Why do we *still* have a Nobel Prize in Economic Sciences?

Ingrid Robyens at Crooked Timber links to some fascinating discussion from Philip Mirowski of the role of Swedish domestic politics in the establishment of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, with emphasis on the way in which claims of “scientific” status for economics helped the claim of the Swedish central bank to independence from government.

In the broader context, it seems pretty clear that, if the idea had arisen even a few years later, it would have been rejected. In 1969, economics really did seem like a progressively developing science in which new discoveries built on old ones. There were some challenges to the dominant Keynesian-neoclassical synthesis but they were either marginalized (Marxists, institutionalists) or appeared to reflect disagreements about parameter values that could fit within the mainstream synthesis.

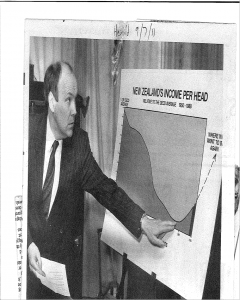

Only a few years later, all of this was in ruins. The rational expectations revolution sought, with considerable success, to discredit Keynesian macroeconomics, while promising to develop a New Classical model in which macroeconomic fluctuations were explained by Real Business Cycles. This project was a failure, but led to the award of a string of Nobels, before macroeconomists converged on the idea of Dynamic Stochastic General Equilibrium models, which failed miserably in the context of the global financial crisis. The big debate in macro can be phrased as “where did it all go wrong”. Robert Gordon says 1978, I’ve gone for 1958, while the New Classical position implies that the big mistake was Keynes’ General Theory in 1936

The failure in finance is even worse, as is illustrated by this year’s awards where Eugene Fama gets a prize for formulating the Efficient Markets Hypothesis and Robert Shiller for his leading role in demolishing it. Microeconomics is in a somewhat better state: the rise of behavioral economics has the promise of improved realism in the description of economic decisions.

Overall, economics is still at a pre-scientific stage, at least, as the idea of science is exemplified by Physics and Chemistry. Economists have made some important discoveries, and a knowledge of economics helps us to understand crucial issues, but there is no agreement on fundamental issues. The result is that prizes are awarded both for “discoveries” and for the refutation of those discoveries.

Recent Comments