- published: 20 Dec 2013

6 min 6 sec

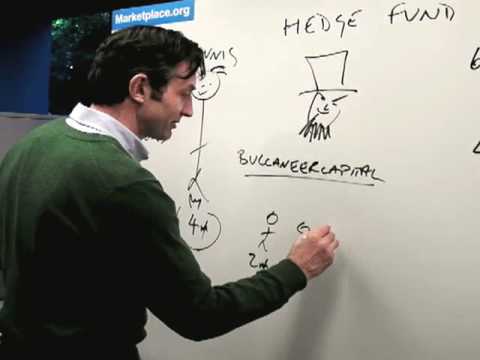

Bonds, notes and bills

So much government debt! But what's the difference between the Treasury's bills, notes and...

published: 20 Dec 2013

Bonds, notes and bills

Bonds, notes and bills

So much government debt! But what's the difference between the Treasury's bills, notes and bonds? Senior Editor Paddy Hirsch explains. More coverage of the financial crisis is at marketplace.org/financialcrisis- published: 20 Dec 2013

3 min 48 sec

Perspectives: central banks and government bonds yields - Erste Group Research 11.4. 2013

Henning Esskuchen discusses with Mildred Hager the movers of German yields, if the US labo...

published: 20 Dec 2013

Perspectives: central banks and government bonds yields - Erste Group Research 11.4. 2013

Perspectives: central banks and government bonds yields - Erste Group Research 11.4. 2013

Henning Esskuchen discusses with Mildred Hager the movers of German yields, if the US labor market and the Fed minutes, the ECB or even the BoJ might have had an impact here. ID_20327 research- published: 20 Dec 2013

1 min 41 sec

Moody's Lowers China Outlook over Local Debt and Lending Risks

China's burgeoning local government debt and shady underground lending banks continue to p...

published: 20 Dec 2013

Moody's Lowers China Outlook over Local Debt and Lending Risks

Moody's Lowers China Outlook over Local Debt and Lending Risks

China's burgeoning local government debt and shady underground lending banks continue to pose a risk to the country's economy. Today, Moody's Investors Services lowered its outlook for the Chinese economy from positive to stable. In a statement, Moody's said high borrowing by China's local government and growing bank lending were sources of concern. These were the same reasons given by Fitch Ratings last week, when it cut China's long-term currency credit rating from AA-minus to A-plus. According to the head of China's National Audit Office, China's local and central governments owed up to 18 trillion yuan, or around $3 trillion US dollars at the end of 2012. Moody's said Chinese authorities have not done enough to reduce the risks associated with local government contingent liabilities by improving transparency. Other reasons for lowering China's economic outlook include a, quote, "significantly greater-than-expected slowdown in economic growth." China's official GDP for the first quarter of this year missed market expectations, and also fell from the previous quarter. Moody's kept its rating for China's government bonds at AA3. That rating isn't expected to go up over the next 12 to 18 months. The agency said while structure reforms are expected to improve credit, the scope and pace isn't enough to justify a ratings upgrade. Moody's also said China's credit ratings would face pressure from a deterioration in government finances, coupled with a rise in social unrest. The agency warned against the risk of shadow banking, saying authorities need to ensure it doesn't destabilize the financial system. Subscribe to NTDonChina ☛ http://www.youtube.com/subscription_c... For more news and videos visit ☛ http://ntd.tv Follow us on Twitter ☛ http://twitter.com/NTDTelevision Add us on Facebook ☛ http://on.fb.me/s5KV2C- published: 20 Dec 2013

1 min 34 sec

Bond Market : How to Buy Government Bonds

Government bonds are issued by the U.S. government to balance the money that they've spent...

published: 20 Dec 2013

Bond Market : How to Buy Government Bonds

Bond Market : How to Buy Government Bonds

Government bonds are issued by the U.S. government to balance the money that they've spent. Find out how to buy government bonds on the U.S. Treasury Web site with help from a personal asset manager in this free video on the bond market and money management. Expert: Roger Groh Bio: Roger Groh is the founder of Groh Asset Management. Filmmaker: Bing Hu- published: 20 Dec 2013

9 min 54 sec

Jim Rogers - 'Short US Government Bonds 'Right Now'

SUBSCRIBE - Win a Free Silver Coin Every Day

http://freesilvernow.com/globalnetwork

More ...

published: 20 Dec 2013

Jim Rogers - 'Short US Government Bonds 'Right Now'

Jim Rogers - 'Short US Government Bonds 'Right Now'

SUBSCRIBE - Win a Free Silver Coin Every Day http://freesilvernow.com/globalnetwork More info about Wealth creation with Gold and Silver https://www.facebook.com/goldandsilver4you- published: 20 Dec 2013

1 min 26 sec

Stocks, Bonds & Investments : How U.S. Government Bonds Work

Many U.S. government bonds work by investing in companies that are linked to the governmen...

published: 20 Dec 2013

Stocks, Bonds & Investments : How U.S. Government Bonds Work

Stocks, Bonds & Investments : How U.S. Government Bonds Work

Many U.S. government bonds work by investing in companies that are linked to the government, so it is important to research the actual company that the bond is supporting. Learn more about how U.S. bonds do not actually go to the government with information from an investments manager in this free video on investing. Expert: Gregory Bramwell-Smith Bio: Gregory Bramwell-Smith is the relationship and portfolio manager at Bramwell-Smith Associates. Filmmaker: David Pakman- published: 20 Dec 2013

5 min 32 sec

Japan Credit Rating Agency President & CEO Makoto Utsumi on Japanese government bonds

Makoto Utsumi is the President and CEO of the Japan Credit Rating Agency, a Japanese finan...

published: 20 Dec 2013

Japan Credit Rating Agency President & CEO Makoto Utsumi on Japanese government bonds

Japan Credit Rating Agency President & CEO Makoto Utsumi on Japanese government bonds

Makoto Utsumi is the President and CEO of the Japan Credit Rating Agency, a Japanese financial services company which publishes credit ratings for Japanese companies, local government, and other interested parties. He spoke with The Prospect Group about the downgrading of Japanese government bonds by Fitch and Moody's and the future outlook of Japan's economy. Copyright 2013 - The Prospect Group For more information, please visit: http://www.theprospectgroup.com/executivefocus/profile/japan-credit-rating-agency-president-ceo-makoto-utsumi-on-japanese-government-bonds/81193/- published: 20 Dec 2013

5 min 34 sec

Marc Faber Sees Bubble in Safest Government Bonds - get out while you still can!

debt crisis 2013, 2013, 2012, 2014, economy 2013 predicitions, economy 2013, 2013 economy,...

published: 20 Dec 2013

Marc Faber Sees Bubble in Safest Government Bonds - get out while you still can!

Marc Faber Sees Bubble in Safest Government Bonds - get out while you still can!

debt crisis 2013, 2013, 2012, 2014, economy 2013 predicitions, economy 2013, 2013 economy, gold 2013, silver 2013, silver 2013 predictions, collapse, dollar, market, financial, government, economic, economy, economy 2013 forecast, prediction, outlook, economy 2014, outlook, crisis, where to invest in 2013, 2013 crisis, global, world, economical, dollar, money, world, new, jim rogers, peter schiff, marc faber, ron paul, money, forecast, war, 2011, china 2013, euro,- published: 20 Dec 2013

16 min 10 sec

Government bonds and UK's screwed economy (04Feb13)

A look at government bonds, so call investors (bond vigilantes) and the UK's totallky f*ck...

published: 20 Dec 2013

Government bonds and UK's screwed economy (04Feb13)

Government bonds and UK's screwed economy (04Feb13)

A look at government bonds, so call investors (bond vigilantes) and the UK's totallky f*cked economy. Recorded from BBC Daily Politics, 04 February 2013.- published: 20 Dec 2013

1 min 8 sec

★ GOVERNMENT BONDS - LARGEST PONZI SCHEME EVER!

This is my video on why the US National Debt is a Ponzi Scheme. Please leave a comment and...

published: 20 Dec 2013

★ GOVERNMENT BONDS - LARGEST PONZI SCHEME EVER!

★ GOVERNMENT BONDS - LARGEST PONZI SCHEME EVER!

This is my video on why the US National Debt is a Ponzi Scheme. Please leave a comment and subscibe! Disclaimer: Opinions expressed in this video do not constitute personalized investment advice and should not be relied on for making investment decisions.- published: 20 Dec 2013

3 min 51 sec

Government bonds on sale in September

Watch KTN Streaming LIVE from Kenya 24/7 on http://www.ktnkenya.tv

Government bonds on sal...

published: 20 Dec 2013

Government bonds on sale in September

Government bonds on sale in September

Watch KTN Streaming LIVE from Kenya 24/7 on http://www.ktnkenya.tv Government bonds on sale in September- published: 20 Dec 2013

13 min 32 sec

Mr. and Mrs. America 1945 US Treasury World War II Bonds Promo with FDR & Eddie Albert, Jr.

more at http://quickfound.net/

"Mobilizing citizens on the homefront in World War II."

P...

published: 20 Dec 2013

Mr. and Mrs. America 1945 US Treasury World War II Bonds Promo with FDR & Eddie Albert, Jr.

Mr. and Mrs. America 1945 US Treasury World War II Bonds Promo with FDR & Eddie Albert, Jr.

more at http://quickfound.net/ "Mobilizing citizens on the homefront in World War II." Public domain film from the Prelinger Archive, slightly cropped to remove uneven edges, with the aspect ratio corrected, and mild video noise reduction applied. The soundtrack was also processed with volume normalization, noise reduction, clipping reduction, and/or equalization (the resulting sound, though not perfect, is far less noisy than the original). http://creativecommons.org/licenses/by-sa/3.0/ http://en.wikipedia.org/wiki/Series_E_bond Series E U.S. Savings Bonds were marketed by the United States government as war bonds from 1941 to 1980. Those issued from 1941 to November 1965 accrued interest for 40 years; those issued from December 1965 to June 1980, for 30 years. They were generally issued at 75 cents per dollar face value, maturing at par in a specified number of years that fluctuated with the rate of interest. Denominations available were $25, $50, $75, $100, $200, $500, $1,000, $5,000 and $10,000. Series E bonds were issued only in registered, physical form and are not transferable. The guaranteed minimum investment yield for the bonds was 4 percent, compounded semiannually... The U.S. Savings Bond programs The first modern U.S. Savings Bonds were issued in 1935, to replace United States Postal Service Bonds. They were marketed as a safe investment that was accessible to everyone. The first bonds, series A, were followed by series B, C, D, E, EE, F, G, H, HH, and I. In October 2008, several news reports claimed there were several billion dollars in unclaimed bonds. The US treasury set up a web site called "Treasury Hunt." The system provides information only on Series E bonds issued in 1974 and after. Financing the War In December 1941, the US declared war on Japan and Germany declared war on the US shortly thereafter. This was the starting point for a large scale -- and thus expensive — defense program. The problem of the financing of World War II was greater than that of World War I, as the struggle lasted longer and the amounts involved were larger. The budgetary expenses for the years 1941-1945 amounted to some $317 billion, of which $281 billion was directly related to the war effort; expenditures climbed from $9.6 billion in fiscal 1940 to nearly $100 billion in 1945. Of these outlays some 45 percent was covered by taxes and other non-borrowing sources. The deficit had to be covered by selling bonds. The Treasury sold $185.7 billion of securities to finance the war. The public debt rose from $50 billion in 1940 to $260 billion in 1945... War Bonds The first Series E Bond was sold to President Franklin D. Roosevelt by Secretary of the Treasury Henry Morgenthau on May 1, 1941. These were marketed first as "defense bonds", then later as "war bonds". During World War II the "drive" technique used during World War I was replaced in part by a continual campaign using a payroll deduction plan. However, eight different drives were conducted during the campaign, in total raising $185.7 billion from 85 million Americans, more than in any other country during the war. Li'l Abner creator Al Capp created Small Fry, a weekly newspaper comic strip whose purpose was to sell Series E bonds in support of the Treasury... After the war Although Series E bonds are usually associated with the war bond drives of World War II, they continued to be sold until June 1980, thereafter being replaced by Series EE bonds. A version of Series EE bonds, known as the Patriot Bond, is a sort of post-September 11 war bond, but has never enjoyed the broad subscription of the Series E war bond.- published: 20 Dec 2013