- Order:

- Duration: 2:19

- Published: 23 Sep 2006

- Uploaded: 08 Aug 2011

- Author: stiff24

An initial public offering (IPO), referred to simply as an "offering" or "flotation", is when a company (called the issuer) issues common stock or shares to the public for the first time. They are often issued by smaller, younger companies seeking capital to expand, but can also be done by large privately owned companies looking to become publicly traded.

In an IPO the issuer obtains the assistance of an underwriting firm, which helps determine what type of security to issue (common or preferred), best offering price and time to bring it to market.

Once a company is listed, it is able to issue additional common shares via a secondary offering, thereby again providing itself with capital for expansion without incurring any debt. This ability to quickly raise large amounts of capital from the market is a key reason many companies seek to go public.

There are several benefits to being a public company, namely:

The sale (allocation and pricing) of shares in an IPO may take several forms. Common methods include:

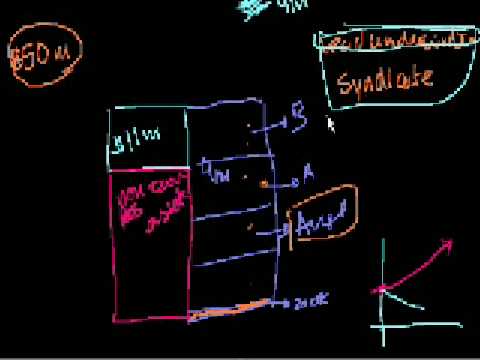

A large IPO is usually underwritten by a "syndicate" of investment banks led by one or more major investment banks (lead underwriter). Upon selling the shares, the underwriters keep a commission based on a percentage of the value of the shares sold (called the gross spread). Usually, the lead underwriters, i.e. the underwriters selling the largest proportions of the IPO, take the highest commissions—up to 8% in some cases.

Multinational IPOs may have many syndicates to deal with differing legal requirements in both the issuer's domestic market and other regions. For example, an issuer based in the E.U. may be represented by the main selling syndicate in its domestic market, Europe, in addition to separate syndicates or selling groups for US/Canada and for Asia. Usually, the lead underwriter in the main selling group is also the lead bank in the other selling groups.

Because of the wide array of legal requirements and because it is an expensive process, IPOs typically involve one or more law firms with major practices in securities law, such as the Magic Circle firms of London and the white shoe firms of New York City.

Public offerings are sold to both institutional investors and retail clients of underwriters. A licensed securities salesperson ( Registered Representative in the USA and Canada ) selling shares of a public offering to his clients is paid a commission from their dealer rather than their client. In cases where the salesperson is the client's advisor it is notable that the financial incentives of the advisor and client are not aligned.

In the US sales can only be made through a final Prospectus cleared by the Securities and Exchange Commission.

Investment Dealers will often initiate research coverage on companies so their Corporate Finance departments and retail divisions can attract and market new issues.

The issuer usually allows the underwriters an option to increase the size of the offering by up to 15% under certain circumstance known as the greenshoe or overallotment option.

Perception of IPOs can be controversial. For those who view a successful IPO to be one that raises as much money as possible, the IPO was a total failure. For those who view a successful IPO from the kind of investors that eventually gained from the underpricing, the IPO was a complete success. It's important to note that different sets of investors bid in auctions versus the open market—more institutions bid, fewer private individuals bid. Google may be a special case, however, as many individual investors bought the stock based on long-term valuation shortly after it launched its IPO, driving it beyond institutional valuation.

Historically, some of IPOs both globally and in the United States have been underpriced. The effect of "initial underpricing" an IPO is to generate additional interest in the stock when it first becomes publicly traded. Through flipping, this can lead to significant gains for investors who have been allocated shares of the IPO at the offering price. However, underpricing an IPO results in "money left on the table"—lost capital that could have been raised for the company had the stock been offered at a higher price. One great example of all these factors at play was seen with theglobe.com IPO which helped fuel the IPO mania of the late 90's internet era. Underwritten by Bear Stearns on November 13, 1998, the stock had been priced at $9 per share, and famously jumped 1000% at the opening of trading all the way up to $97, before deflating and closing at $63 after large sell offs from institutions flipping the stock. Although the company did raise about $30 million from the offering it is estimated that with the level of demand for the offering and the volume of trading that took place the company might have left upwards of $200 million on the table.

The danger of overpricing is also an important consideration. If a stock is offered to the public at a higher price than the market will pay, the underwriters may have trouble meeting their commitments to sell shares. Even if they sell all of the issued shares, if the stock falls in value on the first day of trading, it may lose its marketability and hence even more of its value.

Underwriters, therefore, take many factors into consideration when pricing an IPO, and attempt to reach an offering price that is low enough to stimulate interest in the stock, but high enough to raise an adequate amount of capital for the company. The process of determining an optimal price usually involves the underwriters ("syndicate") arranging share purchase commitments from leading institutional investors.

On the other hand, some researchers (e.g. Geoffrey C., and C. Swift, 2009) believe that IPOs are not being under-priced deliberately by issuers and/or underwriters, but the price-rocketing phenomena on issuance days are due to investors' over-reaction.

Some algorithms to determine underpricing: IPO Underpricing Algorithms

Note: Not all IPOs are eligible for delivery settlement through the DTC system, which would then either require the physical delivery of the stock certificates to the clearing agent bank's custodian, or a delivery versus payment (DVP) arrangement with the selling group brokerage firm.

The other "quiet period" refers to a period of 40 calendar days following an IPO's first day of public trading. During this time, insiders and any underwriters involved in the IPO are restricted from issuing any earnings forecasts or research reports for the company. Regulatory changes enacted by the SEC as part of the Global Settlement enlarged the "quiet period" from 25 days to 40 days on July 9, 2002. When the quiet period is over, generally the underwriters will initiate research coverage on the firm. Additionally, the NASD and NYSE have approved a rule mandating a 10-day quiet period after a Secondary Offering and a 15-day quiet period both before and after expiration of a "lock-up agreement" for a securities offering.

For example, one might expect a certain I.T. company to do particularly well and purchase a large volume of their stock or shares before flotation on the stock market. Once the price of the shares has risen to a satisfactory level the person will choose to sell their shares and make a stag profit.

This text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.