29:18

Why Neoclassical Economists Didnt See the Great Recession Coming

Why Neoclassical Economists Didnt See the Great Recession Coming

Mainstream "Neoclassical" Economists famously did not see the Great Recession coming, and when you look at their theories, it's no wonder. Their favourite model prior to the crisis goes by the name of "Dynamic Stochastic General Equilibrium", or DSGE. These models imagined that the entire economy could be modeled as a single individual. Yet neoclassical researchers proved decades ago that even a single market can't be modeled that way. I explain this proof while outlining the fundamental truth that "Neoclassical Economists Don't Understand Neoclassical Economics".

9:07

Neoclassical Economics: A Philosophical Critique

Neoclassical Economics: A Philosophical Critique

I analyze some of the ontological and epistemological errors of mainstream economics. Herman Daly: en.wikipedia.org Econophysics: en.wikipedia.org Behavioral Economics: en.wikipedia.org

12:59

Classical Economics, Neoclassical Economics and Austrian Economics by Israel M Kirzner

Classical Economics, Neoclassical Economics and Austrian Economics by Israel M Kirzner

www.anarcocapitalista.com

4:19

Three layers of the triangle -- neoclassical economics, processes and IT, behavioural economics

Three layers of the triangle -- neoclassical economics, processes and IT, behavioural economics

Interview with Prashant Srivastava, Managing Partner-India, Gallup India P Ltd, Mumbai (www.gallup.com), May 19, 2009, 4 pm

31:52

The failure of Neoclassical Macro and the Monetary Circuit Theory Alternative

The failure of Neoclassical Macro and the Monetary Circuit Theory Alternative

In writing Debunking Economics II, I realized a transcendental truth: neoclassical economists don't understand neoclassical economics. They instead have a superficial, textbook appreciation of their school of thought, which makes it appear coherent. But in fact deep research, often done by neoclassical economists, establishes that the theory is incoherent. I outline one essential aspect of this--the Sonnenschein-Mantel-Debreu conditions--and show that they are a "proof by contradiction" that market demand curves can have any shape at all, and therefore that even a single market can't be modeled by a simple aggregation of the behavior of rational agents--let alone an entire economy. And yet DSGE models treat the entire economy as a single agent (or at best two, whose tastes can be aggregated into demand functions that obey the "Law of Demand", in contradiction of the Sonnenschein-Mantel-Debreu results). I then show the statistical power of the Credit Accelerator explanation of the Great Depression and the Great Recession, outline my Monetary Circuit Theory approach, and show that it can simulate both the Great Moderation and the Great Recession.

8:01

Renaissance 2.0: Lesson 3 - Revisiting Civics 101 - Ownership

Renaissance 2.0: Lesson 3 - Revisiting Civics 101 - Ownership

(link to Lesson 4: www.youtube.com Lesson 3 - Revisiting Civics 101 describes how the media projects a false picture in terms of who controls the US. This lesson illustrates the real power structure, which is modeled after the corporate governance system. It typically uses Ivy Leaguers to fill its ranks and it exercises ownership rights over the country to some degree.

49:14

Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 1

Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 1

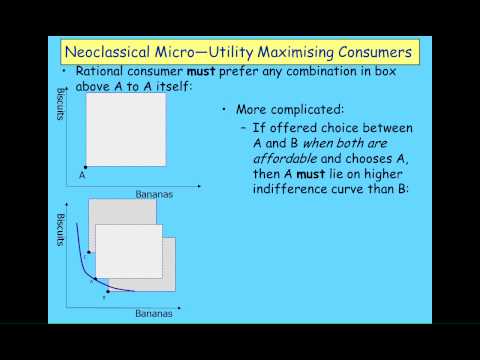

This is the first of about 20 videos of my lectures in Behavioural Finance at the University of Western Sydney (2 videos per lecture). This first lecture presents the Neoclassical theory of consumer behavior--known as Revealed Preference--and an experiment that invalidated it by the German economist Reinhard Sippel.

1:04

Micro Vs. Macro Economics

Micro Vs. Macro Economics

This video explains the difference between micro and macro economics as explained by neo-classical economics. The Austrians would argue that there is no real difference between the two, and I tend to agree with them.

18:00

A critique of @UnlearningEcon 's argument that libertarianism is based on Neoclassical economics

A critique of @UnlearningEcon 's argument that libertarianism is based on Neoclassical economics

A critique of @UnlearningEcon 's argument that libertarianism is based on Neoclassical economics.

3:33

circeconflow.mp4

circeconflow.mp4

A short powerpoint voiceover that explains the concept of material throughput in the economy, and why this is a critical flaw in the neoclassical economic paradigm.

8:37

Steve Keen: Economic Progress one Funeral at a Time? (Part 1)

Steve Keen: Economic Progress one Funeral at a Time? (Part 1)

Many modern economists missed the financial crisis and the economic problems we've seen since then, such as the eurozone debt crisis. Why? Well according to economics professor and author of Debunking Economics Steve Keen, they're not really experts on the economy but experts on a model of the economy. The great tragedy according to Keen is that the model is almost completely irrelevant to the system we actually live in. And despite the learnings of the financial crisis, not much has changed. Keen says the problem is Neoclassical economics, which economists are traditionally trained in. As for the solution? Well we may just have to wait for the economists in charge to die off. In the meantime, should people be occupying the economics departments of universities along with Wall Street? Keen says absolutely. To see part 2 click on the link: www.youtube.com To see more of Capital Account please visit us @ www.youtube.com

10:00

Akerlof-Critique of NeoClassical Macroeconomics Part 1

Akerlof-Critique of NeoClassical Macroeconomics Part 1

Akerlof's Nobel Lecture was a critique of neoclassical economics

5:53

Steve Keen: Economic Progress one Funeral at a Time? (Part 2)

Steve Keen: Economic Progress one Funeral at a Time? (Part 2)

Many modern economists missed the financial crisis and the economic problems we've seen since then, such as the eurozone debt crisis. Why? Well according to economics professor and author of Debunking Economics Steve Keen, they're not really experts on the economy but experts on a model of the economy. The great tragedy according to Keen is that the model is almost completely irrelevant to the system we actually live in. And despite the learnings of the financial crisis, not much has changed. Keen says the problem is Neoclassical economics, which economists are traditionally trained in. As for the solution? Well we may just have to wait for the economists in charge to die off. In the meantime, should people be occupying the economics departments of universities along with Wall Street? Keen says absolutely. Click on the link to see part 1: www.youtube.com To see more of Capital Account please visit us @ www.youtube.com

6:07

Post Galilean Steve Keen Knocks Out Neo Ptolemaic Krugman

Post Galilean Steve Keen Knocks Out Neo Ptolemaic Krugman

Edited Extracts from Steve Keen's Talk to RT's Lauren Lyster. For Full Video Visit Capital Account: youtu.be "The internet has been abuzz over the blogosphere boxing match between Nobel Laureate and New York Times columnist Paul Krugman and debunker of economic conventional wisdom and superhero economist, Steve Keen [...] [...] Steve Keen gave Paul Krugman one upper-cut too many for the establishment intellectual to handle. Krugman declared victory and walked away before he could be dealt any more blows to his economic ego -- not before Krugman could land one more low blow though..." (Capital Account, Apr 4, 2012) Steve Keen is Professor of Economics & Finance at the University of Western Sydney, and author of the popular book "Debunking Economics" (Second edition -- Zed Books UK, 2011) www.debunkingeconomics.com www.debtdeflation.com Since 1999 Paul Krugman is an Op-Ed columnist for The New York Times and professor of Economics and International Affairs at Princeton University. krugman.blogs.nytimes.com Thanks for YouTube Sharing: user/CapitalAccount Uploaded on Apr 4, 2012 twitter.com twitter.com Google The Web: Neoclassical economics Keynesian economics

70:34

Douglas North - Effect of Institutions on Market Performance at FCC

Douglas North - Effect of Institutions on Market Performance at FCC

Effect of Institutions on Market Performance Douglas North, Nobel Laureate, Washington University June 30, 2003 In this 70 minute lecture, Dr. North talks about institutions and economic development. He focuses on two issues. One is what prevents economies from working well and the other is what can we do about it. He begins with Neoclassical economics, the theory we use to understand the problems. He observes that its objective was to explain efficient resource allocation in developed economies and, thus, was never intended to deal with the issues of economic development. He argues that, when we try to Neoclassical theory to development issues, we find that it has two serious problems: first, it mistakenly assumes the economy is frictionless and, second, it incorrectly assumes the economy is timeless (ie, static rather than dynamic). Dr. North then talks about how government should deal with those two problems. He notes that Neo-classical economists have gone into countries and said that all you have to do is get the prices right and everything works, but they have fallen flat on their faces over and over again. What is needed, he says, is to know enough about the background and cultural heritage of a society so you have some feeling for the interplay between the formal rules and the informal norms and the way they work. That is, we must understand the countrys institutions which are the incentive systems that structure human interaction and reduce uncertainty. What is <b>...</b>

47:45

Keen Behavioural Finance 2011 Lecture 06 Part 1: State of Macroeconomics

Keen Behavioural Finance 2011 Lecture 06 Part 1: State of Macroeconomics

One year after the start of the greatest economic crisis since the Great Depression, the editor of the American Economic Review: Macroeconomics claimed that "the state of macro [theory] is good". How could be be so deluded? Macroeconomics has been distorted by appalling scholarship and a misguided belief that macroeconomics and microeconomics should be consistent. The best critics of this, ironically, are given by the authors most responsible for the state of macroeconomics, John Hicks and Robert Solow

15:44

Finance Education "After" the Crisis

Finance Education "After" the Crisis

Finance theory, since it takes neoclassical economics as its starting point, is even more flawed than neoclassical economics itself. Here I point out how absurd its abuse of the English language has been--using "Efficient" and "Rational" to describe behavior that any sensible person would see as "prophetic"--and discuss how it should be reformed.

27:51

Krugman "Knocked out of Neoclassical Orbit" by Steve Keen's Meteoric Rise!

Krugman "Knocked out of Neoclassical Orbit" by Steve Keen's Meteoric Rise!

Follow us @ twitter.com twitter.com Welcome to Capital Account! The internet has been abuzz over the blogosphere boxing match between Nobel Laureate and New York Times columnist Paul Krugman and debunker of economic conventional wisdom and superhero economist, Steve Keen. Remember that game "Mike Tyson's Punch Out?" Well, let's just say that Steve Keen gave Paul Krugman one upper-cut too many for the establishment intellectual to handle. Krugman declared victory and walked away before he could be dealt any more blows to his economic ego -- not before Krugman could land one more low blow though...we'll break it down! And a too big to fail bank agrees to pay 20 million bucks to settle allegations from regulators that it mishandled customer funds before a major broker's collapse, but the details may surprise you. If you guessed JP Morgan, then you got half of the story right, but if you guessed the broker was MF Global, well, we have news for you: it's Lehman Brothers. That's right, JPMorgan Chase agreed to pay a $20m fine to settle allegations that the bank mishandled Lehman Brothers' customer funds for roughly two years before the broker filed for bankruptcy court protection. The Commodity Futures Trading Commission alleged that JPMorgan, at the request of Lehman, began using customer funds in November 2006 to calculate how much credit it would extend to Lehman Brothers intraday, in violation of customer segregation account rules. And last Friday we exposed the myth of the <b>...</b>

70:59

Keen Debunking Economics Oxford 2011 Monbiot Seminar

Keen Debunking Economics Oxford 2011 Monbiot Seminar

This seminar led to George Monbiot's Guardian feature (www.guardian.co.uk As well as outlining my critique of Neoclassical macroeconomics, I explain my credit-based analysis. The discussion at the end about the role of aggregate debt is enlightening in that it shows how most economists can't comprehend that the aggregate level of debt matters.

8:17

Renaissance 2.0: Lesson 2 - Revisiting Economics 101 - Debt

Renaissance 2.0: Lesson 2 - Revisiting Economics 101 - Debt

(link to lesson 3: www.youtube.com Lesson 2 - Revisiting Economics 101 - Debt: Imperial Power and Control discusses the power of debt-based money, emboded in the bond market, and its ability to exert total top-down power and control over the empire. You will learn how our system is not a free market and how neoclassical economics misses so many key points.

21:05

Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 2

Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 2

In this second half of the first lecture, I explain Sippel's result that most people aren't "rational" as Neoclassical economists define it--because the Neoclassical definition of rational behavior is computationally impossible. The next lecture--which I'll post next week--explains that even if the Neoclassical model of individual behavior was sound (which I've just shown it isn't), the market demand curve derived by aggregating the demand functions of "rational utility maximizing individuals" could have any shape at all. The "Law of Demand",a cornerstone of Neoclassical thought, is false.