2:31

Net Income Video Definition

In this financial video definition, we explain the definition of Net Income, provide a cle...

published: 02 Feb 2012

author: sainvestinganswers

Net Income Video Definition

Net Income Video Definition

In this financial video definition, we explain the definition of Net Income, provide a clear example of the formula, and explain why it's an important concep...- published: 02 Feb 2012

- views: 4890

- author: sainvestinganswers

8:27

Net Income

What is net income, what does it measure, and why is it important to my business? What are...

published: 22 Dec 2010

author: Foundry Administration

Net Income

Net Income

What is net income, what does it measure, and why is it important to my business? What are the component parts? How is it figured? What other formulas will I...- published: 22 Dec 2010

- views: 2318

- author: Foundry Administration

9:05

Accounting Equation; Retained Earnings; Net Income; Dividends - video

"What is Financial Accounting and Bookkeeping" - eBook JUST RELEASED! ONLY $.99 @ http://t...

published: 16 Dec 2010

author: Brian Routh TheAccountingDr

Accounting Equation; Retained Earnings; Net Income; Dividends - video

Accounting Equation; Retained Earnings; Net Income; Dividends - video

"What is Financial Accounting and Bookkeeping" - eBook JUST RELEASED! ONLY $.99 @ http://tiny.cc/m7slmw (FREE Sample - see details below) "What is Financial ...- published: 16 Dec 2010

- views: 6303

- author: Brian Routh TheAccountingDr

5:37

Net Income on the Cash Flow Statement

A video tutorial designed to teach investors everything they need to know about Net Income...

published: 05 Jan 2013

author: PSAadmin

Net Income on the Cash Flow Statement

Net Income on the Cash Flow Statement

A video tutorial designed to teach investors everything they need to know about Net Income on the Cash Flow Statement. Visit our free website at http://www.P...- published: 05 Jan 2013

- views: 360

- author: PSAadmin

10:27

Calculating Net Income

How to calculate net income after Income Tax, CPP, and EI deductions in British Columbia a...

published: 12 Sep 2012

author: Steve Watkins

Calculating Net Income

Calculating Net Income

How to calculate net income after Income Tax, CPP, and EI deductions in British Columbia as of January 1, 2012.- published: 12 Sep 2012

- views: 757

- author: Steve Watkins

19:26

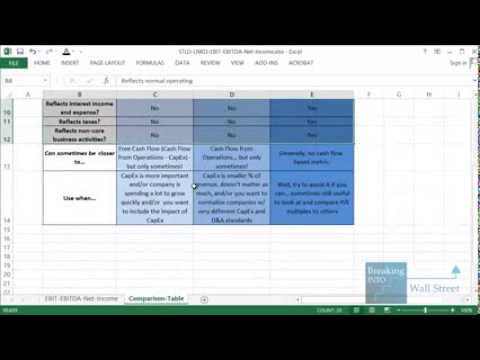

EBIT vs. EBITDA vs. Net Income: Valuation Metrics and Multiples

http://breakingintowallstreet.com/biws/

http://youtube-breakingintowallstreet-com.s3.amaz...

published: 23 Jan 2014

EBIT vs. EBITDA vs. Net Income: Valuation Metrics and Multiples

EBIT vs. EBITDA vs. Net Income: Valuation Metrics and Multiples

http://breakingintowallstreet.com/biws/ http://youtube-breakingintowallstreet-com.s3.amazonaws.com/STLD-LNKD-EBIT-EBITDA-Net-Income.xlsx Why Do You Care About This? It's a very common interview question! "How does EBIT differ from EBITDA? What about EV / EBIT vs. EV / EBITDA? When do you use which one? How does P / E compare to those?" And it's very common on the job as well -- you must decide how to value companies and which metrics / multiples to focus on. What are the Differences Between EBIT, EBITDA, and Net Income? These metrics differ in terms of: 1. Who the Money is Available to -- Equity investors, debt investors, and the government? Just equity investors? Someone else? 2. Operating Expenses vs. Capital Expenditures -- Some metrics reflect the impact of both of these, whereas others only reflect the impact of Operating Expenses and ignore spending on long-term assets. 3. Interest, Taxes, and Non-Core Business Activities -- Some metrics include these, and some exclude them. 4. When They're Useful -- Sometimes you WANT to reflect the impact of CapEx, approximating Free Cash Flow, and sometimes you don't. Same for interest and taxes. Here's the summary of differences, by category: How Do You Calculate It? EBIT = Operating Income on the Income Statement EBITDA = Operating Income on the Income Statement + Depreciation & Amortization from the CFS Net Income = Net Income on the Income Statement They Correspond To... EBIT corresponds to Enterprise Value. EV / EBIT is the multiple. EBITDA corresponds to Enterprise Value. EV / EBITDA is the multiple. Net Income corresponds to Equity Value. P / E is the multiple. Who Has a Claim on the Money? For EBIT and EBITDA, equity investors, debt investors, and the government all have a claim. For Net Income, only equity investors have a claim because debt investors have been paid with interest, and the government has been paid with taxes. What Does It Mean? EBIT = Core, recurring business profitability, before the impact of capital structure and taxes. EBITDA = Proxy for core, recurring business cash flow from operations, before the impact of capital structure and taxes. Net Income = Profit after taxes, the impact of capital structure, AND non-core business activities. Which Expenses Does It Reflect? EBIT reflects operating expenses and the impact of CapEx, but EXCLUDES interest, taxes, and non-core business activities. EBITDA is almost the same, but does NOT include the impact of CapEx. Net Income reflects everything -- operating expenses, CapEx, interest, taxes, and non-core business activities. Which Cash Flow-Based Metric Is It Closer To? EBIT is *sometimes* closer to Free Cash Flow, AKA Cash Flow from Operations -- CapEx, because they both reflect CapEx - but really, only *sometimes* is it closer... EBITDA is *sometimes* closer to Cash Flow from Operations because NEITHER one includes CapEx - but really, only *sometimes* is it closer... And Net Income is generally not close to either one. Which One Do You Use And Why? This is a question with a FALSE premise - you're not just picking one or the other! You'll almost always use a variety of metrics and multiples when valuing companies. So, for example, you might look at EV / Revenue, EV / EBITDA, and P / E all for the same company. But generally speaking, if you WANT to reflect the impact of capital expenditures and it's important to do so for the company/industry you're in, EBIT is better than EBITDA. Whereas EBITDA might be better in an industry where CapEx is less important, such as software/Internet/services/anything else where R&D; exceeds investments in hard assets. But it also depends on a company's state of development -- CapEx is almost always more important to quickly growing companies, whereas it is less important for mature, stable companies! Regardless of the industry. As for Net Income, you usually look at it as a *supplement* to other metrics and multiples -- on its own, it doesn't necessarily give you a great / accurate view of a company because it's distorted by different tax rates, capital structures, and so on.- published: 23 Jan 2014

- views: 45

2:38

How To Estimate Net Income

This tutorial is a invaluable time-saver that will enable you to get good at math, busines...

published: 06 Apr 2011

author: videojugeducation

How To Estimate Net Income

How To Estimate Net Income

This tutorial is a invaluable time-saver that will enable you to get good at math, business accounting. Watch our bite-size tutorial on How To Estimate Net I...- published: 06 Apr 2011

- views: 1244

- author: videojugeducation

6:34

Cost Volume Profit Analysis (CVP): Target Net Income

This video illustrates how to calculate the number of units and sales dollars in order to ...

published: 09 Jul 2013

author: EducationUnlocked

Cost Volume Profit Analysis (CVP): Target Net Income

Cost Volume Profit Analysis (CVP): Target Net Income

This video illustrates how to calculate the number of units and sales dollars in order to reach a target net income or profit level.- published: 09 Jul 2013

- views: 8

- author: EducationUnlocked

7:14

Accounting 101 Part 04 Revenue Expense Net Income

Fourth in series of 17 videos describing the essential ideas typically covered in early we...

published: 01 Oct 2008

author: enlight09

Accounting 101 Part 04 Revenue Expense Net Income

Accounting 101 Part 04 Revenue Expense Net Income

Fourth in series of 17 videos describing the essential ideas typically covered in early weeks of a university-level accounting principles course. This discus...- published: 01 Oct 2008

- views: 41390

- author: enlight09

1:28

Finding The Total Expenses, Total Revenue And Net Income (Loss) In Excel

...

published: 01 Oct 2010

author: NorhananMangadang

Finding The Total Expenses, Total Revenue And Net Income (Loss) In Excel

Finding The Total Expenses, Total Revenue And Net Income (Loss) In Excel

- published: 01 Oct 2010

- views: 4748

- author: NorhananMangadang

6:21

Basic Income Statement - Operating Expense and Net Income

Understand what is the difference between Cost of Goods Sold and Operating Expenses. How t...

published: 25 Sep 2013

Basic Income Statement - Operating Expense and Net Income

Basic Income Statement - Operating Expense and Net Income

Understand what is the difference between Cost of Goods Sold and Operating Expenses. How to calculation Operating Income, Net Income and Profit After Tax. Become familiar with all the components of Operating Expenses and Non-operating Expenses.- published: 25 Sep 2013

- views: 11

Youtube results:

4:50

Income Statement Merchandising Operations (Net Sales, Gross Profit, Net Income)

Merchandising accounting income statement (whats included and how to setup) for a merchand...

published: 08 Sep 2012

author: Allen Mursau

Income Statement Merchandising Operations (Net Sales, Gross Profit, Net Income)

Income Statement Merchandising Operations (Net Sales, Gross Profit, Net Income)

Merchandising accounting income statement (whats included and how to setup) for a merchandising company (a company that sells goods rather than manufacture g...- published: 08 Sep 2012

- views: 1323

- author: Allen Mursau

11:58

"Net Income Theory of capital Structure" lecture by Ms.Shaziya Naz, Biyani group of colleges

This lecture is delivered by Ms.Shaziya Naz, Asst. professor of biyani Girls College. The ...

published: 30 Mar 2013

author: Guru Kpo

"Net Income Theory of capital Structure" lecture by Ms.Shaziya Naz, Biyani group of colleges

"Net Income Theory of capital Structure" lecture by Ms.Shaziya Naz, Biyani group of colleges

This lecture is delivered by Ms.Shaziya Naz, Asst. professor of biyani Girls College. The video is about Net income Theory of capital structure. Acc to this ...- published: 30 Mar 2013

- views: 442

- author: Guru Kpo

2:30

Income Statement, Cont'd: EBITDA, Net Income

Brought to you by StratPad: Simple Business Plan App. Try it free at http://www.stratpad.c...

published: 09 Jun 2013

author: Alex Glassey

Income Statement, Cont'd: EBITDA, Net Income

Income Statement, Cont'd: EBITDA, Net Income

Brought to you by StratPad: Simple Business Plan App. Try it free at http://www.stratpad.com This video completes our look at the income statement. You'll le...- published: 09 Jun 2013

- views: 206

- author: Alex Glassey

7:14

Lesson FA-20-050 - Clip 05 - CVP Example - Determining Net Income - 7:13

Illustrates the completion of a CVP Income Statement to determine net income, highlighting...

published: 25 Apr 2011

author: evideolearner

Lesson FA-20-050 - Clip 05 - CVP Example - Determining Net Income - 7:13

Lesson FA-20-050 - Clip 05 - CVP Example - Determining Net Income - 7:13

Illustrates the completion of a CVP Income Statement to determine net income, highlighting the calculation of total contribution margin, contribution margin ...- published: 25 Apr 2011

- views: 2899

- author: evideolearner