1:11

What is Libor and why should we care?

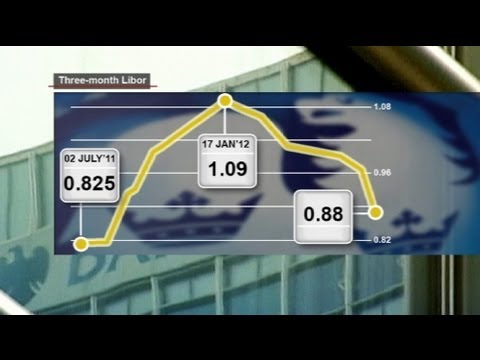

www.euronews.com Libor - the London Interbank Offered Rate - is the average cost of borrow...

published: 02 Jul 2012

author: Euronews

What is Libor and why should we care?

www.euronews.com Libor - the London Interbank Offered Rate - is the average cost of borrowing at which Britain's banks lend each other money. It is calculated daily, based on information supplied by those banks and is used worldwide as a benchmark for prices on trillions fo euros worth of derivatives and other financial products. After the financial crisis, the Libor rate also was seen as a guide to the health of bank's balance sheets. Barclays manipulation alone could not have had a big effect on the final rate, but the suggestion is a lot of the big banks were doing the same thing. And the Libor rate has an effect on the real economy as Tony Greenham, Head of Finance and Business at the New Economics Foundation, explained: "That average is what drives the interest rates paid by hundreds of millions of people on their own mortgages, small business on their loans, student loans, insurance products. It affects a hugely diverse range of financial transactions globally, not just in the UK." Britain's central bank, the Bank of England, is trying to avoid being dragged into this scandal. It has denied it knew about Libor manipulation and was allowing it to happen. "It is nonsense to suggest that the Bank of England was aware of any impropriety in the setting of Libor," a BoE spokesman said. "If we had been aware of attempts to manipulate Libor we would have treated them very seriously." Barclays said it submitted artificially low estimates of its borrowing costs because it <b>...</b>

2:38

How Tom Cruise stole LIBOR scandal

Watch the full Keiser Report E311 here: www.youtube.com In this episode, Max Keiser and co...

published: 06 Jul 2012

author: RussiaToday

How Tom Cruise stole LIBOR scandal

Watch the full Keiser Report E311 here: www.youtube.com In this episode, Max Keiser and co-host, Stacy Herbert, discuss why nobody is freaking about LIBOR in America, while JP Morgan caught doing an Enron on US energy markets and GlaxoSmithKline pays 10% of their ill-gotten gains for bribing doctors and scientists across America. In the second half of the show Max talks to Kevin Sara of the TuNur solar export project of Tunisia about solar exports from the Middle East and toxic derivatives exports from the City of London. Follow Max Keiser on Twitter: twitter.com Watch all Keiser Report shows here: www.youtube.com (E1-E200) www.youtube.com (E201-current) Subscribe to RT! www.youtube.com Like us on Facebook www.facebook.com Follow us on Twitter twitter.com Follow us on Google+ plus.google.com RT (Russia Today) is a global news network broadcasting from Moscow and Washington studios. RT is the first news channel to break the 500 million YouTube views benchmark.

5:52

How Barclays manipulated the libor rates

The Barclays Bank scandal centres around a key interest rate known as Libor. Al Jazeera...

published: 03 Jul 2012

author: AlJazeeraEnglish

How Barclays manipulated the libor rates

The Barclays Bank scandal centres around a key interest rate known as Libor. Al Jazeera's Dominic Kane reports on exactly what that is. We also speak to Bill Black, a former US banking regulator for more clarity on how this multi-million dollar fraud was perpetrated.

28:04

Jim Rogers, War and the Financial Mafia - LIBOR, Centrals Banks and JP Morgan!

Follow us @ twitter.com twitter.com Welcome to Capital Account. US manufacturing activity ...

published: 03 Jul 2012

author: CapitalAccount

Jim Rogers, War and the Financial Mafia - LIBOR, Centrals Banks and JP Morgan!

Follow us @ twitter.com twitter.com Welcome to Capital Account. US manufacturing activity contracts for the first time in 3 years...the weak ISM data came as a shock to economists reportedly. Then orders placed with US factories rose in May for the first time in three months, according to other data. We'll talk about where figures show global confidence, crises, and slowdowns are headed with famed investor Jim Rogers. Also...Blackrock's Vice Chairman Byron Wien says he spoke to the smartest man in Europe, and what he had to say terrified him. He said, "basically, that massive amounts of debt will bring the decline of Western Civilization, but that in the meantime, before that happens, policy makers would pull every trick they could in order to stave off a catastrophic event." Why do you have to be the un-named smartest man as christened by a Blackstone bigwig for that to hold weight? Just watch a lot of smart men and women who break this down openly any given day on Capital Account. Today, commodities guru Jim Rogers will do the honors. And it's one, two, three strikes you're out - Barclays top three executives resign in the wake of the LIBOR manipulation scandal. Chairman. CEO. COO. Why haven't we seen this kind of fallout at big banks in the US from any settlements and scandals? We'll muse over it as what do you know - JP Morgan finds itself under investigation for manipulation of electricity markets.

3:37

LIBOR

London InterBank Offer Rate...

published: 11 Apr 2011

author: khanacademy

LIBOR

London InterBank Offer Rate

3:14

Bank of England Allegedly Secretly Instructed Barclays To Manipulate Libor Interest Rates

A phone conversation between deputy Bank of England governor Paul Tucker and a 'senior...

published: 02 Jul 2012

author: PlanetEarthAwakens01

Bank of England Allegedly Secretly Instructed Barclays To Manipulate Libor Interest Rates

A phone conversation between deputy Bank of England governor Paul Tucker and a 'senior' manager at Barclays is said to have led to traders 'mistakenly' believing they were working under an instruction from the central bank to fix the Libor -- the interest rate at which banks lend money to each other. Mervyn King bob dimond

9:10

LIBOR—A Tutorial

Provides a foundation for learning about LIBOR—the London Interbank Offered Rate, wh...

published: 01 Sep 2008

author: RameshDeonaraine

LIBOR—A Tutorial

Provides a foundation for learning about LIBOR—the London Interbank Offered Rate, which is very important in the setting of interest rates for trillions of dollars of financial products. The presenter is Dr. Ramesh Deonaraine and this is a product of Global Management Solutions—www.gmsinc.us—"Solutions for Improving Lives".

16:27

Must Watch! LIBOR Scandal May Be Black Swan. By Gregory Mannarino

Link to my website/New Book: www.lulu.com...

published: 05 Jul 2012

author: GregVegas5909

Must Watch! LIBOR Scandal May Be Black Swan. By Gregory Mannarino

Link to my website/New Book: www.lulu.com

4:47

Understanding LIBOR, from LearningMarkets.com

LearningMarkets.com explains what this mysterious LIBOR is, and why it's important for...

published: 01 Apr 2009

author: LearningMarkets

Understanding LIBOR, from LearningMarkets.com

LearningMarkets.com explains what this mysterious LIBOR is, and why it's important for people to know. This video along with many others can be seen for free on our website at: www.learningmarkets.com

7:21

Reuters Breakingviews: Barclays' Libor rate timings very significant

July 4 - The timings of the lower rates submitted by Barclays' raises questions; inclu...

published: 04 Jul 2012

author: ReutersVideo

Reuters Breakingviews: Barclays' Libor rate timings very significant

July 4 - The timings of the lower rates submitted by Barclays' raises questions; including whether Barclays could have continued to operate as it did, say Breakingviews.

4:24

Libor: big numbers, big questions

www.FT.com It's integral to the global financial machine and used to generate $350tn i...

published: 12 Mar 2012

author: FinancialTimesVideos

Libor: big numbers, big questions

www.FT.com It's integral to the global financial machine and used to generate $350tn in financial products. But investigations into possible manipulation of the inter-bank offered rate, or Libor, are raising questions over its legitimacy and future use. Seb Morton-Clark reports on the allegations and their potential impact. For more video content from the FT, visit the Financial Times video section at: www.ft.com

7:13

Banking Insider explains LIBOR

Jon Witterick and a group of truthers ask the Banking Insider questions about money, such ...

published: 04 Jul 2012

author: MonopolyMoneyFraud

Banking Insider explains LIBOR

Jon Witterick and a group of truthers ask the Banking Insider questions about money, such as where do they get the money they loan us? He explains the LIBOR, what it is and how it works and goes onto say how banks expose themselves as organisations and take massive risks and how effectively they create money on computer keyboards

22:18

Matt Taibbi explains illegal LIBOR fixing by the banksters at #NATGAT

Recorded live on July 2, 2012 12:17pm CST www.ustream.tv Matt Taibbi the Rolling Stone rep...

published: 04 Jul 2012

author: bearishtrader

Matt Taibbi explains illegal LIBOR fixing by the banksters at #NATGAT

Recorded live on July 2, 2012 12:17pm CST www.ustream.tv Matt Taibbi the Rolling Stone reporter who coined the term "Vampire Squid" in reference to the infamous investment bank Goldman Sachs breaks down how LIBOR rates were illegally rigged by big banks, and what the consequences to the public are for this criminal behavior. See the following articles by Matt Taibbi for additional information on the LIBOR rate fixing scandal: 1. Why is Nobody Freaking Out About the LIBOR Banking Scandal? www.rollingstone.com 2. Another Domino Falls in the LIBOR Banking Scam: Royal Bank of Scotland www.rollingstone.com 3. A Huge Break in the LIBOR Banking Investigation www.rollingstone.com This upload is brought to you courtesy of Nate's @OccupyEye stream www.ustream.tv Please support the live streamers if you can. @OccupyEye 's donation page is www.wepay.com

16:39

Silver Update 7/2/12 LIBOR Liars

***Blackrock is the sponsor, Barclays is the founding sponsor, JPM is the custodian*** See...

published: 03 Jul 2012

author: BrotherJohnF

Silver Update 7/2/12 LIBOR Liars

***Blackrock is the sponsor, Barclays is the founding sponsor, JPM is the custodian*** See www.youtube.com Software Provided With Permission By Netdania.com www.netdania.com LIBOR Scandal www.brotherjohnf.com Libor en.wikipedia.org Q&A: Libor explained uk.finance.yahoo.com LIBOR—A Tutorial www.youtube.com Barclays to Sell Its Stake in BlackRock dealbook.nytimes.com BlackRock Issues Refutation Of SLV Fraud Allegations; Is It Time To Panic For SLV Holders? www.zerohedge.com

25:55

Inside Story - Rigged bank rates: Is there more to come?

In the wake of the bank rate-rigging scandal, Bob Diamond, Barclays chief executive, annou...

published: 04 Jul 2012

author: AlJazeeraEnglish

Inside Story - Rigged bank rates: Is there more to come?

In the wake of the bank rate-rigging scandal, Bob Diamond, Barclays chief executive, announced his resignation from the post with immediate effect, on Tuesday. In a statement, Diamond, who faced mounting calls to step down, said he made the decision as the external pressure on the bank has reached a level that risks "damaging the franchise". Barclays Bank was fined a record $450m last week, for attempting to manipulate the London interbank offered rate, Libor, during the financial crisis between 2005 and 2009. Libor is a measure of how much banks have to pay to borrow from their rival and is worked out every day from estimates submitted by the major banks of their own interbank lending costs.

33:10

LIBOR Scandal: How The Banks Screwed Things Up For Everybody

www.guerillastocktrading.com Things didn't have to be as messed up as they are now, an...

published: 05 Jul 2012

author: StockTradingMaster

LIBOR Scandal: How The Banks Screwed Things Up For Everybody

www.guerillastocktrading.com Things didn't have to be as messed up as they are now, and it only takes a few jerks to ruin life for the rest of us.

2:15

90 seconds at 9 am: LIBOR fallout (news with Bernard Hickey)

Barclays CEO appears Parliamentary inquiry LIBOR rigging 'Reprehensible' 'Phys...

published: 04 Jul 2012

author: ofInterestNZ

90 seconds at 9 am: LIBOR fallout (news with Bernard Hickey)

Barclays CEO appears Parliamentary inquiry LIBOR rigging 'Reprehensible' 'Physically ill When reading emails' 'Sorry/disappointed/angry' Problem found 3 yrs ago BoE's Tucker to testify Suggestion of nod/wink Diamond denies direction 'Misunderstanding' Eurozone contracted 0.6% PMI survey show German services weak Easings expected All eyes on US jobs Due Friday night US markets holiday NZ$ over 64 euro c

1:09

Libor Podmol in Basel 2012 Round 5 - Night Of The Jumps

3rd place for Libor Podmol at Night of the jumps 2012 fifth stop in Basel. www.facebook.co...

published: 14 Apr 2012

author: wwwrebeltv

Libor Podmol in Basel 2012 Round 5 - Night Of The Jumps

3rd place for Libor Podmol at Night of the jumps 2012 fifth stop in Basel. www.facebook.com/rebeltelevision

10:44

The Emerging LIBOR Scandal

This is what you need to understand about LIBOR - It's stands for the London InterBank...

published: 06 Jul 2012

author: TheBigPictureRT

The Emerging LIBOR Scandal

This is what you need to understand about LIBOR - It's stands for the London InterBank Offered Rate. So what does that mean? It's basically the rate that banks around the world are lending money to each other. And the way it's calculated is each day - the banks submit what rate they can afford to borrow money at - and the average of what all the banks submit becomes the LIBOR rate. But what's really important to remember here is - LIBOR doesn't just apply to the rate banks lend money to each other. It also applies to the rate that we consumers pay on several different types of loans - including mortgages, car loans, and credit card rates. So if those rates are manipulated by banks - and artificially driven higher - then it affects a lot of people - and leads to working people paying more on their loans. Which is exactly what happened. Earlier this week - the CEO and COO of Barclays bank resigned after it was revealed their bank was routinely manipulating LIBOR rates between 2005 and 2009. Barclays has since been hit with a $450 million fine for this criminal activity. But the question is - was Barclays alone in this? Or were other banks involved as well - and not only that - were governments and regulators involved in the scam too? Disgraced Barclays CEO Bob Diamond is alleging just that. As the Washington Post reported on Wednesday: "Fallen banking titan Bob Diamond on Wednesday described regulators on both sides of the Atlantic as partly complicit in a scandal involving <b>...</b>

5:52

Iranians Threaten to Close the Strait of Hormuz, Barclays, Libor & More: Weekly News Wrap-Up

usawatchdog.com - In a week dominated with news from the divorce of Actor Tom Cruise, Iran...

published: 06 Jul 2012

author: usawatchdog

Iranians Threaten to Close the Strait of Hormuz, Barclays, Libor & More: Weekly News Wrap-Up

usawatchdog.com - In a week dominated with news from the divorce of Actor Tom Cruise, Iran is quietly back front and center for anyone with a brain. There was a lot of activity, this week, involving the Iranian nuclear program and efforts by the West to curtail it this week. New oil sanctions kicked in from Europe. The Iranians have, once again, threatened to close the Strait of Hormuz as retaliation for the sanctions. The US military has responded to these threats by sending significant new military forces to the Persian Gulf. (We're talking stealth fighter jets and mine sweepers.) Iran, also, made threats to American bases in the region and test fired a new medium range missile that is capable of reaching US bases and Israel. The Israeli government responded by hinting it may strike if sanctions fail to curb the nuke program. One of the shocking things here is how little this story has gotten into the mainstream media. Stories such as the divorce of Tom Cruise and Katie Holms have gotten way more attention. This, in a week, where one Pentagon official reportedly said, "We'll put them on the bottom of the gulf," if Iran's navy threatens US ships. This is not peace talk, and it is coming from both sides in the potential conflict. The other big story is the scandal involved in the alleged rigging of a key interest rate called Libor (London interbank offered rate.) It is alleged that Barclays, along with other banks, have been involved in a scheme to set the rate illegally <b>...</b>

5:32

Breakingviews: Is Libor worth saving?

June 28 - The repercussions of the Libor-fixing scandal go far beyond Barclays and CEO Bob...

published: 28 Jun 2012

author: ReutersVideo

Breakingviews: Is Libor worth saving?

June 28 - The repercussions of the Libor-fixing scandal go far beyond Barclays and CEO Bob Diamond.

11:52

CNBC - Libor's Fixing Scandal 1

28 Jun 2012 CNBC UK's Osborne makes statement on Barclay's Libor Fixing Scandal. -...

published: 03 Jul 2012

author: MrNChoudhury

CNBC - Libor's Fixing Scandal 1

28 Jun 2012 CNBC UK's Osborne makes statement on Barclay's Libor Fixing Scandal. - How were such failures allowed to continue undetected? - The FSA investigation highlights problems in financial system. - FSA report is shocking indictment of culture at banks. - The role of Libor is changing. - What happened at Barclays was unacceptable. - Barclays CEO has serious questions to answer.