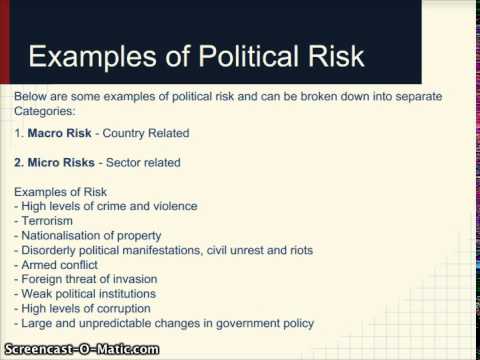

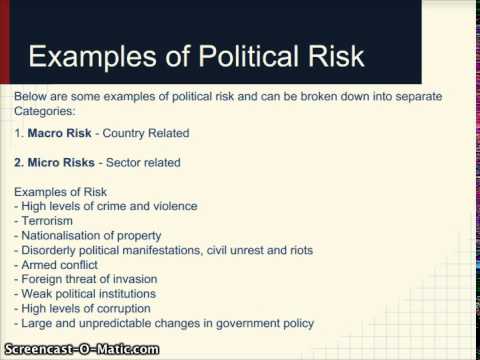

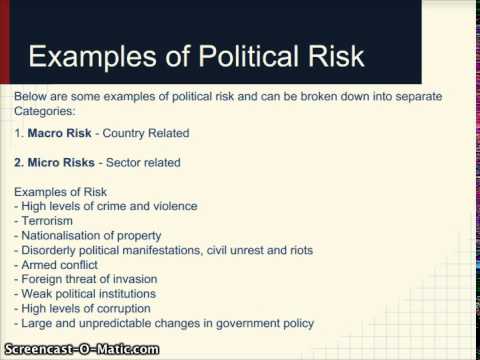

Political risk is a type of risk faced by investors, corporations, and governments. It is a risk that can be understood and managed with reasoned foresight and investment.

Broadly, political risk refers to the complications businesses and governments may face as a result of what are commonly referred to as political decisions—or “any political change that alters the expected outcome and value of a given economic action by changing the probability of achieving business objectives.”. Political risk faced by firms can be defined as “the risk of a strategic, financial, or personnel loss for a firm because of such nonmarket factors as macroeconomic and social policies (fiscal, monetary, trade, investment, industrial, income, labour, and developmental), or events related to political instability (terrorism, riots, coups, civil war, and insurrection).” Portfolio investors may face similar financial losses. Moreover, governments may face complications in their ability to execute diplomatic, military or other initiatives as a result of political risk.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Ian Bremmer (born November 12, 1969) is an American political scientist specializing in US foreign policy, states in transition, and global political risk. He is the president and founder of Eurasia Group, a leading global political risk research and consulting firm, and a professor at Columbia University. Eurasia Group provides financial, corporate, and government clients with information and insight on how political developments move markets. Bremmer is of Armenian and German descent.

Bremmer has authored/published eight books, including the national bestsellers Every Nation for Itself: Winners and Losers in a G-Zero World (Portfolio, May 2012), which details risks and opportunities in a world without global leadership, and The End of the Free Market: Who Wins the War Between States and Corporations (Portfolio, May 2010), which describes the global phenomenon of state capitalism and its implications for economics and politics. He also wrote The J Curve: A New Way to Understand Why Nations Rise and Fall (Simon & Schuster, 2006), selected by The Economist as one of the best books of 2006.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Nassim Nicholas Taleb (Arabic: نسيم نيقولا نجيب طالب, alternatively Nessim or Nissim, born 1960) is a Lebanese American essayist whose work focuses on problems of randomness and probability. His 2007 book The Black Swan was described in a review by Sunday Times as one of the twelve most influential books since World War II.

He is a bestselling author, and has been a professor at several universities, currently at Polytechnic Institute of New York University and Oxford University. He has also been a practitioner of mathematical finance,a hedge fund manager, a Wall Street trader, and is currently a scientific adviser at Universa Investments and the International Monetary Fund.

He criticized the risk management methods used by the finance industry and warned about financial crises, subsequently making a fortune out of the late-2000s financial crisis. He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events. He proposes "antifragility" in systems, that is, an ability to benefit and grow from random events, errors, and volatility as well as "stochastic tinkering" as a method of scientific discovery, by which he means experimentation and fact-collecting instead of top-down directed research.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

Remarks on Political Risk by Dr. Ian Bremmer

Remarks on Political Risk by Dr. Ian Bremmer -

What Is Political Risk?

What Is Political Risk?What Is Political Risk?

This lesson looks at the risk that businesses, investors and governments may face when there is a change in politics or political outcomes. As such, if there... -

What is Political Risk ?

What is Political Risk ?What is Political Risk ?

Political risk is the major political instability at your export destination that can either disrupt or in some cases prevent completion of export contracts.... -

Control Risks' Political Risk Analysis Capabilities

Control Risks' Political Risk Analysis CapabilitiesControl Risks' Political Risk Analysis Capabilities

Jake Stratton, head of Control Risks' team of political and security risk analysts talks about the company's political risk assessment capabilities. He belie... -

Ian Bremmer - Global Political Risk Analyst

Ian Bremmer - Global Political Risk AnalystIan Bremmer - Global Political Risk Analyst

Eagles Talent Speakers Bureau proudly presents Ian Bremmer - http://www.eaglestalent.com/Ian-Bremmer Ian Bremmer is the president and founder of Eurasia Grou... -

Political Risk Insurance

Political Risk InsurancePolitical Risk Insurance

A look at the importance of political risk insurance. Randy Grodman, International Development Opportunities (IDO). -

Massey University - Big Issues in Business - Sasha Molchanov

Massey University - Big Issues in Business - Sasha MolchanovMassey University - Big Issues in Business - Sasha Molchanov

The New Zealand government has the stated a target of lifting exports to 40% of GDP by 2025. For firms wishing to grow by exporting internationally, there are many decisions to be made about where and when – but many companies fail to consider political risk. Associate Professor Sasha Molchanov shares his research insights on exporting to politically risky countries and provides key learnings for businesses looking to export internationally. The reality of our business world is constantly shifting. Global events are unpredictable and their impact is felt ever more quickly. New Zealand businesses need to be increasingly nimble and relevant -

Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)

Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)

Visit http://icould.com/videos/mark-m/ for more careers info. Mark M is an Assistant Political Risk Underwriter at Chaucer Insurance - "We insure things like... -

AIG Specialty Product Lines - Political Risk

AIG Specialty Product Lines - Political RiskAIG Specialty Product Lines - Political Risk

A foreign government's action, or inaction, can result in a client's loss of property, income or financial assets.The Political Risk division of AIG has the ... -

China's Political Risk

China's Political RiskChina's Political Risk

Its command economy and upcoming succession give reason for concern. -

Fletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas Taleb

Fletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas TalebFletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas Taleb

Topic: Fat Tails Speaker: Nassim Nicholas Taleb Moderator: Nadim Shehadi -

Global Exposure: Political Risk Insurance in Emerging Markets

Global Exposure: Political Risk Insurance in Emerging MarketsGlobal Exposure: Political Risk Insurance in Emerging Markets

Jim Thomas, Underwriting Manager for Zurich Credit & Political Risk at Zurich North America, shares insight into the increase in risks for companies operatin... -

How Political Risk Affects An Economy

How Political Risk Affects An EconomyHow Political Risk Affects An Economy

The risk that businesses, investors and governments may face when there is a change in politics or political outcomes. As such, if there is a change in the p... -

Political Risk, James Tompkins

Political Risk, James TompkinsPolitical Risk, James Tompkins

This is the thirteenth and final lecture in the "International Finance" series in which I discuss Political Risk. What is it, how is it measured and how can ...

- CFIUS

- Chief Risk Officer

- Commodity risk

- Concentration risk

- Consumer credit risk

- Corporations

- Credit derivative

- Credit risk

- Currency risk

- Dubai Ports World

- Equity risk

- Eurasia Group

- Expected return

- Fareed Zakaria

- Financial economics

- Financial risk

- Governments

- Hazard

- Hedge (finance)

- Ian Bremmer

- Interest rate risk

- Investors

- Legal risk

- Liquidity risk

- Market portfolio

- Market risk

- Mathematical finance

- Megaprojects

- MIGA

- Operational risk

- OPIC

- Political risk

- Profit risk

- Refinancing risk

- Reputational risk

- Risk

- Risk parity

- Risk pool

- Securitization

- Settlement risk

- Sharpe ratio

- Systematic risk

- Systemic risk

- Terrorism

- The Economist

- The PRS Group, Inc.

- Value at risk

- Volatility risk

- Wikipedia Footnotes

-

Remarks on Political Risk by Dr. Ian Bremmer

Remarks on Political Risk by Dr. Ian BremmerRemarks on Political Risk by Dr. Ian Bremmer

Dr. Ian Bremmer, Founder and President of the Eurasia Group, delivers remarks on political risk to commence the lunch session. Dr. Bremmer discusses the chan... -

What Is Political Risk?

What Is Political Risk?What Is Political Risk?

This lesson looks at the risk that businesses, investors and governments may face when there is a change in politics or political outcomes. As such, if there... -

What is Political Risk ?

What is Political Risk ?What is Political Risk ?

Political risk is the major political instability at your export destination that can either disrupt or in some cases prevent completion of export contracts.... -

Control Risks' Political Risk Analysis Capabilities

Control Risks' Political Risk Analysis CapabilitiesControl Risks' Political Risk Analysis Capabilities

Jake Stratton, head of Control Risks' team of political and security risk analysts talks about the company's political risk assessment capabilities. He belie... -

Ian Bremmer - Global Political Risk Analyst

Ian Bremmer - Global Political Risk AnalystIan Bremmer - Global Political Risk Analyst

Eagles Talent Speakers Bureau proudly presents Ian Bremmer - http://www.eaglestalent.com/Ian-Bremmer Ian Bremmer is the president and founder of Eurasia Grou... -

Political Risk Insurance

Political Risk InsurancePolitical Risk Insurance

A look at the importance of political risk insurance. Randy Grodman, International Development Opportunities (IDO). -

Massey University - Big Issues in Business - Sasha Molchanov

Massey University - Big Issues in Business - Sasha MolchanovMassey University - Big Issues in Business - Sasha Molchanov

The New Zealand government has the stated a target of lifting exports to 40% of GDP by 2025. For firms wishing to grow by exporting internationally, there are many decisions to be made about where and when – but many companies fail to consider political risk. Associate Professor Sasha Molchanov shares his research insights on exporting to politically risky countries and provides key learnings for businesses looking to export internationally. The reality of our business world is constantly shifting. Global events are unpredictable and their impact is felt ever more quickly. New Zealand businesses need to be increasingly nimble and relevant -

Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)

Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)

Visit http://icould.com/videos/mark-m/ for more careers info. Mark M is an Assistant Political Risk Underwriter at Chaucer Insurance - "We insure things like... -

AIG Specialty Product Lines - Political Risk

AIG Specialty Product Lines - Political RiskAIG Specialty Product Lines - Political Risk

A foreign government's action, or inaction, can result in a client's loss of property, income or financial assets.The Political Risk division of AIG has the ... -

China's Political Risk

China's Political RiskChina's Political Risk

Its command economy and upcoming succession give reason for concern. -

Fletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas Taleb

Fletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas TalebFletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas Taleb

Topic: Fat Tails Speaker: Nassim Nicholas Taleb Moderator: Nadim Shehadi -

Global Exposure: Political Risk Insurance in Emerging Markets

Global Exposure: Political Risk Insurance in Emerging MarketsGlobal Exposure: Political Risk Insurance in Emerging Markets

Jim Thomas, Underwriting Manager for Zurich Credit & Political Risk at Zurich North America, shares insight into the increase in risks for companies operatin... -

How Political Risk Affects An Economy

How Political Risk Affects An EconomyHow Political Risk Affects An Economy

The risk that businesses, investors and governments may face when there is a change in politics or political outcomes. As such, if there is a change in the p... -

Political Risk, James Tompkins

Political Risk, James TompkinsPolitical Risk, James Tompkins

This is the thirteenth and final lecture in the "International Finance" series in which I discuss Political Risk. What is it, how is it measured and how can ... -

Political risk factor

Political risk factorPolitical risk factor

www.ktnkenya.tv Political risk factor. -

Is Kenya Political Risk Declining

Is Kenya Political Risk DecliningIs Kenya Political Risk Declining

-

Doug Casey on Crisis Investing, Political Risk, and a Benign Anarchy!

Doug Casey on Crisis Investing, Political Risk, and a Benign Anarchy!Doug Casey on Crisis Investing, Political Risk, and a Benign Anarchy!

Follow us @ http://twitter.com/laurenlyster http://twitter.com/coveringdelta Welcome to Capital Account. The US economy slowed in the second quarter: GDP ros... -

Political risk insurance interpreted by our professionals from MIGA, Sinosure and US Ex-Im Bank

Political risk insurance interpreted by our professionals from MIGA, Sinosure and US Ex-Im BankPolitical risk insurance interpreted by our professionals from MIGA, Sinosure and US Ex-Im Bank

This video was made for a student project at HULT. The video's only purpose is to give basic information about political risk insurance, MIGA, Sinosure and U... -

Political Risk Insurance: Investing in Emerging Markets and Developing Countries...or not

Political Risk Insurance: Investing in Emerging Markets and Developing Countries...or notPolitical Risk Insurance: Investing in Emerging Markets and Developing Countries...or not

Maxwell School, Peer to Peer Political Risk Insurance: Investing in Emerging Markets and Developing Countries...or not Maurice Sarr, EMPA candidate Political... -

(R)evolutions in Political Risk Assessment: Fletcher Political Risk Conference 2015

(R)evolutions in Political Risk Assessment: Fletcher Political Risk Conference 2015(R)evolutions in Political Risk Assessment: Fletcher Political Risk Conference 2015

Introduction by Dean Deborah W. Nutter, Senior Associate Dean and Professor of Practice at The Fletcher School -

Doug Casey on how to Hedge Against Political Risk in the Greater Depression

Doug Casey on how to Hedge Against Political Risk in the Greater DepressionDoug Casey on how to Hedge Against Political Risk in the Greater Depression

check us out on Facebook http://www.facebook.com/CapitalAccount Follow us @ http://twitter.com/laurenlyster http://twitter.com/coveringdelta Welcome to Capit... -

Political Risk Analysis

Political Risk AnalysisPolitical Risk Analysis

2013 AVCJ Forum, Poseidon talk about Political risk analysis. -

On The Money: Political Risk in Russia

On The Money: Political Risk in RussiaOn The Money: Political Risk in Russia

Who should investors listen to when it comes to assessing the level of political risk in Russia? Will we see significant capital inflows in Russia after the ...

- Duration: 10:58

- Updated: 06 May 2014

- author: Concordia

- published: 16 Oct 2013

- views: 347

- author: Concordia

- Duration: 9:09

- Updated: 23 Jun 2014

- author: cedric chehab

- published: 20 Apr 2014

- views: 69

- author: cedric chehab

- Duration: 0:49

- Updated: 25 Nov 2013

- author: B2Bwhiteboard

- published: 22 Jan 2012

- views: 1188

- author: B2Bwhiteboard

- Duration: 3:23

- Updated: 04 Jun 2013

- author: controlrisks

- published: 09 Jan 2012

- views: 3027

- author: controlrisks

- Duration: 5:38

- Updated: 07 Aug 2014

- author: EaglesTalent

- published: 07 Aug 2014

- views: 113

- author: EaglesTalent

- Duration: 8:15

- Updated: 28 Aug 2014

- author: dukascopytv

- published: 08 May 2014

- views: 38

- author: dukascopytv

- Duration: 3:03

- Updated: 08 Sep 2014

- published: 08 Sep 2014

- views: 43

- Duration: 4:02

- Updated: 27 Nov 2013

- author: icouldstories

- published: 23 May 2011

- views: 1832

- author: icouldstories

- Duration: 3:26

- Updated: 04 Dec 2013

- author: AIG

- published: 07 Feb 2013

- views: 886

- author: AIG

- Duration: 2:19

- Updated: 10 Feb 2013

- author: forbes

- published: 10 Dec 2009

- views: 2005

- author: forbes

- Duration: 65:29

- Updated: 14 Apr 2015

- published: 14 Apr 2015

- views: 40

- Duration: 2:45

- Updated: 12 Aug 2014

- author: ZurichNorthAmerica

- published: 30 Oct 2013

- views: 5482

- author: ZurichNorthAmerica

- Duration: 8:19

- Updated: 22 Apr 2014

- author: cedric chehab

- published: 20 Apr 2014

- views: 203

- author: cedric chehab

- Duration: 23:56

- Updated: 24 Aug 2014

- author: Understanding Finance

- published: 27 Mar 2014

- views: 290

- author: Understanding Finance

- Duration: 2:17

- Updated: 21 Nov 2013

- author: KTN Kenya

- Duration: 2:03

- Updated: 08 Oct 2014

http://wn.com/Is_Kenya_Political_Risk_Declining

- published: 08 Oct 2014

- views: 404

- Duration: 28:03

- Updated: 16 Dec 2013

- author: CapitalAccount

- published: 27 Jul 2012

- views: 25467

- author: CapitalAccount

- Duration: 8:08

- Updated: 08 Oct 2013

- author: elixias1

- published: 18 Feb 2013

- views: 182

- author: elixias1

- Duration: 55:22

- Updated: 30 Jul 2014

- author: maxwellschool

- published: 18 Apr 2013

- views: 665

- author: maxwellschool

- Duration: 84:54

- Updated: 14 Apr 2015

- published: 14 Apr 2015

- views: 20

- Duration: 28:03

- Updated: 05 Jul 2014

- author: CapitalAccount

- published: 22 Oct 2012

- views: 28161

- author: CapitalAccount

- Duration: 1:51

- Updated: 19 Jun 2014

- author: Poseidon Group

- published: 16 Apr 2014

- views: 26

- author: Poseidon Group

- Duration: 24:13

- Updated: 18 Mar 2014

- author: RT

- published: 25 Feb 2012

- views: 3339

- author: RT

-

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360

Get economic collapse news throughout the day visit http://x22report.com More news visit http://thepeoplesnewz.com Report date: 5.07.2014 Cyprus still under ... -

The Rise of Global Political Risk

The Rise of Global Political RiskThe Rise of Global Political Risk

Please join Ian Bremmer as he discusses his book The Fat Tail: The Power of Political Knowledge Through Strategic Investing. -

Political risk concerns in Africa: Perception or Reality?

Political risk concerns in Africa: Perception or Reality?Political risk concerns in Africa: Perception or Reality?

On February 4, 2013, on the margins of Mining Indaba 2013, the Canadian government organised its fourth Interactive Discussion Forum with the theme "Politica... -

Political Risk - David Gordon at the World Bank 2009 Part One

Political Risk - David Gordon at the World Bank 2009 Part OnePolitical Risk - David Gordon at the World Bank 2009 Part One

For MSFS575: Intro to Pol Risk Assessment -

Investment and Operations in Complex Environments: Fletcher Political Risk Conference 2015

Investment and Operations in Complex Environments: Fletcher Political Risk Conference 2015Investment and Operations in Complex Environments: Fletcher Political Risk Conference 2015

Panel 2: Investment and Operations in Complex Environments -

Mod-08 Lec-34 Risk Management - Country / Political risks III

Mod-08 Lec-34 Risk Management - Country / Political risks IIIMod-08 Lec-34 Risk Management - Country / Political risks III

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in. -

Mod-08 Lec-35 Risk Management - Country / Political risks IV

Mod-08 Lec-35 Risk Management - Country / Political risks IVMod-08 Lec-35 Risk Management - Country / Political risks IV

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in. -

Mod-08 Lec-32 Risk Management - Country / Political risks I

Mod-08 Lec-32 Risk Management - Country / Political risks IMod-08 Lec-32 Risk Management - Country / Political risks I

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in -

Petrozuata Political Risk and Short Cut Keys

Petrozuata Political Risk and Short Cut KeysPetrozuata Political Risk and Short Cut Keys

Gives a survey of short cut keys and demonstrates how to assess country risk premiums using the probabilty of expropriation -

Jeremy Pam. Dept of Defense Strategy and Planning Reform. JPR Webcast with Anders Corr, Robert Wh...

Jeremy Pam. Dept of Defense Strategy and Planning Reform. JPR Webcast with Anders Corr, Robert Wh...Jeremy Pam. Dept of Defense Strategy and Planning Reform. JPR Webcast with Anders Corr, Robert Wh...

Jeremiah S. Pam 22 Mar 2015 Journal of Political Risk Webcast – 23 Mar 2015 at 7:30 PM Prof. Jeremy Pam on DoD Strategy and Planning Reform Background • While the challenges of the post-9/11 strategic environment and the contemporary upsurge in civil-military “complex operations” have produced many documents and speeches presenting themselves as “strategy,” few of these have been truly strategic in Sun Tzu’s sense of an approach based on realistic, prioritized assessments of both our capabilities and the local environment. • Instead, our strategies all too often resemble a ‘wish list’ of all the things we’d like to achieve if there were no -

Political Risk Premium and Goal Seek Function

Political Risk Premium and Goal Seek FunctionPolitical Risk Premium and Goal Seek Function

Shows how country risk premiums can result in very high probability of default. Computes the implied probability of default using a dynamic goal seek function. -

JPR Webcast: Africa, Extremism, and Influence, with Anders Corr, Robert Whitcomb, and Douglas Lav...

JPR Webcast: Africa, Extremism, and Influence, with Anders Corr, Robert Whitcomb, and Douglas Lav...JPR Webcast: Africa, Extremism, and Influence, with Anders Corr, Robert Whitcomb, and Douglas Lav...

The Journal of Political Risk (JPR) sponsors a webcast on extremism and influence in Africa, with host Anders Corr (Publisher, JPR), and guests Robert Whitcomb (Editor, New England Diary) and Douglas Lavanture (Data Reporter, Bloomberg News). -

Mod-08 Lec-33 Risk Management - Country / Political risks II

Mod-08 Lec-33 Risk Management - Country / Political risks IIMod-08 Lec-33 Risk Management - Country / Political risks II

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in. -

Keynote Address: Ian Bremmer - 2014 Nobel Peace Prize Forum

Keynote Address: Ian Bremmer - 2014 Nobel Peace Prize ForumKeynote Address: Ian Bremmer - 2014 Nobel Peace Prize Forum

Ian Bremmer President and Founder, Eurasia Group Ian Bremmer is the president and founder of Eurasia Group, the leading global political risk research and co... -

Global Ethics Forum: Top Risks and Ethical Decisions 2014 with Ian Bremmer

Global Ethics Forum: Top Risks and Ethical Decisions 2014 with Ian BremmerGlobal Ethics Forum: Top Risks and Ethical Decisions 2014 with Ian Bremmer

So what should we look out for in 2014? "The economic risks are receding. The geopolitical risks are becoming more important," says political risk guru Ian B... -

Economic and Political Risks: Key End Time Events with Larry Bates

Economic and Political Risks: Key End Time Events with Larry BatesEconomic and Political Risks: Key End Time Events with Larry Bates

Former House of Representative for Tennessee, former chairman of the Bank and Commerce Committee and Present day publisher and editor of Monetary and Economi...

- Duration: 35:32

- Updated: 23 Jul 2014

- author: X22Report

- published: 08 May 2014

- views: 10166

- author: X22Report

- Duration: 62:31

- Updated: 25 Jan 2014

- author: NewAmericaFoundation

- published: 08 Apr 2009

- views: 1906

- author: NewAmericaFoundation

- Duration: 76:31

- Updated: 26 Mar 2014

- author: CanadaInSouthAfrica

- published: 20 Feb 2013

- views: 135

- author: CanadaInSouthAfrica

- Duration: 26:14

- Updated: 08 Jan 2015

- published: 08 Jan 2015

- views: 10

- Duration: 64:44

- Updated: 14 Apr 2015

- published: 14 Apr 2015

- views: 35

- Duration: 44:19

- Updated: 01 Feb 2014

- author: nptelhrd

- published: 30 Jan 2014

- views: 121

- author: nptelhrd

- Duration: 50:49

- Updated: 02 Feb 2014

- author: nptelhrd

- published: 30 Jan 2014

- views: 864

- author: nptelhrd

- Duration: 47:32

- Updated: 30 Jan 2014

- published: 30 Jan 2014

- views: 4

- Duration: 34:23

- Updated: 12 May 2015

- published: 12 May 2015

- views: 6

- Duration: 82:36

- Updated: 24 Mar 2015

- published: 24 Mar 2015

- views: 4

- Duration: 39:35

- Updated: 24 May 2015

- published: 24 May 2015

- views: 0

- Duration: 58:11

- Updated: 19 Mar 2015

- published: 19 Mar 2015

- views: 8

- Duration: 51:08

- Updated: 20 Feb 2014

- author: nptelhrd

- published: 30 Jan 2014

- views: 143

- author: nptelhrd

- Duration: 93:41

- Updated: 02 Sep 2014

- author: Nobel Peace Prize Forum

- published: 08 Mar 2014

- author: Nobel Peace Prize Forum

- Duration: 27:02

- Updated: 30 Aug 2014

- author: Carnegie Council for Ethics in International Affairs

- published: 05 Mar 2014

- views: 567

- author: Carnegie Council for Ethics in International Affairs

- Duration: 28:31

- Updated: 12 Aug 2014

- author: TheCrossoverProject CP

- published: 10 Sep 2013

- views: 842

- author: TheCrossoverProject CP

-

PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode]

PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode]PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode]

PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] Show Your Support & Subscribe To Our Channel, Click On Link Below To Subscribe: http://bit.ly/1bYv7QT At http://www.iPakshows.com, We Pride Ourselves ... -

Nouriel Roubini on Italian political risk and emerging mark

Nouriel Roubini on Italian political risk and emerging markNouriel Roubini on Italian political risk and emerging mark

yahoo finance,google finance,google stock,finance,ira,buy gold coin,gold dealers,gold coins in ira,forex,forex trading ... Sept. 6 (Bloomberg) -- New York University economics professor Nouriel Roubini comments on the state of the U.S. economy from Cernobbio, Italy. He speaks ... Martin Baily: President Obama and Congress should quietly plan for another European financial crisis, and ensure that after the changes in U.S. financial regulations following the last crisis,... LOW RATES MEAN ASSET PRICES ON THE RISE ANCHOR (OFF-CAMERA) ENGLISH SAYING: So what's behind the market's run really, since the start of the ... watch the full inter -

political risk and ownership risk was clarified by Mr Mahesh Shetty CEO ENCORE MULTI INC USA

political risk and ownership risk was clarified by Mr Mahesh Shetty CEO ENCORE MULTI INC USApolitical risk and ownership risk was clarified by Mr Mahesh Shetty CEO ENCORE MULTI INC USA

POLITICAL RISK and ownership risk was clarified by Mr. Mahesh Shetty CEO ENCORE MULTI INC USA -

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360.mp4. Get economic collapse news throughout the day visit More news visit Report date: 5.07.2014 Cyprus still under ... hy friends i'm johnson lee,and i have many videos about education related....some video i uploaded...if u like my choice please hit the like button and subsc... Please like and Subscribed our channel for daily update......:) hy friends i'm johnson lee,and i have many videos about education related....some video i uploaded...if u like my choice please hit the like button and subsc. Manipulated Unemployment, Housing Decline -

Journal of Political Risk South China Sea Conference Part XVII

Journal of Political Risk South China Sea Conference Part XVIIJournal of Political Risk South China Sea Conference Part XVII

-

Journal of Political Risk South China Sea Conference Part XV

Journal of Political Risk South China Sea Conference Part XVJournal of Political Risk South China Sea Conference Part XV

-

Journal of Political Risk South China Sea Conference Part XVI

Journal of Political Risk South China Sea Conference Part XVIJournal of Political Risk South China Sea Conference Part XVI

-

Journal of Political Risk South China Sea Conference Part XXIX

Journal of Political Risk South China Sea Conference Part XXIXJournal of Political Risk South China Sea Conference Part XXIX

-

Journal of Political Risk South China Sea Conference Part XXXI

Journal of Political Risk South China Sea Conference Part XXXIJournal of Political Risk South China Sea Conference Part XXXI

-

Journal of Political Risk South China Sea Conference Part XXXII

Journal of Political Risk South China Sea Conference Part XXXIIJournal of Political Risk South China Sea Conference Part XXXII

-

Journal of Political Risk South China Sea Conference Part XXX

Journal of Political Risk South China Sea Conference Part XXXJournal of Political Risk South China Sea Conference Part XXX

-

Journal of Political Risk South China Sea Conference Part XXVIII

Journal of Political Risk South China Sea Conference Part XXVIIIJournal of Political Risk South China Sea Conference Part XXVIII

-

Journal of Political Risk South China Sea Conference Part XXVII

Journal of Political Risk South China Sea Conference Part XXVIIJournal of Political Risk South China Sea Conference Part XXVII

-

Journal of Political Risk South China Sea Conference Part XXV

Journal of Political Risk South China Sea Conference Part XXVJournal of Political Risk South China Sea Conference Part XXV

-

Journal of Political Risk South China Sea Conference Part XXVI

Journal of Political Risk South China Sea Conference Part XXVIJournal of Political Risk South China Sea Conference Part XXVI

-

Journal of Political Risk South China Sea Conference Part XXIII

Journal of Political Risk South China Sea Conference Part XXIIIJournal of Political Risk South China Sea Conference Part XXIII

-

Journal of Political Risk South China Sea Conference XXIV

Journal of Political Risk South China Sea Conference XXIVJournal of Political Risk South China Sea Conference XXIV

-

Journal of Political Risk South China Sea Conference Part XX

Journal of Political Risk South China Sea Conference Part XXJournal of Political Risk South China Sea Conference Part XX

-

Journal of Political Risk South China Sea Conference Part XXII

Journal of Political Risk South China Sea Conference Part XXIIJournal of Political Risk South China Sea Conference Part XXII

-

Journal of Political Risk South China Sea Conference Part XXI

Journal of Political Risk South China Sea Conference Part XXIJournal of Political Risk South China Sea Conference Part XXI

-

Journal of Political Risk South China Sea Conference Part XIX

Journal of Political Risk South China Sea Conference Part XIXJournal of Political Risk South China Sea Conference Part XIX

-

Journal of Political Risk South China Sea Conference Part XVIII

Journal of Political Risk South China Sea Conference Part XVIIIJournal of Political Risk South China Sea Conference Part XVIII

![PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode]](http://web.archive.org./web/20150601184541im_/http://i.ytimg.com/vi/EvS3gMflep0/0.jpg)

- Duration: 1:17

- Updated: 17 May 2015

- published: 17 May 2015

- views: 2

- Duration: 15:48

- Updated: 16 May 2015

- published: 16 May 2015

- views: 1

- Duration: 1:51

- Updated: 14 May 2015

- published: 14 May 2015

- views: 4

- Duration: 35:32

- Updated: 13 May 2015

- published: 13 May 2015

- views: 0

- Duration: 7:39

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XVII

- published: 10 May 2015

- views: 0

- Duration: 1:56

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XV

- published: 10 May 2015

- views: 2

- Duration: 1:56

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XVI

- published: 10 May 2015

- views: 1

- Duration: 5:47

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXIX

- published: 10 May 2015

- views: 0

- Duration: 2:45

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXXI

- published: 10 May 2015

- views: 0

- Duration: 1:17

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXXII

- published: 10 May 2015

- views: 1

- Duration: 1:35

- Updated: 10 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXX

- published: 10 May 2015

- views: 0

- Duration: 6:10

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXVIII

- published: 08 May 2015

- views: 6

- Duration: 6:47

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXVII

- published: 08 May 2015

- views: 3

- Duration: 8:36

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXV

- published: 08 May 2015

- views: 3

- Duration: 3:44

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXVI

- published: 08 May 2015

- views: 0

- Duration: 7:03

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXIII

- published: 08 May 2015

- views: 37

- Duration: 9:07

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_XXIV

- published: 08 May 2015

- views: 4

- Duration: 8:14

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XX

- published: 08 May 2015

- views: 4

- Duration: 3:12

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXII

- published: 08 May 2015

- views: 1

- Duration: 1:13

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XXI

- published: 08 May 2015

- views: 1

- Duration: 1:06

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XIX

- published: 08 May 2015

- views: 2

- Duration: 0:55

- Updated: 08 May 2015

http://wn.com/Journal_of_Political_Risk_South_China_Sea_Conference_Part_XVIII

- published: 08 May 2015

- views: 1

- Playlist

- Chat

Remarks on Political Risk by Dr. Ian Bremmer

Dr. Ian Bremmer, Founder and President of the Eurasia Group, delivers remarks on political risk to commence the lunch session. Dr. Bremmer discusses the chan...- published: 16 Oct 2013

- views: 347

- author: Concordia

What Is Political Risk?

This lesson looks at the risk that businesses, investors and governments may face when there is a change in politics or political outcomes. As such, if there...- published: 20 Apr 2014

- views: 69

- author: cedric chehab

What is Political Risk ?

Political risk is the major political instability at your export destination that can either disrupt or in some cases prevent completion of export contracts....- published: 22 Jan 2012

- views: 1188

- author: B2Bwhiteboard

Control Risks' Political Risk Analysis Capabilities

Jake Stratton, head of Control Risks' team of political and security risk analysts talks about the company's political risk assessment capabilities. He belie...- published: 09 Jan 2012

- views: 3027

- author: controlrisks

Ian Bremmer - Global Political Risk Analyst

Eagles Talent Speakers Bureau proudly presents Ian Bremmer - http://www.eaglestalent.com/Ian-Bremmer Ian Bremmer is the president and founder of Eurasia Grou...- published: 07 Aug 2014

- views: 113

- author: EaglesTalent

Political Risk Insurance

A look at the importance of political risk insurance. Randy Grodman, International Development Opportunities (IDO).- published: 08 May 2014

- views: 38

- author: dukascopytv

Massey University - Big Issues in Business - Sasha Molchanov

The New Zealand government has the stated a target of lifting exports to 40% of GDP by 2025. For firms wishing to grow by exporting internationally, there are many decisions to be made about where and when – but many companies fail to consider political risk. Associate Professor Sasha Molchanov shares his research insights on exporting to politically risky countries and provides key learnings for businesses looking to export internationally. The reality of our business world is constantly shifting. Global events are unpredictable and their impact is felt ever more quickly. New Zealand businesses need to be increasingly nimble and relevant to be competitive. Gaining good market intelligence, quickly, is a key part of ensuring that you are staying at the top of your game. Massey University brings international and local business experts to you, in a video series called ‘Big Issues in Business’. Thanks to 90 Seconds for the production of these videos. ---- Massey University - Big Issues in Business - Sasha Molchanov is produced for Massey University - Massey University, New Zealand's defining university - Massey University - http://massey.ac.nz Massey University, New Zealand's defining university, offers a range of undergraduate and postgraduate degrees, diplomas and certificates to students from around New Zealand, and throughout the world Related Videos: * http://youtu.be/C385Zl5VdX0 * http://youtu.be/yssPonsE7WY * http://youtu.be/sjcJcpjUK5o Video Production by: 90 Seconds NZ - Online Video Production & Video Marketing - Auckland, NZ - http://90seconds.tv 90 Seconds is the Best Video Production company in New Zealand. We have produced over 3,000 online videos in Auckland, Wellington and Nationwide, making 90 Seconds the best online video marketers in NZ. As a leading Video Producer we enable any small business or corporate to get high quality, low cost, fast turn around, hassle-free videos for websites. 90 Seconds does Corporate Video Production and Video Marketing for New Zealands biggest brands and NZ Government agencies. We are also the NZ Small Business Video marketing experts and are a leading Tourism Video Production Company in NZ. 90 Seconds has a unique cloud video production platform that supports the entire production process enabling you to login and manage your video production online with 90 Seconds and collaborate with the 90 Seconds team and a crowd source community of approved video freelancers on the platform. 90 Seconds are a global Video Production company which started in NZ with bases in London, UK and Auckland, New Zealand, we also operate remotely in Australia, Singapore, Europe. We're a passionate crew and have built the business with a vision for changing the way media is produced and delivered globally, lead by entrepreneur Tim Norton- published: 08 Sep 2014

- views: 43

Career Advice on becoming an Assistant Political Risk Underwriter by Mark M (Full Version)

Visit http://icould.com/videos/mark-m/ for more careers info. Mark M is an Assistant Political Risk Underwriter at Chaucer Insurance - "We insure things like...- published: 23 May 2011

- views: 1832

- author: icouldstories

AIG Specialty Product Lines - Political Risk

A foreign government's action, or inaction, can result in a client's loss of property, income or financial assets.The Political Risk division of AIG has the ...- published: 07 Feb 2013

- views: 886

- author: AIG

China's Political Risk

Its command economy and upcoming succession give reason for concern.- published: 10 Dec 2009

- views: 2005

- author: forbes

Fletcher Political Risk Conference 2015, Keynote Speaker - Nassim Nicholas Taleb

Topic: Fat Tails Speaker: Nassim Nicholas Taleb Moderator: Nadim Shehadi- published: 14 Apr 2015

- views: 40

Global Exposure: Political Risk Insurance in Emerging Markets

Jim Thomas, Underwriting Manager for Zurich Credit & Political Risk at Zurich North America, shares insight into the increase in risks for companies operatin...- published: 30 Oct 2013

- views: 5482

- author: ZurichNorthAmerica

How Political Risk Affects An Economy

The risk that businesses, investors and governments may face when there is a change in politics or political outcomes. As such, if there is a change in the p...- published: 20 Apr 2014

- views: 203

- author: cedric chehab

Political Risk, James Tompkins

This is the thirteenth and final lecture in the "International Finance" series in which I discuss Political Risk. What is it, how is it measured and how can ...- published: 27 Mar 2014

- views: 290

- author: Understanding Finance

- Playlist

- Chat

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360

Get economic collapse news throughout the day visit http://x22report.com More news visit http://thepeoplesnewz.com Report date: 5.07.2014 Cyprus still under ...- published: 08 May 2014

- views: 10166

- author: X22Report

The Rise of Global Political Risk

Please join Ian Bremmer as he discusses his book The Fat Tail: The Power of Political Knowledge Through Strategic Investing.- published: 08 Apr 2009

- views: 1906

- author: NewAmericaFoundation

Political risk concerns in Africa: Perception or Reality?

On February 4, 2013, on the margins of Mining Indaba 2013, the Canadian government organised its fourth Interactive Discussion Forum with the theme "Politica...- published: 20 Feb 2013

- views: 135

- author: CanadaInSouthAfrica

Political Risk - David Gordon at the World Bank 2009 Part One

For MSFS575: Intro to Pol Risk Assessment- published: 08 Jan 2015

- views: 10

Investment and Operations in Complex Environments: Fletcher Political Risk Conference 2015

Panel 2: Investment and Operations in Complex Environments- published: 14 Apr 2015

- views: 35

Mod-08 Lec-34 Risk Management - Country / Political risks III

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in.- published: 30 Jan 2014

- views: 121

- author: nptelhrd

Mod-08 Lec-35 Risk Management - Country / Political risks IV

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in.- published: 30 Jan 2014

- views: 864

- author: nptelhrd

Mod-08 Lec-32 Risk Management - Country / Political risks I

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in- published: 30 Jan 2014

- views: 4

Petrozuata Political Risk and Short Cut Keys

Gives a survey of short cut keys and demonstrates how to assess country risk premiums using the probabilty of expropriation- published: 12 May 2015

- views: 6

Jeremy Pam. Dept of Defense Strategy and Planning Reform. JPR Webcast with Anders Corr, Robert Wh...

Jeremiah S. Pam 22 Mar 2015 Journal of Political Risk Webcast – 23 Mar 2015 at 7:30 PM Prof. Jeremy Pam on DoD Strategy and Planning Reform Background • While the challenges of the post-9/11 strategic environment and the contemporary upsurge in civil-military “complex operations” have produced many documents and speeches presenting themselves as “strategy,” few of these have been truly strategic in Sun Tzu’s sense of an approach based on realistic, prioritized assessments of both our capabilities and the local environment. • Instead, our strategies all too often resemble a ‘wish list’ of all the things we’d like to achieve if there were no practical resource, coordination and implementation constraints, or simply compile the preferred approaches of all the national and international organizations involved in drafting the strategy. (Cf. the Obama Administration’s Feb 2015 “U.S. National Security Strategy.) • The critical element missing is neither a civilian counterpart to military planning processes nor a comprehensive manual for strengthening weak states (of which there already exist decent models). Argument • Instead, what’s needed is the bolstering of a conception of strategy that emphasizes the necessity of choosing the few most salient elements from the many possible activities for strengthening a weak state. On this conception of strategy, such choices must be made on the basis of realistic assessments of local context (e.g., what problems are most important and what efforts are most likely to be sustained), U.S./international capabilities (e.g., what objectives and activities a diverse group of international actors can agree on) and overall implementability (e.g., what initiatives can be executed and produce results). • To inculcate such a conception of strategy for future civil-military complex operations, the USG needs to develop a new approach to the professional education of senior civilian and military leaders. While this effort might begin by first targeting specific agencies individually, to be effective it would eventually have to become an interagency initiative. Some Recent References Anthony Cordesman, Strategy, Grand Strategy, and the Emperor’s New Clothes (CSIS, 17 Mar 2015) Steven Metz, To Create Order, the U.S. Needs a Strategic Vision (WPR, 12 Dec 2014) Steven Metz, U.S. Planners Must Start Preparing for Strategic Disaster (WPR, 9 Jul 2014) Steven Metz, Saving America’s Strategic Visionaries (WPR, 2 Apr 2014) Steven Metz, End of War Footing Leaves American Strategy at a Loss (WPR, 5 Feb 2014) Steven Metz, With Small Cuts, U.S. Undermining Its Ability to Think Big (WPR, 23 Oct 2013) Steven Metz, Why Aren’t Americans Better at Strategy? (WPR, 16 Oct 2013) Michael Mazarr, The Risks of Ignoring Strategic Insolvency (Washington Quarterly, Fall 2012) Jeremiah S. Pam, The Paradox of Complexity (NATO Defense College, Jul 2010) Hy Rothstein, Less is More (Third World Quarterly, Mar 2007)- published: 24 Mar 2015

- views: 4

Political Risk Premium and Goal Seek Function

Shows how country risk premiums can result in very high probability of default. Computes the implied probability of default using a dynamic goal seek function.- published: 24 May 2015

- views: 0

JPR Webcast: Africa, Extremism, and Influence, with Anders Corr, Robert Whitcomb, and Douglas Lav...

The Journal of Political Risk (JPR) sponsors a webcast on extremism and influence in Africa, with host Anders Corr (Publisher, JPR), and guests Robert Whitcomb (Editor, New England Diary) and Douglas Lavanture (Data Reporter, Bloomberg News).- published: 19 Mar 2015

- views: 8

Mod-08 Lec-33 Risk Management - Country / Political risks II

Infrastructure Finance by Dr. A. Thillai Rajan,Department of Management Studies,IIT Madras.For more details on NPTEL visit http://nptel.ac.in.- published: 30 Jan 2014

- views: 143

- author: nptelhrd

Keynote Address: Ian Bremmer - 2014 Nobel Peace Prize Forum

Ian Bremmer President and Founder, Eurasia Group Ian Bremmer is the president and founder of Eurasia Group, the leading global political risk research and co...- published: 08 Mar 2014

- author: Nobel Peace Prize Forum

- Playlist

- Chat

PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode]

PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] PLAN C’ Is The Biggest Risk To Imran Khan Political Life Haroon Rasheed [Full Episode] Show Your Support & Subscribe To Our Channel, Click On Link Below To Subscribe: http://bit.ly/1bYv7QT At http://www.iPakshows.com, We Pride Ourselves ...- published: 17 May 2015

- views: 2

Nouriel Roubini on Italian political risk and emerging mark

yahoo finance,google finance,google stock,finance,ira,buy gold coin,gold dealers,gold coins in ira,forex,forex trading ... Sept. 6 (Bloomberg) -- New York University economics professor Nouriel Roubini comments on the state of the U.S. economy from Cernobbio, Italy. He speaks ... Martin Baily: President Obama and Congress should quietly plan for another European financial crisis, and ensure that after the changes in U.S. financial regulations following the last crisis,... LOW RATES MEAN ASSET PRICES ON THE RISE ANCHOR (OFF-CAMERA) ENGLISH SAYING: So what's behind the market's run really, since the start of the ... watch the full interview here : Roubini At the Festival Economia in Trento, Italy. Nouriel Roubini (born March 29, 195 Nouriel Roubini on Italian political risk and emerging mark Nouriel Roubini on Italian political risk and emerging mark- published: 16 May 2015

- views: 1

political risk and ownership risk was clarified by Mr Mahesh Shetty CEO ENCORE MULTI INC USA

POLITICAL RISK and ownership risk was clarified by Mr. Mahesh Shetty CEO ENCORE MULTI INC USA- published: 14 May 2015

- views: 4

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360

Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360.mp4. Get economic collapse news throughout the day visit More news visit Report date: 5.07.2014 Cyprus still under ... hy friends i'm johnson lee,and i have many videos about education related....some video i uploaded...if u like my choice please hit the like button and subsc... Please like and Subscribed our channel for daily update......:) hy friends i'm johnson lee,and i have many videos about education related....some video i uploaded...if u like my choice please hit the like button and subsc. Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360 Manipulated Unemployment, Housing Declines And Geo-Political Risk Equals Collapse -- Episode 360- published: 13 May 2015

- views: 0

- 1

- 2

- 3

- 4

- 5

- Next page »