6:55

Lesson Four: What is Equity? - Financial Aid with Professor Birdthistle

Lesson Four: What is Equity? See also: Introduction Lesson 1: What is a Company? Lesson 2:...

published: 18 Jul 2011

Author: ProfessorBirdthistle

Lesson Four: What is Equity? - Financial Aid with Professor Birdthistle

Lesson Four: What is Equity? See also: Introduction Lesson 1: What is a Company? Lesson 2: What is a Bank? Lesson 3: What is Debt? Lesson 5: What is a Stock Exchange? Lesson 6: What is a Fund? Lesson 7: What is Retirement? Lesson 8: What is Financial Information? Lesson 9: What are Taxes? Lesson 10: What is an Economy? Lesson 11: What is Insurance? Lesson 12: What is Bankruptcy? Original music by Lee Weisert.

0:42

Equity finance Kidderminster - The Right Equity Release

Equity Release is available to home owners over the age of 55 who wish to release tax free...

published: 21 Aug 2012

Author: TouchLocalVideos

Equity finance Kidderminster - The Right Equity Release

Equity Release is available to home owners over the age of 55 who wish to release tax free money from the property they own. find more out at www.touchlocal.com

6:21

Real Estate Investing Tips-Equity Finance vs Debt Financing

www.hisrealestatenetwork.com Rick Melero explains the concept of 'DEBT SERVICE COVER R...

published: 23 Jun 2011

Author: HISRealDeal

Real Estate Investing Tips-Equity Finance vs Debt Financing

www.hisrealestatenetwork.com Rick Melero explains the concept of 'DEBT SERVICE COVER RATIO"" Stronger the DSCR is the best way to protect your self. Investors need to understand how to buy and ask questions: ""How much are we willing to risk based on debt? This commercial real estate investing tip shows limitation of over leveraged finance.Register right now as a guest of Rick Melero and unlock the secrets to 6-figure pay-days and awesome monthly cash flow per deal on an upcoming free webinar with HIS Real Estate Network www.hisrealestatenetwork.com

2:01

60mo Equity Financing

60mo Equity Financing / CAP table...

published: 03 Nov 2010

Author: GetConfer

60mo Equity Financing

60mo Equity Financing / CAP table

1:51

When is Convertible Debt Preferable to Equity Financing a Startup - Dan Street

InChapter 10 of 20 of his 2011 Capture Your Flag interview with host Erik Michielsen, soft...

published: 07 Jun 2011

Author: captureyourflag

When is Convertible Debt Preferable to Equity Financing a Startup - Dan Street

InChapter 10 of 20 of his 2011 Capture Your Flag interview with host Erik Michielsen, software entrepreneur and Borrowed Sugar founder Dan Street shares why he chose to raise convertible debt financing over equity. He shares the pros and cons of each. Convertible debt benefits include structure flexibility and faster time to close. Convertible debt does not provide investor assurance they will own a piece of the company. Street notes the next time he approaches fundraising he would be more open going the equity route. Street is the founder and CEO of Austin, Texas based Borrowed Sugar (www.borrowedsugar.com) which develops Internet software to strengthen local communities. Previously, Street worked in private equity at Kohlberg, Kravis, and Roberts (KKR) and management consulting at Bain & Co. He earned a BA in music and business from Rice University. View more career videos at www.captureyourflag.com Follow us on Twitter www.twitter.com Like us on Facebook: www.facebook.com

9:35

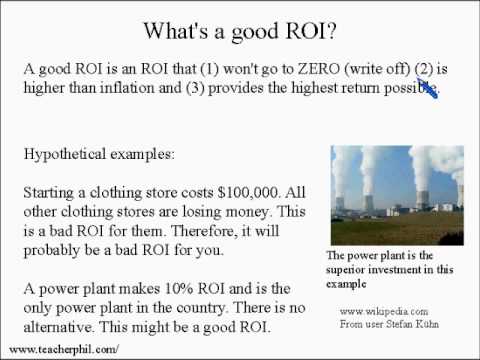

Business and Finance Lesson 2: Return on Investment, Equity, Inflation (Learn English)

We talk about What is Investment vs Gambling? ROE Return on Equity, ROI Return on Investme...

published: 23 Sep 2011

Author: TeacherPhilEnglish

Business and Finance Lesson 2: Return on Investment, Equity, Inflation (Learn English)

We talk about What is Investment vs Gambling? ROE Return on Equity, ROI Return on Investment, Inflation, Real rate of return vs Nominal Rate of Return and some examples how to find information on income statement and balance sheet

6:25

Equity Fincancing

What do people mean when they use te term Equity Financing? Can it be used in conjuntion w...

published: 12 Jun 2010

Author: USparkFoundryTV

Equity Fincancing

What do people mean when they use te term Equity Financing? Can it be used in conjuntion with terms like Stock, Funding Round, or financing event?

7:44

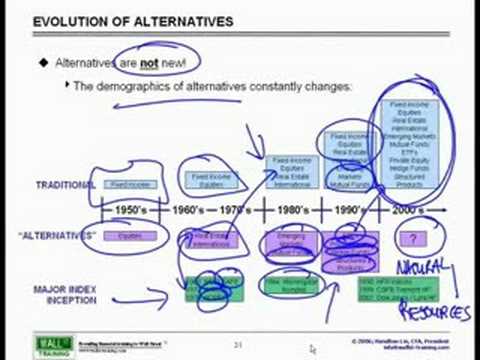

WST: Overview of Financial Mkts -Alternatives Private Equity

Wall St. Training Self-Study Instructor, Hamilton Lin, CFA introduces the major jargon and...

published: 08 Jul 2008

Author: wstss

WST: Overview of Financial Mkts -Alternatives Private Equity

Wall St. Training Self-Study Instructor, Hamilton Lin, CFA introduces the major jargon and finance terminology in finance. What exactly is the sell-side and the buy-side and do they affect the capital markets and why do they have a symbiotic relationship? What exactly is investment banking, sales & trading and research? How is it that asset management is the flip opposite and yet very similar at the same time? Put those questions to rest with this Overview of Financial Markets overview. This course is offered FREE for six months at: www.wstselfstudy.com Register for this course FREE at www.wstselfstudy.com For more information of the video courses previewed here, go to: www.wstselfstudy.com Over 80 hours of online, interactive Self-Study Videos! ***SPECIAL YOUTUBE OFFER*** Receive 20% off 5 month purchase at: www.wstselfstudy.com Use Discount code youtube20 Wall St. Training Self-Study provides online, video-based, self-study financial modeling training solutions to Wall Street. Our interactive course modules are Excel-based and specialize in advanced and complex financial modeling, valuation modeling, investment banking, mergers & acquisitions and leveraged buyout training topics. Enhance your skills and master the content required by Wall Street investment banks, M&A, research, asset management, credit, and private equity firms.

8:55

How private equity works

See www.financialtrainingassociates.com for a course on LBOs and private equity...

published: 23 Jun 2010

Author: training4finance

How private equity works

See www.financialtrainingassociates.com for a course on LBOs and private equity

4:27

Financial Modelling Tests - Private Equity Careers Centre

It's becoming increasingly common for the private equity recruiter to include a financ...

published: 15 Dec 2010

Author: PECareersCentre

Financial Modelling Tests - Private Equity Careers Centre

It's becoming increasingly common for the private equity recruiter to include a financial modelling test as part of the assessment, this will always be in Excel. This guide provides practical examples on concepts that are often missed by candidates when facing a modelling test and will give you the confidence to stand out in this stage of the interview process. This guide is suitable for those preparing for an interview with a private equity fund or currently in an interview process. It will cover a number of techniques you'll find useful in putting together an LBO financial model during the interview including*: Two full financial modelling tests based on real examples from private equity interviews, one for an LBO and one for a real estate investment, both with detailed solutions How the financial statements are integrated How to create sensitivity tables using the Excel TABLE function Compound interest and inflation as a concept How to convert any rate to annual, quarterly or monthly according to the timeline of the model Compound Annual Growth Rate Calculation of the Internal Rate of Return; and Net- Present- Value using the IRR, XIRR, NPV and XNPV Excel formulas A very simple LBO example We'll also give you six months access to an experienced financial modeller who will be able to answer any questions related to the modelling concepts and tests in this guide.

34:47

Excel Finance Class 09: Balance Sheet, Working Capital, Liquidity, Debt, Equity, Market Value

Download Excel workbook people.highline.edu Learn about Balance Sheet, Working Capital, Li...

published: 23 Sep 2010

Author: ExcelIsFun

Excel Finance Class 09: Balance Sheet, Working Capital, Liquidity, Debt, Equity, Market Value

Download Excel workbook people.highline.edu Learn about Balance Sheet, Working Capital, Liquidity, Debt, Equity, Market Value and some Excel formulas associated with the Balance Sheet. Highline Community College Busn 233 Financial Management with Excel taught by Michael Girvin.

17:03

Excel Finance Class 19:Profitablility Rations: Return On Equity & Return On Assets & DuPont Analysis

Download Excel workbook people.highline.edu Learn how to calculate Return On Equity, Retur...

published: 30 Sep 2010

Author: ExcelIsFun

Excel Finance Class 19:Profitablility Rations: Return On Equity & Return On Assets & DuPont Analysis

Download Excel workbook people.highline.edu Learn how to calculate Return On Equity, Return On Assets, Profitablility & DuPont Analysis. Return On Investment Highline Community College Busn 233 Slaying Excel Dragons Financial Management with Excel taught by Michael Girvin.

19:21

Excel Finance Class 17: Leverage & Solvency Ratios: Debt To Equity, Equity Multiplier, more...

Download Excel workbook people.highline.edu Learn how to calculate the Debt Ratio, Debt To...

published: 30 Sep 2010

Author: ExcelIsFun

Excel Finance Class 17: Leverage & Solvency Ratios: Debt To Equity, Equity Multiplier, more...

Download Excel workbook people.highline.edu Learn how to calculate the Debt Ratio, Debt To Equity Ratio, Equity Multiplier Ratio and Times Interest Earned Ratio. Highline Community College Busn 233 Slaying Excel Dragons Financial Management with Excel taught by Michael Girvin.

10:59

What is Private Equity? An Explanation of Private Equity by Privcap.com

What is private equity? What is the difference between a private equity firm and a private...

published: 01 Mar 2012

Author: PrivcapTV

What is Private Equity? An Explanation of Private Equity by Privcap.com

What is private equity? What is the difference between a private equity firm and a private equity fund? (This is a crucial topic for Mitt Romney). This 11-minute video primer is intended for anyone who wants to understand the fundamentals of the private equity industry. The presenter is Privcap.com CEO David Snow, a financial journalist who has covered the private equity industry for 14 years. Snow gives a concise overview of private equity firms, funds and deals, as well as discusses how profits are shared (ie "carried interest") and what the most important trends are in private equity today. "The presentation is a boiled-down version of the 'What is private equity' talk I've had with every entry-level reporter I've hired over the years," said Snow. "It occurred to me that there are many people who would appreciate the same overview as they seek to better understand this often poorly understood corner of the financial world." Privcap.com provides online video programming for participants in the global private capital industry. Its content focuses on prominent opportunities and practices in private capital. www.privcap.com

Youtube results:

2:11

Debt to Equity Ratio

What is debt to equity ratio? A measure of a company's financial leverage calculated b...

published: 02 Jan 2010

Author: DrJobinsp

Debt to Equity Ratio

What is debt to equity ratio? A measure of a company's financial leverage calculated by dividing its total liabilities by stockholders' equity. It indicates what proportion of equity and debt the company is using to finance its assets. To learn more go to: www.investopedia.com

9:07

'Getting into Private Equity' Q&A;

At a Private Equity event hosted by Bright Network, the panel of Stewart Licudi, Hephzi Pe...

published: 07 Jul 2010

Author: BrightNetwork

'Getting into Private Equity' Q&A;

At a Private Equity event hosted by Bright Network, the panel of Stewart Licudi, Hephzi Pemberton, Martin Mignot and Toby Lewis take some questions from the floor. More about the speakers... Stewart Licudi is Vice President and Head of the Financial Sponsors Group and the European Technology Team at William Blair International. He has worked on a broad range of cross-border transactions involving private equity, including the recent private placement into SmallWorld. Hephzi Pemberton is a Partner at Kea Consultants, a niche headhunting firm that specialises in placing candidates into Private Equity organisations. She previously worked for Goldcap Search and was an Analyst at Lehman Brothers. Martin Mignot is an Associate at Index Ventures, Europe's leading early stage venture capital fund. Index has invested in over 100 companies, including LoveFilm, Skype and Net-a-Porter. He was previously an Analyst at UBS in London, where he was part of a team advising a range of media and telecoms clients, including ITV and Vodafone, as well as a range of Private Equity funds. Toby Lewis is acting news editor at Private Equity News, Europe's most read Private Equity title. Bright Network is a fast-growing, invitation-only careers networking community, which helps connect the brightest students and graduates with the information they need to get ahead in their careers. www.brightnetwork.co.uk

1:10

Financial Intelligence: What Is Inflation- - Investopedia Videos

Sharing the knowledge of "Financial Intelligence." "Live, Learn, Apply &...;

published: 03 Oct 2011

Author: asanginov

Financial Intelligence: What Is Inflation- - Investopedia Videos

Sharing the knowledge of "Financial Intelligence." "Live, Learn, Apply & Educate!" DRAZDA

9:50

WACC in 3 Easy Steps: How to Calculate Weighted Average Cost of Capital Finance

Clicked here www.MBAbullshit.com and OMG wow! I'm SHOCKED how easy.. Cost of capital a...

published: 08 Mar 2010

Author: MBAbullshitDotCom

WACC in 3 Easy Steps: How to Calculate Weighted Average Cost of Capital Finance

Clicked here www.MBAbullshit.com and OMG wow! I'm SHOCKED how easy.. Cost of capital arises from either cost of debt or cost of equity. It is necessary to discover your cost of capital to make certain you are able to relate it to the rate of return of your business or task. The rate of return of your enterprise or undertaking should be equal to or higher than your cost of capital; so that your venture or task can break-even or raise a profit. If the capital applied for your business comes from borrowing from the financial institution at, say, 5% interest rate, then your cost of capital is 5%. If the capital used for your business is supplied by the private funding of your pal Harry who demands a 10% return on equity, then your cost of capital is 10%. Relatively easy! The difficulty is this: What if the capital of your business comes from a blend of both loaning from the bank and the personal capital of your pal Harry? What will be your cost now? Shall it be 5% (akin to the bank's interest rate) or will it be 10% (similar to Harry's expected return)? I'm pretty sure you can by now judge that logically, it would be something around the 5% and 10%! Thus, what number precisely? It goes without saying, you find it hard to plainly presume it. You need a formula which will provide you the particular percentage in between 5% and 10%. At this point the WACC Formula comes in. It in basic terms and easily provides you an exact percentage immediately after considering a) the cost of <b>...</b>