- published: 18 Jun 2009

- views: 629

- author: Bloomberg

9:29

Inside Look - Dismantling the Office of Thrift Supervision - Bloomberg

Interview with OTS Acting Director John Bowman (Bloomberg News)...

published: 18 Jun 2009

author: Bloomberg

Inside Look - Dismantling the Office of Thrift Supervision - Bloomberg

Inside Look - Dismantling the Office of Thrift Supervision - Bloomberg

Interview with OTS Acting Director John Bowman (Bloomberg News)- published: 18 Jun 2009

- views: 629

- author: Bloomberg

16:25

Failures of Financial Regulators Explained by Former Reagan Nominee

Professor James Barth was an appointee of Presidents Ronald Reagan and George H.W. Bush as...

published: 16 May 2012

author: TYT Interviews

Failures of Financial Regulators Explained by Former Reagan Nominee

Failures of Financial Regulators Explained by Former Reagan Nominee

Professor James Barth was an appointee of Presidents Ronald Reagan and George H.W. Bush as chief economist of the Office of Thrift Supervision and previously...- published: 16 May 2012

- views: 7073

- author: TYT Interviews

17:30

Elizabeth Warren on the Consumer Financial Protection Bureau Director (2013)

The Act changes the existing regulatory structure, such as creating a host of new agencies...

published: 09 Nov 2013

Elizabeth Warren on the Consumer Financial Protection Bureau Director (2013)

Elizabeth Warren on the Consumer Financial Protection Bureau Director (2013)

The Act changes the existing regulatory structure, such as creating a host of new agencies (while merging and removing others) in an effort to streamline the regulatory process, increasing oversight of specific institutions regarded as a systemic risk, amending the Federal Reserve Act, promoting transparency, and additional changes. The Act purports to provide rigorous standards and supervision to protect the economy and American consumers, investors and businesses, purports to end taxpayer funded bailouts of financial institutions, claims to provide for an advanced warning system on the stability of the economy, creates rules on executive compensation and corporate governance, and eliminates some loopholes that led to the 2008 economic recession.[37] The new agencies are either granted explicit power over a particular aspect of financial regulation, or that power is transferred from an existing agency. All of the new agencies, and some existing ones that are not currently required to do so, are also compelled to report to Congress on an annual (or biannual) basis, to present the results of current plans and to explain future goals. Important new agencies created include the Financial Stability Oversight Council, the Office of Financial Research, and the Bureau of Consumer Financial Protection. Of the existing agencies, changes are proposed, ranging from new powers to the transfer of powers in an effort to enhance the regulatory system. The institutions affected by these changes include most of the regulatory agencies currently involved in monitoring the financial system (Federal Deposit Insurance Corporation (FDIC), U.S. Securities and Exchange Commission (SEC), Office of the Comptroller of the Currency (OCC), Federal Reserve (the "Fed"), the Securities Investor Protection Corporation (SIPC), etc.), and the final elimination of the Office of Thrift Supervision (further described in Title III -- Transfer of Powers to the Comptroller, the FDIC, and the FED). As a practical matter, prior to the passage of Dodd--Frank, investment advisers were not required to register with the SEC if the investment adviser had fewer than 15 clients during the previous 12 months and did not hold itself out generally to the public as an investment adviser. The act eliminates that exemption, thereby rendering numerous additional investment advisers, hedge funds, and private equity firms subject to new registration requirements.[38] Certain non-bank financial institutions and their subsidiaries will be supervised by the Fed[39] in the same manner and to the same extent as if they were a bank holding company.[40] To the extent that the Act affects all federal financial regulatory agencies, eliminating one (the Office of Thrift Supervision) and creating two (Financial Stability Oversight Council and the Office of Financial Research) in addition to several consumer protection agencies, including the Bureau of Consumer Financial Protection, this legislation in many ways represents a change in the way America's financial markets will operate in the future. Few provisions of the Act became effective when the bill was signed.[41] Only over the next 18 months as various regulatory agencies write rules that implement various sections of the Act, will the full importance and significance of the Act be known. http://en.wikipedia.org/wiki/Consumer_Financial_Protection_Act_of_2010#Overview- published: 09 Nov 2013

- views: 83

7:50

Interagency Review of Foreclosure Policies and Practices

Dena M. Roudybush, General Counsel for Compliance Counsel and WMAL's Rick Fowler discuss t...

published: 20 Apr 2011

author: mortgagecrisisupdate

Interagency Review of Foreclosure Policies and Practices

Interagency Review of Foreclosure Policies and Practices

Dena M. Roudybush, General Counsel for Compliance Counsel and WMAL's Rick Fowler discuss the recent Interagency Review of Foreclosure Policies and Practices ...- published: 20 Apr 2011

- views: 504

- author: mortgagecrisisupdate

2:39

Warren Buffett on Financial Regulation, Audits, Corporate Boards, and Committees

In most cases, financial regulatory authorities regulate all financial activities. But in ...

published: 09 Nov 2013

Warren Buffett on Financial Regulation, Audits, Corporate Boards, and Committees

Warren Buffett on Financial Regulation, Audits, Corporate Boards, and Committees

In most cases, financial regulatory authorities regulate all financial activities. But in some cases, there are specific authorities to regulate each sector of the finance industry, mainly banking, securities, insurance and pensions markets, but in some cases also commodities, futures, forwards, etc. For example, in Australia, the Australian Prudential Regulation Authority (APRA) supervises banks and insurers, while the Australian Securities and Investments Commission (ASIC) is responsible for enforcing financial services and corporations laws. Sometimes more than one institution regulates and supervises the banking market, normally because, apart from regulatory authorities, central banks also regulate the banking industry. For example, in the USA banking is regulated by a lot of regulators, such as the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the National Credit Union Administration, the Office of Thrift Supervision, as well as regulators at the state level.[14] In addition, there are also associations of financial regulatory authorities. In the European Union, there are the Committee of European Securities Regulators (CESR), the Committee of European Banking Supervisors (CEBS) and the Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS), which are Level-3 committees of the EU in the Lamfalussy process. And, at a world level, we have the International Organization of Securities Commissions (IOSCO), the International Association of Insurance Supervisors, the Basel Committee on Banking Supervision, the Joint Forum, and the Financial Stability Board. The structure of financial regulation has changed significantly in the past two decades, as the legal and geographic boundaries between markets in banking, securities, and insurance have become increasingly "blurred" and globalized. Think-tanks such as the World Pensions Council (WPC) have argued that most European governments pushed dogmatically for the adoption of the Basel II recommendations, adopted in 2005, transposed in European Union law through the Capital Requirements Directive (CRD), effective since 2008. In essence, they forced European banks, and, more importantly, the European Central Bank itself e.g. when gauging the solvency of EU-based financial institutions, to rely more than ever on the standardized assessments of credit risk marketed by two private US agencies- Moody's and S&P;, thus using public policy and ultimately taxpayers' money to strengthen an anti-competitive duopolistic industry. http://en.wikipedia.org/wiki/Financial_regulation- published: 09 Nov 2013

- views: 18

2:50

Nuevas Regulaciones Hipotecarias - Tulio Rodriguez

Tulio Rodriguez comenta sobre las revisión mas recientes regulaciones hipotecarias (Intera...

published: 19 Apr 2011

author: Arlington357

Nuevas Regulaciones Hipotecarias - Tulio Rodriguez

Nuevas Regulaciones Hipotecarias - Tulio Rodriguez

Tulio Rodriguez comenta sobre las revisión mas recientes regulaciones hipotecarias (Interagency Review of Foreclosure Policies and Practices) realizadas por:...- published: 19 Apr 2011

- views: 272

- author: Arlington357

3:22

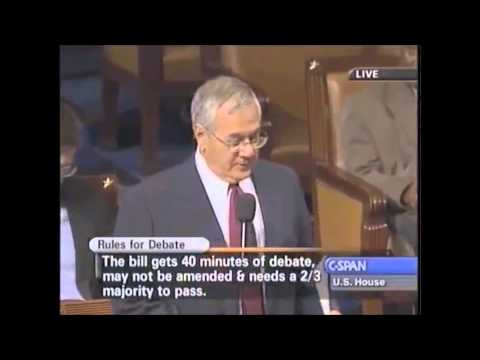

Barney Frank : Lack Of Regulation Caused Financial Crisis

House Financial Services Committee hearing, Sept. 10, 2003:

Rep. Barney Frank (D., Mass.)...

published: 15 Sep 2013

Barney Frank : Lack Of Regulation Caused Financial Crisis

Barney Frank : Lack Of Regulation Caused Financial Crisis

House Financial Services Committee hearing, Sept. 10, 2003: Rep. Barney Frank (D., Mass.): I worry, frankly, that there's a tension here. The more people, in my judgment, exaggerate a threat of safety and soundness, the more people conjure up the possibility of serious financial losses to the Treasury, which I do not see. I think we see entities that are fundamentally sound financially and withstand some of the disaster scenarios. . . . -------- Rep. Frank: I do think I do not want the same kind of focus on safety and soundness that we have in OCC [Office of the Comptroller of the Currency] and OTS [Office of Thrift Supervision]. I want to roll the dice a little bit more in this situation towards subsidized housing. ------------- Rep. Frank: Let me ask [George] Gould and [Franklin] Raines on behalf of Freddie Mac and Fannie Mae, do you feel that over the past years you have been substantially under-regulated? Mr. Raines? Mr. Raines: No, sir. Mr. Frank: Mr. Gould? Mr. Gould: No, sir. . . . Mr. Frank: OK. Then I am not entirely sure why we are here. . . . -------------- Rep. Frank: I believe there has been more alarm raised about potential unsafety and unsoundness than, in fact, exists. http://online.wsj.com/article/SB122290574391296381.html http://boogiefinger.blogspot.com/2012/04/derivatives-disasters-and-democrats.html- published: 15 Sep 2013

- views: 15

1:42

[FREE PDF] An Exploration of Effectiveness in the Regulation of Federal Depository Institutions

Download Link : http://www.rarshare.com/an-exploration-of-effectiveness-in-the-regulation-...

published: 08 Nov 2013

[FREE PDF] An Exploration of Effectiveness in the Regulation of Federal Depository Institutions

[FREE PDF] An Exploration of Effectiveness in the Regulation of Federal Depository Institutions

Download Link : http://www.rarshare.com/an-exploration-of-effectiveness-in-the-regulation-of-federal-depository-institutions-1989-2008-striving-for-balance-by-mike-potter-pdf/ An Exploration of Effectiveness in the Regulation of Federal Depository Institutions, 1989-2008: Striving for Balance by Mike Potter Book Description Publication Date: September 19, 2013 | ISBN-10: 0739179357 | ISBN-13: 978-0739179352 Financial services regulators are tasked with balancing the conflicting roles of empowering and policing their regulated communities. In order to be effective, agencies must be able to accomplish both tasks. This analysis examines several determinants of effectiveness among U.S. bank regulators. Using statistical and narrative analyses, it examines factors that have contributed to the regulatory effectiveness of the National Credit Union Administration, Office of the Comptroller of the Currency, and Office of Thrift Supervision. The study focused on the relationships between regulatory ability to prevent failures and influences including agency longevity, ability to manage complexity, appointee and staff qualities, mission stability, regulatory style, and resources. Agency longevity and resources had the greatest impact on effectiveness among the cases that were examined. Additionally, this study proposes a typology that suggests that more effective regulators are able to balance information from their regulated communities with a public interest orientation. This allows them to have current information regarding emerging regulatory issues but also to avoid becoming too reliant on their supervised institutions for information. By not being overly reliant or out of touch with their regulated communities, agency can better foster regulatory resiliency.- published: 08 Nov 2013

- views: 0

46:25

Is the Dominant Provider of Consumer Credit Scores Planting the Seeds of the Next Financial Crisis?

On November 13, John E. Bowman, former Acting Director of the Office of Thrift Supervision...

published: 15 Nov 2013

Is the Dominant Provider of Consumer Credit Scores Planting the Seeds of the Next Financial Crisis?

Is the Dominant Provider of Consumer Credit Scores Planting the Seeds of the Next Financial Crisis?

On November 13, John E. Bowman, former Acting Director of the Office of Thrift Supervision and Partner at Venable LLP, discussed the risks to our financial system from overreliance on a single legacy credit score provider.- published: 15 Nov 2013

- views: 14

4:03

Reed Says Unifying Bank Regulators Would Add Efficiency: Video

Nov. 12 (Bloomberg) -- U.S. Senator Jack Reed, a Rhode Island Democrat, talks with Bloombe...

published: 23 Mar 2012

author: Bloomberg

Reed Says Unifying Bank Regulators Would Add Efficiency: Video

Reed Says Unifying Bank Regulators Would Add Efficiency: Video

Nov. 12 (Bloomberg) -- U.S. Senator Jack Reed, a Rhode Island Democrat, talks with Bloomberg's Deirdre Bolton about Senate Banking Committee Chairman Christo...- published: 23 Mar 2012

- views: 196

- author: Bloomberg

1:52

Federal Regulators Sanction Over A Dozen Banks For Mortgage Misconduct and Negligence

http://reviewyourbankforeclosure.com | Federal banking regulators on Wednesday sanctioned ...

published: 14 Apr 2011

Federal Regulators Sanction Over A Dozen Banks For Mortgage Misconduct and Negligence

Federal Regulators Sanction Over A Dozen Banks For Mortgage Misconduct and Negligence

http://reviewyourbankforeclosure.com | Federal banking regulators on Wednesday sanctioned many of the nation's largest banks over "a pattern of misconduct and negligence" in residential mortgage loan servicing and foreclosure processing."These deficiencies represent significant and pervasive compliance failures and unsafe and unsound practices at these institutions," the Federal Reserve said in a statement.The sanctioned banks are Bank of America (NYSE:BAC), Citigroup Inc. (NYSE:C), Ally Financial, the HSBC North America unit of HSBC Holdings (NYSE:HBC), J.P. Morgan Chase (NYSE:JPM), MetLife (NYSE:MET), PNC Financial Services (NYSE:PNC), SunTrust Banks (NYSE:STI), U.S. Bancorp (NYSE:USB), Wells Fargo (NYSE:WFC), Everbank, OneWest, Banco Santander's (NYSE:STD) Sovereign Bank and Aurora Bank, which together represent 68% of the market.The action was taken jointly by the Federal Reserve, the Office of the Comptroller of the Currency, and the Office of Thrift Supervision, and found that the banks didn't hire enough workers, didn't adequately supervise outside lawyers, didn't ensure they had accurate foreclosure documentation and didn't stop foreclosure proceedings when warranted.The banks will be required to establish a wide variety of compliance programs and obtain an independent firm to conduct reviews of residential foreclosure actions. They will also have to ensure more effective communication between borrowers and banks when it comes to foreclosures and mortgage modification proceedings.There are no fines included in this action, which could come as a result of the related investigation being conducted by the 50 state attorney generals and the Justice Department. The fines being contemplated in that case have been rumored to total between $20-$30 billion.- published: 14 Apr 2011

- views: 399

4:18

N.Y. Bank Chief Neiman Endorses Consolidating OTC, OCC: Video

Oct. 16 (Bloomberg) -- New York State Banking Superintendent Richard Neiman talks with Blo...

published: 23 Mar 2012

author: Bloomberg

N.Y. Bank Chief Neiman Endorses Consolidating OTC, OCC: Video

N.Y. Bank Chief Neiman Endorses Consolidating OTC, OCC: Video

Oct. 16 (Bloomberg) -- New York State Banking Superintendent Richard Neiman talks with Bloomberg's Erik Schatzker about the Obama administration's proposal t...- published: 23 Mar 2012

- views: 78

- author: Bloomberg

8:58

Without Regulation Capitalism Is Theft

White-collar crime has now affected every taxpayer in the US and it didn't take identity t...

published: 22 Mar 2009

author: GateKeeper50hotmail

Without Regulation Capitalism Is Theft

Without Regulation Capitalism Is Theft

White-collar crime has now affected every taxpayer in the US and it didn't take identity theft to accomplish the act. The door was opened by Bill Clinton, th...- published: 22 Mar 2009

- views: 1053

- author: GateKeeper50hotmail

0:59

Annual Compliance Seminar with OFIR and the CFPB!

This is an event you cannot afford to miss! We are excited to have Kirt Gundry and the exa...

published: 10 Aug 2012

author: MMLANET

Annual Compliance Seminar with OFIR and the CFPB!

Annual Compliance Seminar with OFIR and the CFPB!

This is an event you cannot afford to miss! We are excited to have Kirt Gundry and the examination team from the Office of Financial and Insurance Regulation...- published: 10 Aug 2012

- views: 118

- author: MMLANET

Youtube results:

5:05

The Finance Minute with Dr. Steve Pilloff | George Mason University

Dr. Steve Pilloff provides tips useful tips on how to save money. Pilloff is an assistant ...

published: 10 Feb 2012

author: MasonSOM

The Finance Minute with Dr. Steve Pilloff | George Mason University

The Finance Minute with Dr. Steve Pilloff | George Mason University

Dr. Steve Pilloff provides tips useful tips on how to save money. Pilloff is an assistant professor of finance at the School of Management at George Mason Un...- published: 10 Feb 2012

- views: 553

- author: MasonSOM

1:05

Washington Mutual Bank Run

JPMorgan Chase & Co., the third- biggest U.S. bank by assets, agreed to acquire the deposi...

published: 26 Sep 2008

author: repfreedomforce

Washington Mutual Bank Run

Washington Mutual Bank Run

JPMorgan Chase & Co., the third- biggest U.S. bank by assets, agreed to acquire the deposits of Washington Mutual Inc. for $1.9 billion as the thrift was sei...- published: 26 Sep 2008

- views: 8918

- author: repfreedomforce

13:21

Key stakeholders discuss perspectives on fair delivery of home loans (part 1)

At NCLR's panel on reforming government sponsored enterprises Featuring: Martin Eakes, CEO...

published: 23 Feb 2011

author: National Council of La Raza

Key stakeholders discuss perspectives on fair delivery of home loans (part 1)

Key stakeholders discuss perspectives on fair delivery of home loans (part 1)

At NCLR's panel on reforming government sponsored enterprises Featuring: Martin Eakes, CEO, Self-Help/Center for Responsible Lending Ellen Seidman, Former Di...- published: 23 Feb 2011

- views: 62

- author: National Council of La Raza

7:41

Money Matters 2

The Federal Reserve is the United States' central bank. It controls the flow of money in a...

published: 28 Jan 2009

author: AlexandriaCD

Money Matters 2

Money Matters 2

The Federal Reserve is the United States' central bank. It controls the flow of money in and out of banks and maintains the stability of the financial system...- published: 28 Jan 2009

- views: 266

- author: AlexandriaCD