14:22

Introduction to GAAP and Transaction Analysis

Introduction to GAAP and transaction analysis....

published: 14 Oct 2011

author: Denise Dodson

Introduction to GAAP and Transaction Analysis

Introduction to GAAP and Transaction Analysis

Introduction to GAAP and transaction analysis.- published: 14 Oct 2011

- views: 3498

- author: Denise Dodson

2:12

Generally Accepted Accounting Principles (GAAP)

This video explains in brief Generally Accepted Accounting Principles (GAAP).

Generally ac...

published: 16 Nov 2013

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP)

This video explains in brief Generally Accepted Accounting Principles (GAAP). Generally accepted accounting principles (GAAP) refer to the standard framework of guidelines for financial accounting used in any given jurisdiction; generally known as accounting standards or standard accounting practice. These include the standards, conventions, and rules that accountants follow in recording and summarizing and in the preparation of financial statements. Many countries use or are converging on the International Financial Reporting Standards (IFRS), established and maintained by the International Accounting Standards Board. In some countries, local accounting principles are applied for regular companies but listed or large companies must conform to IFRS, so statutory reporting is comparable internationally, across jurisdictions. All listed EU companies have been required to use IFRS since 2005, Canada moved in 2009, Taiwan in 2013, and other countries are adopting local versions. In the United States, while "...the SEC published a statement of continued support for a single set of high-quality, globally accepted accounting standards, and acknowledged that IFRS is best positioned to serve this role..." progress is less evident. http://www.youtube.com/watch?v=USqF_KCYHnU- published: 16 Nov 2013

- views: 2

11:05

What are US GAAP and IFRS Video Slides 1-20

This video the full video that includes all 20 slides used to discuss the topic "What are ...

published: 29 Apr 2013

author: Kevin Kimball

What are US GAAP and IFRS Video Slides 1-20

What are US GAAP and IFRS Video Slides 1-20

This video the full video that includes all 20 slides used to discuss the topic "What are US GAAP and IFRS?" The individual slide-specific videos are availab...- published: 29 Apr 2013

- views: 176

- author: Kevin Kimball

10:42

Introduction to GAAP - Developing Generally Accepted Accounting Principles

The Webster Academy The tutorial discusses the development of GAAP by its major influences...

published: 16 Jul 2012

author: john webster

Introduction to GAAP - Developing Generally Accepted Accounting Principles

Introduction to GAAP - Developing Generally Accepted Accounting Principles

The Webster Academy The tutorial discusses the development of GAAP by its major influences: AICPA, FASB, and SEC. It is ideal for introductory accounting stu...- published: 16 Jul 2012

- views: 1871

- author: john webster

10:50

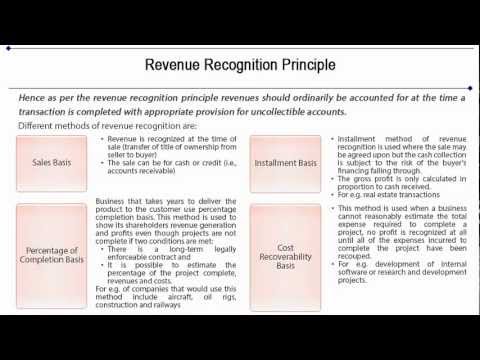

US GAAP -- Revenue Recognition

In this video Krista Pound from KPMG's US Accounting & Reporting Group discusses a key are...

published: 26 Mar 2013

author: KPMGUK

US GAAP -- Revenue Recognition

US GAAP -- Revenue Recognition

In this video Krista Pound from KPMG's US Accounting & Reporting Group discusses a key area of concern for Technology companies reporting under US GAAP -- re...- published: 26 Mar 2013

- views: 365

- author: KPMGUK

2:58

The GAAP RAP by Southwest Airlines Rapping Flight Attendant

Southwest Airlines' Rapping Flight Attendant, David Holmes, explains Generally Accepted Ac...

published: 20 May 2009

author: NutsAboutSouthwest

The GAAP RAP by Southwest Airlines Rapping Flight Attendant

The GAAP RAP by Southwest Airlines Rapping Flight Attendant

Southwest Airlines' Rapping Flight Attendant, David Holmes, explains Generally Accepted Accounting Principles (GAAP) in a "GAAP Rap" at the Company's 2009 Sh...- published: 20 May 2009

- views: 187406

- author: NutsAboutSouthwest

5:26

15 -- The Development of GAAP

An overview of the development of generally acceptable accounting principles (GAAP), to ac...

published: 24 Nov 2010

author: Larry Walther

15 -- The Development of GAAP

15 -- The Development of GAAP

An overview of the development of generally acceptable accounting principles (GAAP), to accompany http://www.principlesofaccounting.com Chapter 15, Financial...- published: 24 Nov 2010

- views: 2743

- author: Larry Walther

46:43

CFA Level II Key differences between US GAAP and IFRS PART I

For more information, visit www.fintreeindia.com....

published: 13 Feb 2013

author: FintreeIndia

CFA Level II Key differences between US GAAP and IFRS PART I

CFA Level II Key differences between US GAAP and IFRS PART I

For more information, visit www.fintreeindia.com.- published: 13 Feb 2013

- views: 3152

- author: FintreeIndia

9:35

Business English Vocabulary Lesson for ESL - Accounting: GAAP

Visit http://BusinessEnglishPod.com to download this video and others covering more busine...

published: 25 Jan 2009

author: Business English Pod

Business English Vocabulary Lesson for ESL - Accounting: GAAP

Business English Vocabulary Lesson for ESL - Accounting: GAAP

Visit http://BusinessEnglishPod.com to download this video and others covering more business ESL vocabulary. This Business English video ESL lesson introduce...- published: 25 Jan 2009

- views: 60655

- author: Business English Pod

21:58

US GAAP vs. IFRS on the Financial Statements

http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-US-GAAP-vs-IFRS.xlsx

ht...

published: 13 May 2014

US GAAP vs. IFRS on the Financial Statements

US GAAP vs. IFRS on the Financial Statements

http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-US-GAAP-vs-IFRS.xlsx http://breakingintowallstreet.com/biws/ Examples of Financial Statements for US-Based Companies: http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-US-Chuck-E-Cheese.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-US-Jazz-Pharmaceuticals.pdf Examples of Financial Statements for International Companies: http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Australia-Telstra.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Brazil-Ambev.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-China-TenCent.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-France-Vivendi.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-India-Infosys.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Japan-Suntory.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Korea-Samsung.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Mexico-FEMSA.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Russia-Rostelecom.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Saudi-Arabia-Saudi-Telecom.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-Singapore-SG-Airlines.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-South-Africa-PPC.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-UAE-DP-World.pdf http://youtube-breakingintowallstreet-com.s3.amazonaws.com/105-09-UK-Easyjet.pdf In this lesson, you'll learn the key differences between US GAAP and IFRS on the 3 main financial statements (Income Statement, Balance Sheet, and Cash Flow Statement). You'll also learn how to adjust an international company's financial statements to make it easier to model and project over time. Table of Contents: 1:46 Why US GAAP vs. IFRS Matters 5:28 Income Statement Terminology Differences 7:34 Balance Sheet Differences 14:09 How to Adjust the Financial Statements for an IFRS Company 20:02 Recap and Summary Income Statement: The Income Statement is very similar regardless of the accounting system. Some items have different names (e.g., Revenue is often called Turnover and Net Income is often called Profit), but that's about it. Balance Sheet: There are more differences on the Balance Sheet - items are often arranged in a different order (sometimes Long-Term Assets are listed first, then Current Assets, then Equity, then Long-Term Liabilities and Current Liabilities at the end). The Balance Sheet itself is usually called the "Statement of Financial Position." Also, items within the Equity section often have different names: Common Stock is called "Share Capital" or "Issued Capital." Additional Paid-In Capital is often called the "Share Premium." Retained Earnings and Treasury Stock tend to have similar names. IFRS-based companies also have many "Reserve" categories for items such as FX translation differences and unrealized gains and losses. For US-based companies, these items show up within Accumulated Other Comprehensive Income (AOIC) rather than being split out into separate "Reserve" categories. But the FUNCTIONALITY of the Balance Sheet is still very similar (items still flow in and change the same way), even if items have different names or are grouped differently. Cash Flow Statement There are more differences on the Cash Flow Statement, because most US-based companies use the INDIRECT method and most international companies use the DIRECT method. The Indirect Method starts with Net Income, makes non-cash adjustments, and lists the changes in Working Capital in the Cash Flow from Operations section. The Direct Method simply lists the cash received from customers and cash paid to suppliers and employees, along with income taxes and interest and other expenses, and so you don't see the full details behind the non-cash adjustments and working capital spending. When this happens, it is much, much harder to link the financial statements because changes in items such as Accounts Receivable and Accounts Payable won't flow into anything on the Cash Flow Statement. So we recommend ADJUSTING the financial statements as follows: First, find a reconciliation between this Cash Flow Statement and the company's operating income and/or net income. Then, make the Cash Flow Statement start with Net Income instead, as it normally does, and include all the line items from this reconciliation (non-cash adjustments, Working Capital changes, etc.). And if there are still remaining differences between items such as income taxes and interest expense on the Income Statement vs. Cash Flow Statement, make adjusting entries on the CFS that indicate the true cash amount that a company paid for those.- published: 13 May 2014

- views: 102

3:49

Introducing the 2013 edition of IFRS and US GAAP: similarities and differences

Learn more at PwC.com -http://pwc.to/19HD51H

PwC Partner David Schmid provides and overvie...

published: 17 Oct 2013

Introducing the 2013 edition of IFRS and US GAAP: similarities and differences

Introducing the 2013 edition of IFRS and US GAAP: similarities and differences

Learn more at PwC.com -http://pwc.to/19HD51H PwC Partner David Schmid provides and overview of the updates contained in the 2013 edition of IFRS and US GAAP: similarities and differences.- published: 17 Oct 2013

- views: 575

10:22

Accounting Principles - GAAP Principles Tutorial 9 of 10

The 9th tutorial video on financial accounting continues to explain the GAAP. In this vide...

published: 19 Apr 2012

author: CXOLearningAcademy

Accounting Principles - GAAP Principles Tutorial 9 of 10

Accounting Principles - GAAP Principles Tutorial 9 of 10

The 9th tutorial video on financial accounting continues to explain the GAAP. In this video Principles are covered. The cash and accrual basis of accounting ...- published: 19 Apr 2012

- views: 3216

- author: CXOLearningAcademy

2:43

ACCOUNTING - Generally Accepted Accounting Principles (GAAP)

Principle of regularity, consistency, sincerity, the permanence of methods, Non-compensati...

published: 26 Aug 2011

author: avenidacult

ACCOUNTING - Generally Accepted Accounting Principles (GAAP)

ACCOUNTING - Generally Accepted Accounting Principles (GAAP)

Principle of regularity, consistency, sincerity, the permanence of methods, Non-compensation, prudence, continuity, periodicity, Full Disclosure/Materiality ...- published: 26 Aug 2011

- views: 5019

- author: avenidacult

7:01

IFRS vs. GAAP

Description Not Provided....

published: 14 Nov 2012

author: Sierra Johnson

IFRS vs. GAAP

Youtube results:

6:40

US GAAP -- An introduction

This discussion focuses on the financial statement aspects of listing in the US and other ...

published: 26 Mar 2013

author: KPMGUK

US GAAP -- An introduction

US GAAP -- An introduction

This discussion focuses on the financial statement aspects of listing in the US and other considerations a public company needs to make whilst operating unde...- published: 26 Mar 2013

- views: 154

- author: KPMGUK

3:20

Convergence of GAAP & IFRS

Clip from SmartPros' Financial Management Network dated May 2011 "Lease Accounting: Moving...

published: 11 Sep 2012

author: LoscalzoAssoc

Convergence of GAAP & IFRS

Convergence of GAAP & IFRS

Clip from SmartPros' Financial Management Network dated May 2011 "Lease Accounting: Moving toward Major Changes" with John Fleming discussing talk of the con...- published: 11 Sep 2012

- views: 1171

- author: LoscalzoAssoc

3:16

GAAP KVLT - Buspirone

GAAP KVLT : http://www,facebook.com/gaapkvlt http://www.soundcloud.com/gaapkvlt http://www...

published: 04 Mar 2013

author: Gaap Paag

GAAP KVLT - Buspirone

GAAP KVLT - Buspirone

GAAP KVLT : http://www,facebook.com/gaapkvlt http://www.soundcloud.com/gaapkvlt http://www.gaapkvlt.bandcamp.com Video : http://freistellen.tumblr.com/ https...- published: 04 Mar 2013

- views: 440

- author: Gaap Paag

1:58

GAAP, FASB Codification

What is the composition of GAAP?

Principles, methods, and procedures that are generally ac...

published: 16 May 2014

GAAP, FASB Codification

GAAP, FASB Codification

What is the composition of GAAP? Principles, methods, and procedures that are generally accepted by the accounting profession Majority of GAAP pronouncements are issued by which organization(s)? Principles, methods, and procedures that are generally accepted by the accounting profession Majority of GAAP pronouncements are issued by which organization(s)? * Committee on Accounting Procedure (CAP) * Accounting Principles Board (APB) * Financial Accounting Standards Board (FASB) What is the sole source of authoritative U.S. GAAP for nongovernmental entities, except for SEC guidance? The FASB Accounting Standards Codification How many levels of hierarchy does the Codification have? * One level * There is no hierarchy for GAAP What are the nonauthoritative GAAP? Accounting and financial reporting practices EXCLUDED from the Codification. What is the purpose of the Codification? To compile GAAP in an structured electronic form, organized by major area and topic. What does the Codification exclude? * Other Comprehensive Basis of Accounting * Cash Basis * Income Tax Basis * Regulatory Accounting Principles * NOT limited to above- published: 16 May 2014

- views: 10

![[Special Event Webcast] Preparing for the 2012 US GAAP XBRL Taxonomy with FASB and Rivet Software; updated 12 Jun 2012; published 06 Jun 2012](http://web.archive.org./web/20140731052321im_/http://i.ytimg.com/vi/F4FK0-yQCxE/0.jpg)