- published: 18 Sep 2013

- views: 334891

-

remove the playlistInternal Rate Of Return

-

remove the playlistLatest Videos

-

remove the playlistLongest Videos

- remove the playlistInternal Rate Of Return

- remove the playlistLatest Videos

- remove the playlistLongest Videos

- published: 20 Apr 2013

- views: 175911

- published: 27 Feb 2010

- views: 416768

- published: 06 Jan 2016

- views: 7611

- published: 30 Nov 2014

- views: 29296

- published: 06 Apr 2011

- views: 64819

- published: 17 Aug 2012

- views: 529911

- published: 15 Aug 2013

- views: 74947

Internal rate of return

The internal rate of return (IRR) or economic rate of return (ERR) is a method of calculating rate of return. The term internal refers to the fact that its calculation does not incorporate environmental factors (e.g., the interest rate or inflation).

It is also called the discounted cash flow rate of return (DCFROR).

In the context of savings and loans, the IRR is also called the effective interest rate.

Definition

The internal rate of return on an investment or project is the "annualized effective compounded return rate" or rate of return that makes the net present value of all cash flows (both positive and negative) from a particular investment equal to zero. It can also be defined as the discount rate at which the present value of all future cash flow is equal to the initial investment or, in other words, the rate at which an investment breaks even.

Equivalently, the IRR of an investment is the discount rate at which the net present value of costs (negative cash flows) of the investment equals the net present value of the benefits (positive cash flows) of the investment.

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Rate of return

In finance, return is a profit on an investment. It comprises any change in value and interest or dividends or other such cash flows which the investor receives from the investment. It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. The latter is also called the holding period return.

A loss instead of a profit is described as a negative return.

Rate of return is a profit on an investment over a period of time, expressed as a proportion of the original investment. The time period is typically a year, in which case the rate of return is referred to as annual return.

To compare returns over time periods of different lengths on an equal basis, it is useful to convert each return into an annual equivalent rate of return, or annualised return. This conversion process is called annualisation, described below.

Return on investment (ROI) is return per dollar invested. It is a measure of investment performance, as opposed to size (c.f. return on equity, return on assets, return on capital employed).

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Return

Return may refer to:

In business, economics, and finance

In technology

In entertainment

Film

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

Internal

Internal may refer to:

See also

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

IRR

IRR or Irr may refer to:

Finance

Organisations

Science and technology

Other

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

7:23

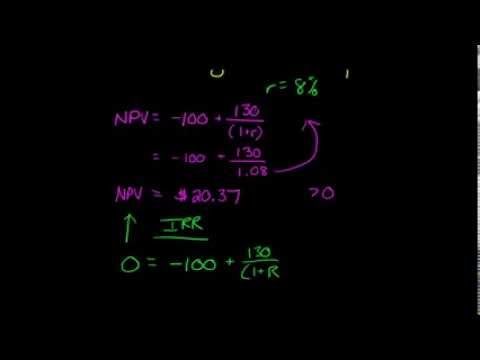

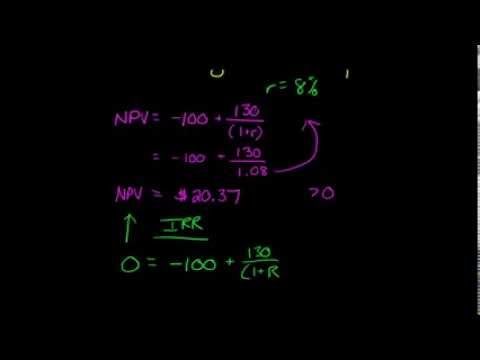

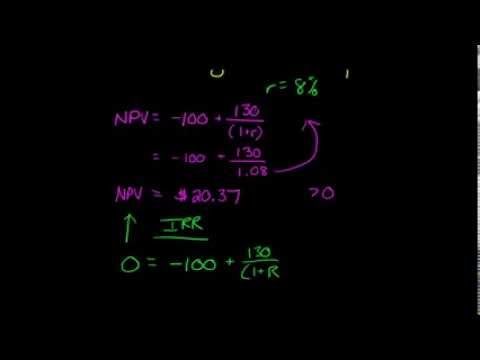

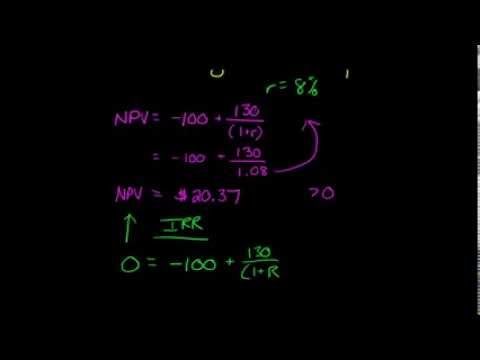

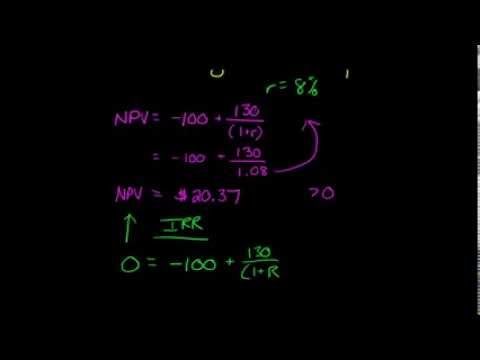

7:23IRR (Internal Rate of Return)

IRR (Internal Rate of Return)IRR (Internal Rate of Return)

This video explains the concept of IRR (the internal rate of return) and illustrates how to calculate the IRR via an example. Edspira is your source for business and financial education. To view the entire video library for free, visit http://www.EducationUnlocked.org/ To like us on Facebook, visit https://www.facebook.com/Edspira Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. The goal of Michael's life is to increase access to education so all people can achieve their dreams. To learn more about Michael's story, visit http://www.MichaelMcLaughlin.com To follow Michael on Facebook, visit https://facebook.com/Prof.Michael.McLaughlin To follow Michael on Twitter, visit https://twitter.com/Prof_McLaughlin -

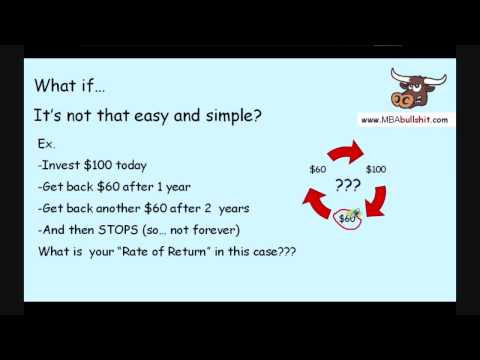

3:27

3:273 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

omg WOW so easy I watched here http://MBAbullshit.com IRR Internal Rate of Return in 3 minutes If You Like My Free Videos, Support Me at https://www.patreon.com/MBAbull Imagine you found a wizard with a boat on a magic river... For every $100 you gave the wizard.. He would give you back $10/year FOREVER and ever! So how much % do you get every year? 10%. Because $10 is 10% of $100. Guess what? This 10% is called your RATE of RETURN (careful, this is not yet your INTERNAL rate of return...) So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. Now what if... It wasn't that simple... What if the wizard brought you back a different amount every year? http://www.youtube.com/watch?v=7w-UWuDi0fY On some lucky years, he might bring back $70 On other years, he might bring back only $5.. And what if... It was NOT forever? What if it was for exactly 7 years? What is your % Rate of Return now? Not so easy to know now, right? It's like the rate of return is now HIDDEN... This "hidden" rate of return is now called the INTERNAL Rate of Return or simply IRR. To find the exact %, we use the IRR Formula. Don't panic! I promise it's much easier that it looks! So if you know your business' Internal Rate of Return, how do you use it? This simplest example is this: Let's say you borrowed money to buy a candy machine for business. When you compare the money you earn from the candy machine with the amount you paid for the candy machine, you can compute your candy machine's IRR... ... and when you know your candy machine's IRR, you can then compare it to your borrowing cost. If your business borrows money from the bank at a 4% interest rate and your Internal Rate of Return is 10%, then you WIN 6%... Because 10% minus 4% is 6%. On the other hand, if your business borrows money at a 4% interest rate, but your candy machine's IRR is only 3%, then you LOSE. -

9:58

9:583 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

OMG wow! Soooo easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom for Internal Rate of Return or IRR. In advance of going deeper into this approach, we need to evaluate the definition of "Rate of Return" (with no "internal" yet). Rate of Return would be the "speed" you are going to earn back profit on an annual basis, every twelve months, endlessly, in contrast to an amount you in the beginning invest. With the intention that it can be compared to the invested bigger sum, this is written just like a percent (%). By way of example, if you invest 100 dollars, and you earn back 3 dollars per annum endlessly, then the "rate of return" is 3%. Trouble-free, is it not? But let us alter the situation somewhat. Suppose, on the same $100 investment previously mentioned, you will definitely make money for a couple of years... and not all in identical amounts in each year? And what if the money coming in will likely stop after a certain number of years? For instance, you are going to get $5 on your 1st year, possibly $8 on your 2nd year, $3 around the third year, and $95 during the fourth year (which could become a final year... so it's not ad infinitum). What is the rate of return now? As you can tell, on this most recent problem, it isn't really easy to find the percentage rate. This is because it's not as simple as in the initial case above for the reason that the annual cash flow is not just a standardizedsum (similar to the $3 in the initial situation above) and it's not without end. This percentage within this newest situation has become popularly known as Internal Rate of Return. Given that it is really not simple to get the percentage, we can easily declare it really is like "a hidden" percent... therefore the term "internal"... due to the reason that the word "internal" is similar to a formal way of expressing "hidden". How is the principle beneficial? If the IRR of your respective undertaking or business enterprise is less than your cost of debt or the total interest rate you would pay to your bank (in case you raise funds money coming from the bank to do the investment or plan), then it is a foul deal. Exactly why? Remember! Because if you will pay 3% to your bank to accomplish a venture or make an investment decision, and then it produces an IRR of only 2%, then you definitely lose 1%. Then again, when your IRR or Internal Rate of Return is above the percentage at which one would borrow from the bank to cover an investment or task, then it is a fine deal, as a result of the helpful "spread" in between your rate of return and cost of debt. Similarly, in case your IRR is the same thing as the interest one would pay to your bank, then you're break-even. This, in summary, is really a simple clarification of IRR. Note that in more difficult problems, you might weigh up your internal rate of return not simply to your cost of debt, but to you cost of equity or weighted average cost of capital or WACC instead. http://www.youtube.com/watch?v=KKqzSGMz9Sk what is irr, the internal rate of return, what is internal rate of return, irr, internal rate of return, khan academy, investopedia -

3:55

3:55Internal Rate of Reutrn Explained in Four Minutes

Internal Rate of Reutrn Explained in Four MinutesInternal Rate of Reutrn Explained in Four Minutes

This video explains the concepts of Internal Rate of Return -

4:02

4:02What Is Internal Rate Of Return? | Vishal Thakkar

What Is Internal Rate Of Return? | Vishal ThakkarWhat Is Internal Rate Of Return? | Vishal Thakkar

Internal rate of return is defined as the rate at which cash flows are recovered so the Finance Guru is back with yet another informative video that will solve all your queries about things that should be keep in mind.Today's topic of discussion 'Internal Rate of Return' For More Updates follow me on: Facebook Link...https://www.facebook.com/tovishalthakkar Twitter Link...https://twitter.com/authorvishalt?lang=en Linked in Link. in.linkedin.com/in/vishalthakkar1405/ To know more about my channel, SUBSCRIBE now http://www.youtube.com/user/financetubebyvishalt?sub_confirmation=1 -

21:29

21:29Investment Decision Rules 2 - Internal Rate of Return

Investment Decision Rules 2 - Internal Rate of ReturnInvestment Decision Rules 2 - Internal Rate of Return

The quality of the video could be improved if you change the resolution. To change this, click on the settings icon (cog wheel) and you can adjust it. Experiment to find which resolution best fits your computer. It might also depend on if you view it in full screen or not. -

12:03

12:0302 03 2015 Prof Vikas Internal Rate of Return IRR

02 03 2015 Prof Vikas Internal Rate of Return IRR02 03 2015 Prof Vikas Internal Rate of Return IRR

-

6:31

6:31How To Calculate Internal Rate Of Return

How To Calculate Internal Rate Of ReturnHow To Calculate Internal Rate Of Return

This tutorial is a invaluable time-saver that will enable you to get good at math, business accounting. Watch our video on How To Calculate Internal Rate Of Return from one of Videojug's experts. Subscribe! http://www.youtube.com/subscription_center?add_user=videojugeducation Check Out Our Channel Page: http://www.youtube.com/user/videojugeducation Like Us On Facebook! https://www.facebook.com/videojug Follow Us On Twitter! http://www.twitter.com/videojug Watch This and Other Related films here: http://www.videojug.com/film/how-to-calculate-irr -

9:00

9:00NPV and IRR in Excel 2010

NPV and IRR in Excel 2010NPV and IRR in Excel 2010

Description: How to calculate net present value (NPV) and internal rate of return (IRR) in excel with a simple example. Download the excel file here: https://codible.myshopify.com/products/npv-and-irr-in-excel-2010-excel-files Some good books on Excel and Finance: Financial Modeling - by Benninga: http://amzn.to/2tByGQ2 Principles of Finance with Excel - by Benninga: http://amzn.to/2uaCyo6 -

5:15

5:15Episode 127: How to Calculate the Internal Rate of Return | Part 1

Episode 127: How to Calculate the Internal Rate of Return | Part 1Episode 127: How to Calculate the Internal Rate of Return | Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P The Internal Rate of Return, or IRR for short, is the discount rate that causes the net present value to equal zero. As a type of capital budgeting tool, the IRR allows managers and business owners the ability to weight a variety of different capital budgeting projects. The video provides a brief description and purpose of IRR in addition to showing how to calculate the internal rate of return. It is recommended that viewers have an understanding of the time value of money and how to calculate both the present value and NPV prior to learning IRR. The following videos are resources that will detail these topics. The Time Value of Money: http://youtu.be/35RkSTjCCx0 How the Calculate the Net Present Value: http://youtu.be/jylJ2r9bklE

-

IRR (Internal Rate of Return)

This video explains the concept of IRR (the internal rate of return) and illustrates how to calculate the IRR via an example. Edspira is your source for business and financial education. To view the entire video library for free, visit http://www.EducationUnlocked.org/ To like us on Facebook, visit https://www.facebook.com/Edspira Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. The goal of Michael's life is to increase access to education so all people can achieve their dreams. To learn more about Michael's story, visit http://www.MichaelMcLaughlin.com To follow Michael on Facebook, visit https://facebook.com/Prof.Michael.McLaughlin To follow Michael on Twitter, visit https://twitter.com/Prof_McLaughlin

published: 18 Sep 2013 -

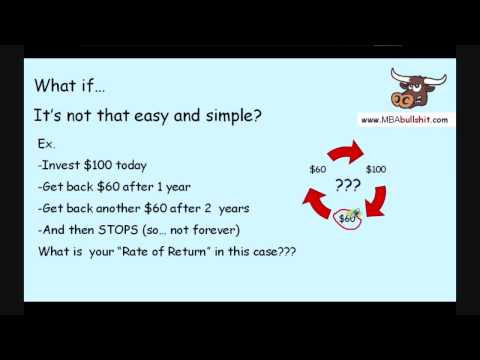

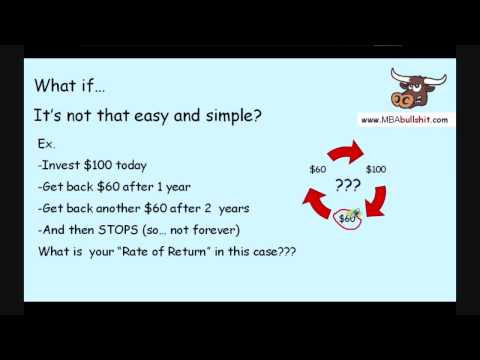

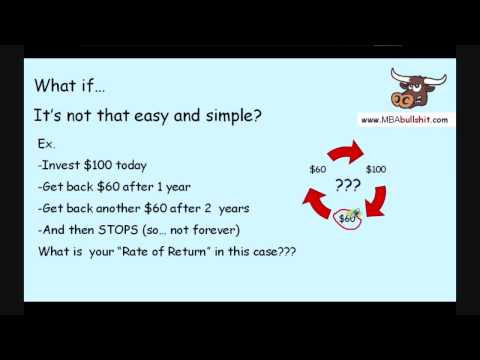

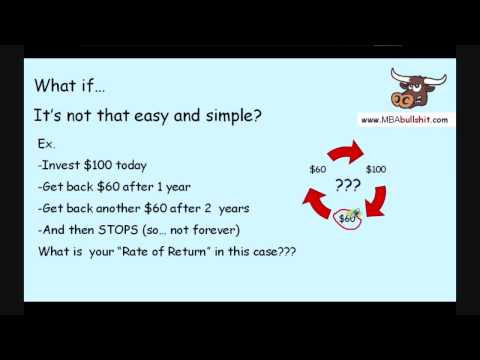

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

omg WOW so easy I watched here http://MBAbullshit.com IRR Internal Rate of Return in 3 minutes If You Like My Free Videos, Support Me at https://www.patreon.com/MBAbull Imagine you found a wizard with a boat on a magic river... For every $100 you gave the wizard.. He would give you back $10/year FOREVER and ever! So how much % do you get every year? 10%. Because $10 is 10% of $100. Guess what? This 10% is called your RATE of RETURN (careful, this is not yet your INTERNAL rate of return...) So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. Now what if... It wasn't that simple... What if t...

published: 20 Apr 2013 -

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

OMG wow! Soooo easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom for Internal Rate of Return or IRR. In advance of going deeper into this approach, we need to evaluate the definition of "Rate of Return" (with no "internal" yet). Rate of Return would be the "speed" you are going to earn back profit on an annual basis, every twelve months, endlessly, in contrast to an amount you in the beginning invest. With the intention that it can be compared to the invested bigger sum, this is written just like a percent (%). By way of example, if you invest 100 dollars, and you earn back 3 dollars per annum endlessly, then the "rate of return" is 3%. Trouble-free, is it not? But let us alter the situation somewhat. Suppose, on the same $100 investment previo...

published: 27 Feb 2010 -

Internal Rate of Reutrn Explained in Four Minutes

This video explains the concepts of Internal Rate of Return

published: 29 Jun 2012 -

What Is Internal Rate Of Return? | Vishal Thakkar

Internal rate of return is defined as the rate at which cash flows are recovered so the Finance Guru is back with yet another informative video that will solve all your queries about things that should be keep in mind.Today's topic of discussion 'Internal Rate of Return' For More Updates follow me on: Facebook Link...https://www.facebook.com/tovishalthakkar Twitter Link...https://twitter.com/authorvishalt?lang=en Linked in Link. in.linkedin.com/in/vishalthakkar1405/ To know more about my channel, SUBSCRIBE now http://www.youtube.com/user/financetubebyvishalt?sub_confirmation=1

published: 06 Jan 2016 -

Investment Decision Rules 2 - Internal Rate of Return

The quality of the video could be improved if you change the resolution. To change this, click on the settings icon (cog wheel) and you can adjust it. Experiment to find which resolution best fits your computer. It might also depend on if you view it in full screen or not.

published: 30 Nov 2014 -

02 03 2015 Prof Vikas Internal Rate of Return IRR

published: 09 Mar 2015 -

How To Calculate Internal Rate Of Return

This tutorial is a invaluable time-saver that will enable you to get good at math, business accounting. Watch our video on How To Calculate Internal Rate Of Return from one of Videojug's experts. Subscribe! http://www.youtube.com/subscription_center?add_user=videojugeducation Check Out Our Channel Page: http://www.youtube.com/user/videojugeducation Like Us On Facebook! https://www.facebook.com/videojug Follow Us On Twitter! http://www.twitter.com/videojug Watch This and Other Related films here: http://www.videojug.com/film/how-to-calculate-irr

published: 06 Apr 2011 -

NPV and IRR in Excel 2010

Description: How to calculate net present value (NPV) and internal rate of return (IRR) in excel with a simple example. Download the excel file here: https://codible.myshopify.com/products/npv-and-irr-in-excel-2010-excel-files Some good books on Excel and Finance: Financial Modeling - by Benninga: http://amzn.to/2tByGQ2 Principles of Finance with Excel - by Benninga: http://amzn.to/2uaCyo6

published: 17 Aug 2012 -

Episode 127: How to Calculate the Internal Rate of Return | Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P The Internal Rate of Return, or IRR for short, is the discount rate that causes the net present value to equal zero. As a type of capital budgeting tool, the IRR allows managers and business owners the ability to weight a variety of different capital budgeting projects. The video provides a brief description and purpose of IRR in addition to showing how to calculate the...

published: 15 Aug 2013

IRR (Internal Rate of Return)

- Order: Reorder

- Duration: 7:23

- Updated: 18 Sep 2013

- views: 334891

- published: 18 Sep 2013

- views: 334891

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

- Order: Reorder

- Duration: 3:27

- Updated: 20 Apr 2013

- views: 175911

- published: 20 Apr 2013

- views: 175911

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

- Order: Reorder

- Duration: 9:58

- Updated: 27 Feb 2010

- views: 416768

- published: 27 Feb 2010

- views: 416768

Internal Rate of Reutrn Explained in Four Minutes

- Order: Reorder

- Duration: 3:55

- Updated: 29 Jun 2012

- views: 88942

What Is Internal Rate Of Return? | Vishal Thakkar

- Order: Reorder

- Duration: 4:02

- Updated: 06 Jan 2016

- views: 7611

- published: 06 Jan 2016

- views: 7611

Investment Decision Rules 2 - Internal Rate of Return

- Order: Reorder

- Duration: 21:29

- Updated: 30 Nov 2014

- views: 29296

- published: 30 Nov 2014

- views: 29296

02 03 2015 Prof Vikas Internal Rate of Return IRR

- Order: Reorder

- Duration: 12:03

- Updated: 09 Mar 2015

- views: 23171

- published: 09 Mar 2015

- views: 23171

How To Calculate Internal Rate Of Return

- Order: Reorder

- Duration: 6:31

- Updated: 06 Apr 2011

- views: 64819

- published: 06 Apr 2011

- views: 64819

NPV and IRR in Excel 2010

- Order: Reorder

- Duration: 9:00

- Updated: 17 Aug 2012

- views: 529911

- published: 17 Aug 2012

- views: 529911

Episode 127: How to Calculate the Internal Rate of Return | Part 1

- Order: Reorder

- Duration: 5:15

- Updated: 15 Aug 2013

- views: 74947

- published: 15 Aug 2013

- views: 74947

-

IRR (Internal Rate of Return)

This video explains the concept of IRR (the internal rate of return) and illustrates how to calculate the IRR via an example. Edspira is your source for business and financial education. To view the entire video library for free, visit http://www.EducationUnlocked.org/ To like us on Facebook, visit https://www.facebook.com/Edspira Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. The goal of Michael's life is to increase access to education so all people can achieve their dreams. To learn more about Michael's story, visit http://www.MichaelMcLaughlin.com To follow Michael on Facebook, visit https://facebook.com/Prof.Michael.McLaughlin To follow Michael on Twitter, visit https://twitter.com/Prof_McLaughlin

published: 18 Sep 2013 -

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

omg WOW so easy I watched here http://MBAbullshit.com IRR Internal Rate of Return in 3 minutes If You Like My Free Videos, Support Me at https://www.patreon.com/MBAbull Imagine you found a wizard with a boat on a magic river... For every $100 you gave the wizard.. He would give you back $10/year FOREVER and ever! So how much % do you get every year? 10%. Because $10 is 10% of $100. Guess what? This 10% is called your RATE of RETURN (careful, this is not yet your INTERNAL rate of return...) So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. So this 10% Rate of Return tells you HOW QUICKLY you get back your money in EXACTLY 1 year... compared to your original $100. Now what if... It wasn't that simple... What if t...

published: 20 Apr 2013 -

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

OMG wow! Soooo easy I subscribed here http://www.youtube.com/subscription_center?add_user=mbabullshitdotcom for Internal Rate of Return or IRR. In advance of going deeper into this approach, we need to evaluate the definition of "Rate of Return" (with no "internal" yet). Rate of Return would be the "speed" you are going to earn back profit on an annual basis, every twelve months, endlessly, in contrast to an amount you in the beginning invest. With the intention that it can be compared to the invested bigger sum, this is written just like a percent (%). By way of example, if you invest 100 dollars, and you earn back 3 dollars per annum endlessly, then the "rate of return" is 3%. Trouble-free, is it not? But let us alter the situation somewhat. Suppose, on the same $100 investment previo...

published: 27 Feb 2010 -

Internal Rate of Reutrn Explained in Four Minutes

This video explains the concepts of Internal Rate of Return

published: 29 Jun 2012 -

What Is Internal Rate Of Return? | Vishal Thakkar

Internal rate of return is defined as the rate at which cash flows are recovered so the Finance Guru is back with yet another informative video that will solve all your queries about things that should be keep in mind.Today's topic of discussion 'Internal Rate of Return' For More Updates follow me on: Facebook Link...https://www.facebook.com/tovishalthakkar Twitter Link...https://twitter.com/authorvishalt?lang=en Linked in Link. in.linkedin.com/in/vishalthakkar1405/ To know more about my channel, SUBSCRIBE now http://www.youtube.com/user/financetubebyvishalt?sub_confirmation=1

published: 06 Jan 2016 -

Investment Decision Rules 2 - Internal Rate of Return

The quality of the video could be improved if you change the resolution. To change this, click on the settings icon (cog wheel) and you can adjust it. Experiment to find which resolution best fits your computer. It might also depend on if you view it in full screen or not.

published: 30 Nov 2014 -

02 03 2015 Prof Vikas Internal Rate of Return IRR

published: 09 Mar 2015 -

How To Calculate Internal Rate Of Return

This tutorial is a invaluable time-saver that will enable you to get good at math, business accounting. Watch our video on How To Calculate Internal Rate Of Return from one of Videojug's experts. Subscribe! http://www.youtube.com/subscription_center?add_user=videojugeducation Check Out Our Channel Page: http://www.youtube.com/user/videojugeducation Like Us On Facebook! https://www.facebook.com/videojug Follow Us On Twitter! http://www.twitter.com/videojug Watch This and Other Related films here: http://www.videojug.com/film/how-to-calculate-irr

published: 06 Apr 2011 -

NPV and IRR in Excel 2010

Description: How to calculate net present value (NPV) and internal rate of return (IRR) in excel with a simple example. Download the excel file here: https://codible.myshopify.com/products/npv-and-irr-in-excel-2010-excel-files Some good books on Excel and Finance: Financial Modeling - by Benninga: http://amzn.to/2tByGQ2 Principles of Finance with Excel - by Benninga: http://amzn.to/2uaCyo6

published: 17 Aug 2012 -

Episode 127: How to Calculate the Internal Rate of Return | Part 1

Go Premium for only $9.99 a year and access exclusive ad-free videos from Alanis Business Academy. Click here for a 14 day free trial: http://bit.ly/1Iervwb View additional videos from Alanis Business Academy and interact with us on our social media pages: YouTube Channel: http://bit.ly/1kkvZoO Website: http://bit.ly/1ccT2QA Facebook: http://on.fb.me/1cpuBhW Twitter: http://bit.ly/1bY2WFA Google+: http://bit.ly/1kX7s6P The Internal Rate of Return, or IRR for short, is the discount rate that causes the net present value to equal zero. As a type of capital budgeting tool, the IRR allows managers and business owners the ability to weight a variety of different capital budgeting projects. The video provides a brief description and purpose of IRR in addition to showing how to calculate the...

published: 15 Aug 2013

IRR (Internal Rate of Return)

- Order: Reorder

- Duration: 7:23

- Updated: 18 Sep 2013

- views: 334891

- published: 18 Sep 2013

- views: 334891

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

- Order: Reorder

- Duration: 3:27

- Updated: 20 Apr 2013

- views: 175911

- published: 20 Apr 2013

- views: 175911

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

- Order: Reorder

- Duration: 9:58

- Updated: 27 Feb 2010

- views: 416768

- published: 27 Feb 2010

- views: 416768

Internal Rate of Reutrn Explained in Four Minutes

- Order: Reorder

- Duration: 3:55

- Updated: 29 Jun 2012

- views: 88942

What Is Internal Rate Of Return? | Vishal Thakkar

- Order: Reorder

- Duration: 4:02

- Updated: 06 Jan 2016

- views: 7611

- published: 06 Jan 2016

- views: 7611

Investment Decision Rules 2 - Internal Rate of Return

- Order: Reorder

- Duration: 21:29

- Updated: 30 Nov 2014

- views: 29296

- published: 30 Nov 2014

- views: 29296

02 03 2015 Prof Vikas Internal Rate of Return IRR

- Order: Reorder

- Duration: 12:03

- Updated: 09 Mar 2015

- views: 23171

- published: 09 Mar 2015

- views: 23171

How To Calculate Internal Rate Of Return

- Order: Reorder

- Duration: 6:31

- Updated: 06 Apr 2011

- views: 64819

- published: 06 Apr 2011

- views: 64819

NPV and IRR in Excel 2010

- Order: Reorder

- Duration: 9:00

- Updated: 17 Aug 2012

- views: 529911

- published: 17 Aug 2012

- views: 529911

Episode 127: How to Calculate the Internal Rate of Return | Part 1

- Order: Reorder

- Duration: 5:15

- Updated: 15 Aug 2013

- views: 74947

- published: 15 Aug 2013

- views: 74947

-

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

Project management topic on Capital budgeting techniques - NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period, Profitability Index or Benefit Cost Ratio.

published: 08 Apr 2015 -

Investment Decision Rules 2 - Internal Rate of Return

The quality of the video could be improved if you change the resolution. To change this, click on the settings icon (cog wheel) and you can adjust it. Experiment to find which resolution best fits your computer. It might also depend on if you view it in full screen or not.

published: 30 Nov 2014 -

CS Professional financial treasury and forex management I CS FTFM I IRR in Capital Budgeting Part 5

INTERNAL RATE OF RETURN -IRR in Capital Budgeting by CMA Chander Dureja -9717356614 ; This is only a demo video. Classes are available for CA/CMA/CS, @ www.cdclasses.com . My all classes are available in Pen drive /Download link mode. For any query, please visit www.cdclasses.com or msg on 9717356614.

published: 27 Dec 2016 -

IRR Internal rate of return ACCA F9 ACCA P4

IRR (Internal rate of return) http://www.globalapc.com This videos explains the topic: internal rate of return. This is different from the return on investment which measures the return of the project per year. But IRR considers the overall return of the project. We also discuss the assumptions behind internal rate of return. One of the main criticisms of IRR is that the cash flow will be reinvested at the IRR which is too optimistic. This topic will help ACCA F9 Financial Management and ACCA P4 Advanced Financial Management students. In the exam, students are required to comment on advantages and disadvantages of IRR compared to net present value (NPV)method. Students are also required to do the simple calculation for internal rate of return as well. Students who are studying CIMA...

published: 20 May 2016 -

Understanding Internal Rate of Return, James Tompkins

This "Understanding Finance Nugget" not only shows you how to calculate the Internal Rate of Return, but also provides an in-depth understanding of what it means and how apply it when a company is deciding on a major asset investment decision (e.g. Apple investing in a new iPhone.) In addition I discuss circumstances in which its application may be useful above and beyond a net present value analysis. Finally I show it is not just good enough to memorize to do the project if the internal rate of return is greater than the discount rate. Based on “understanding” I show there is more to it.

published: 23 Apr 2015 -

-

CFA Level I Capital Budgeting Lecture - Part 2 - by Mr. Arif Irfanullah

This CFA Level I video covers concepts related to: • Internal Rate of Return • Payback Period • Discounted Payback Period • Profitability Index • NPV Profiles • Ranking Conflicts between NPV and IRR • The Multiple IRR and No IRR Problem • Popularity of Capital Budgeting Process • Relationship Between NPV and Stock For more updated CFA videos, Please visit www.arifirfanullah.com.

published: 19 Sep 2011 -

IRR and Capital Budgeting

IRR, MIRR, NPV Capital budgeting techniques, multiple IIR problems

published: 05 Dec 2013 -

Video 1: Concept of IRR for a Startup CXO without finance and mathematics background

IRR means internal rate of return and is a measure of financial attractiveness of an existing, planned business or investment option. There are two videos and this is the first. It is meant for a person without much finance or mathematics background. Please see the link of speech notes on google drive to understand the flow of the aspects covered in the video.

published: 05 Mar 2016 -

Project IRR and Equity IRR Case Study CA Final Level

FINANCIAL MANAGEMENT – A COMPLETE STUDY If you enjoyed this content make sure to check the full course. Click on the following link to avail discount. https://www.udemy.com/financial-management-a-complete-study/?couponCode=YTB10A Indepth Analysis through 300+ lectures and case studies for CA / CFA / CPA / CMA / MBA Finance Exams and Professionals ------------------------------------------------------------------------------------------------------------------------ Welcome to one of the comprehensive ever course on Financial Management – relevant for any one aspiring to understand Financial Management and useful for students pursing courses like CA / CMA / CS / CFA / CPA, etc. A Course with close to 300 lectures explaining each and every concept in Financial Management followed by Solved C...

published: 05 Mar 2016

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

- Order: Reorder

- Duration: 34:20

- Updated: 08 Apr 2015

- views: 183625

- published: 08 Apr 2015

- views: 183625

Investment Decision Rules 2 - Internal Rate of Return

- Order: Reorder

- Duration: 21:29

- Updated: 30 Nov 2014

- views: 29296

- published: 30 Nov 2014

- views: 29296

CS Professional financial treasury and forex management I CS FTFM I IRR in Capital Budgeting Part 5

- Order: Reorder

- Duration: 25:16

- Updated: 27 Dec 2016

- views: 9492

- published: 27 Dec 2016

- views: 9492

IRR Internal rate of return ACCA F9 ACCA P4

- Order: Reorder

- Duration: 32:12

- Updated: 20 May 2016

- views: 993

- published: 20 May 2016

- views: 993

Understanding Internal Rate of Return, James Tompkins

- Order: Reorder

- Duration: 20:58

- Updated: 23 Apr 2015

- views: 830

- published: 23 Apr 2015

- views: 830

Engineering Economy Lecture 17: Single & Multiple Internal Rate of Return (IRRs)

- Order: Reorder

- Duration: 25:48

- Updated: 05 Apr 2016

- views: 2997

CFA Level I Capital Budgeting Lecture - Part 2 - by Mr. Arif Irfanullah

- Order: Reorder

- Duration: 23:55

- Updated: 19 Sep 2011

- views: 32749

- published: 19 Sep 2011

- views: 32749

IRR and Capital Budgeting

- Order: Reorder

- Duration: 36:44

- Updated: 05 Dec 2013

- views: 322

- published: 05 Dec 2013

- views: 322

Video 1: Concept of IRR for a Startup CXO without finance and mathematics background

- Order: Reorder

- Duration: 26:38

- Updated: 05 Mar 2016

- views: 81

- published: 05 Mar 2016

- views: 81

Project IRR and Equity IRR Case Study CA Final Level

- Order: Reorder

- Duration: 25:00

- Updated: 05 Mar 2016

- views: 2463

- published: 05 Mar 2016

- views: 2463

- Playlist

- Chat

IRR (Internal Rate of Return)

- Report rights infringement

- published: 18 Sep 2013

- views: 334891

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

- Report rights infringement

- published: 20 Apr 2013

- views: 175911

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

- Report rights infringement

- published: 27 Feb 2010

- views: 416768

Internal Rate of Reutrn Explained in Four Minutes

- Report rights infringement

- published: 29 Jun 2012

- views: 88942

What Is Internal Rate Of Return? | Vishal Thakkar

- Report rights infringement

- published: 06 Jan 2016

- views: 7611

Investment Decision Rules 2 - Internal Rate of Return

- Report rights infringement

- published: 30 Nov 2014

- views: 29296

02 03 2015 Prof Vikas Internal Rate of Return IRR

- Report rights infringement

- published: 09 Mar 2015

- views: 23171

How To Calculate Internal Rate Of Return

- Report rights infringement

- published: 06 Apr 2011

- views: 64819

NPV and IRR in Excel 2010

- Report rights infringement

- published: 17 Aug 2012

- views: 529911

Episode 127: How to Calculate the Internal Rate of Return | Part 1

- Report rights infringement

- published: 15 Aug 2013

- views: 74947

- Playlist

- Chat

IRR (Internal Rate of Return)

- Report rights infringement

- published: 18 Sep 2013

- views: 334891

3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

- Report rights infringement

- published: 20 Apr 2013

- views: 175911

3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

- Report rights infringement

- published: 27 Feb 2010

- views: 416768

Internal Rate of Reutrn Explained in Four Minutes

- Report rights infringement

- published: 29 Jun 2012

- views: 88942

What Is Internal Rate Of Return? | Vishal Thakkar

- Report rights infringement

- published: 06 Jan 2016

- views: 7611

Investment Decision Rules 2 - Internal Rate of Return

- Report rights infringement

- published: 30 Nov 2014

- views: 29296

02 03 2015 Prof Vikas Internal Rate of Return IRR

- Report rights infringement

- published: 09 Mar 2015

- views: 23171

How To Calculate Internal Rate Of Return

- Report rights infringement

- published: 06 Apr 2011

- views: 64819

NPV and IRR in Excel 2010

- Report rights infringement

- published: 17 Aug 2012

- views: 529911

Episode 127: How to Calculate the Internal Rate of Return | Part 1

- Report rights infringement

- published: 15 Aug 2013

- views: 74947

- Playlist

- Chat

NPV - Net Present Value, IRR - Internal Rate of Return, Payback Period.

- Report rights infringement

- published: 08 Apr 2015

- views: 183625

Investment Decision Rules 2 - Internal Rate of Return

- Report rights infringement

- published: 30 Nov 2014

- views: 29296

CS Professional financial treasury and forex management I CS FTFM I IRR in Capital Budgeting Part 5

- Report rights infringement

- published: 27 Dec 2016

- views: 9492

IRR Internal rate of return ACCA F9 ACCA P4

- Report rights infringement

- published: 20 May 2016

- views: 993

Understanding Internal Rate of Return, James Tompkins

- Report rights infringement

- published: 23 Apr 2015

- views: 830

Engineering Economy Lecture 17: Single & Multiple Internal Rate of Return (IRRs)

- Report rights infringement

- published: 05 Apr 2016

- views: 2997

CFA Level I Capital Budgeting Lecture - Part 2 - by Mr. Arif Irfanullah

- Report rights infringement

- published: 19 Sep 2011

- views: 32749

IRR and Capital Budgeting

- Report rights infringement

- published: 05 Dec 2013

- views: 322

Video 1: Concept of IRR for a Startup CXO without finance and mathematics background

- Report rights infringement

- published: 05 Mar 2016

- views: 81

Project IRR and Equity IRR Case Study CA Final Level

- Report rights infringement

- published: 05 Mar 2016

- views: 2463

Britain Sending 2 Aircraft Carriers To So China Sea To Challenge Sovereignty Claim

Edit WorldNews.com 27 Jul 2017U.S. says Iran rocket test breaches U.N. resolution

Edit Democratic Underground 28 Jul 2017Adobe Flash will finally be killed off in 2020

Edit DNA India 27 Jul 2017Jeff Bezos Surpasses Bill Gates To Become World's Wealthiest Person

Edit WorldNews.com 27 Jul 2017Scaramucci Calls Chief of Staff Priebus a 'Paranoid Schizophrenic' in Vulgar Interview

Edit WorldNews.com 28 Jul 2017Daniel Craig's return as James Bond is a 'done deal'

Edit Mid Day 28 Jul 2017Santi Cazorla determined for Arsenal return but not setting date

Edit Sky Sports 28 Jul 2017Dallas Mayor’s Intern Fellows Program celebrates 10 years of helping young people

Edit The Dallas Morning News 28 Jul 2017Wrapping up African trip, UN deputy chief vows to ensure displaced women return home in dignity

Edit United Nations 28 Jul 2017Anglicans in South Sudan enthrone first archbishop of internal provinces

Edit Public Technologies 28 Jul 2017Martin Landau Died from Massive Internal Bleeding

Edit TMZ 28 Jul 2017Activa International Insurance donates life-saving equipment to Korle Bu

Edit Modern Ghana 28 Jul 2017Raiders love NFL international games. Do they hurt local economies? Packers think so.

Edit Sacramento Bee 28 Jul 2017City of Sanya Launches International Tourism Promotional Event in Indonesia to Promote the Tropical Coastal Charms

Edit PR Newswire 28 Jul 2017The Latest: E. coli found after international pipe breaks

Edit Yahoo Daily News 28 Jul 2017AHS undergoes name change, becomes International Housing Stakeholders Summit

Edit Business Day Online 28 Jul 2017Alexis Sanchez reveals struggles ahead of Arsenal return

Edit Metro 28 Jul 2017Without UID, expatriates unable to file tax returns

Edit The Times of India 28 Jul 2017Legendary Hollywood actor Martin Landau died from 'massive internal bleeding' his death certificate reveals

Edit This is Money 28 Jul 2017New International Trade Facilitation Arrangements

Edit Public Technologies 28 Jul 2017- 1

- 2

- 3

- 4

- 5

- Next page »