- Order:

- Duration: 19:14

- Published: 14 Jan 2009

- Uploaded: 12 May 2011

- Author: visionvictory

- http://wn.com/Credit_Card_Debt,_Bankruptcy,personal_finance_for_doomers

- Email this video

- Sms this video

Credit is the trust which allows one party to provide resources to another party where that second party does not reimburse the first party immediately (thereby generating a debt), but instead arranges either to repay or return those resources (or other materials of equal value) at a later date. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower.

Credit does not necessarily require money. The credit concept can be applied in barter economies as well, based on the direct exchange of goods and services (Ingham 2004 p.12-19). However, in modern societies credit is usually denominated by a unit of account. Unlike money, credit itself cannot act as a unit of account.

Movements of financial capital are normally dependent on either credit or equity transfers. Credit is in turn dependent on the reputation or creditworthiness of the entity which takes responsibility for the funds. Credit is also traded in financial markets. The purest form is the credit default swap market, which is essentially a traded market in credit insurance. A credit default swap represents the price at which two parties exchange this risk the protection "seller" takes the risk of default of the credit in return for a payment, commonly denoted in basis points (one basis point is 1/100 of a percent) of the notional amount to be referenced, while the protection "buyer" pays this premium and in the case of default of the underlying (a loan, bond or other receivable), delivers this receivable to the protection seller and receives from the seller the par amount (that is, is made whole).

The cost of credit is the additional amount, over and above the amount borrowed, that the borrower has to pay. It includes interest, arrangement fees and any other charges. Some costs are mandatory, required by the lender as an integral part of the credit agreement. Other costs, such as those for credit insurance, may be optional. The borrower chooses whether or not they are included as part of the agreement.

Interest and other charges are presented in a variety of different ways, but under many legislative regimes lenders are required to quote all mandatory charges in the form of an annual percentage rate (APR). The goal of the APR calculation is to promote ‘truth in lending’, to give potential borrowers a clear measure of the true cost of borrowing and to allow a comparison to be made between competing products. The APR is derived from the pattern of advances and repayments made during the agreement. Optional charges are not included in the APR calculation. So if there is a tick box on an application form asking if the consumer would like to take out payment insurance, then insurance costs will not be included in the APR calculation (Finlay 2009).

This text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.

| Name | Warren Buffett |

|---|---|

| Caption | Buffett speaking to students from the University of Kansas School of Business, May 6, 2005 |

| Birth name | Warren Edward Buffett |

| Birth place | August 30, 1930Omaha, Nebraska, U.S. |

| Nationality | American |

| Alma mater | University of Pennsylvania University of Nebraska–Lincoln Columbia University |

| Occupation | Investor |

| Salary | US$100,000 |

| Networth | US$45 billion (2010) |

| Spouse | Susan Thompson Buffett (1952–2004)Astrid Menks (2006–present) |

| Children | Susan Alice BuffettHoward Graham BuffettPeter Andrew Buffett |

| Signature | Warren Buffett Signature.svg |

Warren Edward Buffett (; born August 30, 1930) is an American investor, industrialist and philanthropist. He is widely regarded as one of the most successful investors in the world. Often called the "legendary investor, Warren Buffett", he is the primary shareholder, chairman and CEO of Berkshire Hathaway. He is consistently ranked among the world's wealthiest people. He was ranked as the world's second wealthiest person in 2009 and is currently the third wealthiest person in the world as of 2010.

Buffett is called the "Oracle of Omaha" or the "Sage of Omaha" and is noted for his adherence to the value investing philosophy and for his personal frugality despite his immense wealth. Buffett is also a notable philanthropist, having pledged to give away 99 percent of his fortune to philanthropic causes, primarily via the Gates Foundation. He also serves as a member of the board of trustees at Grinnell College.

Even as a child, Buffett displayed an interest in making and saving money. He went door to door selling chewing gum, Coca-Cola, or weekly magazines. For a while, he worked in his grandfather's grocery store. While still in high school, he carried out several successful money-making ideas: delivering newspapers, selling golfballs and stamps, and detailing cars, among them. Filing his first income tax return in 1944, Buffett took a $35 deduction for the use of his bicycle and watch on his paper route. In 1945, in his sophomore year of high school, Buffett and a friend spent $25 to purchase a used pinball machine, which they placed in the local barber shop. Within months, they owned several machines in different barber shops.

Buffett's interest in the stock market and investing also dated to his childhood, to the days he spent in the customers' lounge of a regional stock brokerage near the office of his father's own brokerage company. On a trip to New York City at the age of ten, he made a point to visit the New York Stock Exchange. At the age of 11, he bought 3 shares of Cities Service Preferred for himself, and 3 for his sister. While in high school he invested in a business owned by his father and bought a farm worked by a tenant farmer. By the time he finished college, Buffett had accumulated more than $90,000 in savings measured in 2009 dollars.

(1894–1976)]] (1907–2004)]]

Buffett entered college in 1947 at the Wharton School of the University of Pennsylvania (1947–49). After two years he transferred to the University of Nebraska–Lincoln, where in 1950, at the age of nineteen, he finished his studies for a B.S. in Economics. Buffett enrolled at Columbia Business School after learning that Benjamin Graham (author of "The Intelligent Investor" - one of his favorite books on investing) and David Dodd, two well-known securities analysts, taught there. He received a M.S. in Economics from Columbia Business School in 1951. Buffett also attended the New York Institute of Finance. In Buffett’s own words:

The basic ideas of investing are to look at stocks as business, use the market's fluctuations to your advantage, and seek a margin of safety. That’s what Ben Graham taught us. A hundred years from now they will still be the cornerstones of investing.}}

Warren Buffett was employed from 1951–54 at Buffett-Falk & Co., Omaha as an Investment Salesman, from 1954–1956 at Graham-Newman Corp., New York as a Securities Analyst, from 1956–1969 at Buffett Partnership, Ltd., Omaha as a General Partner and from 1970 – Present at Berkshire Hathaway Inc, Omaha as its Chairman, CEO.

In 1950 (20 years old) Buffett had made and saved $9,800. In April 1952, Buffett discovered Graham was on the board of GEICO insurance. Taking a train to Washington, D.C. on a Saturday, he knocked on the door of GEICO's headquarters until a janitor allowed him in. There he met Lorimer Davidson, Geico's Vice President, and the two discussed the insurance business for hours. Davidson would eventually become Buffett's life-long friend and a lasting influence and later recall that he found Buffett to be an "extraordinary man" after only fifteen minutes. Buffett graduated from Columbia and wanted to work on Wall Street, however, both his father and Ben Graham urged him not to. He offered to work for Graham for free, but Graham refused.

Buffett returned to Omaha and worked as a stockbroker while taking a Dale Carnegie public speaking course. Using what he learned, he felt confident enough to teach an "Investment Principles" night class at the University of Nebraska-Omaha. The average age of his students was more than twice his own. During this time he also purchased a Sinclair Texaco gas station as a side investment. However, this did not turn out to be a successful business venture.

In 1952 Buffett married Susan Thompson at Dundee Presbyterian Church and the next year they had their first child, Susan Alice Buffett. In 1954, Buffett accepted a job at Benjamin Graham's partnership. His starting salary was $12,000 a year (approximately $97,000 adjusted to 2008 dollars). There he worked closely with Walter Schloss. Graham was a tough man to work for. He was adamant that stocks provide a wide margin of safety after weighting the trade-off between their price and their intrinsic value. The argument made sense to Buffett but he questioned whether the criteria were too stringent and caused the company to miss out on big winners that had more qualitative values. That same year the Buffetts had their second child, Howard Graham Buffett. In 1956, Benjamin Graham retired and closed his partnership. At this time Buffett's personal savings were over $174,000 ($1.2 million inflation adjusted to 2009 dollars) and he started Buffett Partnership Ltd., an investment partnership in Omaha.

In 1957, Buffett had three partnerships operating the entire year. He purchased a five-bedroom stucco house in Omaha, where he still lives, for $31,500. In 1958 the Buffett's third child, Peter Andrew Buffett, was born. Buffett operated five partnerships the entire year. In 1959, the company grew to six partnerships operating the entire year and Buffett was introduced to Charlie Munger. By 1960, Buffett had seven partnerships operating: Buffett Associates, Buffett Fund, Dacee, Emdee, Glenoff, Mo-Buff and Underwood. He asked one of his partners, a doctor, to find ten other doctors willing to invest $10,000 each in his partnership. Eventually eleven agreed, and Buffett pooled their money with a mere $100 original investment of his own. In 1961, Buffett revealed that Sanborn Map Company accounted for 35% of the partnership's assets. He explained that in 1958 Sanborn stock sold at only $45 per share when the value of the Sanborn investment portfolio was $65 per share. This meant that buyers valued Sanborn stock at "minus $20" per share and were unwilling to pay more than 70 cents on the dollar for an investment portfolio with a map business thrown in for nothing. This earned him a spot on the board of Sanborn.

In a second letter, Buffett announced his first investment in a private business — Hochschild, Kohn and Co, a privately owned Baltimore department store. In 1967, Berkshire paid out its first and only dividend of 10 cents. In 1969, following his most successful year, Buffett liquidated the partnership and transferred their assets to his partners. Among the assets paid out were shares of Berkshire Hathaway. In 1970, as chairman of Berkshire Hathaway, Buffett began writing his now-famous annual letters to shareholders. However, he lived solely on his salary of $50,000 per year, and his outside investment income. In 1979, Berkshire began the year trading at $775 per share, and ended at $1,310. Buffett's net worth reached $620 million, placing him on the Forbes 400 for the first time.

In 1973, Berkshire began to acquire stock in the Washington Post Company. Buffett became close friends with Katharine Graham, who controlled the company and its flagship newspaper, and became a member of its board of directors. In 1974, the SEC opened a formal investigation into Warren Buffett and Berkshire's acquisition of WESCO, due to possible conflict of interest. No charges were brought. In 1977, Berkshire indirectly purchased the Buffalo Evening News for $32.5 million. Antitrust charges started, instigated by its rival, the Buffalo Courier-Express. Both papers lost money, until the Courier-Express folded in 1982.

In 1979, Berkshire began to acquire stock in ABC. Capital Cities' announced $3.5 billion purchase of ABC on March 18, 1985 surprised the media industry, as ABC was some four times bigger than Capital Cities was at the time. Berkshire Hathaway chairman Warren Buffett helped finance the deal in return for a 25 percent stake in the combined company. The newly merged company, known as Capital Cities/ABC (or CapCities/ABC), was forced to sell off some stations due to FCC ownership rules. Also, the two companies owned several radio stations in the same markets.

In 1987, Berkshire Hathaway purchased 12% stake in Salomon Inc., making it the largest shareholder and Buffett the director. In 1990, a scandal involving John Gutfreund (former CEO of Salomon Brothers) surfaced. A rogue trader, Paul Mozer, was submitting bids in excess of what was allowed by the Treasury rules. When this was discovered and brought to the attention of Gutfreund, he did not immediately suspend the rogue trader. Gutfreund left the company in August 1991. Buffett became Chairman of Salomon until the crisis passed; on September 4, 1991, he testified before Congress. In 1988, Buffett began buying stock in Coca-Cola Company, eventually purchasing up to 7 percent of the company for $1.02 billion. It would turn out to be one of Berkshire's most lucrative investments, and one which it still holds.

In 2002, Buffett entered in $11 billion worth of forward contracts to deliver U.S. dollars against other currencies. By April 2006, his total gain on these contracts was over $2 billion. In 2006, Buffett announced in June that he gradually would give away 85% of his Berkshire holdings to five foundations in annual gifts of stock, starting in July 2006. The largest contribution would go to the Bill and Melinda Gates Foundation. In 2007, in a letter to shareholders, Buffett announced that he was looking for a younger successor, or perhaps successors, to run his investment business. Buffett had previously selected Lou Simpson, who runs investments at Geico, to fill that role. However, Simpson is only six years younger than Buffett.

Berkshire Hathaway acquired 10% perpetual preferred stock of Goldman Sachs. Some of Buffett's Index put options (European exercise at expiry only) that he wrote (sold) are currently running around $6.73 billion mark-to-market losses. The scale of the potential loss prompted the SEC to demand that Berkshire produce, "a more robust disclosure" of factors used to value the contracts.

In 2008, Buffett became the richest man in the world dethroning Bill Gates, worth $62 billion according to Forbes, and $58 billion according to Yahoo. Bill Gates had been number one on the Forbes list for 13 consecutive years. In 2009, Bill Gates regained number one of the list according to Forbes magazine, with Buffett second. Their values have dropped to $40 billion and $37 billion respectively, Buffett having (according to Forbes) lost $25 billion in 12 months during 2008/2009.

In October 2008, the media reported that Warren Buffett had agreed to buy General Electric (GE) preferred stock. The operation included extra special incentives: he received an option to buy 3 billion GE at $22.25 in the next five years, and also received a 10% dividend (callable within three years). In February 2009, Warren Buffett sold part of Procter & Gamble Co, and Johnson & Johnson shares from his portfolio.

In addition to suggestions of mistiming, questions have been raised as to the wisdom in keeping some of Berkshire's major holdings, including The Coca-Cola Company (NYSE:KO) which in 1998 peaked at $86. Buffett discussed the difficulties of knowing when to sell in the company's 2004 annual report:

That may seem easy to do when one looks through an always-clean, rear-view mirror. Unfortunately, however, it’s the windshield through which investors must peer, and that glass is invariably fogged.In March 2009, Buffett stated in a cable television interview that the economy had "fallen off a cliff... Not only has the economy slowed down a lot, but people have really changed their habits like I haven't seen". Additionally, Buffett fears we may revisit a 1970s level of inflation, which led to a painful stagflation that lasted many years.

In 2009, Warren Buffett invested $2.6 billion as a part of Swiss Re's raising equity capital. Berkshire Hathaway already owns a 3% stake, with rights to own more than 20%. In 2009, Warren Buffett acquired Burlington Northern Santa Fe Corp. for $34 billion in cash and stock. Alice Schroeder author of Snowball stated that a reason for the purchase was to diversify Berkshire Hathaway from the financial industry. Measured by market capitalization in the Financial Times Global 500 Berkshire Hathaway as of June 2009 was the eighteenth largest corporation on earth.

In 2009, Buffett divested his failed investment in ConocoPhillips, saying to his Berkshire investors,

I bought a large amount of ConocoPhillips stock when oil and gas prices were near their peak. I in no way anticipated the dramatic fall in energy prices that occurred in the last half of the year. I still believe the odds are good that oil sells far higher in the future than the current $40-$50 price. But so far I have been dead wrong. Even if prices should rise, moreover, the terrible timing of my purchase has cost Berkshire several billion dollars.

The merger with the Burlington Northern Santa Fe Railway (BNSF), closed upon BNSF shareholder approval in 1Q2010. This deal is valued at approximately $34 billion and reflects an increase of a previously existing stake of about 22%.

In June 2010, Buffett defended the credit rating agencies for their role in the US financial crisis, claiming that:

Very, very few people could appreciate the bubble. That's the nature of bubbles – they're mass delusions.

Warren Buffett disowned his son Peter's adopted daughter, Nicole, in 2006 after she participated in the Jamie Johnson documentary, The One Percent. Although his first wife had referred to Nicole as one of her "adored grandchildren", Buffett wrote her a letter stating, "I have not emotionally or legally adopted you as a grandchild, nor have the rest of my family adopted you as a niece or a cousin." He signed the letter "Warren."

His 2006 annual salary was about $100,000, which is small compared to senior executive remuneration in comparable companies. In 2007, and 2008, he earned a total compensation of $175,000, which included a base salary of just $100,000. He lives in the same house in the central Dundee neighborhood of Omaha that he bought in 1958 for $31,500, today valued at around $700,000 (although he also does have a $4 million house in Laguna Beach, California). In 1989 after having spent nearly 6.7 million dollars of Berkshire's funds on a private jet, Buffett sheepishly named it "The Indefensible". This act was a break from his past condemnation of extravagant purchases by other CEOs and his history of using more public transportation.

He remains an avid player of the card game bridge, which he learned from Sharon Osberg, and plays with her and Bill Gates. He spends twelve hours a week playing the game. In 2006, he sponsored a bridge match for the Buffett Cup. Modeled on the Ryder Cup in golf, held immediately before it, and in the same city, a team of twelve bridge players from the United States took on twelve Europeans in the event. He is a dedicated, lifelong follower of Nebraska football, and attends as many games as his schedule permits. He supported the hire of Bo Pelini following the 2007 season stating, "It was getting kind of desperate around here". He watched the 2009 game against Oklahoma from the Nebraska sideline after being named an honorary assistant coach.

Warren Buffett worked with Christopher Webber on an animated series with chief Andy Heyward, of DiC Entertainment, and then A Squared Entertainment. The series features Buffett and Munger, and teaches children healthy financial habits for life. Buffett was raised Presbyterian but has since described himself as agnostic when it comes to religious beliefs. In December 2006 it was reported that Buffett does not carry a cell phone, does not have a computer at his desk, and drives his own automobile, a Cadillac DTS. Buffett wears tailor-made suits from the Chinese label Trands; earlier he wore Ermenegildo Zegna.

In his article The Superinvestors of Graham-and-Doddsville, Buffett refuted the academic Efficient-market hypothesis, that beating the S&P; 500 was "pure chance", by highlighting a number of students of the Graham and Dodd value investing school of thought. In addition to himself, Buffett named Walter J. Schloss, Tom Knapp, Ed Anderson (Tweedy, Brown Inc.), Bill Ruane (Sequoia Fund, Inc.), Charles Munger (Buffett's own business partner at Berkshire), Rick Guerin (Pacific Partners, Ltd.), and Stan Perlmeter (Perlmeter Investments). In his November, 1999 Fortune article, he warned of investors' unrealistic expectations:

From a NY Times article: "I don't believe in dynastic wealth", Warren Buffett said, calling those who grow up in wealthy circumstances "members of the lucky sperm club". Buffett has written several times of his belief that, in a market economy, the rich earn outsized rewards for their talents:

His children will not inherit a significant proportion of his wealth. These actions are consistent with statements he has made in the past indicating his opposition to the transfer of great fortunes from one generation to the next. Buffett once commented, "I want to give my kids just enough so that they would feel that they could do anything, but not so much that they would feel like doing nothing".

In June 2006, he announced a plan to give away his fortune to charity, with 83% of it going to the Bill & Melinda Gates Foundation. He pledged about the equivalent of 10 million Berkshire Hathaway Class B shares to the Bill & Melinda Gates Foundation (worth approximately US$30.7 billion as of 23 June 2006), making it the largest charitable donation in history, and Buffett one of the leaders of philanthrocapitalism. The foundation will receive 5% of the total donation on an annualised basis each July, beginning in 2006. (Significantly, however, the pledge is conditional upon the foundation's giving away each year, beginning in 2009, an amount that is at least equal to the value of the entire previous year's gift from Buffett, in addition to 5% of the foundation's net assets.) Buffett also will join the board of directors of the Gates Foundation, although he does not plan to be actively involved in the foundation's investments.

This is a significant shift from previous statements Buffett has made, having stated that most of his fortune would pass to his Buffett Foundation. The bulk of the estate of his wife, valued at $2.6 billion, went to that foundation when she died in 2004. He also pledged $50-million to the Nuclear Threat Initiative, in Washington, where he has served as an adviser since 2002.

In 2006, he auctioned his 2001 Lincoln Town Car on eBay to raise money for Girls, Inc. In 2007, he auctioned a luncheon with himself that raised a final bid of $650,100 for a charity. On 27 June 2008, Zhao Danyang, a general manager at Pure Heart China Growth Investment Fund, won the 2008 5-day online "Power Lunch with Warren Buffett" charity auction with a bid of $2,110,100. Auction proceeds benefit the San Francisco Glide Foundation. The following year, executives from Toronto-based Salida Capital paid US$1.68 million to dine with Buffett.

In a letter to Fortune Magazine's website in 2010 Buffett remarked:

This statement was made as part of a joint proposal with Bill Gates to encourage other wealthy individuals to pool some of their fortunes for charitable purposes; in August 2010, Buffett and Gates spearheaded The Giving Pledge, inviting the wealthy to donate 50% or more of their wealth to charity.

Speaking at Berkshire Hathaway Inc.'s 1994 annual meeting, Buffett said investments in tobacco are:

Americans ... would chafe at the idea of perpetually paying tribute to their creditors and owners abroad. A country that is now aspiring to an ‘ownership society’ will not find happiness in — and I’ll use hyperbole here for emphasis — a 'sharecropping society’.Author Ann Pettifor has adopted the image in her writings and has stated: "He is right. And so the thing we must fear most now, is not just the collapse of banks and investment funds, or of the international financial architecture, but of a 'sharecropper society, angry at its downfall".

It gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.In 1977 Buffett was also quoted as saying about stocks, gold, farmland, and inflation:

Stocks are probably still the best of all the poor alternatives in an era of inflation — at least they are if you buy in at appropriate prices.

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

Buffett favors the inheritance tax, saying that repealing it would be like "choosing the 2020 Olympic team by picking the eldest sons of the gold-medal winners in the 2000 Olympics". In 2007, Buffett testified before the Senate and urged them to preserve the estate tax so as to avoid a plutocracy. Some critics have argued that Buffett (through Berkshire Hathaway) has a personal interest in the continuation of the estate tax, since Berkshire Hathaway has benefited from the estate tax in past business dealings and had developed and marketed insurance policies to protect policy holders against future estate tax payments. Buffett believes government should not be in the business of gambling, or legalizing casinos, calling it a tax on ignorance.

When a company gives something of value to its employees in return for their services, it is clearly a compensation expense. And if expenses don't belong in the earnings statement, where in the world do they belong?

In October 2008, Buffett invested in new energy automobile business by paying $230 million for 10% of BYD Company (), which runs a subsidiary of electric automobile manufacturer BYD Auto. In less than one year, the investment has reaped him over 500% return of profit.

Category:1930 births Category:American agnostics Category:American billionaires Category:American chief executives Category:American financiers Category:American investors Category:American money managers Category:American philanthropists Category:Berkshire Hathaway Category:Bill & Melinda Gates Foundation people Category:Businesspeople from Omaha, Nebraska Category:Businesspeople in the insurance industry Category:Columbia Business School alumni Category:Equity securities Category:Grinnell College people Category:Living people Category:Nebraska Democrats Category:Stock traders Category:Wharton School alumni Category:University of Nebraska–Lincoln alumni Category:Presidential Medal of Freedom recipients

This text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.

| Name | Suze Orman |

|---|---|

| Birth date | June 05, 1951 |

| Birth place | Chicago, Illinois |

| Caption | Orman at the Time 100 Gala, May 4, 2010. |

| Residence | Florida, New York City, and San Francisco |

| Nationality | American |

| Known for | The Suze Orman Show |

| Education | Bachelor of Arts in social work |

| Alma mater | University of Illinois at Urbana-Champaign (1976) |

| Occupation | Financial advisor, author, television personality, motivational speaker |

| Partner | Kathy Travis |

| Partner-type | Life Partner |

| Website | www.SuzeOrman.com The Suze Orman Show }} |

She is the host of The Suze Orman Show on CNBC. She has written seven consecutive New York Times Best Sellers; has written, co-produced, and hosted six PBS specials based on her books; and is the most successful fundraiser in the history of public television. Similar programs that she hosts on QVC, the leading home shopping network, also place her as the top seller.

In 2004 and 2006, Orman won two daytime Emmy Awards in the category of Outstanding Service Show Host for her PBS specials. Over her television career, she has won six Gracie Awards, more than anyone in the 34-year history of the awards.

In July 2009 Forbes named Orman 18th on their list of The Most Influential Women In Media. In May 2009 Orman was presented with an honorary degree Doctor of Humane Letters from the University of Illinois. In 2009 & 2008, she was selected by Time magazine as one of the TIME 100, The World's Most Influential People. In 2009 she was honored by Gay & Lesbian Alliance Against Defamation (GLAAD) with the Vito Russo Media Award. In April 2008 Orman was presented with the Amelia Earhart Award for her message of financial empowerment for women and Saturday Night Live spoofed Suze three times during 2008. Orman delivered the Commencement address and received an honorary degree at Bentley University on May 15, 2010.

The 2006 documentary "Maxed Out" notes that Susan Orman has a financial agreement with the Fair Isaac Corporation, thus putting into question the impartiality of her financial advice.

Orman has a Q&A; advice section in Oprah Winfrey's monthly magazine O, alongside Dr. Phil's advice section. She is the former author of a biweekly column entitled "Money Matters" on Yahoo!'s finance website. For many years, she has contributed on a monthly basis to Costco Connection, a magazine published by the membership wholesaler. She is also a contributor to several other magazines and publications including The Philadelphia Inquirer, Lowes MoneyWorks, and Your Business at Home Magazine.

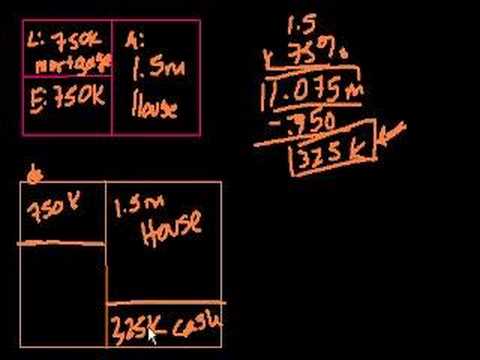

In 2007, Orman launched a segment called "Can I Afford it?" which was also featured as an episode of The Oprah Winfrey Show. People tell Orman what they hope to purchase or refinance and why they want it. She then commands them to "Show me the money". They then tell Orman how much money they make, how much expenses they have, how much debt they have, if any, (mortgages, credit card debt, car loans, student loans, etc.) and how much they have in savings and retirement accounts. After asking questions such as "How are you going to pay for this?" or "How secure is your job?", or "How many miles do you have on your car?", Orman then determines if they can or can't afford it by saying they are "approved" or "denied". She then explains her reasoning; those with high credit card debt, as well a lack of money in savings are usually denied. She will sometimes follow up with past participants to see their current status. Her catch phrases are "Self-worth equals net worth", "People first, then money, then things", and "Truth creates money. Lies destroy it."

In February 2008, Orman appeared on The Oprah Winfrey Show and announced that her most recent book, Women and Money, would be available for free on Oprah's website for 33 hours. Over 1 million people downloaded the book.

In an April 2008 online interview with The Young Turks, Orman stated that her net worth is more than ten million USD. Orman shared her personal investment portfolio strategy. It is highly concentrated compared with traditional investment theory, which emphasizes asset diversification and a significant allocation to equities for long-term growth. Orman stated: "I have a million dollars in the stock market because if I lose a million dollars, I don't personally care. I buy zero-coupon municipal bonds, and all the bonds I buy are triple-A rated and insured so even if the city goes under, I get my money. I take a little lower interest rate to make sure my bonds are 100 percent safe and sound."

In July 2008, CNBC began airing new weeknight editions of The Suze Orman Show. Orman has also been featured on the Food Network's Paula's Party alongside RuPaul.

In January 2011, Orman premiered as part of a weekly show on the Oprah Winfrey Network called "Oprah's Allstars". In each episode, she, Dr. Oz and Dr. Phil answer various questions about life, health and finance.

Category:1951 births Category:Living people Category:American businesspeople Category:American finance and investment writers Category:American Jews Category:American people of Russian-Jewish descent Category:American people of Romanian-Jewish descent Category:American self-help writers Category:Daytime Emmy Award winners Category:Jewish American writers Category:Lesbian writers Category:LGBT Jews Category:LGBT people from the United States Category:LGBT television personalities Category:People from Chicago, Illinois Category:University of Illinois at Urbana–Champaign alumni

This text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.

Ramsey's syndicated radio program The Dave Ramsey Show is promoted with a tagline that "It's about your life and your money," and it is heard on over 450 radio stations throughout the United States and Canada, as well as on XM and Sirius satellite radio. He has written numerous books. His books and broadcasts often feature a Christian perspective that reflects Ramsey's own religious beliefs. Ramsey was named the 2009 Marconi Award winner for Network/Syndicated Personality of the Year.

Ramsey's current company, The Lampo Group, is headquartered in Brentwood, Tennessee, and oversees three divisions geared toward financial counseling.

Ramsey has been featured on many media outlets including The Oprah Winfrey Show, 60 Minutes, and The Early Show on CBS. He has also recorded a pilot and six episodes of a reality show named The Dave Ramsey Project for CBS; however, the Network decided not to air the program. He was the host of The Dave Ramsey Show, which aired at 8 p.m. ET and repeated weekdays on the Fox Business Network; the Fox Business Network canceled the show in June, 2010.

Ramsey's success soon came to an end as the Tax Reform Act of 1986 began to have a negative impact on the real estate business. One of Ramsey's largest creditors was sold to a larger bank, which began to take a harder look at Ramsey's borrowing habits. The bank demanded he pay $1.2 million worth of short-term notes within 90 days, forcing him to file for bankruptcy relief.

Ramsey began counseling couples at his local church. Soon after offering private counseling services, Ramsey began attending every workshop and seminar on consumer financial problems that he could find. He developed a simple set of lessons and materials based partially on his own experience and on works and teachings by Larry Burkett and Ron Blue. After many requests from his clients, in 1992 wrote his first book Financial Peace.

Ramsey has been married to his wife, Sharon, for 25 years; they have three children: Denise; Rachel; and Daniel. The family resides in Franklin.

Ramsey started his radio show, currently known as The Dave Ramsey Show, in 1992 under the title of The Money Game. The radio show began on June 15, 1992. Originally a locally based show, it is now syndicated across the country. In 2007, the Fox Business Network launched a television show under the same title, but cancelled the show in June 2010.

This text is licensed under the Creative Commons CC-BY-SA License. This text was originally published on Wikipedia and was developed by the Wikipedia community.