39:54

Understanding Real Estate Investment Trusts

Presentation by Wilson Tan, CEO, CapitaMall Trust Management Limted....

published: 03 Sep 2012

author: TheSIASTube

Understanding Real Estate Investment Trusts

Understanding Real Estate Investment Trusts

Presentation by Wilson Tan, CEO, CapitaMall Trust Management Limted.- published: 03 Sep 2012

- views: 2381

- author: TheSIASTube

4:10

What is a REIT? (English)

...

published: 30 Apr 2013

author: LaSalleInvestmentMgm

What is a REIT? (English)

2:09

What is a REIT?

http://www.reit.com REITs today are more vital to the economy and the investment landscape...

published: 11 Jan 2013

author: NAREIT1

What is a REIT?

What is a REIT?

http://www.reit.com REITs today are more vital to the economy and the investment landscape than ever before -- fulfilling their essential role of providing e...- published: 11 Jan 2013

- views: 36031

- author: NAREIT1

1:35

Real Estate Investment Trust (REIT)

REITs are one way you can invest in real estate while enjoying a level of liquidity synony...

published: 26 Sep 2013

Real Estate Investment Trust (REIT)

Real Estate Investment Trust (REIT)

REITs are one way you can invest in real estate while enjoying a level of liquidity synonymous with the stock market. Learn more here!- published: 26 Sep 2013

- views: 0

46:29

Real Estate Investment Trust CEOs Panel Discussion

Professor David Ling leads a discussion among Real Estate Investment Trust (REIT) CEOs at ...

published: 10 Apr 2013

author: BergstromCenter

Real Estate Investment Trust CEOs Panel Discussion

Real Estate Investment Trust CEOs Panel Discussion

Professor David Ling leads a discussion among Real Estate Investment Trust (REIT) CEOs at the 2013 UF Bergstrom Center Real Estate Trends & Strategies Confer...- published: 10 Apr 2013

- views: 192

- author: BergstromCenter

47:03

Investing in Real Estate Investment Trusts: Theory and Practice - Knowledge Works lecture

Professor David Parker is a globally recognised authority on both the theory and practice ...

published: 09 Aug 2010

author: UniSouthAustralia

Investing in Real Estate Investment Trusts: Theory and Practice - Knowledge Works lecture

Investing in Real Estate Investment Trusts: Theory and Practice - Knowledge Works lecture

Professor David Parker is a globally recognised authority on both the theory and practice of real estate investment trusts. In this lecture he discusses Aust...- published: 09 Aug 2010

- views: 5059

- author: UniSouthAustralia

13:57

Here's how to capitalize Real Estate Funds/Projects, Real Estate Investment Trusts etc.

If you want to capitalize a Real Estate Funds/Projects, Real Estate Investment Trusts --"R...

published: 12 Jul 2013

author: Charles Dreher

Here's how to capitalize Real Estate Funds/Projects, Real Estate Investment Trusts etc.

Here's how to capitalize Real Estate Funds/Projects, Real Estate Investment Trusts etc.

If you want to capitalize a Real Estate Funds/Projects, Real Estate Investment Trusts --"REITs" or Tenants in Common -- 1031 Exchange Entities -- "TICs" as a...- published: 12 Jul 2013

- views: 22

- author: Charles Dreher

2:20

Real Estate Tips : Buying Rental Property Vs. Investing in an REIT

Buying a rental property and investing in a REIT are two things that have both their advan...

published: 20 Apr 2012

author: eHowFamily

Real Estate Tips : Buying Rental Property Vs. Investing in an REIT

Real Estate Tips : Buying Rental Property Vs. Investing in an REIT

Buying a rental property and investing in a REIT are two things that have both their advantages and disadvantages. Learn about buying rental property versus ...- published: 20 Apr 2012

- views: 522

- author: eHowFamily

26:48

What are Reits (Real Estate Investment Trusts) and Their Dividend?

https://www.youtube.com/watch?v=tclnwQNR6RA

What are Reits (Real Estate Investment Trusts...

published: 25 Jan 2014

What are Reits (Real Estate Investment Trusts) and Their Dividend?

What are Reits (Real Estate Investment Trusts) and Their Dividend?

https://www.youtube.com/watch?v=tclnwQNR6RA What are Reits (Real Estate Investment Trusts) and Their Dividend? Buy my Stock Trading Strategy book or ebook http://www.lulu.com/shop/search.ep?keyWords=djellala&categoryId;=100501- published: 25 Jan 2014

- views: 51

2:06

REITs -Real Estate Investment Trusts

REITs -Real Estate Investment Trusts Hello this is Joan Wilson. Let's talk about REITs tod...

published: 15 Dec 2010

author: Joan Wilson

REITs -Real Estate Investment Trusts

REITs -Real Estate Investment Trusts

REITs -Real Estate Investment Trusts Hello this is Joan Wilson. Let's talk about REITs today, real estate investment trusts. A real estate investment trust i...- published: 15 Dec 2010

- views: 1883

- author: Joan Wilson

2:27

What is a REIT (real estate investment trust)

Do you have any real estate exposure in your portfolio? Like to buy a property, but not su...

published: 13 Jun 2010

author: investorzoo

What is a REIT (real estate investment trust)

What is a REIT (real estate investment trust)

Do you have any real estate exposure in your portfolio? Like to buy a property, but not sure you're cut out to be a landlord? Check out REITS. Real Estate In...- published: 13 Jun 2010

- views: 3074

- author: investorzoo

3:13

Sebi to allow real estate investment trusts

The Securities and Exchange Board of India is likely to allow real estate investment trust...

published: 10 Oct 2013

Sebi to allow real estate investment trusts

Sebi to allow real estate investment trusts

The Securities and Exchange Board of India is likely to allow real estate investment trusts or REITs in India. It aims to attract investment in the realty sector. Mint's Anirudh Laskar and S Unnikrishnan discuss the implication for the sector- published: 10 Oct 2013

- views: 5

3:58

Outlook 2014: Real estate investment trusts

Fundamentals for the property sector are improving quite quickly according to Michael Acto...

published: 18 Dec 2013

Outlook 2014: Real estate investment trusts

Outlook 2014: Real estate investment trusts

Fundamentals for the property sector are improving quite quickly according to Michael Acton, Research Director at AEW Capital Management. Valuations also appear to be at attractive levels. Visit: http://ngam.natixis.com/us/investor/1250209402484/Outlook+2014+Alternatives- published: 18 Dec 2013

- views: 5

0:23

CT Real Estate Investment Trust (CRT.UN:TSX) opens Toronto Stock Exchange, Ocotober 30, 2013.

Ken Silver, President & CEO, CT Real Estate Investment Trust (CRT.UN) joined Kevan Cowan, ...

published: 30 Oct 2013

CT Real Estate Investment Trust (CRT.UN:TSX) opens Toronto Stock Exchange, Ocotober 30, 2013.

CT Real Estate Investment Trust (CRT.UN:TSX) opens Toronto Stock Exchange, Ocotober 30, 2013.

Ken Silver, President & CEO, CT Real Estate Investment Trust (CRT.UN) joined Kevan Cowan, President, TSX Markets and Group Head of Equities, TMX Group to open the market . CT Real Estate Investment Trust (REIT) is an unincorporated, closed-end REIT created to own income producing commercial properties. The Portfolio of Properties is comprised of 255 retail properties across Canada and one distribution centre. Canadian Tire is CT REIT's most significant tenant. Canadian Tire Corporation, Limited (CTC.a) (CTC) is a Family of Companies that includes Canadian Tire Retail, PartSource, Gas+, FGL Sports (Sport Chek, Hockey Experts, Sports Experts, National Sports, Intersport, Pro Hockey Life and Atmosphere), Mark's, CT REIT and Canadian Tire Financial Services. CT Real Estate Investment Trust commenced trading on Toronto Stock Exchange on October 23, 2013. For more information, please visit Corp.CanadianTire.ca- published: 30 Oct 2013

- views: 275

Youtube results:

3:48

ASX talks Australian Real Estate Investment Trusts (A-REITs)

ASX talks Australian Real Estate Investment Trusts (A-REITS). You may know REITs by their ...

published: 15 Oct 2011

author: ASXLtd

ASX talks Australian Real Estate Investment Trusts (A-REITs)

ASX talks Australian Real Estate Investment Trusts (A-REITs)

ASX talks Australian Real Estate Investment Trusts (A-REITS). You may know REITs by their previous name, Listed Property Trusts or LPTs. REITS are another po...- published: 15 Oct 2011

- views: 174

- author: ASXLtd

4:02

How REITs Work

REITs, or real estate investment trusts, were created by Congress in 1960 to give all indi...

published: 26 Mar 2014

How REITs Work

How REITs Work

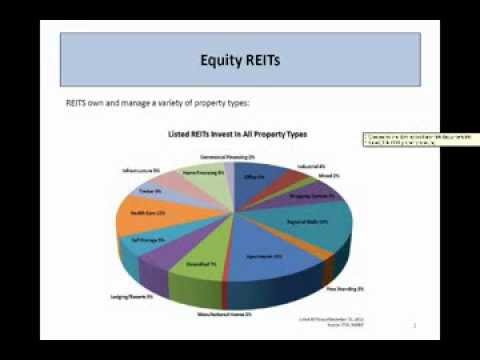

REITs, or real estate investment trusts, were created by Congress in 1960 to give all individuals the opportunity to benefit from investing in income-producing real estate. REITs allow anyone to own or finance properties the same way they invest in other industries, through the purchase of stock. In the same way shareholders benefit by owning stocks in other corporations, the stockholders of a REIT earn a share of the income produced through real estate investment, without actually having to go out and buy or finance property. This video provides some insight into what REITs are and how they work. The REIT industry has a diverse profile, which offers many benefits. REITs often are classified in one of two categories: Equity REITs or Mortgage REITs. Equity REITs own a wide range of property types including offices, shopping centers, hotels, apartments and much more. Equity REITs derive most of their revenue from rent on those properties. Mortgage REITs may finance both residential and commercial properties. Mortgage REITs get most of their revenue from interest earned on their investments in mortgages or mortgage backed securities. In addition, REITs may be publicly registered with the SEC and have their shares listed and traded on major stock exchanges, or they may be publicly registered with the SEC but not have their shares listed or traded on major stock exchanges, or they may be private companies (not registered with the SEC and not having their shares listed or traded on a stock exchange. Regardless of the type, REITs operate under a specific set of rules established by Congress. A REIT is an entity that: • is modeled after mutual funds • is treated by the Internal Revenue Code as a corporation • must be widely held by shareholders • must primarily own or finance real estate, and • must own its real estate with a longterm investment horizon. The IRS implements the REIT rules and oversees what qualifies as a REIT. The Internal Revenue Code requires a REIT to adhere to the following essential rules: at least 75 percent of the corporation's income must be earned from real estate as rent, real estate interest or from the sales of real estate assets; at least 75 percent of the corporation's assets must be real estate assets; and, at least 95 percent of income must be passive. REITs are required to distribute at least 90 percent of taxable income annually to shareholders as taxable dividends. In other words, a REIT cannot retain its earnings. Like a mutual fund, a REIT receives a dividends-paid deduction so no tax is paid at the entity level if 100 percent of income is distributed. REIT shareholders pay taxes on dividends at ordinary rates versus the lower qualified rate. Over time, REITs and the rules and regulations that govern them have evolved to meet the changing needs of the real estate industry and the broader economy. But throughout that process, REITs have remained true to the mission laid out by Congress in 1960: to make the benefits of income-producing real estate accessible to anyone and everyone. And that's still how they work today.- published: 26 Mar 2014

- views: 6

1:36

Real Estate Investment Trusts REITS | Investment Trends and High Income Trusts

For more quality information on Personal Finances and Investing visit http://www.finpipe.c...

published: 15 Jul 2013

author: TheFinancialPipeline

Real Estate Investment Trusts REITS | Investment Trends and High Income Trusts

Real Estate Investment Trusts REITS | Investment Trends and High Income Trusts

For more quality information on Personal Finances and Investing visit http://www.finpipe.com/ Canso Investment Counsel President John Carswell discusses inve...- published: 15 Jul 2013

- views: 29

- author: TheFinancialPipeline