Business Story

CBA first half cash profit jumps 54pc to $2.9bn

- From: AAP

- February 10, 2010

COMMONWEALTH Bank has lifted its first half profit by 13 per cent after strong performance in its business banking and wealth management businesses.

"This is a very good result at a time when many of our global peers struggle with the ongoing consequences of the global financial crisis," chief executive Ralph Norris said in a statement.

"Today's result demonstrates the resilience of our business model and the underlying strength of each of our businesses.

"As a result we are entering 2010 in a strong position."

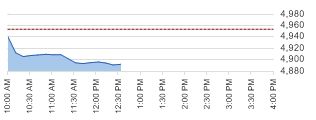

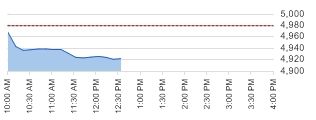

The bank's net profit for the six months ended December 31 rose to $2.914 billion from $2.573 billion the previous corresponding period.

But its cash net profit jumped by 54 per cent to $2.943 billion from $2.013 billion.

The cash result, which was in line with CBA's forecast, is the bank's preferred measure of profitability because it takes out some unrealised changes in asset values.

CBA's impairment expenses for the half year declined 29 per cent to $1.383 billion.

This is on a pro-forma basis, which treats its acquisition of BankWest as part of the bank in the previous corresponding period.

Chief financial officer David Craig said the bank had passed the worst in regard to impairment expenses.

However, there would not be a sudden drop in those charges in the immediate future.

"There won't be a sudden drop because there's always a lag for consumers compared to corporates," he said.

"We are over the corporate peak but there's some difficulty for retail consumers."

CBA's total provisions for loan impairments for the first half increased 47 per cent to $5.244 billion as the bank set aside more money to cover bad loans, particularly for retail customers.

Funding costs will rise

Mr Craig said the bank's funding costs would continue to rise.

"There's no doubt that funding costs are going to keep growing," he said.

"There's much more competition in funding markets and the regional banks will be pushing hard in retail deposits."

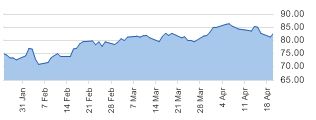

Despite the increased funding costs, the bank was able to return its margins to pre-financial crisis levels.

Its net interest margin rose to 218 basis points, from 216 basis points six month previously, and the highest margin since June 2006.

"It's taken three and a half years to claw our margins," Mr Craig said.

The Sydney-based CBA already has 31.3 per cent of Australian household deposits, 26 per cent of the country's home loans, and also has one of the biggest fund managers in Colonial First State.

Mr Craig said the bank was more keen on organic growth as opposed to takeovers.

"There are fewer things (takeover opportunities) now than there have been," he said.

"We'll grow faster through organic growth."

Still, he didn't rule out takeovers, it they fitted the bank's strategy and were at the right price.

Business and private banking performed strongly, delivering a cash net profit of $440 million, up 18 per cent.

"This robust performance was assisted by continued growth in business lending, effective management of margins and increased equities trading volumes within CommSec," CBA said.

The wealth management unit's cash net profit lifted significantly to $379 million, due and improvement in investment markets. The underlying net profit was up 59 per cent.

Institutional banking and markets achieved a cash profit of f $545 million, an increase of $713 million on the prior comparative period.

Bankwest performing strongly

Bankwest's business performed strongly, with cash net profit of $64 million, compared to $110 million loss.

Its home loans income increased 49 per cent to $1.190 billion.

Business and private banking performed strongly, delivering a cash net profit of $440 million, up 18 per cent.

"This robust performance was assisted by continued growth in business lending, effective management of margins and increased equities trading volumes within CommSec,'' CBA said.

The wealth management unit's cash net profit lifted significantly to $379 million, due and improvement in investment markets. The underlying net profit was up 59 per cent.

Institutional banking and markets achieved a cash profit of f $545 million, an increase of $713 million on the prior comparative period.

Bankwest's business performed strongly, with cash net profit of $64 million, compared to $110 million loss.

Economic outlook has improved

Mr Norris said the economic outlook has improved and that Australian now appears to be on the road to a sustainable recovery.

"That is likely to bring with it a gradual improvement in demand for credit in the 2010 calendar year accompanied by continued upward pressure on our funding costs," he said.

However, Mr Norris said while it appeared that the bank's loan impairment expense has peaked, many of customers were still finding conditions challenging.

This meant means that further reductions in the impairment expense in 2010 were expected to be gradual rather than dramatic

Still, Mr Norris was optimistic about the medium term outlook for the Australian economy and for the bank.

"Clearly, there is still some uncertainty about the speed of recovery for the global economy and, perhaps more importantly, for Australia, the performance of our major trading partners notably China and the United States," he said.

"As a result of these factors, and the uncertainty surrounding the outcome of initiatives by global regulators around banking sector capital and liquidity, the Group plans to retain its current conservative capital and liquidity settings for the foreseeable future."

CBA declared an interim dividend of 120 cents, up six per cent on the prior corresponding period.

More business news

Economy 'going gangbusters', say experts

FINANCIAL markets are pricing in a greater risk of an official interest rate rise next month after being stunned by the jobless rate falling to its lowest level in almost a year.

China charges Stern Hu with spying

CHINA has charged four Rio Tinto employees - including Australian Stern Hu - with bribery and stealing trade secrets, state media reports.