by CalculatedRisk on 7/12/2011 05:15:00 PM

Tuesday, July 12, 2011

DataQuick: SoCal Home Sales increase in June, Record Low New Home Sales

Special Note: It now appears the NAR will release the benchmark revisions in August (ht Mary Ellen). These revisions are expected to show significantly fewer sales and lower levels of inventory for the last few years. Hopefully the new methodology will be fully disclosed. Also, hopefully the NAR will release sales and inventory for all revisions (not just the last year).

From DataQuick: Southland Home Sales Quicken, Median Price Highest This Year

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges ...This is another report suggesting an increase in existing home sales in June compared to the reported 4.81 million sold in May on a seasonally adjusted annual rate (SAAR) basis (before the benchmark revisions).

A total of 20,532 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in June. That was up 11.6 percent from 18,394 in May but down 14.0 percent from 23,871 in June 2010, according to San Diego-based DataQuick.

...

Builders continue to suffer on a scale not seen in decades: The 1,395 newly built houses and condos sold last month marked a 36 percent drop from a year earlier and the lowest new-home total for a June in DataQuick’s records.

...

Distressed property sales accounted for just over half of the Southland resale market last month. Roughly one out of three homes resold was a foreclosure, while almost one in five was a “short sale.”

On New Home sales: My understanding is DataQuick reports when the escrow closes, and the Census Bureau reports when a contract is signed. It usually takes about 6 months to close (builders usually build to contract with few speculative homes these days). So this low level is related to the Census Bureau reports for 6 months ago. Also, last year, June sales (reported at close) were boosted by the housing tax credit.

National existing home sales for June will be reported on July 20th, and new home sales will reported on July 26th.

Moody’s downgrades Ireland to Junk with negative outlook

by CalculatedRisk on 7/12/2011 03:38:00 PM

Bloomberg reports that Moody's has downgraded Irish debt to junk (Ba1) with a negative outlook (further downgrades possible). This wasn't a surprise ...

“The key driver for today’s rating action is the growing possibility that following the end of the current EU/IMF support program at year-end 2013 Ireland is likely to need further rounds of official financing before it can return to the private market, and the increasing possibility that private sector creditor participation will be required as a precondition for such additional support, in line with recent EU government proposals."The Irish 10 year yield is up to a record 13.3%.

But most yields were down today (see table below).

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Seattle: The Downtown Apartment Boom

by CalculatedRisk on 7/12/2011 01:29:00 PM

From Eric Pryne at the Seattle Times: Apartment developers bypass suburbs, target Seattle (ht David)

More new apartments will come on the market in King and Snohomish counties in 2013 than in any year since 1991, one researcher projects.This article touches on several themes we've been discussing:

This apartment boom, however, is different from those that preceded it.

This time it's focused almost entirely on Seattle. Developers, for the most part, are bypassing the suburbs.

...

Observers attributed the turnaround to a host of influences: foreclosed homeowners re-entering the rental market; an economic recovery that was sufficiently strong to allow some young adults to finally move into their own places; and growing disillusionment with homeownership.

Thanks to the recession, however, there was little new supply on the horizon to meet this surge in demand: In King and Snohomish counties, 2011 is shaping up as the worst year for new-project completions since at least 2004.

Now apartment developers are rushing to fill that gap, inspired in part by projections that growing demand will continue to push rents up — perhaps another 25 percent by 2015 ...

• Multi-family completions in 2011 will be at record lows (also total completions).

• Starts for multi-family will pick up sharply this year, but the new supply will not be on the market until 2012 or 2013.

• this lack of supply will put upward pressure on rents (and lower the price-to-rent ratio for homes).

• And there is more "disillusionment with homeownership"

BLS: Job Openings unchanged in May

by CalculatedRisk on 7/12/2011 10:25:00 AM

From the BLS: Job Openings and Labor Turnover Summary

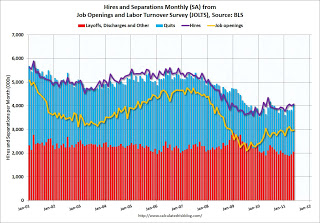

The number of job openings in May was 3.0 million, unchanged from April. The number of job openings in May was 862,000 higher than in July 2009 (the series trough) but remains well below the 4.4 million openings when the recession began in December 2007.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent (and even more dismal) employment report was for June.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in May - and are up about 7% year-over-year compared to May 2010.

Overall turnover is increasing too, but remains low. Quits increased again and have been trending up - and quits are now up about 10% year-over-year (usually a sign of more confidence in the labor market).

Trade Deficit increased sharply in May to $50.2 billion

by CalculatedRisk on 7/12/2011 08:30:00 AM

The Department of Commerce reports:

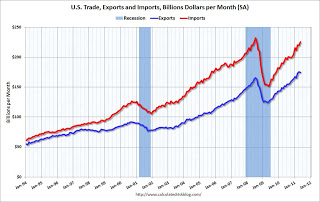

[T]otal May exports of $174.9 billion and imports of $225.1 billion resulted in a goods and services deficit of $50.2 billion, up from $43.6 billion in April, revised. May exports were $1.0 billion less than April exports of $175.8 billion. May imports were $5.6 billion more than April imports of $219.4 billion.The first graph shows the monthly U.S. exports and imports in dollars through May 2011.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in May as both prices and the quantity of oil imported increased. Oil averaged $108.70 per barrel in May, up from $103.18 per barrel in April, and up from $76.95 in May 2010. There is a bit of a lag with prices, and import prices will probably be a little lower in June.

The trade deficit with China increased to $24.96 billion, so once again the deficit is mostly oil and China.