We Only Ask Once a Year!

It’s hard to believe this is CounterPunch’s 20th year. It’s even harder to comprehend celebrating this anniversary without our guiding spirit Alexander Cockburn. The last year has been an extreme challenge for all of us CounterPunchers. But we’ve put our noses to the grindstone and tried very hard to live up to Alexander’s lofty standards to produce every day a style of radical journalism that is smart, unconventional and enlivened with wit and humor.

Many of you have told us you’re proud of the work we’ve done keeping CounterPunch going and developing the magazine format that was one of Alex’s last wishes. Now it’s the time of year when we need to implore you for your financial support. We only interrupt you with one fund appeal a year. And you can be assured that when we ask you for your financial support, we really mean it.

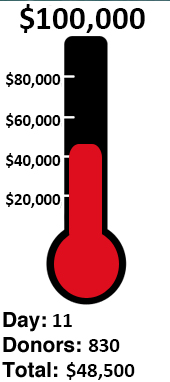

We’ve been telling you for a week that either we meet our fundraising goal of $100,000 over the next month or we’ll be forced to drastically curtail the operation of our website. Many, but not nearly enough of you have rallied with donations. With three more weeks of our fundraiser to go, we’re still far from our make-or-break target.

We’ve been asking some of our readers and writers for our website to say why they value CounterPunch.

Here’s what NOAM CHOMSKY wrote us:

“It is, regrettably, no exaggeration to say that we are living in an era of irrationality, deception, confusion, anger, and unfocused fear — an ominous combination, with few precedents. There has never been a time when it was so important to have a voice of sanity, insight, understanding of what is happening in the world. CounterPunch has performed that essential service with unusual success. It is a matter of paramount importance to ensure that it will continue to do so, with even greater resources than before.”

And RALPH NADER:

“A roaring colosseum of commentary, columnists and tell-it-like-it-was,-is,-and-should be original reportage, complete with a bookstore whose readable volumes tear away the lies, evasions, cover-ups and myths of a censored world. Taste, digest and deepen your mind from this fresh cornucopia called CounterPunch.”

Many websites on the progressive side of the spectrum are cut-and-paste affairs, a mix of columns culled from mainstream newspapers, weeklies, blogs and so forth. Every day our CounterPunch site offers you up to a dozen original articles, and often forty across our three-day weekend site.

Unlike many other outfits, we don’t hit you up for money every month … or even every quarter. But when we ask, we mean it. So this month we humbly ask for your support. We offer in return our independence, our unique position and our editorial choices.

Please, use our brand new secure shopping cart to make a tax-deductible donation to CounterPunch today or purchase a subscription and a gift sub for someone or one of our award winning books (or a crate of books!) as holiday presents. (We won’t call you to shake you down or sell your name to any lists.)

Note to users of Internet Explorer (especially those clinging onto the notoriously clunky IE 7): some of you are experiencing technical issues with the new shopping cart. Please just click the “continue” button to enter the secure server. Our NSA trained technicians are working feverishly to resolve these bugs, but if problems persist, please call us to place your order by phone.

To contribute by phone you can call Becky or Deva toll free in the US at: 1-800-840-3683 or 707-629-3683.

Thank you for your support,

Jeffrey, Joshua, Becky, Deva, and Nathaniel

CounterPunch PO Box 228, Petrolia, CA 95558

Does the Dollar Have a Future?

“If the dollar does indeed lose its role as leading international currency, the cost to the United States would probably extend beyond the simple loss of seigniorage, narrowly defined. We would lose the privilege of playing banker to the world, accepting short-term deposits at low interest rates in return for long-term investments at high average rates of return. When combined with other political developments, it might even spell the end of economic and political hegemony.”

– Economist Menzie Chinn, “Will the Dollar Remain the World’s Reserve Currency in Five Years?”, CounterPunch 2009

Barack Obama’s economic recovery has been a complete bust. Unemployment is high, the economy is barely growing, and inequality is greater than anytime on record. On top of that, inflation has dropped to 1.2 percent, private sector hiring continues to disappoint and, according to Gallup’s “Economic Confidence” survey, households and consumers remain “deeply negative”. More tellingly, the Federal Reserve’s emergency program dubbed QE– which was designed to mitigate the fallout from the 2008 stock market crash and subsequent recession–is still operating at full-throttle five years after Lehman Brothers defaulted. This is inexcusable. It’s an admission that US policymakers have no idea what they’re doing.

Why is it so hard to get the economy up and running? Everyone knows that spending generates growth, so if the private sector (consumers and businesses) can’t spend the public sector (the government) must spend. That’s how sluggish economies shake off recession, through growth.

Spend, spend, spend and spend some more. That’s how you grow your way out of a slump. There’s nothing new or original about this. This isn’t some cutting-edge, state-of-the-art theory. It’s settled science. Economics 101.

So is it any wonder why the rest of the world is losing confidence in the US? Is it any wonder why China and Japan have slashed their purchases of US debt? Get a load of this from Reuters:

“China and Japan led an exodus from U.S. Treasuries in June after the first signals the U.S. central bank was preparing to wind back its stimulus, with data showing they accounted for almost all of a record $40.8 billion of net foreign selling of Treasuries….

China, the largest foreign creditor, reduced its Treasury holdings to $1.2758 trillion, and Japan trimmed its holdings for a third straight month to $1.0834 trillion. Combined, they accounted for about $40 billion in net Treasury outflows.” (“China, Japan lead record outflow from Treasuries in June”, Reuters)

While things have improved since August, the selloff is both ominous and revealing. Foreign trading partners are losing confidence in US stewardship because of policymakers erratic behavior. Here’s how former Fed chairman Paul Volcker summed it up:

“We have lost a coherent successful governing model to be emulated by the rest of the world. Instead, we’re faced with broken financial markets, underperformance of our...

“Slumping asset prices show a recession is probably on its way. … Stocks tend to fall more frequently... When video of the October 14th edition of Thom Hartmann’s TV show appears online (here) it will include... President Barack Obama is determined to prevail in his battle with GOP congressional leaders on the debt ceiling... First, the good news. American hegemony is over. The bully has been subdued. We cleared the Cape of... For the sake of argument, let’s assume the following to be true: Barack Obama is not a stooge,... |

The insidious greed and public looting that Wall Street has nurtured to an art form in New York... Reports are that the Department of Homeland Security (DHS) is engaged in a massive, covert military buildup. An... Will Tea Party machinations over Obamacare lead to the Republican Party’s demise?

No one, so far as I know,... THOSE WHO are interested in the history of the Crusades ask themselves: what brought about the Crusaders’ downfall?... Visit our archives for even more interesting articles from past CounterPunch authors.

|