Joe Hockey urged to dismantle ticking pensions time bomb

- From: News Corp Australia

- March 11, 2014

IF left unchecked, the disability support pension will pay double the jobless allowance in 15 years, creating an irresistible incentive for people to rort the payment.

Amid heightened speculation the disability pension will be targeted for savings in the May budget, analysis by Deloitte Access Economics reveals the Federal Government could save $2.4 billion over four years by limiting increases in the disability pension to inflation.

While the annual saving would start out small — only $220 million next financial year — it would grow to nearly $10 billion a year by 2035. Over 20 years, the saving would be $80 billion.

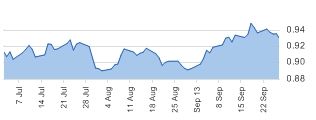

At present, pensions increase each year with wages growth — about 4 per cent a year — while the Newstart allowance rises with inflation — about 2.5 per cent a year.

This has created a “ticking time bomb” in the budget, according to Deloitte Access Economics’ Chris Richardson, who wants all welfare payments indexed at 3 per cent a year.

“You should have Newstart and Disability Support Pension moving the same way, otherwise we’re creating all sorts of problems for ourselves here,” Mr Richardson told News Corp Australia.

Having such a big — and growing — gap between two payments created a perverse incentive for the long term unemployed to be shunted onto the higher payment, he said.

“It increases incentives for everyone, not just the people on the DSP but the people who can put them on the DSP. Whether it’s the Centrelink staff, the doctors, they’re all human and whether it’s because they don’t want to deal with that person any more or they know that person will get a better deal (on DSP), we’re making trouble for ourselves and there’s no need to do that.”

The principal research fellow at NATSEM, Ben Phillips, said there was already a significant “perverse incentive” to try to claim the disability support pension over the Newstart allowance.

From March 30, the DSP will pay $843 per fortnight compared to just $519 for Newstart.

Exclusive modelling by NATSEM reveals that by the end of 2028, the pension, including supplements, will be worth $1469 a fortnight. That will be more than double the Newstart allowance at $733.

“Certainly there’s that incentive there,” Mr Phillips said.

Former Australian of the Year ... Patrick McGorry says funding for mental health services should be increased to help more mentally ill people move from welfare to work. Picture: Mike Burton Source: News Limited

“While most people have a legitimate claim to be on the disability pension, for a small group there is that perverse incentive there.”

Mr Richardson said a review of the disability support pension was timely, given significant new funding for a National Disability Insurance Scheme.

Meanwhile, former Australian of the Year Patrick McGorry has told the government’s welfare review that as many as nine out of 10 disability support pensioners with mental illness could work if given the right specialist support.

“We have done the key research in this area and 90 per cent of those even with more serious illnesses can return to school or work,’’ he said.

Professor McGorry, also the executive director of Orygen Youth Health, said funding for mental health services like Headspace should be increased to help more mentally ill people move from welfare to work.

“The current agencies, like Disability Employment Services etc, are really ineffective for people with mental ill health.”

Mental illness has overtaken physical disability as the number one reason for being on the disability support pension.

New department figures reveal the number of disability pensioners hit a record high of 832,148 in January.

The disability support pension will cost taxpayers $15.8 billion this financial year, rising to $17.8 billion by 2016-17. The age pension remains the biggest drain on public finances, costing $39.6 billion this financial year and $48.7 billion by 2016-17.

A spokeswoman for the Treasurer would not comment on whether the disability support pension was a likely target for savings in the May budget.

“The Commission of Audit, which was asked to look at every function and service of government, has made confidential recommendations to the government and we won’t be commenting on any pre-budget speculation,” she said.

###