Business Story

Champ private equity group will get prized Constellation wines labels Source: The Australian

LOCAL private equity group Champ has spent $290 million for 80 per cent of Constellation Brands' wine business in Australia and Britain.

The deal highlights the twin pressures on local producers of a high currency and a global wine glut.

Stephen Millar, the BRL Hardy chief executive who sold what was largely the same business to Constellation for $1.9 billion in 2003, said yesterday that Champ had done a good deal to secure prized labels like Banrock Station, Hardys, Leasingham and Yarra Burn.

"It's a very attractive price for a buyer where there's confidence in the strategy," Mr Millar told The Australian.

"In the short term, it's more important to run the business for cashflow than for profit, so it suits a buyer that's setting it up for the future."

Private equity, he said, generally had a five-year investment horizon and was a more natural owner of the former BRL Hardy assets in the current environment than Constellation, which was exposed to all the short-term pressures of a listed company.

Champ executive chairman Bill Ferris endorsed this view, saying his group had been in similar situations where investors were "heading for the exit door".

"Sometimes that's the wrong door," Mr Ferris told Reuters.

"It is somewhere towards a cyclical low in this global wine sector and the timing therefore may be sensible." The Constellation assets have effectively been on the market for about a year, with discussions regarding a joint venture with the local and British operations of Australian Vintage terminated last April.

The transaction with Champ, which is expected to close next month, features virtually all of Constellation's brands in Australia, Britain and South Africa.

It also includes the wineries and vineyards and the 50 per cent stake in Matthew Clark, the British wholesale joint venture.

Excluded, however, is New Zealand's second biggest winery operation, which was part of the BRL Hardy business.

A Deutsche Bank note said the sale price highlighted the difficulties for local wine producers, but it said the deal was not a template valuation for the Foster's wine business, Treasury Wine Estates, which was undergoing a demerger.

The reason was Constellation's operations were barely profitable, whereas the comparable Foster's business was expected to make more than $100m in profit this year. Constellation had focused on cost cutting as opposed to growth of the business.

"In our opinion, Foster's portfolio of brands are superior and better positioned in the faster growing premium end of the market," Deutsche said.

"Foster's is now almost two years into its turnaround program for the wine business, with signs of improvement already emerging."

Constellation president and chief executive Rob Sands said the company, over the last two years, had been concentrating on profitable, organic growth.

The main focus was on building premium brands and improving margins, return on invested capital and free cashflow.

While the Australian business was from a geographically important region and had significant scale, it continued to face challenging market conditions.

"Therefore, it is no longer consistent with Constellation's strategy," Mr Sands said. "We believe Champ has the requisite skills and motivation necessary for accelerating the success of the group."

JPMorgan said the Constellation operations were "dramatically underperforming" and had been a drag on capital. It said the operations had suffered from a multitude of issues, including a grape glut, duty increases, retailer consolidation and exchange rate headwinds.

The business's value had been written down several times over the years and annual revenues associated with the sale were in a range of $US800m-$US825m.

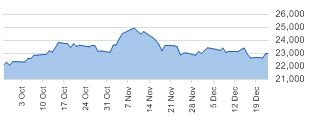

Since it bought BRL Hardy, Constellation has taken a hammering on the currency.

While the Australian dollar has recently achieved parity, it was only worth US68c-US70c at the time the business was purchased.

A margin squeeze has also resulted in costs rising by more than 50 per cent, effectively eliminating the profit margin.

Meanwhile, Moody's lifted its ratings outlook on Constellation from stable to positive. The company is currently pegged at Ba3, or three notches into junk status.

The agency said the deal would create a smaller but more profitable and transparent business with less risk.

Constellation, it said, would be able to generate higher margins on a smaller revenue base, reduce the need for constant restructuring charges and benefit from the reduction of lease and pension adjustments associated with its businesses.

More business news

Brits glum about 2011, poll finds

BRITONS pessimistic about the year ahead, with signs up to five million households could fall behind with mortgage or rent payments.

'Productivity' a dirty word - pollsters

PRODUCTIVITY is beyond the understanding of ordinary voters and the term "globally competitive" conjures images of the Third World and should be avoided.