I was asked last week what I thought about the prospects for “BigLaw.” That question can result in an answer which is too long at 20 seconds or too short at two hours.

I opted for two minutes, suggesting that the sometimes pejorative term BigLaw really doesn’t do high-end corporate legal services justice. I noted that there is really no homogeneous “BigLaw Industry” per se; you have to look at what clients given firms are successfully targeting and servicing. Each “BigClient” faces its own challenges, and a law firm that helps a client compete and win will do well. Many others may continue to be profitable, but will struggle as those profits inevitably decline. Sadly, some firms won’t make it in their current form.

I had a few examples of the reality facing several companies in the “BigClient” category, but the conversation ended there (it was off the meter!).

Just such an example jumped out when I read the morning news last Friday. I saw the earnings announcement by Wells Fargo: second-quarter profits up 19 percent, beating analysts’ estimates. But there was more to this story, and a headline later that day by Bloomberg captured perfectly the BigClient world:

There is a reason Wells Fargo has has been a leader for years. They invest money opportunistically, but they always watch the cost side of the ledger. As an analyst quoted by Bloomberg noted:

“Expenses are probably between $500 million and $1 billion too high,” Marty Mosby, an analyst at Guggenheim Securities LLC, said in an interview before results were disclosed. “That’s a cushion they are whittling down.”

Now do you think legal expenses, particularly for outside services, are part of hitting this nine- or ten-figure cost reduction target?

Before his abrupt exit from HP, Mark Hurd gave this insightful quote to the New York Times in 2006:

Costs and growth are different sides of the same coin. [...] We will spend money to save money and save money to spend money. We will never be done looking at our cost structure.

So what seems normal now really isn’t totally new, is it?

The key takeaway for me: the best companies of the BigClient bunch are more focused than ever on costs. Even with a nascent signs of economic recovery. That mindset is a big reason why they became market leaders in the first place.

Cutting costs during a Great Recession is hard, but it’s almost a reflexive process. Controlling costs when not in urgent crisis-mode requires great management and even better employees.

To meet this challenge, maybe “BetterLaw” is a more productive focus for lawyers and clients alike.

Early last year, I wrote this:

Personal data privacy is an interesting issue for lawyers. For some, it’s part of their corporate practice. For most, it’s a confusing technological jumble, something they want to trust to someone else.

Interestingly, it was in the context of how the Obama administration was proposing a data privacy “bill of rights.” There wasn’t a lot of debate about this last year; perhaps the issue didn’t gain traction in an election year.

But it is now.

Putting aside political issues, in-house counsel and their key outside advisors will certainly be more involved with privacy issues this year. Here are a few that could appear at the top of the list:

1. Who is watching the watchers? A perennial risk issue for in-house counsel is the very IT department relied on to track, collect, and present potential risk inflection points. One of the most insidious parts of the Snowden case is that he was part of an IT group tasked with monitoring network use and security. And he apparently used a thumb drive! Whatever you think about what he did, he has put many people under a microscope; 99.99%+ of whom are professional and trustworthy. (But there are allegedly 1.4 million people with a Top Secret security clearance!)

2. Lawyers are put in a secrecy bind. Companies that receive secret orders from the FISA court cannot legally disclose them. Google has led the charge to obtain permission to disclose more information about these orders and their responses. Observers have noted that it is not in the global business interests of U.S.-based tech companies to operate under this cloud (broad government-mandated data collection) when they are trying to market that cloud (trust us virtually with your data).

3. Lawyers may not be in the loop. There is a report from Bloomberg this morning that some data-sharing “interactions” between the government and tech companies may be conducted on a “need to know” basis. It’s not clear that this would always involve company lawyers.

4. For all the focus on government data collection; watch the private sector. When President Obama first commented briefly on the Snowden disclosures (but before Snowden outed himself), he really didn’t (couldn’t?) say much at all. He did refer to the legality of government programs, and the challenges in balancing privacy and national security. He also noted that private companies collect a lot of data too, which sort of starts a shift in focus to what private companies do with customer data. If the public really understood how their purchase patterns and Internet usage was being monitored and aggregated, it might provoke more of an outcry.

5. Lawyers may not be the answer; some will certainly be asking the questions. One person who will likely have a big part in this unfolding story is James Comey. Reports say he is likely to be nominated as the new FBI director. He is a former Deputy Attorney General; and also later a General Counsel. He almost resigned his position in the Justice Department over some strong-arm tactics intended to certify certain surveillance activities as legal under the nascent Patriot Act. If you want to understand his resume, you can find it online. If you want to see one major reason for his nomination, you can watch it here:

I hope Mr. Comey gets the call and answers it.

We were taught early in the first year of law school the lesson in the cartoon below. A modern corollary to that rule for lawyers might be “ignorance of data privacy is not an option.” Both for our clients, our law practices or businesses, and even ourselves.

When reporters become the story, you have something worth reading about.

Late last week, multiple media sources revealed that Bloomberg news reporters had accessed information about customer usage of the Bloomberg financial terminal. The New York Times covers it this morning here; earlier reporting is summarized by Buzzfeed here.

One of the first Bloomberg customers to complain was Goldman Sachs; one assumes that this would get some attention from management at Bloomberg given their corporate use of the terminal.

Apparently a Bloomberg reporter contacted Goldman about the employment status of an employee, because the reporter noted that this employee hadn’t logged on to their terminal for some time.

Last Friday, Bloomberg CEO Daniel Doctoroff posted a first draft of an apology on the corporate blog:

A Bloomberg client recently raised a concern that Bloomberg News reporters had access to limited customer relationship management data through their use of the Bloomberg Terminal. Although we have long made limited customer relationship data available to our journalists, we realize this was a mistake.

Mistake? At least one important customer apparently saw it as something more.

Then early this morning, the editor-in-chief of Bloomberg News, Matthew Winkler, published a slightly longer explanation, which included this:

The recent complaints go to practices that are almost as old as Bloomberg News. Since the 1990s, some reporters have used the terminal to obtain, as the Washington Post reported, “mundane” facts such as log-on information. There was good reason for this, as our reporters used to go to clients in the early days of the company and ask them what topics they wanted to see covered.

Mundane? What was possibly mundane in the 1990s is apparently different now.

Bloomberg News is really an awesome operation. Their iPhone app, with its integrated video and audio content, is way beyond what others offer right now in terms of global coverage and quality.

In-house counsel can watch this story to see what Bloomberg’s crisis management playbook says, and watch in play out in real time.

There may be more twists and turns to this story. One question some law firms and corporate legal departments may have is this: Did reporter access to selected customer use information extend to the Bloomberg Law product?

We are in the early stages of the digital era as far as privacy and appropriate data use are concerned. This is a really hard issue for lawyers since it has a technological nexus and is difficult to research and understand, let alone monitor in real time.

A common tactic in compliance training is to suggest front-line personnel imagine “reading about the company doing X on the front page of the New York Times” before doing it.

I guess that is no longer a hypothetical scenario for Bloomberg.

(Updated 2:05 pm EDT on 13 May 2013).

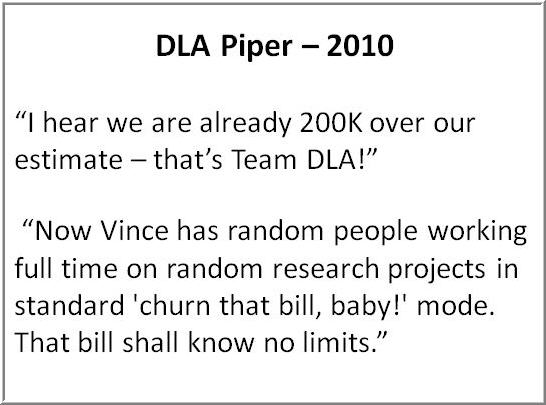

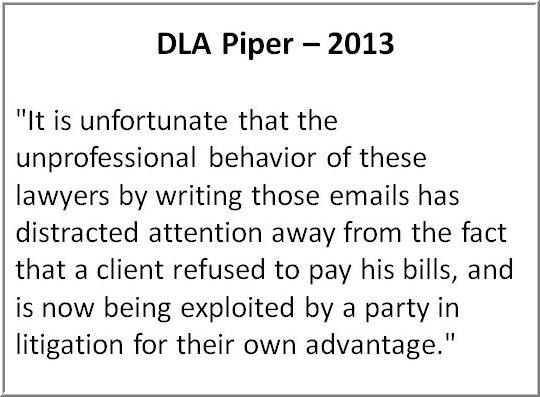

So there is this large dust-up, undoubtedly you’ve heard. A client doesn’t pay a law firm invoice after repeated requests. Law firm threatens to sue. Client doesn’t pay. Law firm sues. Client counterclaims. Client gets discovery. Client gets emails, files some as exhibits. Press gets emails:

So law firm goes into damage control mode, declines to comment to press, and sends memo to staff. Press gets memo:

Wait a minute. Isn’t the point of discovery to find documents and use them to your advantage?

The DLA Piper “That’s Team DLA” lawsuit been covered by Inside Counsel, Thomson Reuters, and even the Op-Ed page of the New York Times. The Op-Ed tries to link this dust-up to the entire billable hour regime.

Wow.

Years ago I asked a very savvy partner at a prosperous law firm whether he had ever sued a client over an unpaid bill. The response was something like this:

No. I can’t say I never would. But it would have to be a large bill, a great result, and a clear winner. And of course a client that I didn’t care about losing.

The intransigent client’s unpaid bill from DLA Piper was reportedly $675,000. To put this in perspective, DLA Piper revenues for 2012 were $2.44 billion (source). I think that works out to about 0.027%.

Some in-house lawyers have put this entire matter in perspective, seeing it as larger than any one firm with a dispute with a single client.

A final explanation in the “not-to-be-commented-upon” internal DLA Piper memo was that the emails were nothing more than:

“…an unfortunate attempt at humor by three former lawyers of the firm.”

Many April Fool “jokes” are unfortunate attempts at humor.

I have to believe many partners at DLA Piper think that the press generated by this collection lawsuit has not been funny. In the least.

Many in the United States think Detroit as an example of failure. Failed industry (autos), failed city (Chapter 9 looming?), failed leadership (see below).

As a life-long resident of the greater Detroit area, I agree that all those designations may be true. But they don’t tell the full story. I don’t see Detroit just as a current laggard. I also see Detroit as a potential leader. And lawyers are on the case.

The quick-rinse bankruptcies of GM and Chrysler were seen at the time as a virtual death knell for the US auto industry. Flash forward a few years, and GM and Chrysler are wildly profitable. Some of the high-end European automakers are starting to see what real worldwide competition is like while facing a horrible economic state and the mess that is the European Union (as a financial system).

Lawyers made the automaker bankruptcies happen. And one lawyer, involved in that, may be part of something more.

Detroit as a city had a lawyer as mayor (Dennis Archer, a former Michigan Supreme Court Justice) some years ago; he basically saw what was on the horizon (and the reality of an intransigent City Council) and took his formidable talents to the private sector. His successor, Kwame Kilpatrick, was a lawyer, until he resigned in disgrace and lost his ticket a few years ago. Yesterday we learned that a federal jury considered Mr. Kilpatrick a criminal, and their verdicts in the morning resulted in Mr. Kilpatrick to being remanded to the custody of federal marshals in the afternoon to await sentencing. It was a big win for US Attorney Barbara McQuade and her team (lawyers all, with AUSAs Mark Chutkow and Michael Bullotta on point).

But into the void of failed leadership rides someone new. That would be Michigan Governor Rick Snyder. He is–wait for it–also a lawyer (University of Michigan JD/MDA). He spent years in the private sector before running for governor. He is just about the least political politician you will ever meet. Under Michigan law, cities failing economically are reviewed by the state, and an Emergency Financial Manager (EFM) can be appointed. A hearing on such a financial emergency for Detroit will be held in Lansing today. All signs point to clear distress in Detroit; although, incredibly, some on the City Council disagree.

So who would Governor Snyder appoint as the Detroit EFM? Well, someone brave for starters. Press reports this morning mention one Kevyn Orr, a partner at Jones Day. Mr. Orr and his firm represented Chrysler in the bankruptcy mentioned above. I hope, if asked, Mr. Orr or someone of his pedigree accepts the challenge.

I have a hunch I’m not alone in thinking that there would be no more challenging public position in America than the Detroit EFM.

And the “Detroit as Leader” part? I see the challenges facing Detroit (financially and otherwise) to be present in many large urban centers and states around the country. Maybe not as urgent, maybe not in the same magnitude. Detroit is a sort of “leading indicator.” And if the Detroit EFM recommends to Governor Snyder that a Chapter 9 is required, it will be one for the record books (and the legal treatises).

Business Blogging 101 says you don’t stray into politics. That’s not really the focus here today. In much of what ails Detroit, there are serious legal challenges involved in fixing the results of 50 years of mostly failed leadership (and complex demographic trends).

Thankfully, there are some lawyers with courage who are willing to take the case.

(Downtown Detroit from Belle Isle; not today, maybe someday. Source)