- published: 24 Oct 2008

- views: 13634

- author: bionicturtledotcom

7:27

Operational Risk in Basel II

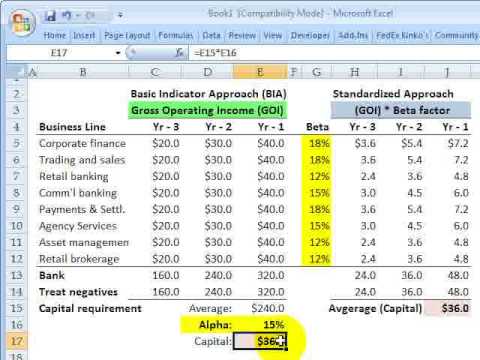

There are three approaches to operational risk in Basel II: basic indicator (BIA), standar...

published: 24 Oct 2008

author: bionicturtledotcom

Operational Risk in Basel II

Operational Risk in Basel II

There are three approaches to operational risk in Basel II: basic indicator (BIA), standardized (SA), and advanced measurement approach (AMA). BIA is alpha (...- published: 24 Oct 2008

- views: 13634

- author: bionicturtledotcom

9:18

Operational Risk Management and Business Performance

...

published: 22 Mar 2011

author: Jared Wade

Operational Risk Management and Business Performance

Operational Risk Management and Business Performance

- published: 22 Mar 2011

- views: 2093

- author: Jared Wade

23:53

Using Visual Analytics for Operational Risk Monitoring in a Trading Environment

To mitigate Operational Risk, trading patterns have to be carefully observed and analyzed....

published: 26 Feb 2013

author: Rama Malladi

Using Visual Analytics for Operational Risk Monitoring in a Trading Environment

Using Visual Analytics for Operational Risk Monitoring in a Trading Environment

To mitigate Operational Risk, trading patterns have to be carefully observed and analyzed. In this 20-minute demo, Rama Malladi from Kubera explains how this...- published: 26 Feb 2013

- views: 118

- author: Rama Malladi

4:46

What is Operational Risk?

What is Operational Risk? - From the Basel ii Compliance Professionals Association, the la...

published: 01 May 2010

author: GeorgeLekatis

What is Operational Risk?

What is Operational Risk?

What is Operational Risk? - From the Basel ii Compliance Professionals Association, the largest association of Basel ii Professionals in the world.- published: 01 May 2010

- views: 1968

- author: GeorgeLekatis

3:53

Coming to Grips with Operational Risk

In this video presentation, William Beale, CEO of Union First Market Bankshares of Richmon...

published: 13 Nov 2012

author: BankDirectorMagazine

Coming to Grips with Operational Risk

Coming to Grips with Operational Risk

In this video presentation, William Beale, CEO of Union First Market Bankshares of Richmond, VA, discusses the key indicators directors need to know when ana...- published: 13 Nov 2012

- views: 135

- author: BankDirectorMagazine

3:41

Definition & Types of Operational Risk

Every One can learn Basel II....

published: 25 Sep 2007

author: dralmadani

Definition & Types of Operational Risk

Definition & Types of Operational Risk

Every One can learn Basel II.- published: 25 Sep 2007

- views: 7728

- author: dralmadani

6:32

Operational Risk Management Training

Operational Risk Management AIR Training presented by PO3 Edgar....

published: 13 Feb 2012

author: NIOCPensacola

Operational Risk Management Training

Operational Risk Management Training

Operational Risk Management AIR Training presented by PO3 Edgar.- published: 13 Feb 2012

- views: 1945

- author: NIOCPensacola

10:39

Operational Risks: Continuous Distributions Introduction Exponential

Get free 10 days Operational Risk tutorials: http://www.edupristine.com/ca/courses/operati...

published: 14 Jan 2013

author: EduPristine Inco

Operational Risks: Continuous Distributions Introduction Exponential

Operational Risks: Continuous Distributions Introduction Exponential

Get free 10 days Operational Risk tutorials: http://www.edupristine.com/ca/courses/operational-risk/ In probability theory and statistics, the exponential di...- published: 14 Jan 2013

- views: 68

- author: EduPristine Inco

2:56

Hilarious Operational Risk Management

Dumb guy tries to rob a store many times and fails....

published: 19 Aug 2010

author: Riater

Hilarious Operational Risk Management

Hilarious Operational Risk Management

Dumb guy tries to rob a store many times and fails.- published: 19 Aug 2010

- views: 14300

- author: Riater

2:45

Basel II Impact on Operational Risk

In this clip from RiskTelevision.com, William DuMond of the Securities Operations Forum di...

published: 12 Apr 2007

author: RISKTelevision

Basel II Impact on Operational Risk

Basel II Impact on Operational Risk

In this clip from RiskTelevision.com, William DuMond of the Securities Operations Forum discusses how Basel II Capital Requirements Impact Operational Risk M...- published: 12 Apr 2007

- views: 5642

- author: RISKTelevision

160:41

What Are the Risks Associated with Hedge Funds? Operational Risk Management & Banking (1998)

Because investments in hedge funds can add diversification to investment portfolios, inves...

published: 01 Oct 2013

What Are the Risks Associated with Hedge Funds? Operational Risk Management & Banking (1998)

What Are the Risks Associated with Hedge Funds? Operational Risk Management & Banking (1998)

Because investments in hedge funds can add diversification to investment portfolios, investors may use them as a tool to reduce their overall portfolio risk exposures. Managers of hedge funds use particular trading strategies and instruments with the specific aim of reducing market risks to produce risk-adjusted returns, which are consistent with investors' desired level of risk. Hedge funds ideally produce returns relatively uncorrelated with market indices. While "hedging" can be a way of reducing the risk of an investment, hedge funds, like all other investment types, are not immune to risk. According to a report by the Hennessee Group, hedge funds were approximately one-third less volatile than the S&P; 500 between 1993 and 2010. Investors in hedge funds are, in most countries, required to be sophisticated qualified investors who are assumed to be aware of the investment risks, and accept these risks because of the potential returns relative to those risks. Fund managers may employ extensive risk management strategies in order to protect the fund and investors. According to the Financial Times, "big hedge funds have some of the most sophisticated and exacting risk management practices anywhere in asset management."[45] Hedge fund managers may hold a large number of investment positions for short durations and are likely to have a particularly comprehensive risk management system in place. Funds may have "risk officers" who assess and manage risks but are not otherwise involved in trading, and may employ strategies such as formal portfolio risk models.[48] A variety of measuring techniques and models may be used to calculate the risk incurred by a hedge fund's activities; fund managers may use different models depending on their fund's structure and investment strategy.[46][49] Some factors, such as normality of return, are not always accounted for by conventional risk measurement methodologies. Funds which use value at risk as a measurement of risk may compensate for this by employing additional models such as drawdown and "time under water" to ensure all risks are captured.[50] In addition to assessing the market-related risks that may arise from an investment, investors commonly employ operational due diligence to assess the risk that error or fraud at a hedge fund might result in loss to the investor. Considerations will include the organization and management of operations at the hedge fund manager, whether the investment strategy is likely to be sustainable, and the fund's ability to develop as a company. Since hedge funds are private entities and have few public disclosure requirements, this is sometimes perceived as a lack of transparency.[52] Another common perception of hedge funds is that their managers are not subject to as much regulatory oversight and/or registration requirements as other financial investment managers, and more prone to manager-specific idiosyncratic risks such as style drifts, faulty operations, or fraud.[49] New regulations introduced in the US and the EU as of 2010 require hedge fund managers to report more information, leading to greater transparency.[53] In addition, investors, particularly institutional investors, are encouraging further developments in hedge fund risk management, both through internal practices and external regulatory requirements.[45] The increasing influence of institutional investors has led to greater transparency: hedge funds increasingly provide information to investors including valuation methodology, positions and leverage exposure. http://en.wikipedia.org/wiki/Hedge_fund- published: 01 Oct 2013

- views: 94

3:56

IBM OpenPages Operational Risk Management

This video introduces the IBM OpenPages GRC Platform and, specifically, the Operational Ri...

published: 25 Jan 2013

author: ibmbusinessanalytics

IBM OpenPages Operational Risk Management

IBM OpenPages Operational Risk Management

This video introduces the IBM OpenPages GRC Platform and, specifically, the Operational Risk Management module.- published: 25 Jan 2013

- views: 932

- author: ibmbusinessanalytics

2:06

BP People - Joan Wales from Safety & Operational Risk

The safety of our people and the communities in which we operate comes first at BP. Safety...

published: 11 Jan 2013

author: BPplc

BP People - Joan Wales from Safety & Operational Risk

BP People - Joan Wales from Safety & Operational Risk

The safety of our people and the communities in which we operate comes first at BP. Safety & Operational Risk (S∨) drives safe, reliable and compliant oper...- published: 11 Jan 2013

- views: 1365

- author: BPplc

2:46

How do I assess operational risks? - ARIS Risk & Compliance Manager

Operational risk management helps organizations to identify and document risks (e.g., fina...

published: 08 Oct 2010

author: ariscommunity

How do I assess operational risks? - ARIS Risk & Compliance Manager

How do I assess operational risks? - ARIS Risk & Compliance Manager

Operational risk management helps organizations to identify and document risks (e.g., financial or security risks). This tutorial describes the risk assessme...- published: 08 Oct 2010

- views: 1133

- author: ariscommunity

Youtube results:

2:52

Back Office and Operational Risk, by Mervyn J. King

http://www.amazon.co.uk/Back-Office-Operational-Risk-Symptoms/dp/1906659362/ref=sr_1_1?ie=...

published: 13 Apr 2010

author: HarrimanHouse

Back Office and Operational Risk, by Mervyn J. King

Back Office and Operational Risk, by Mervyn J. King

http://www.amazon.co.uk/Back-Office-Operational-Risk-Symptoms/dp/1906659362/ref=sr_1_1?ie=UTF8&s;=books&qid;=1269879367&sr;=8-1 http://books.global-investor.com...- published: 13 Apr 2010

- views: 2566

- author: HarrimanHouse

55:09

Achieving High-Performing, Simulation-Based Operational Risk Measurement with RevoScaleR

Under the Basel II Accord, financial institutions are required for the first time to deter...

published: 28 Jun 2012

author: REvolutionAnalytics

Achieving High-Performing, Simulation-Based Operational Risk Measurement with RevoScaleR

Achieving High-Performing, Simulation-Based Operational Risk Measurement with RevoScaleR

Under the Basel II Accord, financial institutions are required for the first time to determine capital requirements for a new class of risk -- operational ri...- published: 28 Jun 2012

- views: 704

- author: REvolutionAnalytics

12:56

18. Operational Risk Reduction: world class production needs sure equipment reliability

LRS Plant Wellness Way Day3 Session 18: Operational Risk Reduction: During the operation o...

published: 06 Apr 2012

author: lrsconsultantsglobal

18. Operational Risk Reduction: world class production needs sure equipment reliability

18. Operational Risk Reduction: world class production needs sure equipment reliability

LRS Plant Wellness Way Day3 Session 18: Operational Risk Reduction: During the operation of your plant and machinery, production can only be guaranteed if yo...- published: 06 Apr 2012

- views: 183

- author: lrsconsultantsglobal

3:22

Business Imperative for Operational Risk Management

Daniel J. Roussell, SVP & Head, Operational Risk, State Street, discusses how operational ...

published: 15 Aug 2012

author: RMA1914

Business Imperative for Operational Risk Management

Business Imperative for Operational Risk Management

Daniel J. Roussell, SVP & Head, Operational Risk, State Street, discusses how operational risk cuts across all processes in an organization, takes many peopl...- published: 15 Aug 2012

- views: 120

- author: RMA1914