Aaron Russo's film, America: Freedom to Fascism. You can watch the film online @ http://video.google.com/videoplay?docid=-16568803038673... -

Income Tax - How it is calculated?

Income Tax - How it is calculated?Income Tax - How it is calculated?

This is the basics of Income Tax Calculation for those who don't maintain NRI status. -

How to Calculate Income Tax in India 2013 - Part 1

How to Calculate Income Tax in India 2013 - Part 1How to Calculate Income Tax in India 2013 - Part 1

This Sunday, My Mistri's two children came to me for taking my help in the calculation of Income Tax. From 5 years, I did not teach offline, but his father i... -

Income Tax - AY 14-15 - Salary - Lecture 1

Income Tax - AY 14-15 - Salary - Lecture 1Income Tax - AY 14-15 - Salary - Lecture 1

Download all assignment @ www.badlanionline.com. -

Paying income tax in America is Voluntary

Paying income tax in America is VoluntaryPaying income tax in America is Voluntary

When you can't dazzle them with brilliance, baffle them with bullshit. Idiot Harry Reid maintains that paying income tax is voluntary in the U.S.. Harry Reid... -

Personal Income Taxes - A Visual Explanation

Personal Income Taxes - A Visual ExplanationPersonal Income Taxes - A Visual Explanation

A visual explanation of the words used in your personal income tax return. To learn more about your taxes, go to: http://www.seeingfinance.com/category/tax/ -

Milton Friedman - The Negative Income Tax

Milton Friedman - The Negative Income TaxMilton Friedman - The Negative Income Tax

In this 1968 interview, Milton Friedman explained the negative income tax, a proposal that at minimum would save taxpayers the 72 percent of our current welf... -

2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)

2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)

My facebook page for filing returns is www.facebook.com/filingreturnsonline In the hour long video showing possibly everything needed to know ,topic's covere... -

I am innocent, have answered all income tax queries: Pankaj Lodhiya

I am innocent, have answered all income tax queries: Pankaj LodhiyaI am innocent, have answered all income tax queries: Pankaj Lodhiya

After being named by the government in its affidavit on black money, Rajkot-based bullion trader Pankaj Chimanlal Lodhiya tells NDTV that he is innocent and neither he nor his family members have any Swiss bank accounts. He says he got the income tax notice 3-4 months ago and has answered all their queries. Watch full video: http://www.ndtv.com/video/player/the-buck-stops-here/black-money-bomb-political-explosion-or-anti-climax/342893?yt -

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1

Full 1st lecture of Introduction of Income Tax.

- Adam Smith

- American Civil War

- Balance sheet

- Black market

- Capital gain

- Capital gains tax

- Civilization

- Company (law)

- Consumption tax

- Corporate tax

- Customs

- Deferred tax

- Direct tax

- Disability

- Dividend

- Dividend tax

- Double taxation

- Duty (economics)

- Eastern Han Dynasty

- Economic rent

- Economy

- Employee

- Employer

- Excess profits tax

- Excise

- Export

- Fiscal policy

- Flat tax

- Frank Chodorov

- Free trade

- Free trade zone

- Georgism

- Gift tax

- Government revenue

- Graduated income tax

- Gross receipts tax

- Henry II of England

- Ideologies

- Import

- Income

- Income tax

- Income tax in Canada

- Income tax in India

- Income tax threshold

- Indirect tax

- Inheritance tax

- Interest

- Investing

- Karl Marx

- Laffer curve

- Laissez-faire

- Land value tax

- Layperson

- Lifetime income tax

- Local income tax

- Means of production

- Money

- Napoleonic Wars

- National sales tax

- Negative income tax

- Non-tax revenue

- Old pence

- Optimal tax

- Panic of 1893

- Papal income tax

- PAYE

- PAYG

- Payroll tax

- Per unit tax

- Pigovian tax

- Pound Sterling

- Profit (accounting)

- Progressive tax

- Property tax

- Proportional tax

- Punch (magazine)

- Real property

- Regressive tax

- Revenue Act of 1861

- Revenue service

- Revenue stamp

- Russian Tax Code

- Saladin tithe

- Sales tax

- Saving

- Shilling

- Sin tax

- Slaves

- Smuggling

- Social insurance

- Social security

- Spahn tax

- Stamp duty

- Tariff

- Tariff war

- Tax

- Tax advantage

- Tax assessment

- Tax avoidance

- Tax bracket

- Tax collection

- Tax competition

- Tax credit

- Tax cut

- Tax deduction

- Tax equalization

- Tax evasion

- Tax exemption

- Tax farming

- Tax harmonization

- Tax haven

- Tax holiday

- Tax in rem

- Tax incentive

- Tax incidence

- Tax investigation

- Tax law

- Tax lien

- Tax noncompliance

- Tax policy

- Tax preparation

- Tax rate

- Tax reform

- Tax refund

- Tax residence

- Tax resistance

- Tax revenue

- Tax shelter

- Tax shield

- Tax shift

- Tax treaty

- Tax year

- Taxable income

- Taxation in Bhutan

- Taxation in Canada

- Taxation in Colombia

- Taxation in France

- Taxation in Germany

- Taxation in Greece

- Taxation in Iceland

- Taxation in India

- Taxation in Iran

- Taxation in Israel

- Taxation in Italy

- Taxation in Japan

- Taxation in Pakistan

- Taxation in Peru

- Taxation in Sweden

- Taxation in Tanzania

- Taxpayer

- Taxpayer groups

- Template Taxation

- Third Crusade

- Tithe

- Tobin tax

- Trade

- Trade pact

- Turnover tax

- Unemployment

- Value added tax

- Wage

- Wages

- Wang Mang

- Wealth

- Wealth tax

- Wilson-Gorman tariff

- Windfall profits tax

- Withholding tax

- Xin Dynasty

-

Basic Income Tax Course - Part 1

Basic Income Tax Course - Part 1Basic Income Tax Course - Part 1

Basic Income Tax taught by Professor Lisa Cole, 15 parts. -

Theft By Deception - Deciphering The Federal Income Tax

Theft By Deception - Deciphering The Federal Income TaxTheft By Deception - Deciphering The Federal Income Tax

The misrepresentation and misapplication of the United States federal income tax constitutes the largest acquisition of wealth by way of deception in history... -

How Did We Start Paying Income Tax?

How Did We Start Paying Income Tax?How Did We Start Paying Income Tax?

The US tax system is notoriously complex, but where did it come from? How did it end up this way, and what sort of alternatives have people proposed? Join Ben Bowlin to learn more about the bizarre evolution of taxes. Whether the topic is popcorn or particle physics, you can count on the HowStuffWorks team to explore - and explain - the everyday science in the world around us on BrainStuff. Download the New TestTube iOS app! http://testu.be/1ndmmMq Watch More BrainStuff on TestTube http://testtube.com/brainstuff Subscribe Now! http://www.youtube.com/subscription_center?add_user=brainstuffshow Watch More http://www.youtube.com/BrainStuffS -

IPCC - Income Tax - Salary - Lecture 1

IPCC - Income Tax - Salary - Lecture 1IPCC - Income Tax - Salary - Lecture 1

Full 1st Lecture of Salary. -

Federal Income Tax - Why you should not pay

Federal Income Tax - Why you should not payFederal Income Tax - Why you should not pay

This clip comes from Aaron Russo's film, America: Freedom to Fascism. You can watch the film online @ http://video.google.com/videoplay?docid=-16568803038673... -

Income Tax - How it is calculated?

Income Tax - How it is calculated?Income Tax - How it is calculated?

This is the basics of Income Tax Calculation for those who don't maintain NRI status. -

How to Calculate Income Tax in India 2013 - Part 1

How to Calculate Income Tax in India 2013 - Part 1How to Calculate Income Tax in India 2013 - Part 1

This Sunday, My Mistri's two children came to me for taking my help in the calculation of Income Tax. From 5 years, I did not teach offline, but his father i... -

Income Tax - AY 14-15 - Salary - Lecture 1

Income Tax - AY 14-15 - Salary - Lecture 1Income Tax - AY 14-15 - Salary - Lecture 1

Download all assignment @ www.badlanionline.com. -

Paying income tax in America is Voluntary

Paying income tax in America is VoluntaryPaying income tax in America is Voluntary

When you can't dazzle them with brilliance, baffle them with bullshit. Idiot Harry Reid maintains that paying income tax is voluntary in the U.S.. Harry Reid... -

Personal Income Taxes - A Visual Explanation

Personal Income Taxes - A Visual ExplanationPersonal Income Taxes - A Visual Explanation

A visual explanation of the words used in your personal income tax return. To learn more about your taxes, go to: http://www.seeingfinance.com/category/tax/ -

Milton Friedman - The Negative Income Tax

Milton Friedman - The Negative Income TaxMilton Friedman - The Negative Income Tax

In this 1968 interview, Milton Friedman explained the negative income tax, a proposal that at minimum would save taxpayers the 72 percent of our current welf... -

2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)

2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)

My facebook page for filing returns is www.facebook.com/filingreturnsonline In the hour long video showing possibly everything needed to know ,topic's covere... -

I am innocent, have answered all income tax queries: Pankaj Lodhiya

I am innocent, have answered all income tax queries: Pankaj LodhiyaI am innocent, have answered all income tax queries: Pankaj Lodhiya

After being named by the government in its affidavit on black money, Rajkot-based bullion trader Pankaj Chimanlal Lodhiya tells NDTV that he is innocent and neither he nor his family members have any Swiss bank accounts. He says he got the income tax notice 3-4 months ago and has answered all their queries. Watch full video: http://www.ndtv.com/video/player/the-buck-stops-here/black-money-bomb-political-explosion-or-anti-climax/342893?yt -

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1

Full 1st lecture of Introduction of Income Tax. -

Bill Gates: Don't tax my income, tax my consumption

Bill Gates: Don't tax my income, tax my consumptionBill Gates: Don't tax my income, tax my consumption

Microsoft founder and Gates Foundation chief Bill Gates tells AEI that if he's supposed to feel guilty about his wealth, then it won't be about his income, b... -

income tax e-filing (ITR 1 for salaried person)

income tax e-filing (ITR 1 for salaried person)income tax e-filing (ITR 1 for salaried person)

Know how to file your income tax return online. * Live e-filing of income tax return for your guidance. * Learn how to file your income tax return in simple ... -

The Truth Behind The Income Tax

The Truth Behind The Income TaxThe Truth Behind The Income Tax

Two-hour introduction to the basic issues revolving around the income tax. Learn about the nature of currency, and how employees of the Treasury Department, ... -

Irwin Schiff's Secrets of Living an Income Tax-Free Life

Irwin Schiff's Secrets of Living an Income Tax-Free LifeIrwin Schiff's Secrets of Living an Income Tax-Free Life

Irwin Schiff has heroically released this Important Information for FREE here on Google Video. You already have seen our hero, Irwin Schiff, on America Freed... -

Step 5 (Filing Tax return ) How to fill the Java Income tax Return(ITR 1 ) (AY 2014 15 )

Step 5 (Filing Tax return ) How to fill the Java Income tax Return(ITR 1 ) (AY 2014 15 )Step 5 (Filing Tax return ) How to fill the Java Income tax Return(ITR 1 ) (AY 2014 15 )

Before the normal description , know that you people always have me with you ...if you ever have any problem or face any issues during return filing , you ca... -

The Illegitimacy of The Income Tax System

The Illegitimacy of The Income Tax SystemThe Illegitimacy of The Income Tax System

Joseph R. (Joe) Banister, a former IRS Criminal Investigation Division Special Agent who learned of serious constitutional questions relating to the federal ... -

U.S. Constitution & Income Tax - Tom Cryer - 2009

U.S. Constitution & Income Tax - Tom Cryer - 2009U.S. Constitution & Income Tax - Tom Cryer - 2009

Presented by Constitutional Attorney, Tom Cryer, who personally beat the IRS in court. A unanimous jury of 12 citizens on July 11, 2007 found Tom Cryer not g... -

CFA Level I Income Taxes Video Lecture by Mr. Arif Irfanullah Part 1

CFA Level I Income Taxes Video Lecture by Mr. Arif Irfanullah Part 1CFA Level I Income Taxes Video Lecture by Mr. Arif Irfanullah Part 1

This CFA Level I video covers concepts related to: • Tax Terminology • Accounting Profit Vs. Taxable Income • Tax Base vs Carrying Value • Deferred Tax Liabi... -

The Three Stooges - Income Tax Sappy (1954)

The Three Stooges - Income Tax Sappy (1954)The Three Stooges - Income Tax Sappy (1954)

The Stooges start a business as crooked tax advisors and get rich.

- Duration: 26:58

- Updated: 30 Aug 2014

- published: 11 Aug 2009

- views: 107495

- author: JCCCvideo

- Duration: 87:52

- Updated: 04 Sep 2014

- published: 02 Nov 2012

- views: 13968

- author: MasterpieceConCen7

- Duration: 5:38

- Updated: 15 Apr 2014

- published: 15 Apr 2014

- views: 4292

- Duration: 64:45

- Updated: 01 Sep 2014

- Duration: 9:55

- Updated: 06 Sep 2014

- published: 01 Apr 2008

- views: 115151

- author: hempsavetheworld

- Duration: 6:43

- Updated: 31 Aug 2014

- published: 13 Jul 2012

- views: 23162

- author: Sriram Balasubramanian

- Duration: 5:46

- Updated: 03 Aug 2013

- published: 07 Mar 2013

- views: 1824

- author: svtuition

- Duration: 81:10

- Updated: 04 Sep 2014

- published: 03 Jan 2014

- views: 24485

- author: CA dilip badlani

- Duration: 4:31

- Updated: 02 Sep 2014

- published: 01 Apr 2008

- views: 2114583

- author: AlliDrac

- Duration: 4:05

- Updated: 11 Feb 2014

- published: 08 Apr 2009

- views: 10878

- author: Paul Van Slembrouck

- Duration: 14:46

- Updated: 05 Sep 2014

- published: 11 May 2012

- views: 56805

- author: LibertyPen

- Duration: 63:05

- Updated: 02 Sep 2014

- published: 28 Jul 2013

- views: 57743

- author: Amlan Dutta

- Duration: 4:22

- Updated: 27 Oct 2014

- published: 27 Oct 2014

- views: 274

- Duration: 76:36

- Updated: 06 Sep 2014

- published: 25 Dec 2013

- views: 10890

- author: CA dilip badlani

- Duration: 1:45

- Updated: 05 Sep 2014

- published: 13 Mar 2014

- views: 32232

- author: American Enterprise Institute

- Duration: 14:30

- Updated: 02 Sep 2014

- published: 25 Jun 2014

- views: 9896

- author: murga g

- Duration: 117:41

- Updated: 20 Aug 2014

- published: 27 Nov 2012

- views: 2552

- author: Michael Nixson

- Duration: 117:41

- Updated: 06 Sep 2014

- published: 17 Nov 2012

- views: 14813

- author: Kurt Annaheim

- Duration: 24:50

- Updated: 05 Sep 2014

- published: 14 May 2014

- views: 11137

- author: Amlan Dutta

- Duration: 54:19

- Updated: 24 Aug 2014

- published: 15 Dec 2012

- views: 25541

- author: TheAlexJonesChannel

- Duration: 385:55

- Updated: 24 Aug 2014

- published: 16 Jan 2012

- views: 8846

- author: freedomlawschool

- Duration: 26:11

- Updated: 23 Aug 2014

- published: 10 Sep 2011

- views: 18125

- author: Irfanullah Financial Training

- Duration: 16:30

- Updated: 09 Aug 2013

- published: 16 Apr 2012

- views: 33169

- author: gvsher

-

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 2

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 2CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 2

Full 2nd lecture of Capital Gain. -

BJP considers abolishing income tax: can it work?

BJP considers abolishing income tax: can it work?BJP considers abolishing income tax: can it work?

Left, Right & Centre: In a radical move, the BJP considers abolishing income tax altogether if it comes to power. Is this super sop practical and feasible? C... -

1 (CA Practise )How to file income tax return(ITR 1 )online(AY 2013 14 )(Hindi)

1 (CA Practise )How to file income tax return(ITR 1 )online(AY 2013 14 )(Hindi)1 (CA Practise )How to file income tax return(ITR 1 )online(AY 2013 14 )(Hindi)

The aim of this tutorial is to know that you could file your return yourself and not give it to CA/financial analyst or advertisers seeking your details for ... -

CSE 103 Class 6 Topic''Income tax''

CSE 103 Class 6 Topic''Income tax''CSE 103 Class 6 Topic''Income tax''

http://www.kenthovindblog.com/?page_id=391 http://www.youtube.com/watch?v=ZKeaw7HPG04 Creation Science Evangelism Classes from Kent Hovind.wide spread of top... -

CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 1

CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 1CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 1

Full first lecture of IHP. -

CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 2

CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 2CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 2

Full 2nd lecture of IHP. -

CA - IPCC - Income Tax - AY 14-15 - PGBP - Lecture 1

CA - IPCC - Income Tax - AY 14-15 - PGBP - Lecture 1CA - IPCC - Income Tax - AY 14-15 - PGBP - Lecture 1

Get all the assignment @ www.badlanionline.com. -

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

http://www.milescpareview.com/ Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns ... -

Income Tax - AY 14-15 - Deductions - Sec 80 - Lecture 1

Income Tax - AY 14-15 - Deductions - Sec 80 - Lecture 1Income Tax - AY 14-15 - Deductions - Sec 80 - Lecture 1

www.badlanionline.com. -

Former IRS agent who quit and challenge the Federal Income Tax - John Turner

Former IRS agent who quit and challenge the Federal Income Tax - John TurnerFormer IRS agent who quit and challenge the Federal Income Tax - John Turner

The former IRS collection agent who courageously resigned form the IRS when he saw conclusive proof that the Federal Income Tax is unconstitutional and illeg... -

(ITR 1 )10 steps to file your income tax return online (Income Tax return filing )

(ITR 1 )10 steps to file your income tax return online (Income Tax return filing )(ITR 1 )10 steps to file your income tax return online (Income Tax return filing )

(Redone with Video Cam and Music )In the hour long video showing possibly everything needed to know ,topic's covered include (1) Create registration in the i...

- Duration: 73:38

- Updated: 04 Sep 2014

- Duration: 22:05

- Updated: 22 Jul 2014

- published: 06 Jan 2014

- views: 4859

- author: NDTV

- Duration: 65:30

- Updated: 02 Sep 2014

- published: 28 Jul 2013

- views: 44804

- author: Amlan Dutta

- Duration: 78:13

- Updated: 05 Sep 2014

- published: 14 Apr 2012

- views: 5697

- author: JesusLostChildren777

- Duration: 35:46

- Updated: 03 Sep 2014

- Duration: 65:57

- Updated: 21 Aug 2014

- Duration: 67:51

- Updated: 31 Aug 2014

- published: 19 Oct 2013

- views: 8006

- author: CA dilip badlani

- Duration: 62:18

- Updated: 04 Sep 2014

- published: 08 Oct 2013

- views: 7915

- author: Miles CPAReview

- Duration: 54:20

- Updated: 04 Sep 2014

- Duration: 46:52

- Updated: 04 Sep 2014

- published: 13 Jan 2012

- views: 24000

- author: freedomlawschool

- Duration: 44:41

- Updated: 02 Sep 2014

- published: 24 Sep 2013

- views: 18554

- author: Amlan Dutta

-

Income Tax Trailer

Income Tax TrailerIncome Tax Trailer

Trailer -

michael murray greenville sc pay calculator 1-864-475-1571 michael murray greenville sc pay calcu

michael murray greenville sc pay calculator 1-864-475-1571 michael murray greenville sc pay calcumichael murray greenville sc pay calculator 1-864-475-1571 michael murray greenville sc pay calcu

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our service is flexible and uncomplicated to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Remove Your Payroll Pains So You Can Focus On Expanding Your Business. michael murray greenville sc pay calculator 1-864-475-1571 michael murray greenville sc pay calculator michael murray greenville sc pay calculator michael murray greenville sc pay calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator -

michael murray greenville sc paycheck calculator 8644751571 michael murray greenville sc paycheck

michael murray greenville sc paycheck calculator 8644751571 michael murray greenville sc paycheckmichael murray greenville sc paycheck calculator 8644751571 michael murray greenville sc paycheck

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our system is flexible and uncomplicated to use. There is absolutely nothing to learn and relearn with each payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Expanding Your Business. michael murray greenville sc paycheck calculator 864.475.1571 michael murray greenville sc paycheck calculator michael murray greenville sc paycheck calculator michael murray greenville sc paycheck calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take ho -

michael murray greenville sc income tax calculator 1 8644751571 michael murray greenville sc incom

michael murray greenville sc income tax calculator 1 8644751571 michael murray greenville sc incommichael murray greenville sc income tax calculator 1 8644751571 michael murray greenville sc incom

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our product is flexible and uncomplicated to use. There is nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Alleviate Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc income tax calculator 1. 864.475.1571 michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take h -

michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculat

michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculatmichael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculat

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our system is flexible and simple to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculator michael murray greenville sc tax calculator michael murray greenville sc tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calcu -

michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculat

michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculatmichael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculat

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our system is flexible and esy to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Concentrate On Growing Your Business. michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculator michael murray greenville sc tax calculator michael murray greenville sc tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay ca -

michael murray greenville sc IRS Forms 864-475-1571 michael murray greenville sc IRS Forms

michael murray greenville sc IRS Forms 864-475-1571 michael murray greenville sc IRS Formsmichael murray greenville sc IRS Forms 864-475-1571 michael murray greenville sc IRS Forms

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our product is flexible and esy to use. There is not a thing to learn and relearn with each payroll. Just click it and forget it. Let Us Alleviate Your Payroll Pains So You Can Concentrate On Expanding Your Business. michael murray greenville sc IRS Forms 864-475-1571 michael murray greenville sc IRS Forms michael murray greenville sc IRS Forms michael murray greenville sc IRS Forms,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculato -

10 Year-End Tax Moves to Make Now

10 Year-End Tax Moves to Make Now10 Year-End Tax Moves to Make Now

April 15 is the target date for taxes, but to ensure that you pay the Internal Revenue Service the least possible amount on that date, you need to make some tax moves before the tax year ends. Congress is not making that easy. Once again, U.S. representatives and senators have delayed action on tax extenders, more than 50 business and individual tax breaks that expired on Dec. 31, 2013. Lawmakers are expected to consider, or extend (hence the laws' collective name) after the Nov. 4 election. The bad news is that there is no guarantee that all the extenders - including popular things such as the higher education tuition and fees deduction, and -

Encuentro norteño el income tax paco

Encuentro norteño el income tax pacoEncuentro norteño el income tax paco

-

UK: "We reject devolved income tax powers to Scotland," says Brown

UK: "We reject devolved income tax powers to Scotland," says BrownUK: "We reject devolved income tax powers to Scotland," says Brown

W/S Houses of Parliament, London SOT, Gordon Brown, MP for Kirkcaldy and Cowdenbeath (in English): "There are areas where we would have to ask the Conservatives to accept Labour and Liberal Democrat proposals, including the entrenchment of the Scottish parliament and the Constitution, new powers over the work programme, the Crown Estate, the Wales Franchise, borrowing for infrastructure, the executive authority for UK safety and equalities and employment law. There are also areas where I would ask Labour and the Liberal Democrats to accept the Conservative proposals for a fiscal commission and for an annual statement for tax-payers on how th -

Income Tax Laws On Alimony In Georgia

Income Tax Laws On Alimony In GeorgiaIncome Tax Laws On Alimony In Georgia

Save Money on Amazon using this link! http://www.amazon.com/?tag=camcam0a8-20 -

Will a Wealth Tax Fix Income Inequality Video Bloomberg

Will a Wealth Tax Fix Income Inequality Video BloombergWill a Wealth Tax Fix Income Inequality Video Bloomberg

-

El Income Tax ATRAILERADOS EN FARGOS VIVO BAR

El Income Tax ATRAILERADOS EN FARGOS VIVO BAREl Income Tax ATRAILERADOS EN FARGOS VIVO BAR

Contrataciones En Monterrey NL 11577905. 17389397. 8110411423 Juan Rocha Jonhhy Gutierrez -

michael murray greenville sc wage calculator 8644751571 michael murray greenville sc wage calcula

michael murray greenville sc wage calculator 8644751571 michael murray greenville sc wage calculamichael murray greenville sc wage calculator 8644751571 michael murray greenville sc wage calcula

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our service is flexible and esy to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc wage calculator 864.475.1571 michael murray greenville sc wage calculator michael murray greenville sc wage calculator michael murray greenville sc wage calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calc -

michael murray greenville sc take home pay calculator 1 8644751571 michael murray greenville sc ta

michael murray greenville sc take home pay calculator 1 8644751571 michael murray greenville sc tamichael murray greenville sc take home pay calculator 1 8644751571 michael murray greenville sc ta

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our product is flexible and uncomplicated to use. There is nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Concentrate On Growing Your Business. michael murray greenville sc take home pay calculator 1. 864.475.1571 michael murray greenville sc take home pay calculator michael murray greenville sc take home pay calculator michael murray greenville sc take home pay calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll -

michael murray greenville sc income tax calculator 8644751571 michael murray greenville sc income

michael murray greenville sc income tax calculator 8644751571 michael murray greenville sc incomemichael murray greenville sc income tax calculator 8644751571 michael murray greenville sc income

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our system is flexible and esy to use. There is not a thing to learn and relearn with each payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc income tax calculator 864.475.1571 michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay ca -

Income Tax Love

Income Tax LoveIncome Tax Love

Showing how people act during income tax season -

How to Create Tax Free Retirement Income

How to Create Tax Free Retirement IncomeHow to Create Tax Free Retirement Income

Joe Anderson, CFP® and “Big Al” Clopine, CPA discuss how to create tax free retirement income using Roth conversions. They continue to discuss three different pools of money and how they are all taxes differently, from tax deferred accounts, tax free accounts to taxable accounts. Aired: 10-18-2014 Your Money, Your Wealth airs Saturday at 11 a.m. on Channel 4 San Diego or at http://yourmoneyyourwealth.com IMPORTANT DISCLOSURES: • Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, Inc. A Registered Investment Advisor. • Pure Financial Advisors Inc. does not offer tax or legal advice. Consult w -

VHP Accounts.Ex Income Tax Officer.mdjabee-vja CNN

VHP Accounts.Ex Income Tax Officer.mdjabee-vja CNNVHP Accounts.Ex Income Tax Officer.mdjabee-vja CNN

Md.Jabeevllah 9849236572 Vijayawada.Ap.INDIA -

option income system review

option income system reviewoption income system review

You Are About To Learn Option Trading 'Cashflow' Secrets That Most Other Option Traders Don't Know Exist!These Videos Will Show You An *Extraordinary* Way To Trade Options For Income - Including A Collection Of Little Known Additional Option Cashflow Strategies That Can Be Traded To Generate Income - Spending As Little As 15 Minutes A Day...Rather than hype this course and tell you how rich you will get, in this page I want to get straight to the point and tell you... click here:http://bit.ly/1vregl3 option income funds option income monthly option income system option income blueprint option income tax treatment instant options income option -

Income Tax Marques McHaffie

Income Tax Marques McHaffieIncome Tax Marques McHaffie

Trailer -

US Income Tax Reporting for Non US Citizens

US Income Tax Reporting for Non US CitizensUS Income Tax Reporting for Non US Citizens

http://www.greenbacktaxservices.com/blog/snow-birds-us-income-tax/ If you are a snow bird who flocks to the warmer states of the US each winter to escape the cold, you may unknowingly incur US income tax liability. David McKeegan explains how this may happen and exactly what you need to know about US income taxation for non-US citizens. "Hi, everybody. I'm David McKeegan with Greenback Expat Tax Services. Our question today is around reporting requirements for non-US citizens. Now, there's one of two tests you need to pass in order to be taxable as a US person. The first one would be if you have a Green Card, basically you're a lawful, perm -

Daily Show mocks Gov. Sam Brownback’s tax cuts (VIDEO)

Daily Show mocks Gov. Sam Brownback’s tax cuts (VIDEO)Daily Show mocks Gov. Sam Brownback’s tax cuts (VIDEO)

“The Daily Show with Jon Stewart” skewered Gov. Sam Brownback in a five-minute feature titled “Laboratories of Fiscal Disaster” on Thursday night. The Comedy Central satirical news show played clips of Brownback on MSNBC in 2012 touting his plan to sharply reduce income tax cuts as “a real live experiment.” “You know how some political ideas sound great in theory and you think, man, if only we could test these theories on a giant experiment involving millions of people’s lives. Eh, turns out Kansas,” quipped host Jon Stewart as he introduced the segment. The Brownback campaign would not comment on the segment Friday morning. “In 2010 form

- published: 20 Oct 2014

- views: 0

- Duration: 0:21

- Updated: 20 Oct 2014

- published: 20 Oct 2014

- views: 0

- Duration: 1:25

- Updated: 20 Oct 2014

- published: 20 Oct 2014

- views: 0

- Duration: 1:26

- Updated: 20 Oct 2014

- published: 20 Oct 2014

- views: 0

- Duration: 1:41

- Updated: 20 Oct 2014

- published: 20 Oct 2014

- views: 0

- Duration: 1:22

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 0

- Duration: 1:31

- Updated: 20 Oct 2014

- published: 20 Oct 2014

- views: 0

- Duration: 3:59

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 0

- Duration: 2:41

- Updated: 19 Oct 2014

http://wn.com/Encuentro_norteño_el_income_tax_paco

- published: 19 Oct 2014

- views: 0

- Duration: 0:21

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 1

- Duration: 1:29

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 1

- Duration: 2:15

- Updated: 19 Oct 2014

http://wn.com/Will_a_Wealth_Tax_Fix_Income_Inequality_Video_Bloomberg

- published: 19 Oct 2014

- views: 1

- Duration: 2:57

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 2

- Duration: 1:25

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 0

- Duration: 1:41

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 0

- Duration: 1:42

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 0

- Duration: 0:24

- Updated: 19 Oct 2014

- published: 19 Oct 2014

- views: 3

- Duration: 9:38

- Updated: 18 Oct 2014

- published: 18 Oct 2014

- views: 2

- Duration: 7:52

- Updated: 18 Oct 2014

- published: 18 Oct 2014

- views: 1

- Duration: 4:03

- Updated: 18 Oct 2014

- published: 18 Oct 2014

- views: 3

- Duration: 1:03

- Updated: 18 Oct 2014

- published: 18 Oct 2014

- views: 0

- Duration: 4:18

- Updated: 17 Oct 2014

- published: 17 Oct 2014

- views: 1

- Duration: 4:41

- Updated: 17 Oct 2014

- published: 17 Oct 2014

- views: 12

- Playlist

- Chat

Basic Income Tax Course - Part 1

Basic Income Tax taught by Professor Lisa Cole, 15 parts.- published: 11 Aug 2009

- views: 107495

- author: JCCCvideo

Theft By Deception - Deciphering The Federal Income Tax

The misrepresentation and misapplication of the United States federal income tax constitutes the largest acquisition of wealth by way of deception in history...- published: 02 Nov 2012

- views: 13968

- author: MasterpieceConCen7

How Did We Start Paying Income Tax?

The US tax system is notoriously complex, but where did it come from? How did it end up this way, and what sort of alternatives have people proposed? Join Ben Bowlin to learn more about the bizarre evolution of taxes. Whether the topic is popcorn or particle physics, you can count on the HowStuffWorks team to explore - and explain - the everyday science in the world around us on BrainStuff. Download the New TestTube iOS app! http://testu.be/1ndmmMq Watch More BrainStuff on TestTube http://testtube.com/brainstuff Subscribe Now! http://www.youtube.com/subscription_center?add_user=brainstuffshow Watch More http://www.youtube.com/BrainStuffShow Twitter http://twitter.com/BrainStuffHSW Facebook http://facebook.com/BrainStuff Google+ http://gplus.to/BrainStuff- published: 15 Apr 2014

- views: 4292

IPCC - Income Tax - Salary - Lecture 1

Full 1st Lecture of Salary.- published: 03 Sep 2013

- views: 13925

- author: CA dilip badlani

Federal Income Tax - Why you should not pay

This clip comes from Aaron Russo's film, America: Freedom to Fascism. You can watch the film online @ http://video.google.com/videoplay?docid=-16568803038673...- published: 01 Apr 2008

- views: 115151

- author: hempsavetheworld

Income Tax - How it is calculated?

This is the basics of Income Tax Calculation for those who don't maintain NRI status.- published: 13 Jul 2012

- views: 23162

- author: Sriram Balasubramanian

How to Calculate Income Tax in India 2013 - Part 1

This Sunday, My Mistri's two children came to me for taking my help in the calculation of Income Tax. From 5 years, I did not teach offline, but his father i...- published: 07 Mar 2013

- views: 1824

- author: svtuition

Income Tax - AY 14-15 - Salary - Lecture 1

Download all assignment @ www.badlanionline.com.- published: 03 Jan 2014

- views: 24485

- author: CA dilip badlani

Paying income tax in America is Voluntary

When you can't dazzle them with brilliance, baffle them with bullshit. Idiot Harry Reid maintains that paying income tax is voluntary in the U.S.. Harry Reid...- published: 01 Apr 2008

- views: 2114583

- author: AlliDrac

Personal Income Taxes - A Visual Explanation

A visual explanation of the words used in your personal income tax return. To learn more about your taxes, go to: http://www.seeingfinance.com/category/tax/- published: 08 Apr 2009

- views: 10878

- author: Paul Van Slembrouck

Milton Friedman - The Negative Income Tax

In this 1968 interview, Milton Friedman explained the negative income tax, a proposal that at minimum would save taxpayers the 72 percent of our current welf...- published: 11 May 2012

- views: 56805

- author: LibertyPen

2 (CA Practise) How to file Income tax return(ITR 1 )online(2013 14 )(English)

My facebook page for filing returns is www.facebook.com/filingreturnsonline In the hour long video showing possibly everything needed to know ,topic's covere...- published: 28 Jul 2013

- views: 57743

- author: Amlan Dutta

I am innocent, have answered all income tax queries: Pankaj Lodhiya

After being named by the government in its affidavit on black money, Rajkot-based bullion trader Pankaj Chimanlal Lodhiya tells NDTV that he is innocent and neither he nor his family members have any Swiss bank accounts. He says he got the income tax notice 3-4 months ago and has answered all their queries. Watch full video: http://www.ndtv.com/video/player/the-buck-stops-here/black-money-bomb-political-explosion-or-anti-climax/342893?yt- published: 27 Oct 2014

- views: 274

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 1

Full 1st lecture of Introduction of Income Tax.- published: 25 Dec 2013

- views: 10890

- author: CA dilip badlani

Bill Gates: Don't tax my income, tax my consumption

Microsoft founder and Gates Foundation chief Bill Gates tells AEI that if he's supposed to feel guilty about his wealth, then it won't be about his income, b...- published: 13 Mar 2014

- views: 32232

- author: American Enterprise Institute

income tax e-filing (ITR 1 for salaried person)

Know how to file your income tax return online. * Live e-filing of income tax return for your guidance. * Learn how to file your income tax return in simple ...- published: 25 Jun 2014

- views: 9896

- author: murga g

The Truth Behind The Income Tax

Two-hour introduction to the basic issues revolving around the income tax. Learn about the nature of currency, and how employees of the Treasury Department, ...- published: 27 Nov 2012

- views: 2552

- author: Michael Nixson

Irwin Schiff's Secrets of Living an Income Tax-Free Life

Irwin Schiff has heroically released this Important Information for FREE here on Google Video. You already have seen our hero, Irwin Schiff, on America Freed...- published: 17 Nov 2012

- views: 14813

- author: Kurt Annaheim

- Playlist

- Chat

CA - IPCC - Income Tax - AY 14-15 - Introduction - Lecture 2

Full 2nd lecture of Capital Gain.- published: 26 Dec 2013

- views: 4569

- author: CA dilip badlani

BJP considers abolishing income tax: can it work?

Left, Right & Centre: In a radical move, the BJP considers abolishing income tax altogether if it comes to power. Is this super sop practical and feasible? C...- published: 06 Jan 2014

- views: 4859

- author: NDTV

1 (CA Practise )How to file income tax return(ITR 1 )online(AY 2013 14 )(Hindi)

The aim of this tutorial is to know that you could file your return yourself and not give it to CA/financial analyst or advertisers seeking your details for ...- published: 28 Jul 2013

- views: 44804

- author: Amlan Dutta

CSE 103 Class 6 Topic''Income tax''

http://www.kenthovindblog.com/?page_id=391 http://www.youtube.com/watch?v=ZKeaw7HPG04 Creation Science Evangelism Classes from Kent Hovind.wide spread of top...- published: 14 Apr 2012

- views: 5697

- author: JesusLostChildren777

CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 1

Full first lecture of IHP.- published: 27 Sep 2013

- views: 10529

- author: CA dilip badlani

CA - IPCC - Income Tax - AY 14-15 - Income from House Property - Lecture 2

Full 2nd lecture of IHP.- published: 29 Sep 2013

- views: 7156

- author: CA dilip badlani

CA - IPCC - Income Tax - AY 14-15 - PGBP - Lecture 1

Get all the assignment @ www.badlanionline.com.- published: 19 Oct 2013

- views: 8006

- author: CA dilip badlani

Individual Income Tax Return = Form 1040 | Regulation | Miles CPA Review ( REG-1 Binder-1)

http://www.milescpareview.com/ Form 1040, U.S. Individual Income Tax Return, is one of three forms used for personal (individual) federal income tax returns ...- published: 08 Oct 2013

- views: 7915

- author: Miles CPAReview

Income Tax - AY 14-15 - Deductions - Sec 80 - Lecture 1

www.badlanionline.com.- published: 16 Feb 2014

- views: 5367

- author: CA dilip badlani

Former IRS agent who quit and challenge the Federal Income Tax - John Turner

The former IRS collection agent who courageously resigned form the IRS when he saw conclusive proof that the Federal Income Tax is unconstitutional and illeg...- published: 13 Jan 2012

- views: 24000

- author: freedomlawschool

(ITR 1 )10 steps to file your income tax return online (Income Tax return filing )

(Redone with Video Cam and Music )In the hour long video showing possibly everything needed to know ,topic's covered include (1) Create registration in the i...- published: 24 Sep 2013

- views: 18554

- author: Amlan Dutta

- Playlist

- Chat

michael murray greenville sc pay calculator 1-864-475-1571 michael murray greenville sc pay calcu

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our service is flexible and uncomplicated to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Remove Your Payroll Pains So You Can Focus On Expanding Your Business. michael murray greenville sc pay calculator 1-864-475-1571 michael murray greenville sc pay calculator michael murray greenville sc pay calculator michael murray greenville sc pay calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator PAY CALCULATOR : 00:00:05 pay calculator 00:00:05 wage calculator 00:00:05 irs forms 00:00:06 IRS Forms 00:00:06 salary calculator http://youtu.be/FTOVePaUrDU http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 20 Oct 2014

- views: 0

michael murray greenville sc paycheck calculator 8644751571 michael murray greenville sc paycheck

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our system is flexible and uncomplicated to use. There is absolutely nothing to learn and relearn with each payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Expanding Your Business. michael murray greenville sc paycheck calculator 864.475.1571 michael murray greenville sc paycheck calculator michael murray greenville sc paycheck calculator michael murray greenville sc paycheck calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator PAYCHECK CALCULATOR : 00:00:05 paycheck calculator 00:00:12 payroll calculator 00:00:19 take home pay calculator 00:00:26 pay calculator 00:00:33 wage calculator http://youtu.be/x_NZPszasSE http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 20 Oct 2014

- views: 0

michael murray greenville sc income tax calculator 1 8644751571 michael murray greenville sc incom

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our product is flexible and uncomplicated to use. There is nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Alleviate Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc income tax calculator 1. 864.475.1571 michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator INCOME TAX CALCULATOR : 00:00:05 income tax calculator 00:00:11 paycheck calculator 00:00:18 payroll calculator 00:00:25 take home pay calculator 00:00:32 pay calculator http://youtu.be/kFJiqmKwaVE http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 20 Oct 2014

- views: 0

michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculat

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our system is flexible and simple to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculator michael murray greenville sc tax calculator michael murray greenville sc tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator TAX CALCULATOR : 00:00:05 tax calculator 00:00:13 income tax calculator 00:00:22 paycheck calculator 00:00:30 payroll calculator 00:00:39 take home pay calculator http://youtu.be/kWzF-W9o5Mk http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 20 Oct 2014

- views: 0

michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculat

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our system is flexible and esy to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Concentrate On Growing Your Business. michael murray greenville sc tax calculator 864-475-1571 michael murray greenville sc tax calculator michael murray greenville sc tax calculator michael murray greenville sc tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator TAX CALCULATOR : 00:00:05 tax calculator 00:00:11 income tax calculator 00:00:17 paycheck calculator 00:00:24 payroll calculator 00:00:30 take home pay calculator http://youtu.be/wMYgnlJ1y08 http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 19 Oct 2014

- views: 0

michael murray greenville sc IRS Forms 864-475-1571 michael murray greenville sc IRS Forms

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our product is flexible and esy to use. There is not a thing to learn and relearn with each payroll. Just click it and forget it. Let Us Alleviate Your Payroll Pains So You Can Concentrate On Expanding Your Business. michael murray greenville sc IRS Forms 864-475-1571 michael murray greenville sc IRS Forms michael murray greenville sc IRS Forms michael murray greenville sc IRS Forms,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator IRS FORMS : 00:00:05 IRS Forms 00:00:12 salary calculator 00:00:19 tax calculator 00:00:26 income tax calculator 00:00:33 paycheck calculator http://youtu.be/fZoOkd_6iCc http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 20 Oct 2014

- views: 0

10 Year-End Tax Moves to Make Now

April 15 is the target date for taxes, but to ensure that you pay the Internal Revenue Service the least possible amount on that date, you need to make some tax moves before the tax year ends. Congress is not making that easy. Once again, U.S. representatives and senators have delayed action on tax extenders, more than 50 business and individual tax breaks that expired on Dec. 31, 2013. Lawmakers are expected to consider, or extend (hence the laws' collective name) after the Nov. 4 election. The bad news is that there is no guarantee that all the extenders - including popular things such as the higher education tuition and fees deduction, and itemized claims for state and local sales taxes and private mortgage insurance payments - will be renewed. The good news is that there still are some tax breaks on the books that you can use to your advantage before the end of 2014. Some tax moves will take a little planning. Others are very easy to accomplish. But all are worth checking out to see if they can reduce your tax bill. Following are 10 year-end tax moves to make before New Year's Day. 1. Defer your income The top tax rate is 39.6 percent on taxable income of more than $406,750 for single taxpayers; $457,600 for married couples filing joint returns ($228,800 if filing separately); and $432,200 for head-of-household taxpayers. If your remaining pay will push you into the top tax bracket, defer receipt of money where you can. Ask your boss to hold your bonus until January. Put more money into your tax-deferred workplace retirement plan. Hold off on selling assets that will produce a capital gain. If you're self-employed, don't send out invoices for year-end jobs until early 2015. This strategy works even if you're not in the top tax bracket, but just about to cross into the next higher one. 2. Add to your 401(k) Even if you're nowhere near the top tax bracket, putting as much money as you can into your company's 401(k) or similar workplace retirement savings plan is a good idea. Since most plan contributions are made before taxes are taken out, you'll have a bit less income that the Internal Revenue Service can touch. (Exceptions are contributions to Roth 401(k) plans, where you put away after-tax money and get tax-free growth.) Plus, the sooner you put the money into the account, the longer the earnings will grow tax-deferred. Few of us will reach the maximum $17,500 that employees can stash in a 401(k), but any amount you can contribute is good. If you are age 50 or older, you can put in an extra $5,500. In most cases, you can modify your 401(k) contributions at any time, but double-check with your benefits office to be sure of your plan's rules. 3. Review your FSA amounts Another workplace benefit, the medical flexible spending account, or FSA, also requires year-end attention so you don't waste it. You can contribute up to $2,500 to an FSA via paycheck withdrawals. If that limit seems lower, you're right. As part of the Affordable Care Act the- published: 19 Oct 2014

- views: 0

UK: "We reject devolved income tax powers to Scotland," says Brown

W/S Houses of Parliament, London SOT, Gordon Brown, MP for Kirkcaldy and Cowdenbeath (in English): "There are areas where we would have to ask the Conservatives to accept Labour and Liberal Democrat proposals, including the entrenchment of the Scottish parliament and the Constitution, new powers over the work programme, the Crown Estate, the Wales Franchise, borrowing for infrastructure, the executive authority for UK safety and equalities and employment law. There are also areas where I would ask Labour and the Liberal Democrats to accept the Conservative proposals for a fiscal commission and for an annual statement for tax-payers on how the Scottish parliament's money is spent and where. But given what has been said by each party and their submissions afterwards, I believe there is scope for agreement on every one of these new powers and I hope the Secretary of State when he replies will say he believes also that this can happen." M/S William Hague, Leader of the House of Commons SOT, Gordon Brown, MP for Kirkcaldy and Cowdenbeath (in English): "I think there is general agreement that first of all, to devolve a wider power to set an income tax rate in Scotland. And secondly a power to set rates of tax at the top too. I suggest, however - and I will explain in a minute why - we reject a 100 per cent devolution of income tax. We should instead agree to retain income tax as a shared tax across the United Kingdom, with 75 per cent of it devolved to the Scottish parliament alongside devolving 50 per cent of VAT revenues and this will ensure accountability is met with the Scottish parliament then responsible for the majority. With 54 per cent of its spending in 2016, the year in which these proposals would be implemented." W/S Houses of Parliament, London SCRIPT Former British Prime Minister and MP for Kirkcaldy and Cowdenbeath, Gordon Brown spoke in the House of Commons in London, Thursday, stating he "rejects" the notion Scotland should have 100 per cent power over its income tax rates, but added "75 per cent" should be devolved to Scotland. Brown addressed more than a dozen MPs in the chambers, following all three main political parties promising Scotland that the UK would grant enhanced power over taxation and spending in exchange for voters opting 'no' to independence. Brown, the former 'No Thanks' independence referendum campaigner, added that income tax should be a shared tax across the UK, and that 50 per cent of VAT revenues should be devolved to the Scottish parliament to "ensure accountability" of the Scottish government at Holyrood.- published: 19 Oct 2014

- views: 1

Income Tax Laws On Alimony In Georgia

Save Money on Amazon using this link! http://www.amazon.com/?tag=camcam0a8-20- published: 19 Oct 2014

- views: 1

El Income Tax ATRAILERADOS EN FARGOS VIVO BAR

Contrataciones En Monterrey NL 11577905. 17389397. 8110411423 Juan Rocha Jonhhy Gutierrez- published: 19 Oct 2014

- views: 2

michael murray greenville sc wage calculator 8644751571 michael murray greenville sc wage calcula

http://payrollmedics.com 864-475-1571 Do You Want To Cure Payroll Headaches? We Have The CURE! Our service is flexible and esy to use. There is absolutely nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc wage calculator 864.475.1571 michael murray greenville sc wage calculator michael murray greenville sc wage calculator michael murray greenville sc wage calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator WAGE CALCULATOR : 00:00:05 wage calculator 00:00:11 irs forms 00:00:18 IRS Forms 00:00:24 salary calculator 00:00:31 tax calculator http://youtu.be/F3LRFokwgT4 http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 19 Oct 2014

- views: 0

michael murray greenville sc take home pay calculator 1 8644751571 michael murray greenville sc ta

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our product is flexible and uncomplicated to use. There is nothing to learn and relearn with every payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Concentrate On Growing Your Business. michael murray greenville sc take home pay calculator 1. 864.475.1571 michael murray greenville sc take home pay calculator michael murray greenville sc take home pay calculator michael murray greenville sc take home pay calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator TAKE HOME PAY CALCULATOR : 00:00:05 take home pay calculator 00:00:13 pay calculator 00:00:21 wage calculator 00:00:30 irs forms 00:00:38 IRS Forms http://youtu.be/-C0HODAfgN8 http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 19 Oct 2014

- views: 0

michael murray greenville sc income tax calculator 8644751571 michael murray greenville sc income

http://payrollmedics.com 864-475-1571 Do You Want To Remove Payroll Headaches? We Have The CURE! Our system is flexible and esy to use. There is not a thing to learn and relearn with each payroll. Just click it and forget it. Let Us Relieve Your Payroll Pains So You Can Focus On Growing Your Business. michael murray greenville sc income tax calculator 864.475.1571 michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator michael murray greenville sc income tax calculator,irs forms,salary calculator,tax calculator,income tax calculator,paycheck calculator,payroll calculator,take home pay calculator,pay calculator,wage calculator,payroll tax calculator,net pay calculator,pay stub,payroll software,payroll deductions,direct deposit,hourly paycheck calculator,income calculator,payroll services,fica tax,salary tax calculator,federal taxes,hourly wage calculator,salary paycheck calculator.w4 calculator.wages calculator INCOME TAX CALCULATOR : 00:00:05 income tax calculator 00:00:13 paycheck calculator 00:00:21 payroll calculator 00:00:30 take home pay calculator 00:00:38 pay calculator http://youtu.be/FpFh7r_3Ypg http://fhstudio.co/search-engines-coral-springs-tarpon-internet-marketing-727-251-9509/- published: 19 Oct 2014

- views: 0

How to Create Tax Free Retirement Income

Joe Anderson, CFP® and “Big Al” Clopine, CPA discuss how to create tax free retirement income using Roth conversions. They continue to discuss three different pools of money and how they are all taxes differently, from tax deferred accounts, tax free accounts to taxable accounts. Aired: 10-18-2014 Your Money, Your Wealth airs Saturday at 11 a.m. on Channel 4 San Diego or at http://yourmoneyyourwealth.com IMPORTANT DISCLOSURES: • Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, Inc. A Registered Investment Advisor. • Pure Financial Advisors Inc. does not offer tax or legal advice. Consult with their tax advisor or attorney regarding specific situations. • Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. • Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. • All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. • Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.- published: 18 Oct 2014

- views: 2

- 1

- 2

- 3

- 4

- 5

- Next page »

An income tax is a tax levied on the income of individuals or businesses (corporations or other legal entities). Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate tax, corporate income tax, or profit tax. Individual income taxes often tax the total income of the individual (with some deductions permitted), while corporate income taxes often tax net income (the difference between gross receipts, expenses, and additional write-offs). Various systems define income differently, and often allow notional reductions of income (such as a reduction based on number of children supported).

The "tax net" refers to the types of payment that are taxed, which included personal earnings (wages), capital gains, and business income. The rates for different types of income may vary and some may not be taxed at all. Capital gains may be taxed when realized (e.g. when shares are sold) or when incurred (e.g. when shares appreciate in value). Business income may only be taxed if it is significant or based on the manner in which it is paid. Some types of income, such as interest on bank savings, may be considered as personal earnings (similar to wages) or as a realized property gain (similar to selling shares). In some tax systems, personal earnings may be strictly defined where labor, skill, or investment is required (e.g. wages); in others, they may be defined broadly to include windfalls (e.g. gambling wins).

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Milton Friedman (July 31, 1912 – November 16, 2006) was an American economist, statistician, and author who taught at the University of Chicago for more than three decades. He was a recipient of the Nobel Memorial Prize in Economic Sciences, and is known for his research on consumption analysis, monetary history and theory, and the complexity of stabilization policy. As a leader of the Chicago school of economics, he influenced the research agenda of the economics profession. A survey of economists ranked Friedman as the second most popular economist of the twentieth century behind John Maynard Keynes, and The Economist described him as "the most influential economist of the second half of the 20th century…possibly of all of it."

Friedman's challenges to what he later called "naive Keynesian" (as opposed to New Keynesian) theory began with his 1950s reinterpretation of the consumption function, and he became the main advocate opposing activist Keynesian government policies. In the late 1960s he described his own approach (along with all of mainstream economics) as using "Keynesian language and apparatus" yet rejecting its "initial" conclusions. During the 1960s he promoted an alternative macroeconomic policy known as "monetarism". He theorized there existed a "natural" rate of unemployment, and argued that governments could increase employment above this rate (e.g., by increasing aggregate demand) only at the risk of causing inflation to accelerate. He argued that the Phillips curve was not stable and predicted what would come to be known as stagflation. Friedman argued that, given the existence of the Federal Reserve, a constant small expansion of the money supply was the only wise policy.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

William Henry "Bill" Gates III (born October 28, 1955 in Seattle, Washington) is an American business magnate, computer programmer and philanthropist. Gates is the former chief executive officer (CEO) and current chairman of Microsoft, the world’s largest personal-computer software company he co-founded with Paul Allen. He is consistently ranked among the world's wealthiest people and was the wealthiest overall from 1995 to 2009, excluding 2008, when he was ranked third; in 2011 he was the wealthiest American and the second wealthiest person. During his career at Microsoft, Gates held the positions of CEO and chief software architect, and remains the largest individual shareholder, with 6.4 percent of the common stock. He has also authored or co-authored several books.

Gates is one of the best-known entrepreneurs of the personal computer revolution. Gates has been criticized for his business tactics, which have been considered anti-competitive, an opinion which has in some cases been upheld by the courts. In the later stages of his career, Gates has pursued a number of philanthropic endeavors, donating large amounts of money to various charitable organizations and scientific research programs through the Bill & Melinda Gates Foundation, established in 2000.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Irwin A. Schiff (born in February 24, 1928) is a prominent figure in the United States tax protester movement. Schiff is known for writing and promoting literature that claims the United States income tax is applied incorrectly. He has lost several civil cases against the federal government and has a record of multiple convictions for various federal tax crimes. Schiff is serving a 13-plus year sentence for tax crimes (with his location listed as the Terre Haute Federal Correctional Institution). His projected release date is October 7, 2016. Schiff is the father of stockbroker and former United States Senate candidate Peter Schiff.

In 1950, Schiff graduated from the University of Connecticut with a Bachelor of Science degree in accounting and economics.

After college, Schiff was in the insurance brokerage business in Connecticut. In connection with his business, he was involved in a tax shelter in which he became the victim of a Ponzi scheme in which he lost his money and the money of his clients. In 1968 he testified before the Senate Committee on Banking and Currency in opposition to the removal of gold backing from Federal Reserve Notes. In 1976, he published a book entitled The Biggest Con: How the Government is Fleecing You. Schiff was a candidate for the Libertarian Party presidential nomination in 1996, and he participated in a Libertarian Party debate in Washington on July 5, 1996.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Tommy K. Cryer, also known as Tom Cryer (born September 11, 1949 in Lake Charles, Louisiana), is an attorney in Shreveport, Louisiana who was charged with and later acquitted of willful failure to file U.S. Federal income tax returns in a timely fashion. In a pending case in United States Tax Court, Cryer is contesting a determination by the U.S. Internal Revenue Service that he owes $1.7 million in taxes and penalties.

According to a resume published by Cryer on his website, Cryer graduated with honors from Louisiana State University (LSU) Law School in 1973, and was inducted into the LSU Law School Hall of Fame in 1987. Cryer is also a member of the Order of the Coif (a law school honor society), that he served as a Special Advisor and Draftsman at the Louisiana Constitutional Convention in 1973 and that he has argued cases before the Louisiana Supreme Court. Finally, he opened a solo law practice in 1975 and gained experience in many different civil and criminal matters.

On his web site Cryer makes a variety of assertions about the legality of the federal income tax in the United States, mostly in regard to taxes on wages. He claims that "the law does not tax [a person's] wages", and that the federal government cannot tax "[m]oney that you earned [and] paid for with your labor and industry" because "the Constitution does not allow the federal government to tax those earnings" (referring to "wages, salaries and fees that [a person] earn[s] for [himself]"). Cryer states:

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

![[u'Income Tax Trailer'][0].replace('](http://web.archive.org./web/20141104175621im_/http://i.ytimg.com/vi/yKnQiLCwAGs/0.jpg)