- go to the top

- About WN

- Contact

- Feedback

- Privacy Policy

- © 2011 World News Inc., all Rights Reserved

-

Allan O. Hunter

Allan Oakley Hunter (June 15, 1916 - May 2, 1995) was an American lawyer and politician. Hunter, a Republican, served as the United States Representative for California's 9th congressional district from 1951 to 1953 and for California's 12th congressional district from 1953 to 1955. After his stint in politics, Hunter served as the president and chairman of the Federal National Mortgage Association (commonly known as Fannie Mae) from 1970 to 1981.

http://wn.com/Allan_O_Hunter -

Chuck Hagel

Charles Timothy "Chuck" Hagel (born October 4, 1946) is a former United States Senator from Nebraska. A member of the Republican Party, he was first elected in 1996 and was reelected in 2002. In 2009, he was elected as Chairman of the Atlantic Council.

http://wn.com/Chuck_Hagel -

Franklin Raines

Franklin Delano "Frank" Raines (born January 14, 1949) is the former chairman and chief executive officer of the Federal National Mortgage Association, commonly known as Fannie Mae, who served as White House budget director under President Bill Clinton. His role leading Fannie Mae has come under scrutiny.

http://wn.com/Franklin_Raines -

Henry M. Paulson

http://wn.com/Henry_M_Paulson -

Herbert M. Allison

Herbert M. Allison, Jr. (born 1943) is currently serving as Assistant Secretary of the Treasury for Financial Stability of the United States. He was confirmed by the Senate on

http://wn.com/Herbert_M_Allison -

Mike Stathis

Mike Stathis Mike Stathis the chief investment strategist of AVA Investment Analytics, a financial research firm catering to financial institutions..

http://wn.com/Mike_Stathis -

Nassim Taleb

http://wn.com/Nassim_Taleb

-

Alaska

Alaska () is the largest state of the United States by area. It is situated in the northwest extremity of the North American continent, with Canada to the east, the Arctic Ocean to the north, and the Pacific Ocean to the west and south, with Russia further west across the Bering Strait. Approximately half of Alaska's 698,473 residents live within the Anchorage metropolitan area. As of 2009, Alaska remains the least densely populated state of the U.S.

http://wn.com/Alaska

- Allan O. Hunter

- Alt-A

- Angelo_Mozilo

- basis swaps

- bonds

- BusinessWeek

- CEO

- Chinese Government

- Chuck Hagel

- conforming loan

- conservatorship

- Daniel Mudd

- David Maxwell

- derivative (finance)

- duration gap

- Federal Reserve

- Fixed rate mortgage

- Franklin Raines

- Freddie Mac

- Ginnie Mae

- Great Depression

- Henry M. Paulson

- Herbert M. Allison

- Hud (housing)

- interest rate cap

- interest rate swaps

- jumbo loan

- jumbo loans

- Lehman Brothers

- Mike Stathis

- Money Market

- Money market fund

- mortgage insurance

- mortgage loan

- Nassim Taleb

- National Debt

- National Housing Act

- New Deal

- New York Times

- securitization

- subprime lending

- swaption

- Tammany Hall

- teaser rate

- The New York Times

- Vernon L. Smith

- Wall Street Journal

- Order: Reorder

- Duration: 3:34

- Published: 02 Sep 2010

- Uploaded: 04 Nov 2010

- Author: YoChicago1

- Order: Reorder

- Duration: 1:36

- Published: 04 Jan 2011

- Uploaded: 04 Jan 2011

- Author: thestockwizards

- Order: Reorder

- Duration: 5:28

- Published: 23 Apr 2011

- Uploaded: 23 Apr 2011

- Author: matthewhgray

- Order: Reorder

- Duration: 5:54

- Published: 09 Jul 2010

- Uploaded: 22 Jul 2010

- Author: getrealrei

- Order: Reorder

- Duration: 0:42

- Published: 13 Jun 2011

- Uploaded: 04 Sep 2011

- Author: tonylac021461

- Order: Reorder

- Duration: 0:57

- Published: 07 Jul 2010

- Uploaded: 26 Aug 2010

- Author: bpoautomation

- Order: Reorder

- Duration: 3:12

- Published: 05 Aug 2010

- Uploaded: 13 May 2011

- Author: StockMarketFunding

- Order: Reorder

- Duration: 6:33

- Published: 03 Dec 2009

- Uploaded: 23 Aug 2011

- Author: TheCasejordan

- Order: Reorder

- Duration: 2:12

- Published: 26 Apr 2011

- Uploaded: 20 Jun 2011

- Author: NicholasDodd

- Order: Reorder

- Duration: 6:44

- Published: 16 Oct 2009

- Uploaded: 27 Aug 2010

- Author: AllianceShortSales

- Order: Reorder

- Duration: 4:00

- Published: 24 Sep 2008

- Uploaded: 01 Nov 2011

- Author: ProudToBeCanadian

- Order: Reorder

- Duration: 1:40

- Published: 11 Oct 2008

- Uploaded: 30 May 2011

- Author: livingonplanetZ

- Order: Reorder

- Duration: 3:52

- Published: 15 Sep 2011

- Uploaded: 15 Sep 2011

- Author: HomesOnTheSound

- Order: Reorder

- Duration: 1:32

- Published: 17 Oct 2010

- Uploaded: 18 Oct 2010

- Author: thestockwizards

- Order: Reorder

- Duration: 2:51

- Published: 19 Oct 2010

- Uploaded: 31 Aug 2011

- Author: thestockwizards

- Order: Reorder

- Duration: 8:37

- Published: 27 Sep 2008

- Uploaded: 01 Nov 2011

- Author: NakedEmperorNews

-

Daddy's little girl! Brad Pitt is image of daughter Shiloh in his 8th grade photo

The Daily Mail

Daddy's little girl! Brad Pitt is image of daughter Shiloh in his 8th grade photo

The Daily Mail

-

Perry's Undisciplined Thinking and Argument, and Ours

WorldNews.com

Perry's Undisciplined Thinking and Argument, and Ours

WorldNews.com

-

Politics of 'Indian Givers' and Thanksgiving

WorldNews.com

Politics of 'Indian Givers' and Thanksgiving

WorldNews.com

-

US rejects destroying chemical weapons

The Siasat Daily

US rejects destroying chemical weapons

The Siasat Daily

-

Russia, China, urge Syria talks, stress U.N. role

The Star

Russia, China, urge Syria talks, stress U.N. role

The Star

- Alaska

- Allan O. Hunter

- Alt-A

- Angelo_Mozilo

- basis swaps

- bonds

- BusinessWeek

- CEO

- Chinese Government

- Chuck Hagel

- conforming loan

- conservatorship

- Daniel Mudd

- David Maxwell

- derivative (finance)

- duration gap

- Federal Reserve

- Fixed rate mortgage

- Franklin Raines

- Freddie Mac

- Ginnie Mae

- Great Depression

- Henry M. Paulson

- Herbert M. Allison

- Hud (housing)

- interest rate cap

- interest rate swaps

- jumbo loan

- jumbo loans

- Lehman Brothers

- Mike Stathis

- Money Market

- Money market fund

- mortgage insurance

- mortgage loan

- Nassim Taleb

- National Debt

- National Housing Act

- New Deal

- New York Times

- securitization

- subprime lending

- swaption

- Tammany Hall

- teaser rate

- The New York Times

- Vernon L. Smith

- Wall Street Journal

size: 3.7Kb

size: 9.6Kb

size: 14.5Kb

size: 8.2Kb

size: 7.4Kb

size: 8.9Kb

| Coordinates | 33°51′35.9″N151°12′40″N |

|---|---|

| foundation | 1938 |

| location city | Washington, D.C. |

| company name | Federal National Mortgage Association (Fannie Mae) |

| company logo | |

| company type | Government-sponsored enterprise & Public company |

| key people | Mike Williams, CEO |

| revenue | US$29.1 Billion (FY 2009) |

| net income | US$-72.0 Billion (FY 2009) |

| assets | US$869 Billion (FY 2009) |

| equity | US$-15.4 Billion (FY 2009) |

| homepage | Fannie Mae }} |

The Federal National Mortgage Association (FNMA; ), commonly known as Fannie Mae, was founded in 1938 during the Great Depression as part of the New Deal. It is a government-sponsored enterprise (GSE), though it has been a publicly traded company since 1968. The corporation's purpose is to expand the secondary mortgage market by securitizing mortgages in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on thrifts.

History

The Federal National Mortgage Association (FNMA), colloquially known as Fannie Mae, was established in 1938 by amendments to the National Housing Act after the Great Depression as part of Franklin Delano Roosevelt's New Deal. Fannie Mae was established to provide local banks with federal money to finance home mortgages in an attempt to raise levels of home ownership and the availability of affordable housing. Fannie Mae created a liquid secondary mortgage market and thereby made it possible for banks and other loan originators to issue more housing loans, primarily by buying Federal Housing Administration (FHA) insured mortgages. For the first thirty years following its inception, Fannie Mae held a monopoly over the secondary mortgage market. In 1954, an amendment known as the Federal National Mortgage Association Charter Act made Fannie Mae into "mixed-ownership corporation" meaning that federal government held the preferred stock while private investors held the common stock; in 1968 it converted to a publicly held corporation, to remove its activity and debt from the federal budget. In the 1968 change, Fannie Mae's predecessor (also called Fannie Mae) was split into the current Fannie Mae and the Government National Mortgage Association ("Ginnie Mae"). Ginnie Mae, which remained a government organization, supports FHA-insured mortgages as well as Veterans Administration (VA) and Farmers Home Administration (FmHA) insured mortgages, with the full faith and credit of the United States government. In 1970, the federal government authorized Fannie Mae to purchase private mortgages, i.e. those not insured by the FHA, VA, or FmHA, and created the Federal Home Loan Mortgage Corporation (FHLMC), colloquially known as Freddie Mac, to compete with Fannie Mae and thus facilitate a more robust and efficient secondary mortgage market.In 1981, Fannie Mae issued its first mortgage passthrough and called it a mortgage-backed security. The Fannie Mae laws did not require the Banks to hand out subprime loans in any way. Ginnie Mae had guaranteed the first mortgage passthrough security of an approved lender in 1968 and in 1971 Freddie Mac issued its first mortgage passthrough, called a participation certificate, composed primarily of private mortgages.

1990s

In 1992, President George H.W. Bush signed the Housing and Community Development Act of 1992. The Act amended the charter of Fannie Mae and Freddie Mac to reflect Congress' view that the GSEs "have an affirmative obligation to facilitate the financing of affordable housing for low-income and moderate-income families." For the first time, the GSEs were required to meet "affordable housing goals" set annually by the Department of Housing and Urban Development (HUD) and approved by Congress. The initial annual goal for low-income and moderate-income mortgage purchases for each GSE was 30% of the total number of dwelling units financed by mortgage purchases and increased to 55% by 2007.In 1999, Fannie Mae came under pressure from the Clinton administration to expand mortgage loans to low and moderate income borrowers by increasing the ratios of their loan portfolios in distressed inner city areas designated in the CRA of 1977. Because of the increased ratio requirements, institutions in the primary mortgage market pressed Fannie Mae to ease credit requirements on the mortgages it was willing to purchase, enabling them to make loans to subprime borrowers at interest rates higher than conventional loans. Shareholders also pressured Fannie Mae to maintain its record profits.

In 1999, The New York Times reported that with the corporation's move towards the subprime market "Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980s." Alex Berenson of The New York Times reported in 2003 that Fannie Mae's risk is much larger than is commonly held. Nassim Taleb wrote in The Black Swan: "The government-sponsored institution Fannie Mae, when I look at its risks, seems to be sitting on a barrel of dynamite, vulnerable to the slightest hiccup. But not to worry: their large staff of scientists deem these events 'unlikely'". Mike Stathis also warned about the risks of Fannie Mae, triggering the financial crisis in America’s Financial Apocalypse. “With close to $2 trillion in debt between Freddie Mac and Fannie Mae alone, as well as several trillion held by commercial banks, failure of just one GSE or related entity could create a huge disaster that would easily eclipse the Savings & Loan Crisis of the late 1980s. This would certainly devastate the stock, bond and real estate markets. Most likely, there would also be an even bigger mess in the derivatives market, leading to a global sell-off in the capital markets. Not only would investors get crushed, but taxpayers would have to bail them out since the GSEs are backed by the government. Everyone would feel the effects. At its bottom, I would estimate a 30 to 35 percent correction for the average home. And in ‘hot spots’ such as Las Vegas, selected areas of Northern and Southern California and Florida, home prices could plummet by 55 to 60 percent from peak values.”

2000s

In 2000, because of a re-assessment of the housing market by HUD, anti-predatory lending rules were put into place that disallowed risky, high-cost loans from being credited toward affordable housing goals. In 2004, these rules were dropped and high-risk loans were again counted toward affordable housing goals.The intent was that Fannie Mae's enforcement of the underwriting standards they maintained for standard conforming mortgages would also provide safe and stable means of lending to buyers who did not have prime credit. As Daniel Mudd, then President and CEO of Fannie Mae, testified in 2007, instead the agency's underwriting requirements drove business into the arms of the private mortgage industry who marketed aggressive products without regard to future consequences: "We also set conservative underwriting standards for loans we finance to ensure the homebuyers can afford their loans over the long term. We sought to bring the standards we apply to the prime space to the subprime market with our industry partners primarily to expand our services to underserved families.

"Unfortunately, Fannie Mae-quality, safe loans in the subprime market did not become the standard, and the lending market moved away from us. Borrowers were offered a range of loans that layered teaser rates, interest-only, negative amortization and payment options and low-documentation requirements on top of floating-rate loans. In early 2005 we began sounding our concerns about this "layered-risk" lending. For example, Tom Lund, the head of our single-family mortgage business, publicly stated, "One of the things we don't feel good about right now as we look into this marketplace is more homebuyers being put into programs that have more risk. Those products are for more sophisticated buyers. Does it make sense for borrowers to take on risk they may not be aware of? Are we setting them up for failure? As a result, we gave up significant market share to our competitors."

Congress, controlled by Republicans during this period, did not introduce any legislation aimed at bringing this proposal into law until the Federal Housing Enterprise Regulatory Reform Act of 2005, which did not proceed out of committee to the Senate.

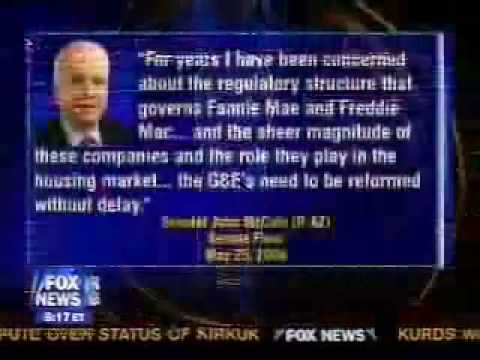

On January 26, 2005, the Federal Housing Enterprise Regulatory Reform Act of 2005 (S.190) was first introduced in the Senate by Sen. Chuck Hagel. The Senate legislation was an effort to reform the existing GSE regulatory structure in light of the recent accounting problems and questionable management actions leading to considerable income restatements by the GSE's. After being reported favorably by the Senate's Committee on Banking, Housing, and Urban Affairs in July 2005, the bill was never considered by the full Senate for a vote. Sen. John McCain's decision to become a cosponsor of S.190 almost a year later in 2006 was the last action taken regarding Sen. Hagel's bill in spite of developments since clearing the Senate Committee. Sen. McCain pointed out that Fannie Mae's regulator reported that profits were "illusions deliberately and systematically created by the company's senior management" in his floor statement giving support to S.190.

At the same time, the House also introduced similar legislation, the Federal Housing Finance Reform Act of 2005 (H.R. 1461), in the Spring of 2005. The House Financial Services Committee had crafted changes and produced a Committee Report by July 2005 to the legislation. It was passed by the House in October in spite of President Bush's statement of policy opposed to the House version. The legislation met with opposition from both Democrats and Republicans at that point and the Senate never took up the House passed version for consideration after that.

The mortgage crisis from late 2007

Following their mission to meet federal Housing and Urban Development (HUD) housing goals, GSEs such as Fannie Mae, Freddie Mac and the Federal Home Loan Banks (FHLBanks) have striven to improve home ownership of low and middle income families, underserved areas, and generally through special affordable methods such as "the ability to obtain a 30-year fixed-rate mortgage with a low down payment... and the continuous availability of mortgage credit under a wide range of economic conditions." (HUD 2002 Annual Housing Activities Report) Then in 2003-2004, the subprime mortgage crisis began. The market shifted away from regulated GSEs and radically toward Mortgage Backed Securities (MBS) issued by unregulated private-label securitization conduits, typically operated by investment banks. The shift occurred as financial institutions sought to maintain earnings levels that had been elevated during 2001-2003 by an unprecedented refinancing boom due to historically low interest rates. Earnings depended on volume, so maintaining elevated earnings levels necessitated expanding the borrower pool using lower underwriting standards and new products that the GSEs would not (initially) securitize. Thus, the shift away from GSE securitization to private-label securitization (PLS) also corresponded with a shift in mortgage product type, from traditional, amortizing, fixed-rate mortgages (FRMs) to nontraditional, structurally riskier, nonamortizing, adjustable-rate mortgages (ARMs), and in the start of a sharp deterioration in mortgage underwriting standards. The growth of PLS, however, forced the GSEs to lower their underwriting standards in an attempt to reclaim lost market share to please their private shareholders. Shareholder pressure pushed the GSEs into competition with PLS for market share, and the GSEs loosened their guarantee business underwriting standards in order to compete. In contrast, the wholly public FHA/Ginnie Mae maintained their underwriting standards and instead ceded market share.The growth of private-label securitization and lack of regulation in this part of the market resulted in the oversupply of underpriced housing finance that led, in 2006, to an increasing number of borrowers, often with poor credit, who were unable to pay their mortgages - particularly with adjustable rate mortgages (ARM), caused a precipitous increase in home foreclosures. As a result, home prices declined as increasing foreclosures added to the already large inventory of homes and stricter lending standards made it more and more difficult for borrowers to get mortgages. This depreciation in home prices led to growing losses for the GSEs, which back the majority of US mortgages. In July 2008, the government attempted to ease market fears by reiterating their view that "Fannie Mae and Freddie Mac play a central role in the US housing finance system". The US Treasury Department and the Federal Reserve took steps to bolster confidence in the corporations, including granting both corporations access to Federal Reserve low-interest loans (at similar rates as commercial banks) and removing the prohibition on the Treasury Department to purchase the GSEs' stock. Despite these efforts, by August 2008, shares of both Fannie Mae and Freddie Mac had tumbled more than 90% from their one-year prior levels.

On Oct 21, 2010 FHFA estimates revealed that the bailout of Freddie Mac and Fannie Mae will likely cost taxpayers $224–360 billion in total, with over $150 billion already provided.

2008 - Crisis and Conservatorship

On July 11, 2008, the New York Times reported that U.S. government officials were considering a plan for the U.S. government to take over Fannie Mae and/or Freddie Mac should their financial situations worsen due to the U.S. housing crisis. Fannie Mae and smaller Freddie Mac own or guarantee a massive proportion of all home loans in the United States and so were especially hard hit by the slump. The government officials also stated that the government had also considered calling for explicit government guarantee through legislation of $5 trillion on debt owned or guaranteed by the two companies.

Fannie stock plunged. Some worried that Fannie lacked capital and might go bankrupt. Others worried about a government seizure. U.S. Treasury Secretary Henry M. Paulson as well as the White House went on the air to defend the financial soundness of Fannie Mae, in a last ditch effort to prevent a total financial panic. Fannie and Freddie underpinned the whole U.S. mortgage market. As recently as 2008, Fannie Mae and the Federal Home Loan Mortgage Corporation (Freddie Mac) had owned or guaranteed about half of the U.S.'s $12 trillion mortgage market. If they were to collapse, mortgages would be harder to obtain and much more expensive. Fannie and Freddie bonds were owned by everyone from the Chinese Government, to Money Market funds, to the retirement funds of hundreds of millions of people. If they went bankrupt, all those investments would go to 0, and there would be mass upheaval on a global scale.

The Administration PR effort was not enough, by itself, to save the GSEs. Their investments were simply too rotten, their managements had been too incompetent, and the market was tanking too quickly. Paulson knew that Lehman Brothers and other banks were in trouble and would soon require his attention; this meant that he would not have the staff or the time to deal with a long, drawn out Fannie and Freddie conflict. Paulson's plan was to go in swiftly and seize the two GSEs; he told president Bush that "the first sound they hear will be their heads hitting the floor". Lockhart also dismissed the firms' chief executive officers and boards of directors, and caused the issuance to the Treasury new senior preferred stock and common stock warrants amounting to 79.9% of each GSE. The value of the common stock and preferred stock to pre-conservatorship holders was greatly diminished by the suspension of future dividends on previously outstanding stock, in the effort to maintain the value of company debt and of mortgage-backed securities. FHFA stated that there are no plans to liquidate the company.

The authority of the U.S. Treasury to advance funds for the purpose of stabilizing Fannie Mae, or Freddie Mac is limited only by the amount of debt that the entire federal government is permitted by law to commit to. The July 30, 2008 law enabling expanded regulatory authority over Fannie Mae and Freddie Mac increased the national debt ceiling US$ 800 billion, to a total of US$ 10.7 Trillion in anticipation of the potential need for the Treasury to have the flexibility to support the federal home loan banks.

2010 - Delisting

On June 16, 2010, Fannie Mae and Freddie Mac announced their stocks would be delisted from the NYSE. The Federal Housing Finance Agency directed the delisting after Fannie's stock traded below $1 a share for over 30 days. Their stocks will continue to trade on the Over-the-Counter Bulletin Board as long as there is trader interest. Reports from the finance agency specified that the delisting had nothing to do with current or future company performance.

Business

Fannie Mae made money partly by borrowing for low rates, and lending at higher rates. It borrowed by selling bonds, and lent by creating mortgages and mortgage backed securities which it held on its own books. Since its implied government guarantee meant it could borrow at very low rates, it earned a higher profit than did the non-government companies doing the same work. This was called "The big, fat gap" by Alan Greenspan. By August, 2008, Fannie Mae's mortgage portfolio was in excess of $700 billion.Fannie Mae also earned a significant portion of its income from guaranty fees it received as compensation for assuming the credit risk on the mortgage loans underlying its single-family Fannie Mae MBS and on the single-family mortgage loans held in its retained portfolio. Investors, or purchasers of Fannie Mae MBSs, are willing to let Fannie Mae keep this fee in exchange for assuming the credit risk; that is, Fannie Mae's guarantee that the scheduled principal and interest on the underlying loan will be paid even if the borrower defaults.

Fannie Mae's charter has historically prevented it from guaranteeing mortgages with a loan-to-values over 80% without mortgage insurance or a repurchase agreement with the lender; however, in 2006 and 2007 Fannie Mae did purchase subprime and Alt-A loans as investments.

Business mechanism

Fannie Mae buys loans from approved mortgage sellers, either for cash or in exchange for a mortgage-backed security that comprises those loans and that, for a fee, carries Fannie Mae's guarantee of timely payment of interest and principal. The mortgage seller may hold that security or sell it. Fannie Mae may also securitize mortgages from its own loan portfolio and sell the resultant mortgage-backed security to investors in the secondary mortgage market, again with a guarantee that the stated principal and interest payments will be timely passed through to the investor. By purchasing the mortgages, Fannie Mae and Freddie Mac provide banks and other financial institutions with fresh money to make new loans. This gives the United States housing and credit markets flexibility and liquidity.In order for Fannie Mae to provide its guarantee to mortgage-backed securities it issues, it sets the guidelines for the loans that it will accept for purchase, called "conforming" loans. Mortgages that don't meet the guidelines are called "nonconforming". Fannie Mae produced an automated underwriting system (AUS) tool called Desktop Underwriter (DU) which lenders can use to automatically determine if a loan is conforming; Fannie Mae followed this program up in 2004 with Custom DU, which allows lenders to set custom underwriting rules to handle nonconforming loans as well. The secondary market for nonconforming loans includes jumbo loans, which are mortgages larger than the maximum mortgage that Fannie Mae and Freddie Mac will purchase. In early 2008, the decision was made to allow TBA (To-be-announced)-eligible mortgage-backed securities to include up to 10% "jumbo" mortgages.

Conforming loans

Fannie Mae and Freddie Mac have a limit on the maximum sized loan they will guarantee. This is known as the "conforming loan limit." The conforming loan limit for Fannie Mae, along with Freddie Mac, is set by Office of Federal Housing Enterprise Oversight (OFHEO), the regulator of both GSEs. OFHEO annually sets the limit of the size of a conforming loan based on the October to October changes in mean home price, above which a mortgage is considered a non-conforming jumbo loan. The conforming loan limit is 50 percent higher in Alaska and Hawaii. The GSEs only buy loans that are conforming to repackage into the secondary market, lowering the demand for non-conforming loans. By virtue of the law of supply and demand, then, it is harder for lenders to sell these loans in the secondary market; thus these types of loans tend to cost more to borrowers (typically 1/4 to 1/2 of a percent). Indeed, in 2008, since the demand for bonds not guaranteed by GSEs was almost non-existent, non-conforming loans were priced nearly 1% to 1.5% higher than conforming loans.

Implicit Guarantee and Government Support

Originally, Fannie had an 'explicit guarantee' from the government; if it got in trouble, the government promised to bail it out. This changed in 1968. Ginnie Mae was split off from Fannie. Ginnie retained the explicit guarantee. Fannie, however, became a private corporation, with only an 'implied guarantee'. There was no written documentation, no contract, and no official promise that the government would bail it out. The industry, government officials, and investors simply assumed it to be so. This unwritten, undocumented guarantee was what enabled Fannie and Freddie to be taken off the balance sheet of the government; this made the National Debt to falsely appear lower than it actually was.Fannie Mae received no direct government funding or backing; Fannie Mae securities carried no actual explicit government guarantee of being repaid. This was clearly stated in the law that authorizes GSEs, on the securities themselves, and in many public communications issued by Fannie Mae. Neither the certificates nor payments of principal and interest on the certificates were explicitly guaranteed by the United States government. The certificates did not officially constitute a debt or obligation of the United States or any of its agencies or instrumentalities other than Fannie Mae. Every sub-prime era Fannie Mae prospectus read in bold, all-caps letters: "The certificates and payments of principal and interest on the certificates are not guaranteed by the United States, and do constitute a debt or obligation of the United States or any of its agencies or instrumentalities other than Fannie Mae." (Verbiage changed from all-caps to standard case for readability).

However, the implied guarantee, as well as various special treatments given to Fannie by the government, greatly enhanced its success.

For example, the implied guarantee allowed Fannie Mae and Freddie Mac to save billions in borrowing costs, as their credit rating was very good. Estimates by the Congressional Budget Office and the Treasury Department put the figure at about $2 billion per year. Vernon L. Smith, 2002 Nobel Laureate in economics, has called FHLMC and FNMA "implicitly taxpayer-backed agencies". The Economist has referred to "the implicit government guarantee" of FHLMC and FNMA. In testimony before the House and Senate Banking Committee in 2004, Alan Greenspan expressed the belief that Fannie Mae's (weak) financial position was the result of markets believing that the U.S. Government would never allow Fannie Mae (or Freddie Mac) to fail.

Fannie Mae and Freddie Mac were allowed to hold less capital than normal financial institutions: e.g., they were allowed to sell mortgage-backed securities with only half as much capital backing them up as would be required of other financial institutions. Regulations exist through the FDIC Bank Holding Company Act that govern the solvency of financial institutions. The regulations require normal financial institutions to maintain a capital/asset ratio greater than or equal to 3%. The GSEs, Fannie Mae and Freddie Mac, are exempt from this capital/asset ratio requirement and can, and often do, maintain a capital/asset ratio less than 3%. The additional leverage allows for greater returns in good times, but put the companies at greater risk in bad times, such as during the current subprime mortgage crisis. FNMA is not exempt from state and local taxes. In addition, FNMA and FHLMC are exempt from SEC filing requirements; they SEC 10-K and 10-Q reports, but many other reports, such as certain reports regarding their REMIC mortgage securities, are not filed.

Lastly, Money market funds have diversification requirements, so that not more than 5% of assets may be from the same issuer. That is, a worst-case default would drop a fund not more than five cents. However, these rules do not apply to Fannie and Freddie. It would not be unusual to find a fund that had the vast majority of its assets in Fannie and Freddie debt.

In 1996, the Congressional Budget Office wrote "there have been no federal appropriations for cash payments or guarantee subsidies. But in the place of federal funds the government provides considerable unpriced benefits to the enterprises... Government-sponsored enterprises are costly to the government and taxpayers... the benefit is currently worth $6.5 billion annually.".

Accounting

FNMA is a financial corporation which uses derivatives to "hedge" its cash flow. Derivative products it uses include interest rate swaps and options to enter interest rate swaps ("pay-fixed swaps", "receive-fixed swaps", "basis swaps", "interest rate caps and swaptions", "forward starting swaps").

Controversies

All the Devils are Here

In All The Devils Are Here, Bethany McLean and Joe Nocera paint an interesting portrait of the GSEs, including Fannie. Fannie had been aggressive in its political fights with Wall Street and Congress in the 1980s. In the 1990s Fannie ramped up the 'cut them off at the knees' strategy against political enemies. Tactics included a massive lobbying effort, neutering the OFHEO (its 1992-created regulator), creating a "partnership office" network to court the politically powerful with pork, giving high level employment to the well connected, giving out campaign contributions, creating a charity foundation, and threatening critics like FM Watch with retaliation. One of McLean & Nocera's sources even compared Fannie's activities to Tammany Hall.McLean and Nocera also claim that Fannie 'gamed' its affordable housing numbers, with a process that was referred to internally as "stupid pet tricks". The National Community Reinvestment Coalition, National Association of Affordable Housing Lenders, and studies by the Department of Housing and Urban Development all found the GSEs lacking in their actual, real support of affordable housing.

Accounting controversy

In late 2004, Fannie Mae was under investigation for its accounting practices. The Office of Federal Housing Enterprise Oversight released a report on September 20, 2004, alleging widespread accounting errors.Fannie Mae was expected to spend more than $1 billion in 2006 alone to complete its internal audit and bring it closer to compliance. The necessary restatement was expected to cost $10.8 billion, but was completed at a total cost of $6.3 billion in restated earnings as listed in Fannie Mae's Annual Report on Form 10-K.

Concerns with business and accounting practices at Fannie Mae predate the scandal itself. On June 15, 2000, the House Banking Subcommittee On Capital Markets, Securities And Government-Sponsored Enterprises held hearings on Fannie Mae.

On December 18, 2006, U.S. regulators filed 101 civil charges against chief executive Franklin Raines; chief financial officer J. Timothy Howard; and the former controller Leanne G. Spencer. The three are accused of manipulating Fannie Mae earnings to maximize their bonuses. The lawsuit sought to recoup more than $115 million in bonus payments, collectively accrued by the trio from 1998–2004, and about $100 million in penalties for their involvement in the accounting scandal.

Conflict of interest

In June 2008, the Wall Street Journal reported that two former CEOs of Fannie Mae, James A. Johnson and Franklin Raines had received loans below market rate from Countrywide Financial. Fannie Mae was the biggest buyer of Countrywide's mortgages. The "Friends of Angelo" VIP Countrywide loan program included many people from Fannie Mae; lawyers, executives, etc.

Fannie Mae and Freddie Mac have given contributions to lawmakers currently sitting on committees that primarily regulate their industry: The House Financial Services Committee; the Senate Banking, Housing & Urban Affairs Committee; or the Senate Finance Committee. The others have seats on the powerful Appropriations or Ways & Means committees, are members of the congressional leadership or have run for president.

Leadership

See also

References

External links

Category:United States government sponsored enterprise Category:Mortgage industry of the United States Category:Companies delisted from the New York Stock Exchange Category:Companies based in Washington, D.C.

ar:فاني ماي da:Fannie Mae de:Fannie Mae es:Fannie Mae fr:Federal National Mortgage Association it:Fannie Mae he:פאני מאי lt:Fannie Mae nl:Fannie Mae ja:連邦住宅抵当公庫 no:Fannie Mae pl:Fannie Mae pt:Fannie Mae ru:Fannie Mae sah:Fannie Mae fi:Fannie Mae sv:Fannie Mae th:สมาคมการจำนองแห่งชาติของรัฐบาลกลาง vi:Fannie Mae zh:房利美This text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.